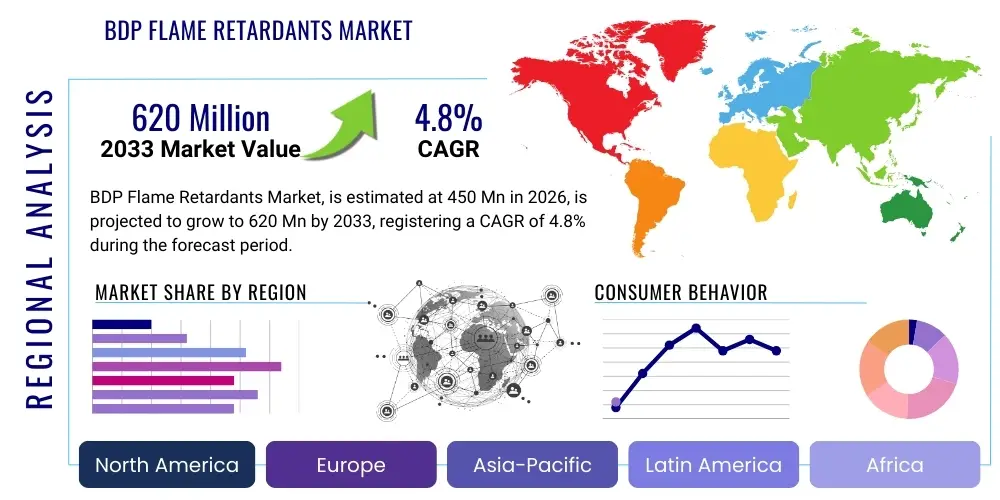

BDP Flame Retardants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442457 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

BDP Flame Retardants Market Size

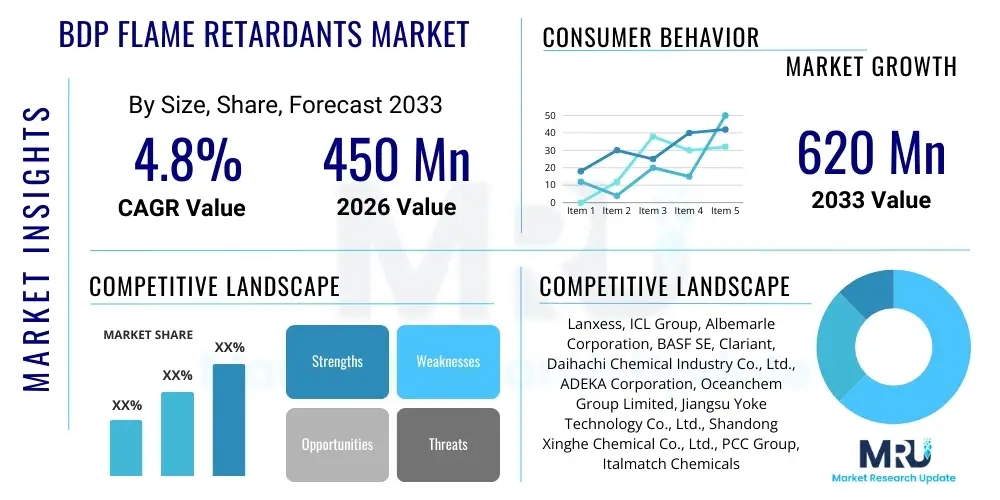

The BDP Flame Retardants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 620 million by the end of the forecast period in 2033.

BDP Flame Retardants Market introduction

The Bisphenol A Bis(diphenyl phosphate) (BDP) Flame Retardants Market encompasses specialized chemical additives used primarily to enhance the fire resistance of polymeric materials. BDP is a prominent member of the organophosphate class of flame retardants, characterized by its effectiveness in high-performance engineering plastics, particularly polycarbonate/acrylonitrile butadiene styrene (PC/ABS) blends and various thermoset resins. Its application is critical in industries demanding stringent fire safety standards, such as electrical and electronics (E&E), automotive manufacturing, and construction. The primary function of BDP is to act in both the solid and gaseous phases during combustion, forming a char layer that inhibits oxygen access and releasing non-combustible gases to dilute flammable vapors, thereby achieving UL94 V-0 ratings in relatively thin sections.

The demand for BDP flame retardants is fundamentally driven by the global legislative shift towards halogen-free alternatives. As environmental regulations intensify scrutiny over traditional brominated flame retardants (BFRs) due to toxicity concerns and persistence in the environment, BDP offers a preferred, high-performance, non-halogenated solution. Its key benefits include excellent thermal stability, low volatility, minimal plasticization effects on the host polymer, and superior hydrolytic stability compared to some other phosphate esters. These attributes make BDP indispensable for critical applications like laptop casings, television bezels, server components, and vehicle interior parts where material integrity under heat is paramount and strict regulatory compliance is mandatory for market entry.

Major applications of BDP center around consumer electronics due to its superb performance profile in E&E equipment where high processing temperatures and thin wall design are common challenges. Furthermore, the automotive sector utilizes BDP in interior components to comply with FMVSS 302 and similar standards, particularly in electric vehicle battery housings and charging infrastructure components, where enhanced thermal management is critical. The market growth is continuously fueled by the rapid expansion of 5G infrastructure, increasing complexity of connected devices, and the requirement for lightweight, yet highly durable, fire-safe materials across global supply chains.

BDP Flame Retardants Market Executive Summary

The BDP Flame Retardants market is experiencing robust expansion, primarily steered by accelerating business trends focused on sustainability, regulatory convergence towards non-halogenated standards, and the explosive growth of the electrical and electronics sector, particularly in Asia Pacific. Business trends indicate a strong preference for high-purity BDP formulations that offer enhanced compatibility with advanced engineering polymers, driving innovation towards additive efficiency and lower loading levels. Supply chain optimization, driven by increasing geopolitical complexities and raw material volatility, is another key factor shaping competitive strategies, prompting major players to focus on regional manufacturing hubs to ensure supply chain resilience and proximity to critical end-use markets.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed growth engine, largely attributed to the massive manufacturing base for consumer electronics, appliances, and automotive components located in China, South Korea, and Southeast Asian nations. Regulatory pressure in Europe and North America, particularly concerning WEEE and RoHS directives, mandates the adoption of effective halogen-free solutions like BDP, ensuring steady demand in these mature markets. Conversely, developing economies are increasingly aligning their fire safety codes with international standards, creating substantial latent opportunities for BDP penetration in emerging construction and electrical infrastructure projects, necessitating localized product development and technical support.

Segmentation trends reveal that the Electrical & Electronics application segment maintains the dominant market share due to continuous miniaturization and increased power density in devices, necessitating higher thermal and fire resistance specifications. The PC/ABS blends sub-segment, which heavily utilizes BDP for achieving V-0 ratings, remains the largest application category. Looking ahead, the automotive segment, especially spurred by the transition to electric vehicles (EVs) and the associated complexity in battery management systems and charging stations, is poised to exhibit the fastest growth. This shift demands flame retardants that offer exceptional thermal aging properties and reliability over the long lifespan of modern vehicles.

AI Impact Analysis on BDP Flame Retardants Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the BDP Flame Retardants market predominantly focus on three critical areas: accelerating material discovery and formulation design, optimizing complex supply chains for raw materials like Bisphenol A (BPA) and Diphenyl phosphate, and enhancing predictive quality control (PQC) in manufacturing processes. Users frequently ask if AI can reduce the time taken to formulate new synergistic BDP systems that meet specific regulatory thresholds without compromising polymer mechanical properties. There is also significant interest in how machine learning algorithms can model the performance of BDP in different polymer matrices under various thermal stress conditions, reducing reliance on extensive and costly physical testing. The key themes revolve around efficiency, predictive accuracy, and mitigating regulatory risk through data-driven approaches, expecting AI to deliver faster time-to-market for novel, compliant BDP solutions.

The integration of AI and machine learning into the R&D cycle for BDP derivatives is dramatically streamlining the identification of optimal molecular structures and processing conditions. AI algorithms can analyze vast datasets concerning thermal degradation kinetics, char formation efficiency, and chemical compatibility, drastically narrowing down the pool of potential BDP modifications or synergistic blend components. This computational advantage translates directly into reduced R&D expenditure and a quicker response time to evolving industry demands, especially concerning stricter fire safety classifications in high-heat applications like 5G base stations and data centers. Furthermore, predictive modeling powered by AI enables manufacturers to anticipate raw material price fluctuations and supply bottlenecks, enhancing strategic sourcing decisions.

In manufacturing and supply chain management, AI is crucial for maintaining the stringent quality and purity required for high-performance BDP. Through real-time monitoring of reactor parameters and quality testing data, AI systems can identify deviations instantly, minimizing batch failures and ensuring consistent product quality critical for demanding applications like medical devices or aerospace components. This PQC capability not only ensures compliance but also reduces operational waste. The overall impact of AI on the BDP market is centered on transforming it from a traditional chemical production industry into a highly precise, digitally managed specialty chemicals sector, optimizing cost structures and improving product reliability across the value chain.

- AI accelerates new BDP formulation design and optimization through molecular modeling.

- Machine learning models predict BDP performance parameters (e.g., UL94 rating) in various polymer blends, minimizing physical trials.

- AI optimizes complex, global BDP supply chains, forecasting raw material price volatility and managing inventory risk.

- Predictive quality control (PQC) utilizes sensor data to ensure high purity and consistency of synthesized BDP batches.

- AI assists regulatory compliance modeling by simulating material behavior under various international fire safety standards.

DRO & Impact Forces Of BDP Flame Retardants Market

The market for BDP flame retardants is powerfully influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and overall trajectory. The predominant Driver is the global, non-negotiable trend toward mandatory halogen-free fire safety standards, particularly in Europe and Asia, compelling manufacturers in the E&E and automotive sectors to adopt high-performance alternatives like BDP. This is coupled with the continuous technological push towards miniaturization and higher power density in electronics, which increases the inherent fire risk and subsequently the necessity for effective, reliable fire suppression additives. Restraints primarily involve the high cost structure of specialty organophosphate flame retardants compared to older, often halogenated, alternatives, presenting a barrier to entry in price-sensitive commodity polymer markets. Furthermore, despite being a preferred alternative to brominated compounds, BDP faces intermittent scrutiny regarding the environmental footprint of its precursor, Bisphenol A, leading to ongoing research into non-BPA based alternatives.

Opportunities for BDP expansion are concentrated in two high-growth sectors: Electric Vehicles (EVs) and 5G infrastructure. The rapid electrification of the automotive fleet necessitates advanced thermal management and fire safety solutions for battery packs and power electronics, areas where BDP's thermal stability excels. The global rollout of 5G and associated data centers requires vast quantities of high-performance plastic enclosures and components that must meet stringent, often specialized, fire safety specifications, presenting a sustained demand surge. Moreover, the opportunity exists in developing synergistic blends where BDP is used in conjunction with metal hydroxides or nitrogen-based FRs to achieve maximum fire safety ratings at optimized loading levels, improving cost-effectiveness and mechanical properties.

Impact forces currently shaping the BDP market are strong and multifaceted. Regulatory impact forces, driven by international bodies and regional directives like REACH (Europe) and national safety codes (China, US), exert the most significant influence, effectively mandating market shifts towards safer chemistries. Economic impact forces, related to fluctuating raw material costs (BPA and phosphorous derivatives) and global shipping logistics, directly affect the profitability and pricing strategies of BDP manufacturers. The technological impact forces are continually pushing for product innovation, focusing on achieving superior performance metrics (low smoke density, reduced corrosion) in increasingly demanding polymer systems, maintaining BDP's competitive edge against nitrogen-based and mineral-based alternatives.

Segmentation Analysis

The BDP Flame Retardants Market is comprehensively segmented based on its physical Form, the major Application type where it is incorporated, and the End-Use Industry served. This multi-dimensional segmentation allows for precise market sizing and strategic targeting based on specific material performance requirements and regulatory landscapes. BDP is predominantly sold in liquid form, facilitating easier incorporation into compounding processes and achieving homogeneous dispersion in complex polymer matrices, though solid or powder forms are also utilized for certain specialty applications or masterbatch production. The most critical segmentation lies in application areas, where specific polymer blends dictate the required BDP loading and performance profile. Understanding these segments is vital as the performance criteria for a PC/ABS computer casing differ significantly from those required for an automotive under-the-hood component.

Application segmentation reveals that PC/ABS blends and Epoxy Resins constitute the largest consumers of BDP, driven by their prevalence in IT hardware, household appliances, and specialized coatings. BDP is particularly valued here for maintaining the high impact strength and thermal properties inherent to these engineering plastics while achieving UL94 V-0 flame retardancy. Emerging applications include polyurethane systems, where BDP contributes to fire resistance in insulation foams and flexible materials, addressing fire safety concerns in building and furniture sectors. The end-use industry analysis confirms that the Electrical & Electronics sector remains the cornerstone of demand, consuming BDP in circuit boards, connectors, and enclosures, reflecting the global dependency on electronic devices and associated fire safety compliance.

Future growth within segmentations will likely be dictated by the automotive sector's demands for specialized BDP grades. As EV penetration rises, the necessity for robust, thermally stable flame retardants in high-voltage components and battery modules will accelerate the demand for BDP variants optimized for harsh operating environments. Furthermore, regulatory tightening in the construction industry regarding smoke toxicity and fire spread in insulation materials could spur significant uptake of BDP in structural and decorative elements, expanding its presence beyond traditional electronics manufacturing.

- By Form:

- Liquid

- Solid/Powder

- By Application:

- PC/ABS Blends

- Epoxy Resins

- Polyurethane Systems

- PVC Compounds

- Other Engineering Plastics (e.g., PBT, PET)

- By End-Use Industry:

- Electrical & Electronics (E&E)

- Automotive

- Construction

- Textiles and Furniture

- Aerospace and Defense

Value Chain Analysis For BDP Flame Retardants Market

The value chain for BDP Flame Retardants commences with the Upstream segment, dominated by the procurement and manufacturing of key chemical precursors: Bisphenol A (BPA) and Diphenyl Phosphate (DPP). These raw materials are typically sourced from large petrochemical and commodity chemical producers. Fluctuations in the price and supply continuity of BPA, which is derived from petroleum feedstocks, directly impact the production cost of BDP. Due to the high regulatory scrutiny associated with BPA, manufacturers often focus on high-purity, traceable sourcing, requiring robust quality control measures at the initial stage. Reliability in this upstream segment is crucial, as the specialized nature of BDP synthesis demands consistent precursor quality.

The Midstream phase involves the complex chemical synthesis and formulation of BDP (Bisphenol A Bis(diphenyl phosphate)). Leading chemical manufacturers utilize proprietary processes to esterify BPA with DPP, followed by purification and stabilization to ensure the final BDP product meets stringent industry specifications, such as low acid value, minimal residual solvents, and optimal thermal decomposition temperature. Post-synthesis, BDP is either sold in bulk liquid form or processed into specialized solid/powder grades or masterbatches. This stage is capital intensive, requiring specialized reaction equipment and adherence to strict environmental health and safety (EHS) protocols, differentiating specialty chemical players based on operational efficiency and technological prowess.

The Downstream segment involves the distribution and final application. Distribution channels include direct sales to large, integrated polymer compounders and OEMs (Original Equipment Manufacturers), and indirect sales through specialized chemical distributors catering to smaller volume users or regional markets. Direct sales enable stronger technical collaboration, crucial for optimizing BDP loading in customized polymer compounds. Final end-users, such as E&E housing manufacturers, automotive tier-1 suppliers, and construction material fabricators, incorporate the BDP into their polymers via compounding equipment (e.g., twin-screw extruders) to achieve the required fire safety rating. Technical service and application expertise provided by BDP suppliers are pivotal in this downstream phase to ensure proper dispersion and maximized fire retardancy performance without sacrificing mechanical properties of the final product.

BDP Flame Retardants Market Potential Customers

The primary customers for BDP flame retardants are organizations involved in the compounding and processing of engineering plastics that require compliance with stringent flammability standards. These customers include major Polymer Compounders, who purchase BDP in large volumes to formulate specialized plastic pellets (like fire-retardant PC/ABS or HIPS) sold to appliance and electronics manufacturers. These compounders often act as technical intermediaries, ensuring the BDP additive is correctly dispersed and stabilized within the polymer matrix to meet specific UL, IEC, or automotive specifications. Their ability to manage inventory and offer customized blends makes them central to the BDP supply chain, requiring reliable, large-scale supply from BDP producers.

Another significant customer segment comprises Original Equipment Manufacturers (OEMs), particularly in the consumer electronics and automotive industries. While some large OEMs purchase compounded materials, others may vertically integrate compounding or require BDP suppliers to work directly with their Tier 1 suppliers to standardize material specifications globally. For example, large computer and appliance brands demand consistent BDP performance across their global product lines. In the automotive sector, customers are predominantly Tier 1 suppliers specializing in interior parts (e.g., dashboards, seating components) and, increasingly, manufacturers of electric vehicle battery enclosures and charging infrastructure components, where thermal runaways pose catastrophic risks and BDP is utilized for superior thermal stability and char formation.

Secondary potential customers include manufacturers specializing in high-end construction materials, such as fire-resistant wire and cable jacketing, insulation foams, and specialized coatings. Additionally, the aerospace and defense sectors, though lower in volume, represent high-value customers due to the extreme performance and regulatory requirements for fire safety in aircraft interiors and defense electronics. These end-users prioritize BDP's non-halogenated status and its effectiveness in maintaining material integrity under severe thermal stress, often requiring customized, low-smoke, low-toxicity formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess, ICL Group, Albemarle Corporation, BASF SE, Clariant, Daihachi Chemical Industry Co., Ltd., ADEKA Corporation, Oceanchem Group Limited, Jiangsu Yoke Technology Co., Ltd., Shandong Xinghe Chemical Co., Ltd., PCC Group, Italmatch Chemicals, Huber Engineered Materials, Emerald Kalama Chemical, Budenheim. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

BDP Flame Retardants Market Key Technology Landscape

The technological landscape of the BDP Flame Retardants market is characterized by ongoing innovation aimed at enhancing efficiency, reducing toxicity profiles, and optimizing compatibility with next-generation polymers. A key area of technological development is the refinement of the synthesis process for BDP itself, focusing on achieving higher purity and reducing residual Bisphenol A (BPA) content, thereby addressing environmental concerns and meeting stricter regulatory limits. Advanced manufacturing techniques, including continuous processing and improved crystallization methods, are being deployed to maximize yield and ensure batch-to-batch consistency, which is crucial for high-specification engineering plastics used in critical infrastructure.

Furthermore, significant advancements are being made in the application technology of BDP. This includes the development of synergistic flame retardant systems, where BDP is combined with other non-halogenated additives, such as nitrogen-based compounds (e.g., melamine polyphosphate) or high-performance mineral fillers (e.g., aluminum trihydrate or magnesium hydroxide). The goal of these synergistic blends is to achieve equivalent or superior fire retardancy performance (e.g., UL94 V-0 at lower thicknesses) while minimizing the total additive loading, thus preserving the desirable mechanical, aesthetic, and processing properties of the base polymer. Microencapsulation technology is also gaining traction, where BDP particles are coated to improve dispersion, minimize interaction with the polymer matrix during processing, and potentially enhance fire performance by controlling the release rate during combustion.

Another emerging technological focus involves developing reactive BDP derivatives. While traditional BDP is an additive that physically blends into the polymer, reactive flame retardants chemically bond with the polymer backbone. This permanent integration prevents leaching, enhances durability, and reduces volatility, making it ideal for applications requiring long-term stability, such such as outdoor photovoltaic components or structural automotive parts. Although the majority of BDP usage remains additive, reactive chemistry represents a high-value technological niche that offers superior environmental profiles and material longevity, driving future premium market expansion, particularly in high-specification automotive and aerospace composites.

Regional Highlights

Regional dynamics within the BDP Flame Retardants Market are highly stratified, reflecting global manufacturing trends, varying regulatory stringencies, and regional demand profiles in key end-use industries.

- Asia Pacific (APAC): APAC commands the largest share of the BDP market and is projected to exhibit the highest growth rate during the forecast period. This dominance is driven by the region's position as the global manufacturing hub for electronics, home appliances, and, increasingly, automotive components, particularly in China, South Korea, and Southeast Asia. Regulatory harmonization, particularly in China's push for stricter fire safety standards in building and electronics, mandates the use of non-halogenated solutions like BDP. The high growth in indigenous electric vehicle production across APAC further solidifies its critical importance to the BDP supply chain.

- North America: North America represents a mature, yet stable, market characterized by strong regulatory enforcement from bodies such as the Consumer Product Safety Commission (CPSC) and UL standards. Demand here is robust in the high-performance E&E sector (data centers, enterprise IT equipment) and the advanced automotive industry. The region is a key adopter of innovative BDP applications, particularly in specialized composite materials and infrastructure projects, focusing heavily on low smoke and low toxicity characteristics.

- Europe: The European market is defined by the most stringent environmental and safety regulations, notably REACH and RoHS, which accelerate the phase-out of traditional halogenated alternatives. This regulatory environment acts as a powerful driver for BDP adoption, particularly in Germany and the Benelux region, which house major chemical and automotive manufacturing centers. European market growth is concentrated in high-value, sustainable applications, with a strong emphasis on achieving circular economy goals through recyclable FR solutions.

- Latin America (LATAM): LATAM is an emerging market for BDP, driven by growing local manufacturing capabilities and increasing adoption of international safety standards in construction and consumer electronics, particularly in Brazil and Mexico. Market penetration is gradually expanding, although growth is often sensitive to economic stability and the pace of infrastructural development.

- Middle East and Africa (MEA): Demand in MEA is primarily linked to large-scale construction projects, infrastructure development, and growing local assembly of electronic goods. While currently a smaller market share, countries like Saudi Arabia and the UAE, with high investment in modern, fire-safe building codes, present significant long-term opportunities for BDP in cable and wire applications and insulation materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the BDP Flame Retardants Market.- Lanxess (Formerly Chemtura)

- ICL Group Ltd.

- Albemarle Corporation

- BASF SE

- Clariant AG

- Daihachi Chemical Industry Co., Ltd.

- ADEKA Corporation

- Oceanchem Group Limited

- Jiangsu Yoke Technology Co., Ltd.

- Shandong Xinghe Chemical Co., Ltd.

- PCC Group

- Italmatch Chemicals S.p.A.

- Huber Engineered Materials

- Emerald Kalama Chemical (A LANXESS Company)

- Budenheim

- Kyodo Chemical Co., Ltd.

- Zhejiang Wansheng Chemical Co., Ltd.

- Guangzhou Li-Feng Chemical Co., Ltd.

- Rianlon Corporation

- Foshan Rich Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the BDP Flame Retardants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using BDP Flame Retardants over traditional halogenated alternatives?

BDP (Bisphenol A Bis(diphenyl phosphate)) is a preferred halogen-free flame retardant, offering key advantages such as superior thermal stability, low volatility, reduced smoke density during combustion, and minimal environmental persistence compared to brominated flame retardants (BFRs), ensuring compliance with stringent global environmental directives like RoHS and WEEE.

In which specific polymer applications is BDP most effective and commonly used?

BDP is highly effective in engineering plastics, primarily used in Polycarbonate/ABS (PC/ABS) blends and Epoxy Resins. Its high efficiency enables these polymers to achieve demanding fire safety standards, such as UL94 V-0, making it indispensable for casings and components in consumer electronics, IT hardware, and electric vehicle battery enclosures.

How is the BDP Flame Retardants market impacted by the growth of the Electric Vehicle (EV) industry?

The EV industry significantly boosts BDP demand, as stringent fire safety and thermal management are required for high-voltage battery modules, charging infrastructure, and interior components. BDP's thermal stability and ability to maintain material integrity under high operational heat make it a critical additive for EV safety compliance.

Are there regulatory concerns regarding the use of BDP due to its Bisphenol A (BPA) component?

While BDP is synthesized using BPA, the final BDP molecule is highly stable, and its high molecular weight significantly limits migration and toxicity risks compared to free BPA monomers. Manufacturers prioritize high-purity BDP with minimal residual BPA to address regulatory concerns and ensure safety in consumer-facing applications, aligning with current international EHS guidelines.

Which geographical region holds the largest market share for BDP Flame Retardants?

The Asia Pacific (APAC) region currently holds the largest market share for BDP Flame Retardants. This dominance is attributed to the presence of the world's largest manufacturing base for electrical and electronic goods, combined with rapidly tightening regional fire safety regulations pushing the adoption of high-performance, halogen-free solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager