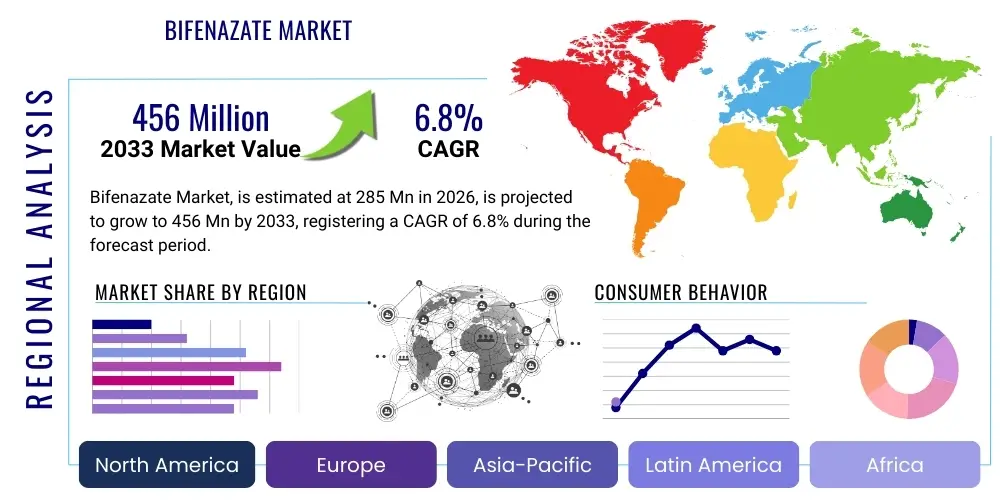

Bifenazate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442692 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Bifenazate Market Size

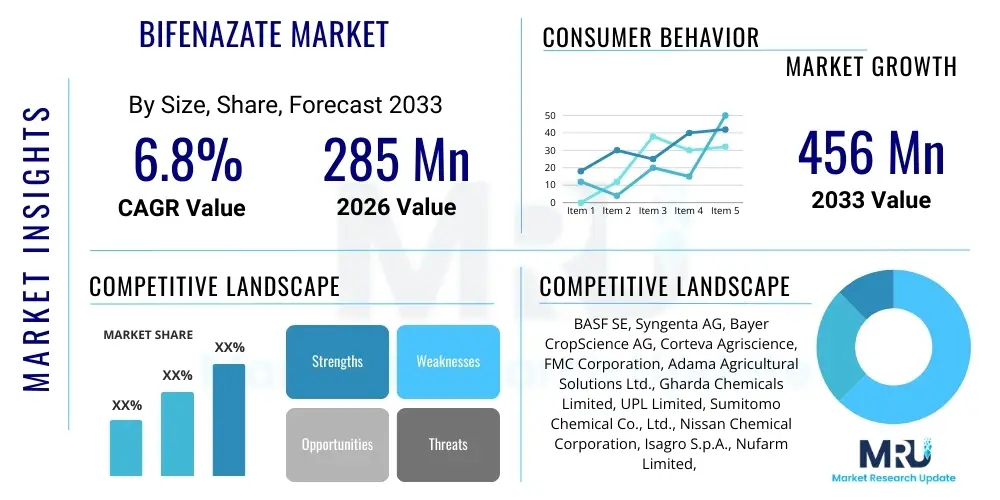

The Bifenazate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 285 million in 2026 and is projected to reach USD 456 million by the end of the forecast period in 2033.

Bifenazate Market introduction

Bifenazate is a highly selective, non-systemic acaricide primarily utilized in agricultural settings globally for the effective control of various economically damaging mite species, notably including the two-spotted spider mite (Tetranychus urticae), European red mite (Panonychus ulmi), and cyclamen mite (Steneotarsonemus pallidus). It is highly valued for its distinct mode of action, which involves inhibiting the function of gamma-aminobutyric acid (GABA) receptors in the mite nervous system. This results in rapid knockdown and provides excellent long residual control across all mobile life stages of mites (larvae, nymphs, and adults), while crucially maintaining minimal toxicity to beneficial insects, including pollinators and predatory mites, positioning it as an cornerstone component in sophisticated Integrated Pest Management (IPM) programs. The primary commercial formulations of bifenazate include wettable powders (WP), suspension concentrates (SC), and emulsifiable concentrates (EC), allowing for tailored application across diverse high-value cropping systems globally.

The product's exceptional efficacy and safety profile make it indispensable across a wide spectrum of horticultural crops. Major applications span high-value sectors such as vineyards, stone and pome fruit orchards (apples, peaches, pears), citrus groves, greenhouse production systems (tomatoes, peppers, flowers), and soft fruit cultivation (strawberries, raspberries). Bifenazate offers profound benefits to the agricultural industry, translating directly into superior crop quality, preservation of yield, and substantial reduction in economic losses caused by severe mite infestations. Its rapid activity, often observable within 24 to 72 hours of application, is highly critical for rescuing crops under heavy infestation pressure. Furthermore, its crucial role in managing chemical resistance development—a rampant issue with older, conventional miticides—ensures its sustained demand and integration into modern crop rotation schedules, driving its continuous market penetration in intensive agricultural zones.

The expansion of the Bifenazate market is fundamentally driven by several macro-environmental and industry-specific factors. Key drivers include the escalating global consumer demand for cosmetically perfect and high-quality fruits and vegetables, which necessitates meticulous, high-performance pest control. This is compounded by the increasing global adoption and refinement of IPM strategies, which favor selective compounds that minimize environmental impact. Moreover, the observed impacts of global climate change, manifesting as extended growing seasons and favorable conditions for rapid mite proliferation, lead to more persistent and severe infestations, thus amplifying the requirement for reliable acaricidal intervention. Additionally, the continuous retirement and stringent regulatory phasing out of older, broad-spectrum pesticides by environmental agencies worldwide creates a regulatory push factor, compelling growers to transition to safer, modern alternatives such as bifenazate, thereby securing its positive market trajectory throughout the forecast period.

Bifenazate Market Executive Summary

The global Bifenazate market is poised for significant expansion, underpinned by essential shifts in agricultural practices toward sustainability and precision. Current business trends indicate a concentrated effort by major agrochemical multinational corporations to solidify their market dominance through securing favorable regulatory approvals in high-growth regions, particularly Asia Pacific (APAC) and Latin America (LATAM). Strategic movements include focused investment in formulation research to develop enhanced, rain-fast, and photostable delivery systems, such as microencapsulation, designed to maximize residual efficacy and minimize environmental runoff. Furthermore, market participants are increasingly leveraging digital agricultural platforms and predictive analytics to offer value-added advisory services, ensuring optimized and resistance-minimizing usage protocols, thereby integrating the product more deeply into the digital farming ecosystem.

Regionally, the market exhibits a clear bifurcation: maturity and high technological adoption in North America and Europe, versus rapid volume-driven growth in emerging economies. APAC remains the primary engine of global demand and production, characterized by large-scale, labor-intensive horticulture in economies like China and India, where favorable climates lead to persistent pest pressure and necessitate year-round chemical control. Conversely, North America maintains high market value despite slower volume growth, driven by stringent quality standards for high-value export crops and a commitment to advanced, targeted application techniques mandated by sophisticated IPM systems. LATAM is rapidly transforming into a major consumption hub, fueled by expanding commodity crops, burgeoning greenhouse sectors, and increasing farmer awareness regarding the need for modern, rotational chemistries to manage difficult pests like spider mites effectively.

Segmentation analysis confirms the overwhelming market preference for liquid formulations, specifically suspension concentrates (SC), due to their superior stability, handling convenience, and compatibility with modern mechanized spray equipment used in large-scale operations. The fruit and vegetable segment continues to be the most critical end-use category, commanding the largest market share, directly correlating with the high susceptibility and economic criticality of these crops to mite damage. A parallel and notable trend is the accelerated growth of the ornamental and turf segment, where absolute aesthetic perfection is required, driving demand for selective and highly reliable miticides like bifenazate. This segment requires tailored marketing and distribution strategies focused on professional landscape managers and specialized greenhouse nurseries, often demanding smaller pack sizes and specific residue profiles suitable for non-food applications and highly sensitive plant species.

AI Impact Analysis on Bifenazate Market

The analysis of common user queries regarding the influence of Artificial Intelligence (AI) on the Bifenazate market reveals a strong consensus on the desire for predictive, precise, and sustainable application methodologies. Users are most frequently asking how AI can utilize complex datasets—including localized weather patterns, historical pest pressure records, satellite spectral imagery, and crop phenology—to accurately forecast the emergence and population density of target mites, thereby optimizing the exact moment for bifenazate application. Key concerns revolve around the reliability and accessibility of these AI tools for small and medium-sized farming operations, and the ability of AI models to effectively track and recommend rotation strategies that proactively combat acaricide resistance, ensuring the longevity of bifenazate as a valuable tool. Expectations are high that AI integration will fundamentally transform bifenazate from a reactive chemical input into a precision-managed component of a digitized, integrated crop protection strategy.

AI technology is currently exerting a transformative influence on the Bifenazate value chain, particularly in enhancing decision-making processes related to application timing and dosage determination. Machine Learning algorithms are employed to analyze field-scouting data collected via high-throughput sensors, drones, and fixed ground stations. These models create dynamic, real-time risk maps that pinpoint areas of elevated mite infestation, allowing farmers to shift from prophylactic, field-wide applications to highly localized, demand-driven treatments. This precision minimizes the total volume of bifenazate needed, significantly reducing input costs, lowering the overall chemical burden on the environment, and critically, decreasing the selection pressure that drives resistance development. The capacity of AI to process non-linear, multifaceted agronomic data far exceeds human capabilities, leading to actionable insights that maximize the efficacy of bifenazate.

The integration of AI is further manifesting through the automation of quality assurance and supply chain logistics within the agrochemical sector. AI systems are used by manufacturers to optimize batch quality control during the synthesis and formulation of bifenazate, ensuring high-purity technical grade material and stable commercial products. Downstream, predictive logistics models, informed by AI-driven regional pest forecasts, optimize the distribution of bifenazate to local retail points, ensuring timely availability during peak demand cycles corresponding to predicted mite outbreaks. This robust optimization, from manufacturing consistency to precise application in the field, elevates the overall utility and perceived value of bifenazate within the highly competitive crop protection market, solidifying its position as a key component in technologically advanced agricultural systems.

- Implementation of AI-driven predictive modeling for mite population dynamics, allowing for optimal, highly targeted timing of bifenazate treatments.

- Integration of machine vision and deep learning algorithms for automated detection and spatial mapping of initial mite infestations via drone and sensor imagery.

- Utilization of AI platforms to track and recommend customized resistance management protocols, ensuring effective rotation of bifenazate with alternate chemistries.

- Enhancement of Variable Rate Technology (VRT) sprayers through AI mapping, leading to optimized dosage delivery and significant reduction in overall chemical volume usage.

- AI-based optimization of agrochemical supply chain logistics, aligning product inventory with forecasted regional pest pressure and seasonal application windows.

DRO & Impact Forces Of Bifenazate Market

The Bifenazate market operates under the influence of strong Drivers (D), significant Restraints (R), clear Opportunities (O), which together define the core Impact Forces. A primary driver is the pervasive, worldwide push towards Integrated Pest Management (IPM), compelling growers to adopt selective acaricides like bifenazate due to their favorable toxicological profile toward beneficial insects and non-target organisms. Furthermore, global intensification of horticulture—especially in crops highly susceptible to quality-damaging mites such as strawberries and grapes—increases the inherent economic reliance on effective, fast-acting solutions. Conversely, the market faces headwinds from regulatory restraints, primarily the stringent establishment and continuous reduction of Maximum Residue Limits (MRLs) in key export markets, which can limit application flexibility. The overarching opportunity lies in leveraging proprietary formulation technology and digital integration to improve efficacy and compliance, effectively navigating the regulatory landscape and resistance challenges.

Specific driving forces are substantially augmented by environmental factors. Changing global climate patterns have extended the active season and increased the reproductive rates of many mite species, leading to higher population densities and sustained pest pressure across broader geographical areas, necessitating increased frequency or intensity of effective acaricide applications. Bifenazate’s superior ability to provide residual control under these harsh conditions makes it a highly preferred agent over older compounds requiring frequent reapplication. Additionally, heightened public and commercial scrutiny regarding food safety and environmental stewardship reinforces the demand for modern, lower-risk chemistries. This regulatory and social pressure acts as a powerful catalyst, accelerating the replacement cycle of older, broad-spectrum miticides with targeted, selective options like bifenazate across all major agricultural jurisdictions globally.

Despite the powerful drivers, several restraints pose significant challenges to market potential. Foremost among these is the critical issue of pest resistance; while bifenazate possesses a unique mode of action, continuous or improper usage inevitably leads to selection pressure, reducing its long-term viability if resistance develops rapidly within local mite populations. This necessitates substantial investment in grower education and rotational product development, incurring significant commercial costs. Furthermore, the inherent capital intensity and time-consuming nature of obtaining new regulatory registrations for agrochemicals, particularly in regions with complex environmental assessment requirements such as the European Union (EU), restrict the swift introduction of new bifenazate products or expanded crop uses, thus slowing market growth potential. Exploiting opportunities in specialized, niche markets—such as bio-based agriculture integration and developing co-formulations with biopesticides—is critical for overcoming these structural constraints.

Segmentation Analysis

Detailed segmentation of the Bifenazate market provides crucial insights into product penetration, application preferences, and major revenue streams. The market is segmented primarily across formulation type, end-use crop category, and geographic region, reflecting the diversity of global agricultural practices. Segmentation by formulation highlights a strong market preference for liquid forms, specifically Suspension Concentrates (SC) and Emulsifiable Concentrates (EC). These liquid systems facilitate efficient mixing, optimal uniform coverage through spray equipment, and enhanced stability in the tank mix, critical factors for maximizing biological efficacy in large-scale mechanized farming environments, ensuring the SC segment maintains significant dominance over traditional Wettable Powders (WP) across high-tech agricultural zones.

Analysis of the end-use market confirms that the Fruits and Vegetables segment remains the paramount revenue generator for bifenazate consumption. This dominance stems from the high economic value of these perishable crops and their inherent vulnerability to mite infestations, where even minor cosmetic damage significantly reduces market value. Key crop areas include perennial crops such as grapes, tree nuts, and pome fruits, which require season-long mite management due to continuous infestation cycles. However, the Ornamental and Turf segment is projected to show accelerated growth; demand in this sector is driven by the zero-tolerance policy for blemishes in professional floriculture and highly managed landscapes (like golf courses), demanding the reliability and fast-acting nature provided by bifenazate formulations specifically designed for non-food applications.

Further segmentation by mode of action is straightforward, classifying bifenazate strictly as a contact acaricide, reinforcing the necessity for thorough spray coverage during application—a critical factor influencing formulation development and sprayer technology choices made by the end-user. Geographic segmentation is perhaps the most dynamic, differentiating mature, regulation-driven markets (North America, Europe) from high-volume, rapid-growth markets (Asia Pacific, Latin America). Understanding these regional variances, including differing pest complexes, climate-driven application frequencies, and local regulatory requirements (e.g., specific MRLs), is essential for major market players to tailor marketing, pricing, and distribution strategies effectively. The continuous technological refinement of SC formulations, ensuring stability under varying climate extremes, remains a key driver within the formulation segment competition.

- By Formulation:

- Wettable Powder (WP): Highly stable, suitable for specific applications and smaller farmers.

- Suspension Concentrate (SC): Dominant liquid form, valued for ease of mixing, handling, and high dispersion stability.

- Emulsifiable Concentrate (EC): Offers efficient coverage and strong penetration on leaf surfaces.

- Others (e.g., Water-Dispersible Granules): Niche use, focusing on handling safety and reduced dust.

- By Crop Type (Application):

- Fruits and Vegetables (Pome, Citrus, Grapes, Berries, etc.): Largest segment, driven by high economic value and susceptibility.

- Ornamental and Turf: High-growth niche requiring aesthetic perfection and low phytotoxicity.

- Field Crops (e.g., Cotton, Soybeans - niche use): Used primarily in localized or severe outbreak scenarios.

- Tree Nuts: Critical application area for perennial mite control in orchards.

- By Mode of Action:

- Contact Acaricide: Requires thorough coverage for maximum efficacy, influencing application technology.

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Bifenazate Market

The value chain for the Bifenazate market initiates with the highly specialized and integrated Upstream activities involving the synthesis of its complex active ingredient. This phase requires proprietary chemical processes to manufacture the technical grade active ingredient (TGAI), relying on the stable sourcing of specialized petrochemical intermediates. Manufacturers must adhere to rigorous global quality and purity standards, often demanding significant capital investment in reaction technology and continuous quality monitoring to ensure the synthesized product meets international regulatory specifications. The successful management of this upstream segment is foundational, as raw material costs and production efficiencies directly dictate the final price point and global competitive position of the subsequent formulated product, requiring long-term supply agreements and intellectual property protection.

Midstream processing focuses on the crucial step of Formulation, where the raw TGAI is converted into marketable products like Suspension Concentrates (SC) or Wettable Powders (WP). This involves combining the active ingredient with specialized inert components—such as emulsifiers, dispersants, wetting agents, and stabilizers—to create a product that is safe, effective, easy to use, and stable under diverse environmental conditions. Formulations are customized based on target crop, application method, and regional climatic requirements (e.g., formulations optimized for high heat or stability in hard water). Failure in formulation stability can lead to poor field performance, residue issues, or application problems, highlighting the technical complexity of this phase, which is a major focus area for R&D spending among key market players seeking differentiated product performance.

Downstream activities center on Distribution, Marketing, and End-User support. The distribution channel is typically multi-layered, combining direct sales to large corporate farms or national distributors with indirect channels utilizing regional dealers and local agricultural retailers. This network not only handles the physical flow of the product but, crucially, provides necessary localized agronomic advice, technical training, and integrated pest management recommendations to farmers, particularly regarding rotational use to prevent resistance. Effective downstream logistics, including managing inventory based on seasonal demand forecasts and ensuring compliance with local labeling requirements, are essential for securing final market penetration and grower loyalty. The effectiveness of the advisory services offered by distributors directly impacts the success of bifenazate in complex agricultural environments.

Bifenazate Market Potential Customers

The core potential customers for Bifenazate are professional agricultural enterprises engaged in the intensive production of high-value crops susceptible to debilitating mite damage. This includes commercial vineyard operators, large-scale pome and citrus fruit growers, specialized soft fruit farmers (e.g., strawberries, blueberries), and professional tree nut cultivators (almonds, walnuts). These customers are typically characterized by high technical proficiency, strong adherence to export market regulations (especially MRLs), and a fundamental reliance on IPM protocols. They prioritize selective acaricides like bifenazate because it integrates well with the use of beneficial insects for biological control, maximizing the return on investment in pest management while safeguarding their ability to access high-premium international markets that demand minimal chemical residues.

A secondary, yet rapidly expanding, customer base comprises commercial greenhouse and nursery operations. These controlled environment agriculture (CEA) enterprises, focused on high-density production of ornamental flowers, foliage plants, and off-season specialty vegetables, require exceptionally high standards of pest control to prevent crop loss, where cosmetic defects are intolerable. The use of bifenazate in greenhouses is valuable due to its excellent efficacy in confined spaces and its comparatively low volatility and minimal impact on beneficials used in CEA systems. These customers often require specialized, smaller-volume packaging and detailed instructions for use within recirculating water systems and other sensitive environmental controls common in modern greenhouses, making them a distinct and profitable niche segment.

Furthermore, large agricultural cooperatives and buying groups form a significant customer segment by aggregating demand from multiple small and medium-sized farmers. These entities focus on securing favorable bulk pricing, reliable supply contracts, and comprehensive technical training packages to disseminate to their members. While their primary objective is cost efficiency, the cooperative model increasingly emphasizes sustainability, pushing for the selection of high-performing, selective chemistries like bifenazate that offer long residual activity and contribute to sustainable farming certifications. Successful engagement with this customer segment requires manufacturers to offer scalable solutions, robust logistical support, and tailored educational programs focused on responsible resistance management practices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 285 Million |

| Market Forecast in 2033 | USD 456 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Syngenta AG, Bayer CropScience AG, Corteva Agriscience, FMC Corporation, Adama Agricultural Solutions Ltd., Gharda Chemicals Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Nissan Chemical Corporation, Isagro S.p.A., Nufarm Limited, Lier Chemical Co., Ltd., SinoHarvest Corporation, Jiangsu Good Harvest-Weien Agrochemical Co., Ltd., Willowood Limited, Hunan Haili Chemical Co., Ltd., Kenso Corporation, United Phosphorus (UPL), Zhejiang Wynca Chemical Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bifenazate Market Key Technology Landscape

The technological evolution within the Bifenazate market is concentrated on sophisticated formulation chemistry and the integration of digital application methods to enhance biological efficacy and sustainability metrics. A major area of innovation is the shift towards advanced proprietary formulation technologies, specifically focusing on microencapsulation. This technique involves coating the bifenazate active ingredient with inert polymers, which creates a protective barrier. This technological advance is crucial for extending the residual activity of the acaricide, protecting the active ingredient from rapid degradation caused by ultraviolet light (photolysis) and rain wash-off, thereby reducing the need for repeat applications and optimizing product longevity in the field. Concurrently, nano-emulsion technology is being explored to create extremely fine particle dispersions, ensuring superior coverage and penetration of the chemical into hard-to-reach areas on the leaf surface, which is essential for maximizing control of mites that hide in crevices or dense foliage.

Another pivotal technological trend involves the development of synergistic co-formulations. Recognizing the persistent threat of mite resistance, manufacturers are investing heavily in research to combine bifenazate, which acts on GABA receptors, with other active ingredients that possess distinctly different modes of action (MoAs), such as METI (Mitochondrial Electron Transport Inhibitor) acaricides or ovicides. The technological challenge is formidable, requiring extensive stability testing and chemical compatibility assessment to ensure that the combined formulation remains effective, stable, and retains the selective profile of bifenazate towards beneficial insects. These novel, multi-MoA products represent a technological safeguard, offering growers an enhanced tool for proactive resistance management and delivering broader-spectrum control against complex mite infestations within a single product application, thereby simplifying farm operational management.

Beyond molecular and formulation science, the application technology landscape is rapidly digitizing. Precision agriculture tools, including high-resolution sensor-equipped drones and sophisticated ground-based Variable Rate Technology (VRT) sprayers, are increasingly used to deliver bifenazate with unprecedented accuracy. These systems utilize data processed by AI to create precise field maps, ensuring that the product is applied only to the specific plant clusters or zones where mite infestation density exceeds an established economic threshold. This technological convergence minimizes chemical usage across the entire farm operation, aligning with global sustainability goals and regulatory pressure to reduce overall pesticide load. Furthermore, the development of specialized drone-compatible, ultra-low volume (ULV) bifenazate formulations is a key area of R&D, aimed at enabling efficient, targeted treatment in high-canopy crops such as orchards and vineyards where conventional spraying is challenging and resource-intensive.

Regional Highlights

The market trajectory for Bifenazate is strongly differentiated by regional agricultural economics and regulatory frameworks. Asia Pacific (APAC) stands as the undisputed leader in both consumption volume and growth rate. This dominance is attributable to the vast agricultural land dedicated to intensive, high-yield cultivation of fruits, vegetables, and ornamental crops, particularly in economic powerhouses like China, which is the world's largest producer of fruits, and India. The warm, often humid climates across much of Southeast Asia and South Asia provide ideal conditions for multiple generations of mites throughout the year, sustaining exceptionally high demand for persistent and effective acaricides. Furthermore, government initiatives promoting advanced agricultural technology and increasing farmer access to modern agrochemicals are solidifying APAC's role as the central driver of global bifenazate market growth.

North America and Europe constitute highly mature and valuable markets, characterized by stringent quality controls, sophisticated application technology, and deep integration of IPM. In North America, demand is particularly high in specialty crop regions such as California (almonds, grapes, citrus) and Florida (citrus, vegetables), where the industry faces chronic challenges from resistant mite populations, making bifenazate's unique mode of action indispensable for rotational strategies. The European market, despite having some of the world's strictest regulations on agrochemical use (driven by the Green Deal policies and continuous MRL pressure), maintains a strong demand, primarily concentrated in Southern European horticulture (Spain, Italy) and the highly advanced greenhouse sector (Netherlands). Here, bifenazate's proven selectivity toward beneficial biological control agents gives it a critical competitive edge over broad-spectrum rivals.

Latin America (LATAM), spearheaded by Brazil, Argentina, and Mexico, is rapidly emerging as a high-potential market. Growth is fueled by the expansion and modernization of high-value export-oriented agriculture, including perennial crops such as coffee, citrus, and table grapes, which frequently experience high seasonal mite pressure characteristic of tropical and subtropical zones. Economic stability and the increased professionalization of farming operations are accelerating the transition from generic or outdated pest management practices toward advanced, proprietary solutions like bifenazate, promising a robust increase in market share throughout the forecast period. The Middle East and Africa (MEA) currently represent a smaller yet developing market, with growth concentrated in technologically advanced farming hubs in South Africa and Egypt, driven primarily by export requirements that necessitate the use of MRL-compliant, effective crop protection solutions.

- Asia Pacific (APAC): Largest market share; highest volume consumption and fastest growth; driven by intensive horticulture in China, India, and favorable climates ensuring year-round pest pressure.

- North America: Mature, high-value market; demand centered on rotational resistance management and premium specialty crops (nuts, grapes, pome fruits); high adoption of precision application technology.

- Europe: Highly regulated market; usage sustained by need for selectivity (compatibility with biocontrol) and adherence to strict Maximum Residue Limits (MRLs) in high-value greenhouse and soft fruit sectors.

- Latin America (LATAM): Strong emerging growth potential; modernization of large-scale agriculture, particularly citrus and berry farms, facing persistent seasonal mite outbreaks.

- Middle East and Africa (MEA): Niche, developing markets; driven by export-focused agriculture demanding MRL compliance, contingent on regional agricultural infrastructural investment and water management capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bifenazate Market.- BASF SE

- Syngenta AG

- Bayer CropScience AG

- Corteva Agriscience

- FMC Corporation

- Adama Agricultural Solutions Ltd.

- Gharda Chemicals Limited

- UPL Limited

- Sumitomo Chemical Co., Ltd.

- Nissan Chemical Corporation

- Isagro S.p.A.

- Nufarm Limited

- Lier Chemical Co., Ltd.

- SinoHarvest Corporation

- Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

- Willowood Limited

- Hunan Haili Chemical Co., Ltd.

- Kenso Corporation

- United Phosphorus (UPL)

- Zhejiang Wynca Chemical Group

Frequently Asked Questions

Analyze common user questions about the Bifenazate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Bifenazate used for and how does it function in crop protection?

Bifenazate is a selective, non-systemic acaricide primarily used to control destructive mite species, such as spider mites, across a wide range of high-value crops including fruits, vegetables, and ornamentals. It functions by inhibiting GABA receptors in the nervous system of mites, leading to rapid knockdown and excellent residual control, making it highly effective for resistance management.

What are the primary drivers of growth for the Bifenazate Market?

Key drivers include the global adoption of Integrated Pest Management (IPM) strategies, which favor selective chemistries; the increasing incidence and severity of mite infestations due to climatic changes; and the sustained demand for high-quality, residue-compliant horticultural products globally.

How does the Bifenazate market address the issue of pest resistance?

Bifenazate addresses resistance by having a unique mode of action distinct from older acaricide classes. It is recommended for use in rotation programs with other chemistries and increasingly incorporated into co-formulations to prevent over-reliance and delay the development of resistance in target mite populations, ensuring long-term product efficacy.

Which geographical region holds the largest market share for Bifenazate?

The Asia Pacific (APAC) region currently holds the largest market share, driven by extensive high-value crop production in countries like China and India, high pest pressure due to favorable climates, and increasing technological adoption in mechanized and intensive agriculture systems.

What is the impact of AI and digital technology on Bifenazate application?

AI impacts the market by enabling precision agriculture techniques, including predictive modeling for infestation outbreaks and automated scouting using machine vision. This integration leads to optimized application timing, highly specific dosage reduction, and enhanced targeting of bifenazate, significantly improving overall field efficiency and environmental sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager