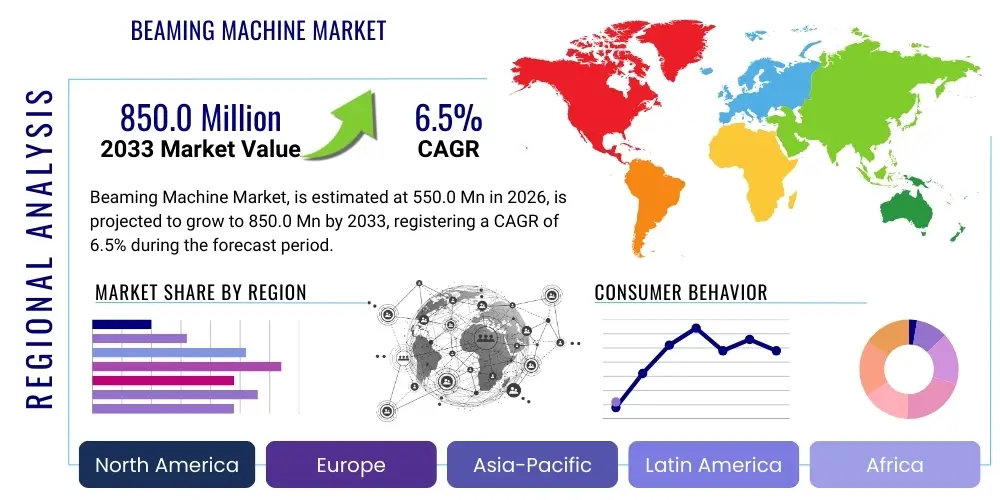

Beaming Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442855 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Beaming Machine Market Size

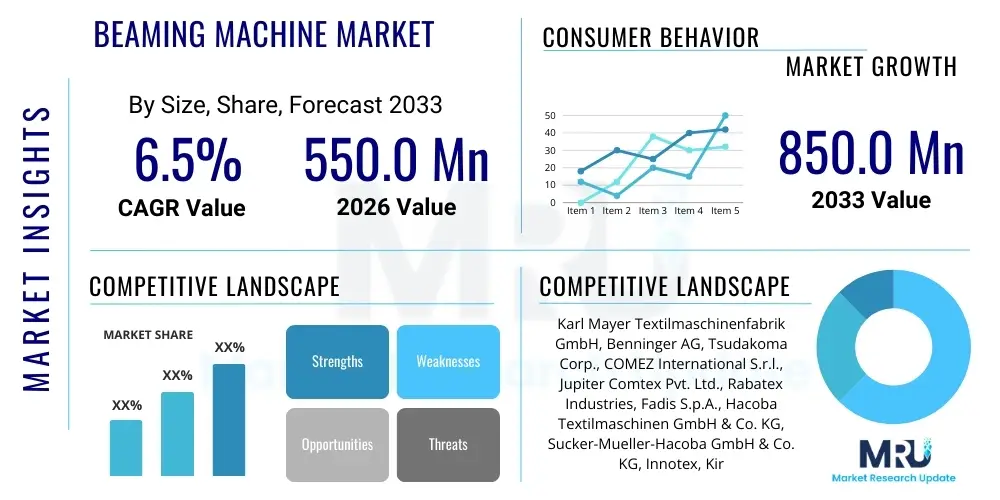

The Beaming Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 550.0 Million in 2026 and is projected to reach USD 850.0 Million by the end of the forecast period in 2033.

Beaming Machine Market introduction

The Beaming Machine Market encompasses specialized industrial equipment designed primarily for preparing large quantities of warp yarn for subsequent weaving processes, particularly within the textile manufacturing sector. These machines precisely wind numerous strands of yarn onto large beams or spools, ensuring uniform tension, density, and length across all threads. This preparatory step is critical to the efficiency and quality of the downstream weaving, knitting, or subsequent material treatment operations. High-precision beaming machines are essential tools for producing high-quality fabrics, ranging from standard apparel textiles to highly specialized technical textiles and composites used in automotive and aerospace applications.

The core functionality of beaming machines involves complex synchronization mechanisms, advanced tension control systems, and robust material handling capabilities. Product descriptions often highlight features such as automatic beam loading, variable speed control, integration with data monitoring systems, and the ability to handle a wide variety of fiber types, including natural fibers, synthetics, and technical filaments like carbon fiber or glass fiber. Modern beaming machines leverage servo motor technology and computerized controls to minimize yarn breakage and maximize operational speed, directly contributing to overall manufacturing productivity and minimizing material waste during preparation.

Major applications for beaming machines span traditional textile mills producing apparel and home furnishings, specialized non-woven material manufacturing, and technical textile production for industries requiring high structural integrity, such as geotextiles, medical textiles, and ballistic protection. Key benefits driving market demand include enhanced product uniformity, significant reduction in manual labor through automation, increased throughput speed, and the capacity to manage complex warping patterns necessary for advanced fabric structures. Market growth is primarily driven by the ongoing global demand for textiles, the increasing shift towards technical and high-performance materials, and continuous technological innovations aimed at improving automation and precision in yarn preparation processes.

Beaming Machine Market Executive Summary

The Beaming Machine Market is characterized by a steady transition toward automation and digitalization, driven by intense competitive pressure across global manufacturing supply chains. Current business trends indicate a strong preference for high-speed, fully automatic beaming solutions equipped with integrated sensor technologies for real-time tension monitoring and fault detection. Key manufacturers are focusing on developing machines compatible with Industry 4.0 frameworks, enabling seamless integration with Manufacturing Execution Systems (MES) and enterprise resource planning (ERP) platforms, thereby enhancing overall operational visibility and predictive maintenance capabilities. Furthermore, there is a growing demand for specialized beaming solutions tailored to handle sensitive or high-strength technical yarns, reflecting the diversification of textile applications beyond traditional apparel.

Regionally, the Asia Pacific (APAC) area remains the primary growth engine for the Beaming Machine Market, propelled by substantial investments in textile infrastructure modernization, particularly in countries like China, India, and Vietnam, which are consolidating their positions as global manufacturing hubs. Europe and North America, while having mature textile markets, demonstrate robust demand for technologically advanced, high-precision beaming machines necessary for the production of highly specialized and premium technical textiles. These regions prioritize efficiency, sustainability, and quality control, leading to high adoption rates of sophisticated, high-cost machinery. The Middle East and Africa (MEA) and Latin America represent emerging markets showing gradual adoption driven by localized textile production growth and capacity expansion.

Segment trends reveal that the Fully Automatic Beaming Machine segment is expanding rapidly due to labor cost optimization and the pursuit of operational scalability, surpassing the growth rate of semi-automatic and manual variants. By application, the Technical Textiles segment is witnessing accelerated growth, fueled by the demand for advanced materials in end-use sectors like automotive composites, filtration systems, and construction materials. Conversely, the traditional apparel textile segment, while still dominant in market share, exhibits stable, moderate growth. Key market challenges include the high initial capital investment required for automated systems and the need for highly skilled labor to manage and maintain complex modern beaming technology.

AI Impact Analysis on Beaming Machine Market

User queries regarding AI integration in the Beaming Machine Market predominantly center on how artificial intelligence can move beyond simple automation to achieve true process optimization. Common themes include the potential for AI-driven predictive maintenance to minimize unplanned downtime, the capability of machine learning algorithms to fine-tune yarn tension and winding parameters dynamically based on material properties, and the effectiveness of AI in enhancing quality control by analyzing image recognition data for microscopic defects. Users are keenly interested in understanding the return on investment (ROI) for incorporating AI modules into existing machinery and the extent to which AI can reduce material waste and energy consumption in high-volume production environments, transforming beaming from a mechanical process into an optimized, self-regulating operation.

The integration of Artificial Intelligence (AI) and machine learning (ML) algorithms is revolutionizing the operation and maintenance of beaming machines, leading to unprecedented levels of precision and operational efficiency. AI is primarily deployed to analyze vast streams of data generated by embedded sensors related to yarn tension, humidity, speed, and vibration. This analysis allows the system to detect subtle anomalies that precede mechanical failure, enabling sophisticated predictive maintenance schedules and significantly extending the lifespan of critical components. Furthermore, AI-driven closed-loop control systems can instantly adjust machine settings to compensate for variations in raw material properties or environmental conditions, ensuring optimal beam quality and consistency throughout the entire winding process, which is critical for specialized, sensitive yarns.

Moreover, AI contributes significantly to quality assurance by processing high-resolution visual data captured by integrated cameras. These systems can identify minute defects in the yarn, such as splices, slubs, or foreign inclusions, far faster and more reliably than human operators. By correlating these defect points with subsequent weaving performance data, ML models continuously improve the winding strategy to minimize stress points. This transformation elevates the beaming process from a mere material transfer operation to a highly intelligent preparation stage, crucial for achieving zero-defect goals, particularly in demanding applications like medical devices or aerospace composites.

- AI enables real-time, dynamic tension control based on fiber characteristics and environmental conditions.

- Machine learning algorithms optimize winding patterns to minimize yarn stress and maximize beam stability.

- Predictive maintenance analytics, powered by AI, forecast component failure, reducing unplanned machine downtime by up to 25%.

- Integrated vision systems utilize AI for automated, high-speed detection of yarn defects and inconsistencies.

- AI optimizes energy consumption by learning optimal operating cycles and speed profiles for different yarn types.

- Enhanced integration with supply chain systems allows AI to correlate raw material quality input with final beam output quality metrics.

DRO & Impact Forces Of Beaming Machine Market

The Beaming Machine Market's trajectory is primarily shaped by the confluence of technological advancements (Drivers) and structural market hurdles (Restraints), opening various avenues for expansion (Opportunities). The main drivers propelling the market include the increasing global emphasis on industrial automation, the accelerating demand for high-quality technical textiles across multiple industries (automotive, defense, healthcare), and the necessity for improved operational efficiency to reduce manufacturing costs. Conversely, major restraints involve the considerable initial capital expenditure required for acquiring advanced automatic beaming machines, the operational complexity and the specialized skill set required for maintenance, and economic volatility affecting capital investment decisions in key manufacturing regions. These competing forces interact to create the market's impact forces, determining the speed and direction of technological adoption and geographical market penetration, particularly favoring highly automated, precision-focused machinery over traditional manual variants.

The primary impact forces currently driving market evolution are the push towards Industry 4.0 compliance and the relentless focus on sustainability. Manufacturers are increasingly prioritizing machinery that offers seamless data integration and connectivity, enabling remote diagnostics and integrated production planning. This focus ensures that new beaming installations are not isolated assets but integrated components of a smart factory ecosystem. Simultaneously, sustainability concerns are influencing design choices, leading to demand for machines with reduced energy footprints, minimal material waste capabilities, and the capacity to handle recycled or alternative fibers without compromising beam quality. These forces ensure that only high-efficiency, digitally enabled machinery will remain competitive in the long term, favoring vendors who invest heavily in R&D for automation and data analytics platforms.

Opportunities for market expansion are significant, especially within emerging economies where textile production capacity is expanding rapidly, and older machinery is being phased out in favor of modern, high-speed equipment. The development of specialized beaming solutions for advanced materials—such as carbon fiber, aramid fibers, and complex composite precursors—presents a high-value niche market. Furthermore, service-based opportunities, including machine leasing, subscription models for predictive maintenance software, and comprehensive training programs, offer avenues for vendors to create recurring revenue streams and mitigate the high upfront cost restraint for smaller or medium-sized enterprises. Successful navigation of these impact forces requires manufacturers to offer scalable solutions that address both cost constraints and the imperative for high precision.

Segmentation Analysis

The Beaming Machine Market is comprehensively segmented based on machine type, level of automation, application, and geography, providing granular insights into demand patterns across various industrial sectors. The segmentation by type typically differentiates between standard warping beams and sectional warping beams, which cater to different weaving complexities and production batch sizes. The most critical segmentation is by automation level, distinguishing between basic manual models, semi-automatic systems, and high-throughput fully automatic machines. Application segmentation reveals the diverse end-use industries, ranging from high-volume production for traditional apparel to highly technical requirements in automotive and aerospace. Analyzing these segments helps stakeholders tailor product development, marketing strategies, and distribution channels to target the most lucrative and fastest-growing sub-markets globally.

- By Type:

- Sectional Warping Machines

- Direct Warping/Beaming Machines

- Sizing-Beaming Machines (integrated solutions)

- By Automation Level:

- Manual Beaming Machines

- Semi-Automatic Beaming Machines

- Fully Automatic Beaming Machines

- By Application:

- Traditional Textiles (Apparel & Home Furnishings)

- Technical Textiles (Automotive, Geotextiles, Medical, Industrial)

- Non-Woven Materials Production

- Advanced Composites Preparation

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, Italy, Turkey, Rest of Europe)

- Asia Pacific (China, India, Japan, Southeast Asia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, South Africa)

Value Chain Analysis For Beaming Machine Market

The value chain for the Beaming Machine Market begins upstream with raw material suppliers, predominantly providers of high-precision mechanical components, servo motors, advanced sensor technology, and computerized control systems. Key activities at this stage include sourcing high-grade steel and aluminum for machine construction, specialized electronics, and software development licenses for integrated control platforms. Manufacturers of beaming machines then engage in design, assembly, testing, and quality control, ensuring the machinery meets stringent performance and safety standards. This upstream segment is highly concentrated, relying on established suppliers who can provide reliable, durable, and highly precise components essential for machine longevity and operational accuracy.

The downstream segment of the value chain focuses on market access, distribution, and post-sale service. Distribution channels typically involve a mix of direct sales teams for large strategic customers, specialized industrial equipment dealers and distributors, and, increasingly, digital platforms for spare parts and maintenance schedules. Direct channels are crucial for customized or highly technical machinery sales, while distributors often handle sales to smaller textile manufacturers. Post-sales services, including installation, commissioning, operator training, maintenance contracts, and technical support, are vital components of the value proposition, often differentiating key market players and contributing significantly to long-term profitability and customer retention. The effectiveness of the service network directly impacts machine uptime for end-users.

The critical link in the middle of the value chain is the machine manufacturer, who transforms components into high-value capital goods. Efficient logistics and inventory management are crucial due to the large size and high cost of these machines. Innovation in the manufacturing process, such as adopting modular designs for faster assembly and customization, optimizes this stage. The interaction between manufacturer and end-user often involves lengthy sales cycles, technical consultations, and financing arrangements, underlining the importance of strong sales engineering capabilities. Success in the market depends not just on product quality but on the manufacturer's ability to integrate components efficiently and support the equipment throughout its operational life via robust service networks, defining the crucial transition from production to deployment.

Beaming Machine Market Potential Customers

Potential customers for Beaming Machines are primarily entities engaged in large-scale yarn preparation and subsequent material conversion processes. The largest segment of buyers consists of integrated textile mills involved in mass production of woven and knitted fabrics for the apparel and home textile sectors. These customers require high-speed, durable direct warping machines capable of handling diverse fibers efficiently. A second, increasingly important customer base is manufacturers specializing in technical textiles, including companies producing automotive seat fabrics, industrial filters, medical gauze, protective clothing, and composite reinforcement materials. These buyers prioritize sectional warping machines offering meticulous tension control and pattern variability to handle high-performance and sensitive technical yarns like glass, aramid, and carbon fibers.

A third category of potential customers includes non-woven manufacturers, who utilize specialized beaming setups for preparing web materials or precursor layers for processes like spun bonding and melt blowing. Furthermore, specialized research and development institutions, universities with material science departments, and pilot manufacturing plants also represent niche buyers, often requiring highly flexible and customizable beaming equipment for experimentation with new materials and processes. For all customer types, purchasing decisions are heavily influenced by the machine's overall equipment efficiency (OEE), labor requirements, footprint size, and, critically, the technological capability to integrate with existing mill management systems (Industry 4.0 compatibility).

The increasing trend toward localized production and specialized manufacturing in developed economies means that even smaller, highly specialized textile operations—often called 'micro-mills' or bespoke manufacturers—are becoming target customers for compact, high-precision beaming solutions. These niche players seek solutions that minimize material waste and allow for rapid changeovers between complex, small-batch orders. The end-user spectrum thus ranges from massive, vertically integrated corporations in Asia utilizing hundreds of standard automatic beaming machines to specialized composite manufacturers in Europe requiring bespoke, technologically advanced systems for highly demanding material preparation tasks, emphasizing precision over sheer volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Million |

| Market Forecast in 2033 | USD 850.0 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Karl Mayer Textilmaschinenfabrik GmbH, Benninger AG, Tsudakoma Corp., COMEZ International S.r.l., Jupiter Comtex Pvt. Ltd., Rabatex Industries, Fadis S.p.A., Hacoba Textilmaschinen GmbH & Co. KG, Sucker-Mueller-Hacoba GmbH & Co. KG, Innotex, Kirloskar Toyoda Textile Machinery Ltd., A.T.E. Enterprises Private Limited, Rius-Comatex, S.A., Dalian Huali Technology Co., Ltd., Simet S.p.A., Zhejiang Huacheng Warp Knitting Machinery Co., Ltd., ITEMA Group, CTMTC, Oerlikon Textile GmbH & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beaming Machine Market Key Technology Landscape

The technological landscape of the Beaming Machine Market is rapidly evolving, moving away from purely mechanical systems toward sophisticated mechatronics incorporating advanced digital control. A core technology advancement is the widespread adoption of precision servo motor drives, replacing older mechanical linkages and providing unparalleled accuracy in tension control, speed synchronization, and beam density management. This shift allows machines to handle highly elastic or brittle yarns without damage, significantly expanding the range of materials that can be processed efficiently. Furthermore, integrated sensor networks, utilizing technologies like non-contact laser measurement and high-resolution load cells, provide the real-time feedback necessary for these servo systems to maintain flawless operational parameters, minimizing material waste and maximizing the quality of the final warp beam, which is crucial for high-speed weaving.

Another pivotal technological development involves the implementation of sophisticated software and Human-Machine Interface (HMI) systems. Modern beaming machines feature intuitive, touch-screen interfaces that enable operators to program complex winding recipes, diagnose faults, and monitor machine performance metrics remotely. This software backbone supports connectivity requirements inherent in Industry 4.0, facilitating seamless communication between the beaming machine, centralized mill management systems (MES), and cloud-based data analytics platforms. This connectivity is essential for implementing predictive maintenance algorithms and optimizing production planning across the entire textile facility, transitioning from reactive maintenance to proactive, data-driven management.

Furthermore, specialized technologies are emerging for handling challenging technical materials. This includes heated or temperature-controlled beaming environments designed for specific synthetic fibers or composite precursors that require precise temperature management during the winding process to maintain structural integrity. Automated material handling systems, such as robotic loading and unloading of heavy beams, are also becoming standard features in high-end systems, improving operational safety and further reducing reliance on manual labor. The continuous evolution of these technologies underscores the market's focus on maximizing throughput, ensuring absolute quality consistency, and facilitating the complex processing requirements of the technical textile segment, thereby maintaining technological competitiveness globally.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Beaming Machine Market, commanding the largest market share due to its status as the world's primary manufacturing hub for textiles and garments. Countries like China, India, Vietnam, and Bangladesh are continually investing heavily in modernizing and expanding their spinning and weaving capacities to meet both domestic and export demands. The region's growth is driven by the sheer volume of production and the ongoing replacement of outdated, manual machinery with high-speed, automatic beaming systems, providing robust volume-based demand. This regional dominance is projected to continue, fueled by favorable governmental policies supporting textile infrastructure development and the large, relatively low-cost labor pool, although the shift toward automation aims to mitigate future labor cost increases.

- Europe: The European market for beaming machines is characterized by high demand for quality, precision, and specialized technical capabilities rather than volume alone. European textile manufacturers, particularly in Italy, Germany, and Turkey, are global leaders in producing high-value, niche products, including advanced technical textiles for automotive interiors, aerospace, and medical applications. This market primarily demands high-end, fully automatic sectional warping machines integrated with AI and sensor technologies for precise control over delicate, high-cost yarns. The emphasis is heavily placed on sustainability features, energy efficiency, and adherence to stringent quality standards, driving continuous innovation among regional suppliers.

- North America: North America represents a mature, high-value market focused on highly specialized applications and short-run production capabilities. While bulk apparel production has largely shifted overseas, the demand for domestically produced technical textiles (e.g., non-woven filtration media, protective gear, advanced composites) remains strong. The region exhibits high adoption rates of advanced automation technologies, prioritizing low-labor solutions and seamless digital integration (Industry 4.0). Purchasing decisions are heavily influenced by the total cost of ownership (TCO) and the machine’s ability to handle complex material changes quickly and efficiently.

- Latin America (LATAM): The LATAM market, particularly Brazil and Mexico, is experiencing moderate but steady growth, driven by localized apparel production aimed at domestic and near-shoring markets. Investment in modern beaming technology is often tied to government initiatives aimed at boosting the competitiveness of local industries. The market primarily targets mid-range semi-automatic and automatic machines that offer a balance between investment cost and operational efficiency, aiming to upgrade existing production infrastructure without excessive capital outlay.

- Middle East and Africa (MEA): The MEA market is an emerging zone showing significant potential, largely driven by investments in textile manufacturing hubs in countries like Turkey (already strong, often categorized partly in Europe), Egypt, and specific Gulf nations seeking economic diversification. Demand is generally focused on durable, reliable automatic machinery suitable for varied production scales. Infrastructure challenges and political stability can occasionally impact investment cycles, but the long-term outlook remains positive, supported by population growth and increasing domestic consumption of textile goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beaming Machine Market.- Karl Mayer Textilmaschinenfabrik GmbH

- Benninger AG

- Tsudakoma Corp.

- COMEZ International S.r.l.

- Jupiter Comtex Pvt. Ltd.

- Rabatex Industries

- Fadis S.p.A.

- Hacoba Textilmaschinen GmbH & Co. KG

- Sucker-Mueller-Hacoba GmbH & Co. KG

- Innotex

- Kirloskar Toyoda Textile Machinery Ltd.

- A.T.E. Enterprises Private Limited

- Rius-Comatex, S.A.

- Dalian Huali Technology Co., Ltd.

- Simet S.p.A.

- Zhejiang Huacheng Warp Knitting Machinery Co., Ltd.

- ITEMA Group

- CTMTC

- Oerlikon Textile GmbH & Co. KG

- Warp Preparation Specialists

Frequently Asked Questions

Analyze common user questions about the Beaming Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for fully automatic beaming machines?

The primary driver is the need for labor cost reduction and enhanced operational precision. Fully automatic machines offer consistent, high-speed winding, minimizing human error and maximizing throughput, which is critical for large-scale textile operations in competitive global markets.

How does Industry 4.0 impact the competitive landscape of the Beaming Machine Market?

Industry 4.0 mandates connectivity and data exchange. Machines integrated with IoT sensors and MES platforms enable predictive maintenance and real-time process optimization, providing manufacturers offering these capabilities a significant competitive advantage in efficiency and service quality.

Which geographical region is expected to show the highest growth rate (CAGR) for beaming machine adoption?

The Asia Pacific region, particularly South and Southeast Asian countries, is expected to exhibit the highest market growth due to continuous capital investment in textile infrastructure modernization, capacity expansion, and the rising global demand for textile exports originating from these regions.

What is the key technological challenge in beaming technical textiles, such as carbon fiber?

The key challenge is maintaining extremely precise and consistent yarn tension control across all threads. Technical fibers are often sensitive, brittle, or expensive, requiring advanced servo motor controls and non-contact tension measurement systems to prevent damage and ensure structural integrity of the final beam.

What are the typical initial costs associated with acquiring an advanced beaming machine?

Initial costs are substantial, often categorized as high capital expenditure. While prices vary widely based on automation level and precision (sectional vs. direct), sophisticated, fully automatic beaming machines designed for technical textiles can represent significant investments, acting as a major restraint for smaller enterprises.

The Beaming Machine Market is currently experiencing a profound transformation, moving beyond conventional winding technology towards highly sophisticated, digitally integrated systems. This strategic shift is largely fueled by the relentless pressure on textile manufacturers globally to enhance operational efficiency, minimize material waste, and achieve unparalleled quality consistency, especially when handling expensive and specialized technical yarns. The market’s resilience is underpinned by the essential role beaming plays in the upstream process of virtually all woven and warp-knitted materials. Consequently, technological innovation, particularly in areas like servo motor precision, sensor integration, and predictive analytics, is not merely incremental but foundational to maintaining competitiveness.

The segmentation by Application, notably the surging Technical Textiles category, underscores a crucial market evolution. As automotive, aerospace, medical, and defense sectors increasingly rely on high-performance materials (such as aramid, carbon, and specialized glass fibers), the demand for beaming machines capable of managing these complex fibers with zero defects and absolute tension accuracy has become paramount. This high-value segment attracts premium pricing and substantial R&D investment, contrasting with the more volume-driven, price-sensitive Traditional Textiles segment, although the latter still accounts for the majority of installed capacity globally. Future growth forecasts depend heavily on manufacturers’ abilities to scale production technologies efficiently while offering tailored solutions that meet the diverse requirements of both mass-market and high-specification end-users.

In terms of strategic decision-making, leading manufacturers are increasingly focusing on developing holistic, software-driven service portfolios rather than just selling standalone machinery. The integration of proprietary software for remote diagnostics, operator training modules, and subscription-based predictive maintenance services is crucial for unlocking sustained revenue growth and building long-term customer relationships. Given the high initial cost barrier (Restraint), offering flexible financing and value-added service packages (Opportunity) helps mitigate investment risk for buyers and accelerates technology adoption, particularly in developing economies within the APAC and LATAM regions, which are eager to modernize their textile footprints to capture greater global market share.

The regulatory environment, particularly concerning safety, energy consumption, and environmental impact, is also shaping product development. European and North American markets are prioritizing machinery designed for minimum energy consumption and capable of handling recycled or sustainable fibers without performance degradation. This regulatory pressure, combined with corporate social responsibility goals, compels manufacturers to invest in eco-friendly designs, creating a distinct competitive advantage for those who can demonstrate superior energy efficiency and material optimization. Therefore, success in the Beaming Machine Market relies on a three-pronged strategy: technological superiority (precision and automation), digital integration (Industry 4.0 compliance), and robust global service support tailored to regional operational requirements.

Further analysis of the competitive landscape reveals that key market players, predominantly based in Europe and Asia, are engaged in aggressive patenting and strategic acquisitions to consolidate technological expertise, particularly in sophisticated control systems and advanced material handling. This consolidation aims to capture the high-margin technical textile segment, where precision requirements are highest. The influence of regional trade agreements and localized manufacturing mandates is also a significant factor, potentially leading to decentralized manufacturing or localized assembly operations by global leaders to better serve specific regional markets like India or Vietnam. This geographical diversification strategy minimizes logistical complexities and ensures prompt local technical support, a critical differentiator in the capital equipment sector.

Investment patterns across the globe show a divergence: APAC focuses on expanding large production facilities demanding durable, high-throughput machines, whereas Western markets prioritize upgrading existing machinery with IoT kits and specialized modules to enhance flexibility and capability for highly customized product lines. This dichotomy ensures continued demand across all segments, from standard direct warping machines to complex, multi-component sectional warping systems. The capacity for manufacturers to customize standard machinery to accommodate niche textile production processes—such as beaming fine filament yarns for medical devices or heavy industrial fibers for geotextiles—is increasingly becoming a key sales criterion, reflecting the market’s move towards customization and high specialization.

The potential threat of substitution remains low, as the beaming process is fundamental and irreplaceable in preparing warp for high-quality weaving and knitting. However, indirect threats arise from innovations in weaving technology itself (e.g., highly advanced air-jet or rapier looms that might tolerate slightly lower beam quality), placing continuous pressure on beaming machine manufacturers to deliver impeccable beam consistency. Consequently, product innovation cycles are accelerating, focusing on integrating artificial intelligence (AI) for self-correcting tension systems and automated quality verification. The transition towards smart manufacturing environments necessitates that beaming machines operate autonomously within a broader, interconnected factory floor, contributing real-time data to enterprise resource planning (ERP) systems for seamless inventory and production management.

The environmental considerations within the Beaming Machine Market are gaining traction, particularly as end consumers and textile brands demand greater supply chain transparency and adherence to sustainable practices. Machines designed for minimum lubricant usage, reduced energy consumption per kilometer of yarn processed, and high efficiency in handling sustainable fibers (e.g., recycled polyester, organic cotton) are seeing preferential adoption in environmentally conscious markets. Manufacturers are responding by offering modular designs that facilitate easier upgrades and end-of-life recycling, aligning product lifecycles with circular economy principles. This commitment to sustainability is rapidly moving from a niche marketing point to a mandatory requirement for high-value sales in developed markets, influencing procurement standards significantly across the industry.

Finally, the challenge of maintaining and operating these sophisticated machines presents a significant market opportunity for training and service providers. The complexity introduced by servo controls, HMI systems, and integrated AI means that textile mill technicians require continuous, specialized training. Manufacturers who offer comprehensive, certified training programs, often leveraging augmented reality (AR) for remote troubleshooting and maintenance instruction, are adding significant value beyond the hardware itself. This service layer mitigates the skilled labor shortage restraint and ensures maximum uptime, solidifying the long-term partnership between the machine vendor and the textile producer. The market is thus shifting towards a model where the provision of advanced knowledge and continuous technical support is as valuable as the machinery itself.

The continued expansion of global trade and regional specialization further influences the Beaming Machine Market dynamics. For instance, the rise of regional textile clusters focusing on specific product niches, such as premium denim in certain parts of Asia or specialized composite manufacturing in Europe, creates concentrated demand for tailored machinery solutions. Manufacturers must adapt their sales strategies to address these unique cluster demands, which might include specific regulatory compliance features or integration capabilities unique to regional industrial standards. This high degree of specialization ensures that market competition is fierce, compelling manufacturers to continually refine their product lines and investment in R&D to maintain a technological edge. The ability to offer rapid customization and highly specific material processing capabilities is becoming a decisive factor in securing large capital equipment contracts.

Furthermore, the financial aspects of capital investment continue to shape the market structure. High upfront costs often necessitate favorable financing terms, extended warranty periods, and guaranteed service level agreements (SLAs). Key players frequently leverage captive finance arms or strong relationships with specialized industrial finance institutions to offer attractive purchase packages, thereby lowering the effective barrier to entry for prospective buyers, especially in emerging markets where local capital liquidity might be constrained. This focus on financial flexibility is essential for driving the replacement cycle of older, less efficient machinery, particularly within established textile manufacturing nations seeking to upgrade their productivity levels to compete with high-volume producers.

The emergence of localized competitors in Asia Pacific poses both a challenge and an opportunity. While these regional players often offer price-competitive alternatives, particularly in the semi-automatic and standard direct warping segments, global leaders maintain dominance in the high-precision sectional warping and fully automated segments due to technological superiority and decades of accumulated expertise. The primary competitive strategy for Western-based market leaders involves emphasizing superior yarn handling quality, greater reliability, integrated digital features, and unparalleled longevity (lower TCO over 15-20 years), differentiating themselves clearly from lower-cost alternatives. Intellectual property protection and continuous innovation in core motion control and data analytics remain vital for these established companies to protect their market share in the high-value sectors.

Ultimately, the Beaming Machine Market reflects the broader trends within the manufacturing sector: a decisive move towards digital integration, automation, and sustainability. The future market success will be defined by machines that not only perform the fundamental task of yarn preparation flawlessly but also act as intelligent, interconnected nodes within a smart factory, contributing to higher productivity, lower waste, and reduced environmental footprint. Stakeholders must continuously monitor shifts in textile production locations, emerging fiber technologies (e.g., bio-based polymers), and advancements in AI/IoT to capitalize on the dynamic growth opportunities present across global regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager