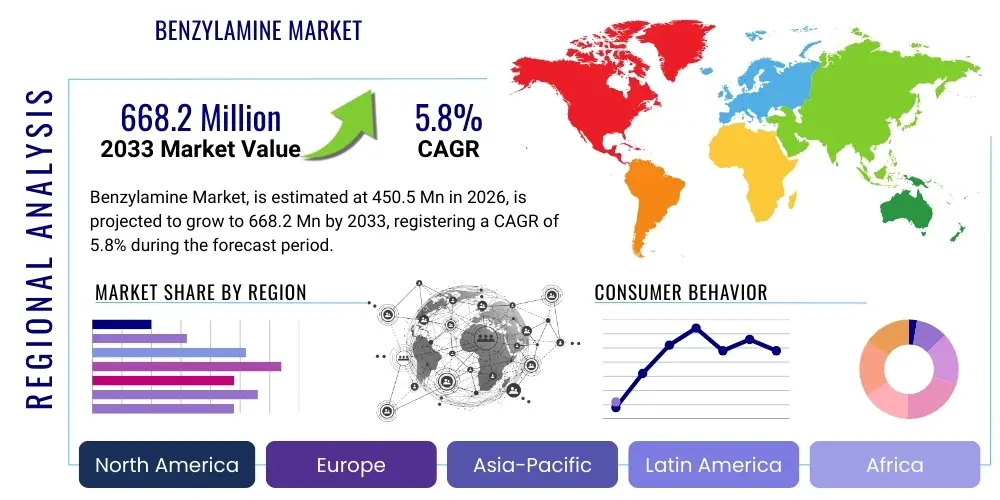

Benzylamine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442305 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Benzylamine Market Size

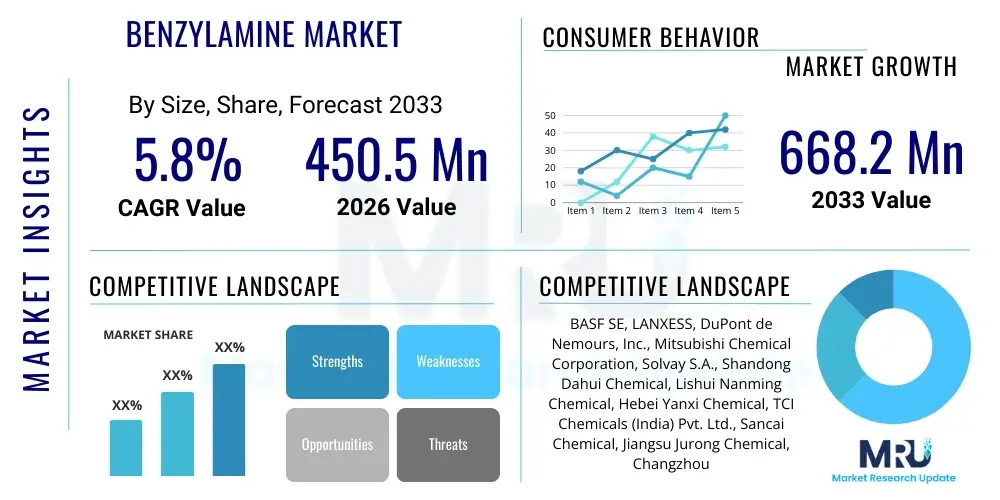

The Benzylamine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.2 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the escalating demand for specialty chemical intermediates in the burgeoning pharmaceutical and agrochemical industries globally. Benzylamine serves as a foundational building block in the synthesis of complex organic molecules, making its demand directly proportional to the innovation and expansion within these highly regulated sectors.

The valuation reflects the increasing industrial application of benzylamine across various niche sectors, including polymer additives, corrosion inhibitors, and dye manufacturing. Market expansion is supported by technological advancements in catalytic synthesis methods that enhance product purity and manufacturing efficiency, addressing stringent regulatory requirements for industrial chemicals. Furthermore, the robust investment in healthcare infrastructure, particularly in developing economies across Asia Pacific, is fueling the requirement for pharmaceutical intermediates derived from benzylamine, thereby securing its commercial importance over the forecast horizon.

Benzylamine Market introduction

Benzylamine (C7H9N), a colorless liquid classified as an organic chemical compound, is a primary aromatic amine characterized by its pungent odor and strong basic properties. It is predominantly synthesized through the reaction of benzyl chloride with ammonia, or through the reductive amination of benzaldehyde. This compound is indispensable in organic synthesis due to the reactivity of both the amine group and the benzyl radical, allowing it to participate in a wide array of chemical transformations, including alkylation, acylation, and condensation reactions. Its versatility establishes it as a critical intermediate across diverse industries.

The major applications of benzylamine are deeply rooted in the life sciences and industrial chemicals domains. It is extensively utilized in the pharmaceutical industry for synthesizing essential drugs, including antihypertensives, bronchodilators, and anti-obesity medications. In the agrochemical sector, it acts as a key component in the production of herbicides, fungicides, and plant growth regulators. Beyond these core uses, benzylamine is vital for manufacturing specialty polymers, performance dyes, and corrosion inhibitors used in various metal processing and coating applications, offering significant protective benefits against environmental degradation.

The market expansion for benzylamine is fundamentally driven by the global imperative for enhanced drug efficacy and increased agricultural output. The inherent chemical benefits of benzylamine, such as its high reactivity and ability to form stable derivatives, ensure its continued adoption in complex synthesis routes. The expanding generics drug market in Asia, coupled with the rising global consumption of processed foods necessitating advanced crop protection solutions, collectively serves as a powerful accelerator for benzylamine demand, cementing its role as a high-value commodity chemical intermediate.

Benzylamine Market Executive Summary

The Benzylamine market is characterized by moderate but stable growth, primarily anchored by persistent demand from the pharmaceutical sector, which uses it extensively as a precursor for active pharmaceutical ingredients (APIs), and the robust agrochemical industry, particularly in developing nations focused on yield improvement. Business trends indicate a strategic shift among leading manufacturers towards optimizing synthesis processes—specifically, moving towards continuous flow chemistry and greener synthesis methods—to meet stricter environmental regulations and reduce operational costs. Competitive dynamics are influenced by raw material price volatility, specifically that of toluene derivatives, necessitating sophisticated supply chain management and forward purchasing strategies to maintain margins.

Regionally, the Asia Pacific (APAC) stands as the dominant growth engine, driven by massive investments in domestic API manufacturing capacity in countries like China and India, coupled with widespread agricultural mechanization. North America and Europe maintain stable demand, characterized by high regulatory oversight and strong focus on specialty, high-purity grades of benzylamine for niche pharmacological applications and advanced materials. Segment-wise, the high-purity grade segment is expanding faster than the industrial grade, reflecting the increasing importance of quality control in end-use applications, particularly in regulated markets. Application trends show the pharmaceutical sector retaining the largest market share, while the use of benzylamine in corrosion inhibition for oil and gas infrastructure demonstrates significant untapped potential.

Market stakeholders are increasingly engaging in backward integration to secure access to key raw materials, thereby mitigating supply chain risks associated with geopolitical instabilities and transportation bottlenecks. Furthermore, strategic alliances focused on co-development of novel derivatives are observed, aiming to penetrate specialized markets such as functional polymers and sophisticated chemical catalysts. This executive overview confirms that while the Benzylamine market is mature in terms of technology, its future growth trajectory is resilient, heavily influenced by global healthcare spending, and geographically concentrated in fast-industrializing economies.

AI Impact Analysis on Benzylamine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Benzylamine market often center on three key themes: how AI can accelerate novel derivative synthesis, whether predictive analytics can stabilize fluctuating raw material supply chains, and the potential for AI-driven process optimization to lower manufacturing costs and improve environmental compliance. Users are keenly interested in moving beyond traditional R&D bottlenecks using computational chemistry powered by AI algorithms, particularly in identifying new uses or safer synthesis routes for benzylamine derivatives for drug discovery. Concerns often revolve around the high initial investment required for integrating AI systems into existing chemical manufacturing infrastructure and the need for specialized data science expertise within chemical engineering teams. The expectation is that AI will eventually streamline quality control (QC) and reduce batch inconsistency, which is crucial for high-purity chemical production.

The primary impact of AI is anticipated in enhancing R&D productivity. Machine learning models can analyze vast libraries of chemical structures and reaction outcomes, predicting the optimal conditions or catalysts required for synthesizing new benzylamine derivatives—such as complex APIs or specialized agrochemicals—with unprecedented speed. This capability dramatically reduces the reliance on costly, time-consuming experimental screening, allowing companies to accelerate their time-to-market for innovative products derived from benzylamine. AI tools are also being deployed to model molecular interactions, ensuring that new derivatives exhibit desired properties, such as specific biological activity or enhanced stability, optimizing the value proposition of the base chemical.

Furthermore, AI is transformative in optimizing manufacturing logistics and operational efficiency. Predictive maintenance systems, driven by AI monitoring of reactor sensor data, minimize unplanned downtime and ensure consistent production quality, vital for meeting the rigorous specifications of pharmaceutical clients. In supply chain management, AI algorithms process real-time market data, geopolitical information, and raw material inventory levels (such as toluene and ammonia prices) to forecast price fluctuations and potential bottlenecks, enabling proactive sourcing decisions. This sophisticated approach to operational planning enhances profitability and stability in a market susceptible to commodity volatility, leading to a more resilient and cost-effective Benzylamine production landscape.

- AI-driven optimization of reaction conditions and yield maximization in synthesis processes.

- Predictive modeling for novel drug discovery using benzylamine as a scaffold, reducing R&D cycles.

- Enhanced supply chain visibility and risk management through AI forecasting of raw material prices (e.g., benzyl chloride).

- Automated quality control (AQC) systems utilizing machine vision and analytical data to ensure high-purity grades for pharmaceutical use.

- Implementation of digital twins for simulating and optimizing energy consumption in chemical reactors, improving sustainability.

DRO & Impact Forces Of Benzylamine Market

The Benzylamine market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and competitive intensity. The primary driver remains the continuous expansion of the pharmaceutical sector globally, particularly the increasing prevalence of lifestyle diseases requiring novel drug therapies that utilize benzylamine intermediates. Simultaneously, significant growth in agricultural technology and demand for high-efficacy crop protection chemicals, especially in highly populated emerging economies, sustains strong baseline demand. However, the market faces significant restraints, chiefly stemming from the high toxicity and regulated nature of Benzylamine and its precursors, demanding stringent environmental, health, and safety (EHS) compliance, which escalates operational costs and restricts expansion for smaller players. Opportunities exist in developing novel, less toxic synthesis routes and penetrating specialized applications such as high-performance resins and advanced electronic chemicals.

Key drivers include the technological transition towards specialty chemicals in manufacturing, where benzylamine’s dual functionality (aromatic and amine groups) makes it uniquely valuable for producing complex molecules that serve as corrosion inhibitors in industrial settings and as curing agents in epoxy systems. The rising disposable income in APAC countries is boosting healthcare spending and consequently API demand, providing a demographic tailwind for benzylamine consumption. Furthermore, government incentives supporting domestic drug manufacturing capacity in regions historically reliant on imports are encouraging localized production and increased utilization of chemical building blocks like benzylamine. The inherent chemical utility across disparate fields ensures a diversified risk portfolio for manufacturers.

The significant impact forces include fluctuating prices of petrochemical feedstocks, which directly influence the cost structure of manufacturing benzylamine, potentially eroding profit margins if not managed effectively through hedging or long-term supply contracts. Regulatory pressures are mounting globally, pushing manufacturers toward investments in waste treatment and emission reduction technologies, a substantial capital expenditure. Conversely, the opportunity landscape is enriched by innovation in sustainable chemistry, exploring bio-based or alternative feedstocks to mitigate dependence on fossil fuels. Successfully capitalizing on these opportunities, particularly in developing high-value, niche derivatives, will differentiate leading market players and define market leadership over the forecast period.

Segmentation Analysis

The Benzylamine market segmentation provides a detailed insight into the various product forms, application areas, and geographical concentrations that define market demand and growth potential. Analyzing the market through these structured segments enables stakeholders to identify high-growth areas and tailor their operational and marketing strategies accordingly. The segmentation primarily focuses on differentiating between varying levels of chemical purity demanded by end-use industries and delineating the consumption patterns across major application fields, reflecting the compound's broad utility from high-specification medicinal uses to large-scale industrial processes.

Market segmentation by application reveals a clear dominance of the life sciences sectors—pharmaceuticals and agrochemicals—due to the mandatory use of benzylamine as a foundational intermediate. The pharmaceutical segment, requiring extremely high purity grades, commands premium pricing and stable demand due to continuous drug development efforts. The agrochemical segment is characterized by high volume consumption, intrinsically linked to global farming trends and regulatory approval cycles for crop protection agents. Other segments, including polymers, corrosion inhibitors, and dye manufacturing, while smaller in volume, represent critical diversification areas, particularly as manufacturers seek resilient demand sources outside the heavily regulated life science fields. This diversified application base contributes significantly to the market's overall stability against sector-specific economic downturns.

The categorization by purity grade—industrial versus high-purity—is crucial. Industrial grade benzylamine typically serves manufacturing purposes such as dye production and rubber processing where trace impurities are less critical. In contrast, high-purity grade (often 99% or higher) is mandated for pharmaceutical synthesis and advanced electronics, where even minute contaminants can compromise product efficacy or safety. The trend indicates a rising demand for high-purity grades, reflecting the global focus on quality assurance and the increasing stringency of regulatory bodies like the FDA and EMA regarding chemical inputs in therapeutic products. Geographically, segmentation highlights the shift of production and consumption centers toward Asia Pacific, while R&D and specialized applications remain strong in North America and Europe.

- By Purity Grade:

- Industrial Grade

- High Purity Grade

- By Application:

- Pharmaceutical Intermediates

- Agrochemicals (Herbicides, Fungicides)

- Dye and Pigment Manufacturing

- Corrosion Inhibitors

- Polymer Additives and Curing Agents

- Others (Rubber Chemicals, Photographic Developers)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Benzylamine Market

The value chain of the Benzylamine market begins with the procurement of upstream raw materials, primarily toluene, which is converted to benzyl chloride, and ammonia. Toluene is a petrochemical derivative, linking the cost structure of benzylamine directly to the global oil and gas market volatility. The transformation of these raw materials into benzylamine involves complex chemical processes, typically ammonolysis of benzyl chloride or reductive amination, demanding high energy consumption and specialized reactor systems. Critical stages include synthesis, purification (especially for pharmaceutical grades), and rigorous quality testing. Manufacturers often invest heavily in patented catalytic processes to improve yield, selectivity, and reduce by-product formation, which is a major differentiator in cost competitiveness.

The midstream segment involves the processing and refinement of benzylamine into various grades. Direct distribution channels are predominantly used for high-volume, long-term contracts with major pharmaceutical and agrochemical manufacturers (downstream users), ensuring tailored specifications and just-in-time delivery. Indirect distribution involves global chemical distributors and specialized traders who aggregate product from multiple suppliers and cater to smaller end-users across diverse geographic locations, including those in the niche markets of specialized polymers and corrosion inhibitors. This dual channel approach ensures market penetration and inventory management efficiency across the spectrum of user requirements.

Downstream analysis focuses on the end-use industries, where benzylamine is incorporated into final products. Key consumers are R&D divisions and bulk manufacturing units of major pharmaceutical companies, using it as a precursor to synthesize APIs such as amphetamine-type stimulants or certain classes of antibiotics. The agrochemical sector uses it to produce active ingredients for crop protection products. The efficiency and consistency of the upstream manufacturing process are critical determinants of quality downstream, particularly as end-use industries face intense regulatory scrutiny. The profitability of the value chain is highly sensitive to the cost efficiency of the synthesis stage and the maintenance of high purity standards demanded by the most lucrative pharmaceutical application segment.

Benzylamine Market Potential Customers

Potential customers for the Benzylamine market are concentrated primarily within sectors requiring precise chemical intermediates for synthesis and industrial performance enhancement. The largest segment of buyers comprises pharmaceutical manufacturing companies, ranging from multinational corporations to specialized contract manufacturing organizations (CMOs) and contract research organizations (CROs). These entities rely on benzylamine as a pivotal building block for developing and producing Active Pharmaceutical Ingredients (APIs) for cardiovascular, respiratory, and neurological drugs. Their purchasing decisions are heavily influenced by supplier compliance with Good Manufacturing Practices (GMP), consistency in high-purity batch production, and robust regulatory documentation support.

Another major customer group resides within the agrochemical industry, specifically manufacturers of pesticides, herbicides (such as glyphosate derivatives), and specialty fertilizers. These buyers consume large volumes of industrial-grade benzylamine, prioritizing competitive pricing, reliable bulk supply, and chemical stability for large-scale compounding operations. The demand from this sector is seasonal and directly correlated with global agricultural cycles and commodity prices, requiring suppliers to manage significant volume variability. These customers seek long-term supply agreements to secure inputs for their product lines designed for crop yield improvement and protection.

Furthermore, specialized chemical and material science companies constitute a significant customer base. This includes manufacturers of advanced polymer additives, specialized industrial dyes, and anti-corrosion chemical formulations targeting the oil & gas and marine industries. Customers in the corrosion inhibition segment require specific formulations of benzylamine derivatives to protect metallic infrastructure in harsh environments. Their needs are less volume-driven than the agrochemical sector but demand highly customized product specifications and technical support. These diversified applications provide resilience to the supplier market, spreading risk across multiple industrial end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, LANXESS, DuPont de Nemours, Inc., Mitsubishi Chemical Corporation, Solvay S.A., Shandong Dahui Chemical, Lishui Nanming Chemical, Hebei Yanxi Chemical, TCI Chemicals (India) Pvt. Ltd., Sancai Chemical, Jiangsu Jurong Chemical, Changzhou Xinkai Chemical, Hangzhou Qianyang Chemical, Shanghai Ruizheng Chemical, Merck KGaA, Aarti Industries Ltd., Lonza Group AG, Vertellus Holdings LLC, China National Chemical Corporation (ChemChina), Dow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Benzylamine Market Key Technology Landscape

The technology landscape for the Benzylamine market is centered around optimizing the core synthesis methods to improve yield, reduce energy intensity, and enhance product purity, especially crucial for the high-value pharmaceutical grade. The classic industrial production routes involve the reaction of benzyl chloride with aqueous ammonia (ammonolysis), which is effective but often results in a mixture of primary, secondary, and tertiary amines, necessitating complex and costly separation and purification steps. Recent technological innovations focus on maximizing the selectivity toward the primary amine product (benzylamine) through the use of specific catalytic systems and controlled reaction parameters, mitigating the formation of undesirable by-products like dibenzylamine and tribenzylamine.

A key area of technological advancement involves catalytic hydrogenation and reductive amination techniques. These methods utilize noble metal catalysts (such as palladium or platinum on carbon supports) to hydrogenate benzonitrile or reductively aminate benzaldehyde. Reductive amination offers a cleaner process with higher selectivity, often leading to a purer product profile suitable for stringent pharmaceutical applications. Manufacturers are increasingly adopting continuous flow chemistry systems over traditional batch reactors. Flow chemistry allows for precise control over temperature and pressure, optimizing reaction kinetics, minimizing safety risks associated with handling highly exothermic reactions, and ensuring superior batch-to-batch consistency, directly addressing the strict quality requirements of end-users.

Furthermore, green chemistry principles are driving innovation, leading to research into solvent-free reactions or the use of benign solvents, and the development of heterogeneous catalysts that are easily separated and recycled, reducing environmental impact and operating expenses. Techniques like microwave-assisted synthesis and enzymatic catalysis are emerging, offering faster reaction times and milder conditions, although these are currently niche and still require scaling for industrial application. The focus on improved purification technology, such as advanced fractional distillation and crystallization techniques, also remains critical to differentiate suppliers offering high-purity Benzylamine required for API synthesis.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Benzylamine, primarily driven by China and India, which serve as global hubs for generic API manufacturing and large-scale agrochemical production. The favorable regulatory environment (compared to Western countries for chemical manufacturing), lower operating costs, and massive domestic demand from agricultural sectors ensure that APAC maintains its dominance. Investment in chemical infrastructure and growing domestic pharmaceutical consumption further accelerate regional growth.

- North America: Characterized by stable demand and a high concentration of sophisticated pharmaceutical R&D, North America is a major consumer of high-purity Benzylamine. Growth here is steady, driven by advancements in specialty chemistry, the utilization of Benzylamine in advanced polymer formulations, and stringent quality control, which commands premium pricing. The market is mature, emphasizing technological innovation and compliance.

- Europe: Similar to North America, the European market is mature and heavily regulated, with a strong focus on sustainability and environmental protection in chemical manufacturing. Demand is robust from major established pharmaceutical companies and specialty chemical manufacturers. European growth is increasingly focused on developing highly selective Benzylamine derivatives for niche medical applications and sustainable agrochemical products, complying with REACH regulations.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets characterized by significant untapped agricultural potential (LATAM) and infrastructure development (MEA). Increased investment in healthcare services and expanding agricultural output are expected to drive moderate growth, albeit from a smaller base. MEA specifically shows potential growth in corrosion inhibition applications due to extensive oil and gas activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Benzylamine Market.- BASF SE

- LANXESS

- DuPont de Nemours, Inc.

- Mitsubishi Chemical Corporation

- Solvay S.A.

- Shandong Dahui Chemical

- Lishui Nanming Chemical

- Hebei Yanxi Chemical

- TCI Chemicals (India) Pvt. Ltd.

- Sancai Chemical

- Jiangsu Jurong Chemical

- Changzhou Xinkai Chemical

- Hangzhou Qianyang Chemical

- Shanghai Ruizheng Chemical

- Merck KGaA

- Aarti Industries Ltd.

- Lonza Group AG

- Vertellus Holdings LLC

- China National Chemical Corporation (ChemChina)

- Dow Inc.

Frequently Asked Questions

Analyze common user questions about the Benzylamine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving Benzylamine market growth?

The primary application driving market growth is its extensive use as a critical intermediate chemical in the synthesis of Active Pharmaceutical Ingredients (APIs) for various therapeutic drugs, coupled with its role in high-performance agrochemicals.

How is the Benzylamine market segmented by purity grade?

The Benzylamine market is typically segmented into Industrial Grade, utilized in dyes and polymers, and High Purity Grade, which is mandatory for stringent pharmaceutical and specialized chemical applications.

Which geographical region dominates the consumption of Benzylamine?

The Asia Pacific (APAC) region, driven primarily by high-volume manufacturing hubs in China and India, dominates both the production and consumption of Benzylamine, particularly for generics and agrochemical products.

What are the main restraints affecting the Benzylamine market?

The main restraints include the volatility of raw material prices (derived from petrochemicals like toluene) and stringent environmental, health, and safety (EHS) regulations pertaining to the handling and disposal of toxic intermediates.

What is the projected Compound Annual Growth Rate (CAGR) for the Benzylamine market?

The Benzylamine market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by steady demand from the life sciences sector.

The following detailed analysis expands upon the primary drivers and applications, focusing on the specific chemical requirements and technological shifts impacting the sector. The market for benzylamine, being intrinsically tied to the global pharmaceutical supply chain, exhibits resilience even during broader economic downturns, as healthcare needs remain constant. This reliance on healthcare is a fundamental characteristic dictating market stability and pricing power for high-purity grades. The demand for generics, especially in fast-developing markets in Southeast Asia and Latin America, mandates continuous high-volume production of affordable APIs, further fueling the market for essential intermediates like benzylamine.

Furthermore, the environmental impact and regulatory burden surrounding Benzylamine production are increasingly influencing capital expenditure decisions. Companies are strategically investing in closed-loop systems and waste minimization techniques to comply with evolving global standards such as the EU's REACH framework. This compliance requirement acts as a barrier to entry for new market players while simultaneously forcing established firms to innovate technologically. The opportunity to develop bio-based routes for producing benzylamine or its precursors represents a significant long-term avenue for sustainable growth, potentially decoupling the market from petrochemical price volatility and addressing environmental concerns head-on. The adoption of AI in process control is crucial here, as precise reaction monitoring can significantly improve efficiency and reduce waste streams.

In the agrochemical sector, benzylamine derivatives are critical components in the next generation of highly specific pesticides and plant growth regulators designed to enhance yields under climate stress. As global food security concerns escalate, the demand for effective crop protection solutions remains high, providing a robust, volume-intensive market segment. The regulatory approval cycles for new agrochemical compounds are lengthy and costly, meaning that once a compound utilizing benzylamine is approved, its demand remains stable for years. This stability provides manufacturers with predictable revenue streams, contrasting with the more fragmented and highly specialized nature of certain niche pharmaceutical applications. The interplay between these major application segments ensures a balanced market dynamic.

The segment analysis regarding Purity Grade is paramount. The difference in production cost between Industrial Grade (typically 95-98%) and High Purity Grade (99%+ required for API synthesis) is substantial due to the rigorous purification steps involved, such as multiple distillations, crystallization, and specialized filtration. Suppliers capable of consistently delivering the high-purity grade gain a significant competitive advantage and can command premium pricing, establishing strong, long-term relationships with major pharmaceutical clients who prioritize quality and supply reliability over marginal cost savings. This specialization pushes R&D efforts towards cleaner, more selective synthesis methods, often utilizing advanced catalytic technologies.

In terms of Key Technology, the future lies in sustainable chemistry. Companies are actively exploring alternatives to the traditional ammonolysis route, which is energy-intensive and produces undesirable by-products. The use of heterogeneous catalysts that can be easily recovered and reused is becoming standard practice. Additionally, micro-reactor technology and continuous manufacturing platforms are gaining traction. These systems allow for highly controlled, small-scale production with rapid throughput, enabling precise chemical reactions and minimizing safety risks associated with large batch processes. This shift not only improves efficiency but is essential for meeting the strict EHS standards enforced globally, particularly in Europe and North America, positioning manufacturers who adopt these technologies as leaders in sustainable chemical production.

The competitive landscape is defined by the presence of large multinational chemical conglomerates (like BASF and Solvay) that leverage integrated production chains and deep pockets for R&D, competing alongside smaller, specialized chemical producers, predominantly located in China and India. These regional players often focus on cost leadership and high-volume output of industrial grades. To compete effectively, global players must focus on service differentiation, regulatory expertise, and the co-development of custom derivatives with key pharmaceutical clients. Mergers and acquisitions are common strategies employed to secure specialized purification expertise or geographic market access, particularly into the high-growth APAC region.

Finally, addressing the impact forces, geopolitical stability plays a subtle but critical role. Toluene, a key feedstock, is tied to the oil refining sector, which is frequently impacted by global political events and trade disputes. Disruptions in global shipping lanes or tariffs imposed on intermediate chemical imports can significantly alter manufacturing costs and supply chain reliability. Effective risk management requires diversification of feedstock sourcing and, where possible, establishing regional manufacturing footprints to mitigate reliance on intercontinental logistics. This strategic diversification ensures robust supply capability, which is a non-negotiable requirement for pharmaceutical and agrochemical customers whose production schedules cannot tolerate raw material shortages.

The evolution of corrosion inhibitors utilizing benzylamine derivatives presents a lucrative, specialized growth opportunity. These inhibitors are increasingly demanded by industries such as oil and gas extraction, pipeline maintenance, and large-scale industrial water treatment facilities. Benzylamine-based inhibitors offer superior performance in high-temperature, high-pressure environments, crucial for advanced exploration and processing technologies. This segment requires tailored formulations and is less sensitive to commodity pricing, providing higher profit margins compared to bulk industrial chemicals. Manufacturers focusing on these high-performance applications must invest in application testing and specific certifications relevant to the energy and infrastructure sectors.

Furthermore, the utilization of benzylamine in advanced materials, specifically as a precursor for certain polyamides and specialized epoxy curing agents, is slowly but steadily expanding. These materials are used in aerospace, automotive lightweighting, and high-specification protective coatings, demanding ultra-high purity and specific isomer ratios. This segment benefits from technological breakthroughs in materials science and necessitates close collaboration between chemical suppliers and end-product engineers to develop compounds with tailored thermal, mechanical, and chemical resistance properties. The intellectual property generated through the synthesis of novel benzylamine-based polymers can secure market exclusivity and premium pricing, rewarding sustained R&D investment.

Considering the regional market dynamics in depth, the intense competition in APAC is driving optimization not just in production yield but also in operational sustainability. Chinese and Indian manufacturers, while initially focusing on cost advantages, are now increasingly adopting global quality standards to penetrate regulated markets in North America and Europe. This shift means more investment in analytical instrumentation and quality management systems adhering to ISO standards and specific pharmaceutical guidelines. Meanwhile, European companies are leading the charge in developing biocatalytic or bio-based routes for related amines, anticipating future regulatory pushes towards sustainable sourcing, seeking to establish a leadership position in green chemistry related to amine synthesis.

The long-term trajectory of the Benzylamine market is strongly linked to global demographic trends. An aging global population requires sustained innovation in pharmaceuticals, keeping demand for APIs high. Concurrently, population growth and urbanization reduce available arable land, increasing the necessity for efficient, high-yield agriculture, which relies on advanced agrochemicals. Therefore, the core demand drivers are deeply structural and unlikely to reverse, ensuring the foundational importance of benzylamine as a chemical building block for the foreseeable future, despite short-term volatility in feedstock costs or geopolitical concerns. Strategic differentiation through purity and reliable, compliant supply chains will remain the key to securing market share.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager