Beef Tallow Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442911 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Beef Tallow Market Size

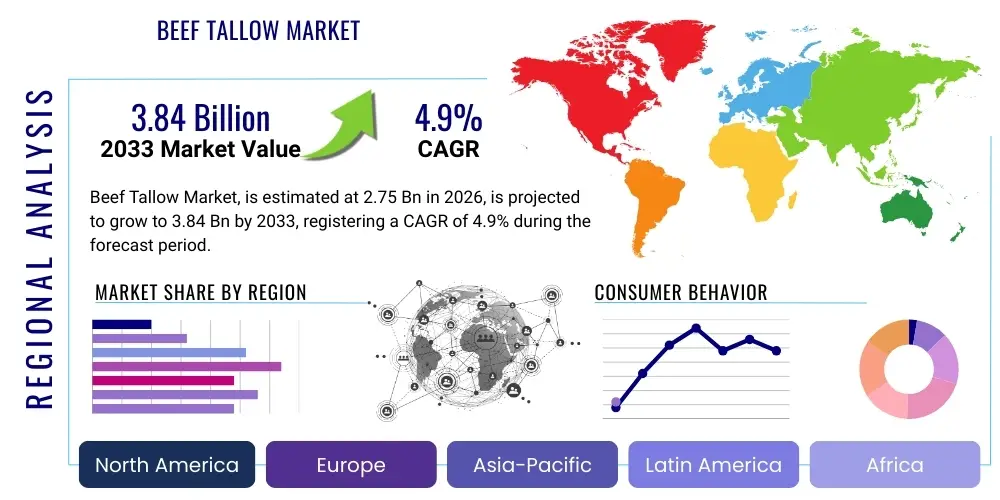

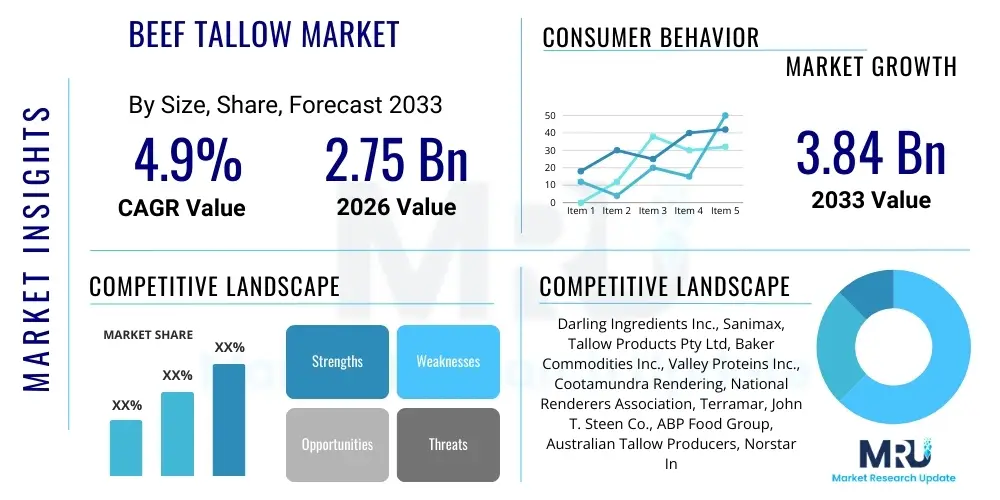

The Beef Tallow Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.85% between 2026 and 2033. The market is estimated at USD 2.75 Billion in 2026 and is projected to reach USD 3.84 Billion by the end of the forecast period in 2033.

Beef Tallow Market introduction

Beef tallow, a rendered form of beef fat, is a versatile commodity derived from the bovine rendering process. Traditionally utilized in cooking for its high smoke point and distinct flavor profile, its modern significance extends far beyond culinary applications. Chemically composed primarily of triglycerides, rich in saturated and monounsaturated fatty acids, tallow offers unique physical and chemical properties that make it essential across various industrial sectors. The purification and processing of crude beef fat into tallow involve stringent steps, including melting, refining, bleaching, and deodorization (MRBD), ensuring compliance with international standards for food, pharmaceutical, and industrial grades.

Major applications of beef tallow span food preparation (baking, frying media), oleochemical production (soaps, detergents, lubricants), animal feed formulation (energy source), and, increasingly, as a critical feedstock for the burgeoning biofuel industry, particularly hydrotreated vegetable oil (HVO) and biodiesel. The revival of interest in natural, whole-fat ingredients, coupled with the escalating global mandate for sustainable energy sources, positions beef tallow as a strategically important commodity in the global fat and oil complex. Its economic benefits, driven by its status as a high-volume byproduct of the meat industry, further enhance its competitiveness against plant-based alternatives in industrial settings.

The market is predominantly driven by the robust demand from the biodiesel sector, where tallow offers a cost-effective and low-carbon intensity (CI) feedstock option compared to virgin vegetable oils. Furthermore, the growing trend toward clean label ingredients in the processed food industry favors animal fats like beef tallow over highly refined or synthetic oils. Supply chain stability, though inherently tied to the dynamics of the global beef industry, is being addressed through advancements in rendering efficiency and sustainable sourcing practices. The convergence of energy demands and consumer preferences for traditional ingredients underpins the strong market trajectory.

Beef Tallow Market Executive Summary

The Beef Tallow Market is experiencing substantial growth, primarily catalyzed by macroeconomic shifts favoring sustainable and cost-effective raw materials. Business trends indicate a marked increase in capital expenditure directed towards advanced rendering facilities globally, focusing on improving yields, quality consistency, and operational energy efficiency. Consolidation among major rendering companies is a notable trend, aiming to stabilize supply chains and gain economies of scale necessary to meet the high-volume requirements of the biofuel sector. Furthermore, vertical integration, particularly involving meat processors entering the downstream refining or oleochemical production space, is reshaping competitive dynamics and reducing reliance on third-party suppliers, thereby optimizing the value extraction from bovine byproducts.

Regional trends reveal the North American market as the largest and fastest-growing hub, largely due to expansive government incentives supporting renewable fuels, such as the US Renewable Fuel Standard (RFS) and state-level Low Carbon Fuel Standards (LCFS) in California and Oregon, which heavily rely on tallow as a preferred feedstock. Conversely, the European market, while mature in oleochemical applications, faces stringent sustainability criteria and competition from advanced waste oils. The Asia Pacific region, particularly China and India, is emerging as a significant consumption center driven by rapid growth in animal feed production and industrial manufacturing, demanding high-quality technical grade tallow for soap and grease production.

Segmentation trends highlight the dominance of the Industrial segment, fueled by the explosive demand for biodiesel and HVO production, which commands substantial purchasing power and dictates global pricing benchmarks for technical tallow grades. Within the Application segment, the Biofuel category is projected to exhibit the highest CAGR through 2033, fundamentally shifting tallow from a traditional food additive/feed ingredient to a strategic industrial commodity. Simultaneously, the food segment maintains stable growth, supported by niche consumer markets and specific ethnic culinary practices, emphasizing the dual-market nature of beef tallow utilization.

AI Impact Analysis on Beef Tallow Market

User inquiries regarding AI's influence on the Beef Tallow Market often center on optimizing the inherently complex and variable rendering process, enhancing supply chain transparency, and predicting commodity price fluctuations. Key themes reflect user concerns about minimizing waste and maximizing yield from raw materials of inconsistent quality, standardizing fat content across batches, and leveraging data analytics for regulatory compliance in global trade. Expectations are focused on AI-driven predictive maintenance for high-capital rendering equipment and sophisticated modeling to determine the optimal timing for feedstock procurement and derivative sales in highly volatile energy and oleochemical markets.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the operational efficiency and strategic positioning of rendering operations. AI algorithms are deployed to analyze real-time input characteristics, such as moisture content, protein levels, and impurity profiles of incoming beef fat, dynamically adjusting processing parameters (temperature, pressure, duration) in rendering cookers. This immediate, data-driven optimization minimizes energy consumption, significantly reduces processing time, and ensures a consistently high-quality output of tallow, meeting stringent specifications required by end-users like biofuel refineries or specialized oleochemical plants.

Furthermore, AI is crucial in sophisticated demand forecasting and inventory management. By integrating global agricultural commodity prices, geopolitical events impacting meat production, regulatory updates affecting biofuel mandates, and real-time logistics data, ML models provide highly accurate predictions regarding future tallow supply and demand curves. This allows major market players to execute proactive hedging strategies, optimize storage utilization, and manage supply contracts more effectively, mitigating the risks associated with commodity price volatility and ensuring resilience in the complex global fats and oils trading environment.

- AI-driven optimization of rendering parameters for consistent quality and reduced energy use.

- Predictive maintenance schedules for high-value rendering equipment, minimizing downtime.

- Machine learning models for commodity price forecasting and strategic feedstock procurement.

- Enhanced supply chain traceability using AI to monitor source compliance and sustainability metrics.

- Automated quality assurance (QA) through computer vision systems inspecting finished tallow color and clarity.

DRO & Impact Forces Of Beef Tallow Market

The Beef Tallow Market is propelled by strong systemic drivers, constrained by critical challenges, and supported by significant emerging opportunities, all interacting to shape its market trajectory. The primary driver is the accelerating global adoption of sustainable aviation fuel (SAF) and renewable diesel (HVO), where tallow serves as a cost-competitive and regulatory-compliant feedstock essential for meeting decarbonization targets, particularly in North America and Europe. This industrial pull is complemented by the consumer trend towards traditional, less-processed fats in the food sector, favoring tallow over hydrogenated vegetable oils. However, the market faces significant restraints, notably the increasing influence of vegetarian and vegan consumer trends, which indirectly limit the expansion of the primary source material (beef production). Furthermore, volatility in global feed grain markets directly impacts the cost of beef production, leading to fluctuating raw material prices for renderers.

Impact forces currently favoring the market include favorable government policies, particularly tax credits and mandates supporting bio-based fuels in developed economies, which solidify long-term industrial demand. The rising need for specialized oleochemicals in biodegradable detergents and lubricants also strengthens the industrial application base. Conversely, a major restraining force is the negative environmental perception associated with large-scale bovine agriculture, leading to scrutiny from environmental regulatory bodies and consumer advocacy groups regarding the sustainability of the supply chain. This regulatory pressure necessitates costly investments in sustainable sourcing verification and wastewater management within rendering facilities.

Significant market opportunities reside in the development of highly refined, specialty tallow derivatives for high-end cosmetic and pharmaceutical applications, capitalizing on the natural composition of bovine fats. Furthermore, technological advancements in fractionation and separation techniques allow renderers to isolate specific fatty acid fractions (e.g., stearic acid, oleic acid) from tallow, creating higher-value niche products and diversifying revenue streams away from purely commodity markets. Strategic partnerships between large rendering companies and energy majors to secure dedicated feedstock pipelines for biofuel production represent a crucial opportunity for stabilizing long-term supply agreements and optimizing logistical costs.

Segmentation Analysis

The Beef Tallow Market is systematically segmented based on Source, Application, and Form, allowing for granular analysis of supply chain dynamics and demand profile shifts across end-user industries. The segmentation reflects the dual nature of tallow, serving both high-volume industrial commodity markets and specialized, high-grade food and pharmaceutical sectors. Analysis across these segments is essential for understanding pricing variations, quality requirement distinctions, and the overall allocation strategy for rendered fats globally, particularly as the biofuel sector increasingly commands higher volumes of technical-grade material.

Segmentation by Source differentiates between pure beef fat trimmings from slaughterhouses (offering higher quality for food use) and mixed bovine byproducts, including bone and carcass remnants, which typically yield technical-grade tallow. The Application segmentation is pivotal, dividing the market into Food (baking, frying), Industrial (oleochemicals, lubricants), Feed (animal nutrition), and Biofuel (biodiesel, HVO), with the latter driving the most aggressive growth. Form segmentation, distinguishing between solid and liquid tallow, impacts logistics, storage requirements, and immediate end-user processing needs, reflecting seasonal and geographical processing capabilities.

- By Source:

- Pure Beef Fat Trimmings

- Mixed Bovine Byproducts

- By Application:

- Food & Culinary

- Animal Feed

- Industrial (Lubricants, Greases, Polymers)

- Oleochemicals (Soaps, Detergents, Fatty Acids)

- Biofuel (Biodiesel, HVO, SAF Feedstock)

- By Form:

- Liquid Tallow

- Solid/Hard Tallow (Flaked or Block)

Value Chain Analysis For Beef Tallow Market

The value chain for beef tallow commences upstream with the highly centralized process of commercial cattle slaughter and primary beef processing at abattoirs. These facilities generate the raw beef fat trimmings and inedible bovine byproducts, which constitute the essential raw material supply for the rendering industry. The efficiency of the upstream segment is intrinsically linked to the scale and operational efficacy of the global beef sector, where factors such as livestock health, feed costs, and transportation logistics significantly influence the volume and initial cost of the raw fat delivered to renderers. Upstream consolidation among major meat packers directly impacts the negotiating power of renderers over feedstock pricing.

The core processing stage involves the rendering plants, where raw fat is transformed into refined tallow, meat and bone meal, and other byproducts through heat and separation processes. Renderers invest heavily in advanced technologies for energy efficiency and quality control, essential for meeting the diverse specifications of downstream users. The value addition here is substantial, turning a low-value byproduct into a specialized commodity. Distribution channels for tallow are highly diversified; direct channels are common for large-volume industrial users like biofuel producers, where integrated pipelines or dedicated tanker shipments facilitate continuous supply. Indirect channels utilize specialized commodity traders, brokers, and logistics providers who handle smaller volumes, regional distribution, and the necessary regulatory documentation for global trade.

Downstream applications are diverse, creating complex market segmentation. The Biofuel sector represents the fastest-growing and largest segment, demanding continuous, high-volume supplies of technical-grade tallow. The Oleochemical sector is a critical consumer, using tallow for fatty acid derivatives that feed into household and industrial products (soaps, lubricants). Food-grade tallow requires the highest level of purity and processing, catering to specialized food manufacturers. The complexity of the value chain necessitates robust traceability systems, particularly for export markets and biofuel mandates requiring verifiable chain-of-custody documentation regarding feedstock origin and sustainability criteria.

Beef Tallow Market Potential Customers

The customer base for beef tallow is heterogeneous, spanning multiple trillion-dollar industries globally, with purchasing decisions dictated by specific quality requirements, cost considerations, and regulatory compliance. The largest and most influential customer cohort comprises biodiesel and renewable diesel (HVO) manufacturers. These firms require vast, continuous supplies of high-quality technical tallow meeting strict specifications for free fatty acids and moisture content to maximize conversion efficiency in their hydrotreating or transesterification processes. Their demand is highly inelastic to moderate price fluctuations due to strong government mandates and the need for reliable, low-carbon intensity feedstocks.

Another major segment consists of oleochemical producers and manufacturers of soaps, detergents, and industrial lubricants. For these buyers, tallow provides a sustainable, cost-effective source of long-chain fatty acids (stearic acid and oleic acid), essential building blocks for surfactants and specialized greases. Their purchasing criteria often prioritize color, odor neutrality (achieved through refining and deodorization), and consistent iodine value, which determines the final properties of the derived oleochemical products. The stability of supply is crucial for continuous manufacturing operations in this segment.

The third significant group includes large-scale food processors, bakeries, and food service companies seeking high-quality frying media and baking ingredients. Tallow offers exceptional oxidative stability and a desirable texture profile for specific food applications (e.g., savory snacks, ethnic foods). Procurement in the food segment demands the highest certification standards, including HACCP and kosher/halal compliance, strict limits on impurities, and verified purity levels. Finally, the animal feed industry utilizes lower grades of tallow as a dense energy source in poultry, swine, and pet food formulations, prioritizing price efficiency and guaranteed absence of prohibited contaminants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.75 Billion |

| Market Forecast in 2033 | USD 3.84 Billion |

| Growth Rate | 4.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Darling Ingredients Inc., Sanimax, Tallow Products Pty Ltd, Baker Commodities Inc., Valley Proteins Inc., Cootamundra Rendering, National Renderers Association, Terramar, John T. Steen Co., ABP Food Group, Australian Tallow Producers, Norstar Industries, Faccenda Group, Dupps Company, West Coast Reduction Ltd., Agri Beef Co., Lopez Foods, Inc., Euro Fats International, Promat S.r.l., Griffin Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beef Tallow Market Key Technology Landscape

The technological landscape in the Beef Tallow market is defined by continuous innovation aimed at increasing efficiency, enhancing product purity, and mitigating environmental impact in the rendering process. The transition from traditional batch rendering to continuous rendering systems (e.g., continuous dry rendering and low-temperature rendering) is a key technological shift. Continuous systems offer superior energy efficiency, higher throughput capacity, and improved control over processing parameters, which results in tallow with lower Free Fatty Acid (FFA) content, crucial for high-value applications like biofuel feedstock and food ingredients. Advanced decanters and centrifuges are used downstream of the cooker to achieve optimal separation of fat, water, and solids, leading to reduced impurities and better final product yield.

Furthermore, post-rendering refinement technologies are critical for market differentiation. These include fractionation, which separates tallow into high-melting point (stearin) and low-melting point (olein) components, enabling renderers to tailor products for specific industrial uses, such as producing specialty lubricants or high-stability frying fats. Hydrogenation and interesterification technologies are also deployed to modify the textural and stability characteristics of tallow, making it suitable for replacement of vegetable oils in certain food manufacturing and oleochemical processes. The goal of these refining steps is to unlock higher market values for various tallow fractions, moving the product up the value chain.

Sustainability technologies are becoming paramount, driven by regulatory pressures and corporate environmental commitments. This includes sophisticated odor control systems (biofilters, thermal oxidizers) to address community concerns, and advanced wastewater treatment systems (anaerobic digestion) to recover energy and clean water from high-strength effluent. Crucially, the integration of heat recovery systems within continuous rendering operations minimizes external energy consumption, leading to lower operating costs and a reduced carbon footprint, which is a significant selling point when supplying feedstock to the highly carbon-sensitive renewable fuel industry.

Regional Highlights

The global Beef Tallow market exhibits distinct regional dynamics driven by local beef production volumes, regulatory landscapes concerning renewable energy, and regional consumption patterns in food and oleochemical industries. North America, encompassing the U.S. and Canada, commands the largest market share and highest growth trajectory. This dominance is directly attributable to the mature and extensive beef processing industry providing abundant feedstock, coupled with aggressive governmental policies like the Renewable Fuel Standard and California’s LCFS, which establish robust, price-supported demand for tallow as a preferred biofuel raw material. The U.S. remains the epicenter of innovation in rendering technology and large-scale renewable diesel production utilizing tallow.

Europe represents a mature market characterized by strong regulatory oversight on rendering byproducts (BSE regulations) and robust demand from the oleochemical sector. While European biofuel mandates also drive consumption, the market often prioritizes domestically sourced, high-quality fats and faces intense competition from used cooking oil (UCO) and specific vegetable oil derivatives. Demand for food-grade tallow remains stable, supported by traditional cooking practices in several Northern and Central European countries. The region’s focus on circular economy principles encourages maximum utilization of byproducts, maintaining steady industrial demand.

The Asia Pacific (APAC) region is categorized by rapid urbanization, expanding middle-class populations, and significant growth in meat consumption and animal feed production, particularly in China, India, and Southeast Asia. These factors drive rising demand for both feed-grade tallow (as an energy booster) and industrial tallow for soap, candle, and basic lubricant manufacturing. While local production capacity is expanding, APAC remains a net importer of technical-grade tallow to meet its burgeoning industrial requirements. Latin America, specifically Brazil and Argentina, are critical as major global beef exporters, resulting in significant capacity for raw fat production and emerging regional rendering hubs capable of servicing both domestic needs and growing export markets, primarily targeting biofuel producers in the U.S. and Europe.

- North America (U.S., Canada): Dominant market share driven by aggressive HVO and biodiesel mandates (RFS, LCFS). High technological adoption in continuous rendering and sophisticated supply chain logistics for renewable fuel feedstock.

- Europe (Germany, UK, France): Mature market with strong oleochemical demand and stringent regulatory standards (BSE regulations). Focus on high-quality industrial fats, facing competition from UCO and internal sustainability sourcing requirements.

- Asia Pacific (China, India, Australia): Fastest growth in feed and basic industrial applications (soaps, candles). Australia and New Zealand are key exporters of high-quality tallow; China is a major importer for industrial processing.

- Latin America (Brazil, Argentina): Major global source of raw beef fat due to vast cattle industries. Emerging local refining capacity focused on exporting technical-grade tallow to energy markets abroad.

- Middle East & Africa (MEA): Niche market driven by regional food traditions and local soap manufacturing. Imports high-grade tallow for specialized applications; limited domestic rendering scale outside of major meat processing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beef Tallow Market.- Darling Ingredients Inc.

- Sanimax

- Tallow Products Pty Ltd

- Baker Commodities Inc.

- Valley Proteins Inc.

- Cootamundra Rendering

- National Renderers Association

- Terramar

- John T. Steen Co.

- ABP Food Group

- Australian Tallow Producers

- Norstar Industries

- Faccenda Group

- Dupps Company

- West Coast Reduction Ltd.

- Agri Beef Co.

- Lopez Foods, Inc.

- Euro Fats International

- Promat S.r.l.

- Griffin Industries

Frequently Asked Questions

Analyze common user questions about the Beef Tallow market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Beef Tallow Market?

The predominant driver is the escalating global demand for renewable fuels, specifically renewable diesel (HVO) and Sustainable Aviation Fuel (SAF). Beef tallow is a critical, cost-effective, and low-carbon intensity feedstock essential for meeting aggressive biofuel production mandates in North America and Europe.

How does the quality of beef tallow impact its end-use application?

Tallow quality, measured by metrics like Free Fatty Acid (FFA) content, moisture, impurity levels, and color, directly determines its market value. Food-grade tallow requires the highest purity (low FFA) while technical-grade tallow is suitable for oleochemicals and biofuel production, where higher FFA content can sometimes be tolerated but impacts processing efficiency.

What are the main alternatives competing with beef tallow in industrial markets?

Key competitive alternatives in the industrial sector, particularly for biofuel and oleochemical production, include Used Cooking Oil (UCO), poultry fat, pork fat (lard), and vegetable oils such as soybean oil and palm oil. UCO poses the strongest competition due to its favorable regulatory status as a sustainable waste product.

Which geographical region holds the largest market share for beef tallow consumption?

North America, particularly the United States, holds the largest market share due to its massive domestic beef production capabilities combined with the robust and financially incentivized renewable diesel industry, which consumes the majority of available technical-grade tallow.

What technological advancements are key to improving beef tallow production efficiency?

The shift toward continuous dry rendering systems, the integration of AI for real-time process optimization, and advanced post-refining techniques such as fractionation are critical technologies that improve yield, reduce energy consumption, and allow renderers to produce specialty, high-value tallow derivatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager