Battery Tray and Cover Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441473 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Battery Tray and Cover Market Size

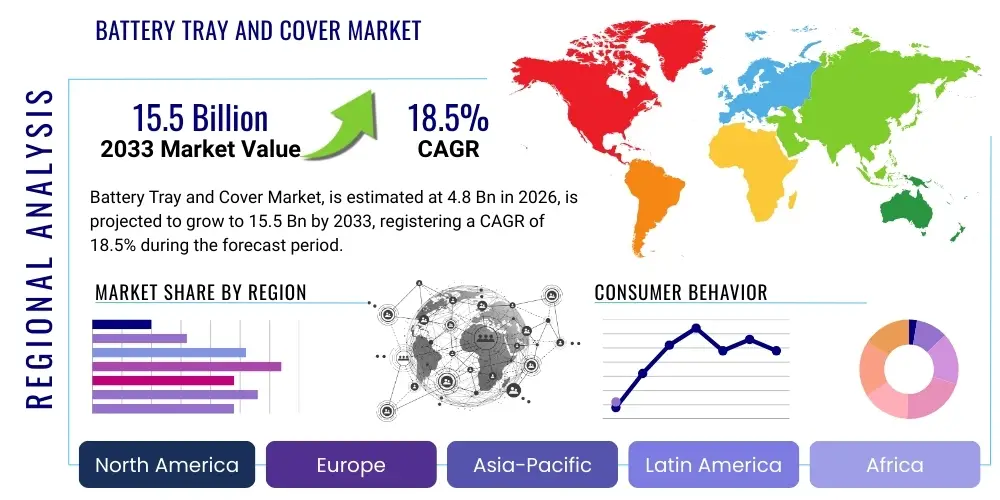

The Battery Tray and Cover Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 15.5 Billion by the end of the forecast period in 2033.

Battery Tray and Cover Market introduction

The Battery Tray and Cover Market encompasses highly engineered components essential for the structural integrity, safety, and thermal management of modern battery systems, particularly within the rapidly expanding electric vehicle (EV) sector and utility-scale energy storage systems. These components, often referred to collectively as the battery enclosure or housing, serve as the primary containment structure for lithium-ion battery cells or modules. Their fundamental role is to protect the delicate internal components from external mechanical shocks, road debris, moisture, and electromagnetic interference, simultaneously providing a crucial barrier against thermal events such as fire propagation. Material selection is highly scrutinized, focusing on a balance between lightweighting—to maximize vehicle efficiency—and structural rigidity, typically involving advanced aluminum alloys, high-strength steels, or sophisticated fiber-reinforced polymer composites (FRPs).

Key applications of these enclosures are overwhelmingly concentrated in the automotive industry, covering Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and specialized heavy-duty electric trucks and buses. The design specifications are complex, requiring integration with the vehicle’s chassis while maintaining strict tolerances for sealing and thermal dissipation pathways. The cover, in particular, must facilitate maintenance access while guaranteeing absolute protection, often incorporating pressure relief valves (PRVs) to manage internal cell gassing events safely. The evolution towards higher energy density batteries necessitates continuous innovation in tray and cover design to manage the increased thermal load and mitigate the risk associated with thermal runaway events, making these components critical safety differentiators in the market.

The primary driving factors propelling market growth include the global shift towards electric mobility, supported by governmental emission mandates and consumer incentives, and the increasing investment in grid modernization requiring robust, long-duration battery storage solutions. Benefits provided by advanced battery enclosures extend beyond mere protection; they contribute significantly to overall vehicle safety ratings, enhance battery longevity by maintaining optimal operating temperatures, and allow for standardized battery module architectures across different vehicle platforms. As battery cell chemistry continues to evolve, the demand for adaptable, fire-resistant, and crash-optimized tray and cover solutions is escalating rapidly across all major geographic regions.

Battery Tray and Cover Market Executive Summary

The Battery Tray and Cover Market is experiencing transformative growth primarily dictated by the accelerating global adoption of electric vehicles and stringent safety regulations demanding enhanced battery protection. Business trends emphasize strategic alliances between material suppliers, specialized fabrication firms, and automotive Original Equipment Manufacturers (OEMs) to co-develop lighter and more thermally efficient enclosure solutions. A significant technological shift is the transition from conventional steel and heavy aluminum structures toward multi-material designs incorporating advanced composites, particularly for achieving substantial weight reduction without compromising crash resistance. This focus on lightweighting is not merely a performance enhancement but a critical cost management strategy, as battery enclosure materials represent a sizable portion of the overall battery pack bill of materials (BOM).

Regionally, the Asia Pacific (APAC) market, spearheaded by China, maintains dominance due to its immense manufacturing capacity and high volume of EV production and sales. Europe is rapidly gaining ground, driven by ambitious decarbonization targets and regulatory pressures such as the European Union’s Battery Regulation, which mandates enhanced sustainability and safety standards for batteries, directly influencing enclosure design. North America is characterized by major investments in gigafactories and a robust push towards domestic supply chains, stimulating demand for regionally sourced trays and covers. These regional trends indicate a decentralized supply chain model focusing on proximity to major EV assembly hubs to reduce logistics costs and complexity.

Segment trends highlight the growing prominence of composite materials, expected to capture significant market share from traditional metallic solutions, particularly in high-performance and premium EV segments where weight savings justify higher material costs. Furthermore, the segmentation by application shows a rapid diversification beyond passenger EVs into commercial vehicles and stationary energy storage (ESS), each requiring specialized tray and cover designs tailored for different duty cycles, vibrational tolerance, and fire protection requirements. The convergence of safety mandates, material science innovation, and mass production economies of scale is defining the competitive landscape, pushing suppliers to offer modular and highly customized enclosure solutions.

AI Impact Analysis on Battery Tray and Cover Market

User inquiries regarding AI's influence in the Battery Tray and Cover market frequently center on how artificial intelligence can optimize the complex design and manufacturing processes essential for high-performance enclosures. Key themes emerging from these questions include the potential for AI-driven material informatics to accelerate the discovery of novel, lightweight, fire-resistant composite materials, and the use of machine learning (ML) in simulating complex thermal and crash scenarios. Users are particularly keen to understand how AI can reduce the iterative testing cycles currently required to validate new tray and cover designs under extreme operating conditions. Furthermore, there is strong interest in applying AI for predictive quality control within the high-volume production environment, ensuring minimal defects in critical components like sealing surfaces and welded joints, which directly impact battery safety and longevity.

The primary expectation is that AI will drastically enhance efficiency and precision, addressing the core conflict between lightweighting and safety mandates. By utilizing AI algorithms to analyze vast datasets related to material stress testing, thermal dynamics, and manufacturing tolerances, OEMs and Tier 1 suppliers can achieve optimal design configurations faster. This not only cuts down on R&D costs but also allows for enclosures tailored precisely to specific battery chemistries and vehicle architectures, a critical capability as the industry moves towards platform standardization. AI integration is also anticipated in automating complex fabrication steps, such as robotic welding and adhesive bonding, thereby increasing throughput and reducing labor intensity in sophisticated production lines.

AI's role extends into the operational lifespan of the battery enclosure. ML models can utilize sensor data collected from the battery management system (BMS) to predict potential material degradation, thermal breaches, or structural failures of the tray or cover over time, enabling proactive maintenance. This predictive capability is especially valuable for commercial vehicle fleets where uptime is paramount. Consequently, AI is shifting the battery enclosure from a static component into an intelligent element of the vehicle's architecture, driving forward the implementation of smart manufacturing practices across the entire value chain.

- AI-driven topology optimization for lightweight enclosure design, reducing material usage while meeting stringent structural requirements.

- Machine learning algorithms utilized for predictive analysis of material properties, accelerating the selection of advanced thermal insulation and fire-retardant composites.

- Integration of Computer Vision systems and AI-based defect detection during manufacturing (e.g., laser welding and sealing checks) to ensure zero-defect production quality.

- Simulation acceleration through AI, drastically reducing the time needed for crash safety (e.g., side impact) and thermal runaway propagation testing.

- Optimization of supply chain logistics and inventory management for specialized raw materials (e.g., carbon fibers, engineering polymers) based on demand forecasting.

DRO & Impact Forces Of Battery Tray and Cover Market

The market for battery trays and covers is powerfully shaped by a confluence of accelerating demand, complex engineering challenges, and rigid regulatory frameworks. The primary driver is the exponential increase in global EV penetration, coupled with regulatory mandates in major markets (Europe, China, California) pushing for phase-outs of internal combustion engines, guaranteeing sustained, high-volume demand for battery enclosures. This is further amplified by the continuous push for longer driving ranges, which necessitates larger battery packs and consequently larger, yet lightweight, trays and covers. However, these market accelerators are counterbalanced by significant restraints, chiefly the volatility and high cost of critical raw materials, such as specific aluminum alloys and carbon fiber, which directly impact the final production cost of the enclosure. Furthermore, the engineering complexity associated with integrating passive and active thermal management systems (cooling plates, heat exchangers) directly into the tray structure presents a technical hurdle requiring significant R&D investment and specialized manufacturing capabilities.

Opportunities for growth are concentrated in material science innovation and design optimization. The shift towards multi-material designs, combining injection-molded composites with hydroformed metal components, offers a path to achieving superior strength-to-weight ratios. The emergence of solid-state battery technology, while potentially altering battery architecture, presents a new design challenge—and thus a massive opportunity—for suppliers capable of designing enclosures optimized for the thermal and volumetric requirements of these next-generation cells. Furthermore, the push for enhanced fire safety, particularly related to the bottom impact protection that prevents thermal runaway spread from road debris damage, creates an opportunity for specialized shielding and composite material solutions.

The impact forces exerted on this market are substantial, driven by safety legislation and standardization efforts. Regulatory bodies are consistently increasing minimum requirements for crash survivability and thermal containment duration (the time an enclosure must withstand a fire before being breached), compelling manufacturers to invest heavily in robust testing and compliance. Supplier consolidation is an emerging force, as OEMs prefer to partner with large-scale, globally capable Tier 1 suppliers who can manage the entire enclosure process, from material sourcing and complex fabrication (e.g., friction stir welding) to integrated thermal component assembly. Economic forces, particularly the need to localize manufacturing near gigafactories to reduce shipping costs for large, voluminous parts, are profoundly reshaping global supply chains.

Segmentation Analysis

The Battery Tray and Cover market is systematically segmented based on material type, product type, battery type, application, and end-use, reflecting the diverse requirements across different vehicle platforms and energy storage applications. The segmentation by material is particularly dynamic, showing a critical division between Metallic and Composite enclosures, driven by performance requirements and cost sensitivity. Product segmentation separates the trays (which house the battery modules and cooling system) from the covers (which provide sealing and impact protection), although these are often sold as an integrated enclosure system. Application segmentation delineates the high-volume Passenger EV market from the structurally distinct Commercial Vehicle and stationary ESS segments, each demanding unique durability and ingress protection standards.

Material choice remains the most critical differentiator. While aluminum alloys dominate the current market due to their excellent heat dissipation characteristics and established manufacturing processes, advanced composites—including Glass Fiber Reinforced Polymers (GFRP) and Carbon Fiber Reinforced Polymers (CFRP)—are gaining traction due to superior lightweighting potential and inherent fire resistance properties. The choice of material often correlates directly with the battery type being housed; high-power, high-density batteries found in long-range premium EVs necessitate complex, often multi-material, enclosures to manage thermal runaway risks effectively. The commercial vehicle segment, prioritizing durability and lifespan, often still utilizes heavier, high-strength steel or robust aluminum enclosures.

Understanding these segmentations is vital for strategic planning, as it defines where R&D resources should be allocated. For instance, companies focusing on the passenger EV market must prioritize mass-production scale and lightweighting innovations, while those targeting stationary storage must emphasize resistance to harsh environmental conditions and long-term modularity. The future market is expected to see rapid growth in standardized, modular trays designed to accommodate various cell formats (prismatic, pouch, cylindrical), optimizing manufacturing efficiencies across vehicle platforms.

- By Material

- Aluminum Alloys (e.g., 5xxx and 6xxx series)

- Steel (High-Strength Low-Alloy Steel)

- Composites (Fiber Reinforced Polymers, Sheet Molding Compound - SMC)

- Multi-Material Systems

- By Battery Type

- Lithium-ion Batteries

- Solid-State Batteries (Emerging)

- Other (e.g., Nickel-Metal Hydride)

- By Product Type

- Battery Trays/Housings (Lower half, integrating cooling)

- Battery Covers (Upper lid, sealing, and protection)

- By Vehicle Type/Application

- Passenger Electric Vehicles (BEV, PHEV)

- Commercial Vehicles (Buses, Trucks)

- Stationary Energy Storage Systems (ESS)

- Industrial Vehicles and Equipment

Value Chain Analysis For Battery Tray and Cover Market

The value chain for the Battery Tray and Cover Market is characterized by high capital intensity and a reliance on specialized material processing and fabrication capabilities. The upstream segment begins with the sourcing of primary raw materials: bulk metals (aluminum ingots, steel coils) and specialized chemical precursors for composites (resins, carbon/glass fibers). Key upstream activities involve alloying metals to meet specific mechanical and thermal requirements, and synthesizing high-performance composite precursors. Suppliers at this stage often include major chemical companies and global metal producers, whose pricing and supply stability significantly dictate the overall cost structure of the downstream product.

The midstream segment involves specialized Tier 2 and Tier 1 manufacturers. Tier 2 suppliers process the raw materials into semi-finished forms (e.g., aluminum extrusions, sheet metal blanks, composite sheets). The core manufacturing expertise resides in the Tier 1 suppliers who undertake complex fabrication processes such as high-pressure die casting, friction stir welding for aluminum trays, deep drawing for steel, and compression molding for composite covers. These operations are highly demanding in terms of precision, as the enclosure must guarantee a perfect seal (IP67 or IP6K9K) and maintain structural integrity during crash events. Quality control, particularly non-destructive testing of welds and seams, is paramount at this stage.

The downstream segment involves the distribution and integration of the final product. Tier 1 suppliers deliver the completed, often partially assembled, trays and covers directly to major automotive OEMs (Original Equipment Manufacturers) or specialized Battery Pack Integrators. Distribution channels are predominantly direct, characterized by long-term strategic contracts due to the high customization and integration requirements of the enclosures into the vehicle chassis. Indirect channels, such as aftermarket suppliers, currently hold a minimal share, focused mainly on replacement parts following collision repair. The increasing vertical integration by major OEMs, who are sometimes bringing enclosure production in-house, represents a disruptive force in the distribution landscape, pushing traditional Tier 1s to enhance service offerings and technological partnerships.

Battery Tray and Cover Market Potential Customers

The primary customers in the Battery Tray and Cover Market are entities responsible for the design, assembly, and deployment of large-scale battery packs requiring robust physical protection. The most significant segment comprises Automotive Original Equipment Manufacturers (OEMs), including global giants focusing on mass-market EV production (e.g., Tesla, Volkswagen, General Motors, BYD, and Hyundai/Kia) as well as emerging electric vehicle startups. These OEMs are the largest volume buyers, dictating specific design, crash performance, and thermal integration requirements based on their proprietary vehicle architectures and safety standards.

A second crucial segment includes specialized Battery Pack Integrators and System Suppliers. These companies often design and assemble the complete battery system—comprising cells, modules, cooling systems, and the management unit (BMS)—and then supply the entire unit to OEMs (including heavy-duty or niche vehicle manufacturers) or to energy utilities. Integrators require highly customized and often modular trays and covers that can adapt to various cell formats and application environments, particularly in the commercial vehicle and marine sectors where standardized, robust enclosures are essential.

Finally, the growing market for stationary Energy Storage Systems (ESS) provides a long-term customer base. ESS deployments, used for grid stabilization, renewable energy integration (solar/wind farms), and industrial power back-up, require large-format battery enclosures. These trays and covers must prioritize durability, resistance to environmental factors (temperature, humidity), fire containment for extended periods, and modular design for easy scalability. Key buyers in this category include utility companies, independent power producers (IPPs), and specialized ESS solution providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 15.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marelli, Magna International, Benteler Group, Hanwha Advanced Materials, GF Linamar, SGL Carbon, Continental Structural Plastics (CSP), L&L Products, Thyssenkrupp, Kirchhoff Automotive, Constellium, Novelis, Aisin Corporation, Minth Group, Sumitomo Chemical, Toray Industries, Cytec Solvay, UACJ Corporation, Freudenberg Sealing Technologies, Teijin Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Battery Tray and Cover Market Key Technology Landscape

The Battery Tray and Cover Market is defined by continuous technological advancement focused on optimizing the three core pillars: crash safety, thermal management, and lightweighting. One of the most impactful technological shifts involves advanced material processing. For metal enclosures, specialized techniques like friction stir welding (FSW) are replacing traditional arc welding to create defect-free, high-strength joints in aluminum trays, which is critical for maintaining structural integrity and achieving high IP ratings (Ingress Protection). Furthermore, the trend toward high-pressure die casting (HPDC) allows manufacturers to produce large, complex aluminum structures in a single, near-net-shape process, significantly reducing assembly time and improving geometric accuracy.

In the domain of composite materials, the utilization of Sheet Molding Compound (SMC) and High-Pressure Resin Transfer Molding (HP-RTM) is becoming prevalent for producing lightweight battery covers and firewalls. These composite technologies allow for the encapsulation of fire-retardant additives directly into the material matrix, enhancing passive safety features. A critical emerging technology is the integration of specialized thermal barriers, often utilizing aerogels or innovative mica-based insulation, applied to the interior surfaces of the tray to prevent the spread of thermal runaway between adjacent cells or modules, thereby extending the critical time required for occupant evacuation in an accident.

Design technology is equally crucial, particularly concerning sealing and structural protection. Modular design concepts are being implemented using advanced fastening systems and specialized adhesives to facilitate easier battery pack assembly and maintenance while ensuring long-term sealing performance against moisture and dust. Furthermore, the development of sophisticated bottom protection systems, designed to absorb and distribute the impact energy from severe road debris strikes, is vital. This often involves multi-layered structures incorporating sacrificial metallic layers or energy-absorbing foams engineered to protect the most vulnerable part of the battery pack, securing the cell integrity during high-stress operating conditions.

Regional Highlights

Regional dynamics play a crucial role in shaping the Battery Tray and Cover Market, largely dictated by local EV manufacturing output, regulatory environments, and material sourcing capabilities. Asia Pacific (APAC) dominates the global market, primarily driven by the colossal EV ecosystem in China, which not only consumes the largest volume of battery packs but also hosts the world’s leading manufacturers of battery cells and enclosures. The high concentration of gigafactories and established supply chains for raw materials and component fabrication in countries like China, South Korea, and Japan ensures cost-effective, high-volume production. China’s focus on affordability and rapid deployment means the market here is segmented, with demand spanning from cost-effective steel/aluminum solutions for entry-level EVs to advanced composite solutions for premium vehicles.

Europe represents the fastest-growing market region, characterized by strict regulatory frameworks and a strong commitment to premium EV manufacturing. The implementation of stringent safety standards, including Euro NCAP’s focus on structural safety and the EU Battery Regulation, pushes demand toward high-performance, multi-material enclosures capable of superior thermal containment and crash performance. Countries such as Germany, France, and Poland are seeing massive investments in battery production capacity, necessitating localized supply chains for trays and covers. European manufacturers are keen on sustainable sourcing and lightweighting, making advanced recycled aluminum alloys and thermoset composites highly attractive.

North America is undergoing a significant transformation, fueled by supportive federal policies like the Inflation Reduction Act (IRA), which incentivizes domestic EV and battery component manufacturing. This policy environment is spurring major automotive OEMs to establish large-scale battery assembly plants (gigafactories) in the US and Mexico, creating immediate, localized demand for sophisticated tray and cover solutions. The North American market is rapidly evolving, focusing on robust design for larger SUV and truck platforms, often requiring heavier-duty, high-strength aluminum enclosures optimized for severe operational environments and high towing capacity requirements.

- Asia Pacific (APAC): Market leader due to high volume EV production in China; focus on cost-efficiency and supply chain scale; strong innovation in cell-to-chassis (CTC) designs influencing integrated tray structures.

- Europe: High growth driven by strict environmental and safety regulations; demand for premium, complex enclosures utilizing advanced composites and recycled materials; emphasis on local manufacturing near gigafactories in Germany and Eastern Europe.

- North America: Accelerating market growth supported by governmental incentives (IRA); characterized by large-format tray requirements for electric trucks and SUVs; intense focus on building robust domestic and regional supply chains.

- Latin America & MEA: Smaller market share, primarily driven by niche industrial applications and early-stage EV adoption; potential long-term growth tied to localized battery assembly projects for public transport and grid storage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Battery Tray and Cover Market.- Marelli

- Magna International

- Benteler Group

- Hanwha Advanced Materials

- GF Linamar

- SGL Carbon

- Continental Structural Plastics (CSP)

- L&L Products

- Thyssenkrupp

- Kirchhoff Automotive

- Constellium

- Novelis

- Aisin Corporation

- Minth Group

- Sumitomo Chemical

- Toray Industries

- Cytec Solvay (now Solvay)

- UACJ Corporation

- Freudenberg Sealing Technologies

- Teijin Limited

Frequently Asked Questions

Analyze common user questions about the Battery Tray and Cover market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary material trends driving innovation in battery enclosures?

The primary material trends involve a shift towards multi-material systems, combining lightweight aluminum alloys (optimized for thermal dissipation) with advanced fiber-reinforced polymer composites (FRPC) for covers and internal fire barriers. This hybridization aims to achieve maximum weight reduction while meeting stringent crash and thermal runaway protection standards.

How do safety regulations, such as those concerning thermal runaway, influence tray and cover design?

Safety regulations mandate that battery enclosures must isolate and contain a thermal event for a specified period (often 5 to 10 minutes) to allow vehicle occupants to safely evacuate. This directly forces designers to incorporate advanced passive fire protection measures, including specialized insulation materials, pressure relief systems, and robust sealing to prevent fire propagation and dangerous off-gassing.

What role does lightweighting play in the overall market strategy for battery enclosures?

Lightweighting is a critical strategy aimed at maximizing EV driving range and efficiency. Every kilogram reduced in the battery enclosure translates directly into energy savings. Suppliers achieve this through advanced design topology optimization (often AI-assisted) and the substitution of heavy metallic components with high-strength, low-density materials like carbon fiber composites or optimized aluminum castings.

Which manufacturing technologies are crucial for producing high-quality battery trays?

Crucial manufacturing technologies include high-pressure die casting (HPDC) for complex aluminum trays, friction stir welding (FSW) for creating ultra-strong, leak-proof joints in large aluminum structures, and compression molding or high-pressure RTM for producing lightweight composite covers with integrated features and high dimensional accuracy.

How is the growth of Stationary Energy Storage Systems (ESS) impacting demand for battery enclosures?

The ESS sector is a growing demand driver, requiring large, modular, and extremely durable enclosures tailored for long-term outdoor operation. Unlike EV trays, ESS enclosures prioritize longevity, environmental resistance, and fire safety (containing much larger cell banks) over strict lightweighting, driving demand for specialized, scalable metal structures or ruggedized composites.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager