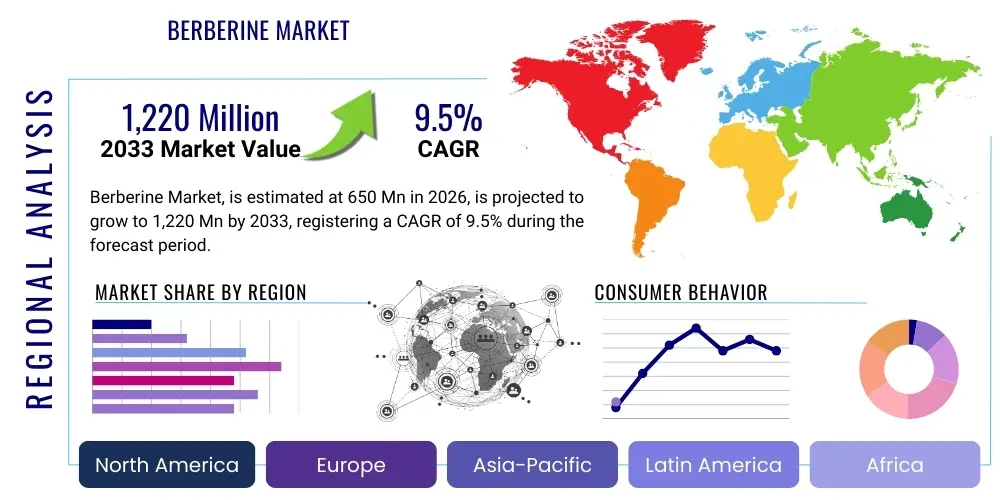

Berberine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442915 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Berberine Market Size

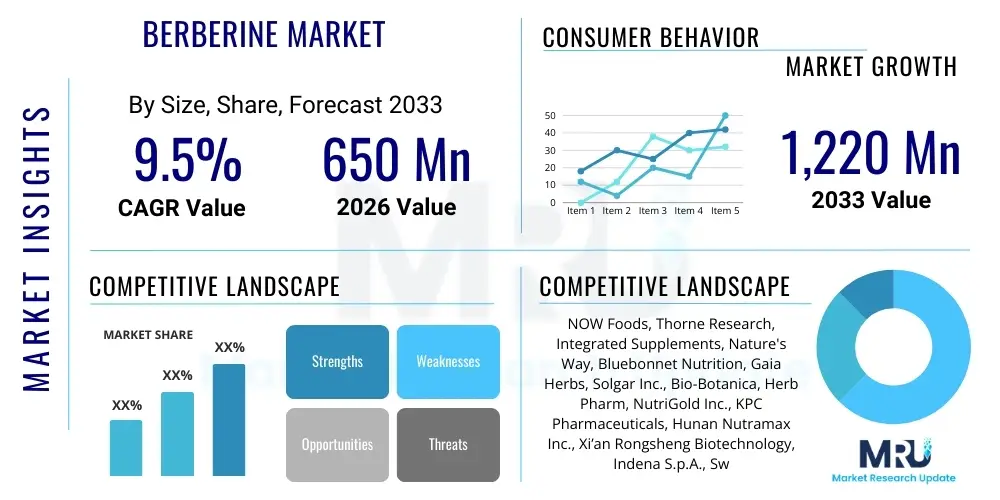

The Berberine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,220 Million by the end of the forecast period in 2033.

Berberine Market introduction

The Berberine Market encompasses the production, distribution, and utilization of Berberine, a natural isoquinoline alkaloid extracted primarily from the roots, rhizomes, and stem bark of various plants, most notably Berberis aristata (Indian barberry), Coptis chinensis (Coptis or goldthread), and Phellodendron amurense (Amur cork tree). This compound has gained substantial commercial traction due to its extensive pharmacological profile, particularly its efficacy in managing metabolic disorders, cardiovascular health, and its significant antimicrobial and anti-inflammatory properties. Historically utilized in traditional Chinese medicine (TCM) and Ayurvedic practices, modern scientific validation has spurred its adoption in the nutraceutical, pharmaceutical, and functional food industries globally, positioning it as a powerful natural therapeutic agent.

Major applications of Berberine span clinical nutrition, dietary supplements, and specialized pharmaceutical formulations. In the supplements sector, it is highly valued for its role as a glucose-lowering agent, often marketed as a natural alternative or adjuvant therapy for improving insulin sensitivity and treating Type 2 Diabetes Mellitus. Beyond glycemic control, Berberine is increasingly integrated into products aimed at cholesterol management, weight loss, and supporting gut health through modulation of the microbiome. The diversity of its applications, coupled with growing consumer preference for natural health solutions, serves as a fundamental driving factor for market expansion, particularly in Western economies where lifestyle-related diseases are prevalent.

The primary benefits driving market demand include its potent effects on AMP-activated protein kinase (AMPK) pathways, which regulate cellular energy metabolism, mimicking the effects of exercise and calorie restriction. This mechanism underlies its benefits in combating obesity, dyslipidemia, and metabolic syndrome. Furthermore, the demonstrated safety profile, when sourced and standardized correctly, reinforces its appeal. Key driving factors include rigorous scientific research confirming its efficacy, increased consumer awareness regarding preventive healthcare, and the accelerating integration of herbal extracts into mainstream medical recommendations, fostering innovation in delivery systems such as sustained-release capsules and enhanced bioavailability formulations.

Berberine Market Executive Summary

The global Berberine market is characterized by robust growth, driven primarily by favorable business trends surrounding consumer acceptance of functional ingredients, particularly those backed by clinical studies focusing on cardiometabolic health. Business strategies are heavily focused on vertical integration among raw material suppliers and manufacturers to ensure quality control and standardized alkaloid content, which is crucial for efficacy claims. Furthermore, strategic partnerships between nutraceutical companies and academic research institutions are accelerating the development of novel delivery formats, addressing historical challenges related to Berberine’s low oral bioavailability. The trend toward personalized nutrition also positions Berberine favorably, especially in formulations targeting specific biomarkers associated with metabolic syndrome.

Regionally, North America and Europe dominate the consumption landscape, reflecting high prevalence rates of diabetes and obesity, coupled with advanced regulatory frameworks that support the commercialization of science-backed dietary supplements. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR, fueled by increased healthcare spending, rising disposable incomes, and the deep-rooted cultural acceptance of traditional herbal medicine, especially in China and India, which are also primary sourcing and processing hubs for Berberine-containing plants. Latin America and the Middle East & Africa (MEA) are emerging markets, showing increasing adoption spurred by Western dietary influence and efforts to manage non-communicable diseases, though market penetration remains lower than established regions.

Segment-wise, the dietary supplements category maintains the largest market share, owing to the ease of access and consumer-driven preference for self-medication for metabolic issues. Within segment trends, the focus is shifting towards standardized extracts and high-purity formulations, particularly those standardized to 97% or higher Berberine Hydrochloride (HCl), which is the most widely studied form. Application segments seeing accelerated growth include formulations targeting gut health (microbiome modulation) and combination therapies that pair Berberine with synergistic compounds like silymarin or chromium to enhance efficacy and absorption, signaling a move towards sophisticated multi-ingredient functional products over single-entity supplements.

AI Impact Analysis on Berberine Market

User inquiries regarding AI's influence on the Berberine market primarily revolve around three key areas: how AI can accelerate natural product drug discovery and optimization, how it can improve supply chain integrity and standardization, and its role in generating personalized dosage recommendations based on individual metabolic profiles. Users express high expectations for AI to solve historical industry challenges, such as the low bioavailability of the compound and the variability in raw material quality. Key concerns focus on whether AI-driven marketing might overstate clinical efficacy or if proprietary AI algorithms could limit transparency in sourcing and formulation. The overarching theme is the anticipation of AI transforming Berberine from a traditional supplement into a highly personalized and pharmacologically optimized therapeutic agent.

AI is set to revolutionize the research and development pipeline for Berberine. Machine learning models are being deployed to analyze vast datasets of human clinical trials, identifying optimal patient populations, effective dosage ranges, and predicting synergistic interactions when Berberine is combined with other compounds. This deep-data analysis accelerates the transition of Berberine from a broadly marketed supplement to precision health applications, aiding in formulating products with higher efficacy and tailored health outcomes. Furthermore, AI-powered predictive analytics can model bioavailability improvements based on different carriers (liposomes, nanoparticles), dramatically reducing experimental time and cost.

In manufacturing and supply chain management, AI algorithms are instrumental in establishing rigorous quality control standards. Computer vision systems combined with spectroscopic analysis can verify the identity and purity of raw botanical materials upon harvest, ensuring consistent alkaloid content, which is paramount for consumer trust and regulatory compliance. AI also enhances supply chain resilience by predicting crop yield fluctuations, optimizing inventory management, and tracing product lineage via blockchain integration, addressing consumer and regulatory demand for traceability and authenticity in high-value botanical extracts like Berberine.

- Accelerated discovery of novel synthetic analogs with improved bioavailability.

- Predictive modeling of Berberine’s efficacy in diverse patient groups using genomic data.

- AI-enhanced quality control and purity verification of raw botanical extracts.

- Optimization of supply chain logistics and forecasting of seasonal supply variations.

- Development of personalized dosing recommendations based on real-time metabolic monitoring.

DRO & Impact Forces Of Berberine Market

The Berberine market dynamics are influenced by a complex interplay of facilitating factors and limiting constraints, which collectively dictate the market’s trajectory and competitive environment. Major drivers include the global epidemic of metabolic syndrome and Type 2 Diabetes, compelling consumers and healthcare providers to seek effective, natural intervention strategies. The robust body of clinical research supporting Berberine’s efficacy in blood sugar and lipid management provides a critical validation factor, converting skeptical consumers into active buyers. Concurrently, the increasing consumer shift towards natural and plant-derived supplements, often driven by concerns over side effects of synthetic pharmaceuticals, strongly propels the demand for high-quality Berberine products. These drivers are amplified by aggressive digital marketing and health education campaigns highlighting the traditional and modern scientific benefits of this alkaloid.

However, significant restraints impede faster growth. The primary challenge remains Berberine’s naturally poor oral bioavailability, meaning a large portion of the ingested compound is not absorbed by the body, necessitating high doses which can sometimes lead to gastrointestinal discomfort, limiting compliance. Secondly, regulatory complexity and inconsistency across major markets, particularly concerning health claims for natural products, create market fragmentation and hinder standardized global commercialization efforts. Furthermore, the supply side faces challenges related to sustainable sourcing and adulteration of raw materials, particularly given the high demand for specific plant species, potentially impacting pricing stability and product authenticity, thus necessitating stringent third-party testing.

Opportunities for market expansion are substantial, particularly through innovation in formulation and delivery technologies aimed at overcoming bioavailability constraints, such as phytosome technology, liposomal encapsulation, and micronization techniques, which promise enhanced absorption and reduced side effects. The untapped potential in specific application niches, such as non-alcoholic fatty liver disease (NAFLD) and Polycystic Ovary Syndrome (PCOS), where Berberine shows promising therapeutic action, represents a key growth pathway. Impact forces, such as changing dietary patterns globally and the rising costs of traditional pharmaceutical treatment for chronic diseases, push consumers towards accessible supplements like Berberine. Regulatory changes that streamline the approval process for structure/function claims, particularly in regions like the EU and North America, would dramatically accelerate market penetration and validate its therapeutic status.

Segmentation Analysis

The Berberine market is analyzed across several critical dimensions, allowing for a precise understanding of consumer behavior and growth pockets. Key segmentation includes the type of extract (Berberine Hydrochloride, Berberine Sulfate, etc.), the application area (Dietary Supplements, Pharmaceuticals, Cosmetics, Functional Food), and the distribution channel (Online Retail, Pharmacies, Health Stores). This granular approach helps manufacturers tailor their product development and marketing strategies to specific end-user needs, addressing efficacy, purity, and ease of access. The dominance of the dietary supplements segment reflects the current primary usage context, although the pharmaceutical segment is poised for significant growth as more clinical trials validate Berberine for specific medical indications.

Segmentation by Source is also crucial, differentiating between extracts derived from Berberis species (e.g., Indian barberry), Coptis species (goldthread), and Phellodendron species (Amur cork tree). While the chemical compound remains the same, the source can impact processing requirements, sustainability concerns, and regional supply chain reliability. High-purity Berberine Hydrochloride remains the standard bearer due to its high concentration and clinical data availability, dominating the segment by extract type. Geographic segmentation reveals strong market maturity in established Western markets, contrasted with high growth potential in emerging Asian and South American economies.

- By Source:

- Berberis aristata (Indian Barberry)

- Coptis chinensis (Goldthread)

- Phellodendron amurense (Amur Cork Tree)

- Others (e.g., Hydrastis canadensis)

- By Form/Type:

- Berberine Hydrochloride (HCl)

- Berberine Sulfate

- Berberine Base

- Standardized Extracts (e.g., 97% purity)

- By Application:

- Dietary Supplements (Metabolic Health, Cardiovascular Support, Gut Health)

- Pharmaceuticals (Investigational Drugs, Traditional Medicine Preparations)

- Functional Food & Beverages

- Cosmeceuticals

- By Distribution Channel:

- Offline Channels (Pharmacies & Drug Stores, Health & Wellness Stores, Supermarkets)

- Online Channels (E-commerce Platforms, Company Websites)

Value Chain Analysis For Berberine Market

The value chain for the Berberine market begins with the upstream segment, which is dominated by the cultivation, harvesting, and initial processing of botanical raw materials, primarily in Asia (China, India) and parts of the Mediterranean. Critical factors at this stage include sustainable farming practices, ensuring the high concentration of the target alkaloid, and meticulous drying processes. Key upstream players include specialized botanical extractors and agricultural cooperatives that manage the wild-harvesting or cultivation of Berberis and Coptis species. The quality and purity of the initial raw material dictate the cost structure and the final product's efficacy, making standardized sourcing a bottleneck and a major focus area for manufacturers.

The midstream phase involves the industrial extraction, purification, and standardization of Berberine into concentrated forms, such as Berberine HCl powder, by specialized chemical and nutraceutical ingredient manufacturers. This stage requires advanced extraction technologies (e.g., supercritical fluid extraction) to maximize purity and minimize contaminants. Following standardization, these ingredients are then supplied to downstream processors—primarily finished product manufacturers (nutraceutical companies, pharmaceutical firms)—who formulate them into capsules, tablets, liquids, or compounded prescriptions. Intellectual property around enhanced bioavailability formulations, such as liposomal delivery systems, adds significant value at this manufacturing stage.

The downstream segment encompasses the distribution and final sale to the end consumer. Distribution channels are bifurcated into direct and indirect methods. Direct channels involve manufacturers selling via their own e-commerce websites, allowing for greater control over branding and consumer data, common among specialty supplement brands. Indirect channels, which account for the majority of sales volume, utilize intermediaries such as wholesalers, large e-commerce platforms (Amazon, dedicated supplement retailers), and traditional brick-and-mortar outlets like pharmacies, drug stores, and health food stores. The efficacy of the indirect channel heavily relies on consumer education efforts by retailers and key opinion leaders, distinguishing premium, high-purity Berberine products from lower-quality alternatives.

Berberine Market Potential Customers

The primary end-users and buyers of Berberine products are individuals seeking natural management strategies for chronic metabolic conditions, making the demographic aged 40 and above a significant customer base. Potential customers suffering from Type 2 Diabetes, pre-diabetes, and metabolic syndrome represent the core target market due to Berberine’s proven efficacy in glucose and lipid regulation. These customers are typically health-conscious, actively seeking supplements that complement or reduce reliance on conventional pharmaceuticals, and are often influenced by recommendations from functional medicine practitioners, naturopaths, and integrative doctors who frequently prescribe Berberine as a foundational metabolic support agent.

A rapidly growing customer segment includes younger individuals and fitness enthusiasts focused on weight management, body composition optimization, and improving gut health. These users utilize Berberine due to its AMPK activation properties, which supports fat metabolism and potentially improves insulin sensitivity related to high-carbohydrate diets. Furthermore, customers with specific gastrointestinal concerns, particularly those dealing with dysbiosis or small intestinal bacterial overgrowth (SIBO), are key consumers, leveraging Berberine’s antimicrobial properties often based on guidance from nutritional therapists specializing in gut protocols.

In the institutional sector, potential customers include compounding pharmacies and specialized health clinics that incorporate Berberine into personalized treatment protocols. Additionally, food and beverage manufacturers exploring functional ingredients represent a future customer segment, integrating low doses of Berberine into dietary bars, specialized shakes, or functional beverages aimed at blood sugar control and satiety. The common denominator among all potential customers is a high propensity for research into natural health solutions and a willingness to invest in clinically substantiated ingredients, prioritizing product purity and standardized alkaloid content.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,220 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NOW Foods, Thorne Research, Integrated Supplements, Nature's Way, Bluebonnet Nutrition, Gaia Herbs, Solgar Inc., Bio-Botanica, Herb Pharm, NutriGold Inc., KPC Pharmaceuticals, Hunan Nutramax Inc., Xi’an Rongsheng Biotechnology, Indena S.p.A., Swisse Wellness, Jarrow Formulas, Pure Encapsulations, Doctor's Best, Source Naturals, Shenzhen Lifeworth Biotechnology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Berberine Market Key Technology Landscape

The technological landscape surrounding the Berberine market is primarily focused on overcoming the inherent limitations of the compound, specifically its poor oral absorption and subsequent low systemic concentration. The most critical technological advancements are centered on drug delivery systems aimed at enhancing bioavailability. Microencapsulation and nano-encapsulation techniques, including the use of solid lipid nanoparticles (SLNs) and liposomal carriers, are being extensively researched and commercialized. These technologies protect the active alkaloid from degradation in the harsh gastrointestinal environment, facilitating increased intestinal absorption and achieving higher concentrations in target tissues, thereby maximizing therapeutic effect while often allowing for reduced dosing and mitigating side effects.

Furthermore, technology related to formulation chemistry is driving market innovation through the development of specialized complexes, such as Phytosomes (Berberine complexed with phospholipids like phosphatidylcholine). This technique capitalizes on creating a lipid-soluble form of the water-soluble Berberine, significantly improving its passage across the lipid-rich cellular membranes of the gut. Parallel to bioavailability enhancement, purification technology remains paramount. Advanced chromatographic techniques, specifically High-Performance Liquid Chromatography (HPLC), are standard industry practice for achieving high-purity Berberine HCl (typically >97%) and ensuring that the final extract is free from heavy metals, pesticides, and other botanical contaminants, meeting stringent regulatory quality standards globally.

Beyond formulation and purity, sustainable sourcing technologies are becoming increasingly important. Biotechnology tools, including tissue culture and controlled environment agriculture (CEA), are being explored to ensure a stable, contaminant-free supply of high-yield plant material, reducing reliance on potentially unsustainable wild harvesting. Additionally, specialized drying and milling technologies are employed to preserve the integrity of the compound during processing, leading to better powder flow characteristics necessary for high-speed pharmaceutical manufacturing operations, ultimately contributing to a more reliable, effective, and ethically sourced market offering.

Regional Highlights

- North America: This region holds the largest market share, driven by a high prevalence of metabolic syndrome and substantial consumer spending on dietary supplements. The market benefits from clear regulatory pathways for health supplements and a robust ecosystem of functional medicine practitioners advocating for natural solutions like Berberine for blood sugar management. Innovation in enhanced delivery systems and aggressive marketing by U.S.-based nutraceutical giants solidify its dominance.

- Europe: Characterized by stringent regulatory oversight (e.g., European Food Safety Authority - EFSA), the European market requires strong scientific substantiation for health claims. Despite these hurdles, rising health awareness and acceptance in countries like Germany and the UK are fueling growth, particularly in pharmacist-recommended supplement channels. Western European consumers prioritize certified organic and clean-label Berberine sources.

- Asia Pacific (APAC): Expected to register the highest CAGR. This growth is underpinned by the region’s traditional use of Berberine-containing plants (especially in China and India), significant manufacturing capacity (raw material sourcing), and the rapid expansion of the middle class with increasing awareness of preventive health. China dominates both production and consumption, utilizing Berberine extensively in traditional Chinese medicine preparations and modern formulations.

- Latin America (LATAM): An emerging market experiencing accelerated growth due to increased Western influence on dietary habits leading to higher rates of chronic diseases. Market growth is reliant on establishing strong distribution networks and overcoming challenges related to inconsistent import regulations and consumer trust in supplement quality. Brazil and Mexico are the largest consumers in the region.

- Middle East and Africa (MEA): This region is lagging but shows potential, particularly in the UAE and Saudi Arabia, driven by high diabetes prevalence and increasing investment in modern healthcare infrastructure. The market is primarily served by imports from North America and Europe, focusing on high-end pharmaceutical-grade Berberine products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Berberine Market.- NOW Foods

- Thorne Research

- Integrated Supplements

- Nature's Way

- Bluebonnet Nutrition

- Gaia Herbs

- Solgar Inc.

- Bio-Botanica

- Herb Pharm

- NutriGold Inc.

- KPC Pharmaceuticals

- Hunan Nutramax Inc.

- Xi’an Rongsheng Biotechnology

- Indena S.p.A.

- Swisse Wellness

- Jarrow Formulas

- Pure Encapsulations

- Doctor's Best

- Source Naturals

- Shenzhen Lifeworth Biotechnology

Frequently Asked Questions

Analyze common user questions about the Berberine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary therapeutic applications driving Berberine market demand?

The primary therapeutic applications driving Berberine market demand are the management of metabolic disorders, specifically Type 2 Diabetes, pre-diabetes, and hyperlipidemia (high cholesterol and triglycerides). Its ability to activate the AMPK pathway makes it highly effective for improving insulin sensitivity and regulating blood glucose levels, positioning it as a powerful natural supplement for cardiometabolic health and weight management.

How is the low bioavailability challenge being addressed in the Berberine market?

The industry is addressing the challenge of low oral bioavailability through advanced technological formulations. Key innovations include liposomal encapsulation, micronization, and the development of phospholipid complexes (Phytosomes). These delivery systems enhance the compound’s absorption in the gastrointestinal tract, allowing for lower effective doses, improved efficacy, and reduced potential for digestive side effects.

Which geographical region is expected to show the fastest growth rate for Berberine?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the Berberine market. This acceleration is driven by the region's historical cultural ties to herbal medicine, expanding consumer base in countries like China and India, increased investment in healthcare, and the region's strong position as a major raw material supplier.

What is the most common form of Berberine used in commercial products?

Berberine Hydrochloride (HCl) is the most common and widely utilized form in commercial products. Berberine HCl is highly favored because it is the most stable and well-researched variant, with the majority of successful human clinical trials referencing this specific salt form, offering manufacturers a strong basis for scientific and marketing claims regarding standardization and efficacy.

How do regulatory standards impact the Berberine market globally?

Regulatory standards significantly impact the Berberine market by dictating permissible health claims and required purity levels. Strict regulatory bodies like EFSA in Europe can limit specific disease-related claims, while the FDA in North America allows more flexibility under supplement guidelines. This regulatory variation influences market segmentation, requiring manufacturers to tailor marketing and formulation strategies to comply with regional mandates regarding testing, labeling, and quality control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager