Biomass Briquette Fuel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442527 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Biomass Briquette Fuel Market Size

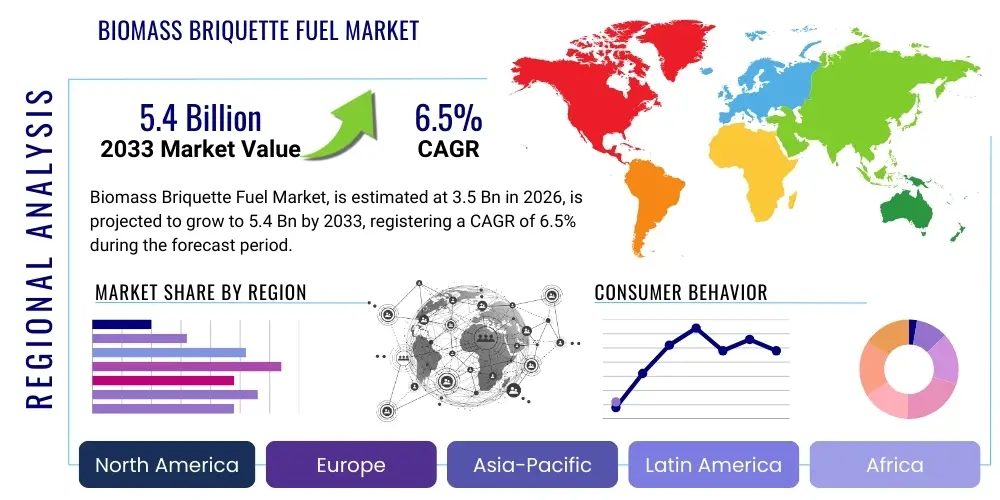

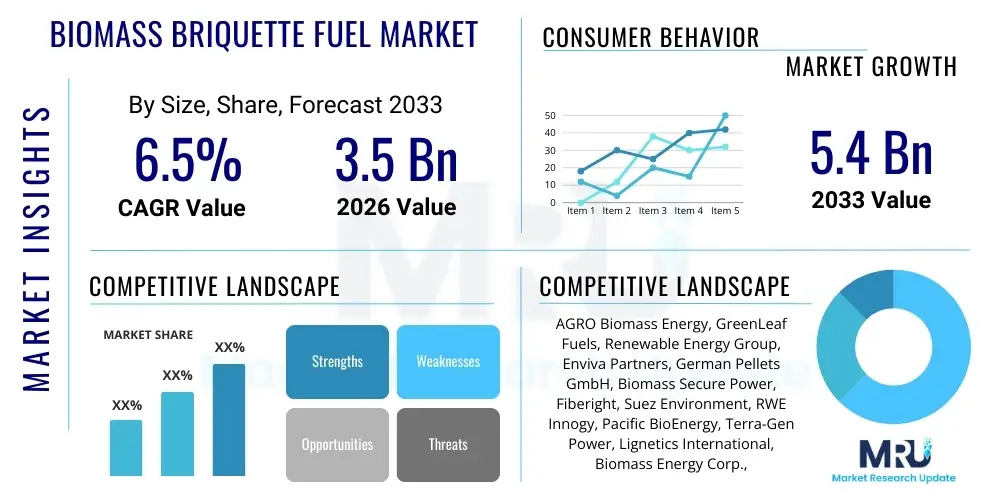

The Biomass Briquette Fuel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global imperative for decarbonization across industrial and commercial sectors, positioning briquette fuel as a critical transitional energy source. Increased governmental support through renewable energy mandates and subsidies, particularly in developing economies transitioning away from highly polluting fossil fuels like coal, further solidifies this growth trajectory.

Biomass Briquette Fuel Market introduction

The Biomass Briquette Fuel Market encompasses the production, distribution, and consumption of densified biomass products, primarily sourced from agricultural residues, forestry waste, and industrial organic byproducts. These briquettes serve as a direct, cleaner substitute for traditional solid fuels such as coal, firewood, and lignite in various thermal applications. The process involves crushing, drying, and compressing waste materials under high pressure and temperature, often without the need for chemical binders, resulting in uniform, high-density fuel with superior energy content and reduced ash emissions. This densification greatly improves handling, storage, and combustion efficiency compared to loose biomass, making it an economically viable and environmentally sound energy solution for large-scale consumers.

Major applications for biomass briquette fuel span across power generation facilities, where co-firing with coal is increasingly common, and industrial boiler operations, particularly in sectors such as textiles, food processing, ceramics, and chemical manufacturing, which require steady, controllable heat input. Furthermore, residential heating in rural and peri-urban areas represents a significant consumption segment, driven by the need for affordable and readily available fuel sources. The primary benefits driving market adoption include the utilization of readily available waste streams, contributing to waste management solutions; the significant reduction in carbon dioxide emissions on a lifecycle basis, as the fuel is considered carbon neutral; and the economic advantage derived from stable pricing compared to volatile fossil fuel markets. These factors collectively position biomass briquettes as essential components in the global energy transition framework.

Key driving factors fueling the market expansion are multifaceted, anchored by stringent environmental regulations aimed at mitigating climate change and improving air quality. Policy initiatives such as carbon taxes and renewable portfolio standards create a competitive advantage for biomass-based fuels. Simultaneously, technological advancements in briquetting equipment, particularly the refinement of screw press and hydraulic press technologies, enhance production throughput and fuel quality, reducing operating costs. The growing global demand for energy security and the imperative to diversify fuel sources away from geopolitical dependencies on natural gas and oil further accelerate the adoption of localized biomass solutions. These economic and regulatory tailwinds ensure sustained investment and innovation within the briquette fuel value chain over the forecast period.

Biomass Briquette Fuel Market Executive Summary

The Biomass Briquette Fuel Market is characterized by robust growth, primarily influenced by shifts in global energy policy favoring sustainable alternatives and significant advancements in briquetting technology that enhance fuel quality and reduce production costs. Business trends indicate a strong move toward vertical integration among market participants, securing reliable feedstock supply chains, often through long-term contracts with large agricultural producers or forestry operations. Furthermore, there is a distinct trend towards the standardization of briquette specifications, such as moisture content, density, and calorific value, which facilitates cross-regional trade and increases buyer confidence, particularly among industrial consumers demanding consistent fuel performance. Investment in decentralized production facilities located near feedstock sources is also accelerating, minimizing transportation costs and improving the overall sustainability profile of the fuel.

Regionally, the market exhibits divergent maturity levels, with Asia Pacific (APAC) emerging as the primary engine for volume growth, driven by massive energy demand, readily available agricultural waste (rice husks, sugarcane bagasse), and government initiatives in countries like India and China aimed at curbing air pollution from coal use. Europe, although a mature market, continues to show strong demand, particularly for high-quality, standardized wood briquettes used in residential heating and co-firing power plants, driven by ambitious EU decarbonization targets and established carbon pricing mechanisms. North America focuses primarily on industrial applications and exports, leveraging extensive forestry residue availability. These regional dynamics create distinct competitive landscapes, requiring market entrants to tailor their feedstock and technology approaches based on local regulatory and waste management structures.

Segment-wise, the Agricultural Waste segment dominates the raw material matrix due to its vast, seasonal availability and lower opportunity cost compared to forestry residues, although forestry waste offers higher energy density. Technologically, the Screw Press segment is gaining traction due to its ability to produce highly dense briquettes without binders, favored by industrial users. Application-wise, the Industrial Boiler Fuel segment holds the largest market share, reflecting the high energy consumption requirements of manufacturing industries transitioning away from conventional fossil fuels. This diversification across feedstock and technology segments ensures market resilience and allows stakeholders to capitalize on varied regional resource bases and consumer needs, optimizing their production portfolios for maximum thermal and economic efficiency.

AI Impact Analysis on Biomass Briquette Fuel Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the biomass briquette fuel sector primarily center on supply chain efficiency, feedstock management, and process optimization. Key themes revolve around how AI can resolve the inherent variability of biomass feedstock (moisture content, consistency, energy density), a critical challenge impacting final briquette quality and profitability. Users also express strong interest in predictive maintenance for briquetting machinery, seeking to minimize costly downtime, and optimizing logistics for timely feedstock collection and briquette delivery to large industrial consumers. The core expectation is that AI will introduce unprecedented levels of precision and cost reduction, transforming the traditionally resource-intensive and unpredictable nature of biomass procurement and conversion processes.

AI-driven solutions are fundamentally reshaping the operational landscape of biomass briquette production, transitioning it toward a more data-intensive and efficient manufacturing model. By deploying ML algorithms to analyze real-time data from feedstock sensors, satellite imagery, and weather patterns, producers can achieve highly accurate predictive modeling for feedstock availability and quality. This predictive capability allows for dynamic adjustment of purchasing strategies and inventory management, significantly reducing material spoilage and optimizing blending ratios to maintain a uniform product specification, regardless of raw material fluctuations. Furthermore, AI is utilized in complex simulation models to optimize the drying and compression parameters within briquetting machines, ensuring maximum density and calorific value while minimizing energy expenditure during the manufacturing phase.

The integration of AI extends deep into the demand side, where sophisticated forecasting models analyze seasonal energy consumption patterns of industrial buyers, coupled with fluctuating fossil fuel prices, to optimize pricing strategies and inventory levels for finished briquettes. Additionally, in quality control, computer vision systems combined with machine learning are employed to rapidly assess the physical integrity and quality of briquettes exiting the press, flagging defects automatically to ensure compliance with stringent international standards. This comprehensive data-driven approach, powered by AI, enhances operational stability, improves resource efficiency, and ultimately increases the competitiveness of biomass briquettes against established fossil fuels in the high-volume industrial energy market.

- Predictive Feedstock Modeling: AI optimizes raw material sourcing by forecasting availability, moisture content, and yield based on geospatial and historical data.

- Manufacturing Process Optimization: Machine Learning algorithms tune press parameters (temperature, pressure) in real-time to maximize briquette density and minimize energy input.

- Supply Chain Logistics: AI enhances routing and scheduling for feedstock collection and finished product delivery, significantly reducing transportation costs and carbon footprint.

- Quality Control Automation: Computer vision systems detect and classify briquette defects instantaneously, ensuring stringent quality standards are consistently met.

- Predictive Maintenance: ML models analyze sensor data from briquetting equipment to anticipate mechanical failures, reducing unplanned downtime and maintenance costs.

DRO & Impact Forces Of Biomass Briquette Fuel Market

The dynamics of the Biomass Briquette Fuel Market are shaped by a complex interplay of strong regulatory drivers, persistent logistical restraints, and emerging technological opportunities. The primary driver is the global regulatory environment favoring renewable energy adoption and carbon neutrality goals, which creates mandated demand, often supported by fiscal incentives like production tax credits or feed-in tariffs. However, the market faces significant restraints, chiefly the inconsistent quality and seasonal availability of feedstock, which complicate continuous high-volume production and necessitate substantial investment in pretreatment and storage infrastructure. Opportunities lie in developing advanced torrefaction techniques to create 'bio-coal' with significantly enhanced energy density and hydrophobicity, opening up vast global trade potential and new applications in large coal-fired power plants.

In terms of competitive intensity, the market exhibits moderate to high rivalry, particularly regionally, due to the relatively low barrier to entry for smaller briquetting operations, although high-volume industrial supply requires significant capital investment in certified machinery and quality assurance systems. Porter's Five Forces analysis highlights the relatively low bargaining power of feedstock suppliers in highly agricultural regions, as waste materials often have limited alternative high-value uses. Conversely, the bargaining power of major industrial buyers is moderate to high, as they often require customized specifications and have the capacity to switch to alternative fuels (e.g., natural gas, coal) if briquette pricing or quality is unfavorable. The threat of substitutes remains substantial, given the entrenched position of natural gas and the increasing viability of solar and wind power, necessitating competitive pricing and consistent quality from briquette producers.

The impact forces influencing profitability are centered around economies of scale and technological differentiation. Companies that successfully scale their operations to achieve lower cost per ton and invest in proprietary technologies for moisture reduction and binderless densification gain significant competitive advantages. Regulatory stability and the long-term commitment of governments to decarbonization policies are paramount, directly influencing investment confidence. Furthermore, the market's success is increasingly tied to effective public perception management, ensuring that biomass sourcing is recognized as sustainable and environmentally responsible, mitigating risks associated with deforestation or competition with food crops for land use, thereby safeguarding the industry's social license to operate.

Segmentation Analysis

The Biomass Briquette Fuel Market is systematically segmented based on the type of raw material utilized, the production technology employed, and the end-user application, providing a granular view of market dynamics and consumer preferences across different geographical areas. Understanding these segments is crucial for stakeholders to align their operational strategies with high-growth niches, optimize feedstock procurement based on regional availability, and target specific industrial or residential consumers with tailored product specifications. The dominance of agricultural residues underscores the symbiotic relationship between the energy sector and farming, particularly in economies with large-scale rice, wheat, or sugarcane production, highlighting sustainable waste utilization as a core market pillar.

The segmentation by technology differentiates between various pressing mechanisms, each offering distinct advantages in terms of throughput, capital cost, and the quality of the final briquette. Screw presses, for instance, are valued for their ability to produce high-density briquettes suitable for international shipping and long-duration combustion, favored by heavy industries. Conversely, piston presses often represent a lower initial investment, making them popular for localized, smaller-scale production aimed at regional heating markets. These technological choices are often dictated by the moisture content and particle size characteristics of the locally available feedstock, necessitating specialized equipment selection to achieve optimal energy efficiency and product consistency.

The application segmentation clearly illustrates the massive industrial shift towards renewable thermal energy. While residential demand provides a stable base, the volatile and large-scale requirements of power generation and general industrial boilers drive the bulk of the market value. Industrial users prioritize calorific value, consistent sizing, and low ash content to protect expensive boiler infrastructure, driving demand for premium, high-specification briquettes, often requiring pre-treatment processes like torrefaction to meet stringent industrial performance criteria. The growth in co-firing applications in existing coal power plants represents a major transitional opportunity, allowing utilities to incrementally reduce their carbon footprint without massive infrastructure overhauls.

- Raw Material Type

- Agricultural Waste (e.g., Rice Husks, Bagasse, Cotton Stalks)

- Forestry Waste (e.g., Wood Shavings, Sawdust, Logging Residues)

- Industrial Waste (e.g., Paper Sludge, Processed Organic Sludge)

- Technology

- Piston Press

- Screw Press

- Hydraulic Press

- Application

- Industrial Boiler Fuel (Textile, Food & Beverage, Cement, Chemical)

- Power Generation (Co-firing and Dedicated Biomass Plants)

- Residential & Commercial Heating

Value Chain Analysis For Biomass Briquette Fuel Market

The value chain for biomass briquette fuel is complex, beginning with the highly fragmented upstream procurement of diverse feedstock materials. Upstream activities involve sourcing, collection, and initial preparation (shredding, drying) of agricultural or forestry residues, which inherently carries high logistical costs due to the low bulk density of raw biomass. Efficiency at this stage is critical, relying heavily on optimized harvesting schedules and strategic collection centers to minimize transportation distances. Producers typically enter into seasonal contracts or acquire rights to waste streams from farming cooperatives or sawmills. The main challenge upstream is mitigating seasonal fluctuations and maintaining quality control of incoming materials, which directly affects the subsequent briquetting process. Investment in large-scale drying technology is often essential here to ensure optimal moisture content for efficient densification.

The midstream phase constitutes the core processing activity: manufacturing. This involves high-pressure densification using piston, screw, or hydraulic press technologies to transform the prepared biomass into briquettes or pellets. This stage demands specialized machinery and significant energy input. Optimization of the briquetting process—specifically managing pressure, temperature, and cooling—is vital for achieving the desired density, durability, and calorific value, ensuring the final product meets end-user specifications. Companies that integrate advanced sensor technology and process control systems during manufacturing gain a competitive edge in product consistency and operational efficiency, reducing waste and machine wear and tear. Certification for sustainability and quality standards (e.g., ENplus, ISO) often occurs during this phase to facilitate market access.

Downstream activities involve distribution and final consumption. The distribution channel is bifurcated into direct sales to large industrial consumers (power plants, factories) and indirect sales through distributors, retailers, and energy service companies (ESCOs) for the smaller commercial and residential markets. Direct sales prioritize long-term, high-volume contracts, requiring reliable logistics and just-in-time delivery capabilities. Indirect sales require extensive retail networks and smaller delivery infrastructure. The high density of briquettes simplifies storage and transport compared to raw biomass, but maintaining structural integrity during handling is crucial. ESCOs often play a vital role by offering boiler conversions and fuel supply contracts as a bundled service, accelerating industrial adoption. The effectiveness of the downstream segment relies heavily on establishing robust warehousing and transport networks that can reliably serve geographically dispersed industrial centers.

Biomass Briquette Fuel Market Potential Customers

The potential customers for biomass briquette fuel are primarily defined by their high thermal energy demand and their regulatory exposure to carbon emission limits, necessitating a transition away from traditional fossil fuels. The largest segment of end-users consists of industrial facilities operating medium to large capacity boilers for process heat and steam generation. This includes sectors such as textiles and apparel manufacturing, where continuous steam is essential for dyeing and finishing; the food and beverage industry, utilizing heat for sterilization, drying, and cooking processes; and cement and lime production, which require high-temperature firing. These buyers are typically sophisticated consumers prioritizing fuel consistency, stable long-term supply agreements, and clear environmental compliance documentation, making high-density, standardized briquettes the preferred choice over loose biomass.

Another major category of buyers is the power generation sector, encompassing both dedicated biomass power plants and coal-fired utilities engaged in co-firing practices. Co-firing, where briquettes are mixed and combusted alongside coal, allows existing infrastructure to meet renewable energy mandates without extensive modification, making utilities in heavily regulated markets like Europe and parts of North America key clients. These customers demand extremely high volumes and strict quality control, particularly concerning ash content and chlorine levels, which can damage boiler equipment. Their purchasing decisions are heavily influenced by government incentives, the prevailing price of carbon, and the logistical efficiency of fuel delivery to large plant sites, often favoring internationally certified wood briquettes or torrefied bio-coal.

The residential and commercial heating market forms the third significant customer base, particularly in regions with cold climates and limited access to affordable natural gas infrastructure. Residential users, often utilizing specialized stoves or small boilers, prioritize ease of storage, cleanliness (low smoke and ash), and competitive pricing relative to firewood or heating oil. Commercial users, such as hospitals, schools, hotels, and small industrial parks, require reliable, bulk deliveries and often utilize automated feeding systems. This segment demands convenient packaging and reliable local distribution networks, contrasting sharply with the large bulk commodity transactions characterizing the industrial and utility segments. Market penetration in this segment is strongly tied to the affordability and convenience compared to traditional heating alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGRO Biomass Energy, GreenLeaf Fuels, Renewable Energy Group, Enviva Partners, German Pellets GmbH, Biomass Secure Power, Fiberight, Suez Environment, RWE Innogy, Pacific BioEnergy, Terra-Gen Power, Lignetics International, Biomass Energy Corp., Woodstone Biomass, CH4 Global, GreenFuel Solutions, New England Wood Pellet, Blue Fire Renewables, PALLMANN Group, and Zilkha Biomass Energy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biomass Briquette Fuel Market Key Technology Landscape

The technological landscape of the Biomass Briquette Fuel Market is dominated by mechanical densification processes, primarily categorized into Piston Press, Screw Press, and Hydraulic Press mechanisms, each optimized for different feedstock characteristics and desired end-product qualities. The Piston Press technology is characterized by high force exerted intermittently via a reciprocating ram, producing dense, high-calorific logs often used for residential or smaller industrial applications. While capital investment is moderate, the technology can be robust enough to handle slightly inhomogeneous materials. However, its efficiency is slightly lower than other methods, and the resultant briquettes may exhibit variable density unless the feedstock is meticulously prepared, demanding consistent moisture and particle size management to ensure structural integrity and minimizing wear on the compression dies.

Screw Press technology, conversely, utilizes a continuously rotating screw that forces biomass through a heated die, relying on the natural lignin within the biomass to act as a binder under friction and heat. This process produces exceptionally dense and structurally stable briquettes (often referred to as 'pini-kay'), which are highly resistant to moisture absorption—a significant advantage for long-distance transport and storage. The continuous operation of the screw press facilitates high throughput and superior product consistency, making it the preferred choice for large-scale commercial operations targeting industrial customers. The main challenge associated with screw presses is the high wear rate on the screw and dies due to the friction involved, necessitating specialized, durable alloy components and planned maintenance schedules to control operating costs.

Beyond densification equipment, crucial supporting technologies define the market's efficiency. Pre-treatment technologies, particularly advanced drying systems (e.g., rotary drum dryers, belt dryers), are essential for reducing the high moisture content of raw biomass to the optimal range of 8% to 15% required for effective briquetting. Furthermore, torrefaction, a thermal pre-treatment process conducted at temperatures between 200°C and 300°C in an inert atmosphere, is gaining prominence. Torrefaction creates 'bio-coal' or 'black pellets' that significantly increase energy density, improve grinding characteristics, and, crucially, make the fuel hydrophobic, vastly improving its suitability for co-firing in existing coal infrastructure and enabling cheaper bulk shipping and outdoor storage, positioning it as a key disruptive technology set to redefine international biomass commodity trade flows.

Regional Highlights

- North America (NA): The North American market, dominated by the United States and Canada, is characterized by large, standardized forestry residue utilization. Demand is primarily driven by industrial co-firing and pellet/briquette exports to Europe and Asia. The abundant availability of sustainable wood waste in the Pacific Northwest and the Southern US provides a cost-effective feedstock base. Regulatory frameworks, such as state-level Renewable Portfolio Standards (RPS) and federal tax incentives, encourage conversion. The region is seeing increased investment in highly automated, large-scale production facilities focused on efficiency and global trade standards.

- Europe: Europe is the most mature market for biomass briquette fuel, driven by stringent EU decarbonization policies, high carbon pricing mechanisms, and well-established thermal markets (both industrial and residential). Northern and Western European countries exhibit high residential demand for premium wood briquettes for heating, while utilities across the continent are primary consumers for co-firing operations. The market is highly standardized, governed by certifications like ENplus, and relies heavily on imports of wood pellets and briquettes, leading to significant logistical and sustainability auditing requirements for suppliers.

- Asia Pacific (APAC): APAC represents the fastest-growing market by volume, fuelled by exponential industrialization in China, India, and Southeast Asia, coupled with severe air pollution challenges caused by coal and agricultural open burning. Countries like India have aggressive goals to replace traditional fuels with biomass in industrial boilers (e.g., textiles, food processing), utilizing readily available agricultural residues like rice straw and mustard stalks. The market structure is highly fragmented, with numerous small-to-medium enterprises, and is increasingly benefiting from targeted government subsidies designed to formalize the biomass supply chain and upgrade technological capacities.

- Latin America (LATAM): The LATAM market is nascent but exhibits strong potential, particularly in countries with large agricultural sectors like Brazil and Argentina. Key feedstock sources include sugarcane bagasse and coffee pulp. The market growth is linked to domestic industrial consumers (sugar mills, food processing plants) seeking to utilize their own waste streams for energy self-sufficiency, often driven by high regional energy costs. Policy support is less centralized than in Europe, leading to more localized market development focused on regional supply chain optimization and immediate energy cost savings.

- Middle East and Africa (MEA): The MEA region is the smallest consumer, yet offers niche growth opportunities, particularly in African nations leveraging agricultural residues (e.g., maize cobs, cotton husks) to provide decentralized, affordable energy solutions and address localized energy poverty. In the Middle East, while hydrocarbon dominance persists, there is emerging interest in biomass for municipal waste management and smaller industrial applications, especially in the context of broader renewable energy diversification strategies and sustainable development goals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biomass Briquette Fuel Market.- Enviva Partners, LP

- German Pellets GmbH

- Biomass Secure Power Inc.

- Lignetics International Inc.

- Pacific BioEnergy Corp.

- Fiberight LLC

- GreenLeaf Fuels Inc.

- Woodstone Biomass Energy

- Helius Energy Plc

- RWE Innogy GmbH

- Terra-Gen Power, LLC

- AGRO Biomass Energy Solutions

- PALLMANN Group

- Zilkha Biomass Energy

- Blue Fire Renewables Inc.

- New England Wood Pellet LLC

- Suez Environment S.A.

- Renewable Energy Group (REG)

- Advanced BioFuel Solutions Ltd.

- Enerkem Inc.

Frequently Asked Questions

Analyze common user questions about the Biomass Briquette Fuel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary environmental advantages of utilizing biomass briquettes over coal?

Biomass briquettes are considered carbon neutral on a lifecycle basis because the carbon dioxide released during combustion is balanced by the CO2 absorbed by the feedstock (plants) during their growth. Furthermore, they typically have significantly lower sulfur and ash content compared to coal, resulting in reduced acid rain precursors and lower solid waste disposal burdens for industrial users.

How does the quality of the feedstock affect the final energy density of the briquette?

Feedstock quality is critical; materials like wood waste (forestry residue) generally have higher inherent lignin content and lower ash than agricultural residues (like rice husks), resulting in denser, higher calorific value briquettes. Consistency in moisture content is also vital, as excessive moisture reduces density and consumes more energy during the briquetting process, negatively impacting overall fuel performance and efficiency.

What is the role of torrefaction in advancing the biomass briquette market?

Torrefaction is a thermal pre-treatment process that transforms raw biomass into a coal-like material ('bio-coal' or 'black pellets'). This process significantly increases the energy density of the fuel, improves its mechanical durability, and makes it hydrophobic (water-resistant), resolving major logistical challenges related to shipping and outdoor storage, thereby facilitating its use as a direct substitute for coal in utility-scale co-firing operations globally.

Which geographical region exhibits the most potential for biomass briquette market expansion?

The Asia Pacific (APAC) region, particularly India, China, and Southeast Asia, holds the highest potential for market expansion. This is driven by large agricultural waste streams, rapid industrial expansion demanding process heat, and strong government mandates aimed at replacing highly polluting fuels like coal and mitigating severe air quality issues in densely populated industrial zones.

What technological factors influence the selection between a Screw Press and a Piston Press for briquette production?

The Screw Press is favored for producing highly dense, durable briquettes required for export or large industrial boilers, leveraging the natural lignin binding for superior structural integrity. The Piston Press, while simpler and potentially lower cost, is often used for localized markets and produces logs with slightly lower density, though it can handle a wider variety of less uniform feedstock materials efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager