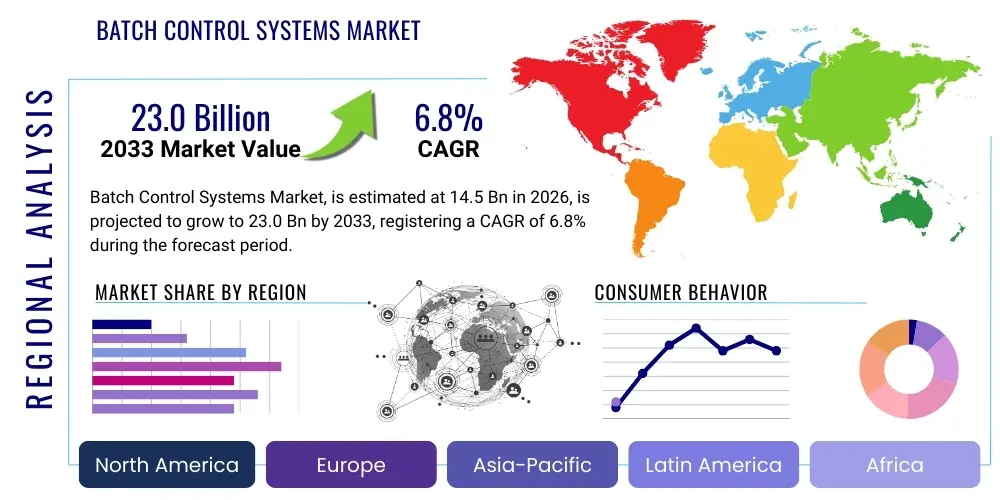

Batch Control Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442857 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Batch Control Systems Market Size

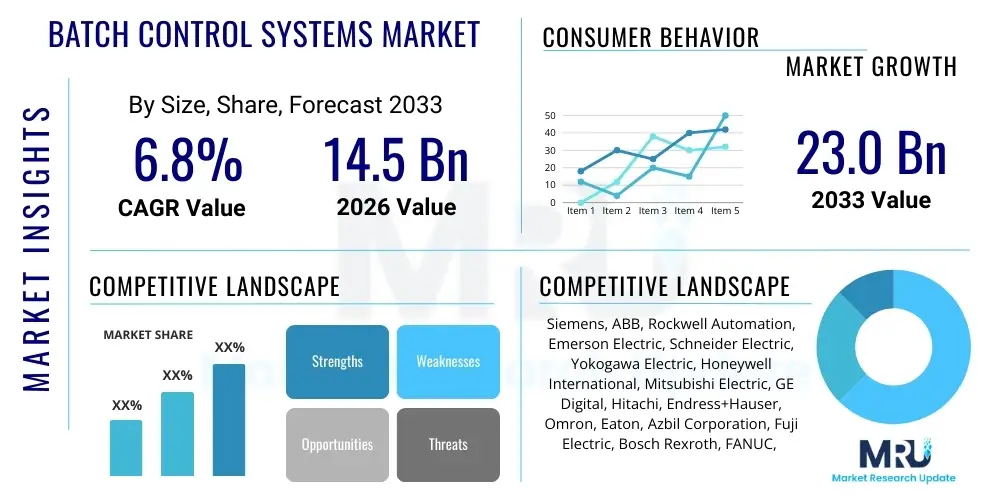

The Batch Control Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $23.0 Billion by the end of the forecast period in 2033.

Batch Control Systems Market introduction

The Batch Control Systems Market encompasses the technologies, software, and services required to automate and optimize sequential or batch-oriented manufacturing processes across diverse industries. These systems are pivotal in environments where discrete quantities of raw materials are combined in specific sequences, under precise conditions (such as temperature, pressure, and time), to produce an end product. Core functionalities include recipe management, procedural control enforcement, material tracking, and comprehensive regulatory compliance logging. The evolution of this market is intrinsically linked to advancements in Industrial Internet of Things (IIoT), edge computing, and standardized architectures like ISA-88, which provide a common framework for designing and operating batch processes efficiently and flexibly.

Product description highlights advanced Distributed Control Systems (DCS), Programmable Logic Controllers (PLCs), and specialized Manufacturing Execution Systems (MES) tailored for batch operations. Modern batch control solutions are shifting towards hybrid architectures that combine traditional rugged hardware with highly flexible, cloud-integrated software platforms, enabling real-time analytics and predictive maintenance capabilities. These systems are essential for industries demanding high product consistency and stringent quality control, minimizing variations between production runs and ensuring traceability throughout the entire production lifecycle. Furthermore, the integration with enterprise resource planning (ERP) systems facilitates seamless operational planning and inventory management.

Major applications span critical sectors, including pharmaceuticals, where compliance with FDA regulations is non-negotiable; specialty chemicals, requiring complex multi-stage synthesis; and the food and beverage industry, focused on rapid product changeovers and hygiene standards. Key benefits derived from implementing these systems include significant reduction in waste, improved energy efficiency, heightened operational safety, and dramatically faster time-to-market for new formulations. Driving factors for market growth include the escalating global demand for high-quality, specialized products, the imperative for digital transformation across manufacturing sectors, and increasing regulatory pressures necessitating detailed electronic batch records (EBR) and enhanced audit trails.

Batch Control Systems Market Executive Summary

The Batch Control Systems market is characterized by robust business trends centered on convergence, digitalization, and enhanced modularity. A primary trend is the shift from proprietary legacy systems toward open, standards-based platforms that facilitate easier integration and scalability, particularly utilizing the ISA-88 standard for recipe management. Furthermore, there is a growing enterprise focus on adopting cloud-native architectures and software-as-a-service (SaaS) models for recipe hosting and data aggregation, allowing for centralized management of geographically dispersed manufacturing sites. Cybersecurity resilience has also emerged as a critical business imperative, driving investments in hardened network infrastructure and identity management solutions specific to operational technology (OT) environments to protect intellectual property and process integrity from increasing cyber threats.

Regional trends indicate significant expansion in the Asia Pacific (APAC) region, driven by rapid industrialization, burgeoning pharmaceutical manufacturing capabilities, and substantial foreign direct investment in chemical and food processing infrastructure, particularly in China and India. North America and Europe, while mature, are focusing on modernization and leveraging advanced analytics and AI integration to optimize existing facilities and enhance sustainability metrics. Regulatory harmonization efforts, such as those related to Good Manufacturing Practices (GMP) and environmental compliance, are accelerating the adoption rate in emerging markets, as companies seek global competitiveness through optimized production efficiency and traceability.

Segment trends reveal that the Software component segment, including advanced recipe management software and MES solutions, is projected to exhibit the highest growth rate, overshadowing hardware sales. This reflects the industry’s prioritizing of flexibility, data utilization, and advanced control algorithms over purely mechanical upgrades. Within industry verticals, the Pharmaceutical and Biotechnology segment remains the most critical adopter, due to the high value and stringent quality requirements associated with biopharmaceutical manufacturing processes. The Services segment, comprising system integration, validation (particularly 21 CFR Part 11 compliance validation), and maintenance, is also expanding rapidly as complexity of integrated systems requires specialized third-party expertise.

AI Impact Analysis on Batch Control Systems Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can move batch processes beyond rigid, pre-defined recipes to truly adaptive, self-optimizing operations. Common questions revolve around the feasibility and safety of using ML models for real-time adjustments of batch parameters, the integration challenges with existing legacy DCS infrastructure, and the validation requirements for AI-driven control loops in heavily regulated industries like pharmaceuticals. There is also significant user concern regarding data governance, ensuring the quality and quantity of operational data needed to train effective AI models, and the trustworthiness or explainability (XAI) of AI recommendations when deviation from standard operating procedures (SOPs) occurs. Users are generally optimistic about predictive quality assurance and yield optimization but cautious about autonomous control execution in critical stages.

The integration of AI is transforming batch control from reactive monitoring to predictive optimization. AI algorithms can analyze vast datasets of historical batch runs, identifying subtle correlations between initial material properties, environmental factors, and final product quality that human operators might miss. This enables the creation of 'golden batch' profiles that serve as dynamic targets, allowing the system to make minor, proactive adjustments during the process to mitigate potential deviations. For example, in fermentation processes, ML can predict the trajectory of microbial growth and adjust feeding rates or temperature profiles hours in advance to maximize yield and prevent costly batch failures, significantly improving overall equipment effectiveness (OEE).

Furthermore, AI significantly enhances maintenance strategies within batch environments. By analyzing sensor data from pumps, valves, and agitators, ML models can predict equipment failure probabilities with high accuracy, shifting maintenance schedules from time-based or reactive to condition-based. This minimizes unexpected downtime, which is particularly costly in batch production due to the complete loss of the in-process batch. The impact of AI extends to improved decision support for operators through natural language processing and augmented reality overlays, providing real-time guidance and reducing the reliance on highly specialized personnel, thereby addressing the growing skills gap in industrial automation.

- AI enables dynamic recipe optimization and adaptive control loops, moving beyond static S88 definitions.

- Machine Learning facilitates advanced predictive quality assurance, forecasting end-product attributes mid-batch.

- Predictive maintenance driven by AI minimizes costly unplanned downtime associated with batch failures.

- AI supports enhanced process troubleshooting and root cause analysis through pattern recognition in historical data.

- Automation of electronic batch record (EBR) review and validation processes using NLP and anomaly detection.

- Augmented Operator Guidance Systems utilizing AI for real-time procedural assistance and error reduction.

- Improved energy consumption profiling and optimization specific to varying batch sizes and schedules.

DRO & Impact Forces Of Batch Control Systems Market

The Batch Control Systems Market growth is driven primarily by the stringent regulatory environment in industries like pharmaceuticals and specialty chemicals, which mandates detailed traceability and audit trails, making automated systems essential for compliance (Driver). Concurrently, the increasing complexity of modern chemical synthesis and bioprocessing requires highly sophisticated, flexible control systems capable of managing multi-variable, multi-stage processes precisely (Driver). Opportunities abound in the digitalization wave, particularly the adoption of modular, skid-based manufacturing units, which necessitate flexible, easily configurable batch software, leveraging the inherent structure of the ISA-88 standard (Opportunity). Additionally, the drive toward sustainable manufacturing and resource efficiency pushes companies to invest in systems that optimize ingredient usage and minimize waste through tighter process control (Driver).

However, significant restraints temper this growth. The high initial capital investment required for implementing or upgrading complex DCS and MES infrastructure poses a barrier, particularly for smaller enterprises and facilities operating on tight margins (Restraint). Furthermore, the pervasive challenge of integrating modern batch systems with deeply entrenched legacy operational technology (OT) infrastructure, often characterized by disparate protocols and outdated hardware, creates substantial technical and logistical hurdles (Restraint). Another major factor is the critical shortage of skilled personnel proficient in both process engineering and modern automation protocols, hindering rapid deployment and maintenance of sophisticated systems (Restraint).

The critical Impact Forces shaping the market landscape stem from technological innovation and competitive intensity. The transition towards open process automation (OPA) standards and the rise of vendor-agnostic software solutions are significant forces, increasing competition and lowering barriers to entry. Regulatory shifts, especially concerning data integrity (e.g., EU Annex 11, FDA 21 CFR Part 11), are powerful impact forces that continually redefine system requirements, pushing vendors to develop more secure and robust electronic record-keeping functionalities. Finally, the macroeconomic force of global supply chain volatility accelerates the need for local, agile manufacturing capabilities, boosting investment in modular, repeatable batch control units globally.

Segmentation Analysis

The Batch Control Systems Market is segmented based on critical factors including the type of components utilized, the specific industry served, and the underlying technology platform. This multi-dimensional segmentation allows market stakeholders to precisely target solutions that address specific operational needs, whether driven by regulatory demands, process complexity, or required computational power. The complexity of modern batch processes necessitates a clear delineation between the control layer, the supervisory MES layer, and the foundational hardware. Understanding these segments is key to analyzing adoption rates and identifying growth vectors, such as the accelerating demand for validated services and advanced recipe management software over basic hardware upgrades. The structure provided by these segments defines the competitive landscape and technological priorities for market participants, focusing investment in areas that deliver the highest value, such as cloud integration and cybersecurity features tailored to specific industry regulations.

- By Component:

- Software (Recipe Management, Sequencing, Reporting, MES Integration)

- Hardware (Controllers, I/O Modules, Field Devices, HMIs)

- Services (System Integration, Validation & Compliance, Maintenance & Support)

- By Technology:

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLC)

- Hybrid Systems

- By Industry Vertical:

- Pharmaceuticals & Biotechnology

- Chemicals (Specialty, Fine, Petrochemicals)

- Food & Beverages

- Water & Wastewater Treatment

- Pulp & Paper

- Others (Cosmetics, Textiles, Metals)

- By Deployment Model:

- On-premise

- Cloud/Hybrid

Value Chain Analysis For Batch Control Systems Market

The value chain for Batch Control Systems begins with upstream activities centered on research and development of core technologies. This involves the innovation of specialized industrial control hardware, robust operating systems, and advanced application software adhering to industry standards like ISA-88 and ISA-95. Key upstream suppliers include manufacturers of industrial CPUs, embedded systems, communication chips, and specialized sensor technologies. Strategic partnerships at this stage focus on ensuring interoperability and security, as the performance and reliability of the final control system are highly dependent on the quality and longevity of these foundational electronic components. Furthermore, software development, particularly for complex recipe editors and supervisory control algorithms, forms a critical early stage in the value creation process.

Midstream activities encompass the system integration and solution delivery phase, where control system vendors and third-party integrators design, configure, program, and validate the complete batch control solution specific to the end-user’s facility and process requirements. This stage involves significant engineering effort in defining control modules, procedural elements, and equipment control structures, followed by extensive Factory Acceptance Testing (FAT) and Site Acceptance Testing (SAT). The distribution channel for Batch Control Systems is complex, typically involving a blend of direct sales models, especially for large, bespoke projects with major pharmaceutical or chemical companies, and indirect channels through certified system integrators and distributors for smaller, standardized applications. The competence of these indirect partners in adhering to strict regulatory protocols (e.g., cGMP) is paramount.

Downstream activities focus on post-implementation support, maintenance, and long-term optimization. This includes providing continuous software updates, hardware replacements, and critical regulatory validation services (e.g., re-validation after significant recipe changes). Direct engagement remains crucial in the downstream phase, particularly for ongoing service contracts and continuous improvement projects, such as integrating AI or upgrading MES connectivity. Indirect channels, primarily local service providers authorized by the main vendor, handle routine preventive maintenance and localized troubleshooting. The total value captured in the downstream phase, driven by high-margin service contracts and compliance consulting, often surpasses the initial implementation revenue, emphasizing the long-term relationship nature of the market.

Batch Control Systems Market Potential Customers

The primary potential customers and end-users of Batch Control Systems are enterprises operating within highly regulated and process-intensive manufacturing environments where consistency, quality, and rigorous traceability are essential for product success and market acceptance. The most critical buyer group resides in the Pharmaceutical and Biotechnology sectors, encompassing large multi-national corporations (MNCs) engaged in drug discovery, API synthesis, and vaccine production, as well as smaller contract manufacturing organizations (CMOs). These buyers require systems capable of managing complex, highly controlled reactions and generating unalterable, compliant Electronic Batch Records (EBRs) mandated by global health authorities, ensuring systems adhere strictly to 21 CFR Part 11 requirements for data integrity and electronic signatures.

Another significant customer segment is the Specialty and Fine Chemicals industry, which requires flexible batch systems to manage multiple product campaigns and rapid changeovers involving hazardous materials and complex reaction kinetics. These customers value the ability of batch control systems to minimize human error and ensure precise material handling and sequencing to maintain product purity. Similarly, the Food and Beverage sector, from large global food processors to specialized craft breweries, represents a high-volume customer base. Their purchasing drivers are centered on minimizing contamination risks, rapid implementation of new recipes for product differentiation, and achieving high throughput while maintaining strict sanitation protocols.

Finally, municipal and industrial Water and Wastewater Treatment facilities are increasingly adopting advanced batch control systems for chemical dosing, filtration sequencing, and sludge processing. While their compliance focus differs slightly, the need for precise, repeatable control over chemical inputs and regulated discharge parameters drives their investment. Across all sectors, the buyer profile typically involves collaboration between automation engineers, IT security specialists, validation experts, and operational managers, reflecting the high technicality and enterprise-wide impact of these systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $23.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, ABB, Rockwell Automation, Emerson Electric, Schneider Electric, Yokogawa Electric, Honeywell International, Mitsubishi Electric, GE Digital, Hitachi, Endress+Hauser, Omron, Eaton, Azbil Corporation, Fuji Electric, Bosch Rexroth, FANUC, Pepperl+Fuchs, Advantech, Beckhoff Automation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Batch Control Systems Market Key Technology Landscape

The core technology landscape of the Batch Control Systems market is dominated by robust control platforms, primarily Distributed Control Systems (DCS) and high-performance Programmable Logic Controllers (PLCs), which execute the critical sequencing and regulatory control algorithms. DCS remains the prevalent choice for highly complex, continuous, and multi-product batch operations, offering superior redundancy, comprehensive historical data management, and native integration capabilities with sophisticated Human Machine Interfaces (HMIs). Conversely, PLCs are often favored for smaller, modular batch skids or discrete unit operations due to their speed, cost-effectiveness, and rugged nature. A crucial technological layer is the adoption of the ISA-88 standard (Batch Control), which provides a formalized, hierarchical model for separating equipment, procedural control, and recipes, ensuring portability and reusability of control code across different platforms and manufacturing sites. This standardization is foundational to modern digital transformation initiatives.

Beyond core control platforms, the market is rapidly integrating advanced software and connectivity solutions. Manufacturing Execution Systems (MES) dedicated to batch operations are increasingly essential, bridging the gap between the plant floor control systems (DCS/PLC) and the enterprise-level ERP systems. These MES solutions manage electronic batch records (EBRs), resource allocation, scheduling, and quality tracking, ensuring compliance and operational visibility across the plant. Furthermore, connectivity technologies are evolving towards IIoT architectures, utilizing MQTT and OPC UA protocols for secure, standardized data exchange from field devices to supervisory systems and cloud platforms. Edge computing is gaining traction, allowing initial data processing and simple control adjustments to occur locally, minimizing latency and bandwidth dependence, which is vital for real-time batch adjustments.

The emerging technological frontier includes the pervasive application of virtualization and containerization (e.g., Docker, Kubernetes) to decouple control software from proprietary hardware, promoting greater system flexibility and faster deployment times. Cybersecurity technologies, including intrusion detection systems tailored for OT networks and multi-factor authentication for operational terminals, are now mandated components of new system implementations due to the critical nature of these processes. The shift toward open-source architectures, driven by initiatives like the Open Process Automation Forum (OPAF), is poised to fundamentally disrupt the traditional vendor landscape by promoting plug-and-play component compatibility and fostering faster innovation cycles in specialized batch control modules.

Regional Highlights

- North America: This region holds a significant market share, characterized by high adoption rates in the pharmaceutical, biotechnology, and specialty chemical sectors, driven by rigorous FDA and EPA regulatory requirements. The U.S. leads in adopting advanced automation technologies, including sophisticated MES integration and AI for predictive compliance monitoring. Investment is focused on modernizing existing infrastructure, incorporating cybersecurity measures, and leveraging cloud-based platforms for multi-site recipe management. The strong presence of major automation vendors further solidifies its position as a technological innovation hub.

- Europe: A mature and technologically advanced market, Europe is driven by strong manufacturing bases in Germany, France, and the UK, particularly in fine chemicals and food processing. The region emphasizes energy efficiency, sustainable manufacturing processes, and adherence to EU directives (like GMP and Annex 11). There is a significant focus on leveraging modular batch plants (skids) and decentralized control architectures to increase production flexibility and rapidly adapt to market demand fluctuations. Standards adherence (ISA-88) is extremely high, facilitating complex system interoperability across different vendors.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC is fueled by massive infrastructure investment, rapid industrialization, and the shift of global manufacturing capacity (especially pharmaceuticals and food production) to countries like China, India, and South Korea. Market growth is primarily driven by greenfield projects and the need for scalable, affordable automation solutions. While cost sensitivity exists, regulatory harmonization efforts and the increasing need for product quality assurance are accelerating the adoption of sophisticated, validated batch control systems across the region.

- Latin America (LATAM): Growth in LATAM is concentrated in key economies such as Brazil and Mexico, focusing on optimizing local chemical and food & beverage production capabilities. The market sees a mix of greenfield projects and upgrades to legacy systems, often influenced by the need to meet international export standards. Adoption is steady but challenged by economic volatility and reliance on imported technology, necessitating careful consideration of local service and support availability.

- Middle East and Africa (MEA): The MEA market growth is closely tied to investment in petrochemicals, oil and gas downstream processing, and water treatment projects. Large-scale, capital-intensive projects primarily drive demand for robust, high-availability DCS-based batch control systems. The adoption in the food sector is also growing, supported by governmental initiatives aiming for food security and domestic production expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Batch Control Systems Market.- Siemens

- ABB

- Rockwell Automation

- Emerson Electric

- Schneider Electric

- Yokogawa Electric

- Honeywell International

- Mitsubishi Electric

- GE Digital

- Hitachi

- Endress+Hauser

- Omron

- Eaton

- Azbil Corporation

- Fuji Electric

- Bosch Rexroth

- FANUC

- Pepperl+Fuchs

- Advantech

- Beckhoff Automation

Frequently Asked Questions

Analyze common user questions about the Batch Control Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary industry driving the demand for advanced Batch Control Systems?

The Pharmaceutical and Biotechnology industry is the primary driver. Demand stems from the critical need for precise recipe execution, meticulous data integrity (21 CFR Part 11 compliance), and detailed electronic batch record (EBR) generation required by global health regulators to ensure product safety and efficacy.

How does the ISA-88 standard influence modern batch control system implementation?

ISA-88 provides a standardized, hierarchical model for designing batch processes, separating equipment control from procedural logic and recipes. This modular approach ensures software reusability, reduces engineering time, and facilitates flexible production across various product lines and manufacturing sites.

What are the key integration challenges when upgrading legacy batch systems?

Key challenges include ensuring seamless communication between new control platforms and existing proprietary field devices, migrating complex historical data while maintaining data integrity, and minimizing operational downtime during the transition phase, which often requires careful sequencing and extensive validation.

What role does the cloud play in the future of Batch Control Systems?

The cloud facilitates centralized recipe management, standardized reporting, and enhanced analytics across multiple global facilities. It is used primarily for supervisory MES functions, historical data storage, and running AI models for process optimization, rather than direct, real-time control execution.

How are cybersecurity threats addressed within industrial Batch Control environments?

Cybersecurity is addressed through defense-in-depth strategies, including network segmentation (zoning OT from IT), implementing strict access controls (Zero Trust principles), utilizing specialized industrial firewalls, and ensuring robust patching and identity management protocols specific to operational technology (OT) systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager