Basic Chromic Sulfate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443413 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Basic Chromic Sulfate Market Size

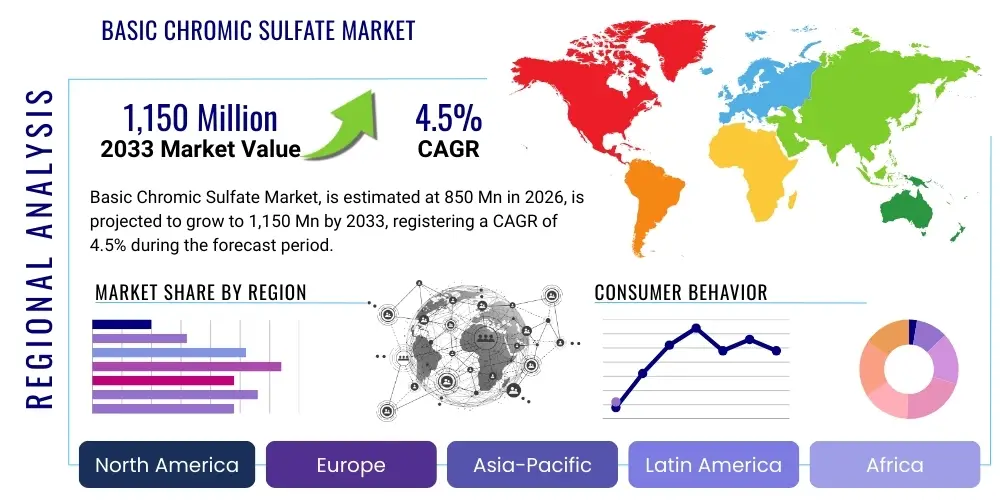

The Basic Chromic Sulfate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,150 Million by the end of the forecast period in 2033.

Basic Chromic Sulfate Market introduction

Basic Chromic Sulfate (BCS), chemically represented as Cr(OH)SO4, is a fundamental chemical compound predominantly utilized in the global leather industry. Its primary function is the chrome tanning process, where it acts as a cross-linking agent with collagen fibers in animal hides, imparting crucial properties such as high hydrothermal stability, softness, flexibility, and resistance to degradation. The widespread acceptance of BCS stems from its efficacy, speed of process, and cost-effectiveness compared to alternative tanning methods, establishing it as the dominant tanning agent worldwide. The efficiency of chrome tanning allows tanneries to produce high volumes of quality leather products, ranging from footwear and apparel to automotive upholstery and luxury goods, thereby cementing BCS's critical role in the global supply chain for finished leather.

The product is typically manufactured through the reduction of sodium dichromate using reducing agents like sulfur dioxide or organic compounds under controlled acidic conditions. Key characteristics influencing its market value include chromium oxide (Cr2O3) content, basicity, and solubility. While the leather tanning sector consumes the largest share, BCS also finds specialized applications in the textile industry for dyeing and printing, in refractory materials production, and as a precursor chemical in certain niche synthetic processes. The market dynamics are intricately linked to global disposable income, regulatory shifts concerning environmental emissions, and advancements in sustainable chemical manufacturing practices aimed at reducing the environmental footprint associated with chromium compounds.

Major market growth drivers include sustained demand for high-quality leather goods, particularly from emerging economies in Asia Pacific where the tanning industry is consolidated, and the relatively high costs and technological barriers associated with switching entirely to chrome-free tanning alternatives. However, the market faces significant restraints due to stringent global regulations focused on preventing the potential formation and discharge of carcinogenic hexavalent chromium (Cr(VI)) into the environment. Continuous innovation in high-exhaustion tanning techniques and chromium recovery systems are pivotal strategies being deployed by manufacturers to mitigate these environmental challenges and ensure the long-term viability of BCS within the global chemical landscape.

Basic Chromic Sulfate Market Executive Summary

The Basic Chromic Sulfate market is characterized by robust regional disparities in production and consumption, with Asia Pacific (APAC), led by China and India, dominating both manufacturing capacity and end-use demand, primarily driven by large-scale leather processing industries. Business trends indicate a focus on process efficiency and vertical integration, especially among large chemical manufacturers who supply integrated solutions to tanneries, often including waste management technologies. Furthermore, there is a discernible trend of product segmentation emphasizing different grades—high basicity and high purity BCS—to cater to specific industrial requirements and meet stricter environmental standards, particularly those governing residual chromium in treated effluent and finished leather goods, which is a key competitive differentiator.

Regional trends highlight a regulatory bifurcation: stringent environmental enforcement in Western markets (Europe and North America) encourages the adoption of chrome-free alternatives or advanced chromium recycling techniques, while rapid industrial expansion in developing regions maintains high reliance on traditional chrome tanning. This divergence is fueling investments in research aimed at stabilizing the Cr(III) compound and preventing its oxidation to Cr(VI) during processing or disposal. Strategic mergers and acquisitions are observed as key players seek to consolidate supply chains, secure raw material access (sodium dichromate), and expand geographical reach into high-growth leather manufacturing hubs across Southeast Asia and Latin America, ensuring supply consistency in a volatile commodities market environment.

Segment trends confirm the leather tanning application segment holds overwhelming dominance, projected to maintain the highest share throughout the forecast period due to the unique performance attributes chrome tanning imparts. However, growth is also anticipated in smaller segments such as catalyst production and specialty chemicals, albeit from a low base, driven by niche industrial applications requiring high thermal stability and specific catalytic properties derived from chromium compounds. The form segment, specifically the powdered BCS, remains the most utilized due to ease of handling, transportation, and accurate dosing in large-scale industrial operations, though liquid formulations are gaining traction in automated tanneries seeking enhanced precision and reduced dust exposure risk for operational personnel.

AI Impact Analysis on Basic Chromic Sulfate Market

Analysis of common user questions reveals strong interest in how Artificial Intelligence (AI) can mitigate the primary risks associated with Basic Chromic Sulfate: environmental compliance, process optimization, and raw material variability. Users frequently inquire about AI's capability to predict the optimal dosage of BCS to achieve maximum chromium exhaustion, thus minimizing effluent waste. Furthermore, concerns revolve around using machine learning models to monitor real-time chemical parameters during the tanning process, ensuring the stability of Cr(III) and preventing inadvertent oxidation to the restricted Cr(VI) form. Key expectations focus on AI-driven supply chain transparency and traceability, linking BCS batches to final product quality and regulatory conformity, thereby enhancing consumer confidence in chrome-tanned leather.

The implementation of AI and machine learning (ML) within the BCS ecosystem is primarily focused on enhancing efficiency and addressing environmental liabilities, turning regulatory compliance from a barrier into a competitive advantage. AI algorithms can analyze vast datasets concerning raw hide quality, processing parameters (pH, temperature, time), and chemical input characteristics to prescribe highly precise recipes. This leads to 'smart tanning' systems that drastically improve the consistency of the finished leather and, critically, push chromium exhaustion rates close to theoretical maximums, reducing the chromium load in wastewater effluent and lowering overall operating costs for tanneries globally.

Furthermore, AI is being deployed in predictive maintenance for equipment involved in chemical mixing and wastewater treatment (e.g., flocculation, filtration, and chromium recovery units). By forecasting equipment failures or process deviations, AI systems ensure uninterrupted compliance with discharge regulations. In the R&D sphere, machine learning accelerates the screening and optimization of new chrome-tanning formulations, including high-salt or low-salt variants, or novel masking agents that further enhance Cr(III) fixation, providing a significant edge in sustainable chemical innovation and driving the adoption of more resource-efficient tanning methodologies across diverse geographical regions.

- AI-driven optimization of chromium exhaustion rates, minimizing waste and ensuring compliance.

- Predictive modeling for quality control in leather tanning processes, ensuring consistency.

- Supply chain risk management through AI monitoring of raw material quality and sourcing transparency.

- Real-time monitoring and anomaly detection to prevent Cr(III) oxidation to toxic Cr(VI).

- Enhanced efficiency in wastewater treatment and chromium recycling through ML-based predictive maintenance.

DRO & Impact Forces Of Basic Chromic Sulfate Market

The Basic Chromic Sulfate market is influenced by a dynamic interplay of economic drivers, stringent environmental restraints, and crucial opportunities for innovation. The core driver remains the unmatched cost-to-performance ratio of BCS in leather tanning, coupled with steady global demand for finished leather goods, especially luxury items and automotive components. However, growth is substantially restrained by increasing global regulatory pressure, particularly the European Union's REACH regulation and similar directives globally, which limit chromium discharge and restrict Cr(VI) levels in final products, pushing tanneries toward alternative processes. This pressure simultaneously creates opportunities in the development of closed-loop systems, advanced chromium recovery technologies, and high-purity BCS formulations designed for minimal environmental impact, ensuring manufacturers can navigate complex legal frameworks while maintaining profitability.

Impact forces are centered around substitution threat and environmental sustainability mandates. The threat of substitution from chrome-free alternatives, such as vegetable tannins, gluteraldehyde, or synthetic organic tanning agents (e.g., TURA), exerts downward pressure on market pricing and incentivizes continuous improvement in chrome utilization efficiency. Conversely, the high technological barrier and processing compromises associated with widespread adoption of these alternatives ensure that chrome tanning retains a significant market share. The need for specialized training and substantial capital investment required for tanneries to switch their entire operations limits the rapid shift away from BCS, providing existing suppliers a buffer for sustained market presence.

The economic impact force related to raw material volatility, primarily sodium dichromate, also heavily influences the market. Manufacturers must employ robust hedging strategies and secure long-term supply agreements to mitigate cost increases, which are often passed down the value chain. Finally, public perception and brand responsibility are growing impact forces; consumers and major brands increasingly demand traceable, environmentally responsible products, forcing BCS manufacturers and tanneries to implement rigorous environmental management systems and achieve certifications that validate sustainable practices, thereby influencing purchasing decisions across the global leather industry.

Segmentation Analysis

The Basic Chromic Sulfate market is primarily segmented based on its physical form (Powder and Liquid), application (Leather Tanning, Textile Dyeing, Chemicals, and Others), and grade (Technical Grade and High Purity Grade). The segmentation reflects the diverse requirements of end-users concerning handling, concentration, and permissible impurity levels. Powder form dominates the market due to its logistical advantages in terms of shipping costs and extended shelf life, while the liquid segment caters to highly automated processes demanding precise dosing. The application segment clearly shows the overwhelming dependence of the market on the leather tanning industry, which dictates overall volume demand, while niche applications provide stability and higher margins.

Grade segmentation highlights the dichotomy between standard industrial requirements and stringent regulatory environments. Technical grade BCS, widely used in bulk tanning operations in developing economies, prioritizes cost-effectiveness. Conversely, high purity grade BCS, characterized by extremely low levels of heavy metals and minimal potential for Cr(VI) formation, commands a premium price and is increasingly utilized by manufacturers targeting high-end leather products and complying with strict international chemical substance standards such as REACH and the ZDHC (Zero Discharge of Hazardous Chemicals) protocols. Analyzing these segments is crucial for understanding regional market maturity and technological adoption rates across the global supply chain.

- By Form:

- Powder

- Liquid

- By Application:

- Leather Tanning

- Textile Dyeing

- Chemicals & Catalysts

- Others (Refractory, Pigments)

- By Grade:

- Technical Grade

- High Purity Grade

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Basic Chromic Sulfate Market

The value chain for the Basic Chromic Sulfate market commences with upstream activities involving the mining and processing of chromite ore, followed by the production of intermediate chemicals, primarily sodium dichromate. This upstream segment is characterized by high capital intensity and oligopolistic structures, often concentrated in resource-rich nations. Manufacturers of BCS rely heavily on the stable and cost-effective supply of sodium dichromate, and volatility in the pricing or availability of this precursor directly impacts the profitability and stability of the midstream BCS production segment. Optimization in this upstream area involves long-term procurement contracts and investment in efficient reduction processes to manage input costs effectively.

The midstream involves the chemical conversion of sodium dichromate into BCS by specialized chemical companies. This stage includes complex reduction processes and quality control measures to ensure the desired basicity, Cr2O3 content, and compliance with purity standards, particularly the absence of detectable Cr(VI). Distribution channels are critical, utilizing both direct sales models for large, integrated tanneries and indirect distribution networks involving regional chemical distributors and agents, particularly in fragmented markets like Southeast Asia. Effective logistics, including specialized chemical handling and packaging (e.g., moisture-proof bags for powder), are essential components of maintaining product quality and ensuring timely delivery to end-users.

Downstream activities center on the end-user applications, predominantly leather processing tanneries globally. These tanneries use BCS as a core component in their production cycle. The final stage involves the finished leather entering the consumer market via manufacturers of footwear, automotive interiors, apparel, and accessories. A critical aspect of the downstream value chain, particularly in developed regions, is waste management and chromium recovery, which often involves dedicated service providers or proprietary in-house systems aimed at minimizing environmental impact and recycling chromium back into the production loop, thus closing the material cycle and enhancing sustainability credentials throughout the chain.

Basic Chromic Sulfate Market Potential Customers

The primary customers and end-users of Basic Chromic Sulfate are commercial tanneries specializing in the processing of raw animal hides into finished leather. These operations range from massive industrial complexes in Asia Pacific, which process hides for export markets, to smaller, specialty tanneries focusing on high-end, artisan leather products in Europe and North America. The purchasing criteria for these buyers are multifaceted, revolving around product consistency (ensuring uniform tanning results), competitive pricing, supplier reliability, and crucially, regulatory compliance certifications, especially regarding the total chromium content and the absence of Cr(VI) in the delivered chemical and the resulting finished leather product.

Secondary potential customers include textile manufacturers who utilize BCS in the dyeing and printing of specific fibers where colorfastness and unique shades are required. Furthermore, chemical and catalyst manufacturers represent a niche but high-value customer base, requiring high-purity BCS as a precursor for synthesizing various chromium-based pigments, catalysts used in organic synthesis, and specific refractory materials designed to withstand high temperatures. These specialized buyers often demand more stringent quality specifications and customized formulations compared to bulk tanning operations, driving innovation in the high purity grade segment.

Geographically, potential customers are concentrated in countries with significant livestock populations and strong export-oriented manufacturing bases, such as China, India, Brazil, Italy, and Turkey. The shift towards greater automation in tanning and growing regulatory oversight is segmenting the buyer base further, favoring suppliers who can provide technical support, assist with process optimization, and offer integrated solutions that encompass chemical supply alongside effective chromium recovery and effluent treatment technologies, making specialized technical expertise a key factor in supplier selection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,150 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess AG, Vishnu Chemicals Ltd., Elementis Plc, Novozymes A/S, BASF SE, Solvay SA, Brother Enterprises Holding Co., Ltd., Sichuan Tianyuan Group Co., Ltd., Gansu Jinshi Chemical Co., Ltd., Saudi Basic Industries Corporation (SABIC), Yinchuan Ruifeng Chemical Co., Ltd., Huntsman Corporation, Chromate Chemical Co., Ltd., Shandong Jinxing Chemical Co., Ltd., American Chrome & Chemicals Inc., TFL Ledertechnik GmbH, Jiahua Chemical Co., Ltd., The Dow Chemical Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Basic Chromic Sulfate Market Key Technology Landscape

The technological landscape in the Basic Chromic Sulfate market is predominantly focused on process efficiency and environmental mitigation, rather than radical product replacement. The central technological advancements revolve around "high exhaustion" tanning techniques. These methods involve optimizing formulation variables (such as pH, concentration of masking agents, and drum rotation schedules) to maximize the percentage of chromium sulfate absorbed by the hide fibers, sometimes reaching over 95%. This minimizes the residual chromium content in the wastewater, thereby reducing the environmental load and lowering the complexity and cost of downstream effluent treatment.

A second critical technology area is the development and implementation of advanced chromium recovery and recycling systems. These systems often employ precipitation, filtration, and acid dissolution techniques to recover chromium from spent tanning liquors. The recovered chromium is then purified and reprocessed, often yielding a concentrated basic chromic sulfate solution that can be re-utilized in the tanning bath. The adoption of closed-loop systems is economically attractive in regions with high water scarcity or stringent environmental laws, as it minimizes both chemical consumption and sludge disposal costs, representing a significant technological step towards circular economy principles within the industry.

Furthermore, technology is being applied in the refinement of the manufacturing process of BCS itself. Innovations are aimed at producing specialty grades, such as high-basicity or high-purity BCS, which offer better penetration kinetics and further reduce the risk of Cr(VI) formation during storage or tanning. Continuous monitoring systems, often utilizing spectrophotometry and sensor technology, are increasingly integrated into production lines to ensure real-batch quality control, verifying stability and composition, which is vital for maintaining compliance with export regulations and premium customer specifications globally.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the undisputed leader in both the production and consumption of Basic Chromic Sulfate, accounting for the largest market share globally. This dominance is driven by the region’s robust and rapidly expanding leather processing industry, particularly in China, India, and Pakistan, which serve as global manufacturing hubs for footwear, garments, and leather accessories. Economic factors, including lower operational costs and the presence of abundant raw materials (hides), perpetuate the reliance on chrome tanning. However, as pollution concerns escalate, governmental pressure in countries like China is pushing towards consolidation and mandatory adoption of wastewater treatment technologies, leading to significant investment in chromium recycling infrastructure and higher-grade BCS inputs. The market growth here is volume-driven, coupled with an increasing focus on achieving international quality and environmental standards for export purposes.

- Europe: Europe represents a mature market characterized by stringent environmental regulations, particularly the directives from the European Chemicals Agency (ECHA). While traditional tanneries, especially those focused on luxury leather goods in Italy, still rely on BCS for superior quality, consumption is highly regulated and focused almost exclusively on high-purity, low-salt formulations. The European market drives innovation in chrome-free and specialty tanning agents, but its primary contribution to the BCS market is setting the standard for sustainable chrome usage, promoting advanced chromium recovery, and requiring full traceability of chemicals used. Due to these regulatory hurdles, the European market exhibits slower volume growth but commands higher prices for premium, certified BCS products.

- North America: The North American market for Basic Chromic Sulfate is stable, mainly serving niche high-quality leather manufacturers (e.g., automotive and specialty footwear). Consumption volumes are comparatively lower than in APAC, and the market is dominated by imports. Focus here is placed on supply chain security and compliance with rigorous local environmental standards, prompting end-users to prefer suppliers who can guarantee minimal environmental impact and consistently deliver products with proven Cr(VI) stability. Innovation is focused on optimizing existing processes rather than volume expansion.

- Latin America (LATAM): LATAM, particularly Brazil and Argentina, is a significant regional player due to substantial cattle industries, providing a consistent supply of hides. The market is primarily geared towards domestic consumption and export of raw and semi-finished leather. While environmental regulations are less uniform than in Europe, growing international trade demands are compelling tanneries to adopt better chrome management practices. This region offers substantial growth potential, assuming continuous improvements in local environmental infrastructure and technological adoption in mid-sized tanneries.

- Middle East and Africa (MEA): The MEA market is nascent and fragmented, with consumption tied to local livestock processing and small-to-medium scale tanneries. Growth is anticipated in countries seeking to develop independent leather manufacturing capacities. Challenges include infrastructural limitations and inconsistent regulatory enforcement. Opportunities exist for BCS suppliers to introduce modern tanning technology and chromium recycling solutions as industrialization progresses, potentially moving away from traditional, less efficient methods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Basic Chromic Sulfate Market.- Lanxess AG

- Vishnu Chemicals Ltd.

- Elementis Plc

- Novozymes A/S

- BASF SE

- Solvay SA

- Brother Enterprises Holding Co., Ltd.

- Sichuan Tianyuan Group Co., Ltd.

- Gansu Jinshi Chemical Co., Ltd.

- Saudi Basic Industries Corporation (SABIC)

- Yinchuan Ruifeng Chemical Co., Ltd.

- Huntsman Corporation

- Chromate Chemical Co., Ltd.

- Shandong Jinxing Chemical Co., Ltd.

- American Chrome & Chemicals Inc.

- TFL Ledertechnik GmbH

- Jiahua Chemical Co., Ltd.

- The Dow Chemical Company

Frequently Asked Questions

Analyze common user questions about the Basic Chromic Sulfate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Basic Chromic Sulfate (BCS)?

The primary application of Basic Chromic Sulfate is in the leather tanning industry, where it is used in chrome tanning to stabilize collagen fibers in hides, imparting durability, flexibility, and heat resistance. Secondary uses include textile dyeing, catalyst production, and specialized chemical synthesis.

What is the main environmental concern related to Basic Chromic Sulfate?

The chief environmental concern is the potential for Basic Chromic Sulfate (Cr(III)) to oxidize into toxic and carcinogenic Hexavalent Chromium (Cr(VI)) under certain conditions (high pH, heat, or inadequate disposal). Strict environmental regulations mandate minimizing Cr(VI) formation and ensuring proper effluent management.

How do high exhaustion tanning methods impact the BCS market?

High exhaustion tanning methods are technological advancements that allow tanneries to maximize the absorption of BCS by leather fibers, reducing the amount of residual chromium in wastewater. This technology supports market sustainability and helps end-users meet stringent environmental discharge limits, ensuring the viability of chrome tanning.

Which region dominates the global Basic Chromic Sulfate consumption?

Asia Pacific (APAC) currently dominates the global consumption of Basic Chromic Sulfate, driven by the massive concentration of leather manufacturing and processing industries in countries such as China and India, which cater extensively to global export markets for leather goods and accessories.

Are there viable alternatives to chrome tanning, and how do they compare in performance?

Yes, viable alternatives include vegetable tannins and synthetic organic tanning agents (e.g., glutaraldehyde and wet-white systems). While alternatives are gaining ground due to environmental pressure, chrome tanning remains dominant because it offers superior performance in terms of leather quality, process speed, and overall cost-effectiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager