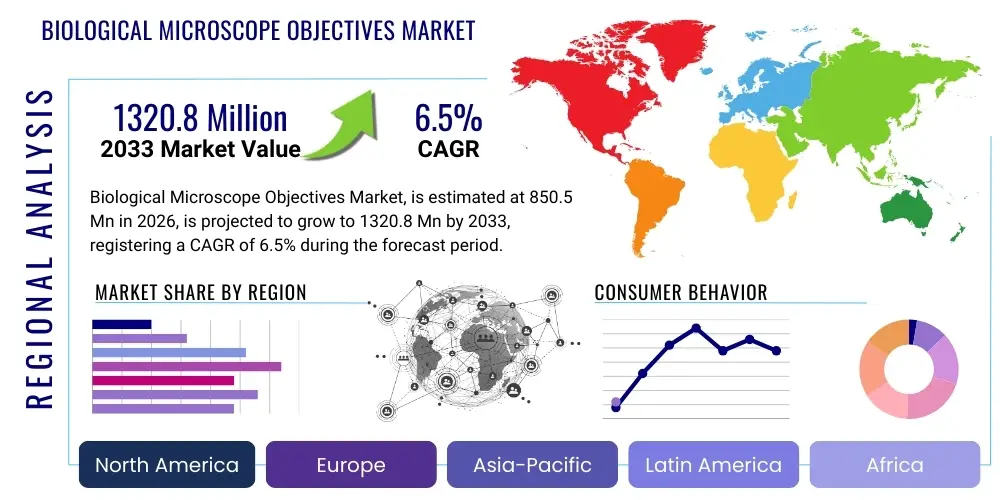

Biological Microscope Objectives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442189 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Biological Microscope Objectives Market Size

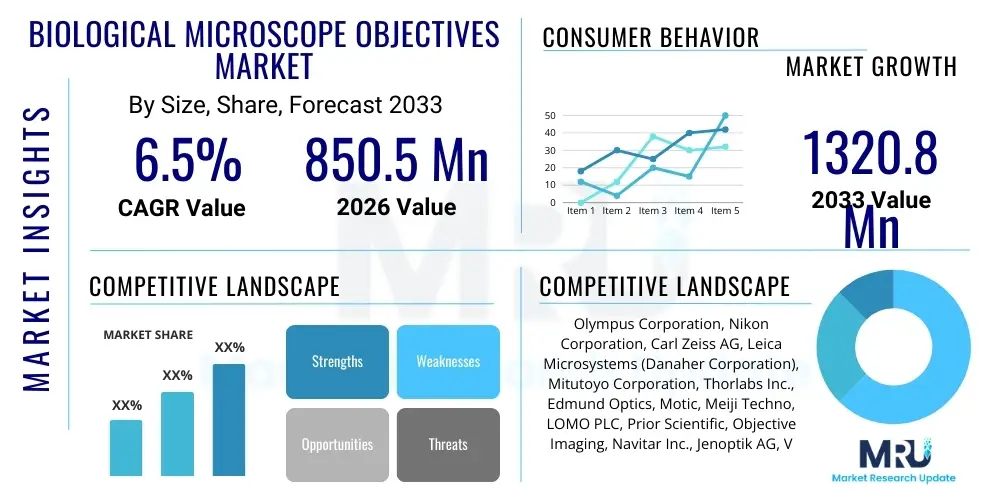

The Biological Microscope Objectives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1320.8 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the escalating global investment in life sciences research, particularly in genomics, cellular biology, and pathology. The demand for higher resolution and advanced imaging techniques across academic institutions, pharmaceutical companies, and clinical diagnostic laboratories necessitates continuous innovation and adoption of specialized microscope objectives designed for superior optical performance.

Biological Microscope Objectives Market introduction

The Biological Microscope Objectives Market encompasses the high-precision optical components essential for light microscopy in biological and medical sciences. These objectives, critical for determining the image magnification, resolution, and quality, are sophisticated lenses optimized for use with biological samples, often requiring specific working distances, numerical apertures (N.A.), and immersion media (oil, water, or air). The market covers a diverse range of products, including achromatic, semi-apochromatic, apochromatic, and specialized objectives like phase contrast, DIC (Differential Interference Contrast), and fluorescence objectives, each tailored for distinct imaging modalities and sample requirements. Key applications span fundamental research, drug discovery, clinical diagnostics, and quality control in biotech industries.

The primary benefit of high-quality biological microscope objectives lies in their ability to deliver exceptional contrast and resolution, enabling researchers to visualize subcellular structures and dynamic biological processes with unprecedented clarity. The technological sophistication, including specialized lens coatings and precision manufacturing, ensures minimal chromatic and spherical aberrations, crucial for quantitative imaging. Driving factors for market expansion include the increasing incidence of chronic diseases, necessitating advanced diagnostic tools, coupled with substantial government and private sector funding directed towards biomedical research and the development of novel therapeutic agents.

Furthermore, the integration of advanced digital imaging systems and automated microscopy platforms has amplified the reliance on high-performance objectives. These technological synergies demand objectives capable of handling high-throughput screening applications while maintaining optical fidelity across large fields of view. The ongoing push toward super-resolution microscopy and multi-photon imaging also mandates the continuous evolution of objective designs, particularly those optimized for UV, infrared, and specialized wavelength transmission, securing the objective’s central role in the modern biological laboratory ecosystem.

Biological Microscope Objectives Market Executive Summary

The global Biological Microscope Objectives Market is characterized by intense technological competition and strategic investments in high-end product development, driven by the expanding biomedical and pharmaceutical sectors. Current business trends indicate a strong shift towards specialized, high Numerical Aperture (N.A.) objectives, optimized for fluorescence and live-cell imaging, often requiring complex integration with motorized stages and advanced software platforms. Leading manufacturers are focusing on miniaturization, enhanced automation compatibility, and objectives optimized for deep tissue imaging, responding directly to the needs of drug discovery pipelines and academic research facilities globally. Strategic collaborations between objective manufacturers and microscopy system integrators are becoming prevalent to offer comprehensive, integrated imaging solutions.

Regionally, North America and Europe maintain dominance, attributed to well-established R&D infrastructures, substantial funding for life sciences, and the presence of major pharmaceutical and biotechnology companies that are early adopters of advanced microscopy technology. However, the Asia Pacific region (APAC) is projected to exhibit the fastest growth, primarily driven by rapid expansion in clinical research, increasing governmental investments in scientific infrastructure in countries like China and India, and the rising establishment of advanced diagnostic laboratories. Emerging markets in Latin America and MEA are also demonstrating growing potential, albeit constrained slightly by infrastructure limitations and capital investment hurdles.

Segment trends reveal that the Apochromatic objectives segment, known for superior color correction and resolution, commands a significant market share due to its indispensable nature in high-precision research, especially in multi-color fluorescence imaging. Application-wise, drug discovery and clinical diagnostics remain the largest segments, emphasizing the need for robust, reliable, and high-throughput objectives. Technology segmentation highlights increasing adoption of objectives specifically optimized for super-resolution techniques (e.g., STED, STORM), driving premium pricing and increased Average Selling Prices (ASP) across the advanced product portfolio.

AI Impact Analysis on Biological Microscope Objectives Market

User inquiries regarding AI's influence on the Biological Microscope Objectives Market frequently revolve around automation, precision manufacturing, and the subsequent analysis of the images produced. Common user questions probe whether AI can optimize objective design for specific applications, how machine learning enhances objective performance correction (e.g., aberration compensation), and, most significantly, how AI-driven image analysis tools necessitate objectives with specific, high-fidelity optical characteristics. The key themes summarized from this analysis indicate a strong expectation that AI will not replace the need for high-quality objectives, but rather elevate the requirement for consistency, standardization, and quantitative precision in the optical hardware to feed reliable, clean data into sophisticated algorithms.

The practical impact of Artificial Intelligence on this market is bifurcated: first, in the enhancement of the objectives themselves, and second, in optimizing the user experience utilizing objectives. AI-driven simulation tools are already being employed in the design phase, allowing manufacturers to rapidly model and optimize complex lens assemblies for specific parameters, such as minimizing field curvature or maximizing Numerical Aperture under restricted physical constraints. This accelerates the R&D cycle for specialized objectives required in niche applications like light-sheet microscopy or high-content screening. Furthermore, AI facilitates real-time performance monitoring and automated calibration routines, ensuring that objectives maintain peak optical performance throughout extended experimental runs, particularly crucial in automated labs where human intervention is minimized.

On the user side, the proliferation of AI in biological image analysis—for tasks such as automated cell counting, feature segmentation, and phenotypic profiling—increases the value proposition of objectives capable of delivering quantitative, distortion-free images. If the initial image captured by the objective is flawed (e.g., poor contrast, significant aberration), subsequent AI analysis suffers drastically (garbage in, garbage out). Consequently, AI tools are driving demand for premium objectives that provide standardized, reproducible image quality across multiple systems and time points, thus cementing the market necessity for precision optics as the foundational data source for machine learning applications.

- AI-Enhanced Objective Design: Utilizing machine learning algorithms to model and optimize complex lens geometries, reducing design cycle time and enhancing performance specifications (e.g., Numerical Aperture, working distance).

- Automated Quality Control: Deployment of AI vision systems during manufacturing to ensure extremely high precision alignment and coating uniformity, guaranteeing objective quality consistency.

- Real-Time Aberration Correction: AI software integration with motorized objectives and adaptive optics to compensate for sample-induced optical distortions in real-time during image acquisition.

- Increased Demand for Quantitative Optics: AI-driven image analysis necessitates objectives that provide high-fidelity, distortion-free images for reliable data input and feature extraction.

- High-Throughput Compatibility: AI-powered automated microscopy requires robust, reliable objectives capable of maintaining optical performance consistently across thousands of automated experimental cycles.

DRO & Impact Forces Of Biological Microscope Objectives Market

The Biological Microscope Objectives Market is fundamentally shaped by a robust set of driving forces centered around scientific advancements and healthcare needs, tempered by significant financial and technical restraints, which together create expansive opportunities. The primary driver is the surging global expenditure on life science research and development, particularly in areas like cancer research, neurobiology, and infectious disease diagnostics, where high-resolution imaging is indispensable for understanding molecular and cellular mechanisms. This is complemented by the rapid technological evolution within microscopy itself, including the transition towards super-resolution, digital pathology, and high-content screening, all of which require increasingly sophisticated and precise objectives to maximize system capabilities. The increasing demand for automation in laboratories further mandates the adoption of objectives optimized for automated handling and prolonged operational cycles, emphasizing reliability and repeatable performance.

Conversely, the market faces significant restraints, chiefly the extremely high cost associated with manufacturing high-end, complex objectives, such as apochromats and those optimized for specific immersion media. These high costs limit adoption, particularly in emerging economies or smaller academic labs with restricted budgets, often leading to the retention of older, less-capable objectives. Furthermore, the technical complexity of integrating specialized objectives with advanced imaging setups requires highly trained personnel, presenting a skill barrier in certain geographical areas. The fragility and sensitivity of these precision optical components also introduce risks related to handling, cleaning, and maintenance, contributing to the overall total cost of ownership (TCO) and potential downtime.

Despite these challenges, substantial market opportunities exist, particularly in developing objectives optimized for specific biological environments, such as those resistant to harsh chemical exposure or capable of long-term live-cell imaging without inducing phototoxicity. The growing market for portable and field-deployable microscopy systems also opens avenues for designing robust, compact objectives with simplified usage protocols. Furthermore, companies focusing on developing advanced materials for lens elements and next-generation anti-reflective coatings stand to gain a competitive advantage by offering objectives with superior light throughput and broader spectral transmission ranges crucial for cutting-edge fluorescence applications. The unmet need for affordable, high-quality objectives in high-volume clinical settings remains a major commercial opportunity.

Segmentation Analysis

The Biological Microscope Objectives Market is critically segmented based on product type, immersion medium, magnification range, application, and end-user, reflecting the diverse and highly specialized needs of the life science community. Product type segmentation distinguishes between general-purpose objectives (achromatic, semi-apochromatic) and high-performance objectives (apochromatic, plan objectives), with performance directly correlating with price and application precision. Immersion medium is vital, separating objectives requiring air, oil, or water immersion, which dictates the achievable Numerical Aperture and resolution. Magnification ranges further delineate use cases, from low magnification objectives used for overview imaging to ultra-high magnification objectives (e.g., 100x) essential for subcellular visualization.

Application segmentation illustrates where market growth is most concentrated, with significant demand originating from fundamental biological research (cellular studies, genetics), drug discovery and pharmaceutical research (high-content screening, efficacy testing), and clinical diagnostics (pathology, cytopathology). Each application imposes unique requirements on objective specifications; for instance, drug discovery demands high speed and large field flatness, whereas clinical pathology emphasizes color accuracy and robustness. The end-user segment reflects the institutional structure of adoption, covering academic and research institutions (high volume, varied needs), pharmaceutical and biotechnology companies (premium, specialized objectives), and diagnostic laboratories (robust, standardized solutions).

Understanding these segments is essential for strategic market planning. The shift towards multi-modality imaging and automated platforms increasingly drives demand for specialized objectives—such as those corrected for deep penetration into tissue (cleared tissue imaging) or those optimized for specific laser wavelengths used in confocal and multi-photon microscopy. Manufacturers are continuously responding to these segmented demands by investing in modular objective systems and custom-engineered coatings, ensuring compatibility across the rapidly evolving landscape of advanced biological imaging.

- By Product Type:

- Achromatic Objectives

- Semi-Apochromatic Objectives (Fluor/Plan Fluor)

- Apochromatic Objectives (Plan Apo)

- Specialized Objectives (Phase Contrast, DIC, Fluorescence, Correction Collar Objectives)

- By Immersion Medium:

- Air Immersion Objectives

- Oil Immersion Objectives

- Water Immersion Objectives

- Glycerin Immersion Objectives

- By Magnification Range:

- Low Power (4x, 10x)

- Medium Power (20x, 40x)

- High Power (60x, 100x)

- By Application:

- Academic Research

- Drug Discovery and Development

- Clinical Diagnostics and Pathology

- Biotechnology and Quality Control

- By End-User:

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

Value Chain Analysis For Biological Microscope Objectives Market

The value chain for the Biological Microscope Objectives Market is characterized by highly specialized, capital-intensive processes, beginning with the sourcing and preparation of specialized optical glass and crystal materials. Upstream analysis focuses on the raw material suppliers, who must provide glass with extremely precise refractive indices and minimal imperfections to meet the rigorous demands of high Numerical Aperture objectives. Key activities at this stage include the manufacturing of various lens elements, involving precise grinding, polishing, and coating techniques (such as multi-layer anti-reflective coatings) that require cleanroom environments and highly proprietary technology. The complexity of manufacturing a single Apochromatic objective, which may contain 10 to 15 individual, perfectly aligned lens elements, underscores the high barrier to entry at the primary production stage.

Midstream activities involve the assembly, integration, and stringent quality control (QC) of the finished objectives. Major microscopy system manufacturers typically perform this integration, ensuring that the objective's performance meets the necessary specifications, including field flatness, chromatic correction, and mechanical precision for parfocality. QC processes often involve automated interferometry and resolution testing to ensure sub-micron accuracy. Distribution channels are predominantly direct sales to large academic or pharmaceutical accounts, allowing manufacturers to provide specialized technical support and customization. Indirect channels involve authorized distributors or certified scientific equipment dealers who manage regional sales, inventory, and localized after-sales support for smaller laboratories and clinical facilities.

Downstream analysis focuses on the end-users—academic researchers, biotech companies, and pathologists—who deploy these objectives within complex, often automated, microscopy systems. The primary value addition at this stage is the generation of high-quality scientific data or accurate clinical diagnoses. The feedback loop from these downstream users is crucial; their evolving imaging needs (e.g., need for deeper penetration, higher speed) directly influence the R&D priorities upstream. Successful market participants manage the entire chain effectively, maintaining strong relationships with specialized material providers while offering robust post-sales service and application consultation to ensure optimal performance in diverse end-user settings.

Biological Microscope Objectives Market Potential Customers

The primary customers and end-users of Biological Microscope Objectives are diverse institutions and organizations deeply entrenched in life science research, drug discovery, and clinical diagnostics, all requiring high-precision optical visualization tools. Academic and university research laboratories constitute a significant customer base, driving demand for a broad range of objectives, from basic achromatic types used in undergraduate teaching to premium apochromatic and specialized objectives essential for cutting-edge cellular and molecular studies funded by government grants. These institutions prioritize resolution, versatility, and the ability to integrate objectives into multi-modality microscopy platforms, often purchasing high volumes of standard objectives alongside niche specialized products.

The pharmaceutical and biotechnology sectors represent another crucial segment of high-value customers. These companies utilize objectives extensively in drug discovery pipelines, toxicology studies, high-content screening (HCS), and quality control processes. Their requirements are stringent, demanding objectives that offer exceptional field flatness, high speed, and robust mechanical stability for continuous, automated operation. Because HCS often involves multi-well plate imaging and quantitative analysis, these customers heavily invest in high-NA, plan-apochromatic objectives compatible with automated liquid handling and digital imaging software, focusing on throughput and quantitative reproducibility.

Finally, hospitals, clinical laboratories, and pathology centers form a critical customer segment, particularly relying on objectives for routine clinical diagnostics, surgical pathology, and cytopathology. While resolution remains important, these environments prioritize durability, ease of use, and objectives optimized for brightfield and basic differential staining techniques. With the rise of digital pathology, there is increasing demand for objectives that can deliver consistent, wide-field imaging necessary for slide scanning systems, ensuring reliable translation of traditional glass slide diagnostics into digitized formats suitable for telepathology and AI-assisted analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1320.8 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, Nikon Corporation, Carl Zeiss AG, Leica Microsystems (Danaher Corporation), Mitutoyo Corporation, Thorlabs Inc., Edmund Optics, Motic, Meiji Techno, LOMO PLC, Prior Scientific, Objective Imaging, Navitar Inc., Jenoptik AG, Vision Engineering, Shanghai Optics, Sunny Optical Technology, Newport Corporation, C.P. Goerz American Optical Co., PCO AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biological Microscope Objectives Market Key Technology Landscape

The core technology driving the Biological Microscope Objectives Market resides in precision optics and advanced material science, focusing on achieving maximum light collection efficiency and minimal optical aberration across wide spectral ranges. A critical element is the application of multi-element lens designs, such as the sophisticated Apochromatic objectives, which employ multiple lens elements crafted from specialized low-dispersion glass (like fluorite or similar synthetic materials) to correct spherical and chromatic aberrations for three or more colors, providing superior color fidelity essential for multi-channel fluorescence imaging. Furthermore, objectives are increasingly corrected for specific operating parameters, including cover glass thickness variability and temperature fluctuations, often incorporating correction collars that allow the user to mechanically fine-tune the objective for precise imaging conditions, optimizing resolution dynamically.

Immersion technology remains a cornerstone of high-resolution biological imaging, with objectives designed for oil or water immersion utilizing media with refractive indices similar to the glass and the biological specimen. This minimizes refractive index mismatch, thereby maximizing the Numerical Aperture (N.A.)—the crucial parameter dictating resolution and light gathering ability. Recent technological developments include specialized silicone oil and high-refractive index water immersion objectives, designed specifically for deep tissue penetration and long-term live-cell imaging, addressing challenges like index mismatch at depth and phototoxicity associated with prolonged high-intensity illumination. These advancements often involve proprietary manufacturing techniques to ensure the robustness of the objective seals against corrosive media.

A significant technological push involves optimizing objectives for fluorescence and advanced imaging techniques. This includes utilizing specialized lens coatings (anti-reflective, anti-fungal) that offer exceptionally high transmission rates across narrow excitation and emission bands, crucial for maximizing signal-to-noise ratio in low-light fluorescence applications. Moreover, manufacturers are developing objectives compatible with adaptive optics, which employ deformable mirrors or spatial light modulators to actively correct wavefront distortions introduced by thick, heterogeneous biological samples. This convergence of advanced objective design with computational correction techniques represents the vanguard of the market, allowing researchers to push the limits of resolution and depth in complex biological systems.

The manufacturing process itself incorporates cutting-edge technologies like Computer Numerically Controlled (CNC) polishing, magnetorheological finishing, and ion-beam etching to achieve surface accuracies often measured in nanometers. This extreme precision is vital for minimizing scattering and maximizing phase coherence, which is particularly critical for techniques like Differential Interference Contrast (DIC) and Phase Contrast microscopy. Continuous innovation in lens bonding techniques, minimizing stress birefringence, and developing highly stable mechanical mounts also ensures that these high-precision objectives maintain their optical alignment even under demanding, high-speed automated operation found in pharmaceutical screening laboratories. These layers of technological complexity ensure that the objective remains the most critical and highest-precision component within any high-end biological imaging system.

Regional Highlights

- North America: North America, particularly the United States, commands a leading position in the Biological Microscope Objectives Market, primarily due to immense private and public funding allocated to life sciences, genomics, and advanced medical research. The region houses the world’s largest concentration of leading pharmaceutical and biotechnology companies, alongside globally recognized academic research institutions (e.g., NIH, Harvard, Stanford) that are early adopters of cutting-edge microscopy technologies. The robust regulatory framework supports innovation, and the high demand for automated and super-resolution microscopy systems ensures continuous investment in premium, specialized objectives. The competitive landscape is mature, characterized by strong sales channels and high awareness regarding the necessity of precision optics for reliable research outcomes.

- Europe: Europe represents a significant and technologically advanced market, driven by powerful research clusters in Germany, the UK, Switzerland, and France. These countries are home to established optics manufacturers and highly active research consortia that benefit from initiatives like Horizon Europe funding for biomedical and clinical research. The European market exhibits high demand for objectives optimized for standardized clinical diagnostics and high-resolution imaging in neurosciences and immunology. Emphasis is often placed on objectives offering long working distances and compatibility with multi-modal setups, catering to the diverse R&D profiles across the continent, though regional budget constraints can sometimes favor robust, mid-range objectives over the most expensive apochromats.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market segment, fueled by massive governmental investments in developing world-class scientific infrastructure, particularly in China, Japan, and India. Rapid expansion of the biotechnology and pharmaceutical manufacturing sectors, coupled with an increasing volume of clinical trials and diagnostic procedures, is accelerating objective adoption. While Japan maintains high standards for precision manufacturing and adoption of premium products, countries like China and India are driving volume growth through expanding academic enrollment and establishing new diagnostic pathology centers, demanding a mix of reliable, cost-effective objectives and highly advanced optics for newly established core facilities.

- Latin America (LATAM): The LATAM market, while smaller, offers notable potential, particularly in Brazil and Mexico, due to improving healthcare infrastructure and rising investment in localized pharmaceutical R&D. Market growth is often dependent on government funding cycles and institutional capacity building, leading to a strong demand for cost-effective, durable microscope systems and objectives suitable for educational and routine clinical use. Adoption of high-end specialized objectives is typically concentrated in major research hubs affiliated with top public universities or regional centers of excellence, often requiring strong distributor support and localized technical training.

- Middle East and Africa (MEA): The MEA market is nascent but shows potential, primarily concentrated in economically stable Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE) and South Africa, where significant oil revenues are being redirected toward establishing advanced medical and research facilities. Demand is heavily skewed towards high-quality objectives for clinical diagnostics and specialized laboratory work, often requiring direct import from leading global manufacturers. Market penetration is currently limited by budget availability and the slower development of a localized technical support network necessary for maintaining sophisticated optical instrumentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biological Microscope Objectives Market. These companies are characterized by their strong intellectual property portfolios, extensive global distribution networks, and continuous investment in high-precision optical manufacturing technologies.- Olympus Corporation

- Nikon Corporation

- Carl Zeiss AG

- Leica Microsystems (Danaher Corporation)

- Mitutoyo Corporation

- Thorlabs Inc.

- Edmund Optics

- Motic

- Meiji Techno

- LOMO PLC

- Prior Scientific

- Objective Imaging

- Navitar Inc.

- Jenoptik AG

- Vision Engineering

- Shanghai Optics

- Sunny Optical Technology

- Newport Corporation

- C.P. Goerz American Optical Co.

- PCO AG

Frequently Asked Questions

Analyze common user questions about the Biological Microscope Objectives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Achromatic, Fluorite, and Apochromatic objectives?

The primary difference lies in the degree of chromatic aberration correction. Achromatic objectives correct for two colors (red and blue) and spherical aberration for one color. Fluorite (or semi-apochromatic) objectives use specialized glass to correct for two or three colors. Apochromatic objectives (Plan Apo) offer the highest correction, correcting chromatic aberration for three colors and spherical aberration for two colors, yielding superior color fidelity and the highest possible resolution, making them essential for advanced multi-color fluorescence and quantitative imaging.

How does Numerical Aperture (N.A.) influence objective performance in biological applications?

Numerical Aperture is the single most critical factor in objective performance; it dictates both the resolution (the ability to distinguish fine details) and the light-gathering capacity of the objective. Higher N.A. objectives, typically achieved using immersion media (oil, water), collect more light, resulting in brighter images and higher resolution, which is crucial for visualizing subcellular structures and dynamic processes under low-light conditions, such as fluorescence imaging.

What factors are driving the demand for specialized water immersion objectives?

Demand for water immersion objectives is driven primarily by live-cell imaging and deep tissue visualization. Water immersion media closely matches the refractive index of biological specimens and aqueous buffers, minimizing spherical aberration as light passes deep into the sample. This allows for superior image quality, deeper penetration, and reduced risk of phototoxicity during extended time-lapse experiments compared to oil immersion, which is prone to refractive index mismatch in biological media.

What impact does the growth of digital pathology have on the objective market?

The growth of digital pathology, driven by slide scanning and remote diagnostics, increases demand for objectives optimized for large field-of-view flatness (Plan objectives) and high-speed operation. Objective manufacturers must ensure optics deliver consistent, distortion-free images across the entire scan area to support accurate automated analysis and archiving of clinical samples, emphasizing mechanical and optical stability over pure resolution metrics alone.

Are cost-effective biological objectives emerging for educational and routine clinical use?

Yes, the market is seeing increased development and adoption of cost-effective, durable objectives, often manufactured by APAC-based companies, specifically targeting high-volume educational institutions and routine clinical laboratories. While these objectives may not match the advanced aberration correction of premium apochromats, they offer sufficient resolution and reliability for brightfield and basic diagnostic applications, democratizing access to functional microscopy technology globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager