Battery Chargers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443589 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Battery Chargers Market Size

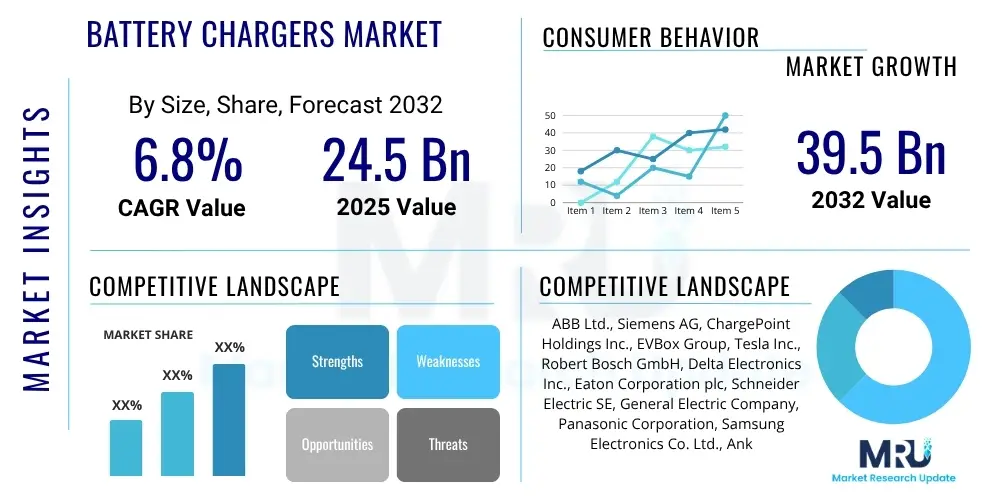

The Battery Chargers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 31.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global adoption of electric vehicles (EVs), coupled with the pervasive integration of portable consumer electronics demanding efficient and fast charging solutions. Furthermore, industrial sectors, particularly those relying on robotics and material handling equipment, are transitioning towards advanced battery management systems (BMS) and corresponding high-capacity chargers, solidifying the market's robust trajectory over the next seven years.

Battery Chargers Market introduction

The Battery Chargers Market encompasses devices designed to inject electrical energy into secondary (rechargeable) cells or batteries by forcing an electric current through them, reversing the electrochemical reactions that occur during discharge. These essential devices vary widely in sophistication, ranging from simple fixed voltage/current sources to highly intelligent systems incorporating microcontrollers for optimized charge profile management, critical for extending battery lifespan and ensuring safety. Major applications span across vast industries, including automotive (EV charging infrastructure), consumer electronics (smartphones, laptops, wearables), industrial equipment (forklifts, backup power systems), and medical devices. The primary benefits derived from modern battery chargers include enhanced energy efficiency, rapid charging capabilities, superior thermal management, and compatibility with diverse battery chemistries like Lithium-ion, Lead-acid, and Nickel-metal hydride, catering to the ubiquitous need for reliable mobile power.

Key driving factors propelling market growth include stringent governmental regulations promoting electric mobility and energy storage systems globally. Technological advancements, particularly in gallium nitride (GaN) and silicon carbide (SiC) semiconductor technology, are enabling the production of smaller, lighter, and significantly more efficient high-power density chargers. Moreover, the increasing demand for fast-charging protocols (e.g., USB Power Delivery, Quick Charge standards) in the consumer electronics sector is compelling manufacturers to innovate quickly. The convergence of smart grid initiatives with vehicle-to-grid (V2G) charging solutions further underscores the crucial role of advanced battery charging technology in future energy ecosystems, positioning the market for sustained high growth.

Battery Chargers Market Executive Summary

The Battery Chargers Market demonstrates high dynamism, fueled predominantly by transformative business trends such as the widespread industrial shift towards automated material handling, necessitating specialized industrial battery chargers, and the rapid deployment of residential and commercial EV charging stations. Regional trends indicate Asia Pacific (APAC) maintaining market dominance, driven by massive manufacturing capacities in electronics and the aggressive push for electric vehicle adoption, particularly in China and India. Europe and North America show strong growth in the smart charging segment, bolstered by favorable regulatory frameworks for grid integration and sustainability mandates. Segment trends highlight Lithium-ion compatibility and wireless charging technology as major growth areas, with smart chargers (incorporating communication capabilities) capturing increasing market share due to their ability to optimize charging cycles, report diagnostics, and integrate seamlessly into smart infrastructure. The competitive landscape is characterized by strategic partnerships between charger manufacturers, automakers, and semiconductor suppliers, focusing on proprietary fast-charging standards and enhanced power density solutions to secure long-term market positions.

AI Impact Analysis on Battery Chargers Market

Common user questions regarding AI's influence in the Battery Chargers Market frequently revolve around how AI can optimize charging speed without compromising battery health, the role of machine learning in predicting battery degradation, and the implementation of smart charging schedules to interact with volatile energy grids. Users are keenly interested in predictive maintenance capabilities, asking if AI algorithms can detect subtle anomalies in charging patterns that signal potential failures or safety risks. Key concerns often center on data privacy regarding charging usage patterns and the standardization of AI-driven battery management systems (BMS). The overall expectation is that AI integration will lead to unprecedented levels of efficiency, safety, and longevity for rechargeable batteries across consumer, automotive, and industrial applications, moving charging from a reactive process to a highly proactive and adaptive system.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is fundamentally reshaping the design and operation of contemporary battery chargers, transforming them into intelligent power management units. AI enables predictive charging optimization by learning individual battery characteristics, usage patterns, and environmental factors (such as ambient temperature) to determine the ideal charge profile (voltage, current, temperature window) in real-time. This dynamic adjustment minimizes stress on the battery's internal components, mitigating common issues like dendrite formation and lithium plating, thereby significantly extending the overall useful life of expensive battery packs, particularly in electric vehicles and large-scale energy storage systems (ESS).

Furthermore, AI facilitates advanced anomaly detection and predictive maintenance within charging infrastructure. By continuously monitoring vast streams of operational data, ML models can identify minute deviations from normal charging behavior that are invisible to traditional rule-based systems. These deviations may indicate early signs of cell imbalance, internal short circuits, or charger component failure, allowing operators to intervene before catastrophic damage or safety incidents occur. This capability is paramount for fleet operators and public charging network providers, ensuring maximum uptime and minimizing maintenance costs associated with unexpected infrastructure downtime. The integration of AI also enhances AEO (Answer Engine Optimization) potential for smart chargers by allowing them to provide precise, data-backed diagnostics directly to end-users via associated applications.

- AI optimizes charge profiles dynamically based on real-time battery state of health (SOH) and predicted usage patterns.

- Machine Learning algorithms enable highly accurate prediction of battery degradation and remaining useful life (RUL).

- AI-driven smart chargers facilitate grid integration through intelligent peak shaving and demand response scheduling (V2G capability).

- Enhanced thermal management systems leverage AI to rapidly adjust cooling or heating during fast charging cycles, maximizing safety.

- ML models improve fault detection and isolation in complex charging networks, drastically reducing system downtime.

DRO & Impact Forces Of Battery Chargers Market

The Battery Chargers Market is governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its evolutionary trajectory and competitive dynamics. Primary drivers include the massive global shift towards electrification across transportation and utility sectors, coupled with continuous innovation in battery chemistry demanding increasingly sophisticated charging electronics. Restraints largely center on the technical challenges associated with achieving ultra-fast charging speeds (e.g., 800V architecture) without compromising thermal safety or battery longevity, alongside the high initial cost of deploying high-power infrastructure and managing the growing issue of e-waste from obsolete charging technologies. Significant opportunities exist in the development of standardized, highly efficient wireless charging systems, robust cybersecurity measures for interconnected charging networks, and specialized, rugged chargers for mission-critical industrial and military applications.

The foremost driving force is the escalating production and sale of electric vehicles (EVs) worldwide, which directly necessitates the expansion of both residential and public charging infrastructure. Governments globally are implementing favorable policies, tax credits, and subsidies to accelerate this transition, creating a guaranteed baseline demand for advanced, Level 2 and DC fast chargers. Additionally, the proliferation of IoT devices and portable medical equipment, all reliant on compact, high-density Lithium-ion batteries, ensures sustained demand within the consumer and niche segments. The relentless push for greater energy efficiency, driven by environmental concerns and rising electricity costs, mandates the adoption of advanced power topologies utilizing SiC and GaN materials, thereby stimulating market innovation and growth in charger component manufacturing.

However, market growth faces notable restraints, particularly the fragmented regulatory landscape across different regions concerning charging standards (e.g., CCS, CHAdeMO, NACS), which creates interoperability challenges and hinders global standardization efforts. Technical limitations related to thermal dissipation during high-power charging remain a critical bottleneck; excessive heat severely limits charging speed and reduces battery life, requiring expensive and complex liquid cooling solutions. Furthermore, the semiconductor supply chain volatility, although improving, continues to pose risks to mass production targets, especially for high-voltage, high-frequency components essential for modern fast chargers. Addressing these restraints requires coordinated industry collaboration and substantial investment in materials science and thermal engineering research.

Segmentation Analysis

The Battery Chargers Market is segmented across multiple dimensions, reflecting the diversity of battery chemistries, application environments, and technological sophistication required by modern rechargeable systems. Key segmentation categories include charger type (e.g., portable vs. stationary, smart vs. conventional), charging technology (wired, wireless), battery chemistry (Lithium-ion dominating, but Lead-acid and Nickel-based remaining relevant), and application (automotive, consumer electronics, industrial). This granular segmentation is essential for understanding market dynamics, as consumer electronics demand compact, fast, low-power solutions, while the automotive sector requires high-voltage, high-current, grid-interactive systems. The fastest-growing segments are typically aligned with the electrification trends, specifically smart DC fast chargers and advanced BMS-integrated solutions for Lithium-ion batteries used in mobility applications.

The critical element in segmentation analysis involves recognizing the growing premium placed on smart charging capabilities across all segments. Smart chargers, which utilize communication protocols like CAN bus, Wi-Fi, or Bluetooth, offer diagnostics, remote control, and integration with broader energy management systems (EMS). This convergence drives value, especially in commercial and fleet operations where optimization of charging schedules based on electricity tariffs and operational needs is paramount. Furthermore, the rise of specialized chargers, such as ruggedized units for military or construction environments, indicates a move toward highly specialized product offerings that command premium pricing due to enhanced durability, ingress protection, and sophisticated power conditioning features tailored to harsh conditions.

- Type: Smart Chargers, Conventional Chargers, High-Frequency Chargers, Multi-port Chargers, Portable Chargers.

- Technology: Wired Charging, Wireless Charging (Inductive, Resonant).

- Application: Automotive (EVs, e-bikes), Consumer Electronics (Smartphones, Laptops, Wearables), Industrial (Forklifts, UPS, Robotics), Medical Devices, Energy & Utility (ESS).

- Battery Type: Lithium-Ion (Li-ion), Lead-Acid, Nickel-based (NiMH, NiCd), Flow Batteries, Solid-State Batteries.

- Power Output: Low Power (<100W), Medium Power (100W–1kW), High Power (>1kW).

Value Chain Analysis For Battery Chargers Market

The Battery Chargers Market value chain begins with the upstream segment, encompassing the raw material suppliers, predominantly specializing in advanced semiconductors (SiC, GaN), passive components (capacitors, inductors, transformers), and integrated circuit (IC) manufacturers responsible for control chips and microcontrollers. Efficiency and cost optimization at this stage are heavily reliant on geopolitical stability and the availability of rare earth materials. Key activities here include rigorous material sourcing, precision manufacturing of power conversion components, and the design of high-density power modules, establishing the foundational performance characteristics of the final product. Strong partnerships with Tier 1 semiconductor suppliers are critical for charger manufacturers to secure component allocation and implement the latest energy-efficient topologies.

The midstream phase involves the core charger manufacturing and assembly process, where Original Equipment Manufacturers (OEMs) design, test, and assemble the final charging units. This stage involves complex thermal management engineering, firmware development (including AI/ML integration), and compliance testing for various safety and electromagnetic compatibility (EMC) standards (e.g., UL, CE, FCC). Distribution channels are multifaceted, ranging from direct sales to large institutional buyers (e.g., automotive manufacturers, fleet operators) to indirect channels such as wholesale distributors, specialized electronics retailers, and e-commerce platforms for consumer products. The rise of sophisticated charging infrastructure requires specialized installers and maintenance providers, often forming partnerships with charger manufacturers to offer end-to-end solutions.

The downstream segment focuses on the end-user application and post-sales services. Direct distribution is common for high-value industrial and EV charging systems, often requiring personalized consultation and custom installation services. Indirect channels dominate the high-volume consumer electronics market, utilizing global retail networks and online marketplaces optimized for rapid fulfillment and competitive pricing. Post-sales service, including warranty support, software updates, and maintenance contracts, is increasingly important, particularly for networked smart chargers, influencing customer loyalty and brand reputation significantly. Optimization across the entire value chain is focused on reducing energy loss during conversion, speeding up time-to-market for new standards, and ensuring cybersecurity integrity for connected devices.

Battery Chargers Market Potential Customers

The Battery Chargers Market serves an extremely broad and diverse customer base, categorized primarily by their application domain and power requirements. The most significant end-user segment is the Automotive industry, which includes major Electric Vehicle Manufacturers (OEMs), automotive parts suppliers (Tier 1), and increasingly, public and private charging infrastructure operators who purchase and deploy Level 2 AC and DC fast charging stations globally. Following this, the Consumer Electronics sector represents a massive volume segment, consisting of device manufacturers (smartphones, tablets, laptops, wearables) who either bundle chargers or rely on aftermarket sales to service their product ecosystems, demanding adherence to fast-charging standards like USB PD.

Furthermore, critical institutional buyers exist within the Industrial and Energy & Utility sectors. Industrial customers include large logistics firms, manufacturing plants utilizing electric material handling equipment (e.g., forklifts, AGVs), and firms requiring robust Uninterruptible Power Supplies (UPS) and battery backup systems, all demanding durable, high-cycle chargers. Energy & Utility companies purchase advanced battery chargers for integration into large-scale grid storage solutions (ESS) and smart grid infrastructure, requiring complex communication and synchronization capabilities. Medical device manufacturers also constitute a niche but high-value segment, prioritizing reliability, safety, and certification for chargers used in life-critical portable and implanted devices, often requiring specialized low-leakage designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 31.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Delta Electronics, Inc., ChargePoint Holdings, Inc., TDK Corporation, Panasonic Corporation, LG Electronics, Samsung SDI, Tesla, General Electric (GE), Exide Technologies, ACME Portable Machines, Inc., Salcomp Plc, Bel Fuse Inc., Eaton Corporation, Infineon Technologies AG, Texas Instruments Incorporated, Huawei Technologies Co., Ltd., Eberspächer Group, Robert Bosch GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Battery Chargers Market Key Technology Landscape

The technological landscape of the Battery Chargers Market is rapidly evolving, driven primarily by the need for higher power density, increased efficiency, and reduced charging times. A foundational shift involves the transition from traditional silicon (Si) power semiconductors to wide-bandgap materials, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN). SiC and GaN components allow for much higher switching frequencies, which dramatically reduces the size of passive components (inductors and capacitors), resulting in smaller, lighter, and more efficient chargers, particularly crucial for high-power DC fast charging stations (Level 3) and compact consumer adapters. This technological adoption enables greater thermal stability and lower energy losses during the conversion process, directly addressing the restraint of heat generation during fast charging.

Another pivotal technology area is the implementation of advanced power factor correction (PFC) topologies, such as totem-pole PFC, and resonant converter architectures (LLC and Phase-Shifted Full-Bridge). These sophisticated topologies ensure the charger draws power from the grid efficiently and minimizes harmonic distortion, adhering to stringent grid stability regulations. Crucially, the growth of wireless charging technology, utilizing inductive and resonant coupling, is transforming how consumer electronics and even commercial vehicles (e.g., buses) are powered. While still facing efficiency challenges compared to wired charging, the convenience and robustness of wireless solutions are propelling innovation in coil design, frequency management, and foreign object detection (FOD) capabilities.

Furthermore, the integration of intelligent Battery Management Systems (BMS) with the charging control unit represents a major technological advancement. Modern chargers communicate bidirectional data with the battery pack’s BMS, allowing for precise monitoring of individual cell voltage, temperature, and State of Charge (SOC). This tight integration, often utilizing CAN or similar protocols, ensures charging is always optimized according to the battery’s real-time condition, which is a significant factor in promoting battery longevity and preventing thermal runaway events. The incorporation of secure communication modules is also vital, facilitating Over-the-Air (OTA) firmware updates, remote diagnostics, and V2G functionalities, transforming the charger into an active grid asset rather than merely a unidirectional power supply device.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for battery chargers, primarily due to the region's immense manufacturing base for consumer electronics and its aggressive leadership in electric mobility. Countries like China, South Korea, and Japan dominate the production of Lithium-ion batteries and related charging equipment. Government mandates and massive infrastructure investments in China—the world's largest EV market—drive unprecedented demand for both AC and DC fast charging solutions. The rapid urbanization and increasing disposable income across Southeast Asian nations further fuel the high volume demand for portable chargers and power banks.

- North America: North America exhibits significant growth, particularly in the high-power segment, driven by the rollout of federal and state initiatives (such as the NEVI program in the U.S.) aimed at electrifying transportation corridors. The region is characterized by a strong focus on smart, interconnected charging infrastructure (Level 2 and DC fast charging) and adherence to strict safety standards (UL certification). Key growth drivers include the commercial fleet electrification and the growing requirement for residential smart home energy management systems integrated with EV chargers.

- Europe: Europe is a highly mature market characterized by stringent environmental regulations and ambitious targets for phasing out internal combustion engine (ICE) vehicles. This drives sustained demand for reliable, grid-friendly chargers capable of V2G integration. Northern and Western European countries lead in the adoption of standardized charging infrastructure and focus heavily on high-efficiency, sustainable charging solutions. The EU's focus on standardized Type 2 and CCS connectors ensures a relatively homogenous market but necessitates high interoperability among different charger brands and vehicle models.

- Latin America (LATAM): The LATAM market is in an nascent stage of development but shows substantial potential, particularly in metropolitan areas like Brazil and Mexico. Growth is concentrated in the e-bus and commercial fleet segments, with initial investments in DC fast charging infrastructure focused along key logistical routes. Market expansion is currently constrained by varying regulatory frameworks and the need for significant capital investment in electrical grid upgrades to support widespread high-power charging.

- Middle East and Africa (MEA): The MEA region presents unique challenges and opportunities. Growth is concentrated in the Gulf Cooperation Council (GCC) nations, driven by government diversification strategies away from oil and into smart city projects. These projects necessitate advanced charging solutions for planned public transit and luxury EV adoption. South Africa leads the African market, focusing on solar-integrated charging solutions to mitigate unstable grid supply, highlighting the demand for specialized, off-grid compatible chargers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Battery Chargers Market, spanning semiconductor providers, dedicated charger manufacturers, and diversified industrial conglomerates integrating charging solutions into their product portfolios.- ABB Ltd.

- Siemens AG

- Delta Electronics, Inc.

- ChargePoint Holdings, Inc.

- TDK Corporation

- Panasonic Corporation

- LG Electronics

- Samsung SDI

- Tesla

- General Electric (GE)

- Exide Technologies

- ACME Portable Machines, Inc.

- Salcomp Plc

- Bel Fuse Inc.

- Eaton Corporation

- Infineon Technologies AG

- Texas Instruments Incorporated

- Huawei Technologies Co., Ltd.

- Eberspächer Group

- Robert Bosch GmbH

Frequently Asked Questions

Analyze common user questions about the Battery Chargers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of high-power DC fast chargers?

The primary driver is the accelerating global transition to electric vehicles (EVs), particularly high-end models equipped with 800V battery architectures. High-power DC fast chargers (Level 3) are essential because they reduce EV charging times significantly, directly addressing consumer range anxiety and making long-distance EV travel feasible, which is crucial for infrastructure viability.

How do SiC and GaN materials influence the future of battery charger design?

Silicon Carbide (SiC) and Gallium Nitride (GaN) are wide-bandgap semiconductors that enable power electronics to operate at much higher switching frequencies and temperatures than traditional silicon. This allows manufacturers to design chargers that are significantly smaller, lighter, and possess superior energy efficiency, optimizing power density critical for compact consumer adapters and high-capacity EV charging stations.

What are the main risks associated with using conventional battery chargers for advanced Lithium-ion batteries?

Conventional chargers often use fixed charging profiles that do not adapt to the battery’s real-time State of Health (SOH) or temperature. This lack of intelligence increases the risk of overcharging, excessive heat generation, and uneven cell balancing, ultimately leading to accelerated battery degradation, reduced lifespan, and potential safety hazards such as thermal runaway.

What role does Vehicle-to-Grid (V2G) technology play in the Battery Chargers Market?

V2G technology transforms the EV charger into a bidirectional energy flow device, allowing the battery to store energy from the grid when electricity is cheap and return surplus energy to the grid during peak demand periods. This capability necessitates advanced smart chargers with robust communication protocols and power conversion systems, positioning chargers as vital components in future smart energy grids and creating new revenue streams for owners.

Which segment of the Battery Chargers Market is projected to see the highest growth rate?

The Smart Charger segment, particularly those integrated with advanced Battery Management Systems (BMS) and optimized for Lithium-ion chemistry, is projected to witness the highest growth. This growth is driven by the automotive sector’s need for intelligent, reliable charging that maximizes battery longevity and integrates seamlessly with sophisticated energy management and remote diagnostic systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Solar Battery Chargers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Pulse Battery Chargers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Battery Chargers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Car Battery Chargers Market Size Report By Type (Smart/Intelligent Chargers, Float Chargers, Trickle Chargers), By Application (Electric/Hybrid Car Battery Chargers, Conventional Chargers), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Industrial Battery Chargers Market Statistics 2025 Analysis By Application (Utilities & Telecommunications, Manufacturing, Transportation, Other Application), By Type (Intelligent Battery Chargers, Float Battery Chargers, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager