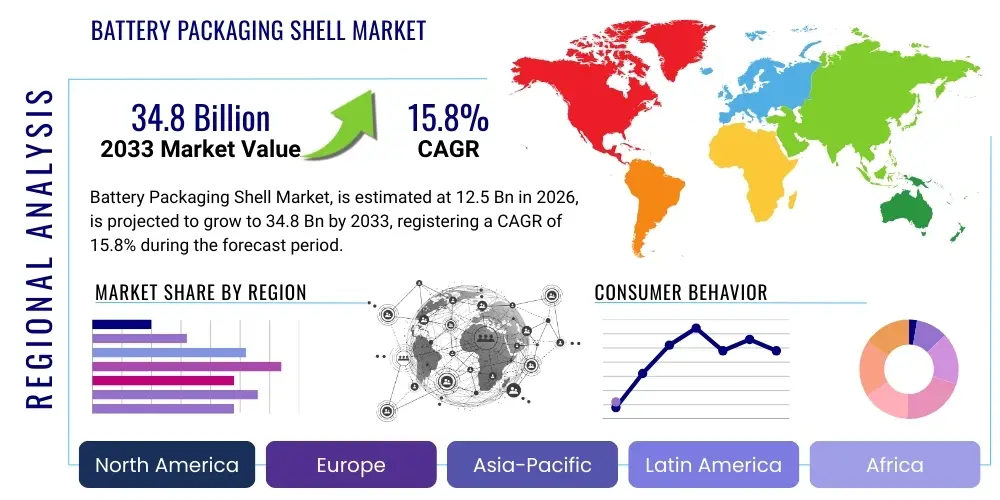

Battery Packaging Shell Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443014 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Battery Packaging Shell Market Size

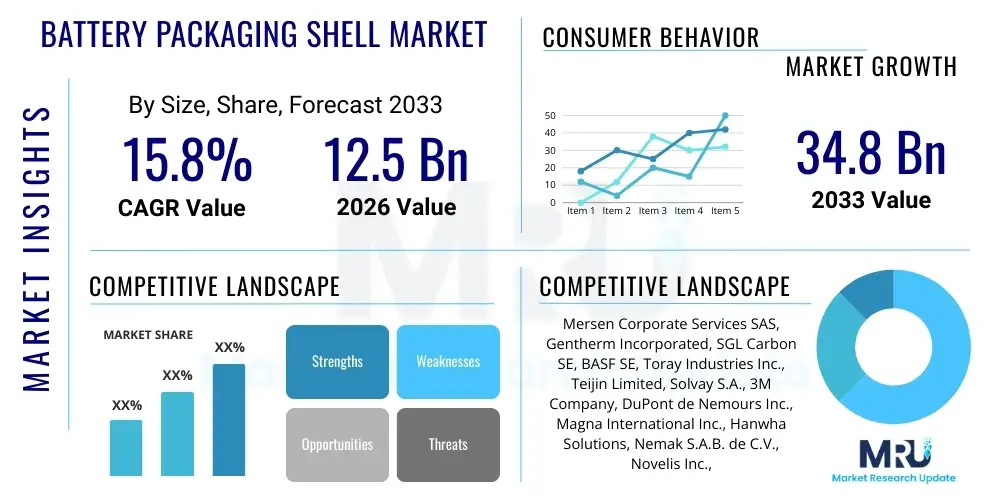

The Battery Packaging Shell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 34.8 Billion by the end of the forecast period in 2033.

Battery Packaging Shell Market introduction

The Battery Packaging Shell Market encompasses the design, manufacturing, and distribution of protective enclosures necessary for lithium-ion and other advanced battery systems, primarily utilized in electric vehicles (EVs), renewable energy storage systems (ESS), and high-power portable electronics. These shells, often constructed from materials such as aluminum, steel, and high-strength plastics, serve critical functions including mechanical protection against impact, thermal management, and prevention of fire propagation. The robust demand for sustainable energy solutions and the global shift toward electrification in transportation are the foundational drivers expanding this specialized industrial segment. Effective packaging is paramount for ensuring battery longevity, safety compliance, and optimal performance under various operational conditions.

A battery packaging shell, often referred to as a battery module or pack housing, integrates several key components: the structural casing, cooling plates, insulating materials, and necessary sealing mechanisms. Product descriptions vary significantly based on the application; for EVs, shells are large, complex structures engineered to withstand vehicle crashes while maintaining strict thermal control via integrated cooling channels. Major applications span across passenger electric vehicles, commercial buses and trucks, grid-scale energy storage facilities supporting solar and wind farms, and specialized industrial equipment requiring reliable power sources. The increasing energy density of modern batteries necessitates increasingly sophisticated shell designs to manage resultant heat and volume expansion pressures efficiently.

The primary benefits derived from advanced battery packaging shells include enhanced safety through thermal runaway prevention, improved structural integrity contributing to longer battery life, and superior dust and water resistance (meeting high IP ratings). Driving factors for market growth include stringent government mandates promoting zero-emission vehicles, massive investments in renewable energy infrastructure requiring large-scale ESS installations, and continuous material science innovation that allows for lighter yet stronger shell designs, directly impacting vehicle range and efficiency. Furthermore, standardization efforts across major automotive original equipment manufacturers (OEMs) regarding battery module sizes are influencing mass production capabilities and cost reduction within the packaging shell supply chain.

Battery Packaging Shell Market Executive Summary

The Battery Packaging Shell Market is experiencing robust expansion fueled primarily by the exponential growth of the global electric vehicle sector and critical needs arising from grid modernization through energy storage systems (ESS). Business trends highlight a strong industry focus on lightweighting, driven by the shift from traditional steel enclosures to advanced aluminum alloys and fiber-reinforced plastics to improve power-to-weight ratios in EV applications. Strategic mergers, acquisitions, and joint ventures between specialized material suppliers and battery pack integrators are becoming commonplace, aimed at establishing vertical integration and securing stable supply chains for high-quality, durable casing solutions. Furthermore, increasing regulatory pressure regarding battery safety and recyclability mandates the adoption of modular designs and easily separable materials, significantly influencing current manufacturing processes and R&D expenditure.

Regionally, the Asia Pacific (APAC) dominates the market landscape, primarily due to the established and rapidly expanding EV manufacturing bases in China, South Korea, and Japan, coupled with substantial government support for domestic battery production capabilities. Europe is emerging as the fastest-growing region, stimulated by ambitious decarbonization goals, significant investments in Gigafactories across the continent, and consumer demand for premium electric vehicles which often incorporate sophisticated, high-performance battery packaging. North America, driven by mandates like the Inflation Reduction Act (IRA), is witnessing a surge in localized battery supply chain development, focusing heavily on robust, domestically produced packaging solutions for heavy-duty electric trucks and utility-scale storage projects.

Segmentation trends reveal that metal enclosures, particularly those utilizing aluminum, currently hold the largest market share due to their superior thermal conductivity, crash resilience, and well-established manufacturing techniques. However, the composite and plastics segment is projected to exhibit the highest CAGR, spurred by continuous advancements in thermoplastic and thermoset materials that offer lower weight, enhanced customization possibilities, and inherent insulation properties, crucial for thermal management challenges. Among applications, the Electric Vehicles segment remains the undisputed leader, though the stationary Energy Storage Systems segment is rapidly gaining ground, demanding specialized, large-format packaging solutions optimized for long-duration durability and harsh environmental conditions.

AI Impact Analysis on Battery Packaging Shell Market

Common user inquiries regarding AI's influence on the Battery Packaging Shell Market frequently revolve around topics such as optimized material selection, predictive thermal stress analysis, automated quality control in manufacturing, and supply chain resilience. Users are keen to understand how artificial intelligence can move beyond simple data analysis to actively guide the design process, specifically in modeling complex thermal dissipation pathways and predicting structural failure points under extreme mechanical stress, thereby reducing lengthy physical prototyping cycles. A recurring concern is the adoption cost and the required skill upgrade for integrating AI-driven simulation tools into traditional sheet metal forming or composite fabrication processes. Key expectations center on AI’s ability to minimize material waste, accelerate time-to-market for new battery pack designs, and ensure compliance with ever-tightening international safety standards by rigorously simulating fault conditions before manufacturing commencement.

- AI-driven topology optimization facilitates the creation of lighter yet structurally sound packaging designs by simulating stress distributions and recommending material reductions in non-critical areas.

- Machine learning algorithms enhance thermal management systems by predicting localized hot spots within the battery pack, optimizing the placement and flow of integrated cooling channels within the shell structure.

- Predictive maintenance analytics, powered by AI, monitor the structural integrity of deployed battery shells in real-time, forecasting potential fatigue or corrosion issues based on operational data.

- Computer vision and automated inspection systems utilize AI to perform high-speed, accurate defect detection during the welding, sealing, and assembly phases of packaging shell manufacturing, significantly boosting quality control.

- AI optimizes the global supply chain for raw materials (aluminum, composites) by predicting price fluctuations, assessing geopolitical risks, and dynamically adjusting sourcing strategies to ensure manufacturing continuity.

DRO & Impact Forces Of Battery Packaging Shell Market

The Battery Packaging Shell Market is propelled by substantial technological innovation and regulatory pressures, counterbalanced by inherent challenges related to material costs and design complexity. Key drivers include the exponential increase in EV adoption globally, demanding millions of protective casings annually, and extensive global investments in stationary energy storage projects requiring large, robust shell solutions. Restraints largely center around the volatility of critical raw material prices, particularly aluminum and specialized composites, alongside the significant tooling and capital expenditure required to set up high-precision manufacturing lines necessary to meet stringent automotive standards. Opportunities are abundant in the development of modular and platform-agnostic packaging designs, recyclable material integration, and the application of advanced manufacturing techniques like high-pressure die casting and additive manufacturing to reduce weight and cost simultaneously. These forces collectively dictate the market trajectory, emphasizing safety, efficiency, and scalability as core metrics for success.

Drivers: Global government mandates promoting EV sales and infrastructure development provide a foundational growth stimulus. Continuous technological improvements in battery energy density necessitate increasingly advanced thermal management solutions, directly driving demand for sophisticated shell designs with integrated cooling features. Furthermore, growing consumer awareness regarding battery safety and performance resilience incentivizes OEMs to invest in premium, high-integrity packaging solutions that offer superior protection against thermal events and mechanical shock.

Restraints: High initial investment costs associated with advanced manufacturing equipment, such as large-scale robotic welding systems and specialized tooling for composite shells, pose a significant barrier to entry. The complex interplay between different safety regulations (e.g., UN 38.3, ECE R100) across various regions complicates the standardization of shell designs, leading to fragmented production runs and higher unit costs. Furthermore, the challenge of designing shells that are lightweight, cost-effective, and still meet extreme crash safety standards often involves difficult trade-offs.

Opportunities: The push towards developing sustainable and circular economy models presents a major opportunity for companies innovating in recyclable composite materials and easily disassemblable packaging architectures, facilitating end-of-life recycling. The rapidly expanding market for large-scale grid energy storage offers a new, high-volume application segment requiring specialized, high-durability shell solutions optimized for long service life in outdoor environments. Moreover, the integration of smart features, such as embedded sensors for real-time structural health monitoring, represents a high-value differentiation opportunity.

Impact Forces: The overarching impact force is the necessity for safety, driven by high-profile thermal incidents in EV and ESS applications, which mandates continuous improvement in shell fire retardation and structural integrity. Material science advancements, particularly in composite technology and specialized aluminum alloys, directly influence the cost-weight-strength dynamic, acting as a crucial internal market pressure point. Finally, global regulatory harmonization efforts, while slow, will eventually impact global sourcing and production strategies, favoring scalable, standardized packaging solutions adaptable across multiple geographical markets.

Segmentation Analysis

The Battery Packaging Shell Market is comprehensively segmented based on material type, design type, battery type, form factor, and application, reflecting the diverse requirements across the electric mobility and energy storage landscapes. Material segmentation is crucial as it dictates the thermal, structural, and weight characteristics of the final product, ranging from heavy-duty steel to ultra-lightweight advanced composites. Design type segmentation distinguishes between conventional single-piece housings and modern modular systems, which are favored for repairability and easier scalability. Application diversity, ranging from small electronic devices to massive utility-scale ESS, necessitates varied sizes and specifications, making this segmentation axis particularly important for strategic market targeting and capacity planning by manufacturers.

The material segment continues to be dominated by metals, specifically aluminum alloys, owing to their excellent combination of high strength-to-weight ratio and superior thermal conductivity, which is essential for effective battery cooling. However, plastics and composite materials are quickly gaining traction, driven by their lightweight properties, inherent corrosion resistance, and simplified integration of complex geometries through processes like injection molding. The application segment sees Electric Vehicles (EVs) accounting for the vast majority of market revenue, propelled by mass production scaling. Nonetheless, the rapid deployment of stationary Energy Storage Systems (ESS) is shifting market dynamics, demanding larger, highly customized enclosures that prioritize durability and long-term environmental protection over strict weight constraints.

Segmentation by form factor reveals distinctions between cylindrical, prismatic, and pouch cell configurations, where each requires uniquely tailored packaging shells optimized for space utilization and mechanical constraint. Prismatic and pouch cell packaging shells are generally more complex due to their rectangular form factor and flexible cell arrangements, often requiring customized internal structures for compression management. Understanding these fine-grained segmentations allows market participants to refine their product portfolios, focusing on specialized solutions that meet the demanding performance criteria of high-growth niches, thereby maximizing profitability and ensuring compliance with evolving technical standards.

- By Material Type:

- Aluminum

- Steel

- Composites (Fiber-Reinforced Plastics)

- Plastics (Polypropylene, Polycarbonate)

- By Design Type:

- Conventional (Single-Piece Casing)

- Modular/Segmented

- By Battery Type:

- Lithium-ion

- Nickel-Metal Hydride (NiMH)

- Lead-Acid (Used in select ESS)

- By Form Factor:

- Prismatic Cell Packaging

- Cylindrical Cell Packaging (e.g., 2170, 4680)

- Pouch Cell Packaging

- By Application:

- Electric Vehicles (EVs)

- Passenger Cars

- Commercial Vehicles (Buses, Trucks)

- Energy Storage Systems (ESS)

- Grid-Scale

- Residential/Commercial

- Portable Electronics

- Industrial Equipment

- Electric Vehicles (EVs)

Value Chain Analysis For Battery Packaging Shell Market

The value chain for the Battery Packaging Shell Market initiates with the procurement and processing of raw materials, primarily aluminum ingots, steel sheets, or specialized polymer resins and fibers (for composites). Upstream activities are dominated by large metallurgical companies and chemical suppliers who provide the specialized grades required for structural integrity and corrosion resistance. The midstream involves complex manufacturing processes, including stamping, die-casting, extrusion, hydroforming for metals, or injection molding and lay-up for composites. These processes are highly capital-intensive and require precision engineering to meet tight tolerances, especially concerning sealing surfaces and integrated cooling channels, thus requiring specialized equipment suppliers.

The downstream segment focuses on integrating the finished shell with the actual battery cells and associated electronic components, typically performed by Tier 1 automotive suppliers or dedicated battery pack assembly specialists. Distribution channels are predominantly Business-to-Business (B2B), moving the finished shells directly from manufacturers to Original Equipment Manufacturers (OEMs) or specialized battery pack builders. Direct channels are common when large OEMs establish in-house shell manufacturing capabilities or forge long-term, exclusive supply agreements with dedicated shell producers. Indirect channels involve material distributors and specialized fabrication shops that may supply smaller ESS integrators or niche vehicle manufacturers.

A critical characteristic of this value chain is the tight interdependence between the shell designer and the battery cell manufacturer, particularly in high-performance applications like EVs, where optimization of thermal management and packaging efficiency is essential. Disruptions in the upstream material supply (e.g., aluminum tariffs or rare earth shortages used in magnet materials for assembly) can severely impact downstream profitability and vehicle production schedules. The ongoing trend towards regionalization, driven by regulatory requirements and geopolitical instability, is forcing manufacturers to localize their value chain components, adding complexity but enhancing resilience against global supply shocks.

Battery Packaging Shell Market Potential Customers

The primary customers for Battery Packaging Shells are large-scale integrators and manufacturers operating within the electric mobility and static power storage domains. Foremost among these are the global Automotive Original Equipment Manufacturers (OEMs), including established players and new electric vehicle startups, such as Tesla, Volkswagen, General Motors, and BYD. These entities require millions of standardized, high-safety shells annually for passenger cars, light commercial vehicles, and heavy-duty trucks. They prioritize shells offering superior crash resistance, lightweight design, and efficient thermal integration, often negotiating multi-year, high-volume contracts to secure supply and standardize components across vehicle platforms.

Another significant customer segment comprises manufacturers of large-scale Energy Storage Systems (ESS), including utility companies, independent power producers, and specialized grid solution providers (e.g., Fluence, Tesla Energy, LG Chem ESS division). These buyers require extremely large, robust shell enclosures designed for long-term durability (20+ years) in often harsh outdoor or industrial environments. Their purchasing criteria emphasize corrosion resistance, ease of assembly and maintenance, high IP ratings, and modular scalability, often favoring steel or specialized heavy-duty aluminum designs.

Finally, industrial equipment manufacturers and producers of high-power portable electronics constitute a crucial, albeit smaller, customer base. This includes companies producing electric forklifts, construction machinery, marine propulsion systems, and high-end power tools. These buyers seek custom-designed shells that conform to specific shape constraints and operational shock/vibration requirements, often requiring smaller batch production runs and highly specialized material compositions, representing a higher-margin, specialized segment of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 34.8 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mersen Corporate Services SAS, Gentherm Incorporated, SGL Carbon SE, BASF SE, Toray Industries Inc., Teijin Limited, Solvay S.A., 3M Company, DuPont de Nemours Inc., Magna International Inc., Hanwha Solutions, Nemak S.A.B. de C.V., Novelis Inc., Constellium SE, Alcoa Corporation, VAMA, Minth Group, Aotecar New Energy Technology, Qingdao Hongda New Energy Technology, Huayu Automotive Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Battery Packaging Shell Market Key Technology Landscape

The technological landscape of the Battery Packaging Shell Market is characterized by a rapid evolution aimed at enhancing safety, reducing weight, and optimizing manufacturing efficiency. One of the most significant advancements is the utilization of advanced high-pressure die casting (HPDC) techniques, particularly for aluminum enclosures. HPDC allows manufacturers to produce large, complex structural components—often the entire shell base—in a single shot, drastically reducing the need for extensive welding and assembly. This integrated approach improves structural rigidity, reduces weight, and minimizes potential leak points, crucial for maintaining thermal integrity and sealing against environmental ingress. The adoption of gigacasting, popularized by major EV manufacturers, further exemplifies this trend toward highly integrated, minimal-part shell construction, challenging traditional multi-component stamped designs.

Material innovation represents another key technological thrust. The market is witnessing a strong movement toward hybrid materials, such as combining high-strength steel inserts in critical crash zones with lightweight aluminum or fiber-reinforced plastic (FRP) sections elsewhere. Composite technology, particularly the use of carbon fiber and glass fiber composites, is advancing rapidly, offering high strength-to-weight ratios and intrinsic thermal insulation benefits. New composite fabrication methods, including resin transfer molding (RTM) and thermoforming, are being optimized for high-volume, cost-effective production, making these formerly specialized materials accessible for mainstream EV applications. These materials are also intrinsically resistant to corrosion, enhancing battery life in adverse climates.

Furthermore, technology focused on thermal management integration is paramount. Modern packaging shells are increasingly designed with complex, integrated cooling circuits, such as snake channels or dedicated liquid cooling plates, embedded directly into the shell structure. This requires specialized welding technologies, like friction stir welding (FSW) for aluminum, which ensures leak-proof, high-integrity joints necessary for circulating coolant. The integration of advanced fire retardation systems, including intumescent coatings and specialized ceramic insulation materials placed within the shell structure, represents the cutting edge of passive safety technology, ensuring compliance with evolving standards related to preventing and mitigating thermal runaway propagation.

Regional Highlights

- Asia Pacific (APAC): APAC retains its dominant position in the global battery packaging shell market, largely driven by overwhelming production volumes in China, which leads both in EV manufacturing and domestic battery cell output. Countries like South Korea (home to major battery producers) and Japan (a hub for automotive technology) contribute significantly through specialized R&D and advanced material supply. The region benefits from robust government policies supporting electrification and established, low-cost supply chains, making it the primary hub for both high-volume production and export, particularly targeting standardized aluminum shell designs for mass-market EVs and significant residential ESS deployments.

- Europe: Europe is characterized by the fastest projected growth rate, stimulated by stringent EU emission targets and massive investments in localized battery Gigafactories across Germany, Poland, Hungary, and France. The region focuses heavily on premium and safety-critical packaging solutions, with strong demand for advanced composite materials and complex aluminum structures engineered to meet rigorous European crash test standards (Euro NCAP). Regulatory emphasis on battery lifecycle management and recycling also drives innovation in modular, easily separable shell designs, pushing European manufacturers to adopt advanced materials and processes rapidly.

- North America: Market growth in North America is accelerating dramatically, primarily fueled by supportive governmental initiatives like the Inflation Reduction Act (IRA), which incentivizes localized manufacturing of EVs and battery components. This region is witnessing substantial investment in constructing domestic shell manufacturing capacity, focusing particularly on high-durability, large-format aluminum and steel enclosures required for the growing segments of electric pickup trucks and heavy-duty commercial vehicles. Demand is heavily concentrated on solutions for large EV platforms and utility-scale grid ESS deployments, driven by renewable energy mandates across key states.

- Latin America (LATAM): The LATAM market is nascent but showing potential, primarily concentrated in Brazil and Mexico, linked to emerging local EV production and light commercial vehicle assembly. Growth is slower compared to mature markets, generally focusing on cost-effective, standard metal packaging solutions. Key development areas include adapting designs for local road conditions (which may require increased shock absorption) and supporting small-scale energy storage projects in remote or off-grid areas.

- Middle East and Africa (MEA): The MEA region is primarily focused on the deployment of grid-scale energy storage systems, vital for stabilizing power grids reliant on intermittent solar generation. Demand for packaging shells is currently centered on high-durability, climate-resilient enclosures optimized to withstand extreme heat and dust (high IP ratings). EV market penetration is lower, concentrated in urban centers like the UAE, driving niche demand for specialized packaging solutions in high-end electric mobility and localized logistics fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Battery Packaging Shell Market.- Mersen Corporate Services SAS

- Gentherm Incorporated

- SGL Carbon SE

- BASF SE

- Toray Industries Inc.

- Teijin Limited

- Solvay S.A.

- 3M Company

- DuPont de Nemours Inc.

- Magna International Inc.

- Hanwha Solutions

- Nemak S.A.B. de C.V.

- Novelis Inc.

- Constellium SE

- Alcoa Corporation

- VAMA

- Minth Group

- Aotecar New Energy Technology

- Qingdao Hongda New Energy Technology

- Huayu Automotive Systems

Frequently Asked Questions

Analyze common user questions about the Battery Packaging Shell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are predominantly used for high-performance battery packaging shells?

The predominant materials are high-strength aluminum alloys (for superior heat dissipation and weight reduction), steel (for robust crash protection and cost-effectiveness in specific zones), and advanced fiber-reinforced composites (for optimal lightweighting and inherent thermal insulation in premium applications).

How does the packaging shell influence battery thermal management?

The packaging shell is critical for thermal management as it integrates the cooling system. Aluminum shells provide excellent conductivity to draw heat away from cells, while modern designs incorporate complex internal cooling plates and channels for precise temperature regulation, preventing thermal runaway and maximizing battery lifespan.

What is the primary driver of growth in the Battery Packaging Shell Market?

The single largest driver is the exponential global adoption and subsequent mass production of electric vehicles (EVs), which requires millions of highly engineered, crash-resistant, and thermally optimized battery enclosures annually to meet production quotas and safety mandates.

Are composite battery shells a cost-effective alternative to aluminum?

While the initial material cost of advanced composites can be higher than standard aluminum, composites offer total system cost savings through reduced component count (part consolidation), lighter vehicle weight (improving efficiency), and often simpler manufacturing processes like injection molding for complex geometries, balancing the overall cost equation.

What role do safety regulations play in battery shell design?

Safety regulations (such as ECE R100 and various UL standards) critically define shell design parameters, mandating high levels of mechanical integrity, resistance to external impacts, and the ability to contain and mitigate the spread of fire or thermal runaway events, necessitating specific internal structures and fire-resistant materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager