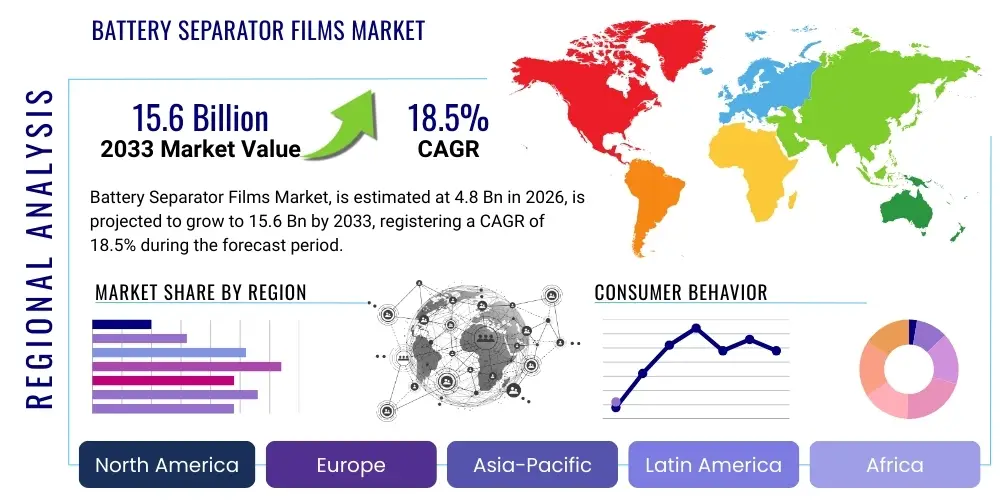

Battery Separator Films Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443134 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Battery Separator Films Market Size

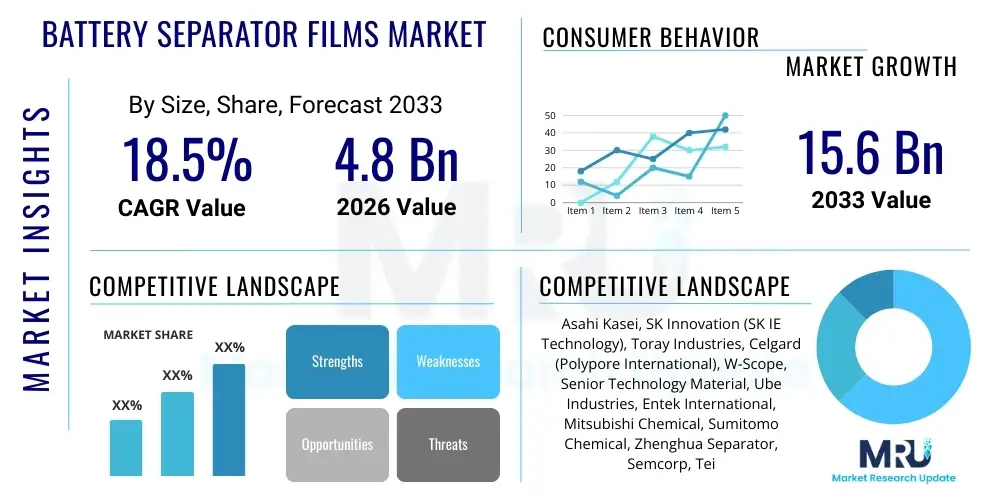

The Battery Separator Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 15.6 Billion by the end of the forecast period in 2033.

Battery Separator Films Market introduction

The Battery Separator Films Market encompasses the manufacturing and distribution of specialized membranes crucial for preventing short circuits between the anode and cathode in electrochemical storage devices, predominantly lithium-ion batteries. These films, typically made from polymers such as polyethylene (PE) and polypropylene (PP), must possess critical characteristics including high mechanical strength, thermal stability, controlled porosity, and optimized thickness. The primary function is ion transport facilitation during charge and discharge cycles while maintaining electrical insulation between the electrodes, ensuring safety, efficiency, and longevity of the battery cell. Advancements in electric vehicle (EV) technology and grid-scale energy storage systems (ESS) are fundamentally reshaping demand, driving innovation toward thinner, safer, and higher-performance ceramic-coated separators.

The market growth is intrinsically tied to the global transition towards sustainable energy and electrification of transportation. Major applications span across consumer electronics, where miniaturization necessitates extremely thin films, and high-power applications like electric vehicles, which require enhanced thermal resistance and rapid ion flow. Furthermore, the increasing deployment of renewable energy sources, such as solar and wind power, mandates reliable and large-scale battery storage, subsequently boosting the demand for advanced separator materials capable of handling sustained high-capacity cycling. The core benefits derived from high-quality separator films include improved battery energy density, reduced risk of thermal runaway, and extended cycle life, making them non-negotiable components in modern battery manufacturing.

Key driving factors accelerating market expansion include stringent government regulations promoting EV adoption, substantial investment in gigafactories globally, and continuous research and development focused on next-generation battery chemistries, such as solid-state batteries. Demand is also bolstered by the necessity for safer battery solutions, pushing manufacturers to adopt multi-layer structures (e.g., PP/PE/PP) and advanced coatings, particularly ceramic layers, to enhance temperature tolerance and puncture resistance. The shift from traditional combustion engines to electric powertrains in the automotive sector remains the most significant demand determinant, establishing separator films as a cornerstone component in the future energy landscape.

Battery Separator Films Market Executive Summary

The global Battery Separator Films Market is characterized by intense technological competition and significant capital investment driven primarily by the escalating demand from the Electric Vehicle (EV) sector. Business trends highlight a strong movement toward vertical integration, where major battery cell manufacturers increasingly form strategic partnerships or acquire separator producers to secure supply chains and integrate material innovation directly into cell design. This assures material quality consistency and helps in meeting the aggressive production schedules set by automotive OEMs. Furthermore, the market is witnessing robust competition between wet-process films, favored for high energy density applications, and dry-process films, which offer cost efficiency and are increasingly being optimized for safer lithium iron phosphate (LFP) batteries.

Regionally, Asia Pacific (APAC), led by China, South Korea, and Japan, dominates the market both in production capacity and consumption, largely due to the concentration of major battery and automotive manufacturers (Gigafactories). China’s dominance is expected to persist, although governmental initiatives in North America and Europe, such as the Inflation Reduction Act (IRA) in the U.S. and similar Green Deal policies in the EU, are stimulating substantial domestic manufacturing capacity build-up. These governmental supports are crucial for diversifying the supply chain away from APAC dependency and are resulting in massive construction projects for separator plants in Western regions, fundamentally shifting the geographical distribution of manufacturing capabilities over the forecast period.

Segment trends reveal that Lithium-ion batteries (Li-ion) maintain their hegemony, with Polymer separators (PE and PP) constituting the largest material type. Within Li-ion, the electric vehicle segment accounts for the highest revenue share due to the larger size and higher performance requirements of EV battery packs. A notable segment trend is the rapid adoption of coated separators, particularly those utilizing ceramic or high-performance polymers like Polyvinylidene Fluoride (PVDF) and aramid fibers. These coated films offer superior thermal stability and structural integrity, directly addressing safety concerns related to thermal runaway, thus becoming the preferred choice for high-end automotive applications and energy storage systems where operational safety is paramount.

AI Impact Analysis on Battery Separator Films Market

User inquiries regarding the impact of Artificial intelligence (AI) on the Battery Separator Films Market generally center on optimizing material development, enhancing quality control during mass production, and predicting performance degradation under various operating conditions. Key concerns revolve around whether AI can significantly reduce the lead time for new material discovery, minimize manufacturing defects (such as pinholes or thickness inconsistencies), and enable personalized separator designs for specific battery chemistries. Users frequently expect AI to revolutionize the R&D process by simulating complex electrochemical reactions and material interactions, thereby accelerating the commercialization of safer and higher-energy density separator films, especially for next-generation solid-state architectures. The prevailing themes underscore leveraging AI for predictive maintenance in manufacturing and accelerating material informatics to sustain the demanding growth trajectory of the global battery industry.

- AI-driven Material Informatics: Accelerating the discovery and selection of novel polymer and inorganic coating materials suitable for high-voltage and high-temperature applications through machine learning modeling.

- Manufacturing Process Optimization: Utilizing AI algorithms to monitor thousands of process parameters (e.g., extrusion temperature, stretching ratio, coating thickness) in real-time, minimizing variability and maximizing yield in gigafactories.

- Predictive Quality Control (PQC): Employing computer vision and deep learning to identify microscopic defects (pinholes, micro-tears) in the film during production, ensuring zero-defect separation components before cell assembly.

- Performance Prediction and Lifetime Modeling: Using neural networks to predict the electrochemical performance degradation rate and thermal runaway probability of battery cells based on the separator’s structural characteristics and operating profile.

- Supply Chain Resilience: Implementing AI tools to forecast demand fluctuations, manage raw material inventory, and optimize logistics for global distribution of specialized separator films.

DRO & Impact Forces Of Battery Separator Films Market

The Battery Separator Films Market is primarily driven by the exponential growth in Electric Vehicle (EV) production globally and the mandatory requirement for energy storage solutions (ESS) to support renewable integration, creating massive, sustained demand. Opportunities arise from technological advancements, specifically the shift towards ceramic-coated separators which offer superior thermal shutdown capabilities and mechanical stability, addressing critical safety concerns that plague high-performance lithium-ion batteries. However, the market faces significant restraints, including the high capital expenditure required for establishing production facilities (especially for wet-process films), reliance on complex, proprietary manufacturing technologies, and vulnerability to fluctuations in raw material prices, particularly specialized polymer resins and ceramic precursors.

Impact forces on the market are profound and multi-directional. Increased governmental subsidies and regulatory mandates, particularly in major automotive markets like China, the EU, and the US, act as powerful accelerators, compelling manufacturers to scale up rapidly. Conversely, intensifying geopolitical tensions and trade barriers pose significant risks to globalized supply chains, pressuring companies to regionalize production, which often involves substantial restructuring and initial cost increases. The demand for higher energy density (longer EV range) forces constant innovation in film thickness and porosity, creating a technological arms race among key players to deliver thinner films without compromising mechanical integrity or safety features.

The synthesis of these forces results in a market environment defined by high growth potential offset by high entry barriers and stringent performance requirements. Success in this market hinges on overcoming the operational complexities associated with ultra-high-speed film production and achieving economies of scale. Furthermore, the long-term viability is tied directly to the development of next-generation separator technologies compatible with solid-state batteries or other emerging battery chemistries, which necessitates substantial and continuous investment in R&D to maintain a competitive edge. Strategic pricing, optimized for both high-end EV segments and cost-sensitive ESS markets, is also critical for market penetration and sustained profitability.

Segmentation Analysis

The Battery Separator Films market is systematically segmented based on material, process, battery type, and end-use application, allowing for a granular analysis of demand drivers and technological preferences across various industry verticals. The predominant material types include Polyethylene (PE) and Polypropylene (PP), utilized either singly or in triple-layer configurations (PP/PE/PP), while advanced materials like aramid, polyimide, and specialized coatings are rapidly gaining traction for high-performance safety applications. Segmentation by process distinguishes between the dry process, generally favored for its cost-effectiveness and suitability for LFP cells, and the wet process, which offers superior porosity and thinness crucial for high-energy density cells like NMC/NCA chemistries used extensively in long-range EVs.

- By Material Type:

- Polyethylene (PE)

- Polypropylene (PP)

- Inorganic Composite (Ceramic-coated/Non-woven)

- Polyimide (PI)

- By Process Type:

- Wet Process (Phase Separation)

- Dry Process (Stretching)

- By Battery Type:

- Lithium-ion Batteries (Li-ion)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Iron Phosphate (LFP)

- Lead-Acid Batteries (Non-rechargeable segment)

- Other Advanced Batteries (e.g., Solid-State, Lithium Sulfur)

- Lithium-ion Batteries (Li-ion)

- By End-Use Application:

- Automotive (Electric Vehicles, Hybrid Electric Vehicles)

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Energy Storage Systems (Grid Storage, Residential Storage)

- Industrial (E-Bikes, Power Tools, Forklifts)

Value Chain Analysis For Battery Separator Films Market

The value chain for battery separator films is characterized by high integration and specificity, starting with the complex upstream extraction and refining of raw materials, primarily specialized polymer resins (such as ultra-high molecular weight polyethylene or high-crystallinity polypropylene). Upstream activities involve petrochemical producers supplying these high-purity resins, which are critical as the slightest impurities can compromise the integrity and performance of the final film. Manufacturers must maintain stringent quality control over the resin input to ensure the required melt flow indices and mechanical properties necessary for the subsequent film extrusion and stretching processes. Securing reliable and consistent supply of these specialized polymers is a key competitive factor upstream, influencing both cost structure and production scalability.

Midstream activities involve the highly technical manufacturing processes: either the wet process (solvent extraction and stretching) or the dry process (uniaxial/biaxial stretching). This manufacturing stage is capital-intensive and requires proprietary know-how to control porosity, thickness uniformity, and thermal shutdown features. Following the initial film production, the application of specialized coatings, such as ceramic particles (Alumina, Silica) dispersed in polymer binders, is a critical step to enhance safety features, thermal resistance, and electrolyte wettability. Downstream, the distribution channel is primarily direct, moving the finished separator rolls directly to major battery cell manufacturers (e.g., CATL, LG Energy Solution, Samsung SDI, Panasonic). The relationship between the separator supplier and the cell manufacturer is generally long-term and collaborative, often involving co-development to meet precise cell specifications.

The distribution logistics are highly focused on business-to-business (B2B) transactions due to the specialized nature of the product. Direct distribution channels dominate, ensuring immediate quality feedback and minimizing handling risks associated with these sensitive components. Indirect distribution channels are minimally utilized, perhaps involving specialized agents or regional distributors in emerging markets, but the vast majority of volume flows directly from the separator factory to the gigafactory floor. The efficiency of this downstream segment directly impacts the speed and scalability of global battery production, necessitating optimized logistics to maintain the required just-in-time inventory levels demanded by high-volume cell assembly lines worldwide.

Battery Separator Films Market Potential Customers

The primary customers and buyers in the Battery Separator Films Market are large-scale battery cell manufacturers, often referred to as Gigafactories, which produce lithium-ion cells for various applications. These manufacturers—including multinational corporations and regional champions—have extremely rigorous quality and volume requirements. Their purchasing decisions are driven by film performance characteristics, particularly thermal stability, uniformity of thickness, and specific porosity levels tailored to their proprietary electrolyte and cathode/anode chemistry designs. The highest volume buyers are those supplying the Electric Vehicle (EV) industry, demanding premium, high-safety ceramic-coated films, often purchased under long-term supply agreements to ensure stable material flow and consistent pricing.

Secondary but rapidly growing customer segments include specialized manufacturers of Energy Storage Systems (ESS) for grid and residential applications. While ESS sometimes tolerates slightly less energy density compared to EVs, safety and extremely long cycle life are paramount. Consequently, these buyers seek highly durable and often larger format separator films. Another crucial segment comprises manufacturers of high-performance consumer electronics, such as high-end smartphones, drones, and medical devices. These buyers prioritize extremely thin separators (often 9µm or less) to maximize volumetric energy density while maintaining adequate safety margins for small, portable devices. Their buying cycles are often tied to product redesign timelines.

The procurement process for these high-volume buyers is complex, involving extensive validation and certification over several months or years. Separator films are considered mission-critical components; therefore, suppliers must demonstrate not only technical superiority but also robust manufacturing capabilities, global reach, and financial stability. Potential customers look for partners who can innovate alongside them, particularly in preparations for next-generation chemistries like solid-state batteries, where current polymer separators may be replaced or heavily modified. Strategic partnerships and joint ventures are common mechanisms for securing future supply and integrating material design early in the cell development process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Asahi Kasei, SK Innovation (SK IE Technology), Toray Industries, Celgard (Polypore International), W-Scope, Senior Technology Material, Ube Industries, Entek International, Mitsubishi Chemical, Sumitomo Chemical, Zhenghua Separator, Semcorp, Teijin Limited, Cangzhou Mingzhu, Jinfa Technology, Sinoma Science & Technology, Foshan Jinhui Hi-Tech, Dreamweaver International, Separator Technology, Solvay S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Battery Separator Films Market Key Technology Landscape

The technological landscape of the Battery Separator Films Market is dominated by two primary manufacturing methods: the wet process (phase separation) and the dry process (stretching). The wet process, utilizing solvent extraction to create micro-pores, is preferred for applications demanding high energy density, primarily EVs, because it yields films that are thinner (typically 5-16 µm) and have a higher porosity, facilitating faster ion transfer. Recent advancements focus on refining the wet process to achieve greater pore uniformity and mechanical strength, even at reduced thicknesses, utilizing specialized co-extrusion techniques and advanced polymer blending to improve thermal characteristics and structural integrity under stress.

The dry process, which involves simple stretching of semi-crystalline polymers like PP, offers a more cost-effective and environmentally friendly approach as it avoids the use of organic solvents. While traditionally offering lower porosity and being slightly thicker, technological breakthroughs are now enabling dry-process films to compete in terms of performance, especially with the introduction of specialized multi-axial stretching equipment that can create more intricate pore structures. The dry process is highly favored for LFP batteries and medium-range energy storage systems, and continuous innovation is centered on boosting the thermal shutdown efficiency and mitigating the inherent lower mechanical strength compared to wet-process counterparts.

A major technological frontier is the widespread adoption of coating technologies, particularly ceramic coating (often Alumina, Al2O3, or Silica), applied to both wet and dry separators. These coatings significantly enhance thermal stability, preventing physical shrinkage at high temperatures and improving the film's adhesion to electrodes. This innovation is critical for meeting stringent automotive safety standards (e.g., freedom from thermal runaway in case of internal short circuits). Furthermore, the industry is exploring hybrid materials, non-woven fabrics, and ultra-high-performance polymers like Aramid and Polyimide, which promise exceptional heat resistance and mechanical robustness, positioning these advanced separators as essential components for the eventual commercialization of high-performance solid-state battery technology.

Regional Highlights

The Asia Pacific (APAC) region constitutes the unequivocal powerhouse of the Battery Separator Films Market, commanding the largest share in both production capacity and consumption. This dominance is attributed to the presence of global battery manufacturing giants in China, South Korea, and Japan, coupled with robust government support for the electric vehicle ecosystem. China, in particular, drives the majority of regional demand due to its immense domestic EV market and strategic deployment of grid-scale energy storage. The region specializes in high-volume, cost-competitive manufacturing across both wet and dry processes, often dictating global pricing trends and technological adoption rates. Significant investment continues to pour into expanding gigafactories, ensuring APAC remains the epicenter of the global battery supply chain.

North America and Europe are positioned as the fastest-growing regions, albeit from a smaller existing base. Growth in these regions is underpinned by substantial governmental interventions, notably the U.S. Inflation Reduction Act (IRA) and the European Green Deal, which incentivize localized manufacturing and supply chain diversification. This has prompted major global players, including those from APAC, to announce and commence construction of significant separator film production facilities within the EU and North America. The European market, benefiting from strong regulatory pressure for low-emission transport and substantial OEM commitments to electrification, focuses heavily on procuring premium, high-safety separators tailored for high-performance EV models.

Latin America and the Middle East & Africa (MEA) represent emerging markets, where growth is primarily linked to localized adoption of renewable energy projects and the nascent stages of EV penetration. While smaller in volume, these regions present niche opportunities for stationary storage separators and specialized films designed for rugged environments. The long-term growth trajectory in MEA is highly dependent on governmental policies promoting sustainable energy and establishing local battery assembly operations, which are currently developing but expected to gain momentum towards the end of the forecast period, potentially driven by sovereign wealth fund investments into strategic manufacturing assets.

- Asia Pacific (APAC): Dominates the global market share, driven by massive EV production in China, South Korea, and Japan. Characterized by high manufacturing capacity and technological leadership in both wet and dry processing.

- North America: Expected to show the highest CAGR due to localization efforts stimulated by the IRA, significant expansion of EV manufacturing plants, and a focus on supply chain resilience outside of Asia.

- Europe: High growth fueled by stringent EU emissions standards, significant investment in domestic gigafactories (e.g., Germany, Hungary, Poland), and strong demand for advanced ceramic-coated separators for high-end EVs.

- Latin America (LATAM): Emerging market, primarily driven by utility-scale energy storage projects and increasing localized assembly of LFP batteries for commercial fleets.

- Middle East and Africa (MEA): Growth tied to utility-scale renewable energy infrastructure development and governmental initiatives to establish localized battery production hubs, focusing on reliable, thermally robust separators.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Battery Separator Films Market.- Asahi Kasei

- SK Innovation (SK IE Technology)

- Toray Industries

- Celgard (Polypore International)

- W-Scope

- Senior Technology Material

- Ube Industries

- Entek International

- Mitsubishi Chemical

- Sumitomo Chemical

- Zhenghua Separator

- Semcorp

- Teijin Limited

- Cangzhou Mingzhu

- Jinfa Technology

- Sinoma Science & Technology

- Foshan Jinhui Hi-Tech

- Dreamweaver International

- Separator Technology

- Solvay S.A.

Frequently Asked Questions

Analyze common user questions about the Battery Separator Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a battery separator film in lithium-ion batteries?

The primary function is to prevent direct electrical contact and short-circuiting between the positive (cathode) and negative (anode) electrodes while simultaneously allowing lithium ions to pass freely between the electrodes during the charge and discharge cycles, which is essential for battery operation and safety.

Why are ceramic-coated separators becoming increasingly popular in the EV market?

Ceramic coatings significantly enhance the thermal stability and safety of the separator. The inorganic material prevents the polymer base film from shrinking or melting at high temperatures, delaying internal short circuits and thermal runaway, which is crucial for high-power electric vehicle battery packs.

What is the difference between the wet process and the dry process for manufacturing separator films?

The wet process uses solvents to create micro-pores and typically results in thinner films with higher porosity, suitable for high energy density batteries (NMC). The dry process uses mechanical stretching and is more cost-effective, producing thicker films often utilized in cost-sensitive LFP and ESS applications.

Which geographical region dominates the global supply chain for battery separator films?

The Asia Pacific (APAC) region, particularly China, South Korea, and Japan, dominates the global supply chain, holding the largest market share in terms of both manufacturing capacity and consumption volume due to the concentration of major EV and battery manufacturers.

How is the rise of solid-state batteries expected to impact the separator film market?

Solid-state batteries (SSBs) may ultimately replace traditional liquid electrolyte separators with solid electrolytes. However, transitional or semi-solid-state designs may require highly specialized, thermally stable composite or non-woven polymer films, driving innovation toward new material solutions that can withstand different processing environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager