Biosimilar Monoclonal Antibody Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443233 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Biosimilar Monoclonal Antibody Market Size

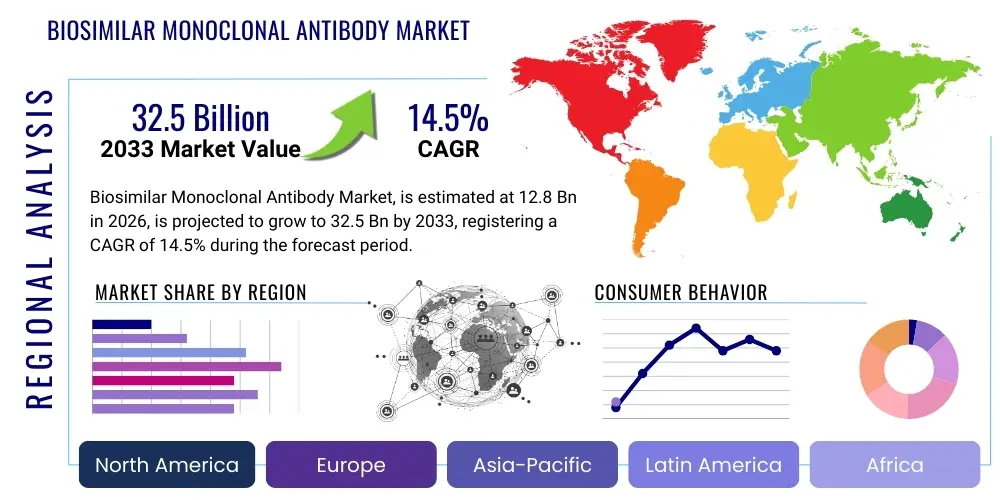

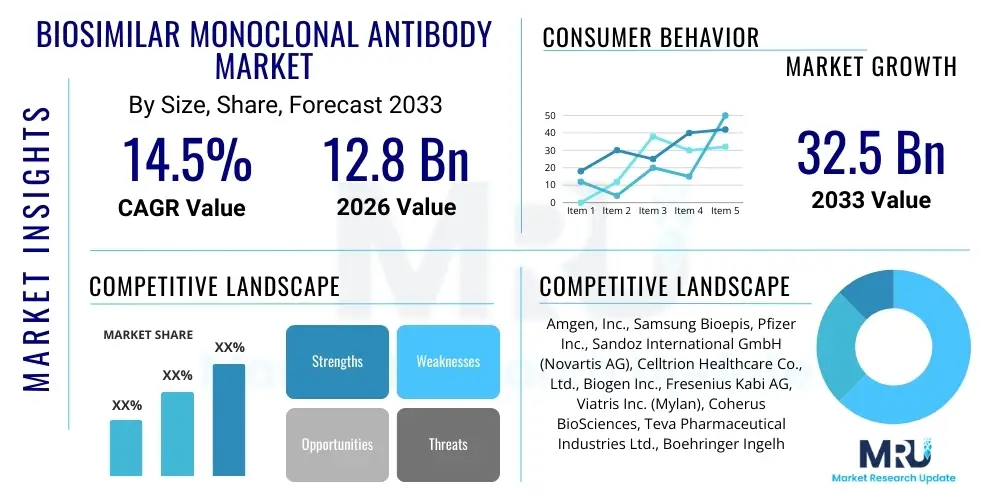

The Biosimilar Monoclonal Antibody Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 12.8 Billion in 2026 and is projected to reach USD 32.5 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the increasing demand for cost-effective therapeutic alternatives to expensive originator biologics, coupled with favorable regulatory pathways established by major health authorities across North America, Europe, and Asia Pacific. The patent expiry of blockbuster monoclonal antibodies (mAbs) opens significant opportunities for biosimilar developers to enter high-value therapeutic areas, driving overall market valuation.

Biosimilar Monoclonal Antibody Market introduction

The Biosimilar Monoclonal Antibody Market encompasses biological medicinal products highly similar to an approved reference monoclonal antibody (mAb) in terms of quality, safety, and efficacy, with no clinically meaningful differences. These sophisticated therapeutic agents are primarily used in treating complex chronic diseases such as cancer, autoimmune disorders (like rheumatoid arthritis and psoriasis), and inflammatory bowel diseases. The product description involves complex biotechnology processes, ensuring that the biosimilar mimics the structural and functional characteristics of the originator product, which often includes targets like TNF-alpha, VEGF, and various interleukins. Major applications span oncology, immunology, endocrinology, and ophthalmology, offering crucial treatment options where high cost previously restricted patient access.

The primary benefit of biosimilar mAbs is their ability to reduce healthcare expenditure significantly, thereby enhancing patient access to critical biologic therapies globally. As healthcare systems grapple with rising pharmaceutical costs, the introduction of biosimilars fosters competition, leading to price reduction mechanisms that benefit payers and patients alike. This economic advantage positions biosimilars as a cornerstone of sustainable healthcare policy. Furthermore, the robust clinical development programs required for approval ensure that these products meet stringent safety and efficacy standards, instilling confidence among prescribers and patients.

Driving factors for this market include the expiration of patents for several high-revenue biologic drugs, aggressive efforts by governments and regulatory bodies (such as the FDA and EMA) to streamline biosimilar approval processes, and increasing awareness among clinicians regarding the clinical equivalence of biosimilars. The growing prevalence of chronic diseases, particularly in aging populations across developed and developing nations, further necessitates the availability of affordable and effective mAb treatments, solidifying the market’s positive trajectory throughout the forecast period. Investment in advanced manufacturing techniques and global supply chain optimization are also critical contributors to market acceleration and expansion.

Biosimilar Monoclonal Antibody Market Executive Summary

The Biosimilar Monoclonal Antibody Market is characterized by intense competition driven by aggressive pricing strategies and rapid pipeline development, transforming the landscape of biologic medicine. Key business trends indicate a strategic pivot toward global partnerships between established pharmaceutical companies and niche biosimilar manufacturers to leverage regional expertise and accelerate market penetration, particularly in emerging economies where regulatory alignment is progressing. Furthermore, there is a distinct trend towards 'second-wave' biosimilars targeting drugs whose patents are expiring later in the decade, requiring significant R&D investment today. Companies are also focusing on improving patient support programs and device usability (e.g., autoinjectors) to gain a competitive edge over established originator brands, moving beyond mere price competition into comprehensive patient experience enhancement.

Regionally, North America and Europe remain the largest revenue contributors due to well-defined regulatory frameworks, high healthcare spending, and substantial adoption rates driven by mandatory substitution policies or preferential formulary placement. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, propelled by escalating healthcare infrastructure investment, a large population base with increasing disposable income, and supportive governmental initiatives aimed at promoting local biosimilar production and consumption to reduce import reliance. Latin America is also emerging as a high-potential market, albeit characterized by greater regulatory fragmentation and slower reimbursement processes, requiring customized market entry strategies focusing on high-volume tender contracts.

In terms of segment trends, oncology remains the dominant application segment, representing the largest proportion of biosimilar revenues, driven by the sheer volume and high cost of cancer treatment drugs. Within product types, biosimilars targeting TNF inhibitors (used primarily for immunology) continue to hold significant market share but face increasing competition, leading to deeper price erosion. The manufacturing segment is witnessing a surge in investment in continuous processing technologies and advanced analytical techniques to ensure product quality consistency and minimize batch variations, which is crucial for biosimilar acceptance. The increasing sophistication of analytical comparability studies is also a major trend, reducing the time and cost associated with late-stage clinical trials.

AI Impact Analysis on Biosimilar Monoclonal Antibody Market

User queries regarding AI’s impact on the Biosimilar Monoclonal Antibody Market typically revolve around three core themes: acceleration of R&D and manufacturing timelines, optimization of clinical trial design, and enhanced pharmacovigilance for post-market surveillance. Users frequently ask how AI and machine learning (ML) can shorten the comparability assessment phase, a historically time-consuming and resource-intensive step. There is significant concern and interest regarding whether AI tools can accurately predict critical quality attributes (CQAs) of biosimilars, thereby minimizing failure rates in large-scale production. Expectations are high that AI can significantly reduce development costs, making biosimilar entry faster and more economically viable, ultimately impacting market competition and pricing structures.

AI's primary influence is expected in the early stages of biosimilar development, specifically in predictive analytics for target product profiles and enhanced analytical comparability. ML algorithms are increasingly being used to analyze vast datasets pertaining to the originator molecule's characteristics, identifying minute differences or potential risks that traditional methods might overlook. This speeds up process development and formulation stabilization. Furthermore, AI tools are optimizing manufacturing by predicting yield variations and contamination risks in bioreactors, ensuring consistent high-quality production which is essential for biosimilar acceptance.

The long-term impact of AI extends to market strategy and patient outcomes. AI-driven predictive modeling can forecast market adoption rates based on formulary coverage, physician prescribing patterns, and patient affordability metrics, allowing companies to tailor their launch strategies optimally. In clinical settings, AI supports the identification of ideal patient cohorts for post-approval safety studies, enhancing the reliability and efficiency of pharmacovigilance efforts necessary to maintain the high trust required in the biosimilar domain. This integration is transforming biosimilar development from a reactive process into a data-driven, predictive endeavor.

- AI accelerates analytical comparability studies by processing complex biological data sets rapidly.

- Machine Learning optimizes manufacturing processes, predicting critical quality attribute variations and improving batch consistency.

- AI enhances clinical trial design efficiency by identifying optimal patient populations and reducing unnecessary trial arms.

- Predictive modeling assists in forecasting market uptake and pricing strategies for new biosimilar entrants.

- Natural Language Processing (NLP) supports robust and timely pharmacovigilance and adverse event reporting post-launch.

DRO & Impact Forces Of Biosimilar Monoclonal Antibody Market

The Biosimilar Monoclonal Antibody Market is primarily driven by the imperative need for healthcare cost containment globally, underpinned by patent expiration of major originator biologics, which creates immediate revenue opportunities. However, the market faces significant restraints, chiefly stemming from complex manufacturing requirements, requiring high capital investment and specialized expertise, along with persistent challenges related to physician and patient perceptions of interchangeability and efficacy, often fueled by originator company resistance. The opportunity lies in the untapped potential of emerging markets and the pipeline development of next-generation biosimilars targeting drugs yet to lose exclusivity, particularly those addressing rare diseases or highly specialized indications. These forces, when combined, create a dynamic and highly competitive environment, where regulatory clarity acts as the primary impact accelerator, dictating the pace of market penetration and overall uptake across different geographies.

A key driver is the successful precedent set by early biosimilar launches in Europe, which demonstrated significant cost savings and established robust regulatory precedents, subsequently influencing global regulatory harmonization efforts. This success has encouraged substantial financial investment into the sector, propelling numerous companies to dedicate R&D resources to biosimilar development. Conversely, a major restraint is the litigation risk associated with intellectual property (IP) disputes, which often delays market entry for several years, eroding the potential first-mover advantage. The complexity of regulatory requirements, particularly in demonstrating clinical non-inferiority, also poses a high barrier to entry, restricting the market to large pharmaceutical entities with deep pockets and specialized analytical capabilities. Managing complex logistics and cold chain requirements for these high-value biologics across varied global distribution networks also adds to operational constraints and costs.

Opportunities are vast, centering on therapeutic expansion beyond the current focus on TNF inhibitors and oncology drugs, moving into areas like chronic kidney disease and ophthalmology, where high-cost biologics currently dominate. Furthermore, the push for biosimilar interchangeability status in the US market, allowing pharmacist-level substitution, represents a monumental opportunity to accelerate patient access and adoption, effectively neutralizing some of the marketing barriers erected by originator manufacturers. The impact forces are thus dominated by regulatory policy and payer preference; favorable regulatory action combined with strong governmental procurement mandates acts as a powerful catalyst for market growth, ensuring that cost-efficiency gains are rapidly passed down to the healthcare system and beneficiaries, strengthening the entire ecosystem.

Segmentation Analysis

The Biosimilar Monoclonal Antibody Market is comprehensively segmented based on product type, application, manufacturing type, and region, allowing for granular analysis of market dynamics and opportunity areas. Product type segmentation primarily focuses on the specific molecular target and mechanism of action, encompassing key therapeutic categories like anti-TNF-alpha agents, anti-VEGF agents, and anti-CD20 antibodies, each commanding distinct market sizes and growth rates influenced heavily by originator patent timelines. Application segmentation delineates the end-use therapeutic areas, predominantly dominated by oncology and immunology, which are the largest consumers of high-cost biologics and thus represent the most lucrative targets for biosimilar developers seeking substantial cost reduction impact. This dual classification helps stakeholders identify high-priority development pipelines and tailor commercialization strategies to specific patient populations and clinical needs.

Further granularity is provided by the manufacturing type segmentation, distinguishing between in-house manufacturing, contract manufacturing organizations (CMOs), and hybrid models. The decision regarding manufacturing strategy is pivotal for biosimilar developers, heavily influencing capital expenditure, control over critical quality attributes (CQAs), and speed to market. While large established players often prefer in-house capacity for core products, strategic partnerships with specialized CMOs are increasingly common for managing high-volume global demand or handling highly complex process steps. Understanding the nuances within each manufacturing segment is critical for assessing capacity limitations and supply chain resilience in the face of rapidly expanding demand, especially as multiple biosimilars for a single reference product enter the market simultaneously, leading to potential surges in required production volume.

The regional segmentation highlights the disparity in market maturity, regulatory acceptance, and price erosion levels across North America, Europe, Asia Pacific, and other global regions. Europe, being the earliest adopter, showcases mature market penetration and significant price competition, whereas North America, particularly the U.S., is characterized by complex reimbursement landscapes but offers massive revenue potential due to the sheer size of the biologics market. Analyzing these segments ensures that companies can allocate resources effectively, focusing R&D investment on segments with impending patent expiries (product type), commercial efforts on high-prevalence disease areas (application), and operational optimization on scalable and quality-assured supply chains (manufacturing type).

- Product Type:

- Rituximab Biosimilars (Anti-CD20)

- Adalimumab Biosimilars (Anti-TNF-alpha)

- Infliximab Biosimilars (Anti-TNF-alpha)

- Trastuzumab Biosimilars (Anti-HER2)

- Bevacizumab Biosimilars (Anti-VEGF)

- Etanercept Biosimilars

- Other Biosimilars (e.g., ranibizumab, cetuximab)

- Application:

- Oncology

- Immunology

- Ophthalmology

- Endocrinology

- Other Chronic Diseases

- Manufacturing Type:

- In-house Manufacturing

- Contract Manufacturing Organizations (CMOs)

- Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (Japan, China, South Korea, India, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East & Africa (MEA)

Value Chain Analysis For Biosimilar Monoclonal Antibody Market

The value chain for the Biosimilar Monoclonal Antibody Market begins with intensive upstream activities, primarily encompassing research and development, selection of the reference product, and complex cell line development. This initial stage involves deep analytical characterization of the originator biologic to establish critical quality attributes (CQAs) and develop proprietary cell lines (e.g., CHO cells) capable of producing the biosimilar molecule with high fidelity. Upstream analysis focuses heavily on regulatory compliance, intellectual property mapping to ensure freedom to operate, and securing high-quality raw materials, including media components and specialized reagents, which must meet stringent pharmaceutical standards. Successful execution in the upstream phase, characterized by efficient process development and cell line stability, is paramount for minimizing later-stage manufacturing risks and ensuring cost-effectiveness throughout the product lifecycle, necessitating significant upfront capital investment.

The midstream segment involves large-scale manufacturing and downstream processing, including bioreactor operations, purification, and formulation development. Manufacturing is capital-intensive and requires highly specialized, compliant facilities operating under cGMP conditions. Downstream analysis is focused on optimizing purification chromatography steps to achieve high purity while maintaining yield and stability. Formulation development ensures the final product is stable, bioavailable, and compatible with specific delivery devices, a critical step for biosimilar acceptance. Distribution channel management then connects the finished product to end-users. Direct channels often involve specialized sales forces targeting large hospital systems, oncology clinics, and national health services (especially in Europe), negotiating large tender contracts directly with governmental or regional procurement agencies.

Indirect distribution involves collaboration with wholesale distributors and specialized pharmaceutical logistics providers who manage the complex cold chain requirements necessary for biologic products. Given the price sensitivity and high volume potential of biosimilars, supply chain efficiency and security are key competitive differentiators in the downstream market. Furthermore, direct engagement with payers and pharmacy benefit managers (PBMs) is crucial for securing favorable formulary placement, which dictates market access and physician prescribing behavior. The entire value chain is heavily regulated, and strict adherence to quality assurance (QA) and quality control (QC) protocols throughout every stage is non-negotiable, emphasizing reliability and consistency as hallmarks of successful biosimilar operations.

Biosimilar Monoclonal Antibody Market Potential Customers

The primary potential customers and end-users of Biosimilar Monoclonal Antibodies are multifaceted, reflecting the complex structure of global healthcare systems. These customers fundamentally include healthcare payers, such as government entities managing national health insurance schemes (e.g., NHS in the UK, centralized procurement agencies in Brazil), private insurance companies, and Pharmacy Benefit Managers (PBMs) in the US, whose core objective is reducing pharmaceutical expenditure without compromising patient care quality. These entities prioritize biosimilars due to the mandated or incentivized cost savings they offer compared to originator brands, making favorable formulary coverage decisions highly dependent on demonstrated price reductions and robust supply reliability.

The second major category of customers consists of healthcare providers, including large hospital networks, specialized oncology and rheumatology clinics, and integrated delivery systems. These professional customers are the prescribers and administrators of the therapy. Their adoption is driven by clinical equivalence data, ease of use (e.g., delivery devices), and hospital-level cost control mandates. Educating these healthcare professionals on the comparability data and regulatory approval pathways is critical for adoption, moving them past any initial hesitancy regarding switching from established brand names. The decision to adopt a biosimilar is often made at the institutional level, based on therapeutic equivalence committees and economic assessments.

Finally, the ultimate beneficiaries and end-users are the patients suffering from chronic conditions like cancer, autoimmune diseases, and macular degeneration. While patients may not directly purchase the product, their willingness to accept a biosimilar, often influenced by their physicians and insurance coverage, is crucial. Increasing patient awareness and ensuring shared decision-making contribute significantly to market success. The market dynamics, therefore, necessitate successful engagement across all three customer segments—payers for market access, providers for prescription volume, and patients for sustained adherence and acceptance, ensuring a comprehensive approach to commercialization and market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.8 Billion |

| Market Forecast in 2033 | USD 32.5 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amgen, Inc., Samsung Bioepis, Pfizer Inc., Sandoz International GmbH (Novartis AG), Celltrion Healthcare Co., Ltd., Biogen Inc., Fresenius Kabi AG, Viatris Inc. (Mylan), Coherus BioSciences, Teva Pharmaceutical Industries Ltd., Boehringer Ingelheim, Dr. Reddy’s Laboratories, Aurobindo Pharma, Wockhardt, Eli Lilly and Company, Merck KGaA, Lupin Limited, Hetero Drugs, Alvotech, Bio-Thera Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biosimilar Monoclonal Antibody Market Key Technology Landscape

The technological landscape of the Biosimilar Monoclonal Antibody Market is highly sophisticated, driven by the need for ultra-precise characterization and scalable, cost-efficient manufacturing. A fundamental technology is advanced analytical characterization, leveraging techniques such as high-resolution mass spectrometry (HRMS), nuclear magnetic resonance (NMR), and various chromatographic methods (e.g., HPLC, UPLC). These technologies are crucial for demonstrating structural and functional similarity to the reference product—the cornerstone of regulatory approval. Developers invest heavily in these analytical platforms to map post-translational modifications, aggregation profiles, and charge variants, ensuring the biosimilar meets stringent quality standards. Furthermore, the push towards establishing robust cell line stability and high yield in host cell systems (like Chinese Hamster Ovary, CHO cells) utilizes advanced genetic engineering and cell culture optimization techniques, including fed-batch and perfusion systems, to maximize volumetric productivity and reduce the cost of goods sold (COGS).

In manufacturing, the trend is moving towards digitalization and automation to enhance efficiency and maintain consistency. Single-use technologies (SUTs) or disposable systems are increasingly adopted in upstream and downstream processing. SUTs reduce the risk of cross-contamination, accelerate facility turnaround times, and significantly lower the high initial capital expenditure associated with traditional stainless steel infrastructure. This scalability is particularly advantageous for biosimilar manufacturers who need flexible capacity to address varying global demands rapidly. Continuous manufacturing, another key technological trend, is being explored to replace traditional batch processing. Continuous bioprocessing promises smaller physical footprints, lower operating costs, and improved product quality control through steady-state operation, representing a significant shift in biopharma production paradigms aimed directly at enhancing the cost-competitiveness of biosimilars globally.

Beyond production, technological advancements in drug delivery systems are also crucial, particularly the development of high-concentration formulations compatible with autoinjectors and pre-filled pens. These innovations improve patient convenience and compliance, which are key factors in physician preference and market adoption, especially for subcutaneous products used in chronic autoimmune diseases. Finally, the integration of data science and Quality by Design (QbD) principles ensures that quality attributes are built into the manufacturing process from the start, utilizing multivariate analysis and statistical process control (SPC) to monitor and adjust critical process parameters in real time. This comprehensive technological approach ensures that biosimilars not only meet efficacy and safety standards but are also manufactured reliably and economically at a global scale, fundamentally leveraging science and engineering to overcome the inherent complexities of replicating large biological molecules.

Regional Highlights

- North America: The North American market, dominated by the United States, represents the single largest revenue opportunity globally, despite regulatory hurdles and complex patent litigation dynamics. The FDA’s commitment to expediting biosimilar approval, particularly through the interchangeability designation pathway, is a significant growth catalyst. Payer strategies, including those employed by Pharmacy Benefit Managers (PBMs) and Medicare/Medicaid programs, are increasingly mandating or incentivizing the use of biosimilars to curb the exorbitant costs of originator biologics, leading to aggressive market entry and high volume uptake, especially for oncology and immunology products. However, intense competition and the need for significant market access investment characterize this region.

- Europe: Europe remains the most mature and successful market for biosimilars globally, owing to early regulatory clarity provided by the European Medicines Agency (EMA) and proactive governmental policies promoting use (e.g., tender systems and mandatory substitution in specific countries). This maturity has led to significant price erosion, often exceeding 50% for certain molecules, benefiting national healthcare systems dramatically. Key markets like Germany, the UK, and France continue to drive adoption, setting precedents for clinical acceptance and physician trust. The focus is now shifting toward optimizing supply chain stability and managing the introduction of second and third-wave biosimilars targeting complex new indications.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure development, expanding healthcare coverage, and the presence of dominant local manufacturers, particularly in South Korea, China, and India. Governments in these regions are actively supporting domestic production through incentives and streamlined regulatory pathways to improve affordability and access for their large populations. South Korea and Japan possess advanced regulatory frameworks and high R&D capability, while China and India focus on mass production and exporting to regulated and semi-regulated markets, making the region a critical hub for global biosimilar supply and future demand growth.

- Latin America (LATAM): The LATAM region presents significant growth potential driven by high unmet medical needs and governments seeking cost-effective treatments via centralized procurement and tender processes, particularly in Brazil and Mexico. However, market penetration is often hampered by disparate regulatory landscapes, long reimbursement cycles, and economic volatility. Successful market entry requires robust localization strategies, focusing on securing high-volume contracts with public health systems, which are the dominant buyers of high-cost biologic therapies in this geography.

- Middle East and Africa (MEA): The MEA market is characterized by increasing healthcare investments and a growing focus on diversifying healthcare providers in wealthy Gulf Cooperation Council (GCC) countries. Regulatory bodies are slowly harmonizing standards, often referencing approvals from the EMA and FDA. While market size is currently smaller compared to major regions, the high prevalence of certain chronic diseases and the willingness of regional governments to invest in advanced treatments suggest future opportunities, especially for biosimilars targeting expensive specialty drugs used in oncology and rare diseases, though reliance on imports remains high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biosimilar Monoclonal Antibody Market, encompassing major pharmaceutical innovators, dedicated biosimilar specialists, and key contract development and manufacturing organizations (CDMOs). These companies are distinguished by their robust pipelines, global manufacturing footprints, extensive regulatory expertise, and strategic commercialization capabilities necessary to compete in this high-stakes segment. Their strategic alliances, focused R&D spending, and sophisticated intellectual property management systems define the competitive dynamics of the global biosimilar landscape, ensuring sustainable supply and driving down costs across therapeutic areas.- Amgen, Inc.

- Samsung Bioepis

- Pfizer Inc.

- Sandoz International GmbH (Novartis AG)

- Celltrion Healthcare Co., Ltd.

- Biogen Inc.

- Fresenius Kabi AG

- Viatris Inc. (Mylan)

- Coherus BioSciences

- Teva Pharmaceutical Industries Ltd.

- Boehringer Ingelheim

- Dr. Reddy’s Laboratories

- Aurobindo Pharma

- Wockhardt

- Eli Lilly and Company

- Merck KGaA

- Lupin Limited

- Hetero Drugs

- Alvotech

- Bio-Thera Solutions

Frequently Asked Questions

Analyze common user questions about the Biosimilar Monoclonal Antibody market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a biosimilar monoclonal antibody and its reference product?

The primary difference is that a biosimilar is highly similar to the reference product in terms of structure, biological activity, safety, and efficacy, with no clinically meaningful differences. Unlike generics, which are chemically identical, biosimilars are large biological molecules derived from living organisms, requiring extensive analytical and clinical data to demonstrate comparability, not exact identity, to the originator product.

How significant is the role of patent expiration in driving the Biosimilar Monoclonal Antibody market growth?

Patent expiration is the single most critical driver. When exclusivity expires for blockbuster monoclonal antibodies (mAbs), it permits biosimilar developers to enter the market, creating immediate price competition. This influx of affordable alternatives substantially increases market volume and accelerates overall growth, particularly for high-cost treatments in oncology and immunology.

Which geographic region currently dominates the global biosimilar monoclonal antibody market in terms of revenue?

Europe currently dominates the global market in terms of cumulative revenue and adoption maturity, due to its early establishment of a clear regulatory pathway (EMA) and aggressive governmental policies promoting biosimilar use. North America, however, is rapidly catching up and is poised to become the largest market segment due to the sheer size of its pharmaceutical expenditure and the recent introduction of interchangeability rules.

What are the main challenges facing the successful commercialization of new biosimilar products?

Key challenges include complex and costly manufacturing scale-up, managing extensive and expensive intellectual property (IP) litigation risks that delay launch timelines, overcoming prescriber and patient hesitancy regarding product switching, and securing favorable formulary access against deeply entrenched originator brands through aggressive price erosion.

How does AI technology specifically contribute to reducing the cost of biosimilar development?

AI reduces development costs primarily by accelerating the analytical characterization phase, using machine learning to predict optimal manufacturing conditions and critical quality attributes, thereby minimizing costly experimental failures and batch variations. AI also optimizes clinical trial design, making studies smaller, faster, and more targeted, resulting in significant savings in R&D expenditure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager