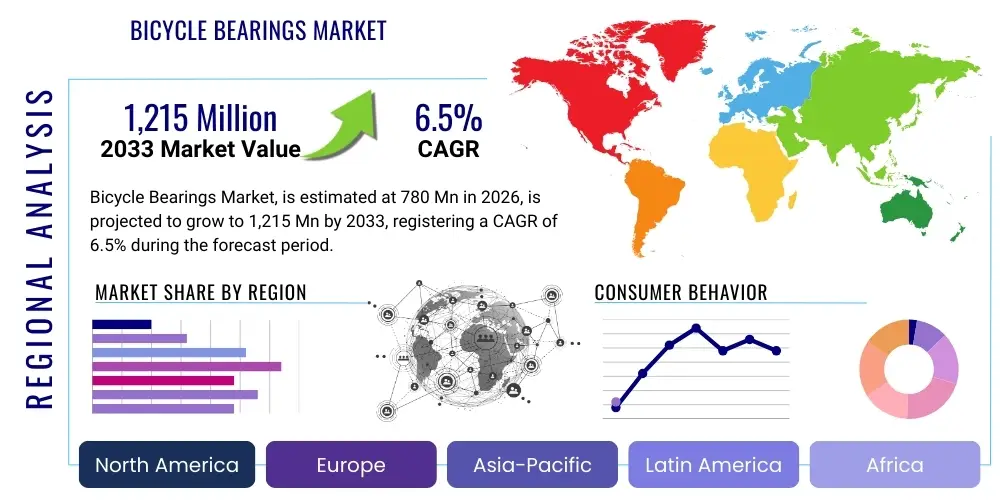

Bicycle Bearings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441042 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Bicycle Bearings Market Size

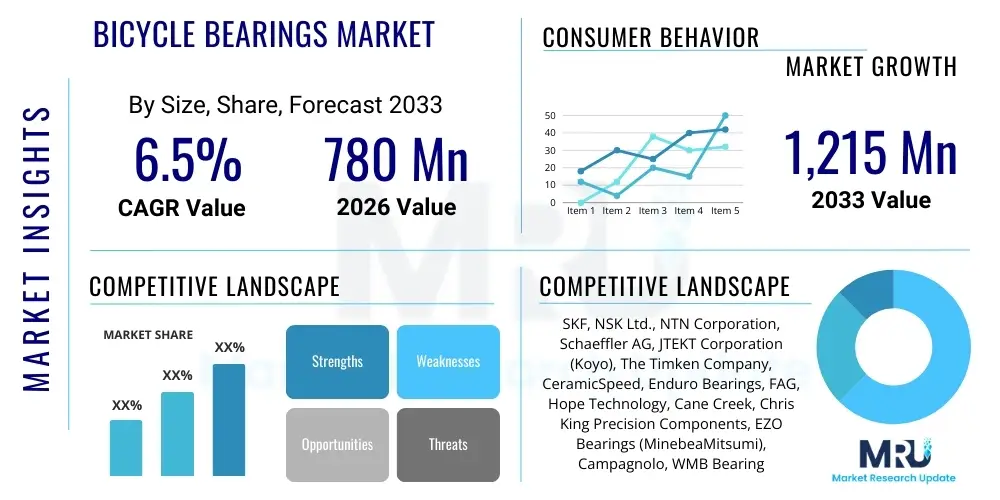

The Bicycle Bearings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $780 Million in 2026 and is projected to reach $1,215 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global interest in cycling, both as a competitive sport and as a sustainable mode of transportation, particularly in urban centers. Furthermore, continuous technological advancements, especially in high-performance ceramic and hybrid bearing systems designed for enhanced durability and reduced friction, are critical factors supporting this upward trajectory. The increasing demand for premium and specialized bicycles, such as electric bikes (e-bikes) and high-end mountain bikes, which require robust and precise bearing components, significantly contributes to the rising market valuation. Global initiatives promoting cycling infrastructure and health-conscious consumer preferences further cement the market’s positive long-term outlook throughout the projection window.

Bicycle Bearings Market introduction

The Bicycle Bearings Market encompasses the production and distribution of various rolling elements and components essential for the smooth, efficient rotation of critical bicycle parts, including wheels, bottom brackets, headsets, and pedals. These components are vital for minimizing rotational friction, ensuring component longevity, and optimizing overall cycling performance. Products range from traditional steel ball bearings found in entry-level bicycles to highly sophisticated, sealed cartridge ceramic bearings utilized in professional racing and high-performance applications. The market is characterized by stringent quality requirements due to the high stress, varied environmental conditions, and necessity for low rolling resistance. Major applications include integration into original equipment manufacturing (OEM) for new bicycle production and serving the extensive aftermarket segment for repair, maintenance, and performance upgrades. The primary benefits derived from high-quality bicycle bearings include increased efficiency, reduced maintenance intervals, superior power transfer, and enhanced rider comfort and control. Key driving factors propelling market growth include the surge in electric bicycle adoption, government investment in sustainable urban mobility, the professionalization and expansion of competitive cycling events, and consumer willingness to invest in performance-enhancing components.

Bicycle Bearings Market Executive Summary

The Bicycle Bearings Market is undergoing a rapid evolution characterized by significant business, regional, and segment trends reflecting the dynamic nature of the global cycling industry. Business trends highlight a strong focus on supply chain resilience, innovation in advanced materials—specifically ceramic and high-grade stainless steel—and strategic partnerships between bearing manufacturers and major global bicycle OEMs to ensure seamless integration of performance components during the design phase. There is an increasing proliferation of direct-to-consumer (DTC) channels, especially for specialized, high-margin aftermarket performance bearings, altering traditional distribution paradigms. Regionally, the Asia Pacific (APAC) stands out as the dominant growth engine, fueled by massive manufacturing bases in China and Taiwan and surging consumer cycling culture in countries like India and Southeast Asia. Europe remains crucial, driven by robust e-bike sales and established cycling traditions, particularly in the Netherlands, Germany, and the UK, which prioritize high-quality, long-lasting components. Segment trends reveal a distinct shift towards sealed cartridge bearings over loose ball systems due to superior reliability and reduced maintenance needs. Furthermore, the hybrid ceramic bearing segment is experiencing exponential growth, underpinned by professional riders and serious enthusiasts seeking marginal gains in speed and efficiency, despite the higher associated costs. Sustainability concerns are also beginning to influence material selection and manufacturing processes across all major segments.

AI Impact Analysis on Bicycle Bearings Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Bicycle Bearings Market primarily center on three areas: predictive maintenance, optimization of manufacturing processes, and supply chain efficiency. Users are keenly interested in how AI-driven analytics can predict bearing failure based on real-time sensor data (especially in e-bikes) to prevent catastrophic mechanical issues and optimize replacement schedules. Furthermore, there is significant curiosity about leveraging AI and machine learning (ML) to refine computer-aided manufacturing (CAM) processes, aiming for near-perfect precision in bearing geometry, which is critical for reducing friction and extending component lifespan. Expectations are high that AI will revolutionize the supply chain, enabling sophisticated demand forecasting, inventory management, and personalized routing of high-value components, thereby reducing lead times and minimizing the risk of obsolescence or stockouts. These concerns underscore a market expectation that AI will transition bearing production from highly manual, skilled labor tasks to automated, data-driven precision engineering, impacting cost structures and quality consistency.

- AI-driven Predictive Maintenance: Utilizing IoT sensors in high-end bicycles (e.g., e-bikes, smart bikes) to monitor vibration, temperature, and rotational speed, allowing algorithms to forecast imminent bearing wear or failure, thus enabling scheduled replacement before component breakdown.

- Manufacturing Optimization via ML: Deployment of machine learning algorithms in Computer Numerical Control (CNC) and grinding operations to continuously adjust parameters, optimizing surface finish, race curvature, and spherical accuracy of rolling elements, leading to superior quality control and reduced material waste.

- Smart Supply Chain Management: Implementation of AI for dynamic demand forecasting, optimizing raw material procurement (e.g., specialized steel alloys, silicon nitride), and logistics planning, ensuring just-in-time delivery for OEMs and aftermarket distributors globally.

- Design and Material Simulation: Use of generative AI and ML simulations to test thousands of material compositions and geometric designs virtually, accelerating the development cycle for new bearing technologies (e.g., hybrid systems with unique cage materials) tailored for specific cycling disciplines.

- Automated Inspection and Quality Control: Utilizing computer vision systems powered by AI for high-speed, non-destructive inspection of finished bearings, instantly identifying microscopic defects far beyond human detection capabilities, ensuring zero-defect output for premium component lines.

DRO & Impact Forces Of Bicycle Bearings Market

The Bicycle Bearings Market dynamics are shaped by a complex interplay of growth drivers, structural restraints, latent opportunities, and compelling impact forces that influence strategic decision-making across the value chain. Key drivers include the robust, sustained demand generated by the rapid globalization of cycling culture, intensified by health consciousness and environmental mandates favoring non-motorized transport. The proliferation of high-performance e-bikes, which place significantly higher loads and require more durable, high-precision bearings, acts as a potent growth catalyst. Restraints primarily involve the intense pricing pressure exerted by mass-market competitors, particularly in basic steel bearing segments, alongside the inherent volatility in raw material costs (steel and specialized alloys). Furthermore, the lack of standardization across different bicycle component manufacturers poses a continual challenge for aftermarket suppliers. Opportunities abound in the development of specialized, low-friction, weather-resistant sealing technologies tailored for demanding off-road (mountain biking) environments, and in leveraging sustainable manufacturing practices to appeal to eco-conscious consumers. The primary impact forces include stringent quality expectations from professional cycling organizations, pushing continuous improvement in marginal gains technology, and the expanding global regulatory frameworks promoting urban cycling infrastructure, ensuring long-term market stability and growth.

Segmentation Analysis

The Bicycle Bearings Market is structurally segmented based on crucial criteria including product type, material composition, application area within the bicycle, and the primary sales channel utilized. This detailed segmentation allows stakeholders to accurately gauge demand heterogeneity and target specific high-value niches, such as the premium ceramic bearing segment or the rapidly expanding e-bike drivetrain application area. Product type differentiation separates common ball bearings from more specialized radial or angular contact systems, dictated by the required load characteristics and rotational speed. Material composition fundamentally defines performance and price, distinguishing standard steel bearings from advanced hybrid or full ceramic options. Application segmentation highlights the highest stress points—the bottom bracket and wheel hubs—which demand the most precise and robust bearing technology. Analyzing sales channels is essential for understanding whether growth is driven by initial factory installation (OEM) or by consumer-led performance upgrades and repair (aftermarket), with current trends showing robust growth in the specialized aftermarket segment.

- By Product Type:

- Ball Bearings (Standard, Angular Contact, Deep Groove)

- Roller Bearings (Less common, specialized applications)

- Needle Bearings (Often used in linkages and suspension pivots)

- Sealed Cartridge Bearings (Most common for high-performance applications)

- Loose Ball Bearings (Traditional, primarily entry-level or vintage bikes)

- By Material:

- Steel Bearings (Chrome Steel, Stainless Steel)

- Ceramic Bearings (Silicon Nitride (Si3N4) full ceramic)

- Hybrid Bearings (Ceramic balls, steel races)

- Polymer/Plastic Bearings (Niche, low-load applications)

- By Application:

- Wheel Hub Bearings (Front and Rear)

- Bottom Bracket Bearings (Crank assembly)

- Headset Bearings (Steering column)

- Pedal Bearings

- Suspension Pivot Bearings (Full-suspension bikes)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement, Upgrade, Repair)

- By Bicycle Type:

- Road Bicycles

- Mountain Bicycles (MTB)

- Electric Bicycles (E-bikes)

- City/Hybrid Bicycles

Value Chain Analysis For Bicycle Bearings Market

The value chain for the Bicycle Bearings Market is complex, beginning with upstream raw material processing and culminating in direct sales to end-users, reflecting a highly specialized manufacturing environment. Upstream analysis focuses heavily on the procurement and processing of high-grade materials, particularly specialized chrome steels (52100) and advanced ceramics like Silicon Nitride (Si3N4). The quality of raw materials dictates the final bearing performance, necessitating stringent quality control at the smelting and forging stages. Precision machining, heat treatment, and super-finishing (grinding and honing) of bearing races and rolling elements constitute the most critical value-add steps, requiring substantial investment in advanced, often automated, CNC machinery to achieve micron-level tolerances essential for low-friction performance. Downstream activities involve distribution channels that bifurcate between high-volume, predictable OEM contracts and the fragmented, often technical aftermarket supply chain. Direct channels involve manufacturers supplying large-scale bicycle assemblers (OEMs) under long-term agreements, ensuring component standardization and volume efficiency. Indirect channels, which are crucial for aftermarket sales, rely on a network of specialized distributors, national wholesalers, independent bicycle dealers (IBDs), and increasingly, specialized e-commerce platforms, offering maintenance and performance upgrades directly to mechanics and consumers.

Bicycle Bearings Market Potential Customers

Potential customers within the Bicycle Bearings Market span a wide spectrum, ranging from multinational corporations producing millions of units annually to individual high-performance cyclists seeking marginal gains in speed. The primary category of buyers is Original Equipment Manufacturers (OEMs), which include major global bicycle manufacturers such as Trek, Specialized, Giant, and Merida. These buyers prioritize supply reliability, consistent quality, competitive pricing for volume orders, and the ability to integrate custom bearing specifications into their component designs. The second major group comprises the vast aftermarket segment, driven by independent bicycle dealers (IBDs), specialized repair shops, and wholesale distributors who stock components for routine maintenance and performance enhancements. These customers typically demand a broad inventory, excellent technical support, and bearings that offer superior durability or performance characteristics compared to stock components. A rapidly growing customer segment includes e-bike manufacturers and service centers, who require highly resilient, sealed bearings capable of handling the increased weight, torque, and continuous operational stress imposed by electric drivetrains. Finally, specialized component manufacturers focusing on high-end hubs, cranksets, and suspension systems also represent key buyers, demanding bespoke, ultra-high-precision bearing solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $780 Million |

| Market Forecast in 2033 | $1,215 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, NSK Ltd., NTN Corporation, Schaeffler AG, JTEKT Corporation (Koyo), The Timken Company, CeramicSpeed, Enduro Bearings, FAG, Hope Technology, Cane Creek, Chris King Precision Components, EZO Bearings (MinebeaMitsumi), Campagnolo, WMB Bearings, TPI Bearings, Full Speed Ahead (FSA), Ridea, Wheels Manufacturing, TOKEN. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Bearings Market Key Technology Landscape

The technological landscape of the Bicycle Bearings Market is primarily defined by the pursuit of friction reduction, component longevity, and resilience against environmental degradation. A pivotal innovation is the widespread adoption of Sealed Cartridge Bearing Systems. Unlike traditional loose ball bearings, sealed cartridges offer a highly efficient, maintenance-free solution by pre-loading and sealing the rolling elements within a self-contained unit, protecting them from dirt and moisture. This technology dramatically simplifies installation and greatly extends the component lifespan, particularly beneficial for mountain biking and gravel cycling where exposure to harsh elements is common. Furthermore, advancements in Advanced Materials Science are critical. Hybrid ceramic bearings, featuring extremely hard and lightweight ceramic balls (typically Silicon Nitride) paired with hardened steel races, represent the pinnacle of performance technology. These hybrids offer significantly lower rolling resistance, higher stiffness, and lighter weight than full steel counterparts, making them essential for competitive racing where every marginal gain is paramount. Continuous innovation in lubrication technology, utilizing specialized low-viscosity greases and sophisticated sealing mechanisms (e.g., non-contact labyrinth seals), further defines the premium segment, ensuring sustained performance over thousands of kilometers without degradation.

Another area of intense technological focus is the development of Bespoke Bearing Geometries and Coatings specifically tailored for high-stress applications like bottom brackets. Manufacturers are engineering angular contact bearings with specific pre-loads designed to handle the combined axial and radial forces exerted during high-wattage pedaling. Specialized surface treatments, such as thin-film coatings (e.g., physical vapor deposition or PVD), are sometimes applied to races to enhance hardness, corrosion resistance, and reduce surface friction further, although these add significant cost. The integration of Industry 4.0 Manufacturing Principles, utilizing highly automated, precision grinding and honing machines alongside real-time laser measurement systems, ensures manufacturing tolerances are held to sub-micron levels, a necessity for ultra-smooth rotation. This automation reduces variability and labor costs, allowing top-tier manufacturers to produce geometrically perfect bearings consistently. The material technology is also expanding beyond traditional materials, with research into advanced polymers for cages and seals that offer enhanced durability and chemical resistance against aggressive cleaning agents and environmental contaminants encountered in varied riding conditions.

The future technology landscape is leaning towards Smart Bearings, especially for the e-bike segment, which includes embedded micro-sensors capable of monitoring temperature, vibration, and strain. While still nascent, this integration promises to unlock predictive maintenance capabilities, allowing riders or fleet managers to receive alerts when bearing performance degrades, preventing failures and optimizing component replacement cycles. Furthermore, significant research and development efforts are directed towards improving the sustainability profile of bearing production, exploring alternative materials and manufacturing processes that minimize energy consumption and reduce waste, aligning with broader environmental responsibility trends observed across the cycling industry. The demand for lightweight, yet immensely strong components, driven by competitive road and mountain biking, ensures that materials science, particularly the refinement of ceramic composites and exotic alloys, remains the central technological battleground.

Regional Highlights

- Asia Pacific (APAC): APAC is the global hub for bicycle manufacturing, with countries like China, Taiwan, and Vietnam housing vast OEM production facilities. This region dominates the volume market for bicycle bearings. Taiwan, in particular, is renowned for producing high-quality mid-to-high-end components and is home to several leading component brands and bearing manufacturers. The rapid expansion of cycling as a leisure activity and the increasing adoption of e-bikes, particularly in densely populated urban centers, are driving substantial growth in both OEM demand and aftermarket consumption across emerging economies like India and Southeast Asia.

- Europe: Europe represents the largest market segment for premium, high-specification bicycle bearings, heavily influenced by its strong cycling tradition (e.g., competitive road racing in France, Italy, and Spain) and its aggressive transition toward electric mobility. Countries such as Germany, the Netherlands, and the UK are major consumers of e-bikes, which require robust, sealed bearing systems due to the increased torque and mileage. Regulatory support for cycling infrastructure and high consumer willingness to pay for performance upgrades make Europe a crucial market for ceramic and hybrid bearing suppliers.

- North America: The North American market is characterized by a high demand for performance-oriented bearings, driven primarily by the high-end mountain biking and road cycling segments. Consumers prioritize durability, low friction, and lifetime warranties. The region is a vital hub for specialized aftermarket brands focused on performance upgrades. The recent boom in gravel cycling has further spurred demand for highly durable, weather-sealed bearing systems capable of handling mixed terrain and harsh conditions prevalent in U.S. and Canadian outdoor environments.

- Latin America (LATAM): LATAM is an emerging market with growing adoption of cycling for commuting and leisure, particularly in Mexico and Brazil. The market is primarily price-sensitive, focusing on robust, cost-effective steel bearing solutions. However, the influence of international competitive cycling is gradually increasing demand for mid-range, sealed cartridge components, especially as disposable incomes rise and local assembly capacities expand.

- Middle East and Africa (MEA): MEA remains a smaller but growing market, constrained by climatic extremes and developing cycling infrastructure. Demand is concentrated in specific urban centers (e.g., Dubai, major South African cities) that support dedicated cycling sports and utility cycling. The market primarily relies on imports, with a specific requirement for high-tolerance, sealed bearings capable of resisting sand, dust, and high temperatures, suggesting a niche demand for specialized sealing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Bearings Market.- SKF

- NSK Ltd.

- NTN Corporation

- Schaeffler AG (FAG)

- JTEKT Corporation (Koyo)

- The Timken Company

- CeramicSpeed

- Enduro Bearings

- WMB Bearings

- FSA (Full Speed Ahead)

- Chris King Precision Components

- Hope Technology

- Cane Creek

- EZO Bearings (MinebeaMitsumi)

- Campagnolo

- Wheels Manufacturing

- TPI Bearings

- TOKEN

- Ridea

- Neco Technology Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Bicycle Bearings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary performance difference between steel and ceramic bicycle bearings?

Ceramic bearings, particularly hybrid systems using ceramic balls, offer significantly lower friction, reduced weight, increased stiffness, and greater durability compared to standard steel bearings. This results in measurable performance gains by improving power transfer efficiency and reducing rotational resistance, especially beneficial in high-speed and competitive cycling applications. While steel bearings are robust and cost-effective, ceramic options are utilized for maximum efficiency and longevity in premium components.

Are sealed cartridge bearings superior to traditional loose ball bearings for modern bicycles?

Yes, sealed cartridge bearings are generally considered superior for modern, high-performance, and demanding cycling applications. They offer superior protection against environmental contaminants (water, dirt), require zero maintenance during their lifespan, ensure precise alignment, and simplify the installation and replacement process. Loose ball bearings are typically found only in entry-level or vintage bikes and require more frequent maintenance and careful adjustment to perform optimally.

Which application segment holds the largest market share in the Bicycle Bearings Market?

The Bottom Bracket and Wheel Hub application segments collectively hold the largest market share. The bottom bracket, which connects the crankset to the bicycle frame, experiences extremely high rotational and axial loads, necessitating durable, high-precision bearings. Wheel hubs, crucial for efficient rolling, also require robust bearings to handle continuous load and varied speeds. These components are critical determinants of overall cycling efficiency and are frequent targets for performance upgrades.

How is the growth of the electric bicycle (e-bike) market impacting bearing technology?

The e-bike market is significantly impacting bearing technology by creating a demand for ultra-durable, higher-load capacity bearings. E-bikes generate greater torque, carry more weight, and operate for longer periods under load than traditional bicycles. This necessitates stronger materials (e.g., high-grade stainless steel or hybrid ceramics), advanced sealing systems to protect against weather and high-pressure washing, and robust designs capable of withstanding the continuous operational stress of the electric drivetrain.

What are the main drivers of aftermarket growth in the bicycle bearings sector?

Aftermarket growth is primarily driven by three factors: the necessity of routine maintenance and replacement of worn components, the strong consumer trend toward performance upgrades (especially hybrid ceramic bearings) to achieve marginal gains, and the expansion of specialized cycling disciplines like gravel and mountain biking, which accelerate component wear and require highly specific, durable replacement parts.

The Bicycle Bearings Market, due to its intrinsic link to the burgeoning global cycling ecosystem, continues to attract strategic investments aimed at technological refinement and operational optimization. The focus on reducing rotational mass and minimizing frictional losses underscores the importance of precision engineering within this sector. Manufacturers are constantly seeking methods to enhance the sealing mechanisms and material purity to deliver products that meet the rigorous demands of both competitive sports and daily commuting. The integration of advanced diagnostics and AI in manufacturing processes promises a future where bearing quality is consistently flawless, pushing the boundaries of what is achievable in mechanical efficiency. This dedication to marginal gains in performance confirms the market's long-term vitality and its critical role in the broader micromobility revolution.

Furthermore, the competitive landscape is highly concentrated at the premium end, where specialized European and North American companies dominate the high-margin performance market, leveraging their brand equity and patented technologies. Conversely, the high-volume, standard steel bearing market is characterized by intense price competition, primarily driven by large industrial bearing manufacturers based in Asia. Success in this fragmented market increasingly depends on achieving a strategic balance between robust global supply chain management, offering highly customized solutions for demanding OEM clients, and developing consumer education initiatives that highlight the long-term cost benefits of investing in superior, low-friction bearing technology over cheaper, less durable alternatives. This dichotomy between volume and value defines the current strategic outlook for market participants across all regional territories.

The strategic imperatives for companies operating in the bicycle bearings space revolve around diversification and specialization. Diversification into e-bike specific components, which promise sustained high growth, is essential for capitalizing on emerging trends. Simultaneously, specialization in niche markets, such as extreme weather-resistant or ultra-low-friction suspension pivot bearings, allows manufacturers to command premium pricing and insulate themselves from commoditization pressures. Investment in R&D must remain centered on material science—exploring lighter, stronger, and more environmentally friendly composites—and innovative manufacturing techniques, including additive manufacturing, to create bespoke geometries that push the limits of efficiency. Compliance with global quality standards (e.g., ABEC ratings) is mandatory, but market leaders are now exceeding these minimums through proprietary processes to gain a competitive edge. This continual drive for technical supremacy ensures that the bicycle bearings market will remain a dynamic and highly rewarding segment within the cycling component industry for the foreseeable future, strongly supported by global governmental initiatives promoting cycling as a core component of sustainable urban planning and public health policy.

In terms of sustainability, the market is beginning to feel pressure to adopt circular economy principles. This includes designing bearings that are easier to service and repair, rather than sealed units that must be entirely replaced. Furthermore, sourcing raw materials from certified ethical and sustainable origins is becoming a key differentiator, particularly among European and North American consumers who place a high value on environmental responsibility. Manufacturers are exploring advanced recycling techniques for bearing components and reducing the use of harmful chemicals in cleaning and lubrication processes. This evolving environmental focus, coupled with the relentless pursuit of mechanical efficiency, positions the Bicycle Bearings Market at the intersection of high performance and sustainable industrial practice, driving meaningful innovation across the component lifecycle. The sheer volume of bicycles produced annually, especially as global transportation shifts toward micro-mobility solutions, ensures that even small improvements in bearing efficiency translate into massive energy savings and reduced maintenance burdens on a global scale, solidifying the market’s importance far beyond competitive cycling.

The role of digitalization extends beyond just AI integration in manufacturing. Digital platforms are transforming how bearings are purchased and serviced. E-commerce sites dedicated to bicycle components now offer sophisticated configurators and compatibility tools, helping consumers and mechanics identify the exact specifications required for highly specialized bikes (e.g., specific bottom bracket standards like T47, BB30, or press-fit). This democratization of access to technical information and specialized components is fueling the aftermarket upgrade segment, as consumers become more educated and empowered to perform their own maintenance and upgrades. This shift necessitates that bearing manufacturers invest heavily in digital marketing, technical documentation, and comprehensive customer support to maintain market relevance and trust among the rapidly growing demographic of highly engaged, technically savvy end-users. This digital evolution is redefining the consumer relationship and shortening the feedback loop between product design and real-world performance validation, leading to faster product iteration cycles.

The competitive strategy for mid-tier manufacturers often involves striking robust deals with large OEM assemblers in Asia, providing high-quality, cost-optimized solutions that bridge the gap between low-cost generic bearings and ultra-premium brands. These companies leverage economies of scale while maintaining a stringent focus on quality assurance and consistent supply. For premium brands, maintaining exclusivity and fostering a strong connection with professional cycling teams and elite athletes is paramount. Endorsements and race wins serve as powerful marketing tools that validate the superior performance claims of expensive ceramic and custom-sealed solutions, driving aspirational purchases among serious amateur cyclists. Furthermore, patent protection on proprietary sealing and geometry designs is critical for safeguarding intellectual property and maintaining competitive barriers in the high-performance segment, ensuring that R&D investments yield long-term market advantage and pricing power.

The impact of global trade regulations and geopolitical shifts cannot be overlooked. Tariffs, changes in international sourcing agreements, and regional protectionist policies directly influence the cost structure and supply chain reliability, particularly for manufacturers relying on key raw materials (e.g., specialized steel alloys) often sourced from a limited number of global suppliers. Manufacturers must maintain highly flexible supply chains, potentially involving dual sourcing strategies, to mitigate risks associated with sudden trade disruptions. Furthermore, evolving safety and environmental certification requirements in key markets like the EU (REACH) and North America require continuous monitoring and compliance updates, adding a layer of complexity to product development and distribution. Successfully navigating this regulatory environment is essential for global market access and sustained operational stability across all major product lines, ensuring that bearings not only perform exceptionally but also meet all legal and ethical criteria for component manufacturing and deployment.

Looking forward, the integration of bearings into smart cycling ecosystems represents a transformative opportunity. Imagine bearings equipped with micro-generators that harvest rotational energy to power integrated sensors, providing data on power output efficiency, friction levels, and environmental conditions directly to the rider’s cycling computer or a mobile app. This level of data feedback will revolutionize training, maintenance, and product development. While challenging to achieve due to the size constraints and required durability, early attempts are already underway in high-end racing and e-bike applications. The market is thus poised to transition from purely mechanical component supply to offering integrated, data-generating solutions, further driving the value proposition of premium, technologically advanced bicycle bearings and cementing their status as high-tech components rather than mere consumables in the cycling world.

The segmentation by Bicycle Type, particularly the distinction between bearings optimized for Road, Mountain (MTB), and Electric (E-bike) use, is becoming increasingly critical. Road bearings prioritize minimal friction and weight, often utilizing sophisticated seals designed for clean, high-speed environments. MTB bearings demand maximum sealing integrity against mud, water, and repeated impacts, often requiring larger clearances to tolerate contamination without seizing. E-bike bearings must combine elements of both, but with significantly reinforced race structures and higher-grade materials to withstand continuous torque loads from the motor. A manufacturer’s ability to offer bespoke bearing specifications for each discipline, clearly communicated to the end-user, directly influences market penetration and brand loyalty within these highly specialized user groups, distinguishing serious component suppliers from generic bulk providers. This specialized engineering approach dictates material selection, lubrication choice, and manufacturing precision across the product portfolio, creating distinct market opportunities in each segment.

Market consolidation is another trend to watch. Larger, industrial bearing conglomerates (like SKF and Schaeffler) are increasingly leveraging their material science expertise and immense production capabilities to capture segments of the high-end cycling market, either through direct acquisition of specialized cycling component brands or through strategic partnerships. This consolidation puts pressure on smaller, niche bicycle bearing companies to either innovate rapidly or focus intensely on specialized service and customization where large industrial players cannot easily compete. The resulting competitive dynamic ensures a continuous push for excellence across the entire spectrum, benefiting the end consumer through improved quality and performance, but also potentially leading to a more bifurcated market structure where only the most innovative specialists and the largest global players can sustain profitability and growth. This market structure is driving continuous M&D activity and strategic positioning, focused on securing intellectual property related to friction reduction and long-term durability under extreme operating conditions. Furthermore, the rising popularity of bike sharing schemes and rental fleets in urban areas, often equipped with robust, low-maintenance componentry, represents a significant, though typically price-sensitive, OEM opportunity for bearing suppliers focused on long service intervals and high reliability in demanding operational contexts.

Finally, the growing awareness and adoption of professional bearing maintenance tools and services contribute significantly to aftermarket sales. As bicycles become more technically complex, proper bearing installation and maintenance require specialized presses, pullers, and diagnostic equipment. Bearing manufacturers who also offer or recommend specialized tooling and training for bicycle mechanics gain a substantial advantage, fostering a closer relationship with the critical independent bicycle dealer (IBD) network. This service-oriented approach not only drives sales of proprietary tooling but also ensures that their high-precision bearings are installed correctly, maximizing performance and minimizing warranty claims. The continuous need for specialized tools reflects the increasingly tight tolerances and complexity of modern bicycle frame standards and component integration, ensuring that the service sector remains a key revenue stream for the market over the long term, supporting sustained growth in high-margin service components.

The evolution of material technology is relentless. Beyond standard ceramics, research is actively exploring the use of high-performance plastics and advanced composite materials in bearing cages and seals to reduce weight without compromising strength or durability. For instance, specific carbon fiber reinforced polymers are being developed for cages used in ultra-lightweight racing applications where every gram counts. Simultaneously, the focus on non-metallic races, although highly niche, is exploring applications in extreme corrosive environments where even stainless steel might fail. This material diversification is a strategic response to the varied and often conflicting demands placed on bicycle components across the diverse range of cycling disciplines, ensuring that specialized solutions exist for everything from deep-sea endurance cycling to high-altitude mountain descents, solidifying the market's technological breadth.

The standardization debate continues to influence market dynamics. While the industry has seen some movement toward standardizing certain bottom bracket and hub axle dimensions, numerous proprietary designs and legacy standards persist. This fragmentation increases complexity for both manufacturers and aftermarket retailers, who must stock a wider array of compatibility solutions (adapters, conversion kits). The manufacturers that successfully navigate this complexity by offering comprehensive compatibility guides and robust, modular bearing kits are best positioned to dominate the aftermarket segment. The industry’s reluctance to fully standardize, driven by proprietary design advantages and continuous innovation, paradoxically fuels the aftermarket, ensuring a steady demand for repair and upgrade components that fit non-standard interfaces, creating both challenges and opportunities for specialized bearing suppliers in the long run.

Addressing the specific concerns related to noise and vibration is also becoming a critical design element. High-quality cycling components are expected to operate with near silence. Bearing manufacturers are investing in advanced metrology and testing facilities to minimize microscopic imperfections in the raceway surface finish, which are the primary sources of operational noise. Acoustic testing and vibration analysis are now standard procedures in the R&D phase, especially for headset and bottom bracket bearings where mechanical noise can be highly irritating to the rider. The pursuit of ultra-quiet operation is intrinsically linked to the pursuit of ultra-low friction, as imperfections that cause noise also inherently increase energy loss, positioning noise reduction as a crucial metric for evaluating premium bearing quality and performance.

The long-term health of the market is also contingent upon the expansion of global cycling events and mass participation rides. These events not only generate immediate demand for components through the associated retail activity but also drive media exposure and consumer awareness regarding the importance of high-quality components. Sponsorship deals and technical partnerships with high-profile cycling teams create powerful marketing narratives that translate directly into consumer purchasing decisions. This visibility is vital for maintaining the premium pricing associated with advanced bearing technologies, ensuring that the market for performance-critical components continues to grow alongside the overall increase in recreational and competitive cycling participation worldwide, reinforcing the cycle of innovation and demand within the sector.

The regulatory environment surrounding materials is tightening, particularly concerning substances used in lubrication and sealing compounds. The shift towards biodegradable and non-toxic greases, while maintaining necessary temperature stability and shear resistance, poses a significant technical challenge for lubricant suppliers and bearing assemblers. Compliance with environmental directives is a prerequisite for market entry in many developed nations, forcing manufacturers to innovate not only in bearing structure but also in the chemical composition of their ancillary products (greases, seals). This focus on "green chemistry" ensures the longevity of product lines in increasingly environmentally conscious markets, adding another layer of complexity to the already stringent quality control requirements inherent in precision bearing manufacturing.

Finally, the resilience of the market during global economic downturns has proven noteworthy. Cycling often sees increased participation during periods when travel and high-cost leisure activities are curtailed, positioning the bicycle components market, including bearings, as relatively recession-resistant. This stability, coupled with the high replacement rate required for consumables like bearings, provides a stable revenue foundation for market participants. The consistent demand for both essential repair parts and performance upgrades across all economic climates ensures that investment in production capacity and R&D remains attractive, supporting the positive long-term growth trajectory projected throughout the forecast period, cementing the bicycle bearings market as a robust and essential segment within the global sporting goods and transportation industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager