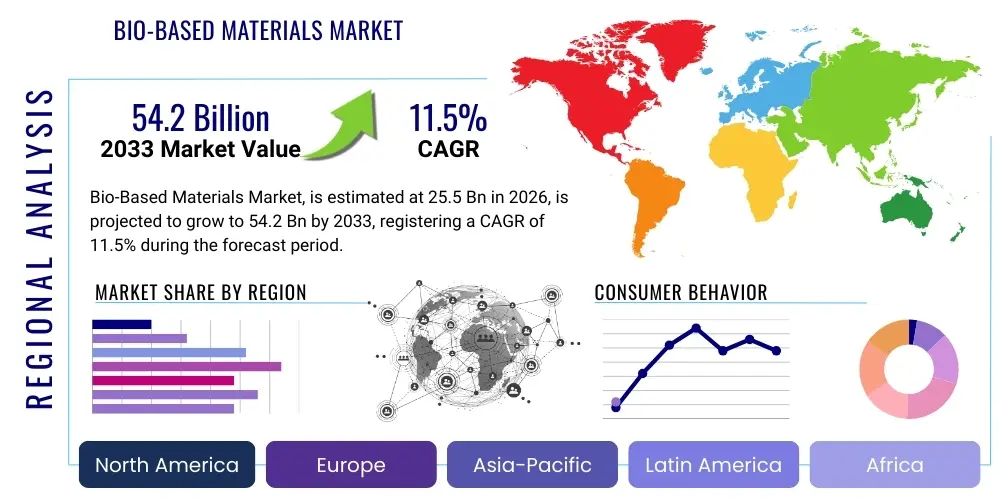

Bio-Based Materials Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441156 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Bio-Based Materials Market Size

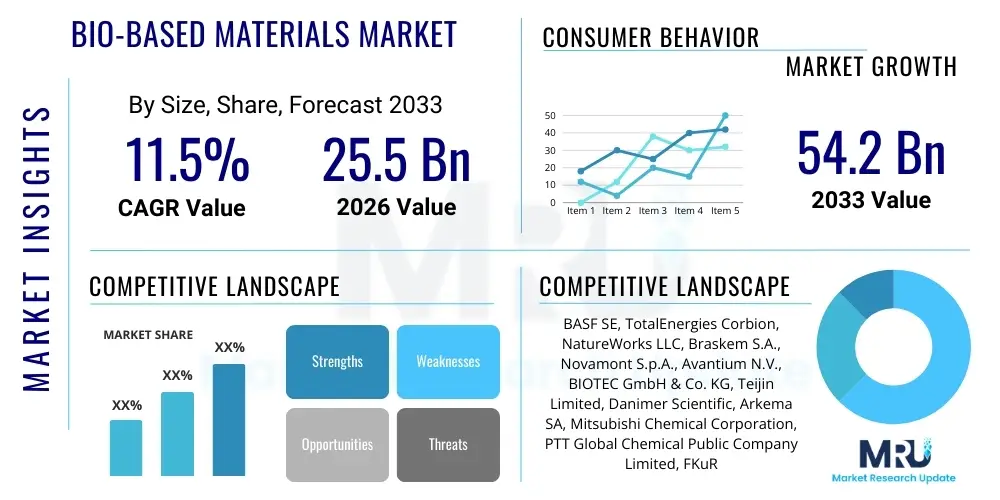

The Bio-Based Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 54.2 Billion by the end of the forecast period in 2033.

Bio-Based Materials Market introduction

The Bio-Based Materials Market encompasses polymers, chemicals, and intermediate products derived wholly or partially from renewable biomass sources, such as vegetable oils, starches, cellulose, and agricultural waste, rather than fossil fuels. These materials, including bioplastics like Polylactic Acid (PLA) and bio-based polyethylene (Bio-PE), are crucial for industries seeking sustainable alternatives to conventional petroleum-derived products. Their inherent biodegradability, lower carbon footprint, and reduced reliance on finite resources position them as central components in the global transition towards a circular economy.

Major applications of bio-based materials span critical sectors, most notably in packaging, where they address rising consumer demand for sustainable food contact and disposable items. Furthermore, the automotive and construction industries utilize durable bio-composites for weight reduction and enhanced sustainability credentials. Key benefits driving adoption include superior environmental performance, compliance with stringent regulatory mandates (such as single-use plastic bans), and the potential for technological innovations that enhance material properties, making them comparable or superior to traditional plastics in terms of performance and processability.

The primary driving factors fueling market expansion are stringent environmental regulations imposed by governing bodies in North America and Europe, coupled with pervasive corporate sustainability commitments from multinational companies across all consumer-facing sectors. Advances in biotechnology, particularly industrial fermentation and metabolic engineering, are enabling the cost-effective and large-scale production of complex bio-based chemicals and monomers, which in turn lowers production costs and increases the competitiveness of bio-based materials against their fossil-fuel counterparts. This technological maturation ensures a stable supply chain necessary for widespread commercial adoption.

Bio-Based Materials Market Executive Summary

The Bio-Based Materials Market is experiencing robust acceleration driven by the imperative to decarbonize industrial supply chains and meet ambitious global climate targets. Current business trends indicate a significant shift in investment towards second and third-generation feedstock technologies, utilizing non-food crops and waste streams, thereby mitigating the "food vs. fuel" debate and securing sustainable raw material sourcing. Strategic alliances between petrochemical majors and biotech startups, focusing on large-scale production capacity expansion and specialized material development for high-performance applications like electronics and medical devices, define the competitive landscape and contribute to market diversification beyond basic packaging applications.

Regionally, Europe maintains its leadership position, propelled by comprehensive regulatory frameworks such as the European Green Deal and high consumer awareness regarding sustainability. North America is poised for accelerated growth, largely due to governmental incentives (e.g., USDA bio-preferred program) and massive private sector R&D spending focused on high-durability biopolymers suitable for automotive interiors and construction composites. The Asia Pacific (APAC) region, while primarily focused on economic growth, is emerging as the largest manufacturing hub for bio-based materials, particularly driven by demand in China, India, and Southeast Asia for biodegradable packaging solutions, reflecting a growing domestic focus on waste management and pollution control.

Segment trends highlight the dominance of biodegradable polymers such as Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHA) within the bioplastics category, favored primarily by the packaging and consumer goods sectors seeking end-of-life solutions. However, the bio-based "drop-in" chemicals, like Bio-PE and Bio-PET, which require minimal adjustments to existing infrastructure, are experiencing rapid adoption in high-volume industries due to their compatibility and performance equivalence with traditional materials. The increasing sophistication of materials derived from marine biomass and agricultural residues points toward future market diversification and reduced dependency on specific crop feedstocks.

AI Impact Analysis on Bio-Based Materials Market

Common user questions regarding AI's impact on the Bio-Based Materials Market often center on its role in optimizing feedstock conversion efficiency, accelerating material discovery, and improving circularity metrics. Users are keen to understand how machine learning can enhance fermentation processes, currently a high-cost bottleneck, and whether AI algorithms can predict the performance and degradation characteristics of novel biopolymer formulations. Key themes involve predictive analytics for supply chain stability, automating quality control in advanced manufacturing, and utilizing generative AI models to design new monomers with specific desired traits (e.g., enhanced thermal stability or toughness) derived from renewable sources, thereby revolutionizing the pace of innovation and reducing traditional trial-and-error R&D expenditure.

- AI-driven optimization of industrial fermentation processes, significantly increasing yield and reducing energy consumption for biopolymer production (e.g., PHA, PLA monomers).

- Machine learning algorithms accelerating the discovery and screening of new enzymatic pathways and microbial strains essential for efficient biomass conversion.

- Predictive modeling enabling researchers to simulate the long-term performance, durability, and controlled biodegradability of novel bio-based material compositions.

- AI improving supply chain resilience by forecasting feedstock availability (e.g., agricultural waste) and optimizing logistics between biorefineries and material processing facilities.

- Automation of quality control and sorting processes in advanced recycling facilities to enhance the purity and recovery rate of bio-based plastics suitable for high-value applications.

DRO & Impact Forces Of Bio-Based Materials Market

The Bio-Based Materials Market is fundamentally influenced by a dynamic interplay of policy incentives and technological advancements. Key drivers include stringent global regulations targeting greenhouse gas emissions and single-use plastic waste, which compel industries to invest in sustainable substitutes. Furthermore, significant advances in synthetic biology and biorefinery technologies are reducing the production costs of complex bio-monomers, improving the price competitiveness of bio-based materials relative to fossil-fuel derivatives. These drivers create an immediate market pull for scalable and performance-equivalent biopolymers across multiple industrial applications, particularly packaging, textiles, and automotive manufacturing.

Restraints primarily revolve around the initial higher manufacturing cost of bio-based materials compared to mature, cost-optimized conventional plastics, particularly during periods of volatile feedstock pricing and nascent economies of scale. Concerns regarding the land use implications associated with first-generation feedstocks (such as corn and sugarcane) and the need for dedicated industrial composting infrastructure to handle specific biodegradable polymers also pose significant hurdles to widespread adoption. While technological progress is addressing cost and performance limitations, the complexity of scaling up novel biotechnological processes remains a critical restraint.

Opportunities are abundant in the high-performance material sector, where customized bio-composites can offer unique performance characteristics, such as ultra-lightweight structures for aerospace or enhanced barrier properties for sophisticated food preservation. The development of 'drop-in' bio-based chemicals (e.g., bio-based ethylene and propylene) that seamlessly integrate into existing manufacturing infrastructure represents a massive opportunity for rapid market penetration in established commodity chemical sectors. Additionally, emerging markets in Asia and Latin America present substantial untapped demand for sustainable, domestically sourced materials driven by urbanization and rising environmental awareness.

Segmentation Analysis

The Bio-Based Materials Market is comprehensively segmented based on material type, application, and source, reflecting the diverse product landscape and end-user requirements. The Type segment differentiates between biodegradable materials like PLA and PHA, favored for short-lifecycle products, and non-biodegradable "drop-in" solutions such as Bio-PE and Bio-PET, which maintain structural integrity and performance identical to their fossil counterparts. Analyzing these material categories is essential for understanding innovation cycles and investment priorities within the market, particularly regarding scaling up production capabilities.

Application segmentation reveals the market's heavy reliance on the packaging sector, which acts as the primary volume driver due to immediate needs for sustainable packaging solutions in food and beverage. However, the fastest growth rates are observed in high-value, technical segments like Automotive & Transportation, where bio-composites contribute to vehicle lightweighting, and Construction, utilizing bio-insulation and durable bio-plastics for internal fittings. The source segmentation, focusing on feedstocks such as sugarcane, corn, and increasingly, agricultural residues (second-generation), indicates the industry's strategic efforts to shift towards more sustainable and non-competitive raw material sourcing to ensure long-term market viability.

- By Type:

- Bio-based Polyethylene (PE)

- Bio-based Polypropylene (PP)

- Bio-based Polyethylene Terephthalate (PET)

- Bio-based Polyamides (PA)

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Bio-based Polyurethane (PU)

- Others (Epoxies, PVC, etc.)

- By Application:

- Packaging (Rigid and Flexible)

- Automotive & Transportation

- Construction & Building Materials

- Textiles & Apparel

- Consumer Goods (Electronics, Appliances)

- Agriculture (Films, Mulches)

- Medical Devices

- By Source:

- Sugar and Starch (Corn, Sugarcane)

- Vegetable Oils (Castor Oil, Palm Oil)

- Cellulose and Lignin

- Agricultural Waste/Residues (Lignocellulosic Biomass)

Value Chain Analysis For Bio-Based Materials Market

The value chain for bio-based materials begins with upstream activities centered on the sustainable sourcing and processing of renewable feedstocks. This involves agricultural entities and biomass processing plants converting primary sources (e.g., corn starch, sugarcane, or lignocellulosic waste) into intermediate monomers or platform chemicals. Efficiency in this initial stage, often involving complex biorefinery processes like fermentation or chemical catalysis, is paramount as it dictates the final cost and environmental footprint of the resulting material. Key challenges upstream include optimizing yield, ensuring stable supply amidst climate variability, and improving the utilization of waste streams to achieve true circularity and cost parity with fossil fuels.

The midstream involves the polymerization and compounding of these bio-based monomers into marketable materials (pellets, resins, or fibers). This stage is characterized by collaboration between chemical companies and specialty material developers who focus on enhancing material performance, such as thermal resistance, strength, and barrier properties, often through advanced compounding techniques and blending with other components. Distribution channels, both direct and indirect, play a critical role here, utilizing specialized logistics networks to move bulk polymer resins to converters and fabricators globally. Direct channels are common for large-volume industrial purchasers (e.g., major packaging companies), while indirect channels rely on regional distributors and specialized chemical traders to reach smaller manufacturers and custom fabricators.

Downstream activities include the conversion of bio-based resins into final products (e.g., films, bottles, components) by molders, extruders, and fabricators, culminating in the sale to end-user industries (packaging, automotive, etc.). The final stage of the value chain addresses end-of-life management, which is crucial for maximizing the sustainability promise of these materials. This includes collection, mechanical and chemical recycling, and, for biodegradable variants, industrial composting infrastructure. The performance and sustainability characteristics of the materials must be clearly communicated across the distribution network to ensure proper end-of-life handling and consumer acceptance.

Bio-Based Materials Market Potential Customers

Potential customers and primary buyers of bio-based materials represent a broad cross-section of global industry focused on mitigating environmental impact and achieving net-zero targets. The largest volume consumers are Fast-Moving Consumer Goods (FMCG) corporations, including major players in food and beverage and personal care, who are under intense public and regulatory pressure to eliminate plastic waste and improve product lifecycle sustainability. These companies prioritize bio-based materials for primary and secondary packaging, seeking solutions that are either recyclable, compostable, or derived from certified renewable sources, often driving large-scale procurement contracts and setting industry standards for material substitution.

Beyond FMCG, significant demand originates from the Automotive and Aerospace sectors, driven by the need for lightweight, high-performance composites that contribute to fuel efficiency and electric vehicle range extension. These industries serve as critical buyers for specialized, durable bio-polymers and bio-fibers used in interior components, under-the-hood applications, and exterior paneling. Furthermore, the Construction industry, particularly companies specializing in green building and sustainable infrastructure, is rapidly increasing its uptake of bio-based insulation, sustainable paints, and composite decking materials, utilizing these products to achieve recognized environmental building certifications and enhance structural longevity.

Other key end-users include independent converters and compounders who purchase bulk resins and modify them for specific customer requirements, acting as essential intermediaries in the supply chain. The Textile industry, particularly apparel brands committed to sustainable sourcing, utilizes bio-based fibers derived from materials like PLA and bio-based nylon for sportswear and high-end fashion, appealing directly to environmentally conscious consumers. Lastly, the Medical sector requires bio-based materials for single-use devices, drug delivery systems, and sterile packaging, where biocompatibility and strict regulatory compliance are paramount purchase criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 54.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, TotalEnergies Corbion, NatureWorks LLC, Braskem S.A., Novamont S.p.A., Avantium N.V., BIOTEC GmbH & Co. KG, Teijin Limited, Danimer Scientific, Arkema SA, Mitsubishi Chemical Corporation, PTT Global Chemical Public Company Limited, FKuR Kunststoff GmbH, Kaneka Corporation, Synvina (JV of BASF and Avantium), Toray Industries Inc., Eastman Chemical Company, Telles (Metabolix and Archer Daniels Midland JV), Genomatica, LanzaTech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bio-Based Materials Market Key Technology Landscape

The technological landscape of the Bio-Based Materials Market is primarily defined by advancements in industrial biotechnology, chemical synthesis leveraging renewable feedstocks, and novel polymerization techniques. Industrial biotechnology, particularly microbial fermentation, is central to producing key monomers such as lactic acid (for PLA) and various hydroxyl-alkanoates (for PHA). Continuous process optimization in bioreactors, coupled with metabolic engineering of microbial hosts, is crucial for lowering fermentation costs, achieving higher purity yields, and enabling the utilization of cheaper, more sustainable non-food biomass sources. This area of technology development is heavily reliant on automation and data analytics to fine-tune biological reactions for commercial scalability.

Another major technological pillar is the development of processes that enable the "drop-in" synthesis of bio-identical chemicals. For instance, processes converting bio-ethanol (derived from sugarcane or corn) into bio-ethylene are crucial for the production of Bio-PE, allowing material producers to utilize existing infrastructure without modification. Similarly, innovations in catalytic chemistry are focused on depolymerizing complex biomass (lignocellulose) into platform chemicals like furanics (e.g., FDCA for Bio-PEF), providing an environmentally superior alternative to petroleum-based monomers. These synthetic pathways aim for chemical equivalence to ensure bio-based materials meet stringent performance standards required by sophisticated industries like automotive and electronics.

Furthermore, significant research is being dedicated to advanced compounding and material science, focusing on creating high-performance bio-composites and specialty blends. This involves incorporating natural fibers (e.g., hemp, flax) or nanoscale bio-fillers into polymer matrices to enhance mechanical strength, thermal resistance, and barrier properties. Nanocellulose technology, for example, is emerging as a promising additive for improving the stiffness and gas impermeability of bioplastic films. The ability to precisely tailor the functional properties of bio-based materials through sophisticated blending and processing techniques is key to displacing conventional plastics in demanding applications and expanding the market footprint beyond simple packaging.

Regional Highlights

- Europe: Europe is the global leader in bio-based materials adoption, driven by progressive legislative actions such as the EU Plastics Strategy and the Circular Economy Action Plan, which strongly incentivize sustainable sourcing and waste reduction. Countries like Germany, the Netherlands, and Scandinavia possess advanced recycling and composting infrastructure, fostering strong demand for both biodegradable polymers and certified bio-based drop-ins. Innovation centers and strategic corporate sustainability targets also contribute significantly to high regional consumption and technology export.

- North America: The market in North America is characterized by robust R&D investment, particularly in the U.S., supported by federal programs aimed at promoting bio-preferred products across government procurement and private sector supply chains. The automotive and packaging sectors are primary demand drivers. While legislative action varies regionally, major corporate commitments, especially among major food and beverage producers headquartered in the region, ensure steady market growth and investment in large-scale production facilities.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, fueled by rapid industrialization, growing populations, and increasing awareness regarding environmental pollution, especially plastic waste. China, Japan, and India are key markets. While cost competitiveness remains vital, government initiatives in countries like China to ban non-degradable plastics are spurring massive investment in domestic bioplastics production capacity, shifting the region from a purely manufacturing base to a significant consumer market, particularly for PLA and starch-based materials.

- Latin America (LATAM): LATAM is a critical feedstock supplier, largely utilizing sugarcane (Brazil) and corn for bio-ethanol and subsequently, bio-PE production. Brazil holds a dominant position due to its advanced agricultural infrastructure and established biochemical industry. Domestic demand for sustainable packaging is increasing, supported by regional regulatory trends, though reliance on agricultural commodity prices presents a unique regional vulnerability.

- Middle East and Africa (MEA): This region is currently characterized by slower adoption rates compared to other areas, primarily due to lower immediate regulatory pressure and a focus on traditional petroleum-based chemical production. However, increasing investments in diversified economic models, particularly in the UAE and Saudi Arabia, are creating emerging opportunities for bio-based materials in high-end construction, specialty chemicals, and sustainable tourism infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bio-Based Materials Market.- BASF SE

- TotalEnergies Corbion

- NatureWorks LLC

- Braskem S.A.

- Novamont S.p.A.

- Avantium N.V.

- BIOTEC GmbH & Co. KG

- Teijin Limited

- Danimer Scientific

- Arkema SA

- Mitsubishi Chemical Corporation

- PTT Global Chemical Public Company Limited

- FKuR Kunststoff GmbH

- Kaneka Corporation

- Synvina (JV of BASF and Avantium)

- Toray Industries Inc.

- Eastman Chemical Company

- Telles (Metabolix and Archer Daniels Midland JV)

- Genomatica

- LanzaTech

Frequently Asked Questions

Analyze common user questions about the Bio-Based Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between biodegradable and bio-based materials?

Bio-based materials are derived from renewable feedstocks (like corn or sugarcane) instead of fossil fuels, focusing on resource origin. Biodegradable materials, conversely, are defined by their end-of-life trait—they can naturally decompose into biomass, CO2, and water under specific conditions (often industrial composting), regardless of their original source.

How do fluctuations in agricultural commodity prices affect the Bio-Based Materials Market?

Since first-generation bio-based materials rely heavily on high-volume feedstocks like corn starch and sugarcane, volatility in agricultural commodity prices directly impacts the production cost and price competitiveness of biopolymers like PLA or Bio-PE against cheaper fossil-fuel alternatives, posing a constant challenge to market stability.

Which application segment holds the largest share in the Bio-Based Materials Market?

The Packaging sector currently holds the largest market share. Driven by extensive consumer demand and stringent regulatory requirements targeting single-use plastics globally, both flexible and rigid packaging utilize bio-based polymers (such as PLA, PHA, and Bio-PET) as substitutes for conventional plastics, maximizing volume adoption.

What are the main technological bottlenecks limiting the scalability of advanced bio-based materials?

Key bottlenecks include optimizing the upstream conversion of lignocellulosic biomass (second-generation feedstock) into high-purity monomers efficiently, and achieving cost-effective large-scale industrial fermentation without excessive energy input. Infrastructure limitations for post-consumer collection and industrial composting also hinder full scalability and circularity.

Which geographic region is expected to demonstrate the fastest growth in the market?

The Asia Pacific (APAC) region is forecasted to experience the fastest growth rate. This acceleration is primarily driven by supportive governmental policies in key economies like China and India aiming to address local plastic pollution, coupled with massive ongoing investment in domestic biorefinery and production capacity expansion.

The imperative for sustainability is driving profound structural changes in global industrial production, positioning bio-based materials at the core of the future chemical and materials economy. Policy support, coupled with breakthroughs in industrial biotechnology, continues to de-risk investments and push these materials toward cost parity. Continuous innovation in high-performance grades and expanding applications beyond traditional packaging into automotive and construction will be crucial for sustaining the high growth trajectory witnessed during the forecast period. Strategic partnerships across the value chain, linking feedstock suppliers, biotech firms, and multinational end-users, are essential for mobilizing the required capital and expertise to realize the full commercial potential of these renewable solutions and address the climate crisis through material substitution.

Future market success hinges significantly on the harmonization of global standards for "bio-based" labeling and "biodegradability" certification, ensuring clarity for both industrial converters and consumers. Furthermore, investment in end-of-life infrastructure—specifically, expanding access to industrial composting facilities and advanced recycling technologies optimized for biopolymers—will determine the true sustainability impact and long-term viability of specific material segments. As the world population grows and resource scarcity becomes more pronounced, the demand for materials that decouple economic growth from fossil fuel consumption will cement the Bio-Based Materials Market as a cornerstone of sustainable development.

The transition toward a fully bio-based materials economy is not merely a technological shift but a systemic transformation requiring regulatory alignment, consumer education, and continued cost reduction achieved through economies of scale and advanced process engineering. Emphasis on second and third-generation feedstocks derived from non-food sources, such as algae and agricultural residues, is non-negotiable for ensuring ethical and sustainable feedstock supply, thereby mitigating competition with global food systems. Companies that strategically invest in vertical integration—from biorefining capabilities to specialized compounding—will be best positioned to capture market share and navigate the evolving regulatory and competitive landscape. This report underscores a fundamental industrial pivot towards renewable chemistry driven by environmental necessity and strong market pull from global consumers and corporations alike.

Investment patterns are increasingly favoring technologies that enable high-volume production of monomers like bio-BDO (1,4-Butanediol) and FDCA (2,5-Furandicarboxylic acid), which serve as key building blocks for high-performance bioplastics like Bio-PBT and Bio-PEF, respectively. These materials possess superior barrier properties and thermal resistance compared to traditional bioplastics, making them ideal candidates for rigorous applications currently dominated by petroleum derivatives. This focus on performance equality or superiority is vital for moving bio-based materials from niche, environmentally conscious products to mainstream industrial components, further stimulating market expansion across automotive, electronics, and technical textile sectors where performance criteria are stringent.

The regulatory environment continues to evolve as governments seek to reconcile environmental goals with industrial capabilities. Policy instruments such as carbon taxes, extended producer responsibility (EPR) schemes, and mandated content requirements for recycled or bio-based material are creating powerful economic incentives for producers to accelerate the shift. Companies operating in the European Union, for example, face tighter restrictions on packaging waste, directly driving the demand for compostable and bio-attributed polymers. Such regulatory clarity provides the necessary long-term signal for large chemical manufacturers and investors to commit the significant capital required for new biorefinery construction and commercialization of next-generation bio-based technologies.

Furthermore, consumer perception and acceptance are pivotal for market adoption. Consumers are increasingly valuing transparency regarding material origin and end-of-life options. Successful market players are leveraging digital tools, such as blockchain technology and specialized certifications, to provide traceable, verifiable information about the sustainability attributes of their bio-based materials, thereby building trust and driving brand loyalty. Educational campaigns focusing on proper disposal methods—differentiating between industrial compostable and home compostable, for instance—are essential to ensure that the environmental benefits of these materials are fully realized and do not contribute to mismanaged waste streams, which could otherwise undermine the market's sustainability narrative.

The convergence of advanced materials science with synthetic biology holds the promise of developing entirely new classes of bio-based materials engineered specifically for circularity. Research is focused on creating polymers that can be chemically recycled back to their original monomers with near-perfect efficiency, or polymers designed to only degrade when exposed to specific triggers, offering controlled longevity. This move towards intelligent materials design, often guided by AI and high-throughput screening, represents the next frontier, ensuring that bio-based materials offer not just a lower carbon footprint during production but also optimized circularity at the end of their functional life. This technological push is essential for meeting the ambitious waste reduction targets set by major global organizations and governments worldwide.

The competitive landscape is characterized by both established chemical giants diversifying their portfolios (e.g., BASF, Mitsubishi Chemical) and specialized biotech pure-plays (e.g., NatureWorks, Novamont). Acquisitions and joint ventures are common strategies employed to merge deep material science expertise with innovative bioprocess technology, accelerating time-to-market for scalable solutions. Price parity, especially against commodity plastics like virgin polyethylene, remains the most significant competitive hurdle, driving continuous investment in process efficiency and scale. Market leaders are those who can effectively manage feedstock costs, maintain consistent material quality, and secure long-term off-take agreements with major consumer brand owners, thus guaranteeing production utilization and favorable financial returns.

Geopolitical factors also influence feedstock security and sourcing strategies. Dependence on single-source biomass commodities, such as Brazilian sugarcane, encourages companies to diversify sourcing geographically and technologically, investing in second-generation feedstocks derived from regional wastes. This distributed manufacturing approach not only enhances supply chain resilience but also aligns with the principles of the circular economy by utilizing localized, non-competitive resources. Consequently, regional market differences—such as Europe's focus on composting, North America's emphasis on drop-in replacements, and APAC's rapid capacity build-up—dictate specific investment priorities and technology deployment strategies for global players in the Bio-Based Materials Market.

The continuous evolution of bioplastics, bio-composites, and bio-intermediates is redefining material possibilities. Novel high-value products, such as bio-isobutene, bio-acrylic acid, and bio-butadiene, are expanding the functional reach of bio-based chemistry into complex industrial sectors like tires, coatings, and adhesives, previously inaccessible to biopolymers. These highly specialized applications, while lower in volume than packaging, offer significantly higher profit margins and contribute disproportionately to technological validation and R&D funding, proving that bio-based materials are increasingly capable of delivering performance without compromise on sustainability.

The integration of digital platforms and IoT (Internet of Things) devices across biorefineries enhances operational transparency and efficiency, further supporting the economic viability of bio-based production. Real-time monitoring of fermentation parameters, predictive maintenance of complex bioreactors, and automated quality checks ensure consistent, high-grade polymer output, which is crucial for meeting the exacting standards of automotive and medical applications. This digitalization trend is essential for overcoming the scale-up challenges historically associated with bringing novel bio-chemical processes from laboratory demonstration to gigatonne-level commercial reality, ensuring a stable and reliable supply for global converters and manufacturers.

Finally, governmental support extends beyond procurement programs to direct funding for R&D through grants and tax credits aimed at sustainable manufacturing. Collaborative research initiatives involving universities, public institutions, and private industry are common mechanisms used to pool resources and accelerate the development of technologies that can utilize municipal solid waste or industrial CO2 emissions as feedstocks—the true third generation of bio-based materials. Such large-scale, coordinated efforts are vital for addressing the inherent complexity of biochemical engineering and materials science, paving the way for a truly net-zero materials infrastructure globally.

The convergence of material performance, cost efficiency improvements driven by technology, and intensifying regulatory pressure ensures that the Bio-Based Materials Market will remain a central pillar of the global sustainable economy transition over the next decade. The market's growth is inherently linked to global climate action and the imperative to secure renewable resource access, making it a critical area for both strategic corporate investment and governmental policy focus across all major industrialized and emerging economies worldwide.

This detailed analysis underscores the shift from mere substitution to performance-driven innovation. Companies are not just replacing plastic; they are leveraging the unique attributes of bio-based chemistry—such as enhanced barrier properties in Bio-PEF or the biocompatibility of PHA—to create superior products. The future competitive edge will belong to firms capable of mastering both the upstream biology/chemistry and the downstream material engineering required to meet the highly technical demands of specialized industry sectors, moving the narrative entirely past the initial challenge of cost parity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager