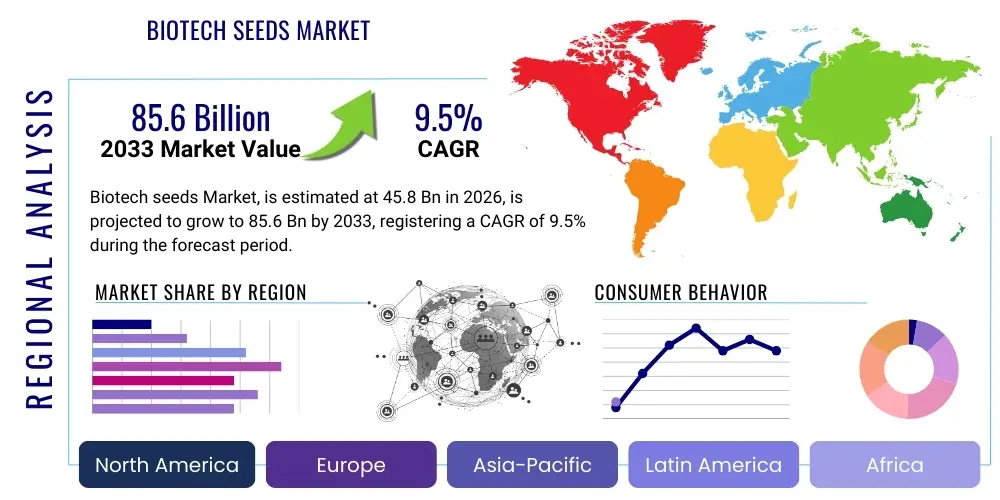

Biotech seeds Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442180 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Biotech seeds Market Size

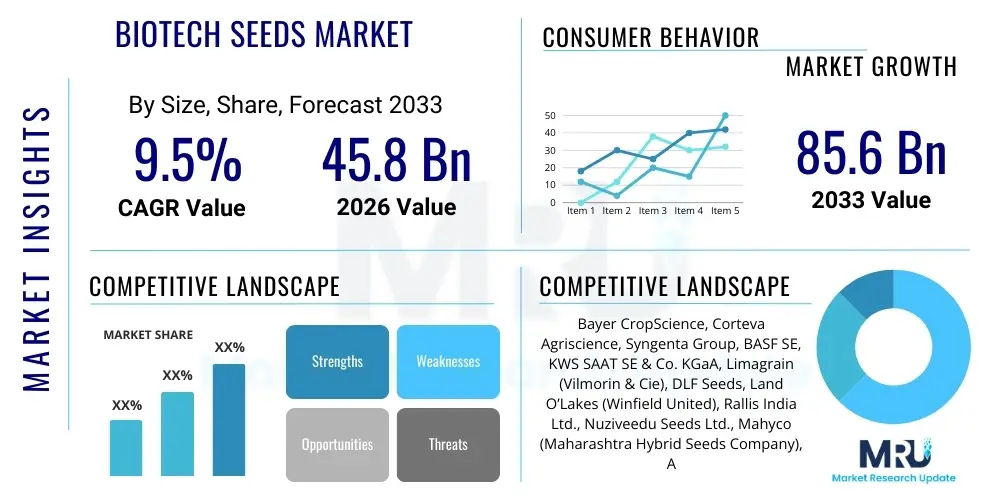

The Biotech seeds Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 85.6 Billion by the end of the forecast period in 2033.

Biotech seeds Market introduction

The Biotech seeds Market encompasses genetically modified seeds developed through advanced biological techniques to enhance desirable agricultural traits such as resistance to pests, tolerance to herbicides, and improved nutritional content. These innovations are critical for addressing global food security challenges, increasing crop yields, and mitigating the environmental impact of conventional farming practices. The core objective of biotech seeds is to provide farmers with tools that improve operational efficiency, reduce input costs associated with pesticides, and ensure stable, high-quality harvests, particularly in the face of variable climatic conditions and emerging plant diseases. The sophistication of genetic engineering, including modern methods like CRISPR/Cas9 and other New Breeding Techniques (NBTs), is continuously expanding the potential applications and commercial viability of these specialized seeds across major global commodity crops, leading to faster development cycles and new trait possibilities that were previously unattainable through traditional breeding.

Product descriptions within the biotech seeds domain typically revolve around two primary categories: insect-resistant (IR) seeds, often utilizing Bt (Bacillus thuringiensis) technology to confer protection against specific insect pests, and herbicide-tolerant (HT) seeds, designed to withstand broad-spectrum chemical sprays, facilitating efficient weed management. Increasingly, the market is characterized by stacked traits, which involve combining multiple genetic modifications (e.g., both HT and IR) into a single seed to provide comprehensive and layered protection against various biological and chemical stresses simultaneously. Major applications of biotech seeds are heavily concentrated in staple commodity crops such as corn, soybeans, cotton, and canola, which collectively account for the vast majority of the global cultivated area dedicated to genetically modified organisms (GMOs). These applications span large-scale commercial agriculture globally, driving productivity gains necessary to sustain a growing world population and meet the accelerating demand for animal feed and biofuels.

The benefits derived from adopting biotech seeds are multifaceted and statistically significant, including substantial yield increases, measurable reductions in the required volume and frequency of chemical insecticide applications, and greater operational flexibility for farmers regarding targeted weed control. Driving factors propelling this market include the urgent necessity for sustainable intensification of agriculture to feed a global population projected to reach nearly 10 billion by mid-century, robust regulatory approvals in key high-volume regions like North and South America, and increasing investment in research and development aimed at developing novel traits for specialized crops and challenging abiotic environments (drought, salinity, heat). Furthermore, the rising global demand for biofuels and high-protein animal feed, largely sourced from high-yield biotech crops, provides a sustained macroeconomic underpinning for market expansion. However, continuous public acceptance, regulatory harmonization across trading blocs, and managing the cost-effectiveness of these advanced seeds remain pivotal considerations for sustained, uniform global growth.

Biotech seeds Market Executive Summary

The Biotech seeds Market is undergoing a rapid and strategic transformation, characterized by intense horizontal consolidation among key global players and a significant pivot toward integrating advanced digital agriculture solutions with proprietary genetics. Current business trends indicate a strong industry focus on developing ‘smart stacks’—seeds incorporating eight or more traits for complete, multi-layered yield protection—and expanding the trait portfolio significantly beyond simple pest or weed resistance to include abiotic stress tolerance (such as drought and salinity resistance) and targeted nutritional enhancement (e.g., high oleic soybeans). Strategic mergers and acquisitions are continuously being utilized by major corporations to gain critical control over proprietary germplasm resources, advanced breeding technologies, and emerging digital platforms, ensuring market dominance in critical, high-value crop segments and reinforcing the oligopolistic structure of the global seed industry.

Regionally, the market exhibits highly differentiated maturity levels and growth trajectories that influence global commercial planning. North America remains the established epicenter of biotech seed adoption, benefiting from permissive, science-based regulatory environments and near-universal acceptance rates among large-scale commercial farmers, particularly in corn and soybean production where adoption saturation is high. Latin America, specifically Brazil and Argentina, represents the fastest-growing market by volume and value, propelled by vast expanding arable land, highly favorable climatic conditions that often allow for two or three harvests per year, and strong global demand for commodity exports. Conversely, adoption in certain key European and Asian nations remains structurally constrained by stringent regulatory hurdles, delays in approval for new breeding techniques (NBTs), and persistent public skepticism regarding genetically modified organisms (GMOs). However, emerging economies in Southeast Asia and sub-Saharan Africa are slowly opening up to specific, locally relevant biotech traits, recognizing their indispensable role in addressing endemic nutritional deficiencies and pest-related yield losses.

Segment trends conclusively highlight the overwhelming dominance and rapid growth of Stacked Traits within the Trait Type category, reflecting the industry's strategic focus on delivering integrated, comprehensive crop management systems that offer robust, layered protection against multiple threats simultaneously. Within Crop Types, soybeans and corn continue to hold the largest market shares globally, primarily due to their extensive cultivation area, high caloric and feed value, and critical commercial importance in global trade flows. Nevertheless, there is a sustained increase in R&D investment being directed towards specialty crops like rice, potato, and various vegetables, targeting consumer-focused traits such as reduced browning, enhanced shelf life, or specialized processing qualities. The strategic integration of cutting-edge genomic editing technologies, particularly CRISPR, is poised to fundamentally revolutionize segment dynamics by enabling quicker development cycles and potentially circumventing some regulatory hurdles associated with older transgenic methods, thereby broadening the scope of application dramatically across the entire agricultural spectrum.

AI Impact Analysis on Biotech seeds Market

Common user questions regarding AI's impact on the Biotech seeds Market frequently center on efficiency gains in complex genomic R&D, the potential for personalized, micro-environment specific seed recommendations, and the ethical implications and data security requirements associated with autonomous farming systems relying on proprietary genetic data. Users are keen to understand how AI-driven genomics and predictive modeling can significantly accelerate the identification, selection, and validation of beneficial genes, aiming to dramatically reduce the typical decade-long development cycle required for commercializing a new biotech trait. Furthermore, there is substantial public and industry interest in how machine learning algorithms can be utilized to optimize the costly and time-consuming field trial process, accurately predict yield performance under highly variable climate scenarios, and effectively integrate complex seed genetics with localized, real-time soil and weather data to provide highly prescriptive agronomic guidance to growers. The key themes summarized from these wide-ranging inquiries underscore robust expectations for AI to drastically cut costs, enhance the precision and sustainability of agriculture, and ultimately accelerate the delivery of novel, climate-resilient seeds to market, although concerns about data ownership, model transparency, and potential bias in algorithmic recommendations across diverse environments persist as significant industry challenges.

AI is fundamentally reshaping the entire seed breeding pipeline by transforming petabytes of disparate genomic, phenotypic, and environmental datasets into predictive, actionable biological insights. Machine learning models, including sophisticated deep learning networks, are now routinely used to correlate complex genetic markers with desired high-value phenotypes far faster and more accurately than conventional statistical and bioassay methods. This profound predictive capability allows researchers to rapidly prioritize the most promising genetic crosses and trait combinations, significantly reducing the labor intensity and sheer amount of time required by traditional, purely empirical breeding approaches. For instance, advanced neural networks are employed to analyze high-throughput phenotyping data collected autonomously from drones, ground sensors, and controlled growth facilities to evaluate how different genetic combinations perform under complex, induced stress conditions, enabling rapid iteration and refinement of product candidates with minimal reliance on costly, multi-year physical field testing in the early stages of development.

Beyond the internal R&D laboratory, AI is proving crucial for optimizing the commercial deployment phase and maximizing realized farmer value at the field level. By efficiently processing vast amounts of real-time farm data—including detailed soil composition maps, historical yield records, high-resolution satellite imagery, and localized, probabilistic weather forecasts—AI systems deliver hyper-localized recommendations on the optimal seed variety selection, precise planting density, and specific timing tailored exactly to the unique micro-climate and soil characteristics of a single field or even a smaller management zone. This seamless integration of cutting-edge genetics and digital intelligence ensures that the high value and specialized performance embedded in biotech seeds are fully realized by the grower, maximizing the return on investment. Moreover, AI contributes significantly to regulatory robustness by improving the automated traceability and meticulous documentation of complex genetic modification events, thereby potentially streamlining the lengthy approval process for complex new traits across diverse global jurisdictions and ensuring compliance with increasingly strict biosecurity and labeling protocols.

- Accelerated Genomic Discovery: AI algorithms rapidly identify and validate novel, complex gene targets for traits like stress tolerance, dramatically speeding up the initial trait development phase.

- Precision Breeding Optimization: Machine learning predicts the highly specific performance outcomes of genetic crosses, efficiently streamlining cross-selection and prioritizing only the most promising candidates for field trials.

- Enhanced Phenotyping: Computer vision, robotics, and drone technologies utilize AI for automated, high-throughput analysis and measurement of intricate plant characteristics under various environmental and nutritional stresses.

- Prescriptive Agronomy Integration: AI platforms integrate sophisticated seed performance data with real-time, hyperlocal field conditions (soil, moisture, weather) to offer individualized planting, fertilization, and crop management recommendations.

- Supply Chain Optimization: Predictive modeling ensures highly efficient production forecasting, inventory management, and tailored distribution of specific seed varieties based on localized, fluctuating agronomic demand forecasts.

- Regulatory Pathway Streamlining: Automated data processing and complex visualization aids in compiling comprehensive, regulatory documentation packages and ensuring end-to-end traceability of all genetic events for governmental scrutiny.

DRO & Impact Forces Of Biotech seeds Market

The market dynamics of the Biotech seeds Market are meticulously governed by a complex and interacting array of drivers, constraints, and opportunities (DRO), which collectively shape the direction, investment intensity, and eventual pace of global market growth. A predominant driver is the relentlessly accelerating global population growth trajectory, necessitating a massive increase in staple food and feed production from a finite and often dwindling supply of arable land resources, thereby making high-yield, protected biotech seeds indispensable tools for maximizing land productivity and resource use efficiency. Simultaneously, the global imperative for highly sustainable and climate-resilient agriculture, which is driven by acute concerns over climate change impacts, water scarcity, and excessive pesticide use, fuels the urgent adoption of insect-resistant and herbicide-tolerant varieties that measurably reduce the agricultural system's overall environmental footprint. Furthermore, radical technological breakthroughs in gene-editing tools, particularly CRISPR, are continually creating disruptive opportunities by facilitating the precise, faster development of next-generation traits that overcome limitations historically associated with older transgenic technologies, opening pathways for commercializing crops previously considered non-viable for biotech intervention.

Despite these powerful drivers, the market faces significant and entrenched restraints, most notably persistent negative public perception and the implementation of highly stringent, non-harmonized regulatory frameworks across major regions. Widespread consumer skepticism and organized opposition regarding genetically modified organisms (GMOs), particularly prevalent in key high-value markets like Europe and certain Asian nations, creates persistent market resistance and necessitates costly, ongoing consumer education and transparency campaigns, hindering adoption. Furthermore, the mandatory regulatory approval process for commercializing new biotech traits is inherently lengthy, staggeringly expensive, and critically, non-harmonized across major global trading nations, creating profound trade barriers, stifling global commercialization timelines, and adding immense risk to R&D investment. Intellectual property (IP) disputes and the prohibitively high initial cost associated with complex R&D also represent structural restraints, concentrating the majority of development and commercialization capabilities within a few large, highly capitalized multinational corporations, thereby limiting competitive diversity and innovation in crucial niche crop segments.

Opportunities for profound, sustained growth are abundant, primarily centered around strategic geographic expansion into largely untapped or underpenetrated markets in Africa, Eastern Europe, and Southeast Asia, where local food security issues are often paramount and inherently conducive to accepting yield-enhancing technologies. Developing robust drought-tolerant, heat-resistant, and other specialized climate-resilient seeds represents a major area of sustained investment, which is crucial for mitigating the highly damaging impact of increasingly erratic and severe weather patterns on global agricultural output and food price volatility. Moreover, the accelerating convergence of seed technology with advanced digital agriculture, including the seamless integration of genomics, IoT sensors, and predictive AI, promises to unlock entirely new levels of precision farming efficiency, dramatically boosting the intrinsic value proposition of biotech seeds far beyond simple yield increases. This synergistic approach, coupled with dedicated R&D towards developing specific stacked traits for previously neglected minor crops and specialty markets, defines the most promising future trajectory for market expansion and crucial product differentiation.

Segmentation Analysis

The Biotech seeds Market is comprehensively segmented based on Trait Type, the specific Crop Type, and global Geography, providing essential stakeholders with a structured, data-driven view of market dynamics, competitive landscapes, and high-growth pockets. Trait Type segmentation is critical as it illuminates the functional utility and technological complexity of the seeds, differentiating between older, single-trait offerings (e.g., first-generation HT) and advanced, multi-trait combinations (stacked traits) that represent the leading edge of technology. Crop Type segmentation reveals the primary areas of commercial adoption, which are historically and economically heavily weighted toward staple row crops vital for global food security, industrial oil production, and the massive animal feed industries. Understanding these detailed segmentations is critically important for stakeholders seeking to optimally tailor their R&D investments, formulate effective commercial strategies, and engage effectively with regional regulatory authorities, ensuring that product pipelines meet specific, evolving regional and functional demands within the highly specialized agricultural sector. The dominance of a few major crop types reflects historical regulatory acceptance timelines and the immense economic scale required to justify the significant, multi-year investment in genetic modification and regulatory approval processes.

Within the Trait Type segment, stacked traits represent by far the most rapidly expanding and highest-value category, clearly demonstrating the industry’s strategic shift from offering singular resistance mechanisms to providing holistic, comprehensive, and multi-layered protection against a wide spectrum of biological, chemical, and environmental threats. This necessary strategic move effectively addresses the increasing complexity of evolving pests and weeds that often require simultaneous defenses to maintain yield stability. The Crop Type segmentation reveals the overwhelming and persistent commercial importance of global row crops like corn, soybeans, and cotton, which sustain high levels of acreage saturation globally due to their essential function in the international commodities market, particularly for oil, protein meal, and fiber production. Nevertheless, the smaller, yet highly strategic, "Other Crops" segment, including high-value specialty vegetables and unique grains, offers significant potential for high-margin, niche market development, especially as consumer preferences increasingly shift toward specific nutritional profiles, aesthetic qualities, and enhanced shelf life achievable through advanced biotechnology and gene editing.

Geographically, market penetration rates for biotech seeds vary dramatically across continents, fundamentally influencing the commercial launch strategies of seed developers. North America and Latin America are firmly established as the foundational pillars of the market, exhibiting mature, high-saturation adoption landscapes and generally favorable policy environments. Conversely, Asia Pacific is strategically poised for the most significant future volume growth, driven by key countries like India and China cautiously expanding their regulatory acceptance of specific biotech traits necessary for domestic consumption, import reduction, and optimized resource utilization. Careful, micro-level analysis of these segmentations enables market participants to precisely identify areas where regulatory environments are supportive (e.g., HT soybeans in Brazil) versus areas requiring intensive public education, rigorous science communication, and persistent policy engagement (e.g., food crops in large parts of Europe and East Asia). The complex interplay between crop economic significance, technological complexity of the trait, and regional regulatory acceptance dictates localized market success and profitability.

- Trait Type

- Herbicide Tolerance (HT) (e.g., Resistance to Glyphosate or Glufosinate)

- Insect Resistance (IR) (e.g., utilizing Bt toxin technology for specific insect control)

- Stacked Traits (Combinations of multiple HT and IR genes, often including quality traits)

- Quality Traits (e.g., Nutritional Enhancement, Improved Oil Profiles, Drought Tolerance, Disease Resistance)

- Crop Type

- Corn (Maize)

- Soybeans

- Cotton

- Canola (Oilseed Rape)

- Alfalfa

- Sugar Beet

- Other Crops (e.g., Potato, Rice, Wheat, Specialty Vegetables, Papaya)

- Geography

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, limited cultivation)

- Asia Pacific (China, India, Australia, Philippines)

- Latin America (Brazil, Argentina, Paraguay)

- Middle East and Africa (MEA) (South Africa, Sudan, various pilot programs)

Value Chain Analysis For Biotech seeds Market

The Value Chain of the Biotech seeds Market is characterized by extremely high levels of vertical integration, immense capital expenditure, and specialization, commencing with intensive upstream research and development, transitioning through complex, highly standardized seed production and processing, and ultimately culminating in tightly controlled and highly regulated distribution to the end-user farmers. Upstream activities are structurally dominated by large R&D firms and specialized academic institutions focusing on advanced genomics, bioinformatics, computational biology, and gene editing techniques to meticulously discover and validate novel genetic traits. This foundational phase requires substantial, long-term capital investment and the acquisition of proprietary intellectual property, serving as a massive financial and technical barrier to entry for smaller or less capitalized firms. The increasing integration of advanced computational tools, specifically AI and high-performance computing, into the R&D cycle is rapidly increasing the efficiency of trait discovery and reducing time-to-market, but also simultaneously escalating the initial investment cost required to maintain a competitive technological edge in this segment.

The midstream segment involves the meticulous and highly standardized processes of trait integration (introgression) into established, high-performing commercial germplasm lines, followed by the large-scale multiplication of the resulting foundation and commercial seeds. Seed production is typically geographically dispersed across multiple favorable climates to mitigate risk and optimize labor costs, but critically requires rigorous quality control, stringent traceability measures, and identity preservation protocols to ensure the absolute genetic purity and integrity of the patented biotech trait. Processing involves critical steps such as cleaning, highly technical treating (often incorporating complex chemical protectants or biological inoculants), and packaging the seeds under controlled conditions. Downstream analysis focuses heavily on targeted marketing, robust distribution logistics, and direct, high-touch farmer engagement. Due to the high value, technical complexity, and stringent regulatory requirements of the product, distribution channels are often controlled or managed directly by the primary seed developers, utilizing either proprietary sales networks or highly specialized, authorized distributors, ensuring accurate technical field support, consistent messaging, and strict regulatory adherence regarding usage guidelines.

Distribution channels in the biotech seed sector exhibit a strategic hybrid model, efficiently combining direct sales to the largest agricultural enterprises and corporate farms with indirect sales executed through an extensive network of local dealers, co-operatives, and trusted agricultural retailers that possess deep regional knowledge and established farmer relationships. Direct channels are absolutely crucial for managing complex, multi-year sales contracts, facilitating technology transfer, and providing integrated digital solutions (e.g., precision farming software access bundled with the seed purchase). Indirect channels are indispensable for leveraging established relationships between local retailers and fragmented customer bases, ensuring broad market reach, particularly important in geographically diverse or fragmented agricultural economies. Due to strict governmental requirements for managing genetically modified materials, the entire value chain is subject to extensive governmental and international regulatory oversight, impacting everything from the location of early field trials (upstream) to mandatory labeling and disposal requirements (downstream). This complex regulatory layer necessitates robust, end-to-end tracking systems and substantially limits the potential for unauthorized or gray market activities, forcing rigorous stewardship protocols across all participants.

Biotech seeds Market Potential Customers

The primary end-users and key commercial buyers of biotech seeds are large-scale commercial farmers, major agricultural holding companies, and expansive agricultural cooperatives operating predominantly in regions characterized by established modern farming infrastructure, such as North America, Latin America, and increasingly, technologically advanced parts of Asia Pacific. These core customers prioritize maximizing their yield per acre and simultaneously minimizing input risks associated with pests and weeds to maintain high competitive margins in the highly volatile global commodity markets. Their purchasing decisions are empirically driven, heavily influenced by proven historical performance data, integrated agronomic consulting services provided by the seed companies, and the demonstrated compatibility of the seeds with large-scale, automated mechanized farming practices and digital platforms. The fundamental economic justification for these farmers hinges on the superior profitability derived from measurable reductions in pesticide usage and substantially higher, more stable harvest yields, which successfully offsets the significantly higher initial cost of biotech seeds compared to traditional or conventional varieties.

A secondary, but strategically growing, customer segment includes smaller, resource-poor farmers, often operating on subsistence or semi-commercial scales, in developing nations, particularly those facing chronic and severe challenges from region-specific pests, pervasive diseases, or harsh environmental conditions like persistent drought. In these specific regions, the measured adoption of specific, government-approved biotech seeds (such as Bt cotton in India, drought-tolerant maize in Africa, or virus-resistant crops) is often strategically supported by targeted public-private partnerships, governmental subsidies, or international aid programs aimed at enhancing localized food security, improving rural livelihoods, and reducing endemic poverty. For this vital segment, the clear benefit derived from reliable, lower-risk production and significantly higher yields often profoundly outweighs the initial price sensitivities, especially when output substantially surpasses highly variable traditional production methods. The need for comprehensive educational support, robust localized training, and careful trait adaptation to local environmental conditions is absolutely paramount for successfully serving this diverse and fragile customer base, requiring tailored distribution and intensive agricultural extension services.

Furthermore, major downstream players such as large food processing conglomerates, industrial ethanol producers, and significant livestock feed manufacturers indirectly act as key stakeholders and powerful market influencers. Although these entities do not purchase the seeds directly, their specific procurement specifications and contractual requirements often dictate and reinforce the demand for specific biotech traits within the supply chain. For example, large-scale food manufacturers seeking specialized high-oleic oils for healthier food products drive targeted demand for biotech soybeans engineered for enhanced nutritional quality and stability. Similarly, the massive global livestock industry requires high-protein, easily digestible corn and feed products, reinforcing the market for high-yield, specific biotech feed grains. Therefore, successful long-term market penetration requires not only successfully convincing the grower (the direct buyer) but also aligning product development and trait specification with the strict quality and performance requirements of the processing and consumer industry sectors, effectively making the value chain demand-driven from the consumption side backward to the initial seed R&D phase.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 85.6 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer CropScience, Corteva Agriscience, Syngenta Group, BASF SE, KWS SAAT SE & Co. KGaA, Limagrain (Vilmorin & Cie), DLF Seeds, Land O’Lakes (Winfield United), Rallis India Ltd., Nuziveedu Seeds Ltd., Mahyco (Maharashtra Hybrid Seeds Company), Advanta Seeds (UPL Group), FMC Corporation, LongPing High-Tech, Stine Seed Company, AgReliant Genetics, Pioneer Hi-Bred, Sakata Seed Corporation, Beijing Genomics Institute (BGI), Cibus. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biotech seeds Market Key Technology Landscape

The technological foundation of the Biotech seeds Market is characterized by a rapid and continuous evolution, fundamentally moving beyond classical, labor-intensive transgenic technologies towards highly precise, efficient, and versatile gene editing techniques. The widespread adoption of advanced genome editing tools, preeminently the CRISPR/Cas9 system, represents the most significant and disruptive technological shift of the current decade. CRISPR offers unprecedented levels of precision and specificity in modifying plant DNA sequences, allowing for the rapid creation of non-transgenic crops (often scientifically termed 'cisgenic' or designated as 'SDN-1' crops) that may potentially face substantially less stringent regulatory scrutiny in certain jurisdictions compared to traditional, first-generation GMOs. This revolutionary precision enables researchers to meticulously fine-tune desirable traits like nutrient utilization efficiency, climate resilience, or systemic disease resistance without the necessity of introducing foreign DNA from unrelated species, significantly accelerating the research and development cycle from initial discovery to full commercialization, potentially cutting several critical years off traditional timelines.

Beyond the foundational gene editing breakthroughs, advancements in bioinformatics, high-performance computing, and highly automated high-throughput screening technologies are integral components of the modern market's technological landscape. High-throughput phenotyping (HTP)—the automated, non-destructive measurement of intricate plant characteristics utilizing sophisticated sensors, robotic platforms, drone technology, and advanced imaging technology—is capable of generating massive, complex datasets essential for training the highly predictive AI models discussed previously. These specialized technologies enable leading seed companies to simultaneously evaluate thousands of genetic variants and combinations under tightly controlled, simulated environmental stress conditions with unparalleled speed and accuracy. Furthermore, established molecular marker-assisted breeding (MAB) and genomic selection (GS) continue to be pivotal, complementary technologies, allowing breeders to efficiently track and select desired traits through successive generations far more effectively than relying solely on time-consuming visual field assessments, thereby ensuring the rapid and accurate introgression of advanced biotech traits into high-performing proprietary germplasm lines.

The contemporary technological landscape is also increasingly and intrinsically defined by the critical integration of these genetic innovations with advanced digital agriculture platforms. Modern biotech seeds are often commercially sold as part of an integrated, data-driven solution that encompasses proprietary data management systems, high-resolution satellite and aerial imagery analysis, and algorithmic recommendations delivered directly to the farmer (as comprehensively detailed in the AI impact analysis). These digital tools are essential for maximizing the intrinsic genetic performance of the seeds by optimizing planting density, irrigation schedules, and input application based on the seed's genetic potential and the dynamic environmental variability of the field. The development of advanced, specialized seed treatments, including biological coatings (e.g., beneficial microbial strains) and tailored chemical protectants, also crucially complements the core genetic modification, offering an additional, protective layer of performance enhancement and stability, thus collectively driving the market towards providing holistic, high-efficiency, and sustainable agricultural solutions rather than relying exclusively on singular genetic traits.

Regional Highlights

North America, particularly the highly advanced agricultural sector of the United States, holds the dominant and technologically mature share of the global Biotech seeds Market, primarily attributable to near-complete levels of adoption in major row crops (corn, soybeans, cotton) and a long-established, stable, and generally supportive regulatory environment guided by scientific consensus. The region profoundly benefits from large-scale, capital-intensive farm operations, highly advanced technological infrastructure, and massive, sustained investments in private-sector agricultural R&D, which continually push the boundaries of genetic innovation. Adoption rates for key biotech crops often consistently exceed 90%, firmly establishing this region as the global benchmark for rapid technological penetration and high commercial success. The strategic R&D focus here is increasingly on developing complex stacked traits (multiple resistance layers) and advanced quality traits (e.g., enhanced nutritional profiles), ensuring continued market leadership and high profitability per unit of land for the technologically proficient grower base.

Latin America, driven overwhelmingly by the colossal agricultural output of Brazil and Argentina, strategically represents the strongest engine for volume growth and market expansion within the global biotech seed industry. Highly favorable climatic conditions in these countries often allow for the feasibility of double or even triple harvests annually, significantly amplifying the economic returns and benefits derived from high-yield, protected seeds. Rapid governmental approval processes for locally relevant specific traits, coupled with relentless, expanding global demand for agricultural exports (predominantly soybeans and corn) to Asia, fuel exponential market expansion and adoption rates. The strategic R&D focus in this crucial region lies squarely on developing seeds adapted for challenging tropical and sub-tropical environments and robust, layered resistance to highly virulent endemic pests and diseases, ensuring reliable supply chains that are absolutely crucial for global commodity trading stability.

Asia Pacific (APAC) is characterized by immense potential driven by population size and food security needs, but the region faces widely varied and often restrictive regulatory landscapes. While countries like China and India are major cultivators of specific biotech crops (notably Bt cotton in India), the large-scale adoption of genetically modified food crops remains structurally constrained by cautious public policy and pervasive consumer acceptance challenges in many key national markets. However, the immense and inescapable demographic pressure of feeding rapidly growing populations, coupled with the strategic imperative to improve domestic agricultural self-sufficiency and resource utilization (especially water), is gradually pushing governments toward targeted, science-based adoption of demonstrably beneficial traits, particularly in foundational staple crops like rice and specialty crops. The region's future market growth hinges critically on overcoming regulatory inertia, achieving international trade harmonization, and successful public engagement to convincingly demonstrate the clear, localized benefits of modern biotech products, specifically those offering enhanced nutrition or essential climate resilience characteristics.

- North America (Dominant Market): Characterized by high market saturation of corn, soybeans, and cotton; strategic R&D emphasis is on next-generation stacked traits, climate resilience, and full integration with digital precision agriculture.

- Latin America (Fastest Growing): Driven by extensive commercial cultivation of soybeans and corn in Brazil and Argentina; strong international export demand fuels rapid, volume-based adoption of high-yield and disease-resistant varieties.

- Asia Pacific (High Potential): Significant long-term opportunity exists in staple crops like rice, oilseeds, and specialty crops; overall growth is constrained by complex, non-harmonized regulatory frameworks and requires highly localized trait development.

- Europe (Highly Restrained): Minimal commercial cultivation of biotech food crops due to extremely strict regulatory hurdles and high consumer resistance; the market is fundamentally limited largely to imported biotech feedstuffs and advanced non-GM seed breeding technologies.

- Middle East and Africa (Emerging Adoption): Growing, but targeted, acceptance of drought-tolerant and key insect-resistant crops to directly address chronic local food security and water scarcity issues; adoption often relies heavily on international development programs and tailored technology transfer initiatives for specific regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biotech seeds Market.- Bayer CropScience (Acquirer of Monsanto and leading developer of HT and IR traits)

- Corteva Agriscience (Result of the merger between DuPont Pioneer and Dow Agrosciences)

- Syngenta Group (Major player in seeds and crop protection, owned by ChemChina/Sinochem)

- BASF SE (Focusing on functional genomics and chemical crop solutions)

- KWS SAAT SE & Co. KGaA (Strong focus on corn, sugar beet, and specialty grains)

- Limagrain (Vilmorin & Cie) (French cooperative, prominent in vegetable and field seeds)

- DLF Seeds (Global leader in forage and turf seeds, utilizing advanced breeding)

- Land O’Lakes (Winfield United) (Major agricultural cooperative and seed distributor)

- Rallis India Ltd. (Subsidiary of Tata Chemicals, significant presence in Indian market)

- Nuziveedu Seeds Ltd. (Key domestic player in India, focusing on cotton and rice)

- Mahyco (Maharashtra Hybrid Seeds Company) (Pioneering Bt cotton in India)

- Advanta Seeds (UPL Group) (Global player focusing on sorghum, sunflower, and vegetable seeds)

- FMC Corporation (Focusing on complementary crop protection solutions)

- LongPing High-Tech (Chinese seed company specializing in rice and corn)

- Stine Seed Company (Large independent seed company in the U.S.)

- AgReliant Genetics (Top corn and soybean seed provider in North America)

- Pioneer Hi-Bred (A specialized, high-performing brand under Corteva Agriscience)

- Sakata Seed Corporation (Japanese company, strong in vegetable and flower seeds)

- Beijing Genomics Institute (BGI) (Major player in genetic sequencing and bioinformatics)

- Cibus (Leading firm utilizing gene-editing technology for trait development)

Frequently Asked Questions

Analyze common user questions about the Biotech seeds market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of projected market growth for the Biotech seeds Market through 2033?

The primary drivers include the necessity to enhance global food security amid a rising population, the critical need for sustainable agricultural practices reducing environmental impact, and accelerated trait innovation achieved through advanced technologies like CRISPR gene editing and other New Breeding Techniques. These factors compel large-scale commercial farmers to adopt high-yield, technologically protected seed varieties.

How is Artificial Intelligence (AI) specifically transforming the research and development (R&D) cycle for new biotech traits?

AI significantly accelerates the R&D cycle by utilizing sophisticated machine learning and bioinformatics to analyze massive genomic datasets, accurately predict the performance of genetic combinations, and optimize high-throughput phenotyping processes. This dramatically speeds up trait validation and reduces reliance on expensive, multi-year traditional field trials.

Which geographic regions exhibit the current highest adoption rates and which are expected to drive future growth?

North America (U.S.) maintains the highest adoption saturation rates, driven by extensive use of corn and soybean stacked traits. Latin America (Brazil and Argentina) is the fastest-growing market by volume, while Asia Pacific, driven by food security imperatives, is expected to provide the largest volume opportunity for future growth.

What is the key technological difference between traditional transgenic biotech seeds and those developed using CRISPR/Cas9?

Traditional transgenic seeds introduce exogenous DNA (foreign DNA) from a different species into the plant genome. In contrast, CRISPR (a gene-editing tool) allows for highly precise modifications or edits within the plant’s existing genome, often resulting in products that do not contain foreign DNA and may therefore be classified differently by regulatory bodies (NBTs).

What are 'Stacked Traits' and why are they becoming the predominant product type in the commercial market?

Stacked Traits refer to biotech seeds engineered to possess multiple distinct genetic modifications simultaneously, such as combining herbicide tolerance with various insect resistance mechanisms, within the same plant. They are dominant because they offer comprehensive, multi-layered protection against a wide range of threats, maximizing yield stability and streamlining complex crop management for global farmers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager