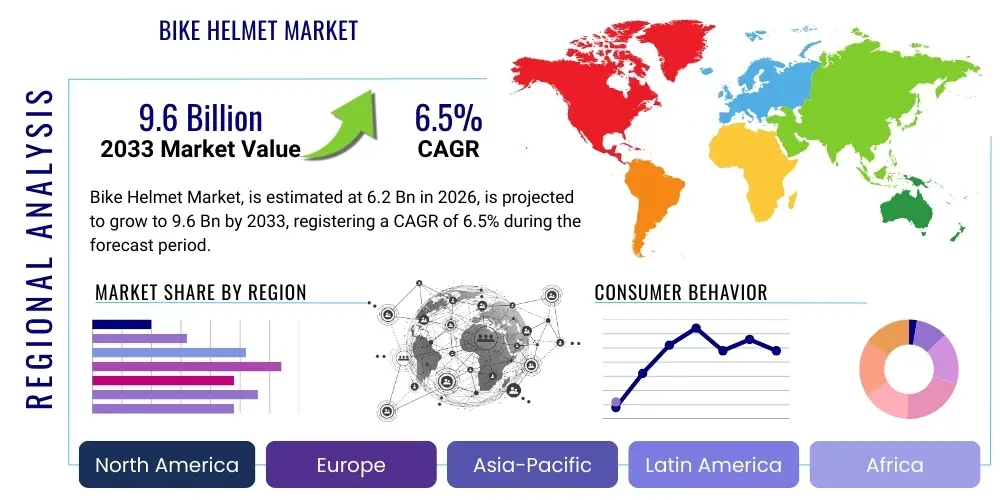

Bike Helmet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443127 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Bike Helmet Market Size

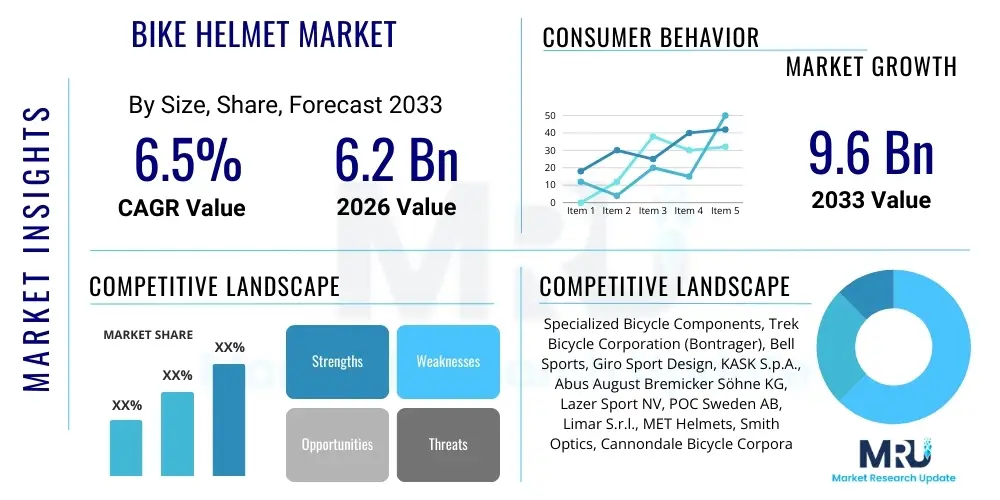

The Bike Helmet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Bike Helmet Market introduction

The Bike Helmet Market encompasses the global production, distribution, and sale of protective headgear designed specifically for cycling activities, ranging from professional racing and mountain biking to urban commuting and recreational use. These products are crucial safety equipment, primarily intended to mitigate the risk and severity of head injuries resulting from falls or collisions. Modern bike helmets are sophisticated products, utilizing advanced materials like expanded polystyrene (EPS) foam, polycarbonate shells, and proprietary rotational impact protection systems (e.g., MIPS), evolving beyond basic protective gear to offer features such as aerodynamics, ventilation optimization, and integrated smart technologies like crash sensors and LED lighting.

The core application of bike helmets spans all facets of cycling, categorized predominantly into Road Helmets (focused on lightweight design and aerodynamics), Mountain Bike (MTB) Helmets (offering greater rear and side coverage and ventilation for low-speed climbs), and Urban/Commuter Helmets (emphasizing visibility, durability, and style). The primary benefit delivered is enhanced cyclist safety, driven by increasingly stringent safety standards and heightened consumer awareness regarding traumatic brain injury prevention. Furthermore, secondary benefits include improved performance through aerodynamic profiling for competitive cyclists and convenience features like magnetic buckle systems for everyday users.

The market growth trajectory is fundamentally driven by several powerful external factors, most notably the global increase in cycling adoption spurred by environmental concerns, the rise of e-bikes which necessitate high-quality protective gear due to increased average speeds, and widespread governmental initiatives promoting cycling infrastructure and mandatory helmet use in certain demographics or regions. Regulatory mandates, particularly in developed economies concerning youth cycling and high-speed e-mobility, provide a stable foundation for demand, while ongoing material innovation focused on improved multi-directional impact protection continuously refreshes the product lifecycle and encourages trade-up among enthusiasts.

Bike Helmet Market Executive Summary

The global Bike Helmet Market is characterized by robust growth, driven by shifting consumer preferences toward active transportation and the rapid proliferation of electric bicycles, which necessitate higher impact standards for head protection. Business trends indicate a strong focus on strategic acquisitions and partnerships aimed at consolidating market share and integrating specialized safety technologies like Multi-Directional Impact Protection System (MIPS) across varied product lines. Leading manufacturers are heavily investing in direct-to-consumer (D2C) channels and digital engagement strategies, optimizing supply chains to respond quickly to seasonal demand fluctuations and regulatory changes, particularly concerning new testing protocols for oblique impacts.

Regionally, the market exhibits dynamic expansion, with Asia Pacific (APAC) emerging as the fastest-growing region due to massive urbanization, increasing disposable incomes, and substantial government investments in smart city infrastructure that prioritize cycling. North America and Europe maintain dominance in terms of value, primarily due to high adoption rates of premium, feature-rich helmets (e.g., smart helmets, specialized racing models) and mature regulatory environments enforcing strict safety standards. However, supply chain volatility, particularly related to the sourcing of advanced polymer compounds and electronic components for smart features, presents an ongoing management challenge for global operations.

Segmentation trends highlight the rapid evolution of the Specialized Helmets segment, encompassing models specifically designed for e-bikes, gravel cycling, and triathlons, demanding bespoke material composition and aerodynamic profiles. Technology adoption is trending heavily toward integrated connectivity, where helmets offer functions such as automatic emergency notifications, built-in indicators, and integrated sound systems, appealing primarily to urban commuters seeking enhanced visibility and utility. Furthermore, material innovation is driving segmentation, with consumers increasingly distinguishing products based on rotational impact safety certifications rather than solely on traditional linear impact standards, influencing premium pricing tiers.

AI Impact Analysis on Bike Helmet Market

Analysis of common user questions regarding AI's influence on the Bike Helmet Market reveals a primary focus on three key themes: enhanced personalized safety, optimized product design and manufacturing, and sophisticated retail personalization. Users frequently ask: "How can AI predict and prevent accidents better than current sensors?" or "Will AI be used to design helmets perfectly molded to my head?" and "Can AI recommend the safest helmet for my specific commuting route and speed?" These questions underscore an expectation that AI will transition helmets from passive protective gear to proactive safety systems, using real-time data analysis to mitigate risk before an impact occurs and delivering hyper-customized product experiences.

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to revolutionize the bike helmet sector by enhancing safety protocols and drastically reducing development time. In design, generative AI can rapidly iterate thousands of internal structures—optimizing EPS density, ventilation channels, and rotational layer placement—to maximize impact energy absorption while minimizing material waste and weight, a feat unattainable through traditional iterative CAD modeling. Furthermore, AI is being deployed in crash testing simulations (virtual testing), allowing manufacturers to anticipate performance under complex, oblique impact scenarios, speeding up compliance with evolving international safety standards (e.g., CEN, CPSC, ASTM) and accelerating the introduction of next-generation protective solutions.

In the consumer-facing realm, AI is vital for interpreting complex data generated by smart helmets, translating accelerometer and GPS data into actionable insights for the user and emergency services. This includes differentiating between a minor fall and a serious crash, triggering automatic emergency calls (A-E-Call) more reliably, and providing personalized safety recommendations based on riding habits, weather conditions, and high-risk route segments. For marketing and sales, ML models are transforming the retail experience by analyzing purchase histories, anthropometric data (via apps), and riding style profiles to recommend the optimal helmet fit and safety rating, moving the industry toward truly individualized head protection.

- AI-driven Generative Design: Optimizes internal foam structure (EPS density mapping) for maximum impact dissipation and weight reduction.

- Predictive Safety Algorithms: Analyze real-time biomechanical and contextual data (speed, sudden braking) to assess imminent risk and potentially adjust smart safety features.

- Enhanced Virtual Crash Testing: Machine learning simulates millions of impact scenarios (linear and rotational) to validate designs before physical prototyping, reducing R&D costs.

- Personalized Fit Recommendations: AI processes 3D scans or detailed user input to recommend the helmet size, shape, and retention system configuration best suited for individual head geometry.

- Supply Chain Optimization: ML algorithms forecast regional demand shifts and material sourcing requirements, minimizing lead times and inventory holding costs.

DRO & Impact Forces Of Bike Helmet Market

The Bike Helmet Market is propelled by robust Drivers (D), moderated by inherent Restraints (R), and offers significant Opportunities (O), all subject to powerful external Impact Forces. The primary drivers include governmental enforcement of cycling safety regulations, particularly concerning mandatory helmet use for children and e-bike riders, coupled with substantial investments in dedicated cycling infrastructure worldwide which naturally increases participant numbers. These regulatory tailwinds ensure baseline demand, while the continuous technological push toward advanced protection systems (e.g., MIPS, WaveCel) acts as a powerful catalyst for premiumization and replacement sales, driven by consumer willingness to pay for demonstrably superior safety features.

Restraints primarily revolve around the high initial cost associated with manufacturing helmets incorporating proprietary advanced safety technologies and integrated electronics, which can act as a barrier to entry in price-sensitive developing markets. Furthermore, market saturation in certain mature European and North American segments limits volumetric growth, necessitating manufacturers to focus on replacement cycles driven by aesthetic trends or safety feature upgrades rather than purely new customer acquisition. The pervasive issue of counterfeiting, particularly involving major brand names, also poses a significant risk, eroding consumer trust and potentially compromising safety standards if substandard imitation products proliferate in informal distribution channels.

Opportunities are concentrated in two major areas: the exponential growth of the e-bike segment globally and the integration of highly functional smart technologies. E-bikes demand helmets certified to higher speed ratings (NTA 8776 standard), opening a specialized, high-margin niche. The opportunity presented by smart helmets, incorporating GPS tracking, integrated lighting, communication systems, and automated crash detection, moves the helmet from a purely protective item to a connected safety device, aligning with broader IoT trends. External impact forces, such as shifting socio-cultural acceptance of cycling as a primary mode of urban transport and increasing health consciousness among aging populations, provide sustained momentum, ensuring long-term structural demand.

Segmentation Analysis

The Bike Helmet Market is meticulously segmented across multiple dimensions to reflect the diversity in cycling disciplines, consumer demographics, material composition, and distribution mechanisms. Segmentation by type differentiates products based on design and use case, such as Road, Mountain (MTB), Urban/Commuter, and Specialty (BMX, Time Trial). This categorical distinction is crucial as each segment requires unique engineering specifications—Road helmets prioritize aerodynamics and ventilation, while MTB helmets emphasize deep coverage and robustness. Understanding these granular segments allows manufacturers to tailor marketing messages and R&D expenditures precisely to meet the distinct performance and safety requirements of different cycling communities globally.

Segmentation by material is increasingly important, reflecting the industry's focus on lightweight durability and enhanced impact absorption. Traditional materials like Expanded Polystyrene (EPS) remain dominant but are being rapidly augmented by advanced composites, aramid fibers, and specific polymeric rotational liners like MIPS or specialized proprietary structures like WaveCel and Koroyd. Distribution channel segmentation is critical for market access, spanning traditional offline channels (Specialty Bicycle Retailers, Sporting Goods Stores) and rapidly expanding online platforms (E-commerce), which currently offer broader selection and competitive pricing, particularly favored by tech-savvy urban consumers.

- By Type:

- Road Cycling Helmets (Aero, Vented)

- Mountain Biking (MTB) Helmets (Full-Face, Half-Shell, Trail)

- Urban/Commuter Helmets (High Visibility, Integrated Lights)

- Specialty Helmets (BMX, Skate Style, Time Trial/Triathlon)

- E-Bike Specific Helmets (NTA 8776 Certified)

- By Application/End-User:

- Amateur/Recreational Cyclists

- Professional/Competitive Cyclists

- Casual Commuters

- Children and Youth

- By Material:

- Expanded Polystyrene (EPS) Foam

- Polycarbonate Shells

- Carbon Fiber Composites

- Advanced Rotational Systems (MIPS, WaveCel)

- By Distribution Channel:

- Offline (Specialty Bike Shops, Sporting Goods Stores)

- Online (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Bike Helmet Market

The value chain for the Bike Helmet Market begins with upstream material sourcing, which is critical given the reliance on specialized foams, polymers, and composite materials. Key upstream activities involve securing high-grade EPS beads (requiring specialized suppliers), advanced composite materials (carbon fiber or aramid), and rotational safety technology licenses (e.g., MIPS licensing fees). Quality control at this stage is paramount, as the chemical properties and consistency of the materials directly determine the helmet's compliance with safety standards. Manufacturers often engage in strategic partnerships with chemical suppliers to ensure material innovation and consistent supply volume, mitigating supply chain risks inherent in proprietary component sourcing.

The manufacturing and assembly phase involves complex processes, including molding the EPS liner (the crucial impact absorption component), thermoforming the external polycarbonate or composite shell, and precisely integrating the retention systems, straps, and ventilation hardware. Leading market players are optimizing manufacturing efficiency through automation and lean production techniques to maintain cost competitiveness while adhering to stringent global safety certifications (CPSC, EN 1078, ASTM, etc.). Downstream activities focus heavily on branding, rigorous certification testing, and effective inventory management, ensuring that region-specific helmet types and certifications are readily available through appropriate channels.

Distribution channels for bike helmets are hybrid, incorporating both direct and indirect routes. Indirect distribution relies heavily on Specialty Bicycle Retailers (SBRs), which offer expertise, fitting services, and immediate customer feedback—essential for premium, high-tech helmets. Direct channels, primarily through e-commerce platforms and brand-owned online stores, provide manufacturers with higher margin potential and direct access to consumer data, enabling faster iteration on design and personalized marketing. The growing influence of the online channel necessitates robust logistical frameworks and reliable sizing guides to minimize returns and maintain customer satisfaction in a product category where fit is synonymous with safety.

Bike Helmet Market Potential Customers

The potential customer base for the Bike Helmet Market is broadly segmented into distinct groups based on usage frequency, motivation, and required performance levels. The largest volume segment comprises Amateur and Recreational Cyclists, including weekend riders, fitness enthusiasts, and family leisure cyclists. These buyers prioritize comfort, adequate ventilation, and aesthetically pleasing designs at accessible price points, often driven by a basic understanding of safety needs and local regulatory environments. Marketing to this group typically emphasizes ease of use, general safety ratings, and diverse color options, representing the foundational demand structure for standard helmet models.

A high-value segment consists of Professional and Enthusiast Cyclists, encompassing competitive racers (road, track, MTB) and serious amateurs who cycle intensively. These customers demand the highest performance specifications, including maximized aerodynamics (for road racing), superior ventilation, ultralight construction (often utilizing carbon fiber), and cutting-edge safety features like MIPS integration. They are highly informed about specific safety standards, willing to pay premium prices, and replacement cycles are driven by marginal performance gains, specialized event needs (e.g., Time Trial specific models), or the latest material innovations, making them crucial for driving technological adoption.

The rapidly expanding Urban Commuter and E-Bike Rider segment represents the most significant growth trajectory, often overlapping with demographics seeking practical, stylish, and highly functional protective gear. Commuters prioritize integrated utility features such as permanent or rechargeable LED lighting, robust durability, anti-theft mechanisms (e.g., compatibility with bike locks), and integrated communication systems. E-bike riders specifically require helmets meeting enhanced standards (like the Dutch NTA 8776 standard) due to higher average speeds, often prioritizing visibility and robust impact coverage, making them key buyers for the emerging "smart helmet" category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialized Bicycle Components, Trek Bicycle Corporation (Bontrager), Bell Sports, Giro Sport Design, KASK S.p.A., Abus August Bremicker Söhne KG, Lazer Sport NV, POC Sweden AB, Limar S.r.l., MET Helmets, Smith Optics, Cannondale Bicycle Corporation, SCOTT Sports SA, Rudy Project, Uvex Sports Group, Coros Wearables Inc., Sena Technologies, 6D Helmets, Thousand, HJC Helmets. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bike Helmet Market Key Technology Landscape

The technological evolution within the Bike Helmet Market is primarily centered on enhancing impact protection mechanisms, improving user experience through smart integration, and optimizing material science for weight and ventilation. The most influential current technology is the implementation of specialized rotational energy management systems, such as MIPS (Multi-Directional Impact Protection System), which uses a low-friction layer designed to allow the head to move relative to the helmet in an oblique impact, significantly reducing the rotational forces transmitted to the brain. This technology has become an industry benchmark, leading to competitive responses such as POC's SPIN (Shearing Pad Inside) and proprietary solutions like WaveCel used by Trek/Bontrager, all aimed at mitigating complex, non-linear impact forces prevalent in cycling accidents.

Beyond impact absorption, the landscape is increasingly defined by the integration of electronics, propelling the rise of the smart helmet category. These innovations include embedded connectivity modules (Bluetooth/GPS), enabling features like automatic crash detection that trigger emergency notifications to pre-set contacts, integrated LED lighting (front and rear) to enhance 360-degree visibility for urban commuting, and communication capabilities such as integrated speakers and microphones for group rides or hands-free calling. This connectivity pivot transforms the helmet from a purely protective shell into a key component of the cyclist's digital safety ecosystem, driving higher average selling prices (ASPs) and attracting tech-forward consumers.

Material science and manufacturing advancements remain foundational to competitive differentiation. Manufacturers are constantly refining Expanded Polystyrene (EPS) foam, utilizing multi-density or cone-shaped structures to manage varying impact speeds effectively. Simultaneously, the increased adoption of lightweight, high-strength composite shells (e.g., carbon fiber weaves) in high-end models allows for reduced mass without sacrificing structural integrity, appealing directly to performance enthusiasts. Furthermore, advanced ventilation modeling, often leveraging Computational Fluid Dynamics (CFD), ensures optimal airflow across the skull, mitigating overheating and enhancing comfort, which is crucial for increasing the sustained use of helmets, thereby reinforcing overall market safety compliance.

Regional Highlights

North America: North America represents a mature and high-value segment of the global bike helmet market, characterized by strong consumer preference for premium, high-tech safety features and established safety regulations. The market here is driven significantly by the robust cycling enthusiast culture, particularly in states like California and Colorado, necessitating specialized gear for mountain biking and road racing. A key growth driver is the rapid adoption of e-bikes, which, while often unregulated in terms of mandatory helmet use, encourages consumers to purchase higher-rated protective gear, pushing demand toward NTA 8776 equivalent models. The market is also heavily influenced by continuous innovation, with consumers willing to replace helmets frequently to adopt the latest MIPS or smart technology offerings, ensuring a steady stream of replacement demand.

Europe: Europe is the largest market segment by revenue and volume, distinguished by strong regulatory support for cycling and significant governmental investment in urban cycling infrastructure, particularly in countries like the Netherlands, Germany, and Denmark. The European market exhibits a diverse segmentation profile, ranging from sophisticated urban commuter helmets incorporating mandatory lights and high visibility elements to premium road racing gear necessary for its deep competitive cycling heritage. A specific regulatory highlight is the aforementioned NTA 8776 standard originating in the Netherlands, which is quickly becoming the de facto safety requirement for high-speed e-pedelec helmets across the continent, shaping product development priorities across all major brands operating in the region. Furthermore, sustainability is a growing concern, influencing demand for helmets made from recycled or sustainable materials.

Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period, driven by unparalleled urbanization rates, rising middle-class disposable incomes, and increasing traffic congestion that favors bicycle commuting. While safety standards compliance varies significantly across countries in this diverse region, governments in nations like China, Japan, and South Korea are increasingly promoting cycling for health and environmental reasons. The demand structure in APAC is characterized by high volume in the budget and mid-range segments, although the premium segment is growing rapidly, particularly in Australia and Japan, where dedicated cycling cultures are mature. The proliferation of shared mobility and micro-mobility services also contributes to foundational demand, necessitating durable, potentially 'shared-use' specific helmet solutions.

- North America: Focus on premium safety (MIPS adoption), high e-bike penetration, strong recreational and professional cycling base.

- Europe: Largest market value, rigorous safety standards (EN 1078, NTA 8776), strong government support for urban cycling and sustainable mobility.

- Asia Pacific (APAC): Fastest growing region, driven by urbanization and rising disposable income; emerging market for both mass-market and premium technology imports.

- Latin America (LATAM): Growth driven by increasing urbanization and infrastructural development; challenges posed by varying regulatory enforcement and price sensitivity.

- Middle East & Africa (MEA): Nascent market with growth concentrated in high-income urban centers, influenced by recreational sport and tourism infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bike Helmet Market.- Specialized Bicycle Components

- Trek Bicycle Corporation (Bontrager)

- Bell Sports

- Giro Sport Design

- KASK S.p.A.

- Abus August Bremicker Söhne KG

- Lazer Sport NV

- POC Sweden AB

- Limar S.r.l.

- MET Helmets

- Smith Optics

- Cannondale Bicycle Corporation

- SCOTT Sports SA

- Rudy Project

- Uvex Sports Group

- Coros Wearables Inc.

- Sena Technologies

- 6D Helmets

- Thousand

- HJC Helmets

Frequently Asked Questions

Analyze common user questions about the Bike Helmet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is MIPS and how does it enhance bike helmet safety?

MIPS (Multi-Directional Impact Protection System) is a patented rotational motion management technology integrated into some helmets. It utilizes a low-friction layer designed to allow a small amount of relative movement between the helmet and the head during certain oblique impacts, aiming to reduce the rotational violence transmitted to the brain, which is a common cause of concussion.

What distinguishes an e-bike helmet from a standard cycling helmet?

E-bike helmets are engineered and tested to withstand higher impact speeds, typically conforming to specific standards like the European NTA 8776, which is more rigorous than standard bicycle helmet certifications (EN 1078 or CPSC). They often feature deeper coverage, increased durability, and may integrate visibility features suitable for higher-speed urban commuting.

How often should a bike helmet be replaced, even without a visible crash?

Industry experts recommend replacing a bike helmet every three to five years, regardless of visible damage. Over time, the Expanded Polystyrene (EPS) foam liner naturally degrades due to exposure to UV light, sweat, and general wear and tear. Furthermore, replacement ensures the cyclist benefits from the latest advancements in safety technology and materials.

Are smart helmets reliable for automatic crash detection and emergency communication?

Yes, modern smart helmets are increasingly reliable for automatic crash detection, utilizing advanced accelerometers and gyroscopes combined with proprietary algorithms to accurately distinguish between a minor drop and a severe impact. Upon detection, they can automatically trigger an emergency notification, often via a linked smartphone application, providing GPS coordinates to emergency contacts, significantly enhancing post-crash response times.

Which factors are driving the greatest growth in the Asia Pacific Bike Helmet Market?

The APAC market growth is primarily fueled by rapid urbanization leading to increased cycling for commuting, substantial government investments in cycling infrastructure across major cities, and the rising consumer awareness regarding personal safety, paralleled by increasing middle-class disposable income allowing access to higher quality, certified protective gear.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager