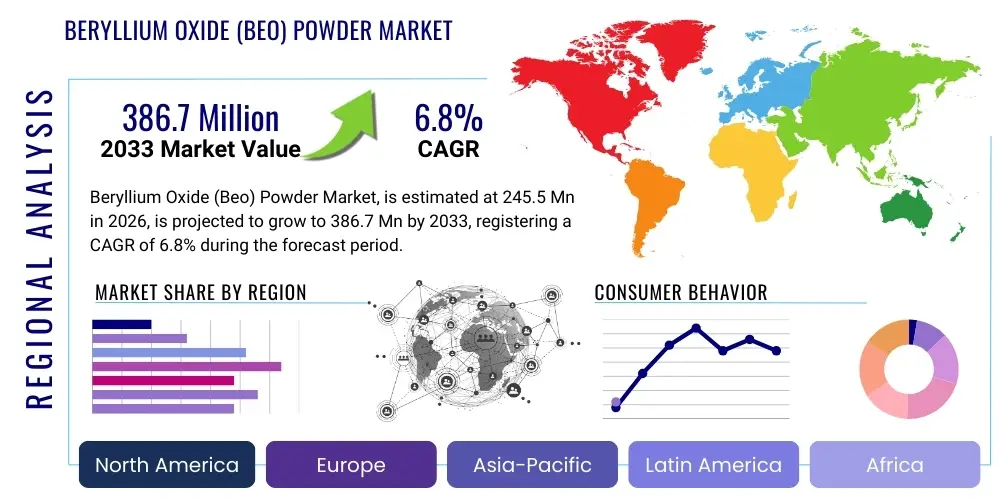

Beryllium Oxide (Beo) Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442047 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Beryllium Oxide (Beo) Powder Market Size

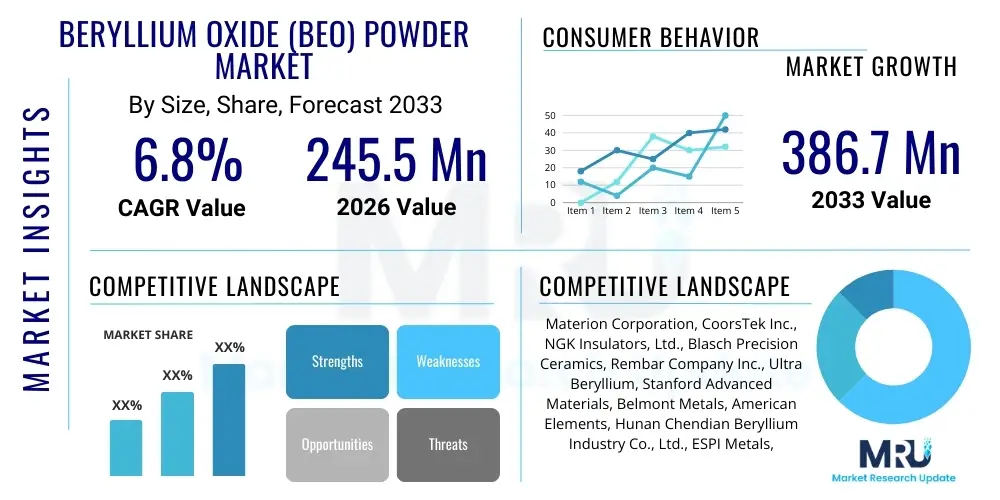

The Beryllium Oxide (Beo) Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 245.5 million in 2026 and is projected to reach USD 386.7 million by the end of the forecast period in 2033.

Beryllium Oxide (Beo) Powder Market introduction

Beryllium Oxide (BeO) powder, often referred to as beryllia, is a highly specialized ceramic material primarily recognized for its exceptional thermal conductivity combined with high electrical resistivity. This unique combination makes it indispensable in high-performance electronics, aerospace, and nuclear applications where efficient heat dissipation and electrical insulation are paramount. The market for BeO powder is driven by the increasing complexity and power density of electronic devices, particularly in sectors requiring robust thermal management solutions, such as high-power radio frequency (RF) components, laser systems, and semiconductor manufacturing equipment. Furthermore, its lightweight nature and high melting point contribute to its selection in demanding operational environments.

The product is typically manufactured through the calcination of beryllium hydroxide or beryllium carbonate, yielding fine-grained powder used in the fabrication of various ceramic shapes, including substrates, heat sinks, insulators, and crucibles. The major applications span defense and telecommunications, where BeO-based components are integral to radar systems, satellite communications, and microwave devices. Key benefits include superior thermal management capabilities compared to conventional aluminum nitride (AlN) or aluminum oxide (Al2O3) ceramics, offering engineers improved performance margins and system reliability under extreme thermal stress. The market is highly regulated due to the toxicity associated with handling beryllium dust, necessitating specialized manufacturing processes and stringent safety protocols, which influences the supply chain structure and overall market competitiveness.

Driving factors for market expansion include the miniaturization trend in microelectronics, which demands more effective heat extraction from smaller volumes, and the sustained investment in 5G infrastructure globally, requiring high-power, thermally stable RF power transistors. Additionally, the proliferation of electric vehicles (EVs) and hybrid vehicles, utilizing power electronics that require excellent thermal management, further boosts demand for BeO powder-derived components. However, market growth is moderated by high material costs, environmental compliance complexity, and the continuous search for high-performance, less toxic alternatives, though few materials currently match BeO's specific profile of properties.

Beryllium Oxide (Beo) Powder Market Executive Summary

The Beryllium Oxide (BeO) Powder Market demonstrates resilient growth, underpinned by critical requirements across high-tech industries. Business trends highlight strategic consolidation among key producers focusing on optimizing production methods to enhance purity levels and minimize processing costs, addressing the historical hurdle of high material expense. There is an increasing emphasis on downstream partnerships with electronics manufacturers to co-develop customized thermal management solutions, moving beyond basic material supply towards integrated component offerings. Furthermore, intellectual property surrounding specialized firing and sintering techniques remains a crucial differentiator, safeguarding technological advantages for established market players. Investment in automation within production facilities is observed to mitigate exposure risks associated with beryllium handling, simultaneously improving efficiency and product consistency.

Regional trends indicate that Asia Pacific (APAC) currently dominates the market, driven by the concentration of semiconductor manufacturing, telecommunications infrastructure development, and defense electronics production, particularly in countries like China, Japan, and South Korea. North America and Europe maintain significant market shares, largely due to robust aerospace and defense sectors and advanced research in high-power electronics and nuclear technology. The market in these regions is characterized by demand for ultra-high purity grades of BeO, catering to mission-critical applications where failure is unacceptable. Future growth is anticipated to accelerate in emerging economies within APAC as industrialization and technological adoption drive increased demand for sophisticated thermal management systems.

Segment trends reveal that the Electronics and Telecommunications segment constitutes the largest revenue share, reflecting the indispensable role of BeO in high-frequency, high-power RF components such as traveling wave tubes (TWTs) and high-electron-mobility transistors (HEMTs). The Powder Grade segment, particularly high-purity (99.9% and above) variants, commands a premium due to its suitability for demanding applications requiring superior dielectric strength and thermal properties. Application segments, including Thermal Management Ceramics and Structural Ceramics, are witnessing steady growth, with significant latent opportunities emerging in medical devices, specifically high-frequency ultrasound transducers, where BeO’s acoustic properties are beneficial alongside its thermal capabilities.

AI Impact Analysis on Beryllium Oxide (Beo) Powder Market

Common user questions regarding AI's impact on the Beryllium Oxide (BeO) Powder Market center around whether Artificial Intelligence can optimize the expensive and hazardous production process, if AI-driven materials discovery might rapidly identify high-performance, safer alternatives, and how machine learning (ML) could enhance the performance predictability of BeO-based electronic components. Users are primarily concerned with efficiency gains in manufacturing—specifically reducing waste, improving yield consistency in high-purity synthesis, and mitigating human exposure risks through AI-monitored automation. Furthermore, there is significant interest in utilizing AI for computational materials science to fine-tune the powder morphology and particle size distribution (PSD), thereby optimizing the final ceramic properties for specific end-use requirements, minimizing the need for extensive physical prototyping and testing which is both costly and time-consuming in this specialized field.

AI is increasingly being integrated into the manufacturing pipeline for advanced ceramics, including BeO. Machine learning algorithms are applied to analyze sensor data from calcination and sintering processes, enabling real-time adjustments to temperature, pressure, and atmosphere. This predictive quality control significantly improves batch consistency, crucial for high-reliability components used in defense and space applications, directly leading to better material yield and reduced cost overheads. The application of AI in process optimization helps address the core market challenge of high production costs associated with ultra-pure BeO powder. By accurately modeling the complex physicochemical reactions involved, manufacturers can operate closer to optimal theoretical limits, reducing energy consumption and material waste, which is environmentally and economically beneficial.

In the research and development domain, generative AI models and ML techniques accelerate the screening of alternative ceramic compositions that might offer comparable thermal conductivity without the toxicity burden of beryllium. While a complete, non-toxic replacement with an identical performance profile remains elusive, AI assists in optimizing existing non-BeO ceramics (like AlN composites) to close the performance gap. Furthermore, for electronic component design, AI-driven simulation tools predict thermal stress distribution and reliability lifetime of BeO substrates under various operating conditions, allowing electronic designers to push performance boundaries confidently. This capability enhances the overall value proposition of BeO components, justifying their high price point by guaranteeing reliability in mission-critical environments.

- AI optimizes complex calcination and sintering parameters, enhancing powder yield and purity consistency.

- Machine learning models predict and mitigate manufacturing defects, reducing expensive waste in high-purity BeO production.

- Generative AI assists in computational materials discovery, accelerating the search for high-performance, non-beryllium alternatives.

- Predictive maintenance schedules for specialized BeO processing equipment are enhanced using AI-driven anomaly detection.

- AI-based thermal simulation tools improve the design and reliability forecasting of BeO-based electronic substrates.

- Automation guided by computer vision systems reduces human contact with hazardous beryllium materials, enhancing worker safety.

DRO & Impact Forces Of Beryllium Oxide (Beo) Powder Market

The Beryllium Oxide (BeO) Powder Market is characterized by strong fundamental drivers rooted in unique material properties, yet its growth is significantly constrained by regulatory hurdles and health concerns. The primary drivers include the relentless demand for superior thermal management in high-power electronic devices, particularly in 5G infrastructure, military radar, and satellite communications, where BeO’s combination of high thermal conductivity and electrical insulation is unparalleled. Opportunities are concentrated in developing specialized applications, such as high-performance ceramics for extreme environments (nuclear fusion research and aerospace thermal protection systems), and integrating BeO into advanced composite materials to enhance thermal dissipation across multiple platforms. The key restraints are the stringent environmental, health, and safety (EHS) regulations globally due to the material's toxicity, which significantly increases manufacturing complexity, disposal costs, and overall market access barriers. These forces collectively shape a niche market that demands high precision, maintains high barriers to entry, and experiences continuous pressure to manage material risks effectively.

Impact forces stemming from technological progress and regulatory shifts exert considerable influence on market trajectory. The accelerating pace of miniaturization in semiconductors necessitates better heat dissipation solutions, creating an acute demand push for BeO. Conversely, continuous investment in competitive non-toxic materials, like advanced forms of AlN or diamond films, acts as a mitigating force, pressuring BeO pricing and innovation requirements. Regulatory adherence, particularly OSHA and REACH regulations concerning beryllium exposure, significantly impacts the supply chain, favoring vertically integrated companies capable of maintaining closed-loop, safe processing environments. Economic forces, such such as fluctuating raw material costs (beryllium ore) and geopolitical stability regarding supply chains, also dictate investment decisions in new capacity, ensuring that market growth remains highly dependent on both technological superiority and operational compliance.

The interplay of these factors mandates that market players focus on product differentiation through enhanced purity and optimized morphology, rather than competing solely on volume or price. High entry barriers related to technological expertise and regulatory compliance protect established players, creating a stable but intensely specialized market structure. The potential for breakthrough applications in advanced nuclear reactors or high-temperature superconductor technologies represents significant opportunities, contingent upon sustained R&D investment. Managing the perception and reality of material toxicity through transparent, high-standard safety practices is vital for unlocking these growth avenues and sustaining market acceptance among end-users.

Segmentation Analysis

The Beryllium Oxide (BeO) Powder Market is comprehensively segmented based on its purity grade, the form in which it is used, and its specific end-user application. Segmentation by grade is crucial as performance in high-reliability applications, such as defense and aerospace, is directly correlated with the purity level, demanding 99.9% purity or higher. Form segmentation often distinguishes between powder used for traditional ceramic pressing and sintering versus powder optimized for advanced techniques like tape casting or additive manufacturing. Application segmentation provides insights into the primary revenue drivers, highlighting the market's dependence on the electronics and telecommunications sectors for thermal management solutions. This detailed segmentation allows stakeholders to target specific niche markets that prioritize BeO's unique combination of thermal and electrical properties over cost considerations.

The market analysis further scrutinizes segmentation across various dimensions to provide granular insight into consumption patterns. For instance, within the Electronics application segment, demand varies significantly between high-power RF transistors, where BeO is often irreplaceable due to its high dielectric strength, and general circuit boards, where less expensive alternatives suffice. Geographical segmentation is equally important, reflecting regional differences in defense spending, semiconductor manufacturing capabilities, and regulatory environments, influencing both production location and end-user demand concentration. Understanding these segment-specific dynamics is essential for forecasting market shifts and allocating R&D resources effectively, particularly as emerging technologies like 6G and advanced packaging necessitate even greater thermal performance.

- By Grade:

- Standard Grade (Below 99.5%)

- High Purity Grade (99.5% to 99.9%)

- Ultra-High Purity Grade (Above 99.9%)

- By Application:

- Thermal Management Ceramics (Heat Sinks, Substrates)

- Structural Ceramics (Crucibles, Fixtures)

- Electronic Components (Transistors, Diodes, Magnetrons)

- Nuclear Applications (Moderators, Reflectors)

- Medical Devices (Imaging Systems)

- Aerospace & Defense

- By Form:

- Sintering Powder

- Pressing Powder

- Tape Casting Powder

Value Chain Analysis For Beryllium Oxide (Beo) Powder Market

The value chain for the Beryllium Oxide (BeO) Powder Market is characterized by high integration and rigorous controls, starting with the upstream mining and refining of beryllium ore (bertrandite or beryl). Upstream activities involve specialized extraction and purification processes to convert ore into high-purity beryllium hydroxide or sulfate, which are the primary precursors. Due to the inherent toxicity, only a few specialized companies globally handle this initial processing phase, establishing significant control over the raw material supply chain. These purified precursors are then calcined and sintered to produce the fine BeO powder, a highly technical process requiring specialized equipment and strict EHS compliance. The scarcity of upstream suppliers and the demanding nature of powder synthesis contribute significantly to the high cost of the final product.

The midstream involves the powder processing and component fabrication. Powder manufacturers might supply BeO powder directly, or often, vertically integrated companies utilize their own powder to manufacture components like ceramic substrates, thermal pads, and insulators. The conversion of powder into usable ceramic parts involves demanding techniques such as hot pressing, isostatic pressing, and advanced machining. Quality control at this stage is critical, as any impurity or structural flaw can compromise the final component's performance, especially its thermal conductivity and dielectric properties under high load. Distribution channels are typically direct or through specialized technical distributors. Direct distribution is preferred for major defense and aerospace contracts, ensuring material traceability and security of supply, given the strategic nature of the end-use components.

Downstream analysis focuses on the end-user industries: electronics, defense, aerospace, and medical. These industries integrate BeO components into complex systems, valuing performance and reliability over marginal cost savings. The distribution channel is often indirect for smaller electronic component buyers via specialized chemical or technical distributors who can manage the logistical and regulatory complexity associated with the material. However, for large OEMs, direct sales and long-term supply agreements are common. The lifecycle management, including safe disposal or recycling of beryllium-containing components at the end of their useful life, also forms a critical, regulated aspect of the downstream value chain, impacting the total cost of ownership for the end-user.

Beryllium Oxide (Beo) Powder Market Potential Customers

Potential customers and primary buyers in the Beryllium Oxide (BeO) Powder Market are primarily large-scale manufacturers and defense contractors operating in highly specialized technology sectors where thermal efficiency and reliability are non-negotiable mission requirements. The key end-users include major semiconductor fabrication houses specializing in high-frequency, high-power devices, particularly those producing Gallium Nitride (GaN) and Gallium Arsenide (GaAs) transistors used in 5G base stations and advanced radar systems. These customers require BeO substrates for their superior heat dissipation capabilities compared to standard ceramic materials, enabling higher power outputs and extended component lifecycles in compact designs. The procurement process for these customers is characterized by stringent quality audits, long qualification cycles, and demand for ultra-high purity materials.

Another significant customer segment is the global aerospace and defense industry, including government agencies and their prime contractors responsible for producing satellite communication systems, missile guidance electronics, and airborne radar units. In these applications, BeO's low density, high thermal shock resistance, and reliability under extreme temperature gradients are critical differentiating factors. Similarly, the nuclear energy sector, specifically research facilities and developers of advanced reactor designs (e.g., molten salt reactors), represents a specialized customer base utilizing BeO powder for moderator and reflector components due to its unique neutron characteristics and stability at high temperatures. These customers demand comprehensive documentation regarding material purity, historical batch testing, and regulatory compliance.

Finally, the medical device sector constitutes an emerging, high-value customer group. Manufacturers of advanced diagnostic equipment, such as high-frequency ultrasound transducers and certain radiation therapy devices, leverage BeO for its specific acoustic impedance and thermal properties to enhance signal quality and component reliability. Although procurement volumes in the medical sector might be lower than in electronics, the required material specification and consistency are equally rigorous. For all customer segments, the decision to purchase BeO is driven by performance imperatives; therefore, suppliers must demonstrate consistent quality, regulatory adherence, and provide specialized technical support for material integration into complex systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 245.5 Million |

| Market Forecast in 2033 | USD 386.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Materion Corporation, CoorsTek Inc., NGK Insulators, Ltd., Blasch Precision Ceramics, Rembar Company Inc., Ultra Beryllium, Stanford Advanced Materials, Belmont Metals, American Elements, Hunan Chendian Beryllium Industry Co., Ltd., ESPI Metals, China Rare Earth Metals, Ceradyne (3M), Chengdu Beryl Materials Technology, Hebei Pengda Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beryllium Oxide (Beo) Powder Market Key Technology Landscape

The technology landscape for the Beryllium Oxide Powder Market is focused primarily on achieving higher purity, tighter control over particle size distribution (PSD), and developing safer, more efficient manufacturing processes. Key technological advancements center around optimizing the calcination process, which converts beryllium precursor materials into BeO powder. Advanced calcination techniques, including controlled atmosphere firing and micro-powderization methods, are used to produce spherical or platelet-shaped particles with highly uniform properties. This uniformity is critical for achieving optimal packing density during subsequent sintering, resulting in ceramic components with minimal porosity and maximized thermal performance. Furthermore, specialized grinding and milling techniques, such as jet milling, are employed post-calcination to precisely control the fineness of the powder, tailoring it for specific fabrication methods like tape casting or high-pressure dry pressing, which are essential for manufacturing complex electronic substrates.

Another crucial technological area involves green manufacturing and handling technologies. Due to the toxicity of beryllium dust, manufacturers heavily invest in closed-loop systems, vacuum handling, and sophisticated air filtration (HEPA and scrubbers) to ensure worker safety and regulatory compliance. The integration of automation and robotics, often coupled with AI monitoring, ensures minimal human intervention during hazardous stages of powder processing. Furthermore, advancements in analytical instrumentation, such as high-resolution electron microscopy and sophisticated surface area analysis, allow manufacturers to characterize the powder morphology and surface chemistry with unprecedented detail. This level of control is necessary to consistently produce ultra-high purity grades required for sensitive military and space electronics, where even trace contaminants can compromise dielectric properties.

In the downstream application segment, the technology focuses on advanced ceramic fabrication methods. Tape casting technology, a thin-film deposition technique, is widely used to create high-density, thin BeO substrates for hybrid circuits. Furthermore, research is ongoing into the application of Additive Manufacturing (AM) for BeO components. While challenging due to the high sintering temperatures and material properties, AM techniques like stereolithography (SLA) or binder jetting, adapted for ceramic slurries, hold the promise of producing intricate, near-net-shape BeO parts, reducing waste and complex machining costs traditionally associated with hard ceramics. Success in AM would significantly open up design freedom for thermal management solutions, driving future demand in specialized component sectors requiring complex geometries.

Regional Highlights

The Beryllium Oxide (BeO) Powder Market exhibits distinct regional consumption and production patterns, highly correlated with defense spending, semiconductor manufacturing capabilities, and regulatory stringency.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, driven primarily by the massive scale of electronic manufacturing hubs in China, Taiwan, South Korea, and Japan. The burgeoning 5G infrastructure rollout across the region, coupled with significant investments in semiconductor foundries (especially for high-power devices like GaN), drives strong demand for BeO thermal substrates. While production capacity exists in China, high-purity material is often sourced from North American and European specialists due to strict performance requirements in export-oriented electronics and defense applications. The large automotive sector in this region, increasingly focusing on EVs and hybrid technology requiring robust power electronics, further fuels localized demand expansion.

- North America: North America is a mature market characterized by extremely high demand for ultra-high purity BeO, predominantly stemming from the aerospace, defense, and advanced nuclear industries. The US defense industrial base relies heavily on BeO ceramics for critical radar systems, electronic warfare platforms, and space-based communication systems. Strict environmental and occupational safety regulations (governed by entities like OSHA) mandate state-of-the-art closed-loop production processes, leading to high production costs but ensuring exceptional material quality and supply chain reliability. Innovation in advanced materials research and development remains concentrated here, particularly concerning next-generation nuclear reactor materials.

- Europe: Europe maintains a significant market share, supported by robust aerospace programs (e.g., in France, Germany, and the UK) and substantial research initiatives in high-energy physics and medical technology. The European market is highly sensitive to the REACH regulatory framework, which imposes substantial restrictions and monitoring requirements on beryllium handling and processing. This regulatory environment encourages specialization in high-value, low-volume applications and drives innovation towards cleaner production technologies. Key demand areas include advanced telecommunications equipment and specialized industrial electronics requiring high thermal stability.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller market shares. Demand in MEA is primarily driven by defense modernization efforts and oil and gas sector monitoring equipment, which require robust electronic components stable under harsh environmental conditions. Growth in LATAM is sporadic, linked mainly to specific infrastructure projects or specialized imports. Future growth potential in both regions is linked to increased domestic investment in communication infrastructure and the establishment of local electronics assembly and maintenance capabilities, though this growth will proceed from a smaller base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beryllium Oxide (Beo) Powder Market.- Materion Corporation

- CoorsTek Inc.

- NGK Insulators, Ltd.

- Blasch Precision Ceramics

- Rembar Company Inc.

- Ultra Beryllium

- Stanford Advanced Materials

- Belmont Metals

- American Elements

- Hunan Chendian Beryllium Industry Co., Ltd.

- ESPI Metals

- China Rare Earth Metals

- Ceradyne (3M)

- Chengdu Beryl Materials Technology

- Hebei Pengda Group

- Accumet Materials

- Müller Group

- Atlantic Equipment Engineers

- J & V Material

- Advanced Ceramic Technology

Frequently Asked Questions

Analyze common user questions about the Beryllium Oxide (Beo) Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Beryllium Oxide (BeO) over other ceramic materials?

BeO offers an unmatched combination of extremely high thermal conductivity (superior to aluminum nitride and alumina) and excellent electrical insulation. This unique property profile is critical for managing heat in high-power electronic devices, ensuring performance and reliability in applications such as military radar and 5G telecommunications where standard ceramics fail.

What is the main factor restraining the growth of the Beryllium Oxide Powder Market?

The primary restraint is the toxicity of beryllium dust. This necessitates highly specialized, expensive, and regulated manufacturing processes to ensure strict occupational and environmental safety, leading to high material costs and significant market entry barriers for new competitors.

Which application segment accounts for the largest demand for BeO powder?

The Electronics and Telecommunications segment constitutes the largest consumer of BeO powder, primarily for manufacturing advanced thermal management ceramics like heat sinks and substrates used in high-frequency, high-power radio frequency (RF) components and advanced semiconductor packaging.

How do regulatory environments impact the Beryllium Oxide market?

Strict global regulations, notably OSHA in the US and REACH in Europe, heavily influence production and usage. These regulations enforce stringent safety protocols and material handling requirements, directly increasing operational costs, favoring large, compliant, and vertically integrated manufacturers, and ensuring traceability throughout the supply chain.

What role does Asia Pacific play in the global Beryllium Oxide Powder Market?

Asia Pacific is the dominant and fastest-growing region, driven by its large concentration of semiconductor fabrication facilities and rapid rollout of 5G and related high-power communication infrastructure. The region demands vast quantities of BeO components for both domestic consumption and global export markets in advanced electronics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Beryllium Oxide (BeO) Powder Market Size Report By Type (Industrial Grade, High Purity Grade), By Application (Beryllium Copper Alloy, Beryllium Oxide Ceramic Material, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Beryllium Oxide (BeO) Powder Market Statistics 2025 Analysis By Application (Beryllium Copper Alloy, Beryllium Oxide Ceramic Material), By Type (Industrial Grade, High Purity Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager