Bellows Pressure Reducing Valve Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442786 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Bellows Pressure Reducing Valve Market Size

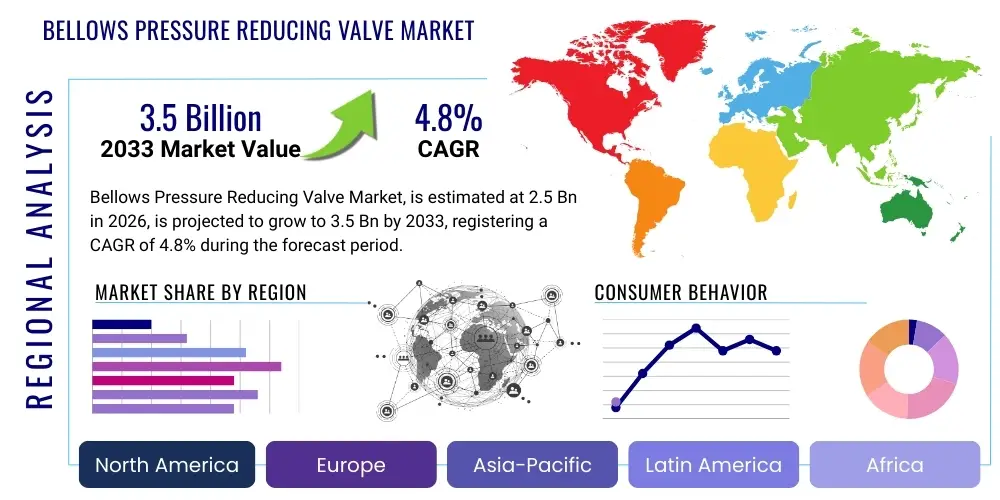

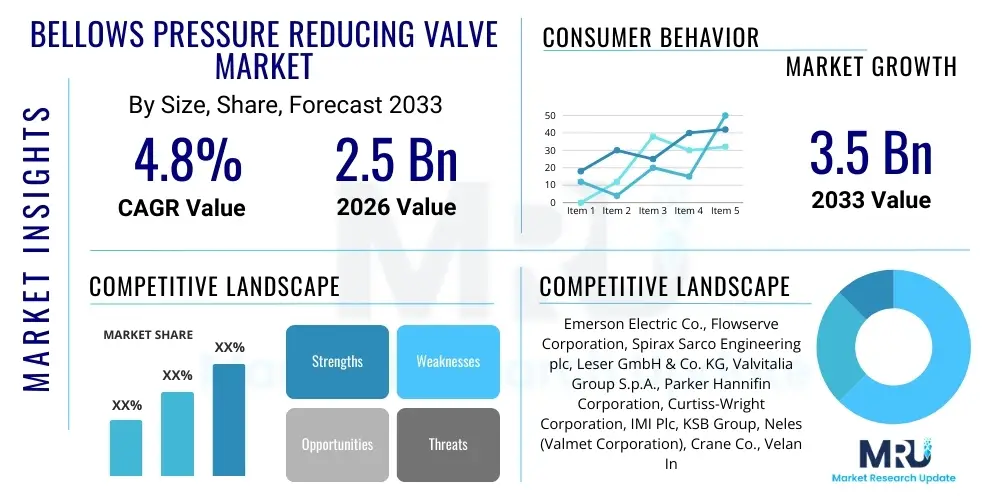

The Bellows Pressure Reducing Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $3.5 Billion by the end of the forecast period in 2033.

Bellows Pressure Reducing Valve Market introduction

The Bellows Pressure Reducing Valve (BPRV) market encompasses specialized fluid control devices designed to automatically reduce a high inlet pressure to a lower, constant outlet pressure, while utilizing a metallic bellows seal to isolate the pressurized media from the valve stem and bonnet area. This critical design element ensures zero stem leakage to the atmosphere, a feature highly valued in applications involving hazardous, toxic, high-temperature, or ultra-pure media. The BPRV stands apart from conventional pressure reducing valves by offering superior containment and operational integrity, making it indispensable in environments where fugitive emissions are strictly regulated or unacceptable due to safety or process purity concerns.

The primary applications driving the demand for these high-integrity valves are concentrated within demanding industrial sectors such as chemical processing, petrochemical refining, nuclear power generation, and specialized gas handling systems, particularly those managing steam, corrosive fluids, or high-purity gases used in semiconductor manufacturing. The core benefit derived from BPRVs is enhanced operational safety and strict adherence to environmental regulations, notably those pertaining to volatile organic compounds (VOCs). Furthermore, the bellows design contributes to long-term reliability and reduced maintenance frequency compared to conventional packed stem valves, leading to favorable total cost of ownership (TCO) in critical infrastructure projects.

Key driving factors bolstering market expansion include global industrial infrastructure modernization, stringent global regulatory frameworks such as the EPA’s Leak Detection and Repair (LDAR) program and similar directives in Europe and Asia, and the growing complexity of industrial processes requiring precise and leak-proof pressure control. The global shift toward hydrogen as an energy carrier also presents a significant growth avenue, as hydrogen handling requires exceptionally high standards for zero-leakage components, inherently favoring bellows-sealed technologies. This confluence of regulatory push and technological necessity is firmly cementing the BPRV’s role as a vital component in high-reliability fluid systems worldwide.

Bellows Pressure Reducing Valve Market Executive Summary

The global Bellows Pressure Reducing Valve market is experiencing robust expansion, primarily fueled by significant capital expenditure in high-risk industries and a global push for enhanced industrial safety and environmental compliance. Key business trends indicate a strong focus on material science advancements, particularly the development of bellows assemblies utilizing advanced alloys such like Inconel and Hastelloy, to withstand increasingly severe operating conditions involving high pressure, extreme temperature fluctuations, and highly corrosive media. Manufacturers are also prioritizing the integration of digital capabilities, leading to the proliferation of smart BPRVs equipped with sensors for predictive maintenance and real-time operational diagnostics, aligning with broader Industry 4.0 paradigms.

Regional trends highlight the Asia Pacific (APAC) region as the dominant growth engine, driven by massive investments in new infrastructure, particularly in China and India, across chemical manufacturing, energy infrastructure, and general industrial expansion. North America and Europe, characterized by mature industrial bases, are focusing heavily on replacement demand and regulatory-driven upgrades, particularly concerning emissions control in existing facilities. Segment trends indicate the highest growth rate within the chemical and power generation sectors, where the need for absolute fluid containment and reliable steam handling is paramount. The pilot-operated segment, offering higher accuracy and larger flow capacity, is projected to command a growing market share over the forecast period compared to simpler direct-acting designs.

In essence, the market trajectory is defined by a dichotomy of growth: volume expansion in developing regions focusing on new plant construction, and value expansion in mature markets concentrating on high-specification, technologically advanced replacement valves. Competitive dynamics suggest continued consolidation and strategic partnerships aimed at optimizing global distribution networks and achieving compliance with diverse international standards (e.g., ASME, PED). The long-term viability of the market is intrinsically linked to sustained global investment in energy security, decarbonization efforts requiring precise industrial gas handling, and mandatory safety enhancements across the oil and gas value chain.

AI Impact Analysis on Bellows Pressure Reducing Valve Market

User queries regarding the impact of Artificial Intelligence (AI) on the Bellows Pressure Reducing Valve market frequently revolve around its utility in preventative maintenance, operational efficiency, and design optimization. Users are keen to understand how AI-driven analytics can translate sensor data from smart valves—such as vibration, pressure, and temperature readings—into actionable insights predicting potential bellows fatigue or seal failure before catastrophic breakdown occurs. Concerns often focus on the financial viability of retrofitting existing infrastructure with AI-compatible sensors and the necessary infrastructure for data handling and secure cloud connectivity. Furthermore, users explore how machine learning models can optimize valve sizing and material selection during the design phase by simulating complex process dynamics, thereby reducing engineering margins and initial equipment costs. The overarching theme is the transition from scheduled maintenance protocols to condition-based, predictive strategies enabled by AI integration.

The deployment of AI tools is fundamentally shifting maintenance strategies from reactive or time-based models toward highly accurate predictive maintenance (PdM) frameworks. AI algorithms analyze historical performance data and real-time operational parameters to detect subtle anomalies indicative of wear, such as changes in pressure ripple characteristics or actuation response times, which are often precursors to bellows failure. This capability minimizes downtime, extends the Mean Time Between Failures (MTBF) for critical BPRVs, and significantly reduces the operational expenditures associated with emergency repairs and unforeseen system shutdowns. The enhanced reliability provided by AI-managed valves is particularly valuable in hard-to-access or continuously operating critical systems, such as offshore platforms or nuclear facilities.

Beyond maintenance, AI is influencing the manufacturing and supply chain segments. Generative design algorithms, leveraging AI, are increasingly employed to optimize the complex geometry of bellows structures, ensuring maximum elasticity and fatigue resistance using minimal material, which translates into lighter, more durable products. On the supply side, AI models are optimizing inventory management for spare parts, predicting regional demand fluctuations based on macro-economic indicators and infrastructure project timelines, ensuring manufacturers can meet the demanding delivery schedules required by major engineering, procurement, and construction (EPC) firms. This holistic impact, spanning design, manufacturing, and lifecycle management, positions AI as a transformative force in the high-specification valve sector.

- AI enables highly accurate Predictive Maintenance (PdM) by analyzing real-time sensor data for early failure detection in bellows seals.

- Machine Learning optimizes valve sizing, material selection, and internal flow path geometry, improving efficiency and durability.

- AI-driven simulation tools reduce the cost and time associated with physical prototyping during new BPRV development.

- Automated diagnostics reduce human intervention in monitoring, enhancing safety in hazardous environments.

- Demand forecasting models, powered by AI, enhance supply chain efficiency for specialized components and replacement parts.

DRO & Impact Forces Of Bellows Pressure Reducing Valve Market

The market for Bellows Pressure Reducing Valves is substantially shaped by a set of dynamic Drivers, Restraints, and Opportunities, which collectively determine the direction and speed of market growth. A primary Driver is the relentless increase in global safety and environmental regulations demanding zero fugitive emissions in industrial processes, particularly in the handling of toxic or volatile media where even minimal leakage is unacceptable. Concurrently, large-scale infrastructural renewal projects across the oil and gas, chemical, and power sectors necessitate the replacement of older, packing-dependent valves with modern, high-integrity bellows designs, creating consistent replacement demand in mature markets and fueling initial installations in emerging industrial hubs. Furthermore, the specialized requirements of emerging industries, such as high-pressure gas handling for Carbon Capture, Utilization, and Storage (CCUS) and cryogenic applications, mandate the superior sealing characteristics inherent to bellows valves.

However, the market faces significant Restraints that temper rapid expansion. Bellows PRVs typically have a higher initial capital expenditure compared to conventional alternatives, often deterring procurement managers in non-critical applications or price-sensitive markets. Complexity in design and manufacturing, requiring specialized welding and testing procedures for the bellows assembly, limits the number of qualified suppliers and contributes to longer lead times. Technological Restraints include the inherent susceptibility of bellows material to fatigue failure under continuous high-frequency cycling or excessive pressure surges, although material science is continually addressing this limitation. Another restraint is the challenge of integrating these specialized mechanical devices seamlessly into existing Industrial Internet of Things (IIoT) frameworks without standardized communication protocols across all manufacturers.

The primary Opportunity lies in the burgeoning hydrogen economy, where BPRVs are critical for ultra-low temperature and high-pressure applications required for hydrogen production, transport, and storage, owing to their zero-leakage capability. The development of smart BPRVs, incorporating advanced sensing and actuator technology, provides a clear opportunity for value-added differentiation and penetration into the digitalized plant environment. Manufacturers who successfully leverage additive manufacturing (3D printing) techniques to produce complex, high-integrity valve components, potentially reducing weight and lead times while enhancing material performance, are poised for significant market gains. Impact forces governing the market are primarily regulatory compliance (ensuring adherence to standards like ISO 15848-1 for fugitive emissions) and materials innovation, which dictate the pressure and temperature envelopes within which BPRVs can safely operate.

Segmentation Analysis

The Bellows Pressure Reducing Valve market is comprehensively segmented based on Type, Material, End-User Industry, and Operating Pressure, allowing for granular analysis of market demand drivers and regional consumption patterns. Understanding these segments is crucial for manufacturers to tailor product specifications, marketing strategies, and distribution channels to meet the highly specialized needs of various industrial applications. Segmentation by Type, distinguishing between direct-acting and pilot-operated designs, directly reflects the trade-off required between simplicity and precise control, where pilot-operated valves generally cater to larger pipelines and highly accurate pressure requirements.

Material segmentation is paramount given the extreme operating environments BPRVs often face, ranging from highly corrosive media in chemical processing to extreme temperatures in power generation. The dominance of stainless steel is challenged by increasing adoption of specialized alloys like Hastelloy, Monel, and Titanium in niche applications requiring exceptional resistance to stress corrosion cracking and elevated temperature service. Furthermore, the End-User Industry segmentation provides the clearest indication of demand volume, with the Power Generation (especially steam systems), Oil & Gas (fugitive emissions control), and Chemical Processing (toxic media handling) sectors representing the core consumer base requiring the guaranteed sealing integrity offered by bellows technology.

- By Type:

- Direct-Acting Bellows PRV

- Pilot-Operated Bellows PRV

- By Material:

- Stainless Steel (304, 316)

- Carbon Steel

- Alloy Steels (e.g., Hastelloy, Inconel)

- Specialty Metals (e.g., Titanium)

- By Operating Pressure:

- Low Pressure (Up to 150 psi)

- Medium Pressure (150 psi to 600 psi)

- High Pressure (Above 600 psi)

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical & Petrochemical Processing

- Power Generation (Thermal and Nuclear)

- Pharmaceuticals & Biotechnology

- Food & Beverage

- Pulp & Paper

- HVAC and Utilities

Value Chain Analysis For Bellows Pressure Reducing Valve Market

The value chain for the Bellows Pressure Reducing Valve market begins with the Upstream activities centered around the sourcing and processing of specialized raw materials. This includes high-grade stainless steel, precision alloys such as Nickel-Chromium blends required for bellows manufacturing, and specialized sealing materials. Critical upstream processes involve the precision machining of valve bodies and the highly specialized process of manufacturing the corrugated metallic bellows itself, which demands stringent quality control, fatigue testing, and welding expertise. Suppliers of these precision metal components and high-purity materials hold significant leverage due to the need for material traceability and compliance with industry standards like NACE and specific chemical compatibility requirements.

Midstream activities encompass the core manufacturing, assembly, and quality assurance processes. This stage involves the complex assembly of the valve components, the crucial welding of the bellows seal, calibration, and rigorous testing protocols, including pressure testing, leak detection (e.g., helium leak testing), and functional testing to ensure the specified pressure reduction curve is achieved. Distribution channels then move the finished product to the end-users. Direct sales channels are highly prevalent for high-specification, large-project orders, especially those involving major Engineering, Procurement, and Construction (EPC) firms or governmental infrastructure projects, allowing manufacturers direct control over technical consultation and after-sales service.

Downstream activities focus on indirect channels, maintenance, repair, and overhaul (MRO) services. Indirect distribution relies heavily on specialized industrial distributors, regional representatives, and valve repair shops that stock common replacement parts and offer immediate local technical support. The long operational lifecycle of BPRVs means that the MRO segment, including the supply of replacement bellows assemblies and internal trim parts, forms a substantial and stable revenue stream. Effective distribution is characterized by strong technical support, rapid availability of replacement components, and deep application expertise required to guide customers in selecting the correctly rated and configured Bellows Pressure Reducing Valve for their specific critical process parameters.

Bellows Pressure Reducing Valve Market Potential Customers

The primary potential customers and end-users of Bellows Pressure Reducing Valves are large industrial entities and infrastructure operators whose processes demand absolute fluid containment, precise pressure control, and reliable operation under severe conditions. The leading customer base resides within the chemical and petrochemical industries, particularly refining facilities and chemical plants handling toxic intermediates (e.g., chlorine, phosgene) or valuable specialty chemicals where any leakage presents both an environmental hazard and a significant economic loss. These buyers prioritize zero-leakage performance, material traceability, and certification to stringent international standards, valuing operational safety above initial cost considerations.

Another crucial customer segment is the power generation sector, especially operators of high-pressure steam systems in conventional thermal plants and, critically, nuclear power facilities. In nuclear applications, the BPRV’s role in preventing leakage of radioactive or demineralized fluids is non-negotiable, placing emphasis on extremely long operational lifecycles and highly specialized qualification processes. Furthermore, infrastructure projects involving industrial gas handling, such as major air separation units (ASUs) and facilities managing high-purity or cryogenic gases (e.g., Oxygen, Nitrogen, Hydrogen), represent highly specialized buyers who require the bellows seal to maintain media purity and prevent atmospheric ingress or egress.

Beyond these heavy industrial segments, niche but high-growth customer bases include the semiconductor manufacturing industry, where bellows valves are essential for controlling ultra-high purity (UHP) process gases without contamination. The pharmaceutical and biotechnology sectors also utilize BPRVs for aseptic and clean steam applications, though usually on a smaller scale than the petrochemical industry, where hygiene and process isolation are paramount. Procurement decisions among these diverse customer groups are driven by technical specifications, adherence to regulatory mandates (e.g., FDA validation, emissions standards), supplier reputation, and the provision of robust, globally available post-sales maintenance and technical support services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $3.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Flowserve Corporation, Spirax Sarco Engineering plc, Leser GmbH & Co. KG, Valvitalia Group S.p.A., Parker Hannifin Corporation, Curtiss-Wright Corporation, IMI Plc, KSB Group, Neles (Valmet Corporation), Crane Co., Velan Inc., Alfa Laval AB, Swagelok Company, TLV Co., Ltd., Zwick Armaturen GmbH, SchuF Fetterolf. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bellows Pressure Reducing Valve Market Key Technology Landscape

The technological landscape of the Bellows Pressure Reducing Valve market is rapidly evolving, driven primarily by the pursuit of enhanced longevity, safety, and digital integration. A pivotal advancement involves the application of advanced material science to bellows manufacturing. Traditional stainless steel bellows are increasingly being supplemented or replaced by specialized corrosion-resistant and high-temperature alloys, such as Inconel, Hastelloy, and other Nickel-based superalloys. These materials offer superior resistance to fatigue failure caused by thermal cycling and process fluid corrosion, dramatically increasing the MTBF in severe service applications. Furthermore, ongoing research focuses on optimizing the convolution geometry and wall thickness of the bellows through finite element analysis (FEA) to maximize resilience against pressure shock and vibration, ensuring operational integrity in seismically active or high-stress environments.

The integration of smart technologies represents another significant technological shift. Modern BPRVs are increasingly designed to be "smart" components, incorporating non-invasive sensors capable of measuring critical parameters like stem position, internal vibration signatures, and temperature profiles. These sensors feed data back to centralized control systems or cloud platforms via Industrial Internet of Things (IIoT) communication protocols. This digitalization enables real-time monitoring of valve health and performance, supporting predictive maintenance models that can accurately forecast bellows wear or potential seal failure months in advance. The ability to monitor critical pressure setpoints remotely also enhances overall plant safety and efficiency, reducing the need for manual inspection in hazardous areas.

Manufacturing process innovations, specifically the adoption of additive manufacturing (AM) or 3D printing for certain valve components, are beginning to impact the supply chain. While full bellows assemblies are still typically produced using conventional precision welding and forming techniques, AM is being explored for complex, custom-designed valve bodies and internal trims, particularly those requiring intricate geometry for optimized flow characteristics and noise reduction. This technology allows for faster prototyping, customization for specific pressure or flow requirements, and potential material consolidation, reducing weight and assembly complexity. The push for modular and easily serviceable designs, where the bellows cartridge can be replaced without removing the entire valve body from the pipeline, is also a key design trend aimed at minimizing downtime and MRO costs for end-users.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and competitive landscape of the Bellows Pressure Reducing Valve market, reflecting disparate levels of industrial maturity, regulatory stringency, and capital investment cycles across the globe. North America, encompassing the US and Canada, represents a technologically mature market characterized by stringent federal and state regulations governing fugitive emissions, such as EPA consent decrees and LDAR requirements. This regulatory environment drives consistent high-value replacement demand as existing infrastructure is upgraded to meet zero-leakage standards. Key sectors driving demand here include refining, chemical manufacturing, and the nuclear power sector, with a strong preference for high-quality, fully certified valves from established international manufacturers, prioritizing reliability and total lifecycle cost over upfront price.

Europe stands out due to its leadership in environmental protection (e.g., the Industrial Emissions Directive) and substantial investment in energy transition, particularly the decarbonization of industrial heat and the rapid expansion of hydrogen infrastructure. Countries like Germany and the UK show high demand for BPRVs in specialized applications, including hydrogen fueling stations and advanced pharmaceutical manufacturing where process purity is critical. The regional market demands products compliant with the Pressure Equipment Directive (PED) and focuses heavily on energy efficiency and safety features, positioning it as a market receptive to smart valve technology and sustainable manufacturing practices.

The Asia Pacific (APAC) region, particularly China, India, and Southeast Asia, is the primary driver of market volume growth. This growth is underpinned by massive government and private sector investments in new industrial capacity, including large-scale petrochemical complexes, coal-to-chemical plants, and significant expansion of urban utilities and power grids. Demand here is often price-sensitive but is rapidly migrating towards higher-specification BPRVs as local environmental regulations become stricter. China, in particular, is both a massive consumer and a growing producer of industrial valves, leading to intense competition. Conversely, Japan and South Korea represent mature APAC markets, focusing on replacement cycles and technologically advanced applications in high-tech manufacturing and nuclear power.

Latin America, and the Middle East and Africa (MEA), demonstrate steady growth tied closely to the fluctuating global oil and gas markets. MEA, especially the Gulf Cooperation Council (GCC) nations, invests heavily in upstream and downstream oil & gas projects, requiring large volumes of high-pressure, severe-service BPRVs to ensure operational safety in hydrocarbon processing. Latin American demand is cyclical, often driven by government investments in national oil companies and general infrastructure upgrades. These regions typically rely on imports from North American and European manufacturers for high-end bellows valves, though local distribution and service capabilities are increasingly becoming competitive differentiators for major suppliers.

- North America: Driven by strict environmental regulations (fugitive emissions) and mature replacement cycles in chemical and nuclear sectors. Focus on high certification standards and total cost of ownership.

- Europe: Growth fueled by energy transition, strict environmental directives (PED), and specialized high-purity demands in hydrogen and pharmaceutical industries.

- Asia Pacific (APAC): Highest volume growth driven by large-scale capital expenditure in China and India across petrochemical and power generation infrastructure. Increasing demand for high-specification valves due to tightening local regulations.

- Middle East & Africa (MEA): Demand closely linked to large-scale oil and gas extraction and refining projects, requiring severe-service, high-pressure capabilities.

- Latin America: Characterized by cyclical demand tied to national energy sector investments and infrastructure modernization projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bellows Pressure Reducing Valve Market.- Emerson Electric Co.

- Flowserve Corporation

- Spirax Sarco Engineering plc

- Leser GmbH & Co. KG

- Valvitalia Group S.p.A.

- Parker Hannifin Corporation

- Curtiss-Wright Corporation

- IMI Plc

- KSB Group

- Neles (Valmet Corporation)

- Crane Co.

- Velan Inc.

- Alfa Laval AB

- Swagelok Company

- TLV Co., Ltd.

- Zwick Armaturen GmbH

- SchuF Fetterolf

- Samson AG

- Apollo Valves (Conbraco Industries)

Frequently Asked Questions

Analyze common user questions about the Bellows Pressure Reducing Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a Bellows Pressure Reducing Valve (BPRV) over conventional PRVs?

The primary advantage of a Bellows PRV is its metallic bellows seal which provides absolute, zero-leakage containment of the process fluid to the atmosphere. This is essential for applications involving hazardous, toxic, or high-purity media where even trace fugitive emissions are unacceptable under strict safety and environmental regulations.

In which industries are Bellows Pressure Reducing Valves most commonly used?

Bellows Pressure Reducing Valves are most commonly utilized in severe service environments within the chemical processing, petrochemical refining, power generation (especially steam and nuclear systems), and specialized industrial gas handling sectors due to their guaranteed sealing integrity and high reliability under extreme conditions.

How is AI impacting the maintenance and longevity of Bellows Pressure Reducing Valves?

AI is transforming BPRV maintenance by enabling predictive models. Machine learning algorithms analyze sensor data (vibration, temperature, pressure) to detect early indicators of bellows fatigue or failure, allowing for condition-based replacement, which significantly extends the valve's service life and minimizes unplanned operational downtime.

What are the key materials used in the manufacture of BPRVs for critical applications?

While stainless steel is common, critical applications often require specialized alloys such as Inconel, Hastelloy, or Monel for the bellows assembly. These materials provide superior resistance to high temperatures, pressure cycling, and corrosive media, ensuring long-term operational integrity in severe service.

Which geographical region is driving the highest growth volume for the BPRV market?

The Asia Pacific (APAC) region, driven primarily by extensive infrastructure development and large-scale capital investments in chemical and power generation facilities in countries like China and India, is currently responsible for the highest volume growth in the Bellows Pressure Reducing Valve market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager