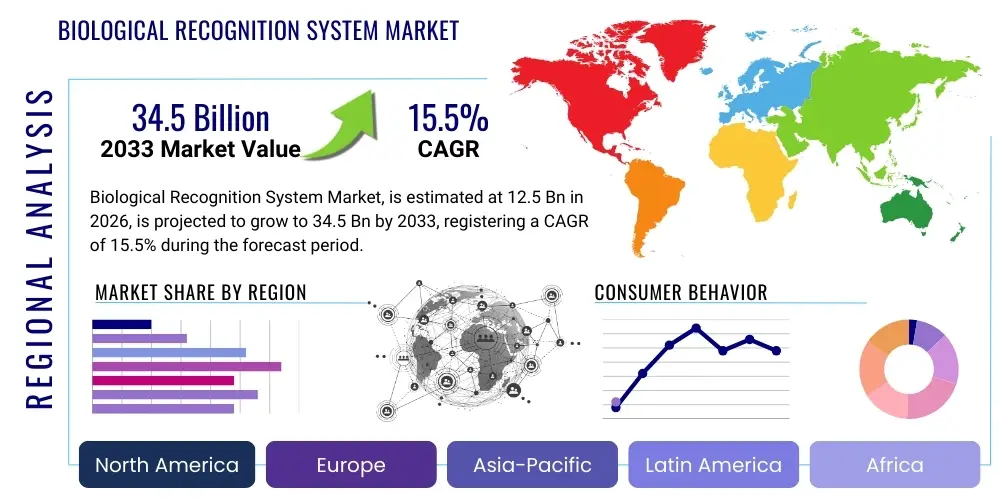

Biological Recognition System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441706 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Biological Recognition System Market Size

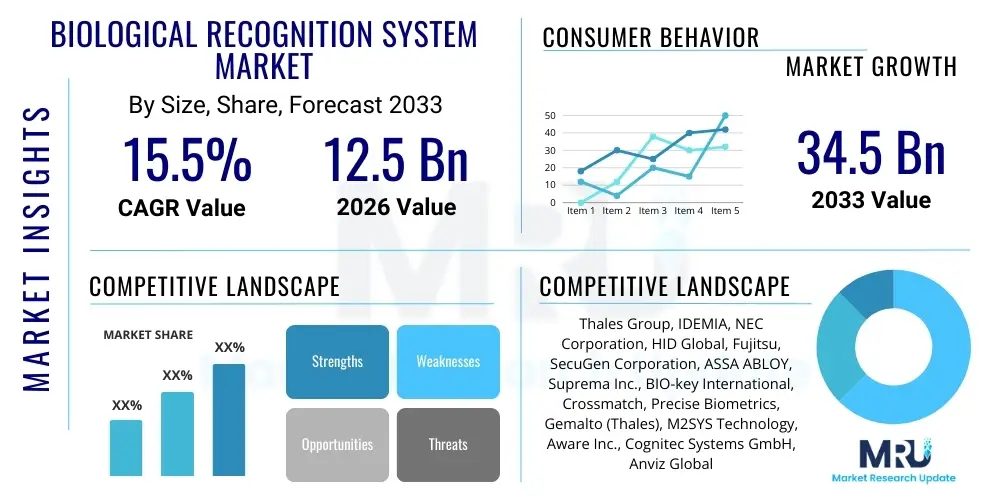

The Biological Recognition System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 34.5 Billion by the end of the forecast period in 2033.

Biological Recognition System Market introduction

The Biological Recognition System Market encompasses the technologies and solutions designed to verify and identify individuals based on unique physiological or behavioral characteristics, such as fingerprints, iris patterns, facial structure, voice, and DNA. These systems are crucial components in enhancing security protocols, streamlining identity management, and ensuring non-repudiation across various sectors globally. The evolution from simple physical access control to complex, multi-modal verification processes has significantly expanded the market’s utility, driven by the increasing need for robust authentication mechanisms in the digital age.

Major applications of these recognition systems span high-security environments, financial services, consumer electronics, and government services, particularly in national ID programs, border control, and law enforcement. In the Banking, Financial Services, and Insurance (BFSI) sector, biological recognition minimizes fraud and secures high-value transactions, while in healthcare, it ensures accurate patient identification and protects sensitive records. The inherent advantages of biological data, which is difficult to replicate or lose compared to traditional passwords or keys, position these systems as the foundational layer for modern security architectures. This widespread adoption is creating significant demand for scalable and interoperable solutions.

Key benefits driving market adoption include enhanced security, improved efficiency in identity verification, and superior user experience. Technological advancements, particularly in sensor miniaturization, machine learning algorithms for pattern recognition, and the integration of multi-factor biological authentication, are accelerating market penetration. The primary factors driving market growth are the global rise in cybercrime and identity theft, stringent regulatory mandates concerning data protection (like GDPR and CCPA), and the pervasive adoption of mobile devices requiring secure, integrated biological features for unlocking and transaction authorization.

Biological Recognition System Market Executive Summary

The Biological Recognition System Market is undergoing a rapid transformation, shifting from single-mode systems to integrated, multi-modal platforms capable of combining multiple biological identifiers for superior accuracy and security. Business trends indicate a strong focus on cloud-based deployment models, enabling scalable management and reduced infrastructure costs for end-users, especially small and medium enterprises. Furthermore, the convergence of biological technology with Artificial Intelligence (AI) and the Internet of Things (IoT) is opening new avenues for passive and continuous monitoring applications, moving beyond mere enrollment and verification points to providing continuous assurance of identity in real-time environments. Investment in R&D remains high, particularly focused on improving anti-spoofing capabilities and developing contactless recognition solutions in response to public health concerns.

Regionally, North America maintains market dominance due to high defense spending, established technological infrastructure, and the early adoption of biological recognition in governmental and commercial sectors, especially BFSI and technology companies. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by massive national ID projects in countries like India and China, increasing governmental investment in border security, and the booming use of mobile payment systems reliant on biological authentication. Europe, driven by strict regulatory frameworks like eIDAS, is prioritizing secure digital identity solutions, pushing the adoption of advanced biological recognition technologies for digital governmental services.

Segment trends highlight the significant growth of facial recognition technology, driven by its non-intrusive nature and high-speed processing capabilities, making it ideal for high-throughput areas like airports and retail access points. Behavioral biological recognition (such as gait or keystroke dynamics) is emerging as a critical sub-segment for continuous authentication in enterprise environments. The hardware component segment, particularly advanced sensors and readers, continues to hold a large market share, although the fastest revenue growth is projected in the software and services segment, driven by subscriptions for cloud-based biological platforms and maintenance contracts supporting complex multi-modal deployments across diverse infrastructure.

AI Impact Analysis on Biological Recognition System Market

Users frequently question how AI integration will affect the accuracy, privacy, and speed of biological recognition systems. Common concerns revolve around potential biases in AI algorithms impacting recognition rates across different demographics, the security risks associated with storing large, centralized biological data sets managed by AI systems, and the regulatory implications of AI making automated decisions regarding access or identity. The underlying expectation is that AI, particularly through deep learning and neural networks, will dramatically improve the resilience against spoofing attacks and enhance the speed of recognition in uncontrolled, real-world environments, such as identifying individuals in crowded public spaces or verifying identities using partially obscured images.

The integration of AI, specifically machine learning (ML) and deep learning (DL), acts as a fundamental catalyst for the next generation of biological recognition systems. AI algorithms are crucial for processing complex, high-dimensional biological data, extracting sophisticated features that traditional algorithms often miss, and continuously refining recognition models based on usage patterns and environmental factors. This results in significantly lower False Acceptance Rates (FAR) and False Rejection Rates (FRR), leading to higher operational reliability, which is essential for mission-critical applications like border control and high-security installations. AI-powered systems can also detect subtle behavioral changes or inconsistencies, bolstering continuous authentication mechanisms.

Furthermore, AI drives major improvements in anti-spoofing capabilities, solving one of the most critical challenges in the biological recognition industry. Deep neural networks can analyze subtle physiological cues, such as blood flow or skin texture variations, to differentiate between a live human presence and a sophisticated synthetic replica (e.g., high-resolution photos, 3D masks, or synthetic voice samples). This advancement ensures system integrity and addresses major security weaknesses that plagued earlier generations of biological identification technology. The deployment of generative adversarial networks (GANs) is also aiding developers in testing system vulnerabilities by creating highly realistic synthetic biological samples for training purposes.

- AI enhances recognition accuracy across diverse conditions and populations through sophisticated deep learning models.

- Machine learning algorithms significantly reduce False Acceptance Rates (FAR) and improve anti-spoofing detection capabilities.

- AI enables seamless, continuous, and passive biological authentication by monitoring behavioral patterns (gait, typing cadence).

- Advanced neural networks facilitate rapid, real-time identification in high-density areas, crucial for public security applications.

- The use of AI drives the development of multi-modal biological fusion, optimizing the weighting and combination of diverse biological inputs.

DRO & Impact Forces Of Biological Recognition System Market

The Biological Recognition System Market is fundamentally shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). The primary drivers include the escalating global threat of terrorism and internal security concerns, necessitating robust identity verification across governmental and critical infrastructure sectors. Concurrently, the consumer electronics market, particularly smartphones and tablets, has normalized biological authentication, driving massive economies of scale and reducing sensor costs, making the technology accessible for mass commercial applications. However, these powerful drivers are tempered by significant restraints, chiefly consumer and regulatory concerns regarding data privacy, the potential for unauthorized surveillance, and the inherent risk associated with biological data breaches, which cannot be remediated like traditional passwords. These factors collectively determine the market's growth trajectory and adoption speed across different geographies and end-user segments.

Opportunity areas lie predominantly in the development of robust, privacy-enhancing technologies (PETs), such as template protection and decentralized biological data storage (e.g., using blockchain), addressing the core restraint of privacy concerns. The healthcare sector presents a high-growth opportunity for patient and staff identification, medication management, and securing electronic health records (EHRs). Furthermore, the trend toward continuous authentication, where identity is verified perpetually rather than at a single login point, offers substantial revenue streams in the enterprise security and industrial IoT domains. Successfully navigating the regulatory landscape by offering certified, privacy-by-design solutions is crucial for converting these opportunities into sustainable market share.

The impact forces influencing the market are high, driven largely by regulatory shifts and technological discontinuity. Mandates like the increasing global requirement for electronic passports and visas incorporating biological data ensure government investment remains consistent. Conversely, the rapid advancement of counter-technologies, such as highly sophisticated spoofing methods (e.g., synthetic biology), forces system providers into continuous cycles of innovation to maintain security integrity. The long-term impact of COVID-19 accelerated the demand for contactless biological solutions, rendering technologies like iris and facial recognition more favorable than contact-based fingerprint systems, thereby reshaping the competitive landscape and technological priorities for the immediate future.

Segmentation Analysis

The Biological Recognition System Market is comprehensively segmented based on technology, component, application, and deployment, allowing for a granular analysis of market dynamics and identifying specific high-growth niches. Segmentation is vital for understanding competitive positioning, as different technologies cater to distinct security needs—for instance, DNA recognition serves forensic and medical purposes, while facial recognition targets large-scale public access control. The structure of segmentation reflects the diverse complexity of the products, ranging from specialized hardware sensors to sophisticated, cloud-deployed software platforms that manage millions of user identities across global enterprises. Detailed analysis reveals a market moving toward highly integrated solutions that combine multiple biological modalities for superior security performance.

By component, the market is dissected into hardware (sensors, readers, scanners), software (SDKs, recognition algorithms, middleware), and services (installation, maintenance, consulting). The increasing maturity of hardware components means revenue growth is accelerating fastest within the software and services segments, driven by demand for perpetual updates, sophisticated AI algorithms, and cloud hosting solutions necessary for managing distributed workforce identities. Application segmentation confirms the dominance of Government and Public Safety applications, yet segments such as BFSI and Travel & Immigration are exhibiting substantial growth due to mandatory compliance and enhanced security requirements for consumer-facing services and border management efficiency. The deployment model split between cloud and on-premise reflects the ongoing digital transformation, with cloud solutions offering scalability and flexibility appealing to sectors with fluctuating identity management needs.

Crucially, technology segmentation illustrates the current technology preference hierarchy. While fingerprint recognition remains pervasive due to its low cost and established use in consumer electronics, contactless methods such as iris, vein, and facial recognition are capturing increasing market share, particularly in sectors prioritizing hygiene and speed, like healthcare and airports. Behavioral biological recognition is gaining traction for continuous authentication, differentiating itself from physical modalities by assessing dynamic traits. Understanding these segment dynamics is paramount for market players seeking to allocate R&D investment and tailor product offerings to specific regulatory environments and user tolerance levels across various geographic regions.

- By Technology:

- Fingerprint Recognition

- Facial Recognition

- Iris Recognition

- Voice Recognition

- Palm/Vein Recognition

- Gait Recognition

- DNA Recognition

- By Component:

- Hardware (Sensors, Scanners, Readers)

- Software (Algorithms, Middleware, SDKs)

- Services (Installation, Integration, Maintenance)

- By Application:

- Government & Law Enforcement

- Military & Defense

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- IT & Telecom

- Consumer Electronics

- Travel & Immigration (Border Control)

- By Deployment:

- On-Premise

- Cloud-Based

Value Chain Analysis For Biological Recognition System Market

The value chain for the Biological Recognition System Market is complex, beginning with upstream suppliers of specialized components and extending through multi-layered distribution channels to diverse end-user applications. Upstream analysis focuses on the provision of highly specialized hardware, including sophisticated optical sensors, ultrasonic sensors, microprocessors, and high-performance camera modules. Key players in this phase include semiconductor manufacturers and specialized sensor producers, whose technological advancements directly impact the cost, size, and accuracy of the final biological product. Supply chain resilience, especially concerning microchip shortages and geopolitical trade restrictions, is a critical risk factor analyzed at this stage, dictating production capacity and pricing stability across the market.

The mid-stream segment involves the core intellectual property—software development, algorithm creation, and system integration. This is where proprietary biological templates and AI-powered matching engines are developed, defining the system's performance metrics (FAR and FRR). Manufacturers and system integrators acquire components and combine them with their specialized recognition software to create complete biological solutions. Distribution channels are varied, involving direct sales for large governmental and defense contracts, and indirect channels relying on value-added resellers (VARs), system integrators, and distributors who customize solutions for specific vertical markets, such as healthcare or education, requiring tailored integration with existing legacy IT infrastructure.

Downstream analysis focuses on installation, maintenance, and after-sales services, which are becoming increasingly critical revenue generators, particularly with the proliferation of complex multi-modal and cloud-based systems. Direct channels are typically utilized for large-scale enterprise or public sector deployments where customized solutions and high levels of security clearance are required. Indirect channels, often through partnerships with telecom operators or mobile device manufacturers, drive mass adoption in the consumer space. The relationship between manufacturers and integrators is crucial in the downstream, ensuring seamless deployment and continuous system updates necessary to combat evolving security threats and spoofing techniques, providing ongoing value to the end customer.

Biological Recognition System Market Potential Customers

The primary customers for Biological Recognition Systems are diversified across public and private sectors, with government agencies representing the largest segment due to their extensive needs for national security, border control, and citizen identification. Governments are crucial buyers for large-scale, enterprise-level systems, procuring solutions for national ID databases, correctional facilities, military bases, and critical infrastructure protection. Law enforcement agencies utilize these systems for forensic identification and criminal investigation, demanding high accuracy and specialized technologies like AFIS (Automated Fingerprint Identification Systems) or DNA recognition. These customers typically require long-term contracts, rigorous certification, and adherence to international standards like ISO/IEC, emphasizing reliability and data security above immediate cost savings.

In the commercial domain, the BFSI sector constitutes a significant customer base, adopting biological solutions to secure mobile banking, ATM access, and internal employee authentication, combating sophisticated financial fraud. The healthcare industry is rapidly becoming a high-potential segment, utilizing biological recognition for patient identification (reducing medical errors and insurance fraud), secure access to restricted areas, and time and attendance tracking for clinical staff. These commercial entities prioritize solutions that offer fast transaction speeds, easy user enrollment, and seamless integration with existing enterprise resource planning (ERP) or patient management systems, seeking a balance between security and user convenience to maintain high operational efficiency.

Emerging key customers include large IT and telecom companies needing enhanced physical and digital access security for data centers and sensitive intellectual property, and major retailers implementing biological systems for point-of-sale verification and loss prevention. Furthermore, the consumer electronics industry, while traditionally integrating solutions internally (e.g., in smartphones), acts as a massive indirect buyer, creating demand for sophisticated, miniaturized, and low-power biological sensors for use in everyday devices. The purchasing decision for these entities is driven not only by security metrics but increasingly by the compliance requirements imposed by international data privacy legislation, demanding suppliers offer auditable and robust privacy protection features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 34.5 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thales Group, IDEMIA, NEC Corporation, HID Global, Fujitsu, SecuGen Corporation, ASSA ABLOY, Suprema Inc., BIO-key International, Crossmatch, Precise Biometrics, Gemalto (Thales), M2SYS Technology, Aware Inc., Cognitec Systems GmbH, Anviz Global Inc., Daon, Safran Identity & Security (IDEMIA), FaceFirst, Iris ID Systems Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biological Recognition System Market Key Technology Landscape

The technology landscape of the Biological Recognition System Market is defined by intense innovation across sensor technology, data processing algorithms, and system architecture. Current dominant technologies include capacitive and optical fingerprint sensors, which are highly mature and widely adopted in commercial devices due to low cost and high production volumes. However, the future is increasingly focused on contactless modalities. Facial recognition technology, bolstered by 3D sensing and thermal imaging, is moving beyond basic 2D matching to incorporate sophisticated depth analysis, significantly reducing vulnerability to photographic spoofing. Similarly, iris recognition continues to be critical for high-security environments due to its exceptional accuracy and stability, with newer systems offering greater working distance and speed.

A crucial technological shift involves the integration of multi-modal biological systems, which combine two or more distinct biological traits (e.g., face and voice, or fingerprint and vein pattern) to achieve unparalleled verification certainty and fault tolerance. This multi-modal fusion relies heavily on machine learning to intelligently weight the reliability of different inputs under varying environmental conditions, such as poor lighting or high ambient noise. Furthermore, the development of behavioral biological recognition systems, analyzing traits like keystroke dynamics, gait analysis, or mouse movement patterns, is growing, particularly for continuous, invisible authentication within enterprise networks, moving security checks from discrete moments to constant monitoring without impacting user workflow.

The next generation of biological technology is focusing on decentralized and privacy-preserving architectures. The use of biological template protection technologies, such as biological cryptosystems and irreversible transformation algorithms (e.g., fuzzy extractors), ensures that the raw biological data cannot be reconstructed, directly addressing major privacy concerns. Furthermore, the concept of "Biological as a Service" (BaaS) utilizing secure cloud infrastructure is becoming prevalent, requiring robust encryption and secure API management. Research into emerging fields like DNA recognition for rapid field deployment and even biological analysis of skin electrical properties is pushing the boundaries of identity verification, although these remain nascent and highly specialized segments focused primarily on forensic and critical medical applications.

Regional Highlights

Geographic analysis reveals diverse adoption rates and technological priorities across global regions, heavily influenced by regional regulatory environments, security threat landscapes, and economic development levels. North America, encompassing the U.S. and Canada, represents the most mature market, characterized by significant governmental investment in defense, high adoption rates in the BFSI sector, and the pioneering integration of biological recognition into consumer technology platforms. The U.S. remains the central innovation hub, driving demand for advanced multi-modal solutions and cloud-based services. Stringent regulatory compliance requirements, particularly in healthcare (HIPAA) and finance, ensure that companies prioritize certified, robust, and highly secure offerings, maintaining premium pricing structures in this region.

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR, primarily driven by large populations and extensive government-led initiatives for national identification and smart city development. Countries like India (Aadhaar project) and China represent massive markets for biological enrollment and verification systems, focusing heavily on fingerprint and facial recognition for public services, finance, and internal security. The region benefits from a dense concentration of consumer electronics manufacturing and a rapid shift towards mobile payments, making biological authentication indispensable. However, the market here is price-sensitive, demanding cost-effective and scalable solutions, often favoring domestic suppliers who can rapidly adapt to local regulatory specifics and infrastructural constraints.

Europe demonstrates a strong focus on balancing security needs with strict data privacy laws (GDPR). This region favors technologies that prioritize template security and decentralized identity management, such as those leveraging blockchain or advanced encryption. Adoption is strong in border control (Schengen Area mandates) and digital government services, ensuring secure citizen interaction. The Middle East and Africa (MEA) region, while smaller, is rapidly investing in biological recognition, especially in the Gulf Cooperation Council (GCC) nations, primarily for internal security, critical infrastructure protection (oil and gas facilities), and modernizing airport security systems, often utilizing high-end iris and facial recognition technologies due to high security standards.

- North America: Dominant market share due to high defense spending, mature technology adoption, and stringent financial security regulations (BFSI, Government). Key focus on cloud-based multi-modal systems.

- Asia Pacific (APAC): Fastest growing region, driven by massive national ID projects (India, China), rapid digitalization, and consumer mobile adoption. Focus on scalable, cost-effective facial and fingerprint recognition.

- Europe: Growth influenced heavily by GDPR and eIDAS, prioritizing privacy-enhancing biological systems (PETs) and border management solutions. Strong governmental demand for secure digital identity services.

- Latin America: Emerging market with increasing use in financial inclusion initiatives and public sector security improvements, overcoming initial challenges related to infrastructure investment.

- Middle East and Africa (MEA): High investment in critical infrastructure security and border management, particularly in oil-rich GCC countries, favoring high-accuracy iris and facial recognition solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biological Recognition System Market.- Thales Group

- IDEMIA

- NEC Corporation

- HID Global

- Fujitsu

- SecuGen Corporation

- ASSA ABLOY

- Suprema Inc.

- BIO-key International

- Crossmatch

- Precise Biometrics

- Gemalto (Thales)

- M2SYS Technology

- Aware Inc.

- Cognitec Systems GmbH

- Anviz Global Inc.

- Daon

- Safran Identity & Security (IDEMIA)

- FaceFirst

- Iris ID Systems Inc.

Frequently Asked Questions

Analyze common user questions about the Biological Recognition System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards contactless biological recognition technologies?

The primary drivers are enhanced user hygiene concerns, particularly following global pandemics, and the demand for increased speed and efficiency in high-throughput environments like airports and large offices. Contactless systems, such as facial and iris recognition, offer rapid, hands-free verification while significantly improving the user experience and maintaining robust security standards necessary for large-scale operations.

How is AI impacting the security and accuracy of biological recognition systems?

AI, through deep learning, dramatically improves system accuracy by minimizing error rates (FAR/FRR) and enabling robust anti-spoofing capabilities. AI algorithms can detect sophisticated synthetic biological samples, ensuring liveness detection and verifying identity even under challenging real-world conditions like partial occlusion or poor lighting, thereby enhancing the overall resilience of the security infrastructure.

What are the primary concerns regarding data privacy in the use of biological recognition systems?

The central concern is the non-revocable nature of biological data. If a biological template is breached, it cannot be reset like a password, potentially leading to permanent identity compromise. This drives demand for privacy-enhancing technologies (PETs) like biological template encryption and decentralized storage solutions, ensuring raw biological data is never stored in a recoverable format, maintaining compliance with global regulations such as GDPR.

Which biological recognition technology segment is expected to show the highest growth rate?

Facial recognition technology is expected to exhibit the highest growth rate, propelled by its non-intrusiveness, integration into consumer electronics and mobile payment systems, and its essential role in government surveillance and smart city initiatives globally. Advancements in 3D facial mapping and AI-based liveness detection further accelerate its adoption across commercial and public safety sectors.

What role does behavioral biological recognition play in modern enterprise security?

Behavioral biological recognition (e.g., analyzing keystroke dynamics, gait, or mouse movement) is crucial for continuous authentication (CA). Unlike traditional physical biological recognition which authenticates only at the point of entry, CA perpetually verifies the user's identity while they interact with a system, providing an essential, invisible security layer against session hijacking and insider threats within enterprise and digital banking environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager