Bicycle Gearbox System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441527 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Bicycle Gearbox System Market Size

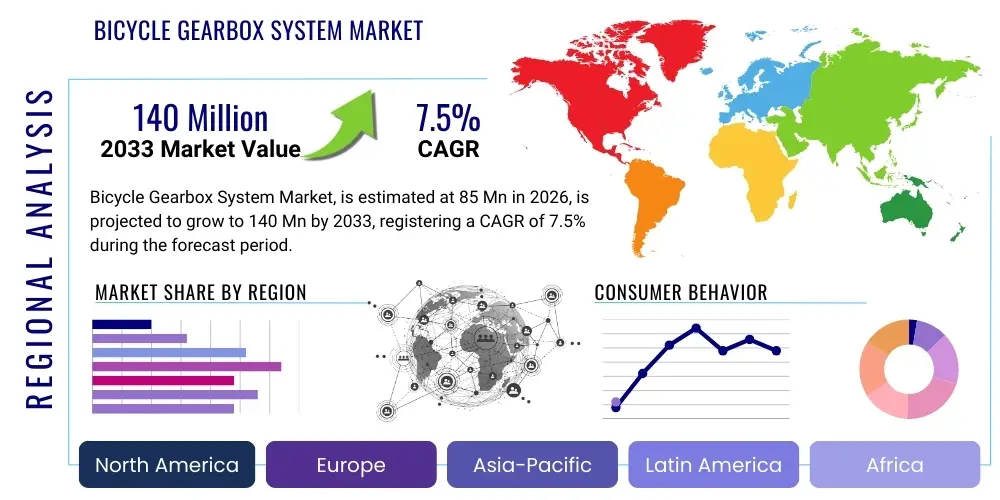

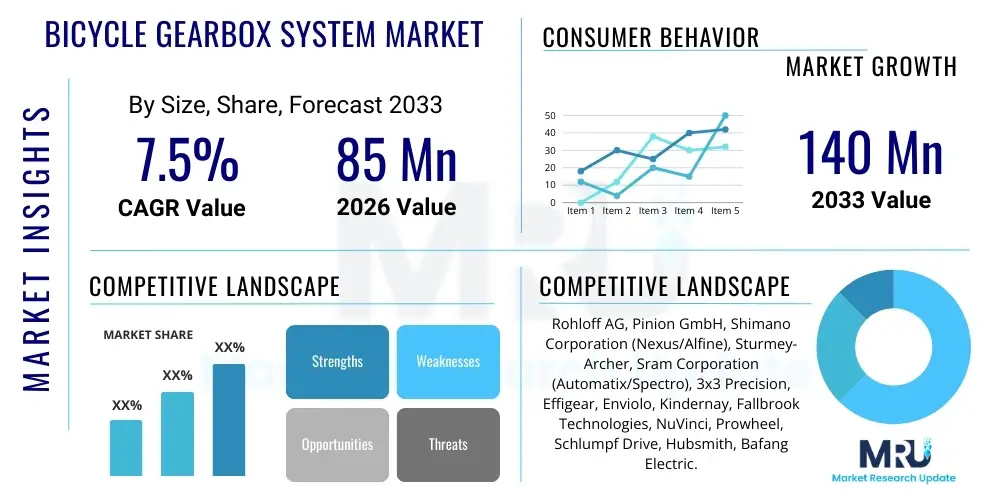

The Bicycle Gearbox System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 85 Million in 2026 and is projected to reach USD 140 Million by the end of the forecast period in 2033.

Bicycle Gearbox System Market introduction

The Bicycle Gearbox System Market encompasses the manufacturing, distribution, and utilization of enclosed gear mechanisms designed to replace traditional external derailleur systems on bicycles. These systems, primarily categorized as internal gear hubs (IGH) or dedicated mid-drive gearboxes (Pinion type), offer a significant departure from conventional shifting, providing superior durability, reduced maintenance requirements, and reliable performance under adverse conditions. Gearboxes encase the critical shifting components within a protective shell, shielding them from dirt, moisture, and impact damage, which is highly advantageous for performance cycling, commuting, and, critically, the burgeoning e-bike segment where torque loads are elevated.

Major applications for bicycle gearbox systems span across various cycling disciplines, including high-end mountain biking (MTB) where resilience and ground clearance are paramount, demanding urban commuting environments where low maintenance is highly valued, and the rapidly expanding electric bicycle (e-bike) market, which benefits from the system's ability to handle high motor torque efficiently. The fundamental benefits driving market acceptance include exceptional longevity, consistent shift quality regardless of pedal load, cleaner aesthetics, and a significantly extended operational lifespan compared to exposed drivetrain components. Furthermore, gearboxes allow for shifting while stationary, a crucial benefit in stop-and-go urban traffic.

The primary driving factors fueling the expansion of this market involve the global surge in electric bicycle adoption, particularly in Europe and Asia-Pacific, where consumers are increasingly prioritizing reliability and reduced upkeep costs. Coupled with this is the growing demand from affluent cyclists seeking premium, technologically advanced drivetrain solutions that maximize rider efficiency and minimize mechanical failure risks during long-distance or extreme off-road use. Government initiatives promoting cycling infrastructure and sustainable transport also contribute indirectly by increasing the overall base of sophisticated bicycle users demanding high-performance, robust components.

Bicycle Gearbox System Market Executive Summary

The Bicycle Gearbox System Market is defined by robust growth, driven primarily by the paradigm shift towards sophisticated e-bike integration and the increasing consumer preference for low-maintenance, high-durability components. Business trends indicate intensified research and development focused on weight reduction and improved efficiency, leveraging advanced materials like magnesium alloys and high-strength polymers to overcome the historical constraint of system weight. Key industry players are focusing on strategic partnerships with e-bike manufacturers (OEMs) to secure integration contracts early in the design cycle, positioning gearboxes as the premium standard for high-torque electric powertrains. Furthermore, a rising trend involves the development of electronic shifting interfaces for gearboxes, enhancing user experience and facilitating integration with smart cycling technologies.

Regionally, Europe dominates the market due to high rates of e-bike adoption, strict adherence to quality standards, and a deeply entrenched cycling culture that values investment in long-term performance. Germany, the Netherlands, and Scandinavia are critical hubs for both consumption and technological innovation. Asia Pacific, particularly China and Taiwan, serves as a crucial manufacturing base and is rapidly transitioning into a significant consumption region, driven by the urbanization and mass production of mid-range and high-end e-bikes. North America exhibits strong growth, particularly in the premium mountain bike segment, where enthusiasts are willing to pay a premium for systems offering unparalleled durability and ground clearance.

Segment trends reveal that the Pinion Gearbox segment, while currently smaller in volume, is projected to register the fastest growth rate, fueled by its inherent superior weight distribution and dedicated central placement, making it ideal for performance-oriented applications like high-end touring and enduro mountain biking. Simultaneously, the Internal Gear Hub (IGH) segment maintains market dominance based on historical adoption rates and ease of integration into standard frames, dominating the urban and commuter bike categories. The shift towards electronic actuation (e-shifting) across both segments is transforming the market, enhancing precision and simplifying cable routing, thereby appealing to a broader spectrum of OEM partners.

AI Impact Analysis on Bicycle Gearbox System Market

Common user questions regarding AI’s impact on the Bicycle Gearbox System Market revolve around performance optimization, predictive maintenance scheduling, and the integration of smart, adaptive shifting algorithms. Users are keen to understand how AI can reduce the existing weight and complexity limitations of gearboxes while simultaneously maximizing efficiency and minimizing wear. Specific concerns center on the reliability of machine learning models to accurately predict mechanical failures in sealed systems and the potential for AI-driven design tools to develop lighter, yet equally robust, materials and structures. The core expectation is that AI will transform gearboxes from passive mechanical systems into intelligent components capable of dynamically adjusting shift characteristics based on real-time biometric data, terrain analysis, and power output.

The initial phase of AI integration is focused heavily on the design and manufacturing spectrum. Generative design tools, powered by artificial intelligence, are capable of simulating thousands of design iterations for gearbox casings and internal mechanisms, optimizing material usage to achieve significant weight savings without compromising structural integrity or torque capacity. Furthermore, AI models are essential for quality control in high-precision manufacturing, using computer vision and sensor data to detect microscopic flaws in gears and shafts, thereby drastically improving the reliability and reducing manufacturing waste, which is critical given the high component complexity of these systems.

In the application phase, especially within the e-bike and electronic shifting segments, AI is enabling advanced performance features. Adaptive shifting algorithms use machine learning to analyze the rider’s pedaling cadence, power output, route topography, and heart rate to anticipate the necessary gear change, initiating shifts automatically and instantaneously to maintain optimal rider efficiency and motor performance. This predictive capability extends into maintenance, where integrated sensors collect vibration, temperature, and torque data, feeding it to an AI model that forecasts component degradation, allowing users or fleet managers to schedule maintenance precisely before a catastrophic failure occurs, significantly enhancing the overall value proposition of high-cost gearbox systems.

- Generative Design Optimization: AI algorithms reduce gearbox weight while maintaining structural integrity.

- Predictive Maintenance: Machine learning analyzes sensor data to forecast component wear and schedule proactive servicing.

- Smart Adaptive Shifting: Real-time analysis of terrain and rider input optimizes gear selection automatically, improving efficiency.

- Manufacturing Quality Control: AI-powered vision systems ensure ultra-precise production tolerances for internal components.

- Supply Chain Efficiency: Optimized inventory management and demand forecasting for specialized gearbox components.

DRO & Impact Forces Of Bicycle Gearbox System Market

The dynamics of the Bicycle Gearbox System Market are fundamentally shaped by the interplay of key Drivers (D), Restraints (R), and Opportunities (O), which collectively exert significant Impact Forces on market trajectories and competitive positioning. The dominant driver is the escalating demand for high-performance, low-maintenance components, especially within the rapidly growing electric bicycle sector, where traditional exposed drivetrains struggle under increased torque loads and require frequent servicing. This driver is counterbalanced by major restraints, primarily the high initial cost relative to standard derailleur systems and the perceptible weight penalty associated with the robust, sealed mechanical assemblies, posing a challenge for weight-conscious performance cyclists.

Opportunities for market expansion are centered on the rapid evolution of materials science, allowing manufacturers to develop lighter alloys and advanced polymers that mitigate the weight constraint. Furthermore, the integration of these systems into shared mobility fleets and high-end rental services, where long service intervals are mandatory for profitability, presents a substantial commercial avenue. The impact forces indicate a strong positive pressure exerted by the consumer shift towards reliability and the environmental benefit of systems that last longer and require fewer replacement parts, thereby aligning with sustainability trends. However, the force of technological inertia and established supply chains for conventional drivetystems acts as a persistent dampener on rapid market penetration, requiring aggressive OEM adoption strategies.

Key impact forces further influence competitive dynamics; for instance, the intense focus on sealing technology and shifting efficiency forces manufacturers to invest heavily in specialized precision engineering, creating significant barriers to entry for smaller players. The market is thus propelled forward by drivers related to performance and longevity, while restrained by factors of cost and legacy technology acceptance. Ultimately, the successful navigation of this market hinges on leveraging opportunities in lightweighting and electronic integration, allowing the price-to-performance ratio to increasingly favor gearbox systems over the forecast period, eventually offsetting the perception of high initial investment.

Segmentation Analysis

The Bicycle Gearbox System Market is comprehensively segmented based on Type, Application, and Distribution Channel, reflecting the diverse requirements of the global cycling community and the distinct engineering approaches employed by manufacturers. Understanding these segments is crucial for strategic market entry and product positioning. The Type segment differentiates between fully integrated internal gear hubs (IGH), which are located within the rear wheel, and purpose-built mid-drive gearbox systems (Pinion systems), which are centrally mounted at the bottom bracket, offering varying benefits in terms of weight distribution, shifting performance, and integration complexity. The Application segments reflect the primary end-use environments, highlighting the differential adoption rates across high-torque e-bikes, rugged mountain biking, and general urban commuting, each requiring specific gearbox characteristics related to gear range and durability. The Distribution Channel segmentation differentiates between products supplied directly to bicycle assemblers (OEMs) and those sold to end-users or repair shops (Aftermarket), reflecting the primary sales methodologies.

- By Type

- Internal Gear Hubs (IGH)

- Mid-Drive Gearbox Systems (Pinion Type)

- By Application

- E-Bikes (Electric Bicycles)

- Mountain Bikes (MTB)

- Commuter and Urban Bikes

- Touring and Adventure Bikes

- By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Gear Ratio/Speed

- Up to 7-Speed

- 8 to 12-Speed

- 13-Speed and Above (High Range)

Value Chain Analysis For Bicycle Gearbox System Market

The value chain for the Bicycle Gearbox System Market is highly specialized and knowledge-intensive, beginning with the procurement of high-grade raw materials such as aerospace-grade aluminum alloys, specialized steels for high-stress gears, and advanced sealants/lubricants. Upstream activities are dominated by specialized component manufacturers who produce the highly precise internal gears, bearings, and casing structures, often requiring advanced CNC machining and heat treatment processes to meet stringent durability and tolerance standards. This early stage is capital-intensive and subject to strict quality control, differentiating it significantly from the value chain of standard bicycle components due to the sealed nature of the product.

Midstream activities involve the primary gearbox assemblers (the key market players) who integrate these precision components, conduct rigorous testing, and finalize the housing design. These manufacturers maintain proprietary intellectual property regarding internal layouts and sealing mechanisms. Once assembled, the products enter the distribution channels. Direct channels involve sales straight to major Original Equipment Manufacturers (OEMs) such as specialized e-bike producers or high-end MTB brands, who integrate the gearbox systems into their frame designs during the bicycle assembly phase. This channel is crucial for establishing market standards and volume sales.

Indirect distribution primarily flows through specialized distributors and regional dealers who supply the Aftermarket segment, catering to individual consumers upgrading their existing bicycles or independent bicycle repair shops providing specialized servicing. Downstream, the value chain terminates with the end-users: performance enthusiasts, commuters, and e-bike fleet operators. The lifecycle maintenance and specialized servicing required for these systems often create an additional, high-margin downstream service loop, particularly due to the complexity and sealed nature of the systems, requiring specific proprietary tools and trained technicians, further solidifying the value proposition for the manufacturers.

Bicycle Gearbox System Market Potential Customers

The primary target demographic and potential customers for the Bicycle Gearbox System Market are highly segmented, prioritizing specific attributes like longevity, performance consistency, and weather resistance over low initial cost. The largest and fastest-growing segment of end-users are E-Bike Manufacturers and riders. E-bikes generate substantial torque, which rapidly wears out traditional exposed drivetrains; therefore, the sealed, robust nature of a gearbox system provides essential reliability and reduces fleet maintenance costs for commercial operators and high-mileage commuters. These buyers prioritize total cost of ownership (TCO) over the initial purchase price.

A second critical customer base includes high-end Mountain Bike (MTB) enthusiasts, particularly those engaged in Enduro, Downhill, or demanding trail riding. These users require exceptional ground clearance and components that can withstand severe mud, water, and impact damage. The central mass distribution offered by Pinion-type gearboxes, coupled with the ability to shift under extreme conditions, makes them a premium solution in this segment. Furthermore, Touring Cyclists and Adventure Riders represent a niche but highly loyal customer segment, valuing the absolute reliability and low maintenance profile essential for extended, unsupported journeys in remote areas where component failure is unacceptable.

Finally, Urban Commuters and operators of Bike Sharing Schemes constitute significant volume buyers, especially for Internal Gear Hub (IGH) systems. Commuters appreciate the ability to shift while stopped at traffic lights and the minimal maintenance required for daily use. Bike share operators, seeking to maximize uptime and minimize operational expenses, find the durability and long service life of gearbox systems to be an extremely cost-effective choice in the long run, positioning fleet management as a major consumption driver in dense metropolitan areas globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85 Million |

| Market Forecast in 2033 | USD 140 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rohloff AG, Pinion GmbH, Shimano Corporation (Nexus/Alfine), Sturmey-Archer, Sram Corporation (Automatix/Spectro), 3x3 Precision, Effigear, Enviolo, Kindernay, Fallbrook Technologies, NuVinci, Prowheel, Schlumpf Drive, Hubsmith, Bafang Electric. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Gearbox System Market Key Technology Landscape

The technology landscape of the Bicycle Gearbox System Market is defined by precision engineering, advanced materials science, and increasingly, electronic integration. The fundamental technology relies on highly complex planetary or countershaft gear arrangements housed within sealed units. Key innovations focus on miniaturization and efficiency, specifically reducing internal friction losses, which has historically been a competitive disadvantage compared to external drivetrains. Manufacturers are heavily investing in proprietary lubricants and sealing mechanisms that maintain performance under extreme temperature and pressure variations while ensuring zero ingress of contaminants, guaranteeing the promised maintenance-free lifespan.

A significant technological push involves lightweighting through the use of exotic materials. While early gearboxes relied heavily on steel and standard aluminum, the current generation utilizes high-strength, lightweight materials such as magnesium alloys and carbon-reinforced polymers for the casing components. This material evolution directly addresses one of the primary market restraints—system weight—and allows these systems to become viable for a broader range of performance applications. Furthermore, the precision required for the internal gear sets necessitates the use of high-end Computer Numerical Control (CNC) machining and specialized heat treatments to ensure the gears can withstand peak torque loads, particularly in the e-bike sector.

The most transformative recent development is the migration towards electronic shifting technology. Electro-mechanical actuation, managed by miniaturized motors and complex wiring harnesses, replaces traditional bulky cables and shifters. This electronic integration not only improves shift speed and accuracy but also facilitates the incorporation of smart features, such as automated shifting based on speed and cadence sensors, or integration with e-bike battery management systems (BMS). Technologies like Continuous Variable Transmission (CVT) systems, such as those commercialized by Enviolo, further complicate the landscape by offering infinite gearing ratios, appealing specifically to urban and utility cycling segments seeking seamless, intuitive operation rather than distinct steps, representing a crucial non-traditional gearbox technology.

Regional Highlights

The global market for Bicycle Gearbox Systems exhibits pronounced regional variations in adoption and market maturity, largely dictated by local cycling culture, regulatory environments governing e-bikes, and disposable income levels. Europe stands as the dominant regional market, characterized by the highest per capita consumption of high-end bicycles and a mature e-bike industry. Government support for sustainable urban mobility in countries like Germany, the Netherlands, and Denmark has fueled the demand for durable, all-weather cycling solutions, making gearboxes standard equipment on premium commuter and utility e-bikes. European consumers demonstrate a higher willingness to pay for components that offer long-term reliability and reduced environmental impact through extended product lifecycles.

Asia Pacific (APAC) represents the fastest-growing region, driven primarily by manufacturing dominance in countries like Taiwan and mainland China, which serve as global production hubs for both conventional and electric bicycles. While historically focused on high-volume, low-cost components, APAC is rapidly transitioning towards high-value production. The escalating middle-class population, especially in urban centers, is boosting domestic demand for sophisticated e-bikes and commuter bicycles where IGH systems are favored for their low maintenance. Furthermore, the emergence of large-scale bike-sharing platforms across major Asian cities requires robust, vandal-resistant drivetrain solutions, creating a substantial volume opportunity for sealed gear systems.

North America maintains a robust market share, largely focused on the premium segments, particularly high-performance mountain biking and specialized touring/bikepacking. The market here is less driven by broad commuter adoption than in Europe but is characterized by high average transaction values, as consumers seek top-tier brands like Pinion and Rohloff for extreme off-road applications. Conversely, the Middle East and Africa (MEA) and Latin America currently hold smaller market shares, where adoption is nascent and generally restricted to high-income sport cycling niches or pilot programs for shared mobility in major economic hubs. Growth in these regions is contingent upon economic development and increased public infrastructure investment supporting widespread cycling usage.

- Europe (Dominance): High e-bike penetration, strong regulatory support for cycling, leading market for premium, low-maintenance components (Germany, Netherlands).

- Asia Pacific (Fastest Growth): Manufacturing base, rapidly rising domestic demand for e-bikes, significant adoption in urban bike-sharing schemes (China, Taiwan).

- North America (Premium Niche): Strong demand for high-end mountain biking and touring applications, emphasizing durability and performance gains.

- Latin America and MEA (Emerging): Market entry concentrated in urban centers and luxury bicycle segments; growth tied to infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Gearbox System Market.- Rohloff AG

- Pinion GmbH

- Shimano Corporation (Nexus/Alfine)

- Sturmey-Archer

- Sram Corporation (Automatix/Spectro)

- Effigear

- Enviolo (formerly NuVinci)

- Kindernay

- 3x3 Precision

- Patria Rad & Technik GmbH

- Bafang Electric (Specific Gearbox Solutions)

- Fallbrook Technologies (Enviolo Parent Company)

- Hubsmith

- Schlumpf Innovations

- Prowheel

- SRAM LLC (Acquired Falcrum Racing)

- TRP Cycling Components

- White Industries

- Componentry Inc. (Specialized Components)

Frequently Asked Questions

Analyze common user questions about the Bicycle Gearbox System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a bicycle gearbox system over traditional derailleur systems?

The primary advantage is superior durability and significantly reduced maintenance. Gearboxes are sealed, protecting crucial components from dirt, water, and impact damage, leading to a much longer lifespan and consistent shifting performance under all weather conditions, which is essential for e-bikes and performance touring.

Are bicycle gearbox systems generally heavier or lighter than standard drivetrains?

Gearbox systems typically have a higher overall weight than a comparable external derailleur system. However, the weight is centrally positioned, often improving bicycle handling and balance. Manufacturers are continuously utilizing advanced lightweight materials to mitigate this weight penalty.

Which application segment drives the highest demand for bicycle gearboxes?

The Electric Bicycle (E-Bike) application segment currently drives the highest growth and demand. The high torque output of electric motors places immense stress on exposed drivetrains, making the sealed, robust nature of gearbox systems a necessary investment for long-term reliability and reduced warranty claims.

What is the difference between an Internal Gear Hub (IGH) and a Pinion system?

An Internal Gear Hub (IGH) places the entire gearing mechanism within the rear wheel hub, suitable mainly for urban and commuter bikes. A Pinion system is a centralized mid-drive gearbox located at the bottom bracket, providing better weight distribution and is generally preferred for high-performance mountain biking and touring applications.

How does AI impact the future design and performance of bicycle gearboxes?

AI is crucial for future gearbox development by enabling generative design (reducing weight while maintaining strength) and facilitating smart, adaptive electronic shifting. AI algorithms analyze rider data and terrain in real time to optimize gear selection and predict component wear for preventative maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager