Bed Slats Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443400 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Bed Slats Market Size

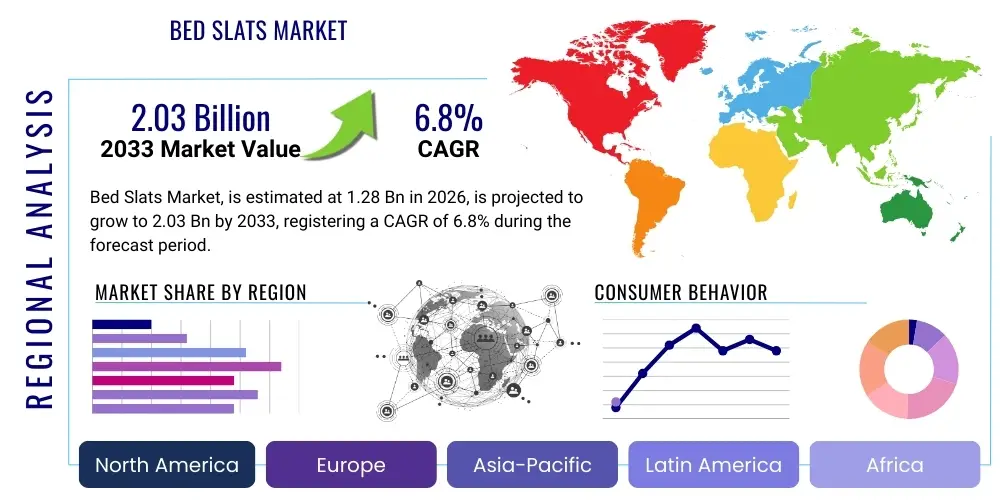

The Bed Slats Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.28 billion in 2026 and is projected to reach USD 2.03 billion by the end of the forecast period in 2033. This consistent expansion is primarily driven by the robust growth in the global furniture and bedding industry, coupled with increasing consumer awareness regarding the importance of proper mattress support for ergonomic sleep health. The replacement cycle for bedding components, alongside the burgeoning hospitality sector, further solidifies the market's trajectory.

Bed Slats Market introduction

The Bed Slats Market encompasses the production and distribution of foundational components used within bed frames to support mattresses, ensuring structural integrity, weight distribution, and adequate ventilation. These components are essential for maintaining mattress longevity and providing the necessary firmness and resilience for sleep comfort. The primary product variations include fixed rigid slats, which offer maximum stability, and sprung or flexible slats, which provide ergonomic adjustments and enhanced cushioning, particularly popular in European markets. Major applications span residential settings, encompassing traditional bedrooms and guest rooms, as well as high-volume commercial environments such as hotels, dormitories, and healthcare facilities.

Key benefits of high-quality bed slats include improved air circulation beneath the mattress, preventing moisture build-up and inhibiting mold and mildew growth, which contributes significantly to a healthier sleep environment. Furthermore, correctly spaced and manufactured slats prevent premature sagging of the mattress, thereby extending its functional lifespan. Driving factors for market growth include the rising global construction of residential units, the steady expansion of the hospitality and tourism sectors necessitating frequent bedding replacement, and a widespread consumer shift toward modular and easy-to-assemble furniture solutions, where slat systems are fundamental.

Modern innovation focuses on material science, favoring laminated veneer lumber (LVL) and specialized composites for enhanced durability and flexibility, replacing traditional solid wood in many premium segments. The demand for customized and adjustable slat systems, often integrated into smart beds or adjustable bases, is increasing, reflecting sophisticated consumer preferences for personalized sleep experiences and solutions tailored to orthopedic needs.

Bed Slats Market Executive Summary

The global Bed Slats Market is characterized by resilient growth, primarily fueled by urbanization and the corresponding surge in demand for space-efficient and functional furniture. Business trends indicate a strong shift towards e-commerce channels for direct-to-consumer sales, allowing specialized slat manufacturers to bypass traditional retail intermediaries. Furthermore, sustainability is emerging as a critical competitive factor, with leading manufacturers investing in responsibly sourced timber and recycled materials to meet stringent environmental, social, and governance (ESG) standards favored by consumers and corporate clients alike. Technological adoption, specifically advanced Computer Numerical Control (CNC) machining and lamination processes, is driving manufacturing efficiencies and enabling the production of more precise and ergonomic slat configurations, supporting market expansion.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, attributed to its massive manufacturing base, particularly in China and Southeast Asia, supplying global original equipment manufacturers (OEMs). Concurrently, APAC also represents the largest consumer market due to rapid population growth and improving living standards leading to higher expenditure on home furnishings. Europe remains a key region for product innovation, specifically in the Sprung Slats segment, where regulatory standards often prioritize orthopedic support and material quality. North America exhibits consistent demand, heavily influenced by the large-scale residential housing market and the high popularity of boxed mattresses, which often require robust and well-ventilated support systems.

Segment trends reveal that the Laminated Veneer Lumber (LVL) material segment is experiencing the fastest adoption rate due to its superior strength-to-weight ratio and consistency compared to traditional solid wood. By type, the Flexible/Sprung Slats segment is projected to gain market share, capitalizing on consumer willingness to invest in higher-cost, ergonomic bedding components. End-user demand remains strong across both residential and commercial sectors, though the residential segment, driven by household turnover and renovation activities, continues to account for the majority of the market value.

AI Impact Analysis on Bed Slats Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Bed Slats Market primarily revolve around operational efficiency, customized product design, and supply chain predictive capabilities. Consumers and industry professionals frequently question how AI can optimize the cutting and yield of expensive raw materials (lumber), minimize waste in complex lamination processes, and improve inventory management to handle fluctuating timber costs and seasonal demand for various bed sizes. Key themes highlight the expectation that AI will transition bed slat production from a highly material-intensive, relatively standardized process to a lean, data-driven operation capable of rapid customization and improved quality control. The anticipation is that AI systems will eventually be integrated into the design phase, allowing manufacturers to simulate stress points and material fatigue based on predicted user weight distribution and sleep habits.

The deployment of AI and machine learning (ML) algorithms is set to revolutionize several stages of the bed slat manufacturing value chain. In the upstream phase, AI-powered systems can analyze real-time timber quality data and optimize cutting patterns to maximize the number of usable components extracted from each raw plank, thereby substantially reducing material waste and production costs. This precision is particularly crucial for Laminated Veneer Lumber (LVL) production, where consistent lamination quality is paramount. Furthermore, integrating AI into factory floor operations allows for predictive maintenance of CNC machinery, minimizing downtime and ensuring continuous, high-volume production necessary for mass-market furniture supply.

Beyond manufacturing, AI is significantly impacting logistics and demand forecasting within the Bed Slats Market. ML models process vast datasets related to furniture sales trends, housing starts, and e-commerce consumer behavior to generate highly accurate predictions of demand for specific slat dimensions (e.g., King, Queen, European sizes). This predictive capability minimizes overstocking and reduces lead times, a critical factor given the global nature of lumber sourcing and component shipping. While AI does not directly interact with the physical bed slat product in the way it might interact with a smart mattress, its influence on the profitability, sustainability, and efficiency of the components' production process is profound and rapidly accelerating.

- AI optimizes raw material yield through advanced cutting algorithms (minimizing lumber waste).

- Machine Learning (ML) enhances predictive demand forecasting for varied bed slat dimensions and types.

- AI-driven quality control systems monitor lamination and precision cutting for defect reduction.

- Predictive maintenance schedules for manufacturing machinery increase operational uptime.

- Algorithms optimize logistics and warehousing, matching inventory levels to e-commerce demand fluctuations.

- AI supports customized slat design by simulating stress tests and load-bearing capacity based on material input.

DRO & Impact Forces Of Bed Slats Market

The dynamics of the Bed Slats Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces defining market growth and limitation. Key drivers include the exponential growth in the global residential housing sector, particularly in emerging economies, alongside a heightened consumer focus on wellness and orthopedic health, necessitating ergonomic bedding foundations. The proliferation of ready-to-assemble (RTA) and modular furniture, which relies heavily on standardized, easy-to-install slat systems, further propels demand. However, the market faces significant restraints, notably the volatile pricing and supply chain instability of raw materials, predominantly various grades of timber, which are susceptible to environmental regulations and global trade disputes. The increasing market penetration of solid platform beds, which bypass the need for traditional flexible slat systems, also poses a structural restraint on certain market segments.

Opportunities for growth are concentrated in the development and market penetration of sustainable and high-performance composite materials, offering enhanced durability and resistance to moisture compared to traditional wood. The growing trend of customization, particularly adjustable and zone-specific support systems integrated with bed slats, presents a premiumization pathway. Furthermore, strategic opportunities exist for manufacturers focusing on vertical integration or strong digital distribution channels to capitalize on the robust global e-commerce furniture market. The impact forces indicate a competitive environment where operational efficiency (driven by technology) and material innovation are crucial for market success.

The primary impact forces can be synthesized into factors concerning raw material dependency, technological adoption, and consumer behavior shifts. The need for precise engineering in slat systems to support modern memory foam and hybrid mattresses, which often require specific, narrow spacing for warranty compliance, acts as a crucial driver demanding higher quality manufacturing. Conversely, the high capital expenditure required for sophisticated lamination and CNC equipment acts as a barrier to entry for smaller manufacturers. The enduring demand from the hospitality industry for durable, easy-to-replace components ensures a stable base demand, offsetting some of the volatility experienced in the residential DIY segment.

Segmentation Analysis

The Bed Slats Market is comprehensively segmented based on material, type, and end-user, reflecting the diverse applications and functional requirements across the global bedding industry. Material segmentation includes traditional options like solid wood (pine, spruce, birch), advanced engineered wood products such as Laminated Veneer Lumber (LVL), metals (steel or aluminum), and various composite materials. This material diversity dictates the strength, flexibility, cost, and lifespan of the final product. Segmentation by type differentiates between rigid, fixed slats, offering basic uniform support, and flexible, sprung, or adjustable slats, which provide ergonomic compliance and targeted body support, commanding a higher price point due to their complex structure and specialized manufacturing requirements. Finally, end-user segmentation separates the high-volume, durability-focused demands of the commercial sector (hospitality, institutional) from the quality- and aesthetic-driven requirements of the residential consumer market.

- By Material:

- Wood (Solid Wood, Plywood)

- Laminated Veneer Lumber (LVL)

- Metal (Steel, Aluminum)

- Composites/Plastics

- By Type:

- Fixed/Rigid Slats

- Sprung/Flexible Slats

- Adjustable Slats/Systems

- By End-User:

- Residential

- Commercial (Hospitality, Healthcare, Institutional)

- By Distribution Channel:

- OEMs (Original Equipment Manufacturers)

- Aftermarket/Retail (E-commerce, Specialty Stores, Home Improvement)

Value Chain Analysis For Bed Slats Market

The value chain for the Bed Slats Market begins with raw material sourcing, primarily focusing on forestry and lumber processing. Upstream analysis involves the procurement of suitable, often sustainably certified, timber (such as spruce or birch for flexibility, or pine for rigidity) which is then transported to specialized lamination and cutting facilities. For Laminated Veneer Lumber (LVL), this stage includes veneer peeling, adhesive application, pressing, and curing, requiring significant capital investment in advanced machinery and strict quality control to achieve optimal strength and consistency. The efficiency and cost-effectiveness at the upstream level are heavily dependent on global commodity prices and adherence to sustainable forest management practices, which increasingly influence market access in Western economies.

The midstream segment involves the transformation of raw or engineered lumber into finished bed slats. This includes precision cutting using CNC machinery, edging, drilling for fasteners, and, for sprung systems, attaching specialized end caps and suspension components made of plastic or rubber. Quality assurance is critical here, ensuring dimensional accuracy and load-bearing capacity meet international standards. Distribution channels form the critical downstream link, connecting manufacturers to end-users. Direct channels involve sales to Original Equipment Manufacturers (OEMs) – major furniture and bed manufacturers who integrate the slats into their final products. Indirect channels leverage wholesalers, large furniture retailers, and, increasingly, specialized e-commerce platforms and DIY home improvement stores, particularly for replacement and repair parts. The rise of e-commerce necessitates robust logistics for handling bulky, long items.

The complexity of the distribution hinges on whether the slats are sold as individual components (aftermarket) or integrated systems (OEM supply). Direct interaction with OEMs often involves long-term contracts and adherence to strict specifications, offering stable, high-volume revenue. Conversely, the aftermarket via e-commerce demands agility in inventory management and customer service, as consumers often require guidance on fitting and compatibility. Effective management of this distribution dichotomy is essential for maximizing market reach and profitability across the fragmented global consumer base. The overall value chain is focused on converting low-value raw materials into a standardized, yet structurally critical, high-precision furniture component, with technology being the key differentiator in material yield and product quality.

Bed Slats Market Potential Customers

Potential customers for the Bed Slats Market are broadly segmented into three primary categories: Original Equipment Manufacturers (OEMs), the global Hospitality and Institutional sectors, and direct Residential Consumers (DIY/Aftermarket buyers). OEMs represent the largest volume purchasers, integrating slats as a core component within their complete bed frame and furniture product lines. These customers demand strict adherence to quality, consistent supply, competitive pricing, and often require tailored dimensions or specific material certifications, making long-term supply agreements a characteristic feature of this buyer segment. The trend among OEMs is to favor LVL or composite materials for improved performance and standardization across their product catalogs.

The hospitality sector, including major hotel chains, resorts, and institutional facilities such as universities and military barracks, requires extremely durable and easily replaceable slat systems capable of enduring heavy, continuous use and frequent turnover. For these buyers, longevity, ease of maintenance, and compliance with fire safety regulations are paramount purchasing criteria. They typically procure components through specialized commercial suppliers or directly from manufacturers via bulk contracts, focusing on fixed or heavy-duty rigid slats that offer maximum structural stability and minimum long-term maintenance costs, ensuring operational efficiency.

Residential consumers form the increasingly important aftermarket and DIY segment. These buyers purchase slats either as replacement parts for existing worn-out foundations or as components for custom-built or modular bed frames. The growth of the 'bed-in-a-box' mattress industry has amplified the need for consumers to purchase adequate support systems separately, driving demand for high-quality, pre-packaged slat kits sold through retail and e-commerce channels. This segment is highly sensitive to online reviews, installation ease, and quick shipping times, favoring modular kits with clear instructions and readily available support, contrasting sharply with the bulk purchase criteria of the OEM and hospitality sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.28 Billion |

| Market Forecast in 2033 | USD 2.03 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leggett & Platt, Spühl, Enkev Natural Fibres, Boyteks Tekstil, Interprint, Carpenter Co., Froli Systems, Völkle, Otto Bock, Auping, Dura-Beam, Texel, Latexco, Recticel, Kessling, Wood Components Group, Zinus, Sige S.p.A., Tvilum A/S, IKEA Components. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bed Slats Market Key Technology Landscape

The technological landscape of the Bed Slats Market is primarily focused on precision engineering, material science advancements, and highly automated manufacturing processes designed to enhance product performance, consistency, and cost-efficiency. A core technology is the production of Laminated Veneer Lumber (LVL), where thin sheets of wood veneer are bonded together under high heat and pressure with specialized adhesives. This process significantly improves the load-bearing capacity and flexibility compared to solid wood, allowing manufacturers to create durable, curved sprung slats that meet stringent ergonomic requirements. The utilization of advanced thermosetting resins and formaldehyde-free adhesives is a key technological trend, addressing health and environmental concerns while maximizing structural integrity and minimizing weight.

Automation plays a pivotal role, with Computer Numerical Control (CNC) machining centers being essential for high-volume production. CNC technology ensures dimensional accuracy for standardized bed sizes (e.g., metric vs. imperial dimensions) and facilitates complex routing and drilling operations required for assembling sprung slat systems and integrating them into modular bed frames. This automation minimizes human error, optimizes the yield from expensive raw timber, and enables manufacturers to rapidly switch between producing different slat types and dimensions, which is crucial for managing diverse global orders and OEM specifications. The integration of robotics for material handling and stacking further enhances production throughput and worker safety in the mill environment.

Furthermore, technology is increasingly focused on the periphery components, particularly the end caps and adjustable mechanisms used in flexible slat systems. Manufacturers employ specialized injection molding techniques for high-density polypropylene or specialized rubber end caps, designed to provide silent operation, absorb shock, and fit securely into bed rails. For adjustable slat systems, proprietary mechanical and electronic actuator technology is used, allowing users to fine-tune the firmness in specific zones (e.g., lumbar region). This integration of specialized material engineering with electronic control systems marks the shift toward viewing bed slats not merely as static support elements, but as integral components of a dynamic, ergonomic sleep foundation, significantly differentiating premium products in the market.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to remain the dominant region in terms of production volume and is poised for the fastest market growth globally. This is driven by its status as a major global manufacturing hub for furniture, with countries like China, Vietnam, and India exporting vast quantities of bed components to North America and Europe. Domestically, rapid urbanization, rising disposable incomes, and mass construction projects fuel substantial demand for basic, cost-effective rigid slat systems in the residential sector. Key opportunities lie in manufacturers adopting automation to maintain cost competitiveness against rising local labor costs.

- Europe: Europe represents a mature market characterized by high consumer preference for quality, ergonomic design, and sprung/flexible slat systems, particularly in Germany, France, and the Nordic countries. Strict regulations regarding material toxicity and sustainability (FSC certification) drive technological innovation, leading to a higher average selling price for bed slats compared to other regions. The market is saturated with specialized, high-performance manufacturers focusing on customizable and adjustable foundation systems, often integrated into premium mattresses and adjustable beds.

- North America: The North American market is highly influenced by the robust demand for "bed-in-a-box" mattresses, which typically require strong, closely spaced slat systems for proper support and warranty compliance. Sales are heavily distributed through large retail chains and, crucially, e-commerce platforms, favoring easy-to-assemble and durable products, primarily fixed wood or metal slats. The US housing market stability and frequent furniture replacement cycles ensure steady demand, with customization gaining traction as consumers seek tailored sleep solutions.

- Latin America (LATAM): LATAM exhibits moderate growth, tied closely to economic stability and construction activity in key markets such as Brazil and Mexico. The market generally favors cost-effective, solid wood options, although luxury segments show increasing adoption of imported or locally manufactured LVL and ergonomic systems. Supply chains in this region can be volatile, making local sourcing strategies critical for competitive positioning.

- Middle East and Africa (MEA): Growth in MEA is highly uneven, concentrated in the Gulf Cooperation Council (GCC) states due to extensive infrastructure development, luxury residential projects, and substantial investment in the hospitality sector. Demand here often prioritizes high-end, durable components suitable for luxury hotel environments. The African sub-regions present niche opportunities centered around localized manufacturing for affordable housing initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bed Slats Market.- Leggett & Platt

- Spühl

- Enkev Natural Fibres

- Boyteks Tekstil

- Interprint

- Carpenter Co.

- Froli Systems

- Völkle

- Otto Bock

- Auping

- Dura-Beam

- Texel

- Latexco

- Recticel

- Kessling

- Wood Components Group

- Zinus

- Sige S.p.A.

- Tvilum A/S

- IKEA Components

Frequently Asked Questions

Analyze common user questions about the Bed Slats market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of bed slats, and why are they necessary?

Bed slats, whether rigid or flexible, serve as the foundational support system for a mattress, directly impacting its performance and lifespan. Their primary functions are to distribute the mattress weight evenly, prevent sagging, and ensure continuous air circulation underneath the mattress, which is vital for preventing moisture build-up and maintaining a hygienic sleep environment.

What is the difference between fixed (rigid) slats and sprung (flexible) slats?

Fixed slats offer uniform, unyielding support, typically made of solid wood or metal, providing a firm foundation suitable for traditional mattresses. Sprung slats, often made from Laminated Veneer Lumber (LVL) with an upward curve, are inherently flexible and provide ergonomic support that conforms slightly to body weight and shape, enhancing comfort and shock absorption, commonly used in European-style beds.

What is Laminated Veneer Lumber (LVL) and why is it preferred in modern bed slats?

LVL is an engineered wood product created by gluing multiple thin layers of wood veneers together under heat and pressure. It is highly preferred because it offers superior strength-to-weight ratio, high consistency, and increased flexibility compared to natural lumber. This makes LVL ideal for producing durable, consistent sprung slats required for high-performance and ergonomic bedding systems.

How far apart should bed slats be to support a memory foam mattress properly?

For optimal performance and to maintain the warranty of most memory foam and hybrid mattresses, slats should be spaced no more than 2 to 3 inches (approximately 5 to 7.5 centimeters) apart. Wider spacing can cause the foam to sag between the gaps, leading to poor support and premature mattress degradation, which is why close spacing is a critical specification for modern support systems.

Which regions lead the market in the manufacturing and adoption of bed slats?

Asia Pacific (APAC), particularly China and Southeast Asia, leads globally in manufacturing volume due to abundant raw materials and large production capacities. Europe, however, leads in the adoption and innovation of high-end, ergonomic sprung slat systems, driven by strong consumer demand for orthopedic and adjustable sleep solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager