Bicycle Infotainment System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440728 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Bicycle Infotainment System Market Size

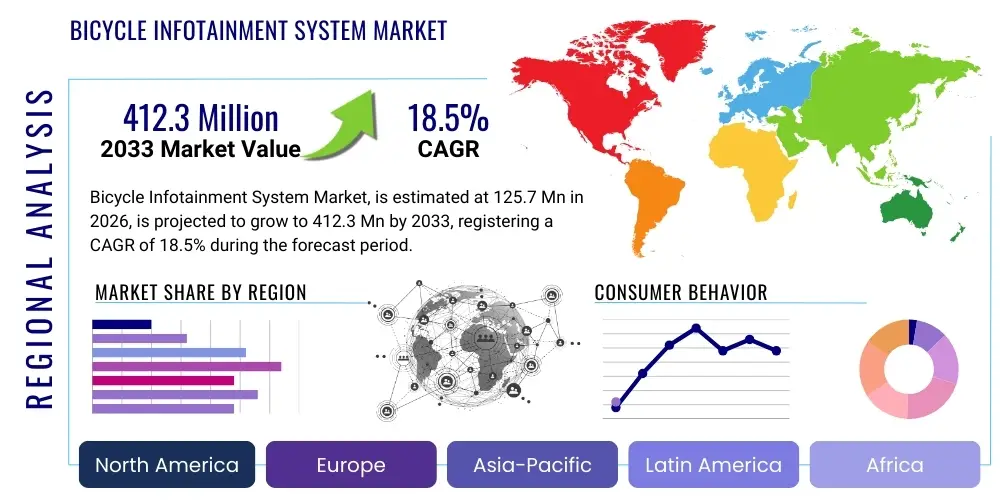

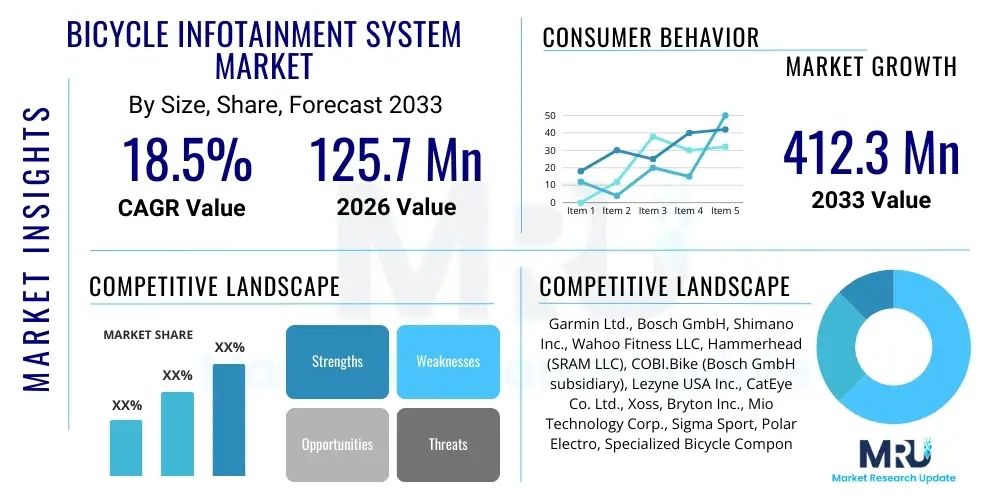

The Bicycle Infotainment System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 125.7 million in 2026 and is projected to reach USD 412.3 million by the end of the forecast period in 2033.

Bicycle Infotainment System Market introduction

The Bicycle Infotainment System Market encompasses a rapidly evolving category of electronic devices designed to enhance the cycling experience by providing a suite of functionalities beyond basic navigation. These sophisticated systems integrate features such as GPS navigation, real-time performance metrics, health monitoring, communication capabilities, and multimedia entertainment into a compact, bike-mountable unit. Product descriptions typically highlight seamless connectivity with smartphones and other peripherals, intuitive user interfaces, and robust, weather-resistant designs optimized for outdoor use, ensuring reliability across diverse environmental conditions.

Major applications for these systems span a broad spectrum of cycling activities, including daily commuting, long-distance touring, competitive cycling, and recreational rides. Commuters leverage them for efficient route planning and traffic avoidance, while touring cyclists benefit from detailed mapping and extended battery life. Fitness enthusiasts utilize integrated sensors for heart rate, cadence, and power output tracking, transforming their bikes into advanced training tools. The primary benefits derived from these systems include enhanced safety through turn-by-turn navigation and incident detection, improved rider performance via comprehensive data analysis, and an enriched overall experience with access to music and communication on the go.

Driving factors propelling the growth of this market are multifaceted, anchored by the global resurgence in cycling for health, environmental sustainability, and urban mobility. Increased adoption of smart devices and a growing consumer expectation for integrated technology in everyday objects further fuel demand. Advancements in sensor technology, improved battery life, and the miniaturization of electronic components enable more powerful and feature-rich systems. Additionally, the proliferation of e-bikes, which inherently support integrated electronic systems, presents a significant growth avenue for the infotainment market, encouraging broader consumer uptake and innovation.

Bicycle Infotainment System Market Executive Summary

The Bicycle Infotainment System Market is experiencing dynamic growth, driven by key business, regional, and segment trends that are reshaping the landscape of personal mobility and outdoor recreation. Business trends indicate a strong move towards integrated ecosystems, where infotainment systems seamlessly connect with other smart devices, fitness trackers, and cloud-based services. This fosters a stickier user experience and opens avenues for subscription-based services, such as premium mapping, advanced analytics, and personalized training plans. Furthermore, strategic partnerships between traditional bike manufacturers and tech companies are becoming more prevalent, aiming to offer holistic solutions that bundle hardware, software, and services. The focus is increasingly on user experience design, prioritizing intuitive interfaces and robust, reliable performance under varied cycling conditions.

Regionally, Europe and Asia Pacific are emerging as frontrunners in market adoption, buoyed by strong cycling cultures, significant investments in cycling infrastructure, and high consumer disposable incomes for premium leisure and fitness products. North America continues to be a substantial market, driven by a large base of recreational cyclists and a high propensity for early adoption of new technologies. Latin America and the Middle East & Africa, while smaller, are showing promising growth as cycling gains popularity and economic development improves access to advanced consumer electronics. Each region presents unique market entry strategies, requiring localized content, language support, and an understanding of specific cycling habits and regulations.

Segment trends highlight a clear shift towards more sophisticated, multi-functional devices that offer comprehensive data integration rather than standalone features. Integrated systems, often original equipment manufacturer (OEM) installations on high-end bikes and e-bikes, are gaining traction due to their aesthetic appeal and deep system integration. The aftermarket segment remains robust, catering to cyclists looking to upgrade existing bikes or customize their riding experience with advanced features. Connectivity options are diversifying, with 5G integration beginning to offer faster data transfer for real-time information and cloud synchronization. Software-centric platforms are also growing in importance, allowing for over-the-air updates, personalized user profiles, and an ever-expanding array of third-party application integrations, pushing the market towards more customizable and future-proof solutions.

AI Impact Analysis on Bicycle Infotainment System Market

Users frequently inquire about how Artificial Intelligence will fundamentally transform the cycling experience, specifically regarding enhanced safety, personalized performance insights, and the intuitiveness of system interaction. Common concerns revolve around data privacy, the potential for AI to distract riders, and the cost implications of integrating advanced AI capabilities. There is a strong expectation that AI will move beyond basic data display to offer predictive analytics for route optimization, real-time hazard detection, and highly personalized coaching, ultimately making cycling safer, more efficient, and more enjoyable. Users anticipate AI-powered voice control and adaptive interfaces that learn individual preferences, simplifying complex operations and reducing cognitive load during rides. However, anxieties persist regarding the ethical use of collected data and ensuring that AI enhancements do not detract from the core joy and focus of cycling.

- AI-powered predictive navigation for optimal routes based on real-time traffic, weather, and rider fitness levels.

- Advanced collision detection and avoidance systems using computer vision and machine learning algorithms.

- Personalized training and coaching algorithms that adapt to rider performance, goals, and recovery needs.

- Enhanced voice control and natural language processing for hands-free operation and seamless interaction.

- Real-time anomaly detection in bike performance or rider biometrics, alerting to potential issues.

- Intelligent battery management for optimal power consumption across connected devices and e-bike systems.

- Adaptive display interfaces that prioritize critical information based on riding context and user preferences.

- Improved theft deterrence through AI-driven anomaly detection and GPS tracking.

- Automated incident reporting and emergency contact notification in case of accidents.

DRO & Impact Forces Of Bicycle Infotainment System Market

The Bicycle Infotainment System Market is propelled by several key drivers, including the surging global popularity of cycling for both leisure and commuting, driven by health consciousness and environmental awareness. Concurrent advancements in GPS, IoT, and sensor technologies are enabling more sophisticated and accurate systems, while the increasing demand for smart and connected devices across all consumer sectors fuels integration into cycling gear. Conversely, the market faces significant restraints such as the relatively high initial cost of these advanced systems, which can be a barrier for mass adoption, alongside persistent concerns regarding battery life and the availability of convenient charging infrastructure. The potential for rider distraction due to complex interfaces and cybersecurity risks related to personal data also pose challenges. Opportunities lie in the burgeoning e-bike market, which inherently offers power sources and space for integrated electronics, and the potential for AI-powered personalized features that cater to specific training or navigation needs. The market’s dynamics are further shaped by the bargaining power of component suppliers, the competitive landscape among established and emerging players, and the evolving preferences of end-users for seamless, integrated technological experiences in their outdoor activities.

Segmentation Analysis

The Bicycle Infotainment System Market is comprehensively segmented to provide a granular understanding of its diverse components, connectivity options, applications, and sales channels. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas, target specific consumer demographics, and tailor product development strategies. The market is broadly categorized by the core elements that constitute these systems, the technological methods they employ to communicate, the specific functions they serve for cyclists, and the primary avenues through which they reach consumers, whether directly integrated into new bicycles or purchased as standalone upgrades.

- By Component

- Display Units (LCD, OLED)

- GPS Modules

- Connectivity Modules (Bluetooth, Wi-Fi, Cellular)

- Sensors (Heart Rate, Cadence, Speed, Power, Ambient Light, Accelerometer, Gyroscope)

- Batteries

- Microcontrollers & Processors

- Software & Firmware

- Speakers & Microphones

- By Connectivity

- Bluetooth

- Wi-Fi

- Cellular (4G, 5G)

- ANT+

- NFC

- By Application

- Navigation & Mapping

- Entertainment (Music Playback, Podcasts)

- Fitness Tracking & Performance Monitoring

- Safety & Security (Incident Detection, Anti-theft)

- Communication (Call/Message Notifications)

- Social Sharing

- By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail Stores, Online Sales)

- By Type

- Integrated Systems

- Standalone Devices

Value Chain Analysis For Bicycle Infotainment System Market

The value chain for the Bicycle Infotainment System Market commences with a robust upstream segment, involving a diverse array of component suppliers crucial for the system's functionality. This includes semiconductor manufacturers providing microprocessors and memory, sensor technology companies supplying GPS modules, accelerometers, heart rate monitors, and power meters, as well as display panel manufacturers. Battery suppliers and connectivity module providers (Bluetooth, Wi-Fi, cellular) also form essential parts of this upstream ecosystem. The quality and innovation from these suppliers directly impact the performance, cost, and miniaturization capabilities of the final product, making strong supplier relationships critical for product development and competitive pricing. Research and development activities, particularly in software and AI algorithms, are also heavily concentrated in this initial phase.

Further down the chain, the manufacturing and assembly phase transforms these components into complete infotainment systems. This segment involves design, engineering, prototyping, and mass production, often managed by specialized electronics manufacturers or the infotainment system brands themselves. Quality control, testing, and compliance with various international standards (e.g., IPX ratings for water resistance, CE/FCC certifications) are paramount here to ensure product reliability and user safety. This phase also includes the development and integration of proprietary software, user interfaces, and custom features that differentiate products in the market.

The distribution channel for bicycle infotainment systems is bifurcated into direct and indirect routes. Direct distribution often involves manufacturers selling directly to consumers through their brand websites, or directly to bicycle original equipment manufacturers (OEMs) for integration into new bicycle models, particularly e-bikes and high-end road/mountain bikes. Indirect channels represent a significant portion of the market, encompassing sales through specialty cycling stores, large sporting goods retailers, and a rapidly growing online retail presence via e-commerce platforms. These indirect channels provide broader market reach and often include value-added services such as installation support and technical advice. Effective logistics, inventory management, and marketing through these channels are vital for market penetration and consumer accessibility, defining the ultimate reach to potential customers.

Bicycle Infotainment System Market Potential Customers

The primary potential customers for Bicycle Infotainment Systems are diverse, encompassing a wide range of cycling enthusiasts and daily riders who seek to enhance their riding experience through technology. This includes urban commuters who prioritize efficient navigation and real-time traffic updates to optimize their routes and reduce travel times. They value features that improve safety, such as turn-by-turn directions and integration with smart city infrastructure. Another significant segment comprises fitness enthusiasts and competitive cyclists, who utilize these systems for detailed performance tracking, including metrics like speed, cadence, heart rate, power output, and advanced training analytics. These users often leverage connectivity features to sync data with third-party fitness apps and share their achievements within online communities. The demand for precise data and structured training programs drives their purchasing decisions.

Furthermore, touring cyclists and adventure riders represent a substantial customer base, requiring robust navigation, extended battery life, and offline mapping capabilities for multi-day trips and remote explorations. For these users, reliability in challenging conditions and the ability to access essential information without cellular connectivity are crucial. The burgeoning market of e-bike users also forms a key customer group, as infotainment systems can seamlessly integrate with the e-bike's power system and display crucial information like battery level, assist mode, and range. This segment appreciates the added convenience and enhanced control that integrated systems provide. Finally, general recreational cyclists, seeking to make their rides more enjoyable and safer with music, communication alerts, and basic navigation, also contribute to the broad customer spectrum, highlighting the versatile appeal of these intelligent cycling accessories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.7 million |

| Market Forecast in 2033 | USD 412.3 million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garmin Ltd., Bosch GmbH, Shimano Inc., Wahoo Fitness LLC, Hammerhead (SRAM LLC), COBI.Bike (Bosch GmbH subsidiary), Lezyne USA Inc., CatEye Co. Ltd., Xoss, Bryton Inc., Mio Technology Corp., Sigma Sport, Polar Electro, Specialized Bicycle Components, Trek Bicycle Corporation, Magene, Quad Lock, SP Connect, Sena Technologies Inc., Canyon Bicycles GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bicycle Infotainment System Market Key Technology Landscape

The Bicycle Infotainment System Market is characterized by a dynamic technology landscape, driven by continuous innovation in several core areas. Global Positioning System (GPS) technology remains foundational, providing highly accurate location tracking and navigation capabilities, with ongoing enhancements in multi-band GNSS (Global Navigation Satellite System) for improved precision in challenging environments. The Internet of Things (IoT) plays a crucial role, enabling seamless connectivity between the infotainment system, various bike sensors (speed, cadence, heart rate, power meters), smartphones, and cloud platforms for data synchronization and analysis. This interconnectedness allows for comprehensive performance monitoring and advanced safety features, transforming the bicycle into a smart, connected vehicle. Furthermore, Human-Machine Interface (HMI) technologies, including high-resolution touchscreen displays, intuitive button layouts, and sophisticated voice control systems, are critical for ensuring a user-friendly and safe interaction experience while riding, minimizing distraction and maximizing operational efficiency.

Wireless communication technologies are indispensable for the functionality of these systems. Bluetooth (BLE) facilitates low-power connections to sensors and smartphones, while Wi-Fi enables faster data transfers for map updates and larger file downloads. The integration of cellular connectivity, particularly 4G and increasingly 5G, is a significant trend, allowing for real-time traffic updates, live tracking, emergency calling, and cloud-based services without the need for a tethered smartphone. This enhances independence and safety for riders. Advanced sensor technologies, beyond traditional speed and cadence, now include gyroscopes, accelerometers, barometers, and even radar systems for collision detection, providing a richer dataset for performance analytics and contributing to rider safety. Artificial Intelligence (AI) and Machine Learning (ML) algorithms are being increasingly embedded to offer personalized coaching, predictive navigation, incident detection, and adaptive user interfaces, moving beyond simple data display to intelligent decision support.

Moreover, robust battery technology is paramount, given the need for extended operational times in outdoor settings. Innovations in lithium-ion and other advanced battery chemistries, coupled with efficient power management systems, are crucial for device longevity and reducing charging frequency. Cloud computing infrastructure supports the storage, processing, and analysis of vast amounts of ride data, enabling advanced analytics, social sharing features, and over-the-air software updates that keep systems current and introduce new functionalities. Secure data encryption and privacy protocols are also becoming vital components of the technology landscape, addressing growing concerns about personal data protection in connected devices. The convergence of these technologies defines the current capabilities and future potential of bicycle infotainment systems, pushing the boundaries of what is possible in cycling technology.

Regional Highlights

- North America: This region represents a significant market, driven by a strong culture of recreational cycling, a high disposable income, and a robust consumer electronics market. The United States and Canada lead in adoption, particularly among fitness enthusiasts and early tech adopters. Demand is fueled by smart device integration and interest in advanced performance metrics.

- Europe: Europe stands as a leading market due to its deeply entrenched cycling culture, extensive cycling infrastructure, and strong government initiatives promoting cycling for urban mobility and environmental sustainability. Countries like Germany, the Netherlands, and France exhibit high penetration rates, with a strong focus on both commuter and touring applications, particularly with the growth of e-bikes.

- Asia Pacific (APAC): The APAC region is poised for rapid growth, driven by increasing urbanization, rising disposable incomes, and a growing awareness of health and fitness. China, Japan, and South Korea are key markets, showing a burgeoning interest in connected devices and a large consumer base for both recreational and commuting cycling. Infrastructure development supporting cycling further fuels demand.

- Latin America: While still an emerging market, Latin America is showing consistent growth in cycling adoption, particularly in urban centers where cycling is increasingly viewed as a viable mode of transport and recreation. Economic development and increasing access to consumer electronics are key drivers, though affordability remains a consideration.

- Middle East and Africa (MEA): This region is at an nascent stage but offers considerable potential. Growth is stimulated by government investments in sports and tourism, a rising health consciousness, and a developing infrastructure for cycling. Adoption rates are gradually increasing, particularly in countries with higher disposable incomes and a focus on modern urban development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bicycle Infotainment System Market.- Garmin Ltd.

- Bosch GmbH

- Shimano Inc.

- Wahoo Fitness LLC

- Hammerhead (SRAM LLC)

- COBI.Bike (Bosch GmbH subsidiary)

- Lezyne USA Inc.

- CatEye Co. Ltd.

- Xoss

- Bryton Inc.

- Mio Technology Corp.

- Sigma Sport

- Polar Electro

- Specialized Bicycle Components

- Trek Bicycle Corporation

- Magene

- Quad Lock

- SP Connect

- Sena Technologies Inc.

- Canyon Bicycles GmbH

Frequently Asked Questions

Analyze common user questions about the Bicycle Infotainment System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of a bicycle infotainment system?

Bicycle infotainment systems offer enhanced navigation with real-time mapping, improved safety through incident detection and awareness features, comprehensive fitness tracking for performance analysis, and entertainment options like music, significantly enriching the overall cycling experience.

How do these systems connect with other devices and networks?

These systems typically connect via Bluetooth for sensors and smartphones, Wi-Fi for updates and data transfer, ANT+ for fitness peripherals, and increasingly cellular (4G/5G) for independent network access, enabling seamless integration with a rider's digital ecosystem.

Are bicycle infotainment systems compatible with all types of bicycles?

Most aftermarket systems are designed for universal compatibility with standard bicycle handlebars, but specific mounting solutions may vary. Integrated OEM systems are typically designed for particular bike models, especially modern e-bikes and high-end road bikes, where they are pre-installed.

What is the typical battery life of these devices, and how are they charged?

Battery life varies widely based on features and usage, ranging from 8-20+ hours on a single charge. Most systems are rechargeable via USB-C, with some offering power integration with e-bike batteries or external power banks for extended rides, ensuring convenience for diverse cycling durations.

What future trends are expected in the bicycle infotainment system market?

Future trends include deeper AI integration for personalized coaching and predictive safety, advanced augmented reality (AR) displays, enhanced 5G connectivity for real-time cloud services, greater modularity, and seamless integration with smart city infrastructure for an increasingly connected and intelligent cycling experience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager