Big Wheel BMX Bike Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441580 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Big Wheel BMX Bike Market Size

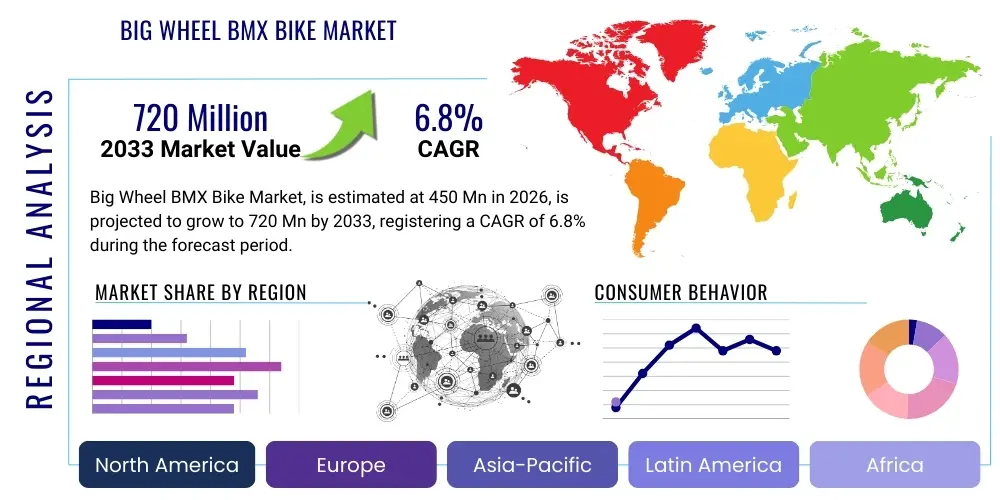

The Big Wheel BMX Bike Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the increasing adoption of cycling as a lifestyle choice, particularly among adult enthusiasts seeking a blend of nostalgia and contemporary performance associated with oversized BMX platforms.

The market expansion is underpinned by demographic shifts, specifically the rising purchasing power of Millennials and Gen Z who prioritize unique and customized recreational equipment. Big wheel BMX bikes (typically 24-inch, 26-inch, and 29-inch models) bridge the gap between traditional 20-inch BMX bikes used for highly technical tricks and larger mountain or road bikes, offering enhanced stability and cruising comfort while retaining the robust, aggressive aesthetic of BMX culture. Furthermore, continuous innovation in frame materials, including lightweight aluminum alloys and advanced chromoly steel, contributes to their appeal by improving durability and reducing overall weight, making them suitable for commuting, urban exploration, and light stunt riding.

Geographical market analysis indicates that North America and Europe currently hold the largest market shares due to established cycling infrastructure, high consumer awareness, and the pervasive influence of urban cycling trends and cultural movements. However, the Asia Pacific region, led by rapidly urbanizing economies like China and India, is expected to exhibit the highest CAGR during the forecast period. This accelerated growth is driven by rising disposable incomes, increasing awareness of cycling as a fitness activity, and the growing prominence of youth culture heavily influenced by Western extreme sports aesthetics, making the distinctive large-format BMX bike a status symbol and performance tool.

Big Wheel BMX Bike Market introduction

The Big Wheel BMX Bike Market encompasses the manufacturing, distribution, and sales of BMX-style bicycles featuring larger wheel sizes, typically ranging from 24 inches to 29 inches, a significant departure from the traditional 20-inch standard. These products, often categorized as "Cruiser BMX" or "BMX 29er," cater primarily to adult riders seeking increased stability, rolling speed, and comfort over longer distances while maintaining the aesthetic and component ruggedness inherent to BMX design. Product descriptions emphasize durable frame construction (often chromoly or high-tensile steel), robust gearing (if applicable), and geometry optimized for cruising, wheelies, and street riding, differentiating them distinctly from competitive racing or freestyle trick bikes.

Major applications for big wheel BMX bikes include urban commuting, recreational cycling, fitness and leisure riding, and participation in specific cultural trends such as "seeding" or organized street rides where bike aesthetics and handling are paramount. The inherent benefits include improved ergonomic suitability for taller or older riders, superior obstacle clearance, and reduced rider fatigue compared to smaller BMX variants. Furthermore, these bikes offer a nostalgic appeal, attracting riders who grew up with traditional BMX but now require a larger, more practical form factor for modern riding demands. The versatility allows riders to transition seamlessly between neighborhood cruising and light park riding, boosting consumer uptake across various demographics.

Driving factors propelling this market include the global increase in health and wellness awareness, pushing consumers toward active transportation alternatives, and the specific rise of cycling as a favored recreational and hobby activity post-pandemic. Significant marketing efforts by manufacturers leveraging social media influencers and collaborations with cycling culture icons further elevate brand visibility and desirability. Furthermore, customization and aftermarket modification trends are particularly strong in this segment; riders frequently upgrade components like handlebars, tires, and seats, creating a robust ecosystem for ancillary parts suppliers and driving continuous sales cycles within the core market.

Big Wheel BMX Bike Market Executive Summary

The Big Wheel BMX Bike Market is undergoing robust expansion, characterized by strong consumer interest in niche cycling segments that blend performance with lifestyle aesthetics. Business trends indicate a focus on premiumization, with manufacturers increasingly offering high-spec models featuring hydraulic disc brakes, specialized lightweight alloys, and high-performance tires, commanding higher average selling prices and improving overall market revenue. Consolidation among smaller, specialized brands and larger bicycle conglomerates is noted, aiming to streamline supply chains and enhance global distribution reach. Key strategic decisions revolve around developing unique geometry optimized for adult street performance and leveraging direct-to-consumer (D2C) channels to bypass traditional retail markups and build direct community engagement with enthusiasts.

Regional trends highlight North America’s dominance, particularly within the United States, driven by significant participation in street riding culture and high discretionary spending on customized bicycles. Europe shows consistent growth, focusing on sustainable urban mobility where these durable bikes find a niche use case. The Asia Pacific region is forecast to be the fastest-growing market segment, fueled by rising middle-class populations in China, Southeast Asia, and India, who are increasingly adopting cycling for recreation and short commutes. Manufacturers are adapting product lines to suit regional preferences, such as integrating features suitable for varied terrain and complex urban environments, alongside localized marketing campaigns emphasizing cultural relevance.

Segment trends underscore the popularity of the 29-inch wheel size, which offers maximum speed and stability, making it the most dominant category by revenue. The Chromoly Steel segment remains crucial due to its excellent strength-to-weight ratio and traditional BMX feel, though aluminum alloy usage is rising, driven by cost-effectiveness and weight reduction demands. The enthusiast segment, defined by consumers willing to pay premium prices for highly customized or limited-edition models, drives innovation and market visibility. E-commerce distribution channels continue to gain market share over traditional bike shops, offering broader selection, comparative pricing, and greater convenience for the technically savvy consumer base.

AI Impact Analysis on Big Wheel BMX Bike Market

User questions regarding the impact of Artificial Intelligence (AI) on the Big Wheel BMX Bike Market generally center on manufacturing efficiency, personalized bicycle design, and optimized supply chain management. Consumers often inquire about whether AI can lead to "perfectly fitted" bikes using predictive ergonomic modeling, or if AI-driven diagnostics will revolutionize bike maintenance. Manufacturers, conversely, are concerned with using AI for predictive maintenance in factory machinery, optimizing inventory based on real-time cultural trends detected across social media, and improving the efficiency of global logistics planning to meet volatile consumer demand cycles. The consensus expectation is that AI will primarily be an invisible backend tool, enhancing customization speed and reducing manufacturing waste, rather than directly influencing the rider's experience, though AI-driven component material simulations could lead to stronger, lighter frames.

The core theme emerging from these inquiries is the desire for hyper-personalization in a market traditionally driven by fixed frame geometries. AI algorithms can analyze vast datasets of rider characteristics, riding styles, and anthropometric data to recommend or even design optimal frame sizes, component specifications (like crank arm length, handlebar rise), and material selections, minimizing fitting errors and maximizing rider performance and comfort. This transition from standardized sizing to data-driven customization represents a significant evolution in product development. Furthermore, AI tools are expected to drastically improve predictive demand forecasting, especially concerning limited-edition colorways or culturally relevant component styles, helping brands avoid costly overstocking or stock-outs which are common in fashion-driven markets.

Although AI’s direct impact on the physical bike itself is limited—as the core product remains fundamentally mechanical—its influence on the entire value chain is transformative. From intelligent robotic welding systems in fabrication that ensure consistent structural integrity, to sophisticated chatbot interfaces providing 24/7 customer support and parts identification, AI enhances operational efficiency and customer engagement. For competitive advantage, companies are exploring machine learning to analyze warranty claims and field failure reports, quickly identifying component weaknesses and rapidly iterating designs for improved longevity and reliability, essential features for the rugged demands placed on Big Wheel BMX frames and components.

- AI-driven optimization of manufacturing processes, improving weld quality and material utilization in frame production.

- Predictive inventory management based on analysis of social media trends and regional demand fluctuations.

- Enhanced customer personalization through AI-based ergonomic fit modeling and component recommendations.

- Development of advanced materials via machine learning simulations for lighter and stronger components (e.g., carbon fiber layup optimization).

- Automated quality control systems (visual inspection via AI) reducing defects in high-volume assembly lines.

- AI-powered logistics and supply chain efficiency, reducing lead times for custom component sourcing.

DRO & Impact Forces Of Big Wheel BMX Bike Market

The Big Wheel BMX Bike Market is propelled by significant drivers, notably the cultural resurgence of urban cycling and the increasing consumer preference for highly durable, low-maintenance bikes suitable for diverse applications, from commuting to recreational street riding. The primary restraint is the higher initial cost compared to standard bicycles or traditional 20-inch BMX bikes, which can deter budget-conscious consumers. Opportunities arise from expanding into emerging markets, developing electric-assist versions (E-BMX Cruisers), and capitalizing on the aftermarket customization sector which drives high-margin parts sales. The market is subject to impact forces primarily related to fluctuating raw material prices, particularly steel and aluminum, and regulatory shifts concerning urban cycling infrastructure and safety standards in key regional markets.

Key drivers include the global fitness trend, encouraging outdoor activities, and the specific influence of cycling communities that organize large-scale rides and events, boosting the visibility and desirability of these distinctive bikes. Furthermore, the robust, simplistic design appeals to consumers seeking reliability without complex mechanical systems, contrasting sharply with high-maintenance road or mountain bikes. Restraints often involve issues of logistics and distribution; the larger dimensions of big wheel bikes increase shipping costs, particularly for international D2C sales. Competition from established categories, such as hybrid bikes and entry-level mountain bikes that offer similar cruising capabilities at comparable price points, also acts as a constraint, forcing BMX brands to constantly innovate on aesthetics and brand loyalty.

Impact forces stemming from technology adoption, particularly the integration of high-performance brake systems (like four-piston hydraulic disc brakes) and durable, specialized tire compounds tailored for asphalt, continually reshape consumer expectations. Economic impact forces, such as currency volatility and inflation affecting component costs sourced globally, necessitate sophisticated hedging strategies for major manufacturers. The powerful cultural impact force of celebrity endorsements and highly viral street riding videos cannot be overstated; these factors often create rapid, localized demand spikes for specific models or limited-edition runs, requiring agile and responsive manufacturing capabilities to capitalize on ephemeral trends and maintain market relevance in a fast-moving consumer goods environment.

Segmentation Analysis

The Big Wheel BMX Bike Market is meticulously segmented based on Wheel Size, Frame Material, Application, and Distribution Channel, allowing for precise targeting of niche consumer groups and tailored product development strategies. Wheel Size segmentation (24-inch, 26-inch, 29-inch) directly correlates with rider height and intended use; 29-inch models dominate for cruising speed and stability, while 24-inch models often retain more maneuverability suitable for light park use. Frame Material—Chromoly Steel, Aluminum Alloy, and High-Tensile Steel—drives pricing and durability, with Chromoly generally preferred by enthusiasts for its unique ride feel and resilience, despite being heavier than aluminum. Application segmentation differentiates between recreational riders, commuters, and high-performance street riders, each requiring specific component ruggedness and geometry considerations.

The market's complexity is further managed through segmentation by Distribution Channel, where the rapid expansion of E-commerce contrasts with the traditional role of specialized Independent Bicycle Dealers (IBDs). While IBDs offer valuable expertise and fitting services, online platforms offer greater inventory depth and competitive pricing, particularly for globally recognized brands. Geographic segmentation remains crucial, as riding culture and disposable income vary significantly between North America, Europe, and emerging Asia Pacific markets, influencing demand for premium vs. budget-friendly options. Understanding these micro-segments is vital for manufacturers to allocate marketing spend effectively and optimize production lines for the most profitable variants, ensuring market saturation across diverse consumer needs.

- By Wheel Size:

- 24-inch (Cruiser)

- 26-inch (Mid-Sized)

- 29-inch (Big Ripper/Flagship Models)

- By Frame Material:

- Chromoly Steel (4130)

- Aluminum Alloy

- High-Tensile Steel

- By Application:

- Recreational & Fitness Riding

- Urban Commuting

- Street & Performance Riding

- Leisure and Nostalgia

- By Distribution Channel:

- Online Retail (E-commerce Platforms and D2C Websites)

- Independent Bicycle Dealers (IBDs)

- Specialty Sports Stores

Value Chain Analysis For Big Wheel BMX Bike Market

The value chain for the Big Wheel BMX Bike Market begins with upstream analysis focusing heavily on raw material procurement, primarily high-grade steel (Chromoly 4130) and specialized aluminum alloys for frame and component manufacturing. Upstream activities also include the production of essential components such as specialized large-diameter rims, spokes, hubs, and unique drivetrain components designed for street durability rather than race weight. Key suppliers in the upstream segment are globally specialized foundries and composite material manufacturers, where price stability and quality consistency are critical inputs determining the final product's cost and structural integrity, often sourced from Taiwan, China, and Eastern Europe due to established manufacturing infrastructure.

Downstream analysis encompasses the assembly, branding, marketing, and distribution phases. Manufacturers often perform final assembly and quality checks in key markets to manage localized inventory and reduce import duties on finished goods. Distribution channels are bifurcated: Direct channels involve D2C sales via brand websites, offering higher margins and direct customer data access, but requiring sophisticated logistics networks capable of shipping oversized packages. Indirect channels utilize Independent Bicycle Dealers (IBDs) and large online retailers (like Amazon or specialized sports e-tailers), leveraging their existing reach and customer service capabilities, although this introduces complexity in managing dealer relationships and maintaining brand pricing consistency against competitive online pressure.

The strength of the indirect distribution channel, particularly through IBDs, remains significant for high-end, customized big wheel bikes, as consumers often require professional assembly, fitting advice, and post-sale maintenance services which specialty dealers provide effectively. However, the rapidly growing direct-to-consumer model is reshaping the market landscape by enabling brands to react faster to viral trends and limited-edition product drops. Effective inventory management across both direct and indirect channels, coupled with robust logistics planning to minimize transit damage and cost, defines competitive success in the downstream segment of this market.

Big Wheel BMX Bike Market Potential Customers

The primary end-users and buyers of Big Wheel BMX Bikes are segmented into several distinct demographics, united by a common appreciation for cycling culture, durability, and a distinctive aesthetic. The largest segment comprises Adult Enthusiasts, typically men aged 25 to 45, who are seeking a performance-oriented cruiser bike combining the nostalgia of childhood BMX with the comfort and stability required for adult physiology. These consumers often have high discretionary income, are active participants in cycling communities, and prioritize premium components and customizable options, driving demand for high-margin 29-inch chromoly models.

A second crucial segment includes Urban Commuters and Recreational Riders who require a robust, reliable, and relatively low-maintenance bike for short to medium-distance travel. For this group, the bikes’ ruggedness, ability to handle poorly maintained urban roads, and distinctive appearance are major selling points. They often opt for mid-range aluminum alloy models (26-inch) that balance weight, cost, and durability, and they are less concerned with advanced stunt performance than with reliability and utility, often seeking integrated features like rack mounts or fender compatibility, even if these are aftermarket additions.

A third, rapidly growing customer base is the Gen Z and younger Millennials (18-30) influenced heavily by specific social media trends (e.g., "wheelie culture" or organized street gatherings). These buyers treat the bike as a fashion statement and a vehicle for self-expression, prioritizing specific colorways, limited-edition releases, and brand affiliations over technical specifications alone. This segment is highly responsive to digital marketing and drives rapid spikes in demand for specific models, often utilizing online D2C channels for immediate purchase, making them essential drivers of short-term market vitality and brand relevance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SE Bikes (Advanced Sports International), Mongoose (Dorel Sports), Haro Bikes, Cult Crew, Specialized Bicycle Components, GT Bicycles (Cycling Sports Group), Redline Bicycles (Alta Cycling Group), Subrosa Brand, Kink BMX, Fitbikeco., Sunday Bikes, WeThePeople, Radio Bikes, Volume Bikes, Stolen BMX, Framed Bikes, Collective Bikes, Mafia Bikes, P.K. Ripper, and Eastern Bikes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Big Wheel BMX Bike Market Key Technology Landscape

The technology landscape for the Big Wheel BMX Bike Market, while rooted in mechanical engineering, is progressively integrating modern material science and component advancements traditionally seen in mountain biking. A critical technological shift involves frame construction, where sophisticated heat-treating processes are applied to 4130 Chromoly steel to maximize its strength-to-weight ratio, ensuring durability for high-impact street riding while minimizing unnecessary bulk. Welding techniques, including hydroforming and CNC machining of critical junctions like the head tube and bottom bracket shell, ensure precision geometry and structural consistency. The development of proprietary tube shapes and internal cable routing also enhances the aesthetic appeal and resilience against external damage, features highly valued by the adult enthusiast segment.

Component technology is another key area of innovation. The adoption of high-performance braking systems, specifically four-piston hydraulic disc brakes, represents a significant upgrade from traditional caliper or U-brakes, offering superior stopping power and modulation essential for heavier, faster big wheel models. Furthermore, advanced tire technology is crucial, with manufacturers developing unique rubber compounds and tread patterns optimized for urban asphalt, maximizing grip for quick maneuvers and maintaining durability against punctures. Tubeless-ready setups, borrowed from mountain bike technology, are slowly entering the premium segment, offering reduced rolling resistance and enhanced flat protection, appealing directly to commuting riders.

Digital technology also plays an indirect role, primarily through design and simulation software. Computer-Aided Design (CAD) and Finite Element Analysis (FEA) are routinely used to stress-test virtual frame prototypes under extreme load conditions before physical production. This simulation capability dramatically shortens the development cycle and reduces the risk of structural failures in the final product, allowing manufacturers to push the limits of material thickness and geometry optimization. Additionally, technologies related to anti-corrosion coatings and durable paint finishes are continuously improving to meet consumer demand for long-lasting aesthetic quality, particularly important in bikes exposed to diverse weather conditions and frequent urban abuse.

Regional Highlights

Regional dynamics play a significant role in shaping the demand, design preferences, and market penetration of Big Wheel BMX Bikes globally. North America, particularly the United States, represents the cultural and commercial epicenter of this market segment. The market here is defined by high consumer spending, a strong influence of specific localized street cycling movements (especially in California and the East Coast), and a high demand for high-end, limited-edition models. Key countries like the U.S. drive component innovation and brand visibility due to extensive social media engagement and large organized riding events, making it the most profitable region for premium big wheel products.

Europe demonstrates consistent, stable growth, driven by a combination of recreational cycling interest and the adoption of these robust bikes for urban utility, especially in countries with well-developed cycling infrastructure such as Germany, the Netherlands, and the UK. European consumers often prioritize functional features like lightweight frames suitable for maneuverability in crowded city centers, and reliability for year-round commuting. While the street riding culture exists, the market tends to be more price-sensitive than North America, leading to strong sales of mid-range aluminum and high-tensile steel options, emphasizing durability and value proposition.

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, rising disposable incomes, and the strong influence of Western youth culture and extreme sports media. While infrastructure development is uneven, large urban centers in China, Japan, and Australia show increasing uptake. Local manufacturing capabilities in countries like Taiwan and China also provide a competitive edge in sourcing and production for the global market, though localized consumer preferences often lean toward highly visible, customized aesthetics, creating a significant opportunity for brands that can effectively localize their product offerings and marketing strategies to meet diverse cultural demands across the continent.

- North America (United States, Canada, Mexico): Dominant market share; driven by strong cycling culture, high customization demand, and rapid adoption of 29-inch models; significant presence of key players and robust direct-to-consumer sales.

- Europe (Germany, UK, France, Italy): Stable growth focused on urban commuting and recreational fitness; emphasis on reliable, mid-range models; good cycling infrastructure supports adoption.

- Asia Pacific (China, Japan, Australia, India): Highest projected CAGR; fueled by rapid urbanization and rising middle-class income; potential for large-scale production and increasing consumer interest in Western cycling trends.

- Latin America (Brazil, Argentina): Emerging market driven by affordability and utility; robust demand for durable, entry-level models suitable for challenging urban environments.

- Middle East and Africa (MEA): Niche market focused primarily in urban centers; growth potential linked to infrastructure investment and promotion of leisure cycling activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Big Wheel BMX Bike Market.- SE Bikes (Advanced Sports International)

- Mongoose (Dorel Sports)

- Haro Bikes

- Cult Crew

- Specialized Bicycle Components

- GT Bicycles (Cycling Sports Group)

- Redline Bicycles (Alta Cycling Group)

- Subrosa Brand

- Kink BMX

- Fitbikeco.

- Sunday Bikes

- WeThePeople

- Radio Bikes

- Volume Bikes

- Stolen BMX

- Framed Bikes

- Collective Bikes

- Mafia Bikes

- P.K. Ripper

- Eastern Bikes

Frequently Asked Questions

Analyze common user questions about the Big Wheel BMX Bike market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Big Wheel BMX bike and a standard 20-inch BMX?

The primary distinction is wheel size (24, 26, or 29 inches versus 20 inches), offering Big Wheel BMX bikes superior stability, higher rolling speed, and enhanced comfort over distance, making them better suited for adult riders, cruising, and urban commuting compared to the maneuverability focus of traditional 20-inch stunt bikes.

Which wheel size (24-inch, 26-inch, or 29-inch) is most popular for urban street riding?

The 29-inch Big Wheel BMX bike segment is currently the most popular and fastest-growing for urban street riding, specifically among adult enthusiasts. The larger diameter provides maximum stability, speed, and a distinctive aesthetic highly valued in organized street cycling cultures.

Is Chromoly steel or Aluminum alloy a better frame material for Big Wheel BMX bikes?

Chromoly (4130 steel) is often considered superior by enthusiasts for its tensile strength, excellent durability, and natural shock absorption, providing a classic BMX ride feel. Aluminum alloy offers a lighter frame at a lower cost, appealing more to commuters or budget-conscious buyers, though it typically has a stiffer ride quality.

How significant is the influence of social media on Big Wheel BMX bike purchasing trends?

Social media influence is highly significant, acting as a major market driver. Viral content, influencer endorsements, and documentation of organized street rides create rapid, measurable demand spikes for specific models, colors, and limited-edition releases, often bypassing traditional advertising channels entirely and favoring D2C sales.

What are the main market restraints impacting the growth of the Big Wheel BMX segment?

The main restraints include the relatively high initial price point of quality models compared to entry-level bicycles, making them less accessible to casual buyers, and ongoing volatility in the global supply chain, which affects the cost and availability of key raw materials like steel and specialty components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager