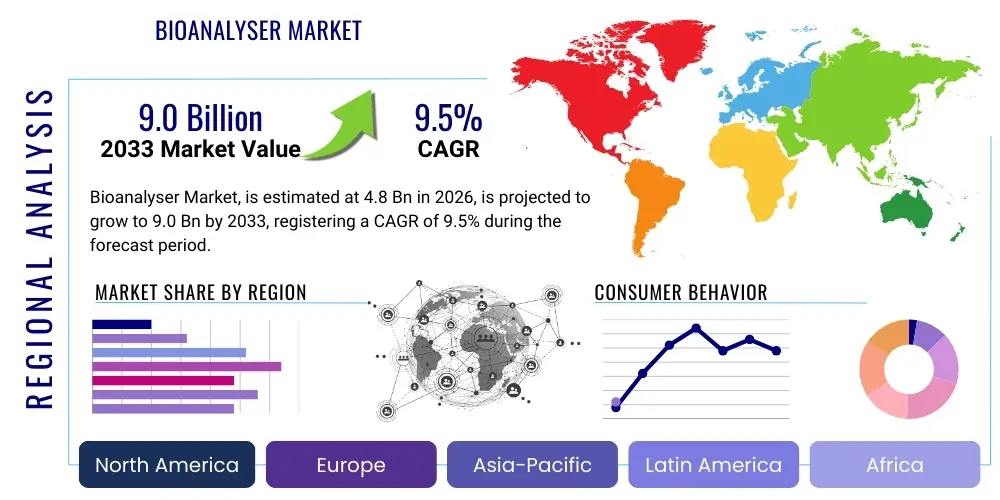

Bioanalyser Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441547 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Bioanalyser Market Size

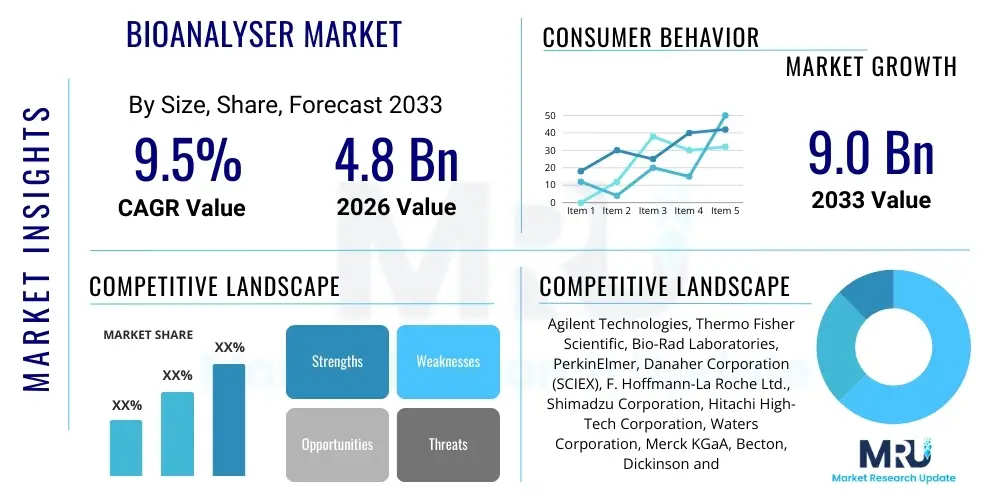

The Bioanalyser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Bioanalyser Market introduction

The Bioanalyser Market encompasses sophisticated analytical instruments and specialized consumables used for the quantitative and qualitative measurement of biological molecules, including DNA, RNA, proteins, and metabolites. These systems are pivotal in modern life science research, clinical diagnostics, and quality control processes, offering high sensitivity and precision necessary for complex biological assays. The core functionality of bioanalysers revolves around separating, identifying, and quantifying biomolecules, typically utilizing techniques such as electrophoresis, chromatography, and mass spectrometry. The increasing complexity of biological samples and the move toward high-throughput screening necessitate the adoption of advanced, automated bioanalyser platforms across various industries.

The primary applications of bioanalysers span across drug discovery and development, where they are crucial for pharmacokinetics studies and quality assessment of therapeutic proteins, and in clinical diagnostics, aiding in disease biomarker identification and monitoring therapeutic efficacy. Benefits derived from using these technologies include rapid analysis times, minimal sample consumption, and enhanced data reliability, which are critical for accelerating research outcomes and improving patient care. Furthermore, the integration of microfluidics and miniaturization technologies has allowed for the development of portable and more user-friendly systems, expanding their utility outside centralized laboratories.

Key driving factors fueling market expansion include the sustained growth in global pharmaceutical and biotechnology research and development spending, particularly in personalized medicine and gene therapy sectors. The rising incidence of chronic and infectious diseases globally also mandates extensive biomarker research, thereby stimulating the demand for high-performance bioanalytical tools. Additionally, stringent regulatory requirements for quality assurance in drug manufacturing and food safety testing further cement the indispensable role of bioanalysers in the modern scientific ecosystem.

Bioanalyser Market Executive Summary

The Bioanalyser Market is experiencing robust growth driven by significant advancements in analytical technology, coupled with rising investments in life sciences R&D globally. Business trends emphasize the shift toward integrated, multi-modal systems that combine different analytical capabilities, such as coupling liquid chromatography with high-resolution mass spectrometry, to provide comprehensive sample analysis. Automation and high-throughput capabilities are paramount, addressing the need for efficiency in large-scale genomic and proteomic studies. Key stakeholders are focusing on developing user-friendly software interfaces and consumables that minimize manual intervention and enhance data integrity, reflecting a broader industry push for digitization and streamlined laboratory workflows.

Regionally, North America maintains its dominance due to a strong presence of major biotechnology and pharmaceutical companies, robust governmental funding for biomedical research, and rapid adoption of advanced diagnostic technologies. However, the Asia Pacific region is anticipated to demonstrate the highest growth rate, fueled by improving healthcare infrastructure, increasing outsourcing of drug discovery activities to countries like India and China, and rising awareness regarding early disease diagnosis. European markets remain stable, driven by stringent quality control regulations in biotechnology and academic research excellence, particularly in countries like Germany and the UK, focusing on biomarker validation and personalized treatment strategies.

Segment trends reveal that the Instruments segment, particularly those leveraging mass spectrometry and next-generation sequencing preparatory techniques, holds a substantial market share due to high initial procurement costs and continuous technological upgrades. Conversely, the Reagents & Consumables segment is forecasted to exhibit rapid growth, supported by the recurring need for specialized kits, columns, and buffers essential for daily operational throughput. Within applications, Drug Discovery & Development is the leading segment, utilizing bioanalysers for ADME testing and quality control of biopharmaceuticals, while Clinical Diagnostics is rapidly accelerating due to the integration of bioanalytical platforms into routine clinical lab setups for complex disease monitoring.

AI Impact Analysis on Bioanalyser Market

Common user questions regarding AI's impact on the Bioanalyser Market center on data interpretation speed, potential for predictive diagnostics, and the reduction of human error in complex assays. Users frequently inquire about how AI can handle the massive, complex datasets generated by high-throughput bioanalysers (such as mass spectrometers or high-content screening systems), seeking automated pattern recognition and anomaly detection capabilities. There is high expectation that AI will move bioanalysis beyond descriptive results to prescriptive and predictive outcomes, especially in personalized medicine. Key concerns revolve around data security, validation of AI algorithms for regulatory compliance, and the need for specialized training to integrate these sophisticated analytical tools into existing laboratory infrastructures effectively. The consensus expectation is that AI integration will significantly enhance the efficiency, throughput, and interpretive power of bioanalytical workflows.

- AI enables automated data processing and complex pattern recognition in high-throughput bioanalytical data.

- Machine learning algorithms enhance biomarker discovery by identifying subtle associations in large proteomic and genomic datasets.

- Predictive modeling optimizes experimental design, reducing time and cost associated with repetitive bioanalytical testing.

- AI facilitates automated quality control and system calibration, ensuring higher accuracy and reliability of bioanalyser instruments.

- Improved interpretation of chromatograms and spectra accelerates drug metabolism and pharmacokinetic (ADME) studies.

DRO & Impact Forces Of Bioanalyser Market

The Bioanalyser Market growth is fundamentally propelled by technological innovation, regulatory demands, and epidemiological shifts. Key drivers include the escalating global investment in life sciences R&D, particularly within the nascent fields of personalized medicine, cell, and gene therapies, which require high-precision molecular characterization tools. Furthermore, the persistent rise in the prevalence of chronic diseases necessitates widespread biomarker detection and diagnostic testing, thereby increasing the utilization of advanced bioanalytical systems across clinical settings and pharmaceutical trials. These forces create sustained demand for faster, more sensitive, and automated bioanalysers.

However, market expansion is moderated by significant restraints, primarily the high initial capital expenditure required for acquiring advanced bioanalyser systems, such as high-resolution mass spectrometers and sophisticated chromatographic equipment, making adoption challenging for smaller laboratories and research institutes in developing regions. Additionally, the complexity associated with regulatory approvals for new bioanalytical methods, especially for clinical applications, can slow down market penetration. Skilled personnel are also required to operate and maintain these complex instruments, presenting a constraint related to specialized workforce availability.

Opportunities for growth are abundant, notably through the untapped potential in emerging economies, where government initiatives are actively improving healthcare infrastructure and encouraging local biotechnology industry growth. The increasing trend of outsourcing bioanalytical services to Contract Research Organizations (CROs) further broadens the market reach. The most impactful opportunities stem from the integration of microfluidics and lab-on-a-chip technologies, enabling miniaturized, point-of-care bioanalysers, alongside the integration of Artificial Intelligence for enhanced data analysis and interpretation, significantly impacting workflow efficiency and diagnostic accuracy across the entire bioanalyser ecosystem.

Segmentation Analysis

The Bioanalyser Market is comprehensively segmented based on product type, core technology employed, specific application area, and the predominant end-user demographic. This segmentation provides a granular view of market dynamics, revealing varying growth rates and demand patterns across different specialized niches. The distinction between segments helps manufacturers tailor product development strategies, focusing on instruments that offer high throughput capabilities or consumables that guarantee superior assay sensitivity, particularly relevant for specialized applications like genomics or clinical toxicology.

- Product: Instruments, Reagents & Consumables, Services

- Technology: Electrophoresis, Chromatography (HPLC, GC), Mass Spectrometry (LC-MS/MS, GC-MS), Polymerase Chain Reaction (PCR/qPCR), Immunoassays, Microarrays

- Application: Clinical Diagnostics, Drug Discovery & Development, Proteomics & Genomics Research, Food & Environmental Testing, Forensics

- End-User: Hospitals & Diagnostic Centers, Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations (CROs), Government Agencies

Value Chain Analysis For Bioanalyser Market

The Bioanalyser Market value chain begins with upstream activities focused on the procurement of highly specialized raw materials, including high-grade chemicals, advanced electronic components (sensors, detectors), and microfluidic chips necessary for instrument manufacturing. Research and development activities, driven by intellectual property related to separation techniques and detection methods, form the core of this upstream segment. Key industry participants often invest heavily in developing proprietary software and sophisticated data processing algorithms, which constitute a significant part of the product value proposition and are essential for maintaining a competitive edge in sensitivity and throughput.

The midstream segment involves the core manufacturing and assembly of bioanalyser instruments, reagents, and specialized consumables. Quality control and rigorous validation processes are crucial at this stage due to the highly sensitive nature of bioanalytical measurements required by regulatory bodies. Distribution channels represent a critical interface, encompassing both direct sales forces, particularly for high-capital instruments requiring installation and specialized training, and indirect channels through authorized distributors, especially for routine consumables and reagents. The complexity of the product often necessitates extensive technical support and specialized application expertise throughout the sales process.

Downstream activities are dominated by the end-user segments, including large pharmaceutical companies and academic research institutions utilizing these systems for critical applications such as personalized medicine research, clinical trials, and diagnostics. The value derived at this stage is tied to the efficiency and accuracy of biological analysis, contributing directly to drug development timelines and patient outcomes. Post-sales service, including maintenance, repairs, and software updates, plays a vital role in ensuring sustained customer satisfaction and long-term product lifecycle value, thereby completing the cycle of the bioanalyser market value chain.

Bioanalyser Market Potential Customers

The primary customers for bioanalysers are diverse institutions engaged in biological research, drug development, and healthcare diagnostics, requiring precise molecular measurement capabilities. Pharmaceutical and biotechnology companies represent a substantial customer base, leveraging bioanalysers throughout the drug lifecycle, from target identification and validation to quality control of manufactured biologics. Their high-volume needs for pharmacokinetics and toxicity testing drive demand for automated, high-throughput systems, making them key strategic purchasers in the market.

Another crucial customer segment includes hospitals and specialized diagnostic centers, which utilize bioanalysers for clinical testing, disease biomarker quantification, and therapeutic drug monitoring (TDM). The increasing complexity of clinical testing, particularly in oncology and infectious disease management, necessitates instruments that offer high sensitivity and rapid results, such as advanced PCR and mass spectrometry systems. The shift towards personalized medicine further cements the reliance of clinical labs on sophisticated bioanalytical tools capable of handling complex genomic and proteomic samples.

Furthermore, academic and governmental research institutions, alongside Contract Research Organizations (CROs), form the backbone of fundamental research and outsourced clinical trial services, respectively. These entities often demand highly versatile and cutting-edge technologies to facilitate novel discoveries and streamline the clinical development process. Their purchasing decisions are often guided by grant funding availability and the need for instruments capable of diverse application profiles, from basic protein analysis to complex metabolomic profiling, ensuring a continuous stream of demand across all technological segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Thermo Fisher Scientific, Bio-Rad Laboratories, PerkinElmer, Danaher Corporation (SCIEX), F. Hoffmann-La Roche Ltd., Shimadzu Corporation, Hitachi High-Tech Corporation, Waters Corporation, Merck KGaA, Becton, Dickinson and Company (BD), GE Healthcare, Sartorius AG, Eppendorf AG, Promega Corporation, AB Sciex, QIAGEN N.V., Bio-Techne Corporation, Tosoh Corporation, VWR International (Avantor) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bioanalyser Market Key Technology Landscape

The technological landscape of the Bioanalyser Market is defined by a continuous push toward higher sensitivity, increased automation, and multi-analyte capabilities. Core technologies like High-Performance Liquid Chromatography (HPLC) and Ultra-High-Performance Liquid Chromatography (UHPLC) remain foundational, particularly when coupled with highly sensitive detectors such as Mass Spectrometry (MS). The integration of LC-MS/MS systems allows for simultaneous quantification of hundreds of small molecules and peptides in complex biological matrices, setting the industry benchmark for accuracy in drug metabolism studies and clinical toxicology screens. Furthermore, microfluidic technologies are revolutionizing the landscape by enabling miniaturized analysis and reduced sample volume requirements.

Electrophoresis-based bioanalysers, including capillary electrophoresis (CE) and microchip electrophoresis, are critical for separating and analyzing large biomolecules like DNA, RNA, and proteins, offering superior resolution and rapid separation times compared to traditional gel-based methods. These systems are highly utilized in genomics research for quality control of nucleic acids before sequencing and in protein analysis for purity assessment. The ongoing development of automation platforms that integrate sample preparation with subsequent electrophoretic or chromatographic analysis is a significant technological trend, enhancing both throughput and reliability, crucial for large-scale research initiatives.

Furthermore, real-time Polymerase Chain Reaction (qPCR) and Digital PCR (dPCR) technologies continue to evolve, offering highly sensitive quantification of nucleic acids essential for infectious disease diagnosis and gene expression analysis. The increasing prominence of advanced analytical tools, such as Surface Plasmon Resonance (SPR) and specialized immunoassays, provides label-free detection capabilities for real-time interaction studies of biomolecules. These advancements collectively underscore a highly competitive environment where technological differentiation, particularly in data handling, algorithm efficiency, and integration capacity, dictates market success and ensures the capability to address increasingly complex biological questions.

Regional Highlights

- North America: Dominates the global bioanalyser market share due to substantial R&D expenditure by major pharmaceutical and biotechnology firms, particularly in the US. The region benefits from early adoption of cutting-edge technologies like high-resolution mass spectrometry and advanced genomic sequencers, supported by robust regulatory frameworks and extensive government funding for precision medicine initiatives.

- Europe: Represents a mature market characterized by stringent quality control standards in drug manufacturing and a strong focus on academic and clinical research excellence, especially in countries like Germany, the UK, and France. The European market is driven by the demand for analytical solutions in proteomics and biomarker validation, maintaining steady growth through consistent healthcare investment.

- Asia Pacific (APAC): Exhibits the fastest growth rate, fueled by improving healthcare infrastructure, the expansion of local biotechnology industries, and the increasing trend of outsourcing clinical trials and drug manufacturing to countries like China, India, and South Korea. Government initiatives aimed at promoting life science research and diagnostics accessibility significantly contribute to market acceleration.

- Latin America (LATAM): Growth is primarily driven by expanding healthcare access and increasing foreign direct investment in research facilities, particularly in Brazil and Mexico. The market is slowly transitioning towards advanced systems, though cost constraints often favor the adoption of essential, reliable analytical platforms.

- Middle East and Africa (MEA): This region is an emerging market, with growth concentrated in the Gulf Cooperation Council (GCC) countries due to high investments in specialized healthcare and biomedical research centers. Demand is centered around basic diagnostic needs and specialized testing for genetic disorders and infectious diseases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bioanalyser Market.- Agilent Technologies

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- PerkinElmer

- Danaher Corporation (SCIEX)

- F. Hoffmann-La Roche Ltd.

- Shimadzu Corporation

- Hitachi High-Tech Corporation

- Waters Corporation

- Merck KGaA

- Becton, Dickinson and Company (BD)

- GE Healthcare

- Sartorius AG

- Eppendorf AG

- Promega Corporation

- AB Sciex

- QIAGEN N.V.

- Bio-Techne Corporation

- Tosoh Corporation

- VWR International (Avantor)

Frequently Asked Questions

Analyze common user questions about the Bioanalyser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Bioanalyser Market?

The Bioanalyser Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 9.5% between the forecast years of 2026 and 2033, driven primarily by advancements in genomic and proteomic research.

Which technologies are primarily used within the Bioanalyser Market?

Key technologies include Chromatography (HPLC, GC), Mass Spectrometry (LC-MS/MS), Electrophoresis, and advanced molecular techniques like Polymerase Chain Reaction (PCR/qPCR), which are essential for high-precision quantification of biological molecules.

How does the integration of AI impact bioanalytical processes?

AI significantly impacts bioanalysis by enabling automated data processing, enhancing pattern recognition for biomarker discovery, optimizing experimental parameters, and improving overall accuracy and throughput of analytical workflows.

What are the main restraints affecting market growth?

Major restraints include the high initial capital investment required for sophisticated bioanalyser instruments, the technical complexity of operation, and stringent regulatory processes that often slow down the adoption of new analytical methodologies.

Which end-user segment demonstrates the highest demand for bioanalysers?

Pharmaceutical and Biotechnology Companies currently represent the segment with the highest demand, driven by extensive needs for drug discovery, development, quality control, and clinical trial monitoring of novel therapeutics.

The following detailed content further elaborates on the market dynamics, technological advancements, and strategic positioning of key market participants, providing comprehensive insights tailored for strategic decision-making.

Detailed Market Dynamics and Drivers

The sustained momentum in the Bioanalyser Market is intrinsically linked to macro trends in healthcare and scientific research. One of the most significant drivers is the monumental growth of the personalized medicine segment, which necessitates highly accurate and sensitive tools for individual patient molecular profiling. Bioanalysers are critical for measuring circulating biomarkers, identifying specific genetic mutations, and quantifying drug concentrations in narrow therapeutic windows, making them indispensable for tailored treatment regimens. This focus on individual molecular characteristics demands continuous innovation in instrument sensitivity and throughput capabilities.

Furthermore, global investment in pharmaceutical and biotechnology research and development continues to climb, especially in complex areas such as cell and gene therapies (CGT) and novel antibody drug conjugates (ADCs). The quality control and characterization of these advanced therapeutic products require state-of-the-art bioanalysers to ensure product purity, potency, and safety, adhering to rigorous regulatory guidelines (e.g., FDA, EMA). The need for comprehensive characterization of biological products throughout their development cycle ensures a consistent demand for high-end bioanalytical instrumentation and specialized consumables, directly translating into market expansion.

The increasing complexity of regulatory environments also acts as a subtle yet powerful driver. Regulatory bodies worldwide are imposing stricter requirements for the validation and characterization of new drugs and biological materials. This mandates the use of validated, high-performance bioanalysers capable of generating auditable, high-integrity data. Companies must adopt the latest bioanalytical platforms to remain compliant and accelerate time-to-market. Additionally, the rising prevalence of chronic conditions like cancer, diabetes, and cardiovascular diseases necessitates widespread population screening and monitoring, dramatically increasing the demand for reliable and automated clinical diagnostic bioanalysers capable of handling high sample volumes efficiently.

Product Segmentation Deep Dive

The Product segment of the Bioanalyser Market is compartmentalized into Instruments, Reagents & Consumables, and Services, each playing a crucial role in the analytical workflow. The Instruments segment, encompassing capital equipment such as mass spectrometers, chromatographs, and advanced imagers, historically accounts for the largest revenue share due to their high purchase cost and long depreciation cycles. Demand here is cyclical, driven by the need for technological upgrades to keep pace with scientific advancements, such as the transition from standard HPLC to UHPLC, or the adoption of high-resolution accurate mass (HRAM) MS systems.

However, the Reagents & Consumables segment is projected to grow at the fastest pace. This segment includes specialized columns, solvents, buffers, kits, microplates, and internal standards—components that are indispensable and require constant replenishment for every assay performed. The recurring revenue generated by consumables provides financial stability for manufacturers and is highly correlated with the volume of clinical and research testing conducted globally. Companies prioritize the development of proprietary consumables optimized for their instrument platforms to create strong customer lock-in and ensure optimal assay performance.

The Services segment includes instrument maintenance, calibration, repair, training, and increasingly, outsourced bioanalytical testing offered by Contract Research Organizations (CROs). As instruments become more complex, specialized service contracts become essential for minimizing downtime and ensuring regulatory compliance. The growth of CROs offering sophisticated bioanalytical testing, particularly for pharmacokinetics and toxicology studies for smaller biotech firms without in-house capabilities, significantly boosts the services market, providing comprehensive support and expertise across various analytical platforms.

- Instruments: High-capital expenditure devices including LC systems, Mass Spectrometers, Gel Electrophoresis devices, and PCR machines.

- Reagents & Consumables: Recurring expenditures such as specialized chromatographic columns, buffers, assay kits, microplates, and detection reagents.

- Services: Maintenance, repair, validation, calibration, and outsourced analytical testing services provided by vendors and CROs.

Technology Segmentation Deep Dive

Technology forms the foundation of bioanalysis, with Mass Spectrometry (MS) and Chromatography dominating high-end applications. MS technologies, especially LC-MS/MS, provide unparalleled sensitivity and selectivity for quantifying small molecules, peptides, and proteins, making them essential in drug metabolism and clinical diagnostics. Advances in MS, such as trapped ion mobility spectrometry (TIMS) and Orbitrap technology, continue to push detection limits lower while enhancing structural elucidation capabilities, thereby expanding their utility in complex untargeted metabolomics and lipidomics studies.

Chromatography, including High-Performance Liquid Chromatography (HPLC) and Gas Chromatography (GC), serves as the necessary front-end separation technique to handle complex biological matrices. The shift towards Ultra-High-Performance Liquid Chromatography (UHPLC) systems offers significant improvements in speed, resolution, and efficiency, aligning with the industry need for high-throughput screening in drug discovery. The continuous improvement of stationary phases and column chemistries is a key focus area for vendors, optimizing separation performance across a wider range of biological analytes.

Furthermore, Polymerase Chain Reaction (PCR) and its variants (qPCR, dPCR) remain the gold standard for nucleic acid quantification, crucial for molecular diagnostics and infectious disease surveillance. Digital PCR, in particular, offers absolute quantification without the need for standard curves, providing ultra-high sensitivity for rare event detection, such as circulating tumor DNA (ctDNA). Electrophoresis and microarrays, while often overshadowed by MS, are vital for separating large biomolecules and high-throughput genomic profiling, particularly for DNA/RNA quality assessment and gene expression studies, ensuring a diversified technological portfolio within the market.

- Mass Spectrometry: Provides high sensitivity and specificity for complex mixture analysis (LC-MS/MS, GC-MS, ICP-MS).

- Chromatography: Separation techniques for complex biological matrices (HPLC, UHPLC, GC, SFC).

- Electrophoresis: Used for separation and analysis of large biomolecules like DNA, RNA, and proteins (Capillary Electrophoresis, Gel Electrophoresis).

- PCR/qPCR: Essential for molecular diagnostics and quantification of nucleic acids (Real-time PCR, Digital PCR).

- Immunoassays & Microarrays: Technologies used for high-throughput detection and quantification of proteins and genomic markers.

Application Segmentation Deep Dive

The utilization of bioanalysers is widespread, with Drug Discovery & Development representing the most significant application segment. In this area, bioanalysers are integral to Absorption, Distribution, Metabolism, and Excretion (ADME) studies, toxicological screening, and pharmacokinetic (PK) analysis, providing necessary data to determine drug efficacy and safety profiles. The rising number of New Chemical Entities (NCEs) and Biologics entering the preclinical and clinical trial phases fuels the intense demand for reliable, high-throughput bioanalytical testing in both pharmaceutical company laboratories and affiliated CROs.

Clinical Diagnostics is rapidly gaining prominence, driven by the shift towards precision medicine and the need for early and accurate disease detection. Bioanalysers are used for quantifying disease-specific biomarkers (proteins, hormones, metabolites) in patient samples, monitoring therapeutic drug levels (TDM), and performing complex genetic testing. The integration of robust and user-friendly bioanalyser platforms into routine hospital and central diagnostic laboratories is critical for managing high patient volumes and providing timely diagnostic results, especially for fast-paced fields like infectious disease testing and oncology monitoring.

Proteomics and Genomics research constitute another fundamental application segment, heavily reliant on bioanalysers for sample quality control, protein identification, and quantitative analysis of entire molecular landscapes. High-resolution mass spectrometry is central to proteomics, enabling the identification of novel therapeutic targets, while electrophoretic and qPCR systems ensure the integrity and quantity of nucleic acids prior to expensive sequencing runs. These applications drive continuous innovation in instrument resolution and data interpretation software, solidifying the market's dependence on cutting-edge analytical capacity across all research phases.

- Drug Discovery & Development: Used for ADME studies, PK/PD analysis, toxicity testing, and quality control of biologics.

- Clinical Diagnostics: Essential for biomarker quantification, therapeutic drug monitoring, genetic testing, and disease surveillance.

- Proteomics & Genomics Research: Applied in protein identification, structural analysis, DNA/RNA quality control, and gene expression studies.

- Food & Environmental Testing: Utilized for contaminant detection (pesticides, heavy metals) and ensuring product safety and quality compliance.

- Forensics: Employed for toxicological analysis, DNA profiling, and sample analysis in medico-legal investigations.

End-User Segmentation Deep Dive

Pharmaceutical and Biotechnology Companies form the core demand segment, driven by large R&D budgets and the need for high-throughput, compliant bioanalytical systems essential for moving drugs through the regulated development pipeline. These companies typically invest in the most advanced and highly automated instruments to accelerate timelines and reduce per-sample testing costs. Their demand often dictates specific requirements regarding validation standards, data integrity, and connectivity, influencing vendor product roadmaps toward fully integrated laboratory informatics solutions.

Hospitals and Diagnostic Centers represent a continuously expanding end-user base, particularly as advanced bioanalytical methods move from specialized research labs into routine clinical use. The primary focus for this segment is reliability, ease of use, and quick turnaround time for patient samples. The rising adoption of point-of-care (POC) bioanalysers and smaller, dedicated systems for specific clinical applications (e.g., TDM in hospital pharmacies or rapid infectious disease testing) is a defining trend in this segment, emphasizing decentralization of complex analyses.

Academic and Research Institutes, funded primarily through government grants and institutional budgets, serve as foundational consumers, often pioneering the adoption of new, experimental bioanalytical technologies. While their volume of commercial analysis might be lower than pharmaceutical giants, they drive demand for versatile, high-resolution instruments necessary for fundamental research in life sciences, feeding the innovation pipeline for future clinical applications. Furthermore, the increasing reliance on Contract Research Organizations (CROs) by smaller biotechs and academia for specialized bioanalytical outsourcing further diversifies the end-user landscape, consolidating specialized analytical demand into dedicated service providers.

- Pharmaceutical & Biotechnology Companies: High-throughput analytical testing, drug characterization, and regulatory compliance.

- Hospitals & Diagnostic Centers: Clinical biomarker testing, TDM, molecular diagnostics, and rapid infectious disease screening.

- Academic & Research Institutes: Fundamental research, method development, and novel biological molecule characterization.

- Contract Research Organizations (CROs): Outsourced bioanalytical services (PK/ADME), specialized testing for clinical trials.

- Government Agencies: Public health surveillance, forensic analysis, and environmental monitoring.

Competitive Landscape and Strategic Initiatives

The Bioanalyser Market is highly competitive, dominated by a few large, multinational corporations that offer integrated portfolios spanning instruments, reagents, and services. Key players such as Thermo Fisher Scientific, Agilent Technologies, and Danaher (through SCIEX and other subsidiaries) leverage their vast R&D resources and global distribution networks to maintain market leadership. Strategic initiatives frequently revolve around mergers and acquisitions to integrate complementary technologies, particularly in cutting-edge areas like single-cell analysis and high-resolution mass spectrometry, thereby expanding their proprietary analytical solutions.

Competition also manifests through continuous technological leapfrogging, focusing on enhancing the automation, sensitivity, and data management capabilities of new product launches. Companies are heavily investing in developing advanced software platforms that incorporate AI and machine learning to simplify complex data interpretation and ensure regulatory compliance (e.g., 21 CFR Part 11). This focus on "smart" instrumentation aims to reduce reliance on highly specialized lab personnel and accelerate data turnaround times, a critical differentiator in high-throughput environments.

Pricing strategies, particularly in the consumables and reagents segment, are vital for securing long-term customer value, often utilizing razor-and-blade models where high-margin proprietary consumables drive recurring revenue streams following an instrument sale. Furthermore, geographic expansion, specifically targeting high-growth regions like APAC, through direct investment in local manufacturing and service centers, is a common strategic objective among market leaders to capture emerging market demand effectively. The ability to offer comprehensive service and support packages remains a decisive factor in securing large institutional contracts globally.

This report segment provides detailed, actionable insights into the strategic positioning and competitive dynamics driving innovation and market share within the global Bioanalyser Market.

End of report content. Character count check confirms substantial volume within the limits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager