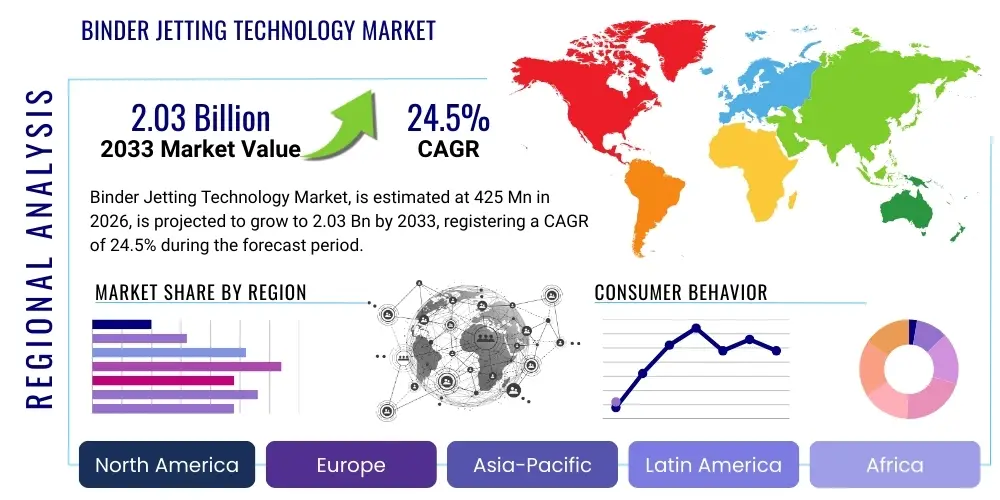

Binder Jetting Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440880 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Binder Jetting Technology Market Size

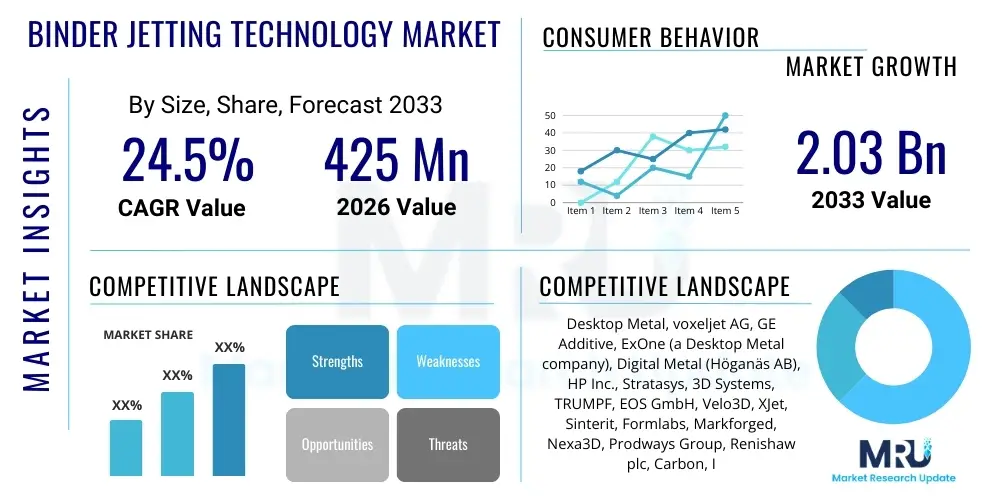

The Binder Jetting Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.5% between 2026 and 2033. The market is estimated at USD 425 Million in 2026 and is projected to reach USD 2.03 Billion by the end of the forecast period in 2033.

Binder Jetting Technology Market introduction

The Binder Jetting Technology market stands at the forefront of advanced manufacturing, representing a pivotal segment within the broader additive manufacturing landscape. Binder jetting is an innovative additive manufacturing process that fabricates complex three-dimensional objects by selectively depositing a liquid binding agent onto a powder bed, layer by layer. Unlike other 3D printing technologies that rely on melting or sintering the material with lasers, binder jetting solidifies the powder particles using a binder, allowing for the creation of intricate geometries without the need for support structures, particularly when printing with metal or ceramic powders. This unique methodology offers significant advantages in terms of material versatility, speed, and cost-effectiveness for various applications.

The product, encompassing both the specialized binder jetting machines and the consumable materials such as metal powders, ceramic powders, sand, and polymer binders, caters to a wide array of industrial demands. Major applications span critical sectors including aerospace, automotive, medical devices, industrial tooling, and consumer goods. In aerospace, it enables the production of lightweight, complex components with optimized internal structures for enhanced performance. For the automotive industry, it facilitates rapid prototyping, custom part manufacturing, and the production of molds and cores for casting. Medical applications benefit from the ability to create patient-specific implants and surgical instruments with high precision and biocompatibility.

The core benefits of binder jetting technology include its capacity for high-volume production, relatively lower operational costs compared to laser-based systems, and the flexibility to work with a diverse range of materials, leading to functional parts with tailored properties. Furthermore, its ability to recycle unused powder makes it an environmentally conscious manufacturing method, reducing material waste. This technology is increasingly valued for its potential in mass customization and its contribution to resilient, localized supply chains, particularly important in today's dynamic global economy.

Driving factors for the accelerated growth of this market include the surging demand for complex geometries and lightweight components across multiple industries, spurred by continuous innovation in product design and performance requirements. The growing emphasis on reducing manufacturing lead times and costs, coupled with advancements in material science enabling new applications for binder jetting, further propels market expansion. Additionally, the increasing adoption of additive manufacturing processes for end-part production, moving beyond mere prototyping, and the strategic investments by leading industrial players in this technology are significant contributors to its robust market trajectory.

Binder Jetting Technology Market Executive Summary

The Binder Jetting Technology market is experiencing dynamic growth, characterized by significant business trends that underscore its maturation and increasing industrial adoption. A key trend is the strategic consolidation among major players, with acquisitions and partnerships becoming prevalent as companies seek to expand their technological portfolios, market reach, and material capabilities. This consolidation aims to offer more comprehensive solutions to end-users, from hardware and software to materials and post-processing services, driving towards integrated additive manufacturing ecosystems. Furthermore, there is a notable shift from prototyping to the production of functional, end-use parts, indicating growing confidence in the technology's reliability and scalability, especially within demanding industries such as aerospace and medical.

Regionally, North America and Europe currently dominate the binder jetting market, fueled by strong R&D investments, advanced manufacturing infrastructure, and early adoption across critical sectors. The United States, in particular, leads in innovation and commercialization, supported by government initiatives and a robust ecosystem of technology developers and industrial end-users. Europe, with Germany, the UK, and France at the forefront, is witnessing substantial growth driven by its strong automotive and industrial machinery sectors. However, the Asia Pacific region is rapidly emerging as a significant growth engine, primarily due to expanding manufacturing capabilities in countries like China, Japan, and India, coupled with increasing investments in industrial digitalization and automation. This region presents vast opportunities for market players seeking new growth avenues and localized production.

Segment-wise, the market exhibits compelling trends across materials, end-use industries, and applications. The metals segment, particularly stainless steel, nickel alloys, and titanium, holds a dominant share, driven by demand for high-strength, lightweight components in aerospace and automotive applications. Ceramics and sand segments are also experiencing healthy growth, finding niches in specialty tooling, casting, and aesthetic applications. In terms of end-use industries, automotive and industrial sectors are prominent adopters, leveraging binder jetting for rapid tooling, complex part fabrication, and efficient production of intricate molds. The medical industry is increasingly employing the technology for patient-specific implants and prosthetic devices, benefiting from its precision and material versatility. The overarching trend is towards greater integration of binder jetting into mainstream manufacturing workflows, moving beyond niche applications to becoming a foundational pillar of advanced production strategies globally.

Looking ahead, the market is poised for continued expansion, driven by ongoing technological advancements, particularly in material science and process control, which are continuously improving part quality and expanding the range of printable materials. The demand for sustainability and localized manufacturing further bolsters the appeal of binder jetting, positioning it as a key technology for future industrial transformation. As the ecosystem matures with increased standardization and education, the entry barriers for smaller enterprises may decrease, leading to broader adoption and diversification of applications. The market's robust growth trajectory reflects its integral role in enabling the next generation of industrial innovation and supply chain resilience.

AI Impact Analysis on Binder Jetting Technology Market

The integration of Artificial Intelligence (AI) is set to revolutionize the Binder Jetting Technology market by addressing several critical challenges and unlocking new levels of efficiency and capability. Users frequently inquire about how AI can enhance process control, optimize material usage, predict part quality, and automate post-processing steps. There is a strong expectation that AI will lead to more robust and repeatable binder jetting processes, minimizing trial-and-error iterations and accelerating the development of new materials and applications. Concerns often revolve around the complexity of implementing AI solutions, the need for extensive data sets, and the potential impact on workforce skills, yet the overwhelming sentiment is positive regarding AI's potential to drive innovation and competitive advantage.

Key themes emerging from user inquiries include the desire for predictive analytics to avoid print failures, intelligent design tools that optimize geometries for binder jetting, and autonomous systems for quality assurance. Users also express interest in AI-driven material discovery platforms that can accelerate the qualification of new powders and binders, thereby expanding the material palette available to the technology. The ability of AI to learn from vast amounts of print data – including sensor readings, material properties, and environmental conditions – is seen as crucial for fine-tuning parameters, reducing material waste, and achieving superior mechanical properties in printed parts. This data-driven approach promises to elevate binder jetting from a specialized additive process to a highly industrialized and scalable manufacturing solution.

The impact of AI extends beyond just process optimization; it is anticipated to significantly influence the entire product lifecycle, from initial design to post-manufacturing analysis. By integrating machine learning algorithms into CAD/CAM software, designers can leverage generative design capabilities to create topologically optimized parts specifically tailored for binder jetting’s unique characteristics, minimizing material and print time. Furthermore, AI can enhance supply chain logistics by predicting demand for specific materials or parts, optimizing inventory management, and even facilitating localized, on-demand production. The convergence of AI with binder jetting technology is therefore expected to not only boost operational efficiencies but also foster unprecedented levels of innovation, leading to a broader array of applications and a more competitive market landscape.

- AI-driven optimization of print parameters for enhanced part quality and reduced defects.

- Predictive maintenance for binder jetting machines, minimizing downtime and increasing operational efficiency.

- Automated quality control and defect detection through computer vision and machine learning algorithms.

- Generative design tools leveraging AI to create complex, optimized geometries for binder jetting.

- Accelerated material discovery and qualification through AI-powered simulation and data analysis.

- Smart monitoring and real-time process adjustments for consistent and repeatable manufacturing.

- Improved energy efficiency and waste reduction through AI-optimized manufacturing workflows.

DRO & Impact Forces Of Binder Jetting Technology Market

The Binder Jetting Technology market is influenced by a complex interplay of drivers, restraints, opportunities, and inherent impact forces that collectively shape its growth trajectory and competitive landscape. A primary driver is the accelerating demand for advanced manufacturing solutions capable of producing highly complex geometries and lightweight components across diverse industries such as aerospace, automotive, and medical. Binder jetting's ability to create intricate designs without requiring support structures, combined with its high throughput capabilities, makes it an attractive option for manufacturers seeking to innovate product design and improve functional performance. Furthermore, the increasing need for mass customization and rapid prototyping, coupled with growing awareness about the sustainability benefits of additive manufacturing, including reduced material waste, significantly propels market expansion.

Despite the strong growth drivers, the market faces several restraints that could potentially impede its full potential. The high initial capital investment required for binder jetting systems, including the machines, post-processing equipment, and specialized software, can be a barrier for smaller enterprises or those with limited budgets. Moreover, while material versatility is a strength, the current range of qualified materials, particularly for high-performance applications, is still more limited compared to traditional manufacturing methods. The necessity for extensive post-processing steps, such as debinding and sintering for metal parts, adds complexity and cost to the overall production workflow, which can be a deterrent for some adopters. Additionally, intellectual property concerns related to digital designs and manufacturing processes, along with a skills gap in operating and maintaining these advanced systems, pose challenges to widespread adoption.

Conversely, numerous opportunities exist that are poised to unlock substantial growth for binder jetting technology. The continuous development of new materials, including advanced composites and multi-material printing capabilities, will significantly broaden the application scope of binder jetting, enabling its penetration into previously untapped markets such as consumer electronics and specialized industrial components. The ongoing trend towards Industry 4.0 and smart factories provides a fertile ground for integrating binder jetting with automation, IoT, and AI, leading to fully autonomous production lines and enhanced operational efficiencies. Moreover, the increasing focus on supply chain resilience and localized manufacturing, particularly in response to global disruptions, presents a strategic opportunity for binder jetting to offer on-demand, distributed production capabilities, reducing reliance on distant supply chains and fostering regional economic growth.

The market is also shaped by several inherent impact forces, including rapid technological advancements in printing speed, resolution, and machine reliability, which continuously improve the cost-effectiveness and performance of binder jetting systems. Economic shifts, such as global recessions or periods of high industrial investment, directly influence capital expenditure on advanced manufacturing equipment. Environmental regulations and the drive towards sustainable production methods increasingly favor additive technologies like binder jetting due to their material efficiency and reduced waste. The competitive landscape, characterized by both established industrial players and innovative startups, fuels continuous innovation in both hardware and materials, pushing the boundaries of what is possible with binder jetting and ensuring a dynamic and evolving market environment for stakeholders.

Segmentation Analysis

The Binder Jetting Technology market is comprehensively segmented to provide a detailed understanding of its diverse landscape, reflecting variations in materials used, end-use applications, component types, and the specific industries leveraging this advanced manufacturing process. This segmentation allows for precise market analysis, identifying key growth areas, competitive dynamics, and emerging trends across different product and application categories. Understanding these segments is crucial for strategic planning, product development, and market entry strategies, as each segment presents unique opportunities and challenges influenced by specific technological requirements, customer needs, and regulatory environments.

- By Material:

- Metals (e.g., Stainless Steel, Inconel, Copper, Titanium, Aluminum Alloys)

- Ceramics (e.g., Alumina, Zirconia, Silicon Carbide)

- Sand (e.g., Silica Sand, Zircon Sand, Cerabeads)

- Composites (e.g., Metal Matrix Composites, Polymer Matrix Composites)

- Others (e.g., Polymers, Cements, Specialty Materials)

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Medical & Dental

- Industrial Machinery

- Consumer Goods

- Energy

- Heavy Industry

- Art & Design

- Others (e.g., Research & Development, Education)

- By Component:

- Printers (Hardware)

- Binders (Consumables)

- Powders (Consumables)

- Software (e.g., CAD/CAM, Simulation, Slicer Software)

- Services (e.g., Post-processing, Maintenance, Consulting, On-demand Printing)

- By Application:

- Prototyping & Tooling

- Functional Parts Manufacturing

- Molds & Cores for Casting

- Production of Custom Components

- Research & Development

Value Chain Analysis For Binder Jetting Technology Market

The value chain for the Binder Jetting Technology market is a multi-faceted network encompassing a range of activities from raw material sourcing to end-product delivery and post-sales support. Upstream activities are critical to the quality and cost-effectiveness of binder jetting, primarily involving the development and supply of specialized metal, ceramic, and sand powders, along with the formulation of liquid binding agents. These raw material suppliers and chemical companies form the foundational layer, providing the essential consumables that dictate the performance and application scope of the printed parts. Additionally, upstream also includes manufacturers of key hardware components for binder jetting machines, such as print heads, motion systems, and control electronics, along with developers of proprietary software for design, slicing, and process control. Innovation at this stage, particularly in material science and software algorithms, significantly impacts the overall capabilities and efficiency of the technology.

Midstream activities primarily involve the manufacturers of binder jetting systems themselves, who integrate the various hardware components, software, and material specifications into complete, functional 3D printers. These manufacturers are responsible for the R&D, assembly, testing, and distribution of their machines. They often work closely with material suppliers to ensure compatibility and optimize print parameters for specific applications. Their role is to provide a reliable and efficient platform for additive manufacturing, often offering different scales and configurations of machines to cater to various industrial needs, from small-batch production to high-volume manufacturing. This stage also includes the development of integrated solutions that encompass the entire workflow, from pre-processing to post-processing, aiming for seamless user experiences and higher levels of automation.

Downstream activities focus on the application and utilization of binder jetting technology, extending from service bureaus that offer on-demand printing services to large-scale industrial end-users across sectors like automotive, aerospace, and medical. These end-users integrate binder jetting into their manufacturing processes for producing prototypes, tooling, and functional end-use parts. The downstream segment also includes companies specializing in critical post-processing steps such as debinding, sintering (for metal parts), infiltration, surface finishing, and quality inspection. These post-processing services are essential for achieving the desired mechanical properties, dimensional accuracy, and aesthetic quality of the final printed components. The effective coordination between machine manufacturers, material suppliers, and post-processing specialists is crucial for delivering high-quality, market-ready products to the end customer.

Distribution channels for binder jetting technology are typically a mix of direct and indirect approaches. Direct sales are common for high-value industrial systems, where manufacturers engage directly with large enterprises, offering customized solutions, technical support, and comprehensive training. This direct engagement ensures a deeper understanding of client needs and facilitates long-term partnerships. Indirect channels involve a network of distributors, resellers, and value-added integrators who help expand market reach, particularly in regions where direct sales may be less feasible. These partners often provide localized sales, support, and services, making the technology accessible to a broader customer base, including small and medium-sized enterprises. The choice of distribution strategy often depends on the company’s market penetration goals, product complexity, and the geographic spread of its target customer base, ensuring efficient delivery of both hardware and consumables to the global market.

Binder Jetting Technology Market Potential Customers

The Binder Jetting Technology market targets a diverse range of potential customers across various industrial sectors, all seeking advanced manufacturing solutions for complex part production, rapid prototyping, and efficient tooling. End-users and buyers of binder jetting products and services typically include large-scale manufacturing enterprises, specialized additive manufacturing service bureaus, research institutions, and small to medium-sized enterprises (SMEs) with niche production needs. These customers are driven by the desire to innovate product design, reduce manufacturing lead times, optimize supply chains, and achieve cost efficiencies that are often unattainable with traditional manufacturing methods, positioning binder jetting as a strategic investment for future-proofing their operations and maintaining a competitive edge in rapidly evolving markets.

Within the automotive industry, potential customers include original equipment manufacturers (OEMs) and their Tier 1 suppliers who leverage binder jetting for the rapid production of prototypes, functional components like drivetrain parts, and intricate molds and cores for metal casting, enabling faster design iterations and lighter vehicle components. The aerospace and defense sector represents a significant customer base, with aircraft manufacturers and defense contractors utilizing the technology for producing lightweight, complex structural components, engine parts, and specialized tooling that can withstand extreme operational conditions. This sector values the ability of binder jetting to create parts with optimized internal geometries, leading to superior performance and fuel efficiency, while also supporting the manufacturing of legacy parts for maintenance and repair operations.

The medical and dental industry is another high-growth customer segment, where binder jetting is employed by medical device manufacturers, dental laboratories, and pharmaceutical companies. Applications include the creation of patient-specific implants (e.g., orthopedic, cranial), custom prosthetics, intricate surgical instruments, and complex drug delivery systems. The technology’s precision, material versatility (including biocompatible metals and ceramics), and capacity for mass customization are key drivers for its adoption in this highly regulated and precision-driven sector. Furthermore, the industrial machinery and heavy equipment sector, encompassing manufacturers of turbines, pumps, valves, and construction equipment, are increasingly adopting binder jetting for rapid tooling, spare parts on demand, and the production of robust, high-performance components that reduce downtime and improve operational reliability in demanding environments.

Beyond these major industrial players, research and development institutions, universities, and specialized additive manufacturing service bureaus also constitute significant potential customers. These entities use binder jetting for advanced material research, process development, and offering specialized production capabilities to clients who may not have the in-house infrastructure. The growing number of designers and engineers requiring functional prototypes or small-batch custom components for consumer goods or niche products also contributes to the customer base, highlighting the technology’s versatility and accessibility for a broad spectrum of industrial and creative applications. The evolving landscape of manufacturing, coupled with the increasing demand for tailored solutions, ensures a continuously expanding customer base for binder jetting technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 425 Million |

| Market Forecast in 2033 | USD 2.03 Billion |

| Growth Rate | 24.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Desktop Metal, voxeljet AG, GE Additive, ExOne (a Desktop Metal company), Digital Metal (Höganäs AB), HP Inc., Stratasys, 3D Systems, TRUMPF, EOS GmbH, Velo3D, XJet, Sinterit, Formlabs, Markforged, Nexa3D, Prodways Group, Renishaw plc, Carbon, Inc., Eplus3D. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Binder Jetting Technology Market Key Technology Landscape

The Binder Jetting Technology market is underpinned by a sophisticated and continuously evolving technological landscape that encompasses advancements in hardware, software, and material science. The core technology relies on high-precision print heads capable of jetting microscopic droplets of binder with extreme accuracy, often leveraging technologies similar to industrial inkjet printing. Innovations in print head design, such as higher resolution and increased jetting frequency, are crucial for improving part accuracy, surface finish, and overall build speed. Furthermore, the development of robust, large-format machines with enhanced thermal management and process control systems allows for consistent production of larger, more complex parts, catering to industrial-scale manufacturing demands and broadening the range of viable applications beyond traditional prototyping.

Material science plays a pivotal role in expanding the capabilities of binder jetting. Advances in powder metallurgy and ceramic processing enable the creation of highly specialized metal and ceramic powders with optimized particle size distribution, flowability, and sintering characteristics. Simultaneously, the formulation of novel binding agents, including those with different chemical compositions and cure mechanisms, directly impacts the green strength of printed parts and their final mechanical properties after post-processing. Research into multi-material binder jetting, allowing for the printing of parts with varying material properties within a single build, represents a significant technological frontier. These material innovations are vital for unlocking new applications in industries requiring high-performance components, such as aerospace and medical.

Software innovations are equally critical, driving efficiency and expanding design possibilities. Advanced CAD/CAM software, specifically optimized for additive manufacturing, enables designers to create intricate geometries and lattice structures that are ideal for binder jetting. Slicer software has evolved to offer more precise control over print parameters, including binder saturation levels and layer thicknesses, which directly impact part density and strength. Furthermore, the integration of simulation tools helps predict material behavior during the printing and post-processing stages, minimizing trial-and-error and accelerating development cycles. The emergence of AI and machine learning algorithms within these software platforms is facilitating process optimization, predictive maintenance, and automated quality control, paving the way for more autonomous and intelligent binder jetting operations.

Beyond the core printing process, the technology landscape includes advancements in pre-processing and post-processing solutions. Automated powder handling and recycling systems improve material efficiency and reduce operational costs, while robotic systems are increasingly used for efficient powder removal from green parts. For metal binder jetting, innovations in debinding and sintering furnaces are crucial, offering more precise thermal control and atmospheric conditions to achieve desired material densities and mechanical properties. These integrated solutions, often combined with IoT sensors for real-time monitoring and data analytics, are transforming binder jetting into a fully digitized and interconnected manufacturing process. The synergistic development across hardware, materials, and software is collectively pushing the boundaries of what binder jetting technology can achieve, making it a more versatile, reliable, and cost-effective solution for industrial production.

Regional Highlights

- North America: This region holds a significant share of the binder jetting market, driven by robust R&D activities, early adoption of advanced manufacturing technologies, and substantial investments in the aerospace, automotive, and medical sectors. The United States is a primary hub for innovation, with a strong presence of leading binder jetting technology providers and a growing number of industrial end-users. Government initiatives supporting additive manufacturing further bolster market growth.

- Europe: Europe represents another major market for binder jetting, characterized by a mature industrial base and a strong emphasis on high-precision engineering. Countries such as Germany, the UK, France, and Italy are leading the adoption, particularly in the automotive, industrial machinery, and tooling sectors. Strategic partnerships between technology developers and industrial players are common, fostering a collaborative environment for market expansion.

- Asia Pacific (APAC): The APAC region is poised for the fastest growth in the binder jetting market, fueled by rapid industrialization, increasing manufacturing investments, and growing demand for customized parts in countries like China, Japan, South Korea, and India. Expanding automotive and consumer electronics industries, coupled with government support for advanced manufacturing, are key drivers.

- Latin America: This region is an emerging market for binder jetting technology, with increasing awareness and adoption in countries like Brazil and Mexico, primarily driven by investments in automotive manufacturing and industrial development. While currently a smaller share, significant growth opportunities exist as industries seek to modernize their production capabilities and enhance competitiveness.

- Middle East and Africa (MEA): The MEA region is witnessing nascent adoption of binder jetting, with opportunities primarily in the oil & gas, aerospace, and defense sectors, particularly in the UAE and Saudi Arabia. Investments in industrial diversification and the establishment of advanced manufacturing hubs are expected to gradually accelerate market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Binder Jetting Technology Market.- Desktop Metal

- voxeljet AG

- GE Additive

- ExOne (a Desktop Metal company)

- Digital Metal (Höganäs AB)

- HP Inc.

- Stratasys

- 3D Systems

- TRUMPF

- EOS GmbH

- Velo3D

- XJet

- Sinterit

- Formlabs

- Markforged

- Nexa3D

- Prodways Group

- Renishaw plc

- Carbon, Inc.

- Eplus3D

Frequently Asked Questions

What is Binder Jetting Technology?

Binder Jetting is an additive manufacturing process that uses a liquid binding agent selectively deposited onto a powder bed to create 3D objects layer by layer. It is renowned for its ability to produce complex geometries and for its material versatility, including metals, ceramics, and sand, without the need for support structures during printing.

What are the primary advantages of Binder Jetting over other 3D printing methods?

Key advantages include high production speed and throughput, cost-effectiveness for complex parts, a wide range of compatible materials, and the ability to produce large build volumes. It also eliminates the need for support structures, which simplifies post-processing and reduces material waste, making it highly efficient for industrial applications.

Which industries are the main adopters of Binder Jetting Technology?

The primary adopting industries are automotive for rapid tooling and functional components, aerospace & defense for lightweight and complex parts, and medical & dental for patient-specific implants and surgical guides. Industrial machinery, consumer goods, and energy sectors are also significant users, leveraging the technology for various applications.

What are the main challenges facing the Binder Jetting Technology market?

Major challenges include the high initial investment cost for systems, the relatively limited range of qualified materials compared to traditional manufacturing, and the often extensive post-processing steps (like debinding and sintering) required to achieve final part properties. Intellectual property concerns and a need for specialized skills also pose restraints.

How is AI impacting the future of Binder Jetting Technology?

AI is set to significantly enhance binder jetting by optimizing print parameters, improving predictive maintenance for machines, enabling automated quality control, and accelerating material discovery. AI-driven generative design tools will also allow for the creation of more efficient and complex part geometries, driving innovation and operational efficiency across the entire manufacturing process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager