Banknote Binding Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441278 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Banknote Binding Machine Market Size

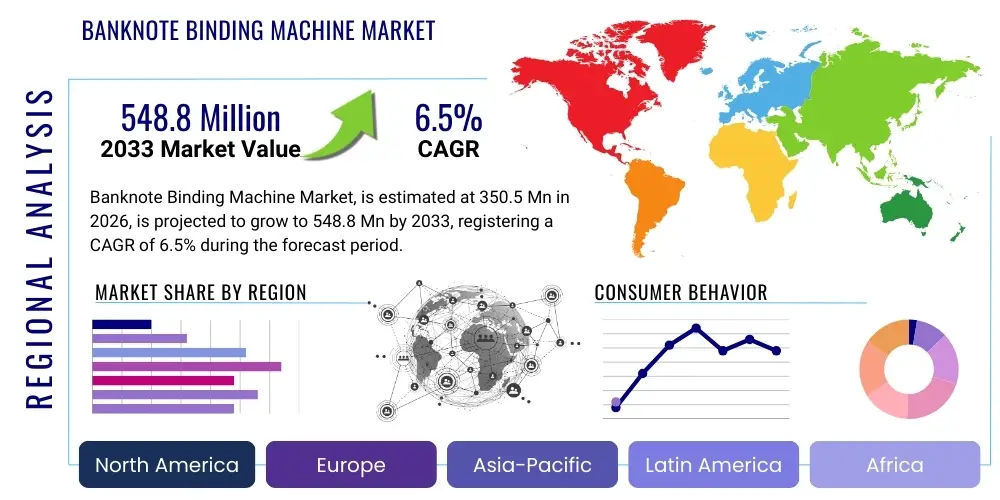

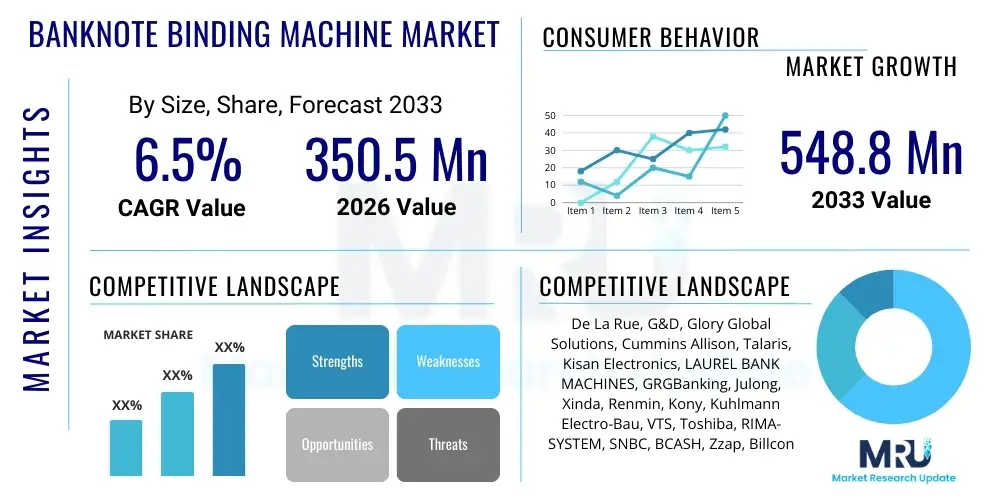

The Banknote Binding Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 548.8 Million by the end of the forecast period in 2033.

Banknote Binding Machine Market introduction

The Banknote Binding Machine Market encompasses specialized equipment designed for the secure and efficient packaging of currency notes into standardized bundles. These machines are essential components in the cash handling operations of financial institutions, central banks, retail chains, and cash-in-transit (CIT) companies. Their primary function is to apply strong, tamper-evident bands or straps around preset quantities of banknotes, typically 100 notes per bundle, significantly reducing manual effort and minimizing errors associated with large-volume currency processing. The technology integrates aspects of precision engineering, thermal bonding, and increasingly, automated counting and authentication features to ensure the integrity of the bound bundles.

The core product offerings within this market include automatic banknote banding machines, semi-automatic wrappers, and integrated currency processing systems that combine counting, sorting, and binding functionalities. Major applications span high-volume cash processing centers, commercial banks needing rapid preparation of notes for circulation or storage, and specialized vaults requiring stringent security protocols for currency management. Key benefits derived from the deployment of these machines include enhanced operational efficiency, reduced labor costs, standardized bundling practices critical for compliance and accountability, and improved security through documented sealing processes. The ability to handle diverse currency denominations and materials (paper and polymer) reliably is a vital feature driving adoption across international markets.

Driving factors propelling market expansion include the consistent global growth in cash circulation, particularly in developing economies, necessitating robust cash infrastructure management. Furthermore, stringent regulatory requirements concerning cash handling security and the increasing focus of financial institutions on optimizing back-office processes encourage the replacement of older, less efficient equipment with modern, high-speed automated binders. Technological advancements focusing on enhanced durability, reduced maintenance requirements, and integration with broader cash management software systems are also contributing significantly to sustained market demand.

Banknote Binding Machine Market Executive Summary

The Banknote Binding Machine Market is experiencing robust growth driven by the continuous need for optimized cash logistics and security across the global financial ecosystem. Current business trends indicate a strong pivot towards fully automated, high-speed binding solutions capable of processing mixed denominations and integrating seamlessly with larger currency sorting infrastructure. Furthermore, sustainability is becoming a key design metric, prompting manufacturers to develop machines utilizing eco-friendly strapping materials and energy-efficient operations. Competitive intensity remains high, focusing on product reliability, after-sales service quality, and technological differentiation, particularly in incorporating sophisticated sensors and IoT capabilities for predictive maintenance and remote monitoring.

Regionally, the market exhibits divergent growth patterns. Asia Pacific (APAC) leads in terms of adoption volume, fueled by high cash usage in countries like India, China, and Indonesia, coupled with rapid expansion of bank branches and commercial activities. North America and Europe, characterized by established financial infrastructure, show demand centered around technological upgrades, replacement cycles, and sophisticated security features required by central banking authorities. Emerging markets in Latin America and the Middle East & Africa (MEA) present significant opportunities as financial inclusion initiatives and efforts to modernize local banking systems drive initial procurement of basic to mid-range binding equipment.

Segmentation trends highlight the increasing dominance of the fully automatic segment due to its efficiency benefits in high-throughput environments. While paper/film strapping remains the conventional material, there is a growing interest in polymer and tamper-evident materials for increased security. End-user segmentation reinforces the dominance of financial institutions (banks, central banks, credit unions) as the primary purchasers, although the retail sector, especially hypermarkets and large-scale enterprises with substantial daily cash receipts, is rapidly emerging as a crucial growth segment requiring tailored, user-friendly binding solutions.

AI Impact Analysis on Banknote Binding Machine Market

User queries regarding AI’s influence on the Banknote Binding Machine market primarily center on how artificial intelligence can enhance security, predictive maintenance, and operational throughput without fundamentally altering the core mechanical binding function. Common concerns include whether AI can detect subtle anomalies in banknote bundles post-binding (e.g., fraudulent tampering or miscounts) that human operators might miss, and how sophisticated machine learning algorithms can be applied to forecast equipment failures, minimizing costly downtime in critical cash centers. Users also frequently question the role of AI in optimizing strapping consumption and speed settings based on real-time operational data and varying banknote quality, moving beyond simple automation toward intelligent processing management. The overarching expectation is for AI integration to translate into higher uptime, greater accuracy, and reduced total cost of ownership (TCO) for currency processing machinery.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (vibration, heat, stress) for anticipating mechanical failures, enabling just-in-time component replacement and maximizing operational uptime.

- Enhanced Security and Authentication: AI integration within adjacent counting and sorting systems to cross-verify the integrity of the bundles, identifying pattern discrepancies or inconsistencies in strapping tension that could indicate attempted tampering.

- Optimized Throughput Management: Applying AI to dynamically adjust binding speed, pressure, and temperature settings based on the condition and type of banknotes being processed, ensuring optimal binding quality regardless of currency age or material.

- Automated Error Diagnosis: Implementing intelligent diagnostic systems that use AI to pinpoint the exact cause of operational errors (e.g., misfeeds, strapping material issues), significantly reducing manual troubleshooting time.

- Inventory and Consumable Forecasting: Utilizing machine learning to predict consumption rates of binding materials (straps, film) based on historical usage patterns and anticipated volume, ensuring efficient supply chain management for cash centers.

- Integration with Robotic Process Automation (RPA): Enabling intelligent interfaces between the binding machine and adjacent robotic sorting or packing arms, creating fully automated, end-to-end currency processing lines managed by integrated AI systems.

DRO & Impact Forces Of Banknote Binding Machine Market

The dynamics of the Banknote Binding Machine Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and inherent Impact Forces. A primary driver is the global increase in stringent regulatory standards governing cash handling, which mandates secure, traceable, and standardized currency processing procedures in financial institutions worldwide. This regulatory pressure, coupled with the escalating volume of cash in circulation, especially in high-growth economies, compels institutions to invest in high-capacity, automated binding solutions to maintain operational efficiency and compliance. Furthermore, labor cost reduction and the minimization of human error remain powerful incentives for automation across all cash processing stages, favoring advanced binding machines over manual methods.

However, market growth is tempered by several critical restraints. The high initial capital expenditure associated with purchasing sophisticated, fully automated binding machines often poses a barrier, particularly for smaller financial institutions or emerging market banks operating on tighter budgets. Furthermore, the global trend toward digitalization and the increasing acceptance of cashless transactions, while currently not eliminating cash, introduce long-term uncertainty regarding future cash processing volumes, potentially leading to delayed investment decisions in advanced hardware. Technological obsolescence risk, driven by rapid innovations in currency processing and anti-counterfeiting measures, also requires manufacturers to continuously invest in R&D, adding to product costs.

Significant opportunities for market expansion arise from two main areas: geographical penetration into underserved regions in Africa and Latin America, and technological expansion through integration. In terms of technology, developing modular, scalable binding solutions that can be easily integrated into existing legacy sorting systems offers a lucrative avenue. Additionally, the increasing need for machines capable of handling polymer banknotes and detecting sophisticated counterfeit straps presents specialized high-value opportunities. The impact forces affecting the market include the bargaining power of buyers (dominated by large central banks and global commercial banks demanding competitive pricing and customization), the threat of substitutes (primarily enhanced cashless payment systems), and the high entry barriers due to the precision engineering and certification required for banknote machinery.

Segmentation Analysis

The Banknote Binding Machine Market is comprehensively segmented based on various technical and functional parameters, including product type, binding technology utilized, and the specific end-user industry employing the machinery. This segmentation is crucial for understanding the diverse demands across different operational environments, from high-throughput central bank vaults to smaller retail cash offices. The fundamental distinction lies between fully automatic machines, which offer maximum speed and minimal manual intervention, and semi-automatic models, which provide a cost-effective solution for mid-to-low volume applications. Technological differentiation focuses on the method of securing the bundle, primarily using specialized thermal paper or polymer film, each offering distinct advantages in terms of cost, security, and durability.

The segmentation by end-user provides the most critical insight into market demand drivers. Financial institutions, encompassing commercial banks and central banks, represent the foundational demand base due to the sheer volume and stringent security requirements associated with currency processing. However, non-banking sectors, specifically large retail chains, casinos, and high-volume vending operators, are increasingly procuring their own binding equipment to streamline their internal cash logistics before depositing funds. Analyzing these segments helps manufacturers tailor machine features—such as capacity, footprint, and connectivity options—to specific operational needs, ensuring optimal market penetration and addressing diverse budgetary constraints.

Furthermore, geographic segmentation is vital, as regulatory frameworks and currency processing habits vary drastically across regions. For instance, European markets prioritize compact, highly secure machines, whereas APAC markets often demand rugged, high-capacity models capable of continuous operation under demanding conditions. Understanding these segment dynamics is paramount for devising effective marketing strategies, resource allocation, and product development pipelines that align with localized market realities and evolving cash management trends globally.

- By Product Type:

- Fully Automatic Banknote Binding Machines

- Semi-Automatic Banknote Binding Machines

- Integrated Currency Processing Systems (Binding Module)

- By Binding Material/Technology:

- Paper Banding Machines (Thermal/Adhesive)

- Polymer Film Strapping Machines

- Ultrasonic Welding Binders

- By End-User:

- Financial Institutions (Commercial Banks, Credit Unions)

- Central Banks and Monetary Authorities

- Cash-in-Transit (CIT) Companies

- Retail and Commercial Establishments (Hypermarkets, Casinos)

- Government and Public Sector

- By Speed/Capacity:

- High-Capacity (Over 30 bundles/minute)

- Medium-Capacity (15-30 bundles/minute)

- Low-Capacity (Under 15 bundles/minute)

Value Chain Analysis For Banknote Binding Machine Market

The value chain for the Banknote Binding Machine market commences with upstream activities involving the sourcing of specialized components and raw materials. Key inputs include precision mechanical parts (motors, gears, chassis components), advanced electronic controls (sensors, microprocessors, control boards), and specialized binding materials (thermal paper bands, polymer films, adhesives). Suppliers in this upstream segment are highly specialized, often providing customized components that meet stringent quality and durability standards required for continuous cash processing operations. Efficiency and cost control in this stage are crucial, as fluctuations in material costs, particularly metals and electronic components, directly impact the final product pricing and manufacturer margins.

Midstream activities involve core manufacturing, assembly, and rigorous quality assurance. Banknote binding machine manufacturers focus heavily on R&D to enhance speed, accuracy, and security features, often integrating patented binding mechanisms and tamper detection technologies. Distribution channels represent a critical midstream link. Most manufacturers utilize a hybrid distribution model: direct sales channels are typically employed for large governmental tenders (Central Banks) or major global commercial banking clients, allowing for customized solutions and direct service contracts. Indirect channels, consisting of authorized distributors, local agents, and value-added resellers (VARs), are utilized for reaching smaller financial institutions, retail markets, and maintaining localized inventory and immediate technical support.

Downstream analysis focuses on installation, technical support, maintenance, and the supply of consumables. Post-sale service is highly significant in this market, as machine downtime directly affects cash flow logistics. Manufacturers must maintain robust global service networks, offering timely repairs, calibration services, and continuous supply of specialized binding materials. The end-users, primarily financial institutions and CIT companies, place a high value on long-term service agreements (LSAs) and certified technician availability, making the quality of downstream support a major competitive differentiator influencing purchasing decisions and customer loyalty.

Banknote Binding Machine Market Potential Customers

The primary and largest segment of potential customers for Banknote Binding Machines consists of high-volume financial institutions, specifically commercial banks and central banks. Commercial banks utilize these machines intensively in their cash processing centers and back offices to prepare notes for ATM replenishment, inter-branch transfers, and vault storage, requiring machines that prioritize speed, reliability, and integration capability with existing cash counters and sorters. Central banks and monetary authorities represent the most security-sensitive customers, demanding extremely high accuracy, tamper-evident binding, and robust auditing features, often procuring customized, heavy-duty machinery through formal tender processes.

A rapidly expanding customer base includes Cash-in-Transit (CIT) companies, which require binding machines to process and bundle large volumes of currency collected from multiple commercial clients before deposit or secure transport. CIT companies prioritize mobile, durable, and sometimes modular units that can withstand high operational intensity across various locations. Furthermore, non-financial commercial entities that handle significant daily cash receipts—such as large retail chains (supermarkets, department stores), entertainment venues (casinos, amusement parks), and large service providers—are increasingly internalizing their cash processing, thus becoming key customers for mid-range, user-friendly binding equipment tailored for non-specialist staff operation.

Lastly, governmental organizations and public services that deal directly with high volumes of cash, such as postal services, tax collection departments, and public transport authorities in certain regions, also represent niche, yet stable, customer segments. These customers typically seek durable, standard-capacity machines that offer ease of use and long operational lifespan. Understanding the operational scale and security requirements of each customer group allows vendors to effectively position their product line, ranging from basic strap binders to fully integrated, audit-compliant currency management solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 548.8 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | De La Rue, G&D, Glory Global Solutions, Cummins Allison, Talaris, Kisan Electronics, LAUREL BANK MACHINES, GRGBanking, Julong, Xinda, Renmin, Kony, Kuhlmann Electro-Bau, VTS, Toshiba, RIMA-SYSTEM, SNBC, BCASH, Zzap, Billcon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Banknote Binding Machine Market Key Technology Landscape

The technological landscape of the Banknote Binding Machine market is characterized by a focus on increasing operational speed, enhancing security features, and promoting integration capabilities. Modern machines utilize sophisticated microprocessor controls to manage precise note feeding, accurate counting verification, and consistent binding tension, ensuring that bundles meet legal and institutional standards without damaging the currency. A key technological advancement involves the shift from traditional friction-based feeding mechanisms to vacuum-assisted systems, which provide gentler handling and improved performance, particularly with polymer notes and heavily circulated paper currency. Furthermore, the integration of high-resolution sensors allows for real-time monitoring of the binding process and immediate detection of misfeeds or material shortages, minimizing operational interruptions.

In terms of binding methodology, thermal bonding technology remains predominant for paper strapping due to its cost-effectiveness and speed. However, highly secure environments are increasingly adopting specialized ultrasonic welding for polymer film strapping, which creates stronger, tamper-evident seals critical for CIT operations. Connectivity and data management are rapidly becoming standard technological features. The latest generation of binding machines incorporates IoT connectivity, enabling them to transmit operational data, binding counts, error logs, and consumable usage directly to centralized cash management software platforms. This facilitates remote monitoring, predictive maintenance scheduling, and comprehensive auditing trails necessary for compliance reporting.

Future technological advancements are centered around AI integration for self-optimization and enhanced counterfeit detection capabilities. Manufacturers are developing systems where the binding machine acts as the final check in the currency processing chain, utilizing embedded banknote authentication sensors (UV, IR, magnetic ink readers) to verify the authenticity of the last few notes before strapping, adding an extra layer of security. Miniaturization and modular design are also crucial trends, allowing financial institutions to deploy high-capacity binding capabilities in more restricted physical spaces while maintaining flexibility for system upgrades.

Regional Highlights

The global Banknote Binding Machine market exhibits pronounced regional variations in demand, technological maturity, and competitive structure. These differences stem from varying levels of cash usage, economic development, and regulatory environments governing currency handling and anti-money laundering efforts.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by massive cash circulation volumes in emerging economies like India, China, and Southeast Asian countries. Demand here is characterized by the need for high-throughput, robust, and cost-efficient fully automatic machines to manage the exponential growth in physical currency handling by commercial banks and large public sector enterprises. Replacement cycles are accelerating due to financial infrastructure modernization.

- North America: This region is a mature market where demand is primarily driven by technological upgrades, compliance mandates, and the replacement of older systems with advanced, networked, and audit-compliant machines. High labor costs necessitate investment in fully automated solutions, often integrated with complex sorting and reconciliation software, catering mainly to large financial institutions and specialized CIT firms focusing on high security and efficiency.

- Europe: The European market is characterized by strict regulatory standards (e.g., European Central Bank guidelines) emphasizing the integrity and fitness of banknotes for circulation. Demand focuses on high-precision, secure binding machines capable of handling various European currencies and denominations. Emphasis is often placed on connectivity, integration into European cash logistics systems, and compact design suitable for vault optimization.

- Latin America (LATAM): LATAM represents a high-potential emerging market where investment is often tied to macroeconomic stability and financial infrastructure modernization projects. Demand is mixed, spanning from basic, durable semi-automatic binders for smaller banks to sophisticated, high-capacity machines required by central banks and major commercial institutions focused on streamlining cash processes and combating counterfeiting.

- Middle East & Africa (MEA): This region is characterized by substantial untapped potential, particularly in Africa where cash usage remains dominant. Investment is often centralized through national central banks or major international banking groups establishing regional hubs. Security features and robust performance under challenging environmental conditions are critical purchasing criteria, driving growth in sophisticated, imported technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Banknote Binding Machine Market.- De La Rue plc

- Glory Global Solutions Ltd.

- Giesecke+Devrient (G&D)

- Cummins Allison Corp.

- Talaris (now part of Glory)

- Kisan Electronics Co., Ltd.

- LAUREL BANK MACHINES CO., LTD.

- GRGBanking Equipment Co., Ltd.

- Julong Europe GmbH

- Shanghai Xinda Computer Equipment Co., Ltd.

- Renmin Machine Co., Ltd.

- Kony Co., Ltd.

- Kuhlmann Electro-Bau GmbH

- VTS Vending & Telemetry Services

- Toshiba Infrastructure Systems & Solutions Corporation

- RIMA-SYSTEM GmbH

- SNBC (Sichuan New Bidder Communication Co., Ltd.)

- BCASH S.r.l.

- Zzap Ltd.

- Billcon Corporation

Frequently Asked Questions

Analyze common user questions about the Banknote Binding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Banknote Binding Machine Market between 2026 and 2033?

The Banknote Binding Machine Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033. This growth is driven primarily by increased automation requirements in global cash handling processes and necessary technology upgrades.

Which end-user segment drives the highest demand for banknote binding equipment?

Financial institutions, encompassing commercial banks, credit unions, and central banks, constitute the primary end-user segment demanding the highest volume of banknote binding equipment. Their continuous need for high-speed, secure, and compliant cash processing necessitates investment in advanced fully automatic systems.

How is AI impacting the maintenance and security of banknote binding machines?

AI integration significantly enhances operational reliability by enabling predictive maintenance through real-time sensor data analysis, anticipating mechanical failures before they occur. Furthermore, AI contributes to security by cross-verifying binding integrity and detecting subtle anomalies in bundled currency, thus improving overall trustworthiness.

What is the difference between paper banding and polymer film strapping technologies?

Paper banding, typically utilizing thermal activation, is widely used due to its lower cost and simplicity for standard internal bundling. Polymer film strapping, often secured via ultrasonic welding, offers superior durability and tamper-evidence, making it preferred for high-security applications like Cash-in-Transit (CIT) and inter-vault transfers.

Why is the Asia Pacific region considered the fastest-growing market for these machines?

The Asia Pacific (APAC) region is the fastest-growing market due to rapid economic expansion, high reliance on physical cash transactions across major economies (e.g., China, India), continuous modernization of banking infrastructure, and the necessity to manage massive volumes of currency efficiently and securely.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager