Bike Phone Holder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442256 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Bike Phone Holder Market Size

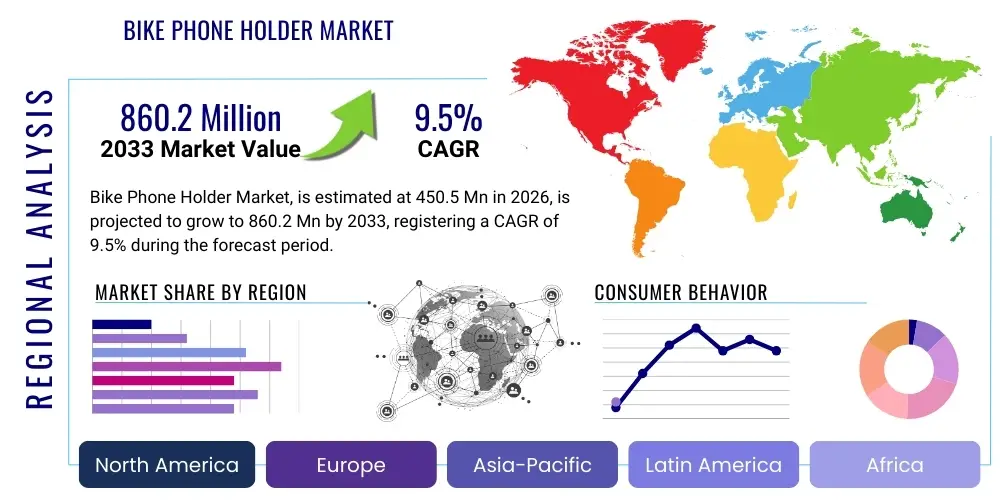

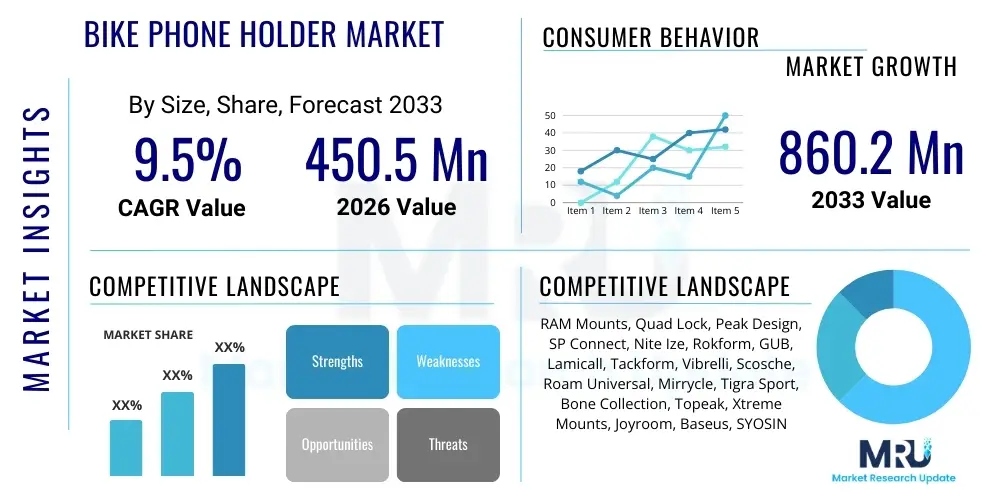

The Bike Phone Holder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 860.2 Million by the end of the forecast period in 2033.

Bike Phone Holder Market introduction

The Bike Phone Holder Market encompasses the production, distribution, and sale of devices specifically engineered to securely fasten smartphones onto bicycle handlebars, stems, or frames. These devices have transitioned from simple clamps to sophisticated mounting systems, becoming essential accessories for modern cyclists globally, enabling effortless, hands-free access to critical digital resources such as GPS navigation applications, real-time fitness trackers, safety communication features, and entertainment options while actively cycling. The market expansion is fundamentally driven by the pervasive global trend of cycling, which is increasingly adopted both as a primary sustainable transportation solution in urban environments and as a popular recreational and professional sport focused on health and environmental consciousness. The continuous necessity for highly reliable, robustly shockproof, and weather-resistant mounting solutions is a core catalyst for ongoing innovation within the sector, pushing manufacturers to integrate advanced material science and precision engineering into their designs.

Major applications for bike phone holders are diverse, spanning the entire cycling spectrum, from daily urban commuting and professional high-performance road racing to rugged recreational mountain biking (MTB). For urban commuters, the holder is invaluable for precise, turn-by-turn navigation in complex metropolitan settings, optimizing route efficiency and time management. In the domain of competitive or long-distance touring, these holders facilitate the continuous monitoring of crucial performance metrics—such as speed, cadence, and heart rate—via integrated cycling applications, while also guaranteeing the phone remains accessible for immediate safety checks and emergency calls, particularly in remote areas. The proliferation of specialized cycling applications, coupled with the increasing integration of IoT (Internet of Things) devices within bicycles, further solidifies the phone holder’s critical position as the primary interface component of the modern connected cycling experience. Key benefits derived from using these holders include a substantial improvement in rider safety through minimized distraction via hands-free operation, enhanced situational awareness due to readily available information, and the systematic ability to track and analyze personal cycling performance data.

The principal driving factors fueling this market’s robust trajectory include the exponential worldwide growth of cycling culture, significantly amplified by sustained governmental and municipal investments promoting cycling infrastructure, such as dedicated lanes and expansive bicycle-sharing programs across major global cities. Crucially, continuous technological advancements in material science are facilitating the development of lightweight yet extraordinarily durable mounting materials, including advanced reinforced plastics and specialized aluminum alloys, which substantially elevate product quality, mechanical performance, and long-term user satisfaction. The ubiquitous ownership of high-powered smartphones globally, coupled with their ever-increasing functionality in sophisticated navigation, detailed fitness tracking, and robust data collection, establishes a firm, continually expanding foundational demand for secure and reliable mounting solutions. These interconnected factors collectively forecast a positive and resilient market outlook, underpinned equally by profound shifts in consumer lifestyle preferences toward mobility and continuous product innovation focused on maximizing convenience, stability, and digital integration during cycling activities.

Bike Phone Holder Market Executive Summary

The global Bike Phone Holder Market is poised for substantial growth, driven by dynamic shifts in consumer preferences towards active lifestyles and smart connectivity while commuting or recreating. Key business trends indicate a strong focus on differentiation through design patents related to enhanced anti-vibration technology and universal compatibility features, allowing manufacturers to capture niche segments, particularly the high-end mountain biking community requiring extreme durability and precise mounting capability. This technological focus is critical because modern smartphone cameras rely heavily on sensitive Optical Image Stabilization (OIS) systems which are highly susceptible to damage from sustained, high-frequency bike vibrations, necessitating advanced dampening solutions that differentiate premium offerings from budget alternatives. Consolidation among smaller regional players by large accessory manufacturers is accelerating, aiming to achieve economies of scale and optimize global distribution networks, particularly through strategic partnerships with major e-commerce platforms to improve supply chain velocity and direct-to-consumer reach. Sustainability is also emerging as a critical trend, with increasing interest in phone holders made from recycled or biodegradable materials, influencing procurement decisions in environmentally conscious regions like Northern Europe, requiring companies to reformulate their material sourcing and production processes to meet evolving regulatory and consumer demands for eco-friendliness and reduced environmental impact.

Regionally, Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate, fueled by massive urbanization, substantial government investments in smart city infrastructure actively promoting bicycle use, and the rapid adoption of e-bikes, which inherently necessitate reliable mounting solutions for supplementary integrated displays or dedicated navigation systems. The sheer volume of cycling activity in densely populated countries like China and India, driven by both transportation necessity and increasing leisure cycling, provides a massive addressable market, though pricing strategies must remain extremely competitive and localized to penetrate the large mass-market segment effectively. North America and Europe currently hold the largest cumulative market shares due to high consumer disposable incomes, deeply mature cycling cultures, and traditionally high recreational spending. However, the maturation and replacement cycles in these established markets mean future growth will increasingly rely heavily on quick adaptation to new smartphone form factors and camera placements, alongside the successful adoption of premium, technology-integrated models that offer significant value-added features such as certified wireless charging capabilities and seamless sensor connectivity. Conversely, Latin America and the Middle East & Africa (MEA) are starting to show promising initial adoption rates as middle-class populations expand and crucial cycling infrastructure slowly improves, indicating a strong, yet price-sensitive, latent demand for affordable, yet reliable, entry-level products that prioritize basic functionality and robust physical security against opportunistic urban theft.

Segmentation analysis highlights the enduring dominance of handlebar-mounted universal clamp systems due to their unparalleled ease of installation and broad compatibility with most smartphone models, serving the expansive bulk of the commuting and leisure cycling segments. Nevertheless, specialized waterproof and shockproof casing holders are gaining significant and accelerated traction, driven by the expanding requirements of the extreme sports and off-road cycling segments where full environmental and mechanical protection of the device is paramount. Material-wise, high-strength engineering plastics and composites maintain market leadership primarily due to their superior cost-effectiveness and excellent weight performance ratio, although precision CNC-machined aluminum alloy holders are steadily increasing their market penetration in the premium category. Aluminum is highly valued for its superior structural stability, intrinsically high clamping force, and its premium aesthetic appeal that aligns well with high-end bicycle components. The distribution landscape is experiencing a pronounced shift towards sophisticated e-commerce platforms, offering consumers vast product choices, transparent competitive pricing, and the crucial social proof provided by detailed peer-to-peer product reviews. Despite this shift, specialized physical cycling shops remain critically vital for the high-end, brand-loyal consumer segment seeking professional installation services, expert technical advice, and crucial hands-on demonstrations of complex proprietary locking mechanisms, necessitating a sophisticated omnichannel approach for leading brands.

AI Impact Analysis on Bike Phone Holder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Bike Phone Holder Market frequently revolve around two primary, interconnected themes: the potential integration of smart, active features directly into the holder mechanism, and more significantly, how AI-powered cycling applications fundamentally influence the critical design requirements and performance expectations of the physical mount. Users are actively keen to understand if AI processing can enable sophisticated features such as automated, dynamic adjustment of the phone's orientation, predictive maintenance alerts derived from real-time vibration data collected by the phone while securely mounted, or context-aware lighting integration triggered via the holder’s power system. A core commercial and technical concern is whether the holder will remain simply a passive mechanical mount or transition into an active, data-enabling interface component within the larger connected cycling ecosystem. There is a strong, discernible expectation that AI algorithms will substantially enhance safety features and personalize the navigation experience, invariably necessitating more technologically sophisticated and structurally robust mounting platforms capable of accommodating real-time augmented reality overlays or advanced integrated sensors for continuous environmental and performance feedback.

The prevailing industry consensus suggests that AI's direct impact on the material science or core manufacturing processes of a traditional, simple physical phone holder remains minimal, concentrating instead on enhancing the functionality of the software and integrated sensor ecosystem that is facilitated by the mount. However, the indirect consequences of AI are profound and market-defining. For instance, high-demand AI algorithms powering sophisticated, real-time navigation and route optimization apps demand that the smartphone screen maintains perfect positional alignment and remains supremely stable for optimal usability and safety, thereby exponentially driving demand for premium holders featuring superior anti-shake and glare reduction technologies. Furthermore, the development of advanced predictive analytics for crucial bicycle component wear and tear, achieved by meticulously analyzing accelerometer and gyroscope data streamed via the phone while it is securely mounted, adds immense functional value to the overall cycling experience. This crucial shift fundamentally necessitates holders that are engineered to minimize all forms of electromagnetic signal interference, provide highly consistent and stable data transmission paths, effectively transforming the product from a simple mechanical accessory into a highly reliable, data-enabling interface component essential for sophisticated connected cycling.

Ultimately, the escalating influence of AI mandates a structural transition toward developing "smart mounts." Although these holders may not necessarily house dedicated AI processing units themselves, their physical design and material selection must proactively and flawlessly support the demanding performance criteria of AI-driven mobile applications. This engineering mandate includes ensuring optimized thermal management capabilities to prevent overheating during prolonged, CPU-intensive navigation sessions, utilizing highly resilient and robust locking mechanisms to instantaneously prevent sensor misalignment, and incorporating standardized mechanical interfaces for potential future sensor or battery pack attachments. The future commercial success of companies in the Bike Phone Holder Market will be determined not merely by the foundational grip strength of the holder, but critically by its intrinsic ability to reliably support the demanding computational, positional accuracy, and energy needs of advanced, AI-enhanced cycling software, ensuring the critical digital feedback loop remains entirely uninterrupted and precise throughout the cyclist's journey, thus justifying premium pricing and establishing brand loyalty among technology-forward consumers.

- AI drives demand for enhanced anti-vibration technology in mounts to ensure superior sensor accuracy for performance tracking, stability for augmented reality (AR), and reliable predictive maintenance algorithms.

- Integration possibilities include smart mounts featuring context-aware lighting (e.g., automated signaling) or optimized wireless charging protocols based on user activity patterns predicted and managed by AI.

- AI-powered navigation and augmented reality apps necessitate perfect, non-shifting screen stability, heavily influencing premium design toward extremely robust, precision-engineered locking systems and advanced anti-slip materials.

- AI utilizes complex data streams collected while the phone is securely mounted (e.g., GPS, accelerometer, gyroscope) to personalize route recommendations and improve proactive safety warnings, demanding the highest possible structural integrity from the holder unit.

- Manufacturing processes can be significantly optimized using AI for quality control, accurately detecting microscopic flaws in specialized plastic injection molding or CNC milling for high-stress components, thereby reducing failure rates in critical locking mechanisms.

DRO & Impact Forces Of Bike Phone Holder Market

The Bike Phone Holder Market is propelled by significant Drivers (D), constrained by certain Restraints (R), and offers substantial Opportunities (O), all shaped by critical Impact Forces. A key driver is the overwhelming global adoption of smartphones as primary navigation and comprehensive fitness tracking tools, replacing dedicated, expensive cycle computers for a vast majority of casual, commuting, and mid-level riders, thereby rendering a reliable mount an absolutely indispensable accessory for virtually every cyclist worldwide. This substantial trend is further amplified by the dramatic, accelerating global rise in electric bike (e-bike) sales, where the integrated phone often serves as the essential secondary dashboard or a supplemental display for monitoring battery life and integrated route guidance. Additionally, increasing public health awareness campaigns and decisive government initiatives actively promoting cycling as a sustainable, low-emission, and healthy transport alternative directly fuel the underlying market demand for core cycling accessories, including high-quality phone holders. Manufacturers greatly benefit from the rapid, yet predictable, innovation cycle inherent in the smartphone industry, as the periodic release of new phone models with varying dimensions and sophisticated camera layouts often necessitates replacement or upgrade purchases for compatible mounts, effectively ensuring a consistent and resilient demand floor in all major developed markets.

However, the market faces significant and persistent restraints, primarily revolving around deep-seated consumer concerns over phone safety and the critical risk of theft. Cyclists operating in high-density urban environments are frequently hesitant to openly mount expensive, flagship smartphones due to the high risk of opportunistic, quick-grab theft when paused at traffic intersections or during brief stops. This prevalent restraint actively pushes consumer demand toward highly secure, proprietary locking systems that are meticulously designed to be difficult and time-consuming to remove quickly without the correct tools or release mechanism. Furthermore, the low-end segment of the market suffers structurally from the significant saturation of ultra-low-quality, inexpensive products, particularly those mass-manufactured in certain Asian hubs and distributed indiscriminately via massive global e-commerce platforms. While these budget options successfully cater to the most price-sensitive consumers, they frequently exhibit rapid mechanical failure or lack adequate vibration dampening, leading to severely negative user experiences and collectively diluting overall consumer confidence in the general reliability and safety performance of budget-tier bike phone holders. Another critical technical restraint is the constantly and rapidly changing physical form factor of modern smartphones, specifically the unpredictable size and precise positioning of increasingly complex camera lenses, which consistently challenges manufacturers to develop truly universal designs that can accommodate these variations without compromising fundamental security, structural integrity, or access to essential ports and buttons.

Opportunities abound through targeted technological innovation and strategic market specialization, which can circumvent competitive pressures in the low-end sector. This includes the focused development of specialized mounts meticulously tailored explicitly for unforgiving, extreme cycling environments, offering high Ingress Protection (IP) ratings for superior waterproofing and dust protection, coupled with advanced, integrated mechanical shock absorption capabilities, which are highly valued and profitable within the specialized mountain biking and extreme sports segments. A particularly lucrative and expanding niche is the emerging market for seamless integrated charging solutions, specifically robust Qi-certified wireless charging holders that are engineered to be fully compatible with advanced e-bike battery management systems, thereby providing uninterrupted, essential power for prolonged commuting, extensive touring, or lengthy delivery services. Moreover, establishing strategic, high-impact partnerships with major telecommunication companies, leading fitness app developers, or global bicycle brands to offer optimized, proprietary mounting solutions or attractively bundled service packages can unlock substantial new revenue streams and enhance product stickiness. The most significant external impact forces defining the structural market landscape include the intense, hyper-competitive environment among numerous domestic and large international manufacturers, which precipitates rapid product innovation cycles, continual material sourcing optimization, and aggressive, dynamic pricing strategies, particularly throughout the mid-range segment. Concurrently, consistent regulatory shifts promoting micromobility, coupled with large-scale governmental investments in developing and maintaining safer cycling infrastructure across mature economies, act as a powerful, sustained external force, fundamentally increasing the population of dedicated, regular cyclists and, consequently, guaranteeing the long-term, structural demand for all associated high-quality accessories.

Segmentation Analysis

The Bike Phone Holder Market segmentation provides a comprehensive structural analysis based on several pivotal criteria, including the specific mounting location/type, the primary material composition, the predominant distribution channel utilized, and the ultimate cycling application or end-user segment targeted. This analytical granularity allows manufacturers and specialized retailers to strategically identify and target distinct end-user groups, encompassing the full spectrum from casual urban commuters to highly dedicated professional endurance cyclists, thereby ensuring that specialized product offerings meticulously address the unique requirements for durability, environmental resistance, functional security, and specialized locking mechanisms pertinent to each segment. The delineation of primary market segments clearly highlights a critical commercial bifurcation between two dominant product categories: the widely adopted universal clamp systems, favored primarily for their inherent flexibility, ease of use, and cost-effectiveness, versus the more secure proprietary locking systems, which prioritize maximum device security, integration stability, and mechanical reliability, often commanding substantial premium pricing and catering to performance-focused users.

- By Mounting Type:

- Handlebar Mounts (Most common, high visibility)

- Stem Mounts (Centralized, higher stability, less conspicuous)

- Frame Mounts (Top Tube/Tank Bag Integration, for storage and stability)

- Mirror Mounts (Crucial crossover market for scooters and motorbikes)

- Out-Front Mounts (Aero design, positions phone ahead of handlebars for racing bikes)

- By Material Type:

- Engineering Plastics and Composites (PC, TPU, Nylon-reinforced for cost and weight)

- High-Grade Aluminum Alloys (CNC-machined for premium strength and longevity)

- Silicone and Rubber (Low-cost, entry-level, universal fit, and basic shock absorption)

- By Sales Channel:

- Online Retail (Dominant channel: E-commerce platforms, Official Brand Websites, Specialized Portals)

- Offline Retail (Specialty Bicycle Stores, Large Sporting Goods Stores, Mass Hypermarkets)

- By Application/End-User:

- Commuting and Leisure Cycling (Focus on convenience and universality)

- Mountain Biking (MTB) and Off-Road (Focus on extreme shock-proofing and robust locking)

- Road Cycling and Professional Racing (Focus on low weight, aerodynamics, and precise positioning)

- E-Bikes and Scooter Use (Focus on integrated charging and high vibration resistance)

- By Price Range:

- Economy/Low-Cost (High-volume, basic plastic clamps)

- Mid-Range (Balanced features, good durability, often incorporating basic dampening)

- Premium/High-End (Patented locking, advanced materials, dedicated vibration dampening, wireless charging)

Value Chain Analysis For Bike Phone Holder Market

The Value Chain of the Bike Phone Holder Market initiates with crucial Upstream activities, which are predominantly concentrated on the secure sourcing and initial processing of essential raw materials. These materials include specialized engineering polymers (such as high-impact polycarbonates, nylons, and thermoplastic polyurethanes), high-grade aluminum billets, and specialized silicone or rubber compounds critical for achieving optimal grip and superior shock absorption capabilities. Key strategic activities in this initial stage involve meticulous material selection to proactively ensure critical performance characteristics like long-term UV resistance, high mechanical strength under cyclical loading, and appropriate flexibility, all of which directly determine the final product quality, structural longevity, and safety compliance. Procurement efficiency and securing favorable, long-term contracts with globally reliable material suppliers are critically important for maintaining highly competitive manufacturing costs, particularly in the plastics segment where material price volatility, often linked to global oil prices, can substantially affect core input costs. Innovation at the upstream level is increasingly focusing on developing sustainable alternatives, such as certified eco-friendly or recycled composite materials, driven by global environmental mandates and consumer preference shifts.

The Midstream processes encompass the entire scope of component manufacturing, intricate assembly, and rigorous quality control testing. Fabrication methods include precision injection molding for complex plastic components, meticulous CNC machining for high-tolerance aluminum parts, and careful electronic integration for high-end models incorporating active charging capabilities or sensor housings. Precision engineering is fundamentally essential for the development and execution of reliable locking mechanisms, ensuring the holder performs flawlessly and securely under persistent high vibration and sudden impact conditions typical of cycling. Manufacturers often strategically focus on developing modular product designs to significantly achieve economies of scale and simplify highly technical assembly processes across diverse product lines. The subsequent Downstream phase efficiently covers professional distribution and final sales, utilizing a mix of both direct and indirect sales channels. Direct channels commonly include selling through the company’s official e-commerce website or proprietary retail stores, allowing for maximum control over brand narrative, pricing, and specialized customer service interactions. Indirect distribution heavily relies on utilizing established global networks of wholesalers, distributors, and large-scale online marketplaces to achieve broad geographical market penetration.

The optimization of distribution channels is categorized broadly into high-volume online retail and traditional, consumer-facing offline brick-and-mortar stores. Online retail, encompassing dominant large-scale e-commerce marketplaces and specialized cycling portals, holds significant market share due to its unparalleled geographical reach, substantially lower operational overheads, and the pervasive consumer trend toward purchasing accessories based on extensive and validated online peer reviews and detailed product specifications. Specialized bicycle shops within the offline channel remain critically important for the sales of premium and professional-grade products, as they uniquely offer highly personalized technical advice, professional bike fitting services, and immediate, expert installation support, justifying a higher price point. The increasing professional reliance on global third-party logistics (3PL) providers significantly facilitates efficient, low-cost cross-border shipping, minimizes expensive localized inventory holding costs, and crucially accelerates market responsiveness, which is an absolutely critical competitive factor given the rapidly evolving nature of the consumer electronics accessory market and the fast replacement cycles driven by new smartphone releases.

Bike Phone Holder Market Potential Customers

Potential customers for the Bike Phone Holder Market are broadly and systematically categorized based on their primary cycling intent, frequency of use, and specialized performance requirements, encompassing a vast spectrum that ranges from casual, utility-focused city riders to dedicated, highly demanding sports enthusiasts. The quantitatively largest segment of end-users includes daily urban commuters and frequent recreational riders who rely on their bicycles for routine urban travel, fitness regimens, or relaxed weekend excursions. These high-volume buyers primarily prioritize essential convenience, straightforward installation mechanisms, high reliability, and basic security for immediate navigation and essential communication, typically favoring universally compatible clamp systems and products within the competitive mid-range pricing bracket. Targeted marketing strategies for this specific demographic often emphasize crucial features like quick-release functionality, simple installation tools, and proven compatibility with the most common bicycle types found in densely populated urban and suburban settings, focusing heavily on value and practicality.

A second, highly lucrative segment consists of serious cycling hobbyists, including dedicated mountain bikers (MTB) who tackle extreme terrain and performance-driven road racers. These customers have stringent requirements, demanding extreme durability, sophisticated specialized shock mitigation features, and absolute, unwavering reliability, as mechanical failure of the device during intense, high-speed activity can pose severe safety risks. They are notably less price-sensitive and consistently invest in premium, high-strength material mounts (e.g., aerospace-grade aluminum or advanced glass-filled composites) featuring proprietary, meticulously engineered locking mechanisms (such as Quad Lock or specialized twist-lock systems). For these highly discerning users, the phone holder is considered an integral, performance-enhancing piece of equipment, making critical attributes like extremely low weight, optimized aerodynamic profile, and uncompromising resistance to harsh environmental factors (including mud, persistent water exposure, and temperature extremes) paramount considerations throughout their purchasing evaluation process. This segment is highly influenced by credible professional endorsements, favorable peer reviews, and detailed technical performance specifications.

A rapidly expanding and strategically important customer base is the massive e-bike and shared micro-mobility scooter user demographic. Given that e-bikes are increasingly utilized for longer, power-assisted commutes and delivery services, a highly secure and reliable phone mounting solution is absolutely essential for continuously monitoring critical parameters such as real-time battery life, dynamic route planning, and accessing integrated, proprietary e-bike management apps. This specific group often actively seeks holders that incorporate integrated active charging capabilities (either robust wired or highly efficient wireless charging options), ensuring the smartphone’s battery sustains the entirety of the long journey. This demand reflects a definitive market shift towards viewing the phone holder not merely as a physical support apparatus, but increasingly as an essential power and centralized connectivity hub. Successfully targeting this segment requires heavily emphasizing guaranteed robust charging features, superior thermal management, and certified electrical compatibility with high-power output e-bike battery systems and complex electronic architectures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 860.2 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RAM Mounts, Quad Lock, Peak Design, SP Connect, Nite Ize, Rokform, GUB, Lamicall, Tackform, Vibrelli, Scosche, Roam Universal, Mirrycle, Tigra Sport, Bone Collection, Topeak, Xtreme Mounts, Joyroom, Baseus, SYOSIN |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bike Phone Holder Market Key Technology Landscape

The core technology landscape of the Bike Phone Holder Market is fundamentally characterized by continuous, incremental mechanical and material engineering innovations strategically aimed at maximizing device security, enhancing structural durability, and optimizing user convenience, rather than relying on complex electronic components in the mount itself. A foundational and critical technology driving premium market growth is advanced, proprietary vibration dampening. This highly specialized process involves incorporating sophisticated components such as tuned elastomers, specialized viscoelastic silicone pads, or internal mechanical spring systems meticulously designed to isolate the sensitive smartphone hardware from destructive high-frequency handlebar vibrations. This protection is absolutely crucial for safeguarding the sophisticated Optical Image Stabilization (OIS) mechanisms embedded in modern phone cameras, which are highly susceptible to permanent mechanical damage from sustained road chatter and off-road impacts. Manufacturers are heavily investing substantial R&D resources into patented, highly intuitive quick-release and maximally secure locking mechanisms, such as robust twist-lock interfaces or magnetic-assisted, multi-point locking systems, which successfully provide instantaneous mounting/dismounting convenience while rigorously ensuring the device remains firmly and reliably attached even during the most aggressive and high-impact off-road riding conditions. These sophisticated mechanical systems represent the dominant core intellectual property and competitive differentiator within the premium accessory segment.

Material science innovation plays a pivotal, non-negotiable role in market development, with a pronounced and steady trend toward exclusively utilizing high-performance engineering composites, such as meticulously glass-filled nylon or high-grade, corrosion-resistant aluminum alloys (e.g., aerospace-grade 6061), to achieve an optimal and essential balance between ultimate structural strength and minimal product weight. The specialized manufacturing processes prominently utilize precision CNC machining for all critical metal components to guarantee extremely tight tolerances and perfect fitment, which is paramount for achieving reliable anti-shake performance and system longevity. For plastic components, advanced, multi-axis injection molding techniques are skillfully employed to achieve the complex geometries necessary for proprietary locking features and integrated shock absorption components, concurrently ensuring that the final product can flawlessly withstand significant temperature fluctuations, prolonged UV exposure, and intense mechanical stress without compromising integrity or showing signs of brittle degradation. The targeted development of highly resilient, yet concurrently lightweight, next-generation materials is entirely essential to maintain strong product appeal to performance-oriented cyclists who are meticulously concerned with minimizing the overall weight added to their high-end bicycles.

Furthermore, electronic technology is increasingly and seamlessly integrated into the structural periphery of the high-end holder design, particularly regarding crucial power management solutions. The successful adoption and implementation of the Qi standard for wireless charging technology directly within the mount structure represents a significant and highly desirable technological advancement, effectively addressing the major consumer pain point of severe smartphone battery drain during extended, continuous GPS navigation sessions. This integration demands the engineering of compact, highly efficient circuitry, robust voltage regulation, and highly sophisticated thermal management solutions within the holder's restricted form factor, especially for e-bike applications where reliable, continuous power is sourced directly from the bicycle battery system. Future technological innovation is definitively expected to focus on micro-sensor integration, potentially incorporating miniature ambient light sensors for automated screen brightness adjustment or simple, low-power accelerometers to feed basic crash detection algorithms. However, this level of deep electronic integration remains nascent and is highly dependent on achieving successful, standardized communication protocols and direct hardware partnerships with major smartphone operating system developers, representing the final frontier in making the holder a truly smart device.

Regional Highlights

Regional dynamics are critically important to fully understanding the diverse distribution patterns and nuanced growth opportunities within the Bike Phone Holder Market, as they clearly reflect significant differences in local cycling culture, the level of government-backed infrastructure investment, and distinct consumer purchasing power across the major geographical areas. The market exhibits clear distinctions in consumer preferences and specific growth drivers within each region, which necessitates highly localized product strategies and optimized channel management for successful market penetration. A detailed comparative regional analysis is vital for providing strategic, actionable insights for market entry, competitive positioning, and effective resource allocation.

- North America (US and Canada): This market is strongly characterized by high consumer discretionary spending on specialized recreational sports equipment and benefits from a deeply mature, highly competitive e-commerce landscape. Demand is consistently robust for premium, highly durable mounts suitable for both demanding daily commuting and extensive high-performance outdoor activities, particularly aggressive trail biking. The US market emphasizes strong brand loyalty, proven technological reliability, and critical innovation, particularly related to patented, certified locking systems and seamless, high-speed wireless charging integration to support data-intensive applications.

- Europe (Germany, UK, France, Netherlands): Europe is home to deeply established, historical cycling infrastructure and benefits from strong, sustained governmental support for bicycle commuting as a key transport solution. This results in high volume demand for reliable, consistently universally compatible, and often aesthetically subtle phone holders. The German market, in particular, is highly focused on achieving stringent technical safety standards (e.g., TÜV certification) and precision quality engineering. The exceptionally rapid and widespread growth of the e-bike sector across Northern and Western Europe is the single most powerful, structural market growth catalyst.

- Asia Pacific (APAC, particularly China, Japan, India, Southeast Asia): Projected overwhelmingly as the fastest-growing global region due to massive urban population density, the swift and widespread adoption of micromobility solutions, and the accelerating expansion of the middle class. China is strategically important as both a major global manufacturing hub and an enormous consumer market, driving high-volume demand for both ultra-low-cost, mass-market products and sophisticated high-tech integrated solutions. Market growth across APAC is highly sensitive and dependent on achieving high accessibility and optimal affordability at various price points.

- Latin America (LATAM, focused on Brazil and Mexico): Market growth is primarily concentrated within major, rapidly industrializing urban centers where cycling is increasingly utilized as a cost-effective, time-saving daily transport option. The entire regional market is highly price-sensitive, with the predominant demand centered on essential, mechanically highly durable, and robust holders that are specifically engineered to reliably withstand challenging, harsh road infrastructure conditions and high temperatures.

- Middle East and Africa (MEA): Currently represents the smallest comparative market share but is exhibiting promising expansion, particularly within wealthier Gulf Cooperation Council (GCC) nations that are aggressively investing in premium cycling infrastructure for both high-end recreation and specialized tourism development. Demand often structurally mirrors advanced European and North American trends, favoring higher quality, reputable branded products, although the established regional distribution channels remain comparatively less mature and fragmented than those in highly developed markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bike Phone Holder Market.- RAM Mounts (Represents the benchmark for extreme durability and modularity, strong presence in heavy-duty and non-standard mounting applications)

- Quad Lock (The definitive industry leader and innovator in proprietary twist-lock systems, possessing powerful brand recognition among serious, performance-focused cyclists globally)

- Peak Design (Acclaimed for superior aesthetic industrial design and broad product ecosystem integration, prioritizing premium materials and user experience)

- SP Connect (Offers a comprehensive range of high-quality, specialized mounting solutions tailored for various sports and multiple vehicle types, emphasizing device protection)

- Nite Ize (Focuses heavily on highly innovative material usage and versatile, reliable quick-release mechanisms)

- Rokform (Well-known for exceptionally rugged, highly protective cases and strong integrated magnetic mounting technology)

- GUB (A dominant market presence in the APAC region, offering a wide, competitive range of precision CNC-machined aluminum mounts)

- Lamicall (A major volume player in the mass-market, budget-friendly segment, achieving high distribution penetration primarily via international e-commerce channels)

- Tackform (Specializes in industrial-grade, highly durable, and infinitely adjustable mounting solutions often used in commercial fleet applications)

- Vibrelli (Provides reliable, entry-level, universal holders with a strong commercial focus on maximizing ease of installation and user simplicity)

- Scosche (Known for robust consumer electronics integration expertise and high-strength magnetic mounting solutions)

- Roam Universal (Focuses on highly adjustable, highly affordable universal clamp solutions targeting the budget-conscious mass market)

- Mirrycle (A long-established specialized bike accessory manufacturer with a range of basic and functional phone mounts)

- Tigra Sport (Provides specialized waterproof protective cases and integrated solutions specifically optimized for fitness tracking)

- Bone Collection (Differentiates strategically with unique, highly visible, and environmentally friendly silicone-based product designs)

- Topeak (A well-established global leader in sophisticated bicycle accessories, offering fully integrated mounting systems and tool kits)

- Xtreme Mounts (Focuses strategically on rugged, extreme off-road compatible mounting systems demanding high impact resistance)

- Joyroom (A prominent Chinese manufacturer leveraging high-volume production with significant e-commerce presence in the aggressive budget segments)

- Baseus (Offers sleek, technologically advanced consumer electronic accessories, including modern, integrated bike mounts)

- SYOSIN (A high-volume, e-commerce focused brand providing inexpensive universal clamps and basic protective solutions)

Frequently Asked Questions

Analyze common user questions about the Bike Phone Holder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between handlebar and stem mounts for securing a phone?

Handlebar mounts typically offer maximum superior screen visibility and the quickest access to the phone but can consume significant space needed for lights or bells. Conversely, stem mounts, being positioned closer to the bicycle’s geometric center, provide a substantially more streamlined, aerodynamic profile and inherently greater stability, which helps reduce high-frequency vibration transmission, making them the preferred choice for competitive cyclists focused on precise data reading and minimal drag coefficient.

How effective are modern bike phone holders in mitigating potentially catastrophic vibration damage to smartphone cameras?

High-quality, premium bike phone holders now systematically incorporate specialized vibration dampening modules, frequently utilizing high-grade elastomers or sophisticated mechanical shock absorbers in their core design. These advanced technologies are absolutely crucial because sustained vibrations from rough road surfaces can permanently and irreparably damage the sensitive Optical Image Stabilization (OIS) mechanisms in modern, high-end smartphone cameras. Consumers should rigorously seek mounts explicitly and verifiably advertised as camera-safe or those proven to utilize certified shock-absorbing interfaces.

Which material type offers the best long-term combination of structural durability and lightweight performance for professional use?

Precision CNC-machined high-grade aluminum alloys, such as 6061 or 7075 series aluminum, provide the optimal and most reliable combination of mechanical durability, exceptional structural stability, and minimal product weight, establishing them as the industry standard for all premium and professional-grade mounting solutions. While high-impact engineered composites are lighter and more cost-effective for mass-market products, aluminum delivers demonstrably superior long-term resistance to high mechanical stress, temperature extremes, and persistent environmental corrosion in demanding conditions.

Is integrated wireless charging becoming a standard feature in bike phone holders, and what are its primary technological limitations?

Wireless charging is rapidly transitioning into a significant commercial trend, particularly for robust holders specifically designed for e-bikes or extensive touring applications, effectively addressing the major consumer concern of severe battery drain caused by continuous GPS app usage. The primary technological limitation involves the essential need for a constant, high-output power source (which often requires dedicated wiring to the bike’s main battery system) and effectively managing the internal heat dissipation generated within the often-sealed holder enclosure, which can be technologically challenging during prolonged operation under direct, intense sunlight.

What are the most critical factors consumers should prioritize when selecting a bike phone holder specifically for aggressive mountain biking (MTB)?

MTB riders must unequivocally prioritize two key attributes: absolute device security and uncompromising shock absorption capabilities. Essential selection factors include proven proprietary locking mechanisms (e.g., highly reliable twist-lock or multi-point ratchet systems), complete device enclosure or integrated full case protection for comprehensive environmental resilience (against mud, dust, and water), and military-grade anti-vibration technology to ensure the phone neither shakes loose nor sustains severe internal component damage across extreme, high-impact terrain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager