Battery Pasting Papers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442018 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Battery Pasting Papers Market Size

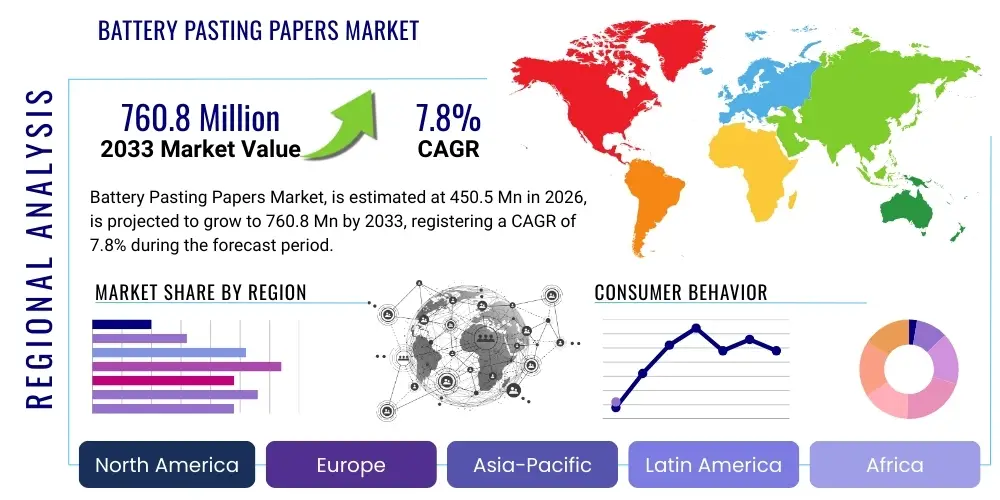

The Battery Pasting Papers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 760.8 Million by the end of the forecast period in 2033.

Battery Pasting Papers Market introduction

Battery pasting papers, often referred to as battery separators or non-woven papers, are specialized materials primarily utilized in lead-acid battery manufacturing. These papers serve a critical function by facilitating the curing process of the lead oxide paste onto the grids, ensuring uniform distribution, preventing material shedding during handling, and contributing significantly to the structural integrity and operational longevity of the battery plates. They are essential for both flooded and valve-regulated lead-acid (VRLA) batteries, including Start-Stop systems and deep-cycle applications. The core product characteristic involves high porosity, adequate tensile strength, and superior resistance to sulfuric acid and elevated temperatures, which are necessary conditions within the battery environment.

The major applications of battery pasting papers span across automotive, industrial, and telecommunication sectors. In the automotive industry, they are indispensable for Starter, Lighting, and Ignition (SLI) batteries, particularly those utilizing advanced technologies such as Enhanced Flooded Batteries (EFB) and Absorbed Glass Mat (AGM) systems, which require robust plate protection. Industrial applications include large-scale backup power systems, forklifts, and uninterrupted power supply (UPS) units, where reliability and cycle life are paramount. The benefit derived from using high-quality pasting paper includes reduced short-circuits caused by plate shedding, improved acid stratification control, and ultimately, enhanced battery performance and extended service life, which directly addresses consumer demand for durable energy storage solutions.

Market growth is predominantly driven by the escalating global demand for lead-acid batteries, particularly in emerging economies where automotive production and infrastructure development are surging. Furthermore, regulatory shifts favoring stricter emission standards and the increasing adoption of micro-hybrid and electric vehicles (EVs) are stimulating demand for advanced battery types like EFB and AGM, thereby accelerating the need for high-performance pasting papers. The resilience and cost-effectiveness of lead-acid battery technology, combined with ongoing innovations in paper material science to improve acid resistance and mechanical strength, solidify the market's positive trajectory despite competition from lithium-ion technologies in certain sectors.

Battery Pasting Papers Market Executive Summary

The Battery Pasting Papers Market is poised for substantial expansion, underpinned by robust growth in the automotive sector and sustained industrial demand for reliable backup power solutions. Key business trends indicate a strong focus on material innovation, specifically the development of non-woven fabrics with enhanced porosity and greater resistance to electrolyte attack, tailored for high-drain applications such such as those found in modern micro-hybrid vehicles. Manufacturers are increasingly investing in proprietary coating technologies and material blends (e.g., combinations of polyester, glass fibers, and synthetic pulp) to differentiate their products based on performance metrics like reduced electrical resistance and improved pasting efficiency. Furthermore, strategic collaborations between raw material suppliers, paper converters, and major battery manufacturers are becoming commonplace to optimize the supply chain and ensure product consistency across global production facilities.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by the massive scale of automotive manufacturing in China, India, and Southeast Asian nations, coupled with high demand for batteries in telecommunications infrastructure and renewable energy storage projects. North America and Europe demonstrate mature market dynamics, characterized by stringent quality standards and a higher rate of adoption of advanced battery technologies (AGM, EFB) due to stringent environmental regulations and the prevalence of sophisticated vehicle architectures. These mature markets prioritize premium pasting papers that contribute directly to improved fuel efficiency and lower total cost of ownership (TCO). Emerging markets in Latin America and the Middle East & Africa (MEA) are also experiencing steady growth, linked to urbanization and increased vehicle parc size, although price sensitivity remains a key factor influencing purchasing decisions in these regions.

Segment trends reveal that the Glass Fiber material segment is growing rapidly, largely due to its superior acid resistance and mechanical properties, making it ideal for the demanding environments of VRLA and AGM batteries. Concurrently, the application segment focused on EV/HEV auxiliary systems (which often utilize 12V lead-acid batteries for safety and start-stop functions) is exhibiting the fastest growth rate, surpassing traditional SLI applications in terms of relative expansion, driven by the overall shift toward vehicle electrification. The market is also seeing a trend toward thinner pasting papers, which allows battery designers to maximize energy density while maintaining adequate mechanical protection for the plates. This push for efficiency and miniaturization is forcing pasting paper manufacturers to refine their production processes and quality control measures significantly.

AI Impact Analysis on Battery Pasting Papers Market

Common user questions regarding AI's impact on the Battery Pasting Papers Market often center on how AI can optimize manufacturing processes, predict material failures, and accelerate R&D for next-generation separators. Key themes that emerge include the potential for AI-driven predictive maintenance in battery plants, the role of machine learning in refining non-woven material formulations for better performance (e.g., optimal fiber distribution and porosity), and the integration of AI-powered quality control systems to ensure uniformity in pasting paper thickness and integrity. Users expect AI to minimize waste, improve manufacturing throughput, and ultimately contribute to the creation of more reliable and cost-effective battery components, thereby maintaining the competitiveness of lead-acid solutions against alternatives like lithium-ion.

- AI optimizes manufacturing parameters, reducing material defects and increasing the uniformity of the pasting paper structure.

- Predictive maintenance algorithms deployed in battery assembly lines minimize downtime associated with pasting paper feeding or processing errors.

- Machine learning accelerates the R&D process by simulating the long-term chemical and mechanical degradation of different paper materials under varying electrolyte conditions.

- AI-driven quality control systems utilize computer vision to detect microscopic flaws and inconsistencies in the paper web in real-time.

- Supply chain management benefits from AI forecasting, ensuring just-in-time inventory of specialized raw materials, such as specific cellulose or glass fibers.

DRO & Impact Forces Of Battery Pasting Papers Market

The dynamic interplay of drivers, restraints, and opportunities fundamentally shapes the trajectory of the Battery Pasting Papers Market. A primary driver is the pervasive, indispensable role of lead-acid batteries globally, particularly in the automotive and backup power sectors, coupled with their inherent cost advantage over advanced chemistries. The continuous innovation in lead-acid battery design, such as the growing prominence of EFB and AGM technologies required for modern vehicle hybridization and high performance, necessitates superior pasting paper quality and specification, thus boosting premium segment growth. Conversely, significant restraints include the environmental concerns associated with lead toxicity, stringent regulatory hurdles regarding recycling and production processes, and the increasing competitive pressure exerted by lithium-ion batteries in stationary storage and electric vehicle propulsion, which could potentially cap long-term growth in traditional applications.

Opportunities for market players are largely concentrated in developing specialized papers that can withstand the intense thermal cycling and high depth-of-discharge common in renewable energy storage systems (e.g., solar and wind applications utilizing deep-cycle lead-acid batteries). Furthermore, geographical expansion into rapidly industrializing regions of Asia and Africa, where vehicle ownership and infrastructure projects are accelerating, presents significant market access opportunities. The impact forces acting upon the market include technological advancements, such as the shift towards lighter and thinner materials without compromising tensile strength, and macroeconomic forces like fluctuating commodity prices (e.g., specialized pulp and synthetic fiber costs), which directly affect the profitability and pricing strategies of pasting paper manufacturers. Successful navigation of these forces requires continuous material science research and strategic long-term supply agreements.

The market also experiences inherent cyclicality tied to the automotive replacement cycle and industrial capital expenditure. While the replacement market provides stable demand, volatility in new vehicle sales in major economic zones can temporarily dampen growth. The high cost of R&D required to meet highly specialized specifications for advanced batteries, such as papers with extremely tight thickness tolerances and optimized permeability for faster charging, also acts as a restraint for smaller manufacturers. However, the sustained need for reliable, cost-effective, and robust energy storage in essential services like telecommunications and data centers ensures a baseline stability for the industrial application segment of the pasting paper market, buffering against fluctuations in the passenger vehicle sector.

Segmentation Analysis

The Battery Pasting Papers Market is meticulously segmented based on key differentiators including the material composition, the thickness of the paper, the specific battery application, and geographical region. Material segmentation is crucial as it determines the chemical resistance, mechanical strength, and cost profile of the product, with cellulose-based papers typically serving standard SLI applications, while superior materials like glass fiber or advanced synthetic blends are reserved for high-performance VRLA and AGM batteries. Thickness segmentation directly relates to the required energy density and plate spacing, with thinner papers gaining prominence in compact, high-output designs. Application-based segmentation reflects the primary end-use sectors, ensuring that product properties meet the specific operational demands of automotive, industrial, or specialized deep-cycle systems.

- Material:

- Cellulose Fiber Pasting Paper

- Glass Fiber Pasting Paper (GFPP)

- Synthetic Fiber Blends (e.g., Polyester/PP)

- Thickness:

- Below 0.15 mm

- 0.15 mm to 0.25 mm

- Above 0.25 mm

- Application:

- SLI (Starting, Lighting, and Ignition) Batteries

- Industrial Batteries (Forklifts, Motive Power)

- Standby/Stationary Batteries (UPS, Telecom)

- Specialized Deep Cycle Applications

- Electric Vehicle (EV) and Hybrid Electric Vehicle (HEV) Auxiliary Systems (EFB/AGM)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Battery Pasting Papers Market

The value chain for the Battery Pasting Papers Market commences with the upstream supply of specialized raw materials, including bleached sulfate pulp, synthetic polymers like polyester and polypropylene, and high-purity glass microfibers. Manufacturers of these pasting papers operate sophisticated non-woven production lines, requiring precision machinery for web formation, saturation, drying, and surface treatment to achieve the required chemical stability and mechanical specifications. Key upstream factors determining cost and quality include the availability and pricing of specific chemical treatments necessary for acid resistance and the technological expertise required to handle delicate microfibers, which constitutes a significant entry barrier for new players. Strong relationships with high-quality raw material suppliers are paramount to maintaining a competitive edge and ensuring consistent product output that meets stringent battery manufacturer specifications.

The midstream involves the core manufacturing process, where paper mills convert raw fibers into finished pasting paper rolls. This stage involves complex quality control checks for parameters such as permeability, thickness tolerance, porosity, and tensile strength. The distribution channel predominantly utilizes direct sales and long-term supply contracts, particularly when dealing with large, multinational battery producers such as Johnson Controls (Clarios), Exide Technologies, and GS Yuasa. Indirect channels are less common but may involve specialized industrial distributors or agents who cater to smaller regional battery assemblers. Efficiency in logistics is critical, given the need to deliver large, bulky rolls of material to geographically dispersed battery manufacturing plants globally, necessitating robust inventory management systems.

The downstream analysis focuses on the integration of the pasting paper into the final product—the lead-acid battery. Battery manufacturers are the primary consumers, utilizing the paper during the pasting and curing stages of plate production. The performance of the pasting paper directly impacts the efficiency of the assembly line (e.g., machine speed compatibility) and the ultimate quality and lifespan of the battery. Therefore, paper selection is a highly technical procurement decision. Ongoing R&D collaboration between pasting paper manufacturers and downstream battery producers is essential to customize paper properties for new battery designs, especially in the rapidly evolving EFB and AGM segments. This collaborative approach minimizes potential manufacturing bottlenecks and ensures optimal battery performance in highly demanding applications.

Battery Pasting Papers Market Potential Customers

The primary consumers and end-users of battery pasting papers are overwhelmingly manufacturers of lead-acid batteries, across all scales of production, ranging from global industry giants to specialized regional players. These manufacturers require pasting papers to protect the active material on the positive and negative plates during the critical curing process and subsequent handling, ensuring the plates arrive intact for final battery assembly. The decision to purchase specific grades of pasting paper is driven by the type of battery being manufactured (SLI, industrial motive power, VRLA, deep cycle) and the required performance characteristics, such as expected cycle life and resistance to shedding under vibration.

Specific potential customers include large multinational automotive battery suppliers who serve original equipment manufacturers (OEMs) and the vast replacement market, requiring high volumes of consistent, high-quality material. Additionally, companies specializing in industrial batteries, used in sectors such as forklifts, heavy machinery, and backup power generation, represent a dedicated customer base demanding papers optimized for deep cycling and robust performance under high stress. Emerging customers include niche producers focused on specialized stationary storage for telecommunications towers and remote area power systems, who place a premium on reliability and extended maintenance intervals, further cementing the pasting paper’s role as an essential component in energy storage infrastructure worldwide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 760.8 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lydall (A part of Berry Global), Hollingsworth & Vose, Bernard Dumas, Nippon Kodoshi Corporation, Ahlstrom-Munksjö, Dreamweaver International, Hokuetsu Industries, Teijin Limited, Glatfelter Corporation, Trovato Manufacturing, Weidmann Electrical Technology, Fibertex Nonwovens, B&V Nonwovens, Neenah Inc., Toyo Seikan Group Holdings, Shijiazhuang Shida Paper, Hubei Ruide Paper, Suzhou Xianlong Nonwoven, Chongqing Liyuan Battery Materials, S.G. Fiber Glass |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Battery Pasting Papers Market Key Technology Landscape

The manufacturing technology for battery pasting papers is centered around advanced non-woven fiber processing, primarily utilizing wet-laid or dry-laid techniques to form a highly uniform web structure. The wet-laid process, analogous to traditional papermaking but adapted for complex fibers like glass and synthetics, is crucial for achieving the fine structural consistency, optimized porosity, and controlled thickness necessary for high-performance battery applications, particularly AGM and EFB. Key technological innovations focus on improving fiber dispersion homogeneity, which directly correlates with the paper's mechanical strength and electrolyte absorption capability. Furthermore, specialized chemical treatments and binders are employed during the saturation and drying stages to impart critical characteristics such as superior acid resistance, thermal stability, and low electrical resistance, ensuring the pasting paper withstands the harsh operational environment within the battery cell for years.

Recent technological advancements are pushing the boundaries of material science, focusing on creating multi-layered or gradient-structure papers that offer differential properties across their thickness. For example, some papers are engineered to have a fine pore structure on the plate contact side for maximal material retention, transitioning to a coarser structure toward the electrolyte side to facilitate efficient acid circulation and charging. The integration of proprietary synthetic fibers, often high-strength polyester or polyolefin blends, with traditional cellulose or glass fibers aims to enhance the overall tear and puncture resistance of the paper, crucial for automated high-speed battery assembly lines. Manufacturers are also heavily utilizing digital microscopy and spectroscopic analysis during production to ensure strict adherence to microstructural specifications, thereby minimizing batch-to-batch variability and maximizing consistency for global battery manufacturing operations.

Another significant technological focus is on sustainability and process efficiency. Innovations include optimizing drying processes to reduce energy consumption, developing environmentally benign binder systems, and increasing the utilization of recycled or bio-based raw materials without compromising performance metrics like acid stability and tensile strength. The move towards thinner pasting papers for high-density batteries requires extremely precise caliper control technology, often involving laser or ultrasonic measurement systems integrated directly into the production line. This technological evolution ensures that the pasting paper remains a viable, high-performance component, enabling lead-acid battery technology to continue competing effectively in sectors where reliability and cost efficiency are prioritized over maximum energy density, thus securing the market's technological relevance well into the forecast period.

Regional Highlights

Regional dynamics play a crucial role in the Battery Pasting Papers Market, heavily influenced by local automotive production, industrialization rates, and regulatory landscapes concerning energy storage. The Asia Pacific (APAC) region stands as the undisputed market leader, driven by the massive scale of vehicle manufacturing in nations like China, which is the world's largest automotive market, and India, experiencing rapid motorization. The substantial presence of major battery producers, combined with extensive telecommunications and infrastructure development requiring reliable backup power, ensures continuous high-volume demand for pasting papers. Furthermore, APAC serves as a global manufacturing hub for lead-acid batteries, necessitating high capacity and competitive pricing from paper suppliers.

North America and Europe represent mature markets characterized by technological sophistication and stringent environmental standards. These regions exhibit a strong demand for advanced pasting papers suitable for high-end AGM and EFB batteries, driven by regulatory mandates for CO2 reduction and the proliferation of vehicles equipped with sophisticated Start-Stop systems. European markets, in particular, prioritize papers offering long cycle life and acid durability, leading to a higher average selling price for pasting paper in this region compared to volume-driven markets. Investment in R&D is concentrated here to produce highly customized materials that minimize internal resistance and maximize battery efficiency, catering to OEM requirements.

Latin America and the Middle East & Africa (MEA) are emerging growth regions. LATAM's market expansion is tied to steady growth in the vehicle parc and industrial activity, particularly in countries like Brazil and Mexico. MEA's growth is often linked to the deployment of backup power solutions for unstable grids and rapid expansion of mobile network infrastructure, where reliable, cost-effective lead-acid batteries are the preferred choice. While these regions are typically more price-sensitive, the underlying increase in demand for basic and industrial batteries provides a robust foundation for market growth, requiring reliable supply chains and regionally adapted product specifications.

- Asia Pacific (APAC): Dominates market share due to high-volume automotive production (China, India), rapid industrial growth, and extensive infrastructure development necessitating large battery manufacturing bases.

- Europe: Focuses on high-performance pasting papers for premium AGM/EFB batteries, driven by stringent vehicle emission regulations and high quality standards for automotive OEMs.

- North America: Stable market with increasing adoption of advanced VRLA technologies, backed by strong industrial and replacement automotive sectors; high importance placed on material consistency and robust supply chains.

- Latin America (LATAM): Exhibits steady growth fueled by general vehicle parc expansion and industrial activity, representing an important, though often price-sensitive, consumption base.

- Middle East & Africa (MEA): Emerging market primarily driven by infrastructure projects, telecommunications, and backup power needs, showing potential for long-term growth as urbanization increases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Battery Pasting Papers Market.- Lydall (A part of Berry Global)

- Hollingsworth & Vose (H&V)

- Bernard Dumas

- Nippon Kodoshi Corporation (NKK)

- Ahlstrom-Munksjö

- Dreamweaver International

- Hokuetsu Industries

- Teijin Limited

- Glatfelter Corporation

- Trovato Manufacturing

- Weidmann Electrical Technology

- Fibertex Nonwovens

- B&V Nonwovens

- Neenah Inc.

- Toyo Seikan Group Holdings

- Shijiazhuang Shida Paper

- Hubei Ruide Paper

- Suzhou Xianlong Nonwoven

- Chongqing Liyuan Battery Materials

- S.G. Fiber Glass

Frequently Asked Questions

Analyze common user questions about the Battery Pasting Papers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of battery pasting paper in lead-acid batteries?

The primary function of battery pasting paper is to physically hold the active lead oxide paste onto the battery grid during the manufacturing (pasting and curing) process, preventing material shedding, ensuring structural integrity, and facilitating efficient plate handling before assembly.

How does the type of pasting paper material affect battery performance?

Material type significantly impacts performance; cellulose papers are used for standard SLI batteries, while specialized Glass Fiber Pasting Papers (GFPP) and synthetic blends are essential for VRLA and AGM batteries, offering superior acid resistance, higher mechanical strength, and enhanced thermal stability for extended cycle life.

Which application segment is driving the highest growth in the pasting paper market?

The highest growth is currently driven by the Electric Vehicle (EV) and Hybrid Electric Vehicle (HEV) auxiliary systems segment, which utilizes advanced Enhanced Flooded Batteries (EFB) and Absorbed Glass Mat (AGM) technologies that require high-performance, specialized pasting papers.

What role do thickness and porosity play in the selection of battery pasting papers?

Thickness directly dictates plate spacing and energy density, with thinner papers allowing for more compact battery designs. Porosity ensures optimal electrolyte penetration and acid stratification control, which are critical factors for maximizing charging efficiency and battery lifespan.

Which geographical region holds the largest market share for battery pasting papers?

The Asia Pacific (APAC) region maintains the largest market share, driven by its extensive manufacturing capacity for lead-acid batteries, particularly in the massive automotive and industrial sectors across China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager