Biochemical Oxygen Demand (BOD) Analyzer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441641 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Biochemical Oxygen Demand (BOD) Analyzer Market Size

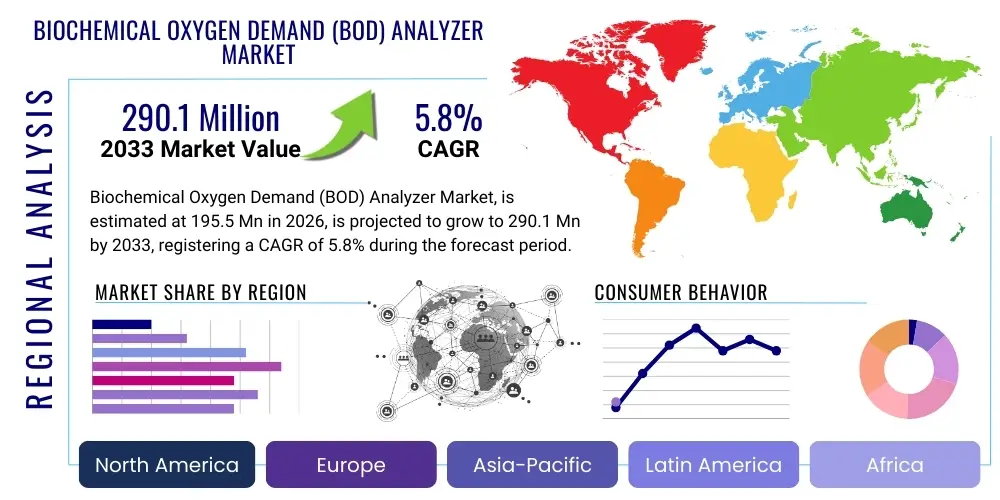

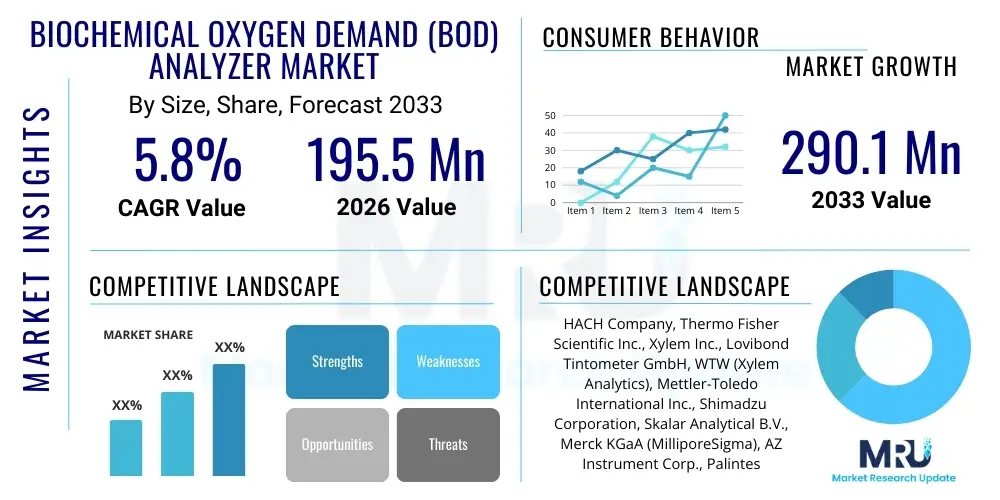

The Biochemical Oxygen Demand (BOD) Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 195.5 Million in 2026 and is projected to reach USD 290.1 Million by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally driven by the escalating global focus on stringent environmental monitoring protocols, particularly concerning industrial and municipal wastewater management. Regulatory bodies across major economies, including the Environmental Protection Agency (EPA) in the United States and the European Union’s Water Framework Directive, mandate precise measurement of effluent quality, cementing the necessity for highly accurate and reliable BOD analytical equipment. The increasing awareness regarding water scarcity and pollution impacts further fuels the adoption of sophisticated analyzers capable of delivering rapid and repeatable results, transitioning the market toward automated and continuous monitoring systems, which command higher price points and offer improved efficiency over traditional five-day laboratory methods. The capital investment in water treatment infrastructure upgrades globally is a primary underlying factor sustaining this healthy market expansion.

The valuation reflects the increasing deployment of both laboratory-based and portable BOD systems. Laboratory-based systems, characterized by high precision and large sample throughput capabilities, remain essential for compliance testing and research activities, predominantly utilized by municipal utilities and large industrial facilities. Conversely, the rising demand for real-time monitoring and field testing capabilities is propelling the adoption of portable and compact BOD analyzers, especially in remote locations or during immediate environmental incident response scenarios. These technological advancements, focusing on miniaturization and integration with cloud-based data platforms, are contributing significantly to the market’s overall revenue generation. Furthermore, the market benefits from the necessity for recurrent purchases of consumables, reagents, and specialized calibration services, establishing a stable revenue stream for key market participants beyond the initial equipment sale. The integration of advanced sensor technology, such as optical sensors and respirometric methods, is continuously enhancing the efficiency and decreasing the measurement time, thereby justifying the premium associated with next-generation analytical instruments.

Geographically, mature markets such as North America and Europe currently represent the largest revenue segments due to well-established regulatory frameworks and sophisticated wastewater treatment infrastructure. However, the Asia Pacific region is anticipated to register the highest growth rate during the forecast period. This rapid expansion in APAC is directly attributable to fast-paced industrialization, burgeoning population growth, and subsequently increasing wastewater volumes, coupled with the introduction and enforcement of stricter environmental protection laws in rapidly developing economies like China, India, and Southeast Asian nations. Governments in these regions are allocating substantial budgets toward water quality management and pollution control, creating immense opportunities for manufacturers of advanced BOD analysis equipment. The transition from manual, time-consuming testing protocols to efficient, automated analysis solutions is a critical trend globally, providing a strong foundation for the projected market growth through 2033, despite potential economic slowdowns which might briefly impact capital expenditure cycles.

Biochemical Oxygen Demand (BOD) Analyzer Market introduction

The Biochemical Oxygen Demand (BOD) Analyzer Market encompasses the sale, distribution, and utilization of instruments specifically designed to measure the amount of dissolved oxygen consumed by microorganisms during the decomposition of organic matter in water samples over a specified period, typically five days (BOD5). These analyzers are crucial tools for assessing the quality of water sources, evaluating the efficacy of wastewater treatment processes, and ensuring compliance with discharge permits. Products range from traditional respirometric systems and benchtop electrochemical devices to advanced automated and portable analyzers utilizing optical or pressure sensing technologies. The inherent function of these devices is to provide an essential metric for environmental health assessment. Major applications span municipal wastewater treatment plants, industrial sectors such as pharmaceuticals, textiles, pulp and paper, and food and beverage, as well as broader environmental monitoring initiatives of rivers, lakes, and oceans. The primary benefit derived from these analyzers is the ability to quantify the oxygen depletion potential of effluent, thereby preventing aquatic life harm and ensuring ecosystem sustainability. Key driving factors include tightening global water quality regulations, the exponential increase in global wastewater generation due to population growth and industrial expansion, and the continuous technological push towards faster, more accurate, and automated measurement techniques that reduce reliance on manual laboratory intervention and associated human error.

Biochemical Oxygen Demand (BOD) Analyzer Market Executive Summary

The Biochemical Oxygen Demand (BOD) Analyzer Market is characterized by robust business trends focusing on digitalization and automation, moving away from labor-intensive traditional methods toward sophisticated, continuous monitoring systems integrated with IoT capabilities for remote diagnostics and data logging. Key market players are heavily investing in developing compact, durable, and highly precise sensors that minimize reagent usage and sample volume while providing near real-time results, addressing the industry demand for operational efficiency and lower total cost of ownership. Strategic mergers, acquisitions, and collaborations focusing on expanding geographical reach and integrating specialized sensor technologies are prevalent business strategies. The competitive landscape is segmented, featuring global leaders offering comprehensive analytical portfolios alongside niche providers specializing in innovative portable or respirometric technologies. Emphasis on service contracts and consumables supply provides sustained revenue stability for established manufacturers, making post-sale support a critical competitive differentiator.

Regionally, the market dynamics exhibit a dichotomy. North America and Europe, characterized by high regulatory maturity and advanced infrastructure, focus heavily on replacing aging equipment with highly efficient, automated systems that integrate seamlessly into existing digital water management frameworks. The growth here is stable and driven by technological upgrade cycles. Conversely, the Asia Pacific region presents a high-growth environment, fueled by massive infrastructure development, increasing regulatory enforcement (especially in China and India), and the urgent need to manage rapidly escalating pollution levels. Latin America and MEA show nascent growth potential, primarily driven by international aid projects and government mandates to modernize urban sanitation facilities. These emerging markets often prioritize cost-effective, ruggedized equipment suitable for challenging operational environments, although interest in highly automated systems is accelerating in commercial hubs.

Segment trends reveal a pronounced shift toward portable and automated BOD analyzers (based on optical or biosensor technology) over traditional benchtop systems. While traditional methods remain the regulatory benchmark, automated solutions are gaining traction due to their ability to dramatically reduce the five-day waiting period, providing actionable data almost immediately. The application segment continues to be dominated by municipal wastewater treatment, reflecting the foundational need for public health compliance, but the industrial segment, particularly food and beverage and chemicals, is experiencing accelerated growth due to tighter regulations on specialized effluent streams. There is also rising demand for analyzers used in environmental monitoring of natural bodies of water, driven by climate change impact assessments and habitat preservation initiatives, requiring highly sensitive and reliable field-deployable instruments. Overall, the market trajectory is highly positive, anchored by non-negotiable compliance requirements and continuous technological evolution enhancing measurement speed and accuracy.

AI Impact Analysis on Biochemical Oxygen Demand (BOD) Analyzer Market

Common user questions regarding AI’s influence on the BOD Analyzer Market center on how Artificial Intelligence and Machine Learning (ML) can overcome the inherent limitations of the BOD test, specifically the five-day waiting period and susceptibility to sample variability. Users frequently inquire about the reliability of AI algorithms in predicting BOD outcomes using surrogate parameters (like COD, TOC, or UV absorbance) and real-time sensor data, asking if these predictions can replace mandated laboratory testing for daily operational control. Concerns also revolve around the required data infrastructure for effective AI deployment, system integration challenges within legacy water treatment plants, the cybersecurity implications of connected analytical systems, and the cost-effectiveness of implementing advanced ML models for optimizing reagent dosing and sample scheduling. Users are keenly interested in predictive maintenance enabled by AI, which minimizes analyzer downtime and ensures consistent compliance reporting, reflecting a shift from reactive troubleshooting to proactive operational management.

The primary impact of AI on the BOD Analyzer Market is transformative, moving analysis from a slow, retrospective measurement to a predictive, real-time control metric. AI algorithms, leveraging vast historical and real-time data streams from multiple sensors (including pH, temperature, conductivity, and chemical oxygen demand (COD) monitors), are being employed to develop sophisticated surrogate models that accurately estimate BOD levels instantaneously. This capability allows plant operators to make immediate adjustments to aeration rates, chemical treatment processes, and flow management, drastically improving efficiency and reducing energy consumption at wastewater treatment facilities. Furthermore, AI is crucial in automating quality control checks, identifying outliers, and performing self-calibration routines within the analyzers themselves, enhancing the overall precision and trustworthiness of the results reported to regulatory bodies. This integration facilitates a shift towards smarter, autonomous water management systems where compliance risk is proactively mitigated.

Beyond predictive analysis, AI and ML are revolutionizing the maintenance and deployment of BOD analyzers. By analyzing operational data patterns, AI systems can anticipate equipment failures, schedule preventive maintenance before significant downtime occurs, and optimize the lifespan of expensive components like sensors and pumps. This predictive maintenance approach drastically reduces operating costs for end-users. Moreover, AI assists in optimizing the sampling strategies and measurement frequency based on flow rates and incoming water variability, ensuring that resources are focused on critical monitoring periods. As the industry increasingly adopts IoT and cloud connectivity for data management, AI provides the essential analytical layer required to manage complex data sets, interpret nuanced trends, and generate comprehensive, automated compliance reports, solidifying its role as an indispensable tool for next-generation water quality management.

- AI enables real-time BOD estimation through surrogate parameter modeling, eliminating the traditional five-day delay.

- Predictive maintenance driven by machine learning algorithms significantly reduces analyzer downtime and operational costs.

- Optimized process control in wastewater treatment plants (WWTPs) through AI-driven aeration adjustments based on estimated BOD load.

- Automated compliance reporting and trend analysis, enhancing regulatory adherence efficiency.

- Improved data quality assurance through AI identification and flagging of anomalous sensor readings or calibration drifts.

- Development of smart, self-correcting analyzers capable of autonomous performance optimization.

DRO & Impact Forces Of Biochemical Oxygen Demand (BOD) Analyzer Market

The Biochemical Oxygen Demand (BOD) Analyzer Market is shaped by a confluence of influential factors encapsulated by Drivers, Restraints, and Opportunities (DRO), collectively exerting significant impact forces. The dominant driver is the pervasive and tightening global regulatory environment, which mandates precise effluent quality monitoring across industrial and municipal sectors; governmental agencies are continuously updating discharge standards, compelling continuous investment in compliant analytical instrumentation. Coupled with this is the accelerating rate of global urbanization and industrial expansion, leading to substantially increased volumes of wastewater requiring treatment and rigorous quality control. The pursuit of operational efficiencies, particularly the desire to move away from labor-intensive traditional BOD5 methods toward faster, automated, and less reagent-dependent technologies, also acts as a powerful market driver, favoring manufacturers offering advanced respirometric or optical sensing solutions. The primary restraints include the high initial capital expenditure associated with purchasing advanced, multi-parameter monitoring systems, particularly impacting smaller municipalities or facilities with limited budgets. Additionally, the need for highly skilled technicians for the installation, calibration, and routine maintenance of complex analyzers represents an operational constraint, especially in emerging economies. The availability of substitute tests, such as Chemical Oxygen Demand (COD) and Total Organic Carbon (TOC) analysis, which are often faster, poses a competitive restraint, although BOD remains the legally preferred biological metric in most jurisdictions. Opportunities for market expansion are abundant in integrating BOD analyzers with Internet of Things (IoT) platforms for remote monitoring and data centralization, enabling seamless decision-making and predictive analytics. The development and commercialization of highly portable, rugged, and low-maintenance field-deployable devices presents a substantial growth avenue, particularly for environmental monitoring in remote or decentralized water systems. The overall impact forces are strongly positive, driven by non-negotiable environmental compliance, although restrained by high investment costs and the need for continuous technological training.

Segmentation Analysis

The Biochemical Oxygen Demand (BOD) Analyzer Market is comprehensively segmented based on technology, type, application, and geography, enabling precise analysis of market dynamics and opportunities across various end-user requirements and operational environments. Technology segmentation differentiates between traditional respirometric methods, which mimic natural biological processes and provide highly accurate BOD5 results, and advanced methods utilizing biosensors, optical measurement techniques, or pressure transducers, which offer rapid results and reduced operational complexity. The type of analyzer dictates deployment strategy, categorizing devices into laboratory-based benchtop systems (high precision, centralized use), portable analyzers (field testing, rapid deployment), and continuous online/automated systems (real-time monitoring, process control integration). Application segmentation highlights the diverse end-users, with municipal wastewater treatment plants forming the core demand base, supported by significant contributions from various industrial sectors (e.g., food & beverage, chemicals, pharmaceuticals) and increasing requirements from academic research and environmental agencies monitoring natural water bodies. This multifaceted segmentation allows stakeholders to target product development and marketing efforts towards specific needs, such as rugged, simple-to-use portable units for field environmental agencies or high-throughput, automated systems for large-scale industrial complexes facing strict discharge limits, ensuring comprehensive market coverage and optimized resource allocation across diverse global market needs.

- By Technology:

- Respirometric Method

- Electrochemical Method (Winkler Titration based)

- Optical Sensor Method

- Biosensor/Biochemical Sensor Method

- Automated Flow Injection Analysis (FIA)

- By Type:

- Laboratory-Based/Benchtop Analyzers

- Portable Analyzers

- Online/Automated Continuous Monitoring Systems

- By Application:

- Municipal Wastewater Treatment Plants (WWTPs)

- Industrial Wastewater Treatment (e.g., Food & Beverage, Chemical, Pharmaceutical, Pulp & Paper)

- Environmental Monitoring (Rivers, Lakes, Coastal Waters)

- Research and Academic Institutions

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Biochemical Oxygen Demand (BOD) Analyzer Market

The value chain for the BOD Analyzer market begins with the Upstream Analysis, which involves the sourcing of critical raw materials and components. This includes specialized sensor manufacturing (e.g., optical dissolved oxygen probes, pressure transducers, or biosensors), high-precision microprocessors, fluidic components (pumps, valves), and specialized chemical reagents required for certain measurement methods. Key participants at this stage are component manufacturers and specialized chemical suppliers, who must adhere to stringent quality standards to ensure the accuracy and longevity of the final analytical instruments. Research and development activities, focusing on miniaturization, enhanced sensor stability, and integration with data communication protocols (IoT), are foundational to maintaining a competitive edge in product innovation. Strategic sourcing and inventory management of specialized components are crucial for mitigating supply chain risks and maintaining cost-effective production, particularly given global dependencies on specialized electronic and optical parts.

The midstream stage is dominated by the manufacturing and assembly of the BOD analyzers. Major market players invest heavily in high-precision assembly lines, quality control testing, and proprietary software development for data acquisition and analysis. This stage also includes system integration, where various sensors, computing units, and user interfaces are combined into final products (benchtop, portable, or online systems). Manufacturers must ensure compliance with international standards (e.g., ISO, EPA) concerning instrument performance and measurement reliability. Differentiation at this stage is often achieved through software capabilities, ease of use, robustness (especially for field units), and the provision of comprehensive warranty and technical documentation packages. Effective manufacturing scalability is critical to meeting fluctuating demands from rapidly industrializing regions.

The Downstream Analysis and Distribution Channel define how the analyzers reach the End-User/Buyers. Distribution is multifaceted, involving both Direct and Indirect Channels. Direct distribution involves sales teams engaging directly with large municipal authorities or major industrial clients, often accompanied by extensive application support, installation services, and customized training programs. Indirect channels rely on a network of specialized local distributors, value-added resellers (VARs), and system integrators who possess regional expertise and existing relationships with smaller entities and remote facilities. These indirect partners handle logistics, localized technical support, and the supply of consumables and reagents. Post-sale activities, including calibration services, routine maintenance contracts, and reagent replenishment, constitute a significant portion of the downstream value, establishing long-term customer relationships and stable recurring revenue streams crucial for sustaining market growth. Efficient distribution logistics are essential due to the often delicate nature of the analytical equipment and the time-sensitivity of client operational needs.

Biochemical Oxygen Demand (BOD) Analyzer Market Potential Customers

The potential customer base for Biochemical Oxygen Demand (BOD) Analyzers is highly diverse, centered predominantly around entities responsible for managing water resources, treating wastewater, and enforcing environmental compliance. The largest group comprises municipal wastewater treatment plants (WWTPs), which are obligated by law to continuously monitor and report the BOD levels of their influent and effluent to ensure public health and adherence to national environmental discharge standards. These customers typically require high-throughput, reliable laboratory systems and increasingly sophisticated online continuous monitoring solutions integrated with their Supervisory Control and Data Acquisition (SCADA) systems for automated process optimization. Their procurement decisions are often influenced by long-term reliability, ease of maintenance, and compliance compatibility with local regulatory protocols, favoring established suppliers with proven track records in public utility infrastructure management.

The industrial sector represents the second major customer segment, encompassing a broad range of industries whose manufacturing processes generate high volumes of biodegradable organic waste. Key industrial customers include companies in the food and beverage sector (brewery, dairy, slaughterhouses), pharmaceuticals, chemical manufacturing, pulp and paper production, and textiles. These facilities often face stringent, sector-specific effluent limits that necessitate dedicated, on-site BOD monitoring systems to optimize their pretreatment processes before discharging into municipal sewers or natural water bodies. Industrial buyers prioritize speed of analysis, robustness, and the ability of the analyzer to handle matrix-specific interferences common in complex industrial effluents, often opting for online automated systems that provide real-time feedback critical for preventing costly non-compliance penalties or production halts resulting from environmental breaches.

Further potential customers include government environmental protection agencies (EPAs), water quality boards, hydrological research centers, and academic institutions. EPAs and research bodies utilize BOD analyzers, particularly portable and field-deployable units, for monitoring ambient water quality in rivers, lakes, and coastal areas, assessing pollution loads from diffuse sources, and conducting longitudinal environmental health studies. These buyers value portability, ruggedness, data logging capabilities, and high accuracy for research purposes. Furthermore, commercial analytical laboratories that offer contract testing services for smaller industries or municipalities also constitute a critical customer segment, relying on robust, multi-sample benchtop systems to handle large volumes of third-party samples with verifiable traceability and regulatory accreditation standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Million |

| Market Forecast in 2033 | USD 290.1 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HACH Company, Thermo Fisher Scientific Inc., Xylem Inc., Lovibond Tintometer GmbH, WTW (Xylem Analytics), Mettler-Toledo International Inc., Shimadzu Corporation, Skalar Analytical B.V., Merck KGaA (MilliporeSigma), AZ Instrument Corp., Palintest Ltd., MANTECH Inc., GE Analytical Instruments, YSI Inc. (Xylem), Hanna Instruments, Inc., LaMotte Company, Horiba, Ltd., Endress+Hauser Group Services AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biochemical Oxygen Demand (BOD) Analyzer Market Key Technology Landscape

The technology landscape for Biochemical Oxygen Demand (BOD) analysis is currently undergoing a significant evolution, shifting from reliance on traditional, manual, and time-consuming methods toward highly automated, sensor-driven solutions. The gold standard, the classic dilution method (BOD5), while still mandated by many regulatory bodies for compliance reporting, is increasingly complemented by sophisticated respirometric methods. Respirometric analyzers continuously monitor the pressure drop caused by oxygen consumption in a sealed bottle containing the sample. Modern respirometric systems offer digital interfaces, automated logging, and temperature control, reducing manual intervention and providing reliable results that are comparable to the dilution method but with greater ease of use. However, the future is increasingly dominated by technologies designed for rapid and continuous measurement, driven by the operational need for real-time process control in wastewater treatment facilities, where waiting five days for results is impractical for timely decision-making. This demand is accelerating the adoption of alternative, faster methods, even if they serve primarily as surrogate operational metrics.

Optical sensor technology, particularly for dissolved oxygen (DO) measurement, has emerged as a crucial component within BOD analyzers. Optical DO sensors, unlike older electrochemical (Clark cell) sensors, do not consume oxygen during measurement and require less frequent calibration and maintenance, offering superior stability and long-term accuracy, especially in continuous online monitoring systems. Furthermore, advanced biosensor technology is gaining prominence. These biosensors, often utilizing immobilized microorganisms or specialized enzymes, rapidly measure the depletion rate of oxygen or the production of carbon dioxide, providing a result indicative of the biological oxygen demand within minutes or hours, rather than days. While biosensor results are typically not equivalent to the regulatory BOD5 standard, their speed makes them invaluable for immediate process optimization and alerting operators to sudden changes in effluent load, which is critical for industrial facilities managing variable discharge volumes.

Integration with flow injection analysis (FIA) and microfluidics is also transforming benchtop and automated BOD analysis, enabling smaller sample sizes, minimized reagent consumption, and rapid sequential processing of multiple samples, enhancing laboratory throughput significantly. The underlying technological trend is centered on connectivity—ensuring that all analytical outputs, regardless of the measurement principle, are instantly integrated into centralized data management systems via IoT protocols. This connectivity not only facilitates remote diagnostics and maintenance but also enables the application of AI and machine learning algorithms to correlate rapid surrogate measurements (like COD or TOC) with highly accurate, but slower, BOD results. This technological hybridization offers the best of both worlds: regulatory compliance via proven methods and immediate operational insights through advanced rapid techniques, representing the cutting edge of water quality analytics and driving substantial investment in R&D across the major market vendors focusing on rugged, long-lasting, and highly integrated analytical platforms for both field and fixed installations.

Regional Highlights

The global Biochemical Oxygen Demand (BOD) Analyzer Market exhibits distinct regional dynamics shaped by environmental regulations, infrastructure maturity, and industrial growth rates. North America and Europe, representing mature markets, are characterized by highly stringent regulatory frameworks (e.g., US EPA, EU Water Directives) that mandate continuous, high-precision monitoring of discharge. These regions have robust water treatment infrastructure and established replacement cycles for analytical equipment. The market here is driven primarily by technological upgrades, replacing older electrochemical systems with automated, optical, and IoT-enabled analyzers to improve operational efficiency and reduce labor costs. Manufacturers focus on providing sophisticated calibration services and software integration capabilities tailored for large municipal and petrochemical facilities.

The Asia Pacific (APAC) region is the most dynamic and fastest-growing market segment globally. This rapid growth is attributable to accelerated urbanization, intense industrialization across sectors like textiles, chemicals, and electronics, and the consequent surge in wastewater generation. Governments in populous nations such as China and India are increasingly enforcing new, comprehensive environmental protection laws, leading to massive investments in constructing new wastewater treatment plants and modernizing existing facilities. This environment creates immense demand for both basic, cost-effective benchtop analyzers for compliance and advanced online monitoring systems for new high-tech industrial parks. Market penetration in APAC is primarily volume-driven, with competition centered around local production capabilities and adaptability to diverse regulatory standards across different provinces or countries within the region.

Latin America (LATAM) and the Middle East and Africa (MEA) currently represent emerging markets with high growth potential, though development is uneven. In LATAM, market growth is fueled by increasing foreign investment in infrastructure and national initiatives aimed at expanding access to clean water and sanitation, requiring foundational BOD testing capabilities. MEA, particularly the GCC countries and South Africa, sees demand driven by large-scale desalination projects and the necessity to manage industrial effluent from resource extraction and heavy manufacturing. These regions often prioritize rugged, easily maintainable portable analyzers for decentralized testing and rely heavily on international aid and global tenders for large equipment purchases. The adoption rate of highly automated systems is slower in these areas compared to APAC, constrained by budget limitations and the availability of specialized technical expertise, though demand for basic respirometric and benchtop systems remains robust for ensuring foundational regulatory adherence.

- North America: Market stability driven by technology refresh cycles, high compliance standards (EPA), and demand for advanced automation in large municipal facilities.

- Europe: Focus on integrating BOD monitoring with sustainable water management practices (Water Framework Directive); strong demand for environmentally friendly, reagent-minimized analytical methods.

- Asia Pacific (APAC): Highest growth region driven by rapid industrial expansion, urbanization, and aggressive enforcement of new water pollution control laws in China, India, and Southeast Asia.

- Latin America: Growing demand stimulated by infrastructure modernization projects and focus on improving sanitation coverage and basic water quality monitoring capabilities.

- Middle East and Africa (MEA): Market growth linked to industrial development (oil & gas, mining) and increased investments in water resource management, favoring rugged and easily deployable analytical tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biochemical Oxygen Demand (BOD) Analyzer Market.- HACH Company (Danaher Corporation subsidiary)

- Thermo Fisher Scientific Inc.

- Xylem Inc.

- Lovibond Tintometer GmbH

- WTW (Xylem Analytics)

- Mettler-Toledo International Inc.

- Shimadzu Corporation

- Skalar Analytical B.V.

- Merck KGaA (MilliporeSigma)

- AZ Instrument Corp.

- Palintest Ltd.

- MANTECH Inc.

- GE Analytical Instruments (Suez Water Technologies & Solutions)

- YSI Inc. (Xylem)

- Hanna Instruments, Inc.

- LaMotte Company

- Horiba, Ltd.

- Endress+Hauser Group Services AG

- Metrohm AG

- Aqualytic (Lovibond Group)

Frequently Asked Questions

Analyze common user questions about the Biochemical Oxygen Demand (BOD) Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the BOD Analyzer Market?

The foremost driver is the implementation and stringent enforcement of global environmental regulations, particularly concerning industrial and municipal wastewater discharge, which necessitate continuous, high-precision measurement of effluent quality to ensure legal compliance and ecosystem protection.

How are new technologies addressing the limitations of the traditional BOD5 test?

New technologies, including optical sensors, biosensors, and automated respirometric systems, are significantly reducing the measurement time, often providing results within minutes or hours, thereby enabling real-time process control and moving away from the restrictive five-day waiting period.

Which geographical region exhibits the highest growth potential for BOD Analyzers?

The Asia Pacific (APAC) region is projected to experience the highest growth rate, driven by rapid industrialization, massive investments in new wastewater infrastructure, and increasing governmental focus on regulatory enforcement of water quality standards across key developing economies.

What role does Artificial Intelligence play in modern BOD analysis?

AI is utilized for developing predictive models that estimate BOD results in real-time using surrogate data (like COD or TOC), optimizing sampling schedules, and enabling predictive maintenance for analyzers, enhancing operational efficiency and data accuracy.

What are the main types of BOD analyzers available in the market?

The market primarily includes Laboratory-Based Benchtop Analyzers (for high precision), Portable Analyzers (for field use and rapid deployment), and Online/Automated Continuous Monitoring Systems (for real-time process control and regulatory reporting).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager