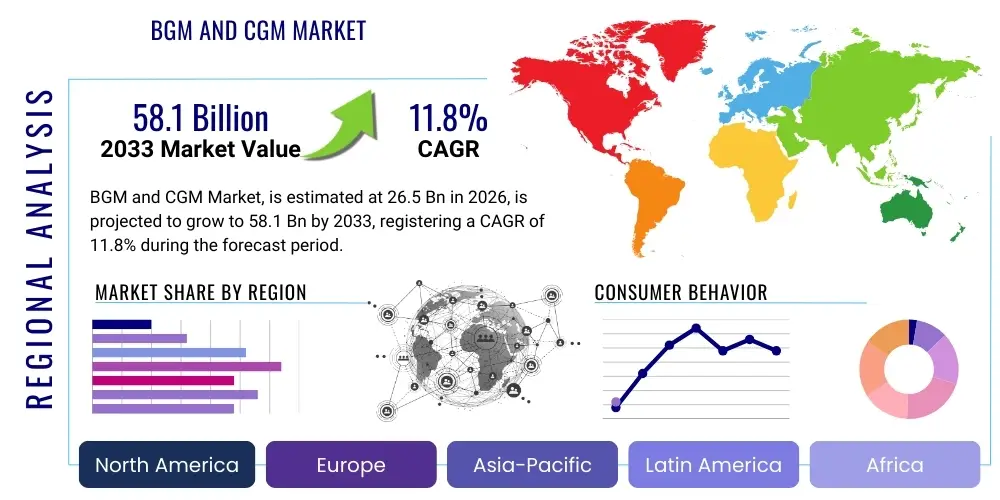

BGM and CGM Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443273 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

BGM and CGM Market Size

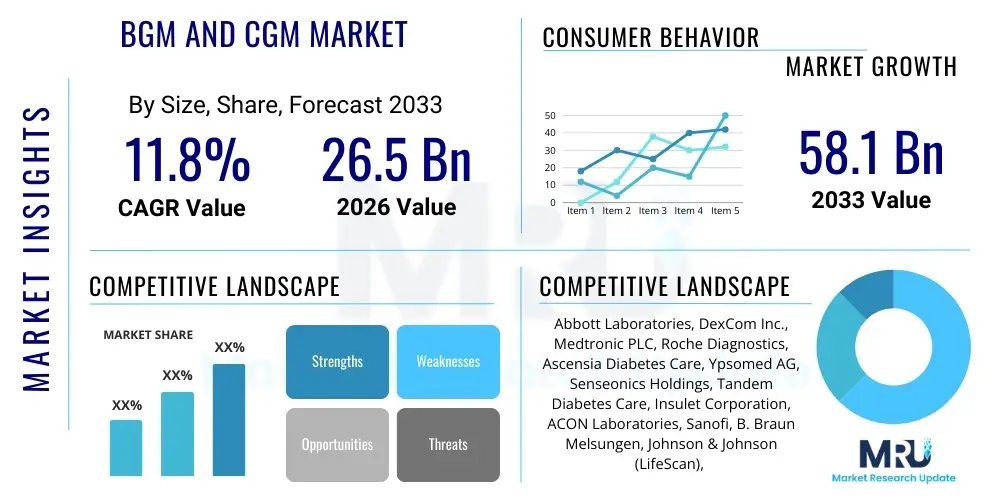

The BGM and CGM Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at $26.5 Billion in 2026 and is projected to reach $58.1 Billion by the end of the forecast period in 2033.

BGM and CGM Market introduction

The Blood Glucose Monitoring (BGM) and Continuous Glucose Monitoring (CGM) market encompasses devices and systems used by individuals with diabetes to track and manage their blood sugar levels effectively. BGM, the traditional method, involves using a glucometer and test strips to obtain spot readings of capillary blood glucose. In contrast, CGM represents a significant technological advancement, utilizing a sensor inserted under the skin to measure interstitial glucose levels continuously, providing real-time data and trend arrows. This constant feedback loop allows for proactive management, reducing the risk of hypo- and hyperglycemia, thereby improving overall glycemic control and quality of life for patients globally. The primary products include traditional glucose meters, test strips, lancets, integrated insulin pump systems, and standalone CGM devices.

Major applications for BGM and CGM devices span across Type 1 Diabetes Mellitus (T1DM), Type 2 Diabetes Mellitus (T2DM), and gestational diabetes management. While T1DM patients often rely heavily on CGM technology due to the severity and volatility of their glucose levels, the adoption rate among T2DM patients, particularly those requiring intensive insulin therapy, is rapidly increasing. The market expansion is intrinsically linked to the global rise in diabetes prevalence, driven by sedentary lifestyles, poor dietary habits, and aging populations. Moreover, the shift in healthcare philosophy towards preventative care and patient empowerment fuels demand for sophisticated self-monitoring tools that offer actionable data insights.

The benefits associated with advanced glucose monitoring systems are substantial, extending beyond mere measurement to encompass improved clinical outcomes. CGM, in particular, offers superior time-in-range (TIR) metrics compared to traditional A1C testing, leading to a reduced incidence of long-term diabetes complications such as neuropathy, retinopathy, and cardiovascular disease. Key driving factors include increasing reimbursement coverage across major economies, miniaturization and enhanced accuracy of sensors, the integration of monitoring data with smartphone applications, and the successful transition of CGM from a niche product for intensive users to a standard of care for a broader diabetic population. This technological convergence with digital health platforms is transforming diabetes management from reactive treatment to predictive intervention.

BGM and CGM Market Executive Summary

The BGM and CGM market is currently characterized by a robust transition from legacy BGM systems toward advanced, high-fidelity CGM solutions. Business trends indicate a fierce competitive landscape focused on innovation in sensor longevity, accuracy, and user comfort, alongside strategic partnerships between device manufacturers and pharmaceutical companies specializing in insulin delivery systems (e.g., automated insulin delivery or closed-loop systems). Market incumbents are prioritizing geographic expansion into emerging economies, where the prevalence of undiagnosed and poorly managed diabetes is exceptionally high, coupled with investment in consumer-friendly, prescription-free models to capture the pre-diabetic or general wellness segment. Furthermore, the push towards integrating glucose data into electronic health records (EHRs) and telehealth platforms defines a major operational and strategic imperative for leading companies, aiming to solidify their position in the evolving digital healthcare ecosystem.

Regionally, North America remains the dominant market, driven by high diabetes awareness, significant healthcare expenditure, favorable reimbursement policies for CGM, and early adoption of innovative technologies. However, the Asia Pacific region is projected to exhibit the highest growth rate, fueled by its vast patient pool, improving healthcare infrastructure, rising disposable incomes, and government initiatives aimed at diabetes screening and management in populous nations like China and India. Europe maintains a strong position, characterized by universal healthcare systems and increasing regulatory approval for advanced devices, though pricing pressures are generally more pronounced than in the US. Regional trends also highlight the divergent adoption rates between high-income and low-to-middle-income countries, necessitating varied market entry strategies centered on affordability and basic feature sets for the latter.

Segment trends underscore the supremacy of the Continuous Glucose Monitoring segment, which is rapidly cannibalizing market share from the traditional BGM segment. Within CGM, the professional segment (used clinically for diagnostic purposes) is growing steadily, but the personal use segment drives the bulk of the revenue. Technology-wise, non-invasive glucose monitoring remains the ‘holy grail’ and a primary area of intensive R&D, promising to revolutionize user experience if technical hurdles regarding accuracy and reliability can be overcome. End-user analysis shows that clinics and hospitals, which rely on monitoring for critical care and diagnostic purposes, contribute substantially, yet the home care/personal user segment represents the largest and fastest-expanding application, necessitating durable, easy-to-use, and aesthetically acceptable devices optimized for daily life rather than a clinical setting.

AI Impact Analysis on BGM and CGM Market

User inquiries regarding Artificial Intelligence (AI) in the BGM and CGM market predominantly center on four themes: predictive capabilities, integration with insulin delivery, data security, and personalized treatment recommendations. Users are keenly interested in knowing how AI algorithms can move beyond simple trend analysis to accurately predict hypoglycemic and hyperglycemic events hours in advance, allowing for preemptive intervention. A major expectation is the seamless integration of AI-driven control systems within closed-loop insulin pumps (Artificial Pancreas Systems), optimizing basal rates and bolus dosing with minimal user input. Concerns often revolve around the reliability of these automated decisions, the potential for algorithmic bias based on diverse patient populations, and the stringent security protocols required to protect sensitive, continuous health data generated by these connected devices. Consumers expect AI to deliver hyper-personalized glucose management strategies that account for lifestyle factors like specific meals, stress levels, and exercise intensity, moving far beyond generalized medical advice.

The incorporation of sophisticated machine learning models is fundamentally reshaping the utility of BGM and CGM data. AI does not merely process the large datasets generated by these continuous monitors; it extracts complex, non-obvious patterns indicative of future glucose excursions. This capability is instrumental for enhancing the accuracy and robustness of the monitoring systems themselves, for instance, by compensating for sensor drift or calibrating readings against physiological lag times. For clinicians, AI tools are transforming patient management by automating risk stratification, identifying patients who require immediate intervention, and generating summarized, actionable reports from months of complex data, significantly reducing the cognitive load associated with manual data review.

From a product development standpoint, AI is the backbone of next-generation devices. It allows manufacturers to create more intuitive user interfaces that present data not as raw numbers, but as contextualized health insights. Furthermore, AI facilitates the development of adaptive control systems for insulin pumps, which learn the individual patient's metabolism over time, leading to tighter glycemic control and less fear of nocturnal hypoglycemia. This profound impact on automation, personalization, and clinical decision support solidifies AI as the most critical technological catalyst for innovation within the glucose monitoring market over the next decade, driving both clinical efficacy and patient satisfaction.

- Enhanced predictive modeling for hypoglycemia and hyperglycemia events

- Optimization of automated insulin delivery (AID) and closed-loop systems

- Personalized therapeutic recommendations based on deep learning analysis of individual physiological responses

- Improved sensor accuracy through algorithmic error correction and drift compensation

- Automated analysis of high-volume glucose data for clinical decision support and risk stratification

- Facilitation of remote patient monitoring and tele-diabetology services

DRO & Impact Forces Of BGM and CGM Market

The dynamics of the BGM and CGM market are primarily shaped by a powerful confluence of drivers (D), restraints (R), and opportunities (O). A key driver is the escalating global prevalence of diabetes, directly increasing the addressable market size, coupled with favorable shifts in clinical guidelines recommending CGM use for a wider patient base, including T2DM patients not on intensive insulin regimens. Opportunities abound in the development of highly anticipated non-invasive glucose monitoring technologies and the massive, untapped market potential in emerging economies where penetration rates remain low. Conversely, significant restraints include the relatively high cost associated with CGM systems (sensors require frequent replacement), complex reimbursement scenarios in certain regions, and persistent data security and privacy concerns related to connected health devices, which can deter consumer adoption and institutional integration. These forces collectively dictate the pace of market expansion and technological prioritization.

Major driving forces fueling market growth include technological advancements leading to smaller, less intrusive, and highly accurate devices, significantly enhancing patient compliance and comfort. For example, the development of sensors with 14-day or longer wear times reduces the physical and psychological burden on users. Furthermore, widespread government and private payer recognition of CGM's cost-effectiveness in preventing expensive long-term complications is translating into expanded insurance coverage. The shift toward integrated care models, where data from glucose monitors flows seamlessly to providers, facilitating timely intervention through telehealth services, also acts as a potent market accelerant, improving adherence and outcomes across diverse patient demographics.

Restraints, however, pose structural challenges. High upfront and recurring costs for sensors and transmitters remain a barrier to entry, particularly for lower-income populations globally. Despite advancements, achieving perfect accuracy, particularly during rapid glucose changes or when subjected to external interferents (such as certain medications), remains a technical restraint that limits the full clinical utility of some devices. Moreover, the steep learning curve associated with interpreting and acting upon CGM data effectively can overwhelm patients and requires substantial investment in patient education. Opportunities primarily lie in leveraging connectivity—integrating CGM data with smartwatches, fitness trackers, and other wearable technologies to provide comprehensive metabolic health monitoring, extending the market beyond traditional diabetic care into general preventative health and personalized nutrition segments, thereby creating novel revenue streams for innovators.

Segmentation Analysis

The BGM and CGM market is systematically segmented across various critical dimensions including the type of device (BGM vs. CGM), component (sensor, transmitter, receiver, test strips), technology (invasive, minimally invasive, non-invasive), end-user (hospitals, home settings, diagnostics), and geography. This multifaceted segmentation is essential for understanding revenue distribution and identifying high-growth pockets. The dominance of the CGM segment reflects its superior clinical utility and the ongoing shift in medical consensus regarding intensive monitoring. Within the components segment, sensors constitute the most significant revenue stream due to their disposable nature and high replacement frequency, indicating a strong recurring revenue model for manufacturers. Analyzing these segments reveals that the future trajectory of the market is heavily skewed toward non-invasive technologies and the expansion of personal home-use applications.

The market’s competitive dynamics are highly influenced by the device segmentation, with manufacturers continually investing in making CGM devices smaller, more affordable, and easier to use to capture the vast home-user segment. End-user analysis highlights the critical role of home care, which accounts for the majority of sales, contrasting with the clinical segment that focuses on high-precision monitoring tools for critical or complex patients. Geographic segmentation reveals diverging market maturity levels, with established markets like North America focused on technological upgrades and service integration, while emerging markets in the Asia Pacific prioritize accessibility and basic device affordability. Understanding this granular structure is crucial for targeted marketing and resource allocation.

- Device Type:

- Blood Glucose Monitoring (BGM) Devices

- Continuous Glucose Monitoring (CGM) Devices

- Component:

- Sensors

- Transmitters & Receivers

- Consumables (Test Strips, Lancets)

- Technology:

- Minimally Invasive

- Non-Invasive (Emerging)

- End-User:

- Hospitals & Clinics

- Diagnostic Centers

- Home Care/Personal Use

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For BGM and CGM Market

The value chain for the BGM and CGM market is complex, beginning with upstream activities focused on sophisticated raw materials and core scientific R&D, moving through manufacturing, and culminating in highly regulated distribution channels. Upstream analysis involves suppliers of critical microelectronics, biocompatible sensor materials (e.g., glucose oxidase enzymes, polymers), and advanced battery components. The necessity for high-purity, standardized materials that ensure accurate electrochemical reactions at the sensor site drives strong linkages between device manufacturers and specialized biochemical suppliers. R&D activities at this stage are capital-intensive, focusing on reducing sensor size, improving chemical stability, and developing highly secure data transmission protocols, establishing a crucial foundation for product quality and regulatory compliance.

The middle segment of the value chain is dominated by manufacturing, assembly, and quality assurance processes, characterized by stringent regulatory oversight (e.g., FDA, CE Mark). Manufacturing involves high-precision assembly of micro-sensors and transmitters, often outsourced to specialized contract manufacturing organizations (CMOs) to leverage economies of scale. Direct distribution involves sales teams targeting large hospital networks and integrated delivery systems (IDSs), emphasizing clinical efficacy and total cost of ownership. Indirect distribution, which accounts for the majority of revenue for consumables like test strips and replaceable sensors, utilizes established pharmacy chains, online retailers, and medical supply distributors to ensure widespread patient access and efficient inventory management across various geographical locales, necessitating robust logistics and cold chain management for biological components.

Downstream analysis centers on market access, patient education, and post-market surveillance. The primary distribution channels are segmented into direct sales (for large capital equipment and institutional contracts) and retail/pharmacy channels (for continuous consumables). Effective downstream success hinges on favorable reimbursement coverage and strong marketing campaigns that educate both endocrinologists and general practitioners on the clinical benefits of newer technologies, thereby driving prescription rates. Patient support programs and integrated digital platforms, which facilitate data sharing and adherence monitoring, are vital for maximizing the long-term lifetime value of the customer base, ensuring the successful adoption and continued use of these sophisticated medical devices outside of clinical settings.

BGM and CGM Market Potential Customers

Potential customers for the BGM and CGM market are primarily segmented into individuals diagnosed with diabetes (Type 1 and Type 2), pre-diabetic individuals seeking intensive lifestyle intervention, healthcare providers (HCPs) who use the data for treatment adjustment, and institutional buyers like hospitals and clinics. The core customer base remains the T1DM population, who require daily, rigorous glucose management and are the earliest adopters of advanced CGM technology. However, the largest volume growth is now originating from the T2DM population, especially those using insulin, driven by compelling evidence of improved outcomes and expanded insurance coverage for this group. The emergence of personalized medicine and wellness tracking is expanding the customer definition to include non-diabetics interested in metabolic optimization and athletic performance monitoring.

End-users can be broadly categorized into clinical customers and personal/home-use customers. Clinical customers—comprising endocrinology departments, intensive care units (ICUs), and diagnostic labs—purchase BGM and professional CGM systems for patient testing, inpatient monitoring, and diagnostic screening protocols, valuing accuracy, speed, and connectivity with institutional EHR systems. The personal user segment, which purchases devices and recurring consumables for daily self-management, prioritizes ease of use, comfort (minimal invasiveness), discretion, smartphone integration, and affordability. Success in this vast consumer segment requires strong brand loyalty built through excellent user experience and seamless integration into daily life activities.

Furthermore, payer organizations (insurance companies, government health services) act as critical indirect customers, influencing market adoption through reimbursement policies. Manufacturers must demonstrate robust health economics data proving the long-term cost savings associated with these devices (e.g., reduced hospitalization and complication management costs) to secure favorable coverage decisions. Corporate wellness programs and specialized athletic training facilities represent an emerging customer niche, leveraging advanced glucose monitoring for optimizing employee health or enhancing sports performance, showcasing the expanding application scope of the core technology beyond traditional disease management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $26.5 Billion |

| Market Forecast in 2033 | $58.1 Billion |

| Growth Rate | CAGR 11.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, DexCom Inc., Medtronic PLC, Roche Diagnostics, Ascensia Diabetes Care, Ypsomed AG, Senseonics Holdings, Tandem Diabetes Care, Insulet Corporation, ACON Laboratories, Sanofi, B. Braun Melsungen, Johnson & Johnson (LifeScan), Nipro Corporation, Terumo Corporation, GlySens Incorporated, Sibionics, GlucoRx, Novo Nordisk, Biocon Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

BGM and CGM Market Key Technology Landscape

The technology landscape of the BGM and CGM market is rapidly evolving, driven by the imperative to improve accuracy, reduce invasiveness, and enhance connectivity. Traditional BGM relies on electrochemical biosensors activated by glucose oxidase enzymes on test strips, a mature technology now focused on cost reduction and improved sample size requirements. The current state-of-the-art in CGM involves minimally invasive, continuous electrochemical sensors that measure glucose levels in the interstitial fluid. Key technological advancements here include prolonged sensor wear time (up to 14 days or longer), reduced warm-up periods, and factory calibration eliminating the need for fingerstick verification. Furthermore, the integration of near-field communication (NFC) and Bluetooth low-energy (BLE) technology facilitates seamless data transmission to smartphones and cloud-based platforms, acting as a crucial enabler for personalized digital health services.

A central focus of R&D investment is Non-Invasive Glucose Monitoring (NIGM). While several technologies are under investigation—including near-infrared spectroscopy, thermal methods, and radiofrequency sensing—all face significant technical challenges in achieving clinical-grade accuracy comparable to minimally invasive methods, primarily due to high levels of signal interference from skin tissues and other biomarkers. However, achieving successful commercialization of a reliable NIGM device would be highly disruptive, potentially opening up the market to the entire general population for metabolic health tracking. Another significant technological push involves the integration of glucose monitoring data into closed-loop systems, forming the basis of the Artificial Pancreas. This requires sophisticated algorithms, machine learning, and secure communication protocols to ensure reliable, automated insulin delivery based on predicted glucose trends.

Beyond the core sensing technology, data management and analytical tools are crucial technology components. Cloud computing infrastructure, coupled with advanced data visualization and AI-driven predictive analytics, transforms raw glucose readings into actionable clinical insights for both patients and healthcare providers. The development of smaller, more discreet transmitters, often integrated with disposable sensors, underscores the trend toward miniaturization and enhanced user acceptance. Patent filings indicate a strong pipeline focused on biowearables, microfluidics for improved sensor performance, and enhanced cybersecurity measures to protect the integrity of real-time patient health data transmitted across digital networks, securing the foundation for future innovations in this critical medical device category.

Regional Highlights

- North America: Dominant market share attributed to high per capita healthcare spending, favorable and expanding reimbursement policies (especially for Medicare/Medicaid coverage of CGM), high prevalence of obesity and diabetes, and the presence of key market leaders (e.g., DexCom, Abbott). The US market is characterized by rapid adoption of premium CGM systems and high technology penetration rates among both T1DM and T2DM insulin users.

- Europe: Characterized by strong government support for chronic disease management and high patient awareness. Adoption is robust, particularly in Western European nations (Germany, UK, France), often driven by national health services providing subsidized access to monitoring devices. Pricing pressure is generally higher than in North America, necessitating competitive cost-efficiency from manufacturers, though clinical guideline adoption is swift.

- Asia Pacific (APAC): Fastest-growing regional market due to an alarmingly high increase in diabetes incidence, driven by urbanization and dietary shifts, especially in India and China. Growth is contingent on improving healthcare infrastructure, increasing disposable incomes, and local production capabilities. The focus in this region is balanced between low-cost BGM solutions and the gradual, targeted introduction of advanced CGM systems in metropolitan areas.

- Latin America (LATAM): Market growth is moderate but accelerating, primarily concentrated in countries like Brazil and Mexico, which face severe diabetes epidemics. Challenges include fragmented healthcare systems, reliance on out-of-pocket payments, and economic instability. Opportunities exist through partnerships with large regional healthcare providers and the introduction of entry-level, reliable monitoring devices.

- Middle East and Africa (MEA): Emerging market segment with significant potential, particularly in the Gulf Cooperation Council (GCC) countries where diabetes prevalence is among the highest globally. High purchasing power in certain Gulf states allows for rapid adoption of premium technologies, while the African continent primarily relies on basic BGM and is a target for global health initiatives focusing on essential diagnostics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the BGM and CGM Market.- Abbott Laboratories

- DexCom Inc.

- Medtronic PLC

- Roche Diagnostics

- Ascensia Diabetes Care

- Ypsomed AG

- Senseonics Holdings

- Tandem Diabetes Care

- Insulet Corporation

- ACON Laboratories

- Sanofi

- B. Braun Melsungen

- Johnson & Johnson (LifeScan)

- Nipro Corporation

- Terumo Corporation

- GlySens Incorporated

- Sibionics

- GlucoRx

- Novo Nordisk

- Biocon Limited

Frequently Asked Questions

Analyze common user questions about the BGM and CGM market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the CGM market?

The primary driver is the demonstrable clinical superiority of CGM in achieving 'Time-in-Range' (TIR) targets, coupled with expanded reimbursement coverage globally, making the technology accessible to a wider population, including non-intensive insulin users with Type 2 Diabetes.

How does AI technology specifically enhance Continuous Glucose Monitoring devices?

AI significantly enhances CGM by providing superior predictive analytics to forecast glucose trends, optimizing sensor calibration for improved accuracy, and enabling the core functionality of automated insulin delivery (closed-loop systems) for personalized glycemic control.

What are the main technical restraints preventing the widespread adoption of non-invasive glucose monitoring?

The main technical restraint is achieving clinical-grade accuracy and reliability without penetrating the skin. Non-invasive methods struggle with signal interference from physiological factors and achieving precise correlation with blood glucose levels across diverse patient conditions.

Which geographic region is expected to show the highest market growth rate through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by the region's massive, growing diabetes patient population and rapidly improving healthcare infrastructure and affordability.

What is the crucial difference in utility between BGM and CGM for diabetic management?

BGM provides singular, instantaneous 'spot checks' of blood glucose, useful for calibration or critical checks. CGM, conversely, provides continuous, real-time data streams and trend arrows, enabling proactive management and reducing the frequency and severity of dangerous hypo- or hyperglycemia events.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager