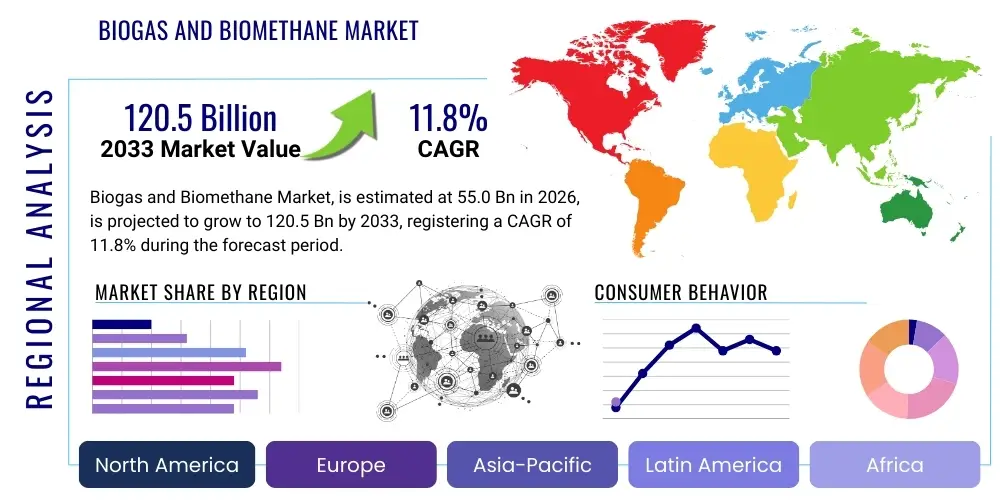

Biogas and Biomethane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441689 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Biogas and Biomethane Market Size

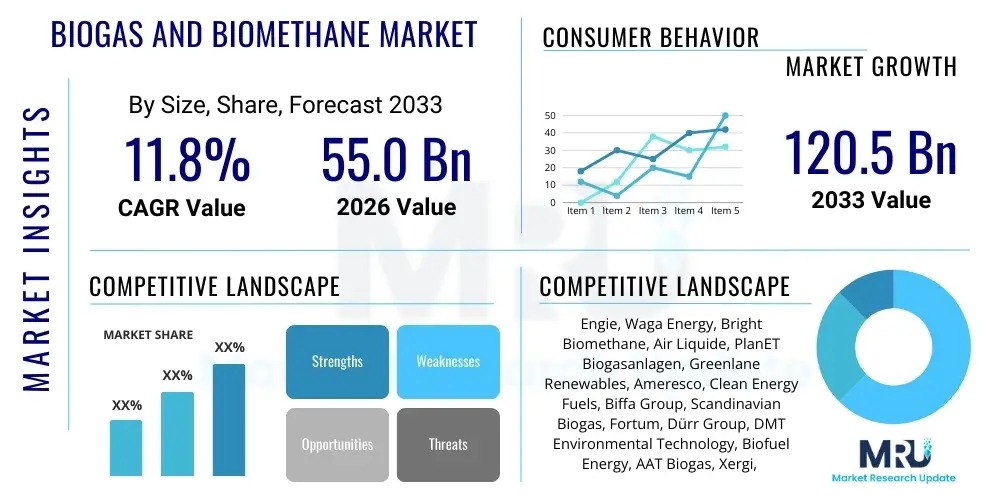

The Biogas and Biomethane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at $55.0 Billion USD in 2026 and is projected to reach $120.5 Billion USD by the end of the forecast period in 2033.

Biogas and Biomethane Market introduction

The Biogas and Biomethane Market encompasses the production, upgrading, and distribution of renewable gases derived primarily from the anaerobic digestion of organic feedstock, including agricultural residues, municipal solid waste (MSW), sewage sludge, and industrial wastewater. Biogas, a mixture predominantly of methane (50–75%) and carbon dioxide, serves as a versatile energy source used directly for heat and power generation. Biomethane, also known as Renewable Natural Gas (RNG), is produced when raw biogas undergoes rigorous upgrading processes—removing CO2, H2S, and siloxanes—to achieve pipeline quality specifications (typically >97% methane). This upgraded gas is fully interchangeable with fossil natural gas and can be injected into existing gas grids, utilized as Compressed Natural Gas (CNG) or Liquefied Natural Gas (LNG) for transportation, or used in high-efficiency combined heat and power (CHP) facilities. The primary applications span across electricity generation, residential and industrial heating, and sustainable transportation fuel, offering a crucial pathway for decarbonizing hard-to-abate sectors.

Major applications of biomethane are increasingly concentrated in the transportation sector due to mandates aiming to reduce carbon intensity, particularly in Europe and North America, positioning it as a key alternative to traditional diesel and gasoline. Furthermore, the agricultural sector benefits significantly by utilizing the digestate byproduct as a nutrient-rich biofertilizer, thereby closing the nutrient loop and improving farm sustainability while generating revenue from energy production. The inherent benefits of biogas and biomethane include significant reductions in greenhouse gas (GHG) emissions compared to fossil fuels, effective waste management solutions, and the provision of flexible, baseload power that complements intermittent renewable sources like solar and wind. These benefits are strongly reinforced by global environmental commitments, comprehensive national decarbonization strategies, and regulatory incentives such as feed-in tariffs, Renewable Fuel Standards (RFS), and carbon credits, which collectively stimulate market investment and accelerate technological adoption.

The market is predominantly driven by stringent governmental policies promoting circular economy models and energy security concerns stemming from geopolitical instability, making locally sourced, renewable gas highly valuable. Technological advancements in anaerobic digestion efficiency, particularly through co-digestion techniques and advanced microbial processes, are lowering production costs and expanding feedstock flexibility. Increased public and private investment into dedicated biomethane injection infrastructure and gas purification technologies (e.g., membrane separation, PSA, water scrubbing) are critical accelerating factors. Conversely, the market faces constraints related to feedstock availability logistics, high capital expenditure requirements for upgrading facilities, and the necessity for robust regulatory frameworks that harmonize gas quality standards across different regions to facilitate cross-border trade and grid injection.

Biogas and Biomethane Market Executive Summary

The Biogas and Biomethane Market is undergoing a transformation characterized by aggressive scaling and vertical integration, moving beyond traditional small-scale biogas operations toward large, centralized biomethane production hubs designed for grid injection and vehicular fuel supply. Business trends show a strong shift toward consolidation, with energy majors and specialized waste management companies actively acquiring smaller regional players to secure feedstock supply chains and expand geographical footprints. Project financing models are maturing, reducing investment risk through long-term power purchase agreements (PPAs) and gas supply contracts (GSCs) linked to favorable regulatory schemes. Furthermore, there is significant emphasis on digital integration, leveraging technologies like advanced sensor arrays, predictive analytics, and AI-driven process optimization to maximize methane yield, reduce operational costs, and ensure consistent adherence to stringent quality standards for pipeline injection, thus enhancing the overall commercial viability of complex projects.

Regionally, Europe remains the global leader, driven by the EU’s ambitious RePowerEU plan, which targets 35 billion cubic meters (bcm) of domestic biomethane production by 2030, necessitating massive investments in new capacity, particularly in countries like Germany, France, and Italy, which possess mature agricultural and waste management sectors. North America, especially the United States, is experiencing exponential growth, primarily fueled by the economic stimulus provided by the Renewable Fuel Standard (RFS) and state-level Low Carbon Fuel Standard (LCFS) programs, making RNG production from landfills and agricultural manure highly profitable. The Asia Pacific region, while lagging in grid injection infrastructure, shows immense potential, led by India and China, where biogas is heavily promoted for rural energy access and decentralized electricity generation, focusing heavily on waste-to-energy conversion to address escalating urbanization challenges and improve public sanitation outcomes.

Segmentation trends highlight the dominance of agricultural feedstock, given its vast, consistent availability and favorable regulatory status in many regions, although municipal solid waste (MSW) and sewage sludge are gaining momentum due to their lower procurement costs and integrated waste management benefits for urban environments. The application segment reveals the highest growth trajectory within the vehicle fuel category, where biomethane is used as a drop-in replacement for natural gas vehicles, driven by government fleet mandates and corporate sustainability targets focusing on Scope 3 emission reductions. Technological segmentation demonstrates a strong market preference for advanced upgrading technologies, such as membrane separation and pressure swing adsorption (PSA), which offer high methane purity, energy efficiency, and scalability necessary for meeting high-volume grid injection requirements, signaling a shift away from less efficient, older generation upgrading processes.

AI Impact Analysis on Biogas and Biomethane Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Biogas and Biomethane Market consistently revolve around optimization, prediction, and automation across the entire value chain. Key user concerns focus on how AI can enhance the notoriously variable biological processes within anaerobic digesters, such as predicting optimal blending ratios of diverse feedstocks (co-digestion), real-time anomaly detection in fermentation stability, and preemptive maintenance scheduling for complex machinery like compressors and upgrading units. There is also significant user interest in utilizing AI for strategic asset management, including optimizing plant site location based on feedstock availability and grid capacity, and forecasting dynamic biomethane demand and pricing in volatile energy markets. Overall, users expect AI to transition biogas production from an empirical, operator-dependent process to a highly precise, data-driven manufacturing operation, thereby improving efficiency and reducing the operational risk associated with biological variability and equipment failure.

The application of sophisticated AI algorithms, including machine learning (ML) and deep learning, offers transformative potential by processing massive datasets generated by SCADA systems, gas analyzers, and feedstock quality sensors. This data analysis allows operators to maintain optimal pH levels, temperature, and nutrient concentration within the digesters, resulting in maximized methane conversion rates (yield) and reduced process instability (e.g., foaming or souring). Furthermore, AI-driven digital twin modeling is emerging as a critical tool, enabling simulation of various operational scenarios and training of autonomous control systems to respond instantly to changes in feedstock composition or external temperature fluctuations, significantly reducing downtime and ensuring reliable, continuous gas output quality, which is paramount for grid injection compliance.

Deployment of AI is also critical in the logistical and market integration facets of biomethane. Predictive models are used to optimize feedstock collection routes, minimizing transportation costs and carbon footprint, particularly for dispersed agricultural residues. On the market side, AI algorithms analyze real-time grid balancing requirements and carbon credit prices (such as RINs or Guarantees of Origin), advising plant managers on the most profitable timing for selling biomethane or converting it to electricity, thereby maximizing revenue generation from this highly flexible energy source. This strategic optimization capability ensures that new biomethane capacity is developed where it provides the greatest energy security and economic returns.

- AI-driven real-time optimization of anaerobic digestion parameters (temperature, pH, loading rate) to maximize methane yield.

- Predictive maintenance schedules for compressors, pumps, and gas upgrading units, significantly reducing unplanned downtime and capital expenditure costs.

- Machine learning algorithms for feedstock blend optimization (co-digestion), ensuring stable biological processes regardless of varying input quality.

- Enhanced process safety and anomaly detection through rapid analysis of sensor data, identifying potential risks like H2S spikes or explosive gas mixtures.

- Optimization of biomethane injection timing and electricity sales strategies based on dynamic energy market pricing and carbon credit valuations.

- Autonomous control systems reducing reliance on manual operator adjustments, improving consistency and reducing human error.

- Logistical optimization for efficient collection and transportation of dispersed agricultural and waste feedstocks.

DRO & Impact Forces Of Biogas and Biomethane Market

The market trajectory for biogas and biomethane is principally shaped by the powerful confluence of decarbonization mandates, energy security requirements, and advancements in biological and chemical engineering. The core driver is the robust governmental support, particularly in developed economies, manifested through ambitious renewable energy targets and specific incentives for renewable gas, such as high-value Renewable Identification Numbers (RINs) in the US and mandated blending quotas across the EU. This regulatory environment creates a stable investment climate, guaranteeing revenue streams and accelerating project development. Furthermore, the inherent waste management benefit—converting problematic organic residues into valuable energy—appeals strongly to municipal authorities and large industrial producers, effectively addressing environmental liabilities while creating a circular economy model. The growing corporate demand for credible, verifiable decarbonization solutions, often targeting Scope 3 emissions, increasingly positions biomethane as an essential tool for large organizations seeking to demonstrate sustainability leadership and fulfill voluntary commitments.

Significant restraints challenge the market's rapid scaling, most notably the high initial capital expenditure (CAPEX) required for sophisticated gas upgrading and pipeline injection infrastructure, making project financing challenging for smaller developers, especially outside established regulatory zones. Another critical restraint involves the logistical complexity and variability of feedstock supply. Sourcing large, consistent volumes of agricultural waste or dedicated energy crops requires complex coordination and infrastructure, and the varying composition of the feedstock directly impacts the efficiency and stability of the anaerobic digestion process. Furthermore, the public perception and potential regulatory conflicts arising from 'food vs. fuel' debates concerning dedicated energy crops, alongside land-use restrictions and stringent environmental permitting processes, introduce delays and uncertainty into the project lifecycle, slowing overall market maturation.

Despite the constraints, substantial opportunities exist, primarily centered on technological innovation and market expansion. The development of advanced gas cleaning technologies, particularly cryogenic separation and catalytic conversion methods, promises to reduce operational costs (OPEX) and improve the purity of the final biomethane product, enabling broader market acceptance and easier grid integration. Geographically, emerging economies in Southeast Asia, Africa, and Latin America represent vast untapped potential where population growth generates increasing volumes of manageable organic waste, and the need for decentralized, reliable energy solutions is paramount. Moreover, the integration of Carbon Capture and Storage (CCS) with biomethane plants (Bio-CCS or BECCS) offers the unique possibility of achieving net-negative carbon emissions, transforming these facilities into environmental assets that can generate additional revenue through carbon removal credits, positioning biomethane as a core component of future deep decarbonization strategies.

The overall impact forces demonstrate a strong positive momentum, with drivers significantly outweighing restraints in mature markets due to powerful regulatory backing and clear economic incentives linked to carbon abatement. While capital costs and feedstock logistics remain frictional forces, sustained technological improvements, combined with global political prioritization of energy transition and circular economy principles, ensure an accelerating rate of adoption. The opportunity to leverage existing natural gas infrastructure provides a cost-effective pathway to scale up renewable energy supply rapidly, cementing biomethane's role as a vital bridge fuel and, ultimately, a long-term sustainable energy source.

Segmentation Analysis

The Biogas and Biomethane Market segmentation provides a granular view of the dynamic ecosystem, categorized primarily by Feedstock, Technology, Application, and Geography. Analyzing these segments is crucial for understanding investment flows and identifying high-growth niches. The market structure reflects a transition driven by policy, where high-purity applications, such as grid injection and vehicular fuel, are increasingly dominating investment over basic heat and power generation. This shift requires sophisticated upgrading technologies and robust infrastructure, leading to a natural consolidation among producers capable of meeting pipeline standards. The viability of a project is fundamentally linked to the available feedstock, with agricultural residues offering the largest potential supply base, followed closely by municipal organic fractions, which benefit from public waste management mandates.

In terms of technology, the shift is highly concentrated towards advanced purification methods. While traditional water scrubbing and chemical absorption methods remain viable, membrane separation and Pressure Swing Adsorption (PSA) are favored for their energy efficiency, small footprint, and ability to achieve the ultra-high purity (>97%) required for seamless grid injection. Furthermore, the integration of innovative pre-treatment techniques for complex feedstocks, such as thermal hydrolysis and enzymatic treatments, is expanding the types of organic matter that can be efficiently digested, thereby broadening the accessible feedstock market. This technological evolution is vital for lowering the Levelized Cost of Biomethane (LCOB) and making it competitive with conventional natural gas sources, thereby encouraging wider utility adoption.

The application landscape clearly shows that while power generation (CHP) remains foundational, the highest value creation resides in the Renewable Natural Gas (RNG) segment dedicated to transportation and industrial use. Many major energy companies are now focusing their RNG outputs on securing long-term contracts with large logistics and fleet operators or channeling the product into carbon-heavy industries seeking certified, auditable emission reductions. This high-value application is heavily supported by government mandates specifying minimum renewable content in transportation fuels. Understanding these segmented value pathways is essential for strategic market entry and developing resilient supply chain strategies focused on meeting these premium-demand sectors.

- By Feedstock:

- Agricultural Residues (Manure, Crop Residues)

- Municipal Solid Waste (Organic Fraction)

- Sewage Sludge

- Industrial Organic Waste

- Energy Crops

- By Technology:

- Anaerobic Digestion (Wet, Dry, Co-digestion)

- Gas Upgrading Technologies

- Membrane Separation

- Pressure Swing Adsorption (PSA)

- Water Scrubbing

- Chemical Scrubbing (Amine)

- By Application:

- Electricity Generation (CHP)

- Heating (Residential, Industrial)

- Transportation Fuel (CNG/LNG/RNG)

- Grid Injection/Pipeline Supply

- By Geography:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Nordics)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Biogas and Biomethane Market

The Biogas and Biomethane value chain is characterized by a complex interplay between resource management, technological processing, and energy distribution infrastructure, beginning with the procurement of upstream raw materials. Upstream activities are critical and encompass the sourcing, collection, and pre-treatment of diverse organic feedstocks, which may include agricultural residues, slurries, food waste, or sewage sludge. Efficiency at this stage determines the overall profitability and sustainability of the operation, requiring advanced logistics planning to minimize transportation costs and specialized pre-processing equipment (e.g., shredders, pasteurizers, separation units) to ensure optimal conditions for anaerobic digestion. Investment in reliable, long-term feedstock supply contracts is paramount, as feedstock cost typically constitutes a major operating expense. Strategic partnerships with large farming cooperatives or waste management corporations are therefore essential to secure consistent, high-volume inputs necessary for utility-scale production.

The core midstream segment involves the actual conversion process: anaerobic digestion (AD), followed by gas upgrading. AD facilities, ranging from simple farm-scale units to sophisticated centralized plants, convert organic matter into raw biogas and digestate. The raw biogas must then pass through the rigorous upgrading stage, where contaminants (H2S, CO2, water, particulates) are removed using specialized technologies like membranes, PSA, or amine scrubbing to produce biomethane of pipeline quality. This upgrading process is technology-intensive and dictates the final product's value and suitability for downstream applications. The quality control mechanisms, including continuous monitoring and analysis, are extremely strict to meet the stringent specifications set by pipeline operators and regulatory bodies, emphasizing safety and consistency.

Downstream activities focus on distribution, sales, and end-use application. Biomethane can be injected directly into the natural gas grid (direct channel), distributed as vehicular fuel via dedicated refueling stations (CNG/LNG), or sold for localized heat and power generation (indirect channel). The direct channel, grid injection, is highly valued due to its ability to utilize existing national infrastructure, facilitating large-scale market penetration. The indirect channels often involve specialized logistics for transportation fuel or dedicated industrial contracts. The final sale is usually monetized through two primary mechanisms: the sale of the energy commodity (natural gas price) and the sale of environmental attributes (carbon credits, RINs, Guarantees of Origin), which often represent the majority of the project's revenue. Therefore, robust regulatory compliance and traceability systems are crucial elements of the downstream value proposition.

Biogas and Biomethane Market Potential Customers

The potential customer base for the Biogas and Biomethane Market is remarkably diverse, spanning utilities, transport operators, industrial manufacturers, and the agricultural sector, driven by differing motivations ranging from regulatory compliance to deep decarbonization commitments. Utility companies and natural gas grid operators represent major buyers, viewing biomethane as a key tool for achieving portfolio compliance mandates for renewable gas injection, particularly in Europe and parts of North America where blending targets are increasing. These customers require high-volume, continuously supplied biomethane that meets stringent pipeline specifications, often secured through long-term, multi-year supply agreements that ensure reliable renewable energy content for their residential and commercial customer base. Their purchasing decisions are heavily influenced by regulatory clarity and the cost-competitiveness relative to alternatives like power-to-gas solutions.

The transportation sector, encompassing logistics companies, municipal bus fleets, waste haulers, and long-haul trucking operations, forms another highly valuable customer segment, especially in regions with Low Carbon Fuel Standards (LCFS). These customers prioritize biomethane (RNG) because it offers a significant, immediate reduction in carbon intensity compared to fossil fuels, allowing them to meet tightening environmental standards without requiring major engine overhauls or changes to existing refueling infrastructure. For corporate fleets, using RNG is a highly visible sustainability action, often linked directly to mandated or voluntary Scope 3 emission reporting goals, making the verified environmental attributes as important as the fuel itself.

Furthermore, major industrial consumers in sectors such as food and beverage processing, chemicals, and cement production are increasingly seeking biomethane for process heating and thermal applications. These industries face immense pressure to decarbonize their heat requirements, which are often difficult to electrify. Biomethane provides a carbon-neutral or negative-carbon solution that can be seamlessly integrated into existing boiler and furnace infrastructure. Lastly, the agricultural sector itself acts as both a supplier (feedstock) and a consumer, utilizing generated heat and electricity on-site, as well as the digestate byproduct for biofertilizer, thereby achieving energy independence and reduced input costs, completing a localized circular economy loop.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.0 Billion USD |

| Market Forecast in 2033 | $120.5 Billion USD |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Engie, Waga Energy, Bright Biomethane, Air Liquide, PlanET Biogasanlagen, Greenlane Renewables, Ameresco, Clean Energy Fuels, Biffa Group, Scandinavian Biogas, Fortum, Dürr Group, DMT Environmental Technology, Biofuel Energy, AAT Biogas, Xergi, Maas Energy Works, FutureFuel, NGV Global, SGN Commercial Services |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biogas and Biomethane Market Key Technology Landscape

The Biogas and Biomethane market relies heavily on a sophisticated technological landscape encompassing efficient biological conversion, robust gas purification, and integrated smart control systems. The foundation is Anaerobic Digestion (AD), which has seen incremental improvements, particularly in reactor design (e.g., Continuous Stirred Tank Reactors, Plug Flow Reactors, Upflow Anaerobic Sludge Blanket (UASB) reactors) tailored for specific feedstock characteristics. Recent innovations focus on high-solids AD and co-digestion systems, allowing facilities to process a diverse range of waste streams simultaneously to achieve maximized methane output and operational stability. Pre-treatment technologies, such as thermal hydrolysis and ultrasonication, are increasingly employed upstream to break down recalcitrant materials, thereby increasing the bioavailability of substrates and significantly reducing digestion retention times, leading to higher overall throughput and efficiency in large commercial plants.

The crucial technological differentiator in the modern market is the gas upgrading process, which transforms raw biogas into high-purity biomethane suitable for pipeline injection or vehicle fueling. Leading technologies include membrane separation, which uses selective polymeric films to separate methane from carbon dioxide and other trace gases, favored for its modularity and relatively low energy consumption. Pressure Swing Adsorption (PSA) is another dominant method, utilizing absorbent materials to capture CO2 at high pressure, yielding exceptional methane purity often exceeding 98%. Water scrubbing and chemical absorption (amine scrubbing) are older, established methods but are gradually being replaced by PSA and membranes due to their superior efficiency, smaller environmental footprint, and lower operational complexity, especially in utility-scale projects demanding extremely high purity levels and continuous operation.

Further technological integration focuses on optimizing the entire plant lifecycle through automation and digital platforms. Advanced sensor networks monitor critical parameters like gas flow, composition, pressure, and biological indicators in real time, feeding data into SCADA and specialized process control systems. These systems utilize predictive modeling to anticipate operational issues, optimize energy consumption within the plant (parasitic load reduction), and ensure compliance with grid standards. Furthermore, the integration of digestate treatment technologies, such as separation, drying, and nutrient recovery (e.g., struvite precipitation), is becoming standard practice. This not only mitigates disposal costs but also creates a valuable biofertilizer product, enhancing the overall economic and environmental viability of the biogas ecosystem and completing the circular economy loop for nutrient management.

Regional Highlights

Regional dynamics play a paramount role in shaping the Biogas and Biomethane Market, dictated by local feedstock availability, energy policy maturity, and existing natural gas infrastructure. Europe holds the highest production capacity and market maturity globally. The region benefits from decades of established policy support, particularly feed-in tariffs and the recently reinforced RePowerEU targets, which mandate a rapid increase in domestic biomethane production. Countries like Germany, France, and the UK have highly sophisticated AD infrastructure, focused on grid injection and vehicle fuel. European growth is now primarily driven by optimizing existing sites and building large, centralized biomethane plants near agricultural clusters, focusing on deep decarbonization across heating and transport sectors through certified Guarantees of Origin systems.

North America, led by the United States, is experiencing the fastest rate of new project development, primarily driven by the highly lucrative economic framework established by the Renewable Fuel Standard (RFS) and state-level Low Carbon Fuel Standards (LCFS), particularly in California and Oregon. The US market focuses heavily on large-scale RNG production from existing municipal landfills and agricultural manure lagoons, channeling the upgraded gas predominantly into the high-value vehicular fuel market. The robust financial incentives linked to the carbon intensity scores of RNG projects make them extremely profitable, attracting substantial private equity and major energy company investments. Canada also contributes significantly, concentrating on sustainable waste management and provincial mandates for green gas use.

The Asia Pacific region represents the largest long-term potential for capacity expansion, though current implementation is more fragmented. China and India are leading the charge, prioritizing decentralized biogas solutions for rural cooking and localized power generation to address energy poverty and environmental pollution from waste. While grid injection infrastructure is less developed compared to the West, rapid urbanization is generating vast volumes of municipal organic waste, pushing governments toward large-scale waste-to-energy projects. Market maturation in APAC will depend on bridging the gap between small, rural applications and utility-scale, high-purity biomethane production capable of meeting industrial and urban energy demands, requiring significant foreign investment in modern gas upgrading and distribution technology.

- Europe: Leading market share driven by mandatory blending targets (RePowerEU), strong regulatory support (FITs, certificates), and mature AD technology base. Focus on agricultural and sewage feedstock for grid injection.

- North America: Highest growth rate fueled by economic incentives (RFS/RINs, LCFS) for Renewable Natural Gas (RNG), focusing on large landfill and dairy manure projects directed toward the transportation sector.

- Asia Pacific (APAC): Significant long-term potential due to massive organic waste generation from urbanization. Current focus on decentralized rural biogas, transitioning towards centralized utility-scale projects in China and India.

- Latin America: Emerging market, particularly Brazil and Argentina, leveraging high biomass availability (sugar cane, livestock) for bioenergy production. Focus on utilizing waste streams to support industrial energy self-sufficiency.

- Middle East & Africa (MEA): Nascent market primarily driven by waste management solutions in high-population urban centers and localized power generation needs, necessitating modular and robust technology solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biogas and Biomethane Market.- Engie

- Waga Energy

- Bright Biomethane

- Air Liquide

- PlanET Biogasanlagen

- Greenlane Renewables

- Ameresco

- Clean Energy Fuels

- Biffa Group

- Scandinavian Biogas

- Fortum

- Dürr Group

- DMT Environmental Technology

- Biofuel Energy

- AAT Biogas

- Xergi

- Maas Energy Works

- FutureFuel

- NGV Global

- SGN Commercial Services

Frequently Asked Questions

Analyze common user questions about the Biogas and Biomethane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between biogas and biomethane (RNG)?

Biogas is the raw product of anaerobic digestion, typically containing 50-75% methane and significant carbon dioxide. Biomethane, or Renewable Natural Gas (RNG), is upgraded biogas that has been purified to remove contaminants and CO2, achieving pipeline quality (>97% methane), making it fully interchangeable with fossil natural gas.

How do global carbon reduction mandates impact the biomethane market?

Global mandates, such as the EU's RePowerEU and the US RFS/LCFS programs, significantly accelerate market growth by creating a high-value economic incentive structure. These mandates increase the demand for verified low-carbon fuels, driving investment into biomethane production and infrastructure development necessary for utility and transport sector compliance.

Which feedstock type holds the largest market share in biomethane production?

Agricultural residues, particularly animal manure and crop residues, currently hold the largest market share in terms of raw volumetric potential and established supply chains, especially in Europe and North America, due to favorable policy incentives designed to address agricultural emissions.

What are the key technological challenges in scaling up biomethane production for grid injection?

The key challenges involve achieving and consistently maintaining ultra-high methane purity (>97%) to meet pipeline specifications, managing the variability of diverse feedstocks, and mitigating the high capital costs associated with advanced gas upgrading and compression technologies.

Where is the highest demand application segment for biomethane expected in the forecast period?

The transportation fuel segment is projected to exhibit the highest growth in demand, driven by stringent carbon intensity reduction targets for heavy-duty fleets and logistics companies. Biomethane provides a crucial, low-carbon, drop-in fuel solution for existing natural gas vehicle infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager