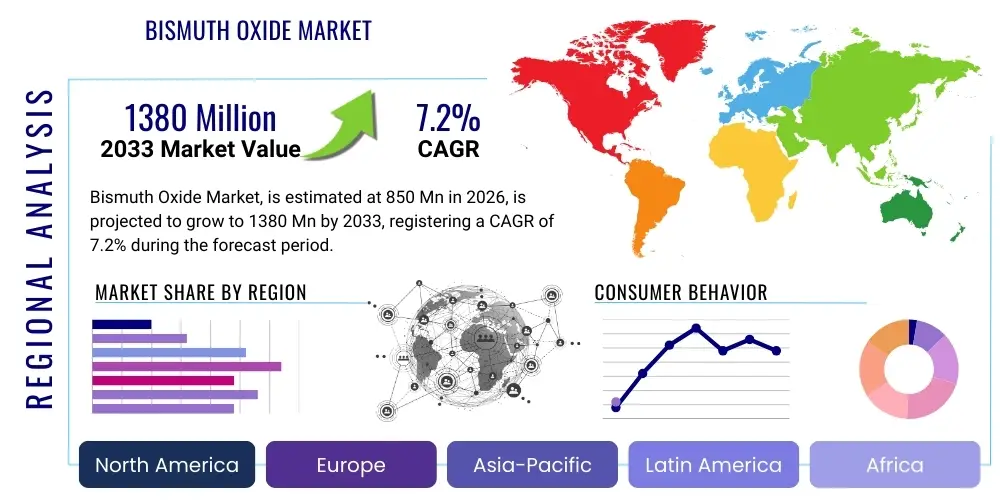

Bismuth Oxide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442735 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Bismuth Oxide Market Size

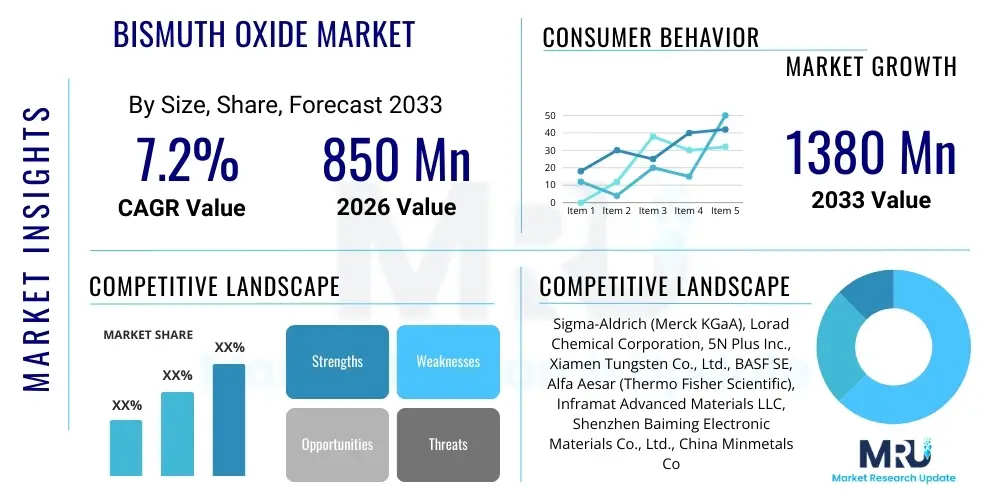

The Bismuth Oxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1380 Million by the end of the forecast period in 2033.

Bismuth Oxide Market introduction

Bismuth oxide (Bi2O3) is a crucial inorganic compound characterized by its high density, unique electrical properties, and relatively low toxicity compared to other heavy metal oxides, making it a highly valued industrial material. This versatile compound serves as an indispensable raw material utilized extensively across several high-growth industries, including advanced ceramics manufacturing, electronics component production, specialized optical glass fabrication, and pharmaceutical precursors. Its distinctive crystalline structure and physical properties, such as an excellent dielectric constant, low melting temperature for fluxing, and promising piezoelectric capabilities, make it essential in modern technological applications, particularly in the fabrication of zinc oxide varistors, thermal fuses for circuit protection, and specialized superconducting ceramics where material purity is paramount.

The market encompasses diverse product grades, ranging from technical quality material used in glazes and general chemical applications to ultra-high purity grades (99.99% and above) tailored to meet the exacting standards of the semiconductor and medical imaging industries. High-purity bismuth oxide is critical for advanced applications such as optical coatings, gamma-ray scintillators used in security and healthcare, and as a stable precursor in certain pharmaceutical formulations due to its lower toxicity profile. Its primary role in the electronics sector involves enhancing the chemical stability and sintering performance of multilayer ceramic capacitors (MLCCs) and improving the nonlinear characteristics of surge protection devices, directly supporting the global trend toward component miniaturization and enhanced device reliability.

The market expansion is fundamentally driven by two core benefits: the compound's superior thermal stability under various operational conditions and its non-toxic nature, which allows it to successfully substitute environmentally restricted lead compounds in numerous industrial processes, including specialized solders and protective coatings. Key market drivers include the rapid, sustained growth in the consumer electronics market, necessitating high volumes of high-performance, stable passive components, and the increasingly stringent global environmental regulations, such as RoHS and REACH, that actively promote the adoption of lead-free alternatives. Additionally, the burgeoning photovoltaic industry is exploring the use of bismuth oxide in novel thin-film solar cell architectures, further diversifying and securing its long-term market position within sustainable energy technology solutions.

Bismuth Oxide Market Executive Summary

The Bismuth Oxide market is poised for robust expansion, fundamentally propelled by aggressive technological advancements in electronic materials science and the overarching industrial migration toward globally recognized green chemistry practices. Current business trends emphatically point toward strategic capacity augmentation, predominantly concentrated within the Asia Pacific region, capitalizing on its entrenched position as the world's primary manufacturing nucleus for sophisticated electronics, advanced ceramics, and automotive components. Market participants are increasingly engaging in vertical integration and forming strategic collaborative alliances between specialized raw material refiners and high-tech component manufacturers to ensure a consistent, secure supply of ultra-high-purity inputs, thereby maximizing supply chain operational efficiency and mitigating geopolitical supply risks associated with the base metal bismuth.

An analysis of regional trends confirms the unequivocal market dominance of the Asia Pacific, whose leadership is anchored by immense manufacturing outputs from key economies including China, Japan, and South Korea, which collectively represent the largest global consumer base for semiconductors, advanced battery components, and technical ceramics. Conversely, North America and European markets exhibit characteristics of maturity and high-value specialization, marked by substantial institutional investment in research and development activities focused specifically on leveraging bismuth oxide in high-end applications, such as specialized pharmaceutical intermediates, sophisticated nuclear shielding materials, and high-specification sensor technologies, thus demanding materials of exceptional purity and traceability. The developing markets of Latin America and the Middle East & Africa are registering measurable increases in consumption, primarily driven by localized industrial expansion in areas like architectural paints, protective coatings, and foundational chemical additive production, aligning with regional infrastructure and industrial maturation initiatives.

Segment-specific trends highlight the exceptional growth trajectory of the electronic grade Bismuth Oxide segment, a growth directly correlated with the global rollout and mass deployment of 5G telecommunication infrastructure, the accelerated adoption of electric vehicles (EVs), and the proliferation of internet-of-things (IoT) devices, all of which mandate the use of stable, high-performance passive components. Within the application matrix, the established ceramics and glass segment maintains its foundational importance, buoyed by consistent demand from the construction material industry and the increasing need for specialized technical glass used in display technology and medical instruments. Examination by purity type demonstrates that high-purity bismuth oxide (≥99.99%) commands a significant price premium and is experiencing a measurably faster rate of value appreciation compared to standard technical grades, reflecting the intensifying stringency of material specifications across performance-critical, regulated industries globally.

AI Impact Analysis on Bismuth Oxide Market

Analysis of common user questions reveals a central theme regarding AI's utility in transcending current material science limitations, specifically focusing on optimizing the complex synthesis pathways of Bismuth Oxide, accurately predicting potential supply chain bottlenecks, and significantly accelerating the discovery timeline for novel functional applications. Key concerns frequently raised relate to the deployment of Machine Learning (ML) models to precisely predict optimal sintering profiles, crystalline phase stability, and specific composition ratios within complex bismuth oxide-based ceramic systems, which fundamentally reduces resource-intensive experimental trial cycles and minimizes material waste in high-volume production. User expectations are strongly centered on AI functioning as an advanced precision tool capable of dramatically elevating manufacturing yield consistency, reliability, and precision, particularly in the production of highly sensitive electronic components that rely intrinsically on meticulously controlled bismuth oxide doping and morphology.

Sophisticated AI algorithms and computational material science techniques are now being actively employed to conduct large-scale analysis of intricate crystallographic and spectroscopic data associated with various bismuth oxide compounds and their alloys. This capability allows researchers to computationally predict and model the emergence of novel functional properties—such as enhanced ionic conductivity or superior photocatalytic efficiency—when Bi2O3 is integrated with other elements, thereby substantially streamlining and de-risking the entire material research and development continuum. For example, AI modeling is crucial for simulating the long-term thermal and electrochemical stability of bismuth oxide in challenging operational environments, which is essential for its successful incorporation into advanced solid oxide fuel cells (SOFCs), high-temperature superconductors, and specialized thermal barrier coatings in aerospace applications.

The integration of deep learning and big data analytics capabilities is fundamentally revolutionizing inventory planning, procurement strategies, and accurate demand forecasting across the Bismuth Oxide supply chain. Recognizing that bismuth metal's production is often inelastic and tied to the output cycles of primary metals like lead and copper, AI systems offer a crucial solution by synthesizing real-time data spanning global mining yields, complex refinement schedules, logistics constraints, and relevant geopolitical risk indicators. This predictive modeling provides Bismuth Oxide manufacturers with essential foresight for optimizing high-cost precursor procurement, hedging against potential commodity price volatility, and ultimately enhancing the overall financial stability and operational resilience of the entire bismuth oxide procurement and production ecosystem, transitioning from reactive management to predictive strategic planning.

- AI-driven optimization of synthesis parameters (including temperature gradients, precursor concentrations, and flow rates) for maximizing yield and homogeneity of ultra-high-purity Bi2O3.

- Deployment of Machine Learning models to accurately predict complex performance characteristics, service life, and degradation rates of bismuth oxide incorporated into advanced ceramic and electronic matrices.

- Implementation of advanced quality control and high-speed defect detection systems utilizing computer vision and spectral analysis in the rigorous inspection of high-volume semiconductor components.

- Utilization of predictive supply chain analytics platforms for managing and mitigating the inherent market volatility associated with global sourcing of primary bismuth metal inputs.

- Acceleration of novel material discovery for high-potential applications, such as room-temperature superconductors, highly efficient photocatalysts, and solid electrolytes, leveraging generative AI computational modeling.

- Automation and interpretation of complex spectroscopic, thermal, and electrical analytical testing procedures, leading to increased laboratory throughput and highly accurate data generation essential for qualification.

DRO & Impact Forces Of Bismuth Oxide Market

The operational dynamics of the Bismuth Oxide market are meticulously governed by a powerful convergence of factors, notably strong regulatory drivers compelling industrial transformation and continuous technological advancements, which actively counter inherent supply-side rigidities and the pressures of market competition. The singular most potent driver continues to be the overwhelming global legislative mandate across multiple jurisdictions advocating for the comprehensive substitution of lead in all non-essential industrial and consumer applications, spanning from soldering materials and specialized plumbing components to industrial pigments, where Bismuth Oxide offers a technically superior, environmentally compliant, and biologically safer alternative. Concurrently, the unyielding industrial requirement for miniaturization across the entire electronics manufacturing landscape perpetually increases the demand for high-K dielectric materials like Bi2O3, guaranteeing a robust and expanding order book from manufacturers of critical passive electronic components globally.

The primary restraints severely affecting market stability are predominantly rooted in the supply chain vulnerabilities linked to the sourcing of raw bismuth metal. Bismuth is fundamentally classified as a co-product, mainly recovered from the refining of primary metals such as lead, copper, and tungsten, resulting in an inherently inelastic supply structure. This dependence means that bismuth supply cannot be rapidly scaled up independently of the demand for the major base metals, leading to cyclical price volatility and potential supply shortages during periods of intense Bismuth Oxide demand. Furthermore, the specialized and energy-intensive manufacturing processes required to produce ultra-high purity grades of Bismuth Oxide, which are mandatory for sensitive electronic and optical uses, impose a substantial cost burden that restricts immediate mass adoption in highly price-sensitive industrial sectors, requiring specialized capital investment and technological expertise.

Significant strategic opportunities exist for pronounced market expansion, particularly within revolutionary emerging fields such as advanced energy storage solutions, including specialized bismuth oxide-based solid-state battery electrolytes and high-density supercapacitors, alongside its potential application in advanced medical imaging and specialized pharmaceutical delivery systems. Crucially, the development of economically viable and robust recycling infrastructure focused on recovering bismuth oxide from high-volume electronic waste streams (WEEE) presents a dual opportunity: stabilizing the long-term supply base and substantially improving the overall sustainability metrics of the industry, contributing decisively to circular economy objectives. The current momentum analysis confirms that the high-impact generative drivers (regulatory mandates and electronic demand surges) are decisively overwhelming the medium-impact structural restraints (supply volatility and high processing costs), thus projecting a strong, positive growth trajectory for the Bismuth Oxide market throughout the forecast period.

- Drivers: Accelerated global implementation of lead substitution mandates; massive capacity expansion in the consumer electronics, 5G infrastructure, and EV markets; inherent superior non-toxic properties of Bi2O3 compared to traditional heavy metal compounds.

- Restraints: Structural volatility and potential scarcity in the upstream supply chain due to bismuth metal's status as a mining co-product; significantly elevated capital and operational costs associated with achieving and maintaining ultra-high material purity specifications; persistent, though manageable, competitive pressures from technologically mature alternative metal oxides in less critical applications.

- Opportunities: Major expansion potential in cutting-edge energy storage technologies (batteries and supercapacitors); increasing utilization in specialized radiation shielding materials for advanced medical and defense applications; rapidly increasing adoption as a high-efficiency photocatalyst and chemical precursor in environmental remediation.

- Impact Forces: High cumulative impact derived from favorable regulatory and dominant electronic demand sectors; Medium sustained negative impact exerted by predictable supply limitations and associated elevated pricing pressures for high-purity inputs.

Segmentation Analysis

Segmentation analysis of the Bismuth Oxide market furnishes crucial, granular insights into the diverse requirements of specific industrial applications and the rigorous technological specifications demanded by end-users, meticulously classifying the market based on achievable purity levels, primary application sectors, and distinct end-use industry characteristics. The distinction based on purity is fundamental and serves as the primary value determinant; ultra-high purity material (e.g., 99.999%) is mandatory for use in advanced electronic components, specialized optical coatings, and sensitive medical applications, while the lower-cost technical grade material is sufficient for high-volume, general industrial uses such as glazes, protective coatings, and certain chemical processes. An accurate understanding of this segmented demand structure is essential for all market participants seeking to optimize production portfolios, pricing strategies, and distribution channels efficiently.

The application-based segmentation clearly identifies the electronics and advanced ceramics industries as the foundational pillars of the market, collectively accounting for the largest proportion of total Bismuth Oxide volume consumption. This substantial consumption is driven by the compound's multifaceted functional roles, including acting as an effective fluxing agent to lower ceramic sintering temperatures, a stabilizing additive to prevent material degradation, and a critical component providing essential dielectric and nonlinear resistive properties in high-frequency components. The electronics segment, specifically focusing on components like multilayer ceramic capacitors (MLCCs) and zinc oxide varistors, is projected to demonstrate the most aggressive growth rate, a trajectory directly reflecting global investment in next-generation IT infrastructure, automotive electronics, and the IoT ecosystem.

Geographic segmentation is equally paramount, revealing the entrenched manufacturing dominance of Asia Pacific, which dictates the global equilibrium of supply and demand, contrasting sharply with the North American and European markets. These latter regions specialize almost exclusively in high-value, research-intensive, and regulatory-driven applications, consuming fewer metric tons but commanding significantly higher average selling prices due to stringent quality control requirements. Effective global market strategy formulation must meticulously account for these stark regional divergences, ensuring that product manufacturing specifications, certification procedures, and targeted distribution methodologies are precisely aligned with the local industrial ecosystem complexities, specific regulatory compliance mandates, and inherent price sensitivities of each distinct geographical market cluster.

- By Purity:

- High Purity Bismuth Oxide (99.99% and above)

- Technical Grade Bismuth Oxide (99% - 99.9%)

- By Application:

- Electronics (Varistors, Thermal Fuses, Dielectrics in MLCCs)

- Ceramics and Glass (Specialized Glazes, Frits, Fluxing Agent for Low-Temperature Firing)

- Chemical and Catalysis (Precursors for Pharmaceutical Intermediates, Synthesis Catalysts)

- Pigments and Coatings (Non-toxic Yellow Pigments, Anti-Corrosion Additives)

- Others (Medical devices shielding, Nuclear applications, Specialized radiation detection scintillator materials)

- By End-Use Industry:

- Consumer Electronics and Telecommunications

- Automotive (Electric Vehicle Components and Sensors)

- Building and Construction (Paints, Glazes, and Materials)

- Healthcare and Pharmaceuticals (Diagnostics and Therapeutics)

- Aerospace and Defense (Specialized Components and Shielding)

Value Chain Analysis For Bismuth Oxide Market

The Bismuth Oxide value chain commences critically at the upstream stage, involving the global mining, recovery, and initial refining of raw bismuth metal, which is predominantly sourced as a co-product from the smelting and refining operations focused on major base metals such as lead, copper, tin, and occasionally tungsten. Key upstream processes involve the initial separation of the bismuth concentrate from the primary metal stream, followed by intensive, highly technical purification steps, frequently employing advanced hydrometallurgical or specialized pyrometallurgical techniques to attain the required base metal purity. The inherent efficiency and cost structure of this upstream segment are inextricably linked to the unpredictable global production cycles of the primary base metals, coupled with strict regulatory oversight concerning the processing of heavy metal residues, collectively introducing a core element of supply instability and price sensitivity across the entire subsequent value chain.

The midstream sector is defined by the complex chemical transformation of purified bismuth metal into various grades and morphologies of Bismuth Oxide (Bi2O3) powder, typically executed through controlled oxidation processes such as chemical precipitation, calcination, or specialized thermal decomposition methods utilizing nitrates or carbonates as precursors. Highly specialized manufacturers operating in this segment dedicate significant resources to precisely controlling the critical material characteristics, including the final particle size distribution (PSD), overall morphology, surface area, and crystalline structure—all of which are paramount performance determinants, particularly for high-frequency electronic and advanced ceramic applications. Distribution within the midstream is bifurcated: large-volume industrial end-users (e.g., major ceramic or electronics manufacturers) often secure inputs via direct, long-term supply contracts, while smaller, more geographically dispersed industrial consumers rely on established, specialized chemical distributors and regional material trading houses. This dual distribution model ensures both high-volume efficiency and widespread market accessibility.

The downstream segment represents the final value addition stages where Bismuth Oxide is integrated into finished, functional products. Direct engagement with suppliers is vital for high-tech, specialized users like semiconductor fabricators and advanced materials R&D firms, demanding unparalleled quality control and traceability. The indirect distribution channel primarily serves general industrial applications, including the formulators of specialized pigments, industrial protective coatings, and non-critical ceramic additives. Key downstream activities include the precision compounding of bismuth oxide with other materials to produce high-performance components such as zinc oxide varistors essential for electrical surge protection, or its incorporation into specialized optical glass melts to achieve desired indices of refraction and superior radiation shielding capabilities. The highest economic value is typically realized at this downstream integration stage, where the material's unique properties are leveraged in high-specification, high-margin technological solutions.

Bismuth Oxide Market Potential Customers

Potential customers for Bismuth Oxide are strategically concentrated within industries that demand material inputs offering crucial functionalities such as non-toxicity, superior dielectric performance, and high thermal endurance in their operational components. The most significant primary buyer segments include high-precision manufacturers of passive electronic devices, especially those engaged in the large-scale production of multilayer ceramic capacitors (MLCCs), specialized thermal fuses designed for high-reliability circuit protection, and zinc oxide varistors, which are foundational components essential for managing voltage spikes in consumer electronics, automotive systems, and critical electrical grid infrastructure. These technically demanding customers place an overriding purchasing emphasis on the consistent supply of ultra-high purity material, verified morphological consistency, and validated supplier certifications, often making long-term reliability and compliance far more important than marginal cost differences.

A second substantial customer demographic encompasses manufacturers in the technical ceramics and specialized optical glass sectors. These end-users utilize Bismuth Oxide for its excellent properties as a fluxing agent, enabling lower processing temperatures and reducing energy costs during sintering, as well as its functional role as a specialized yellow or green pigment additive. Furthermore, in the specialized glass market, Bi2O3 is indispensable as an additive to engineer high refractive index glass for advanced optics and to provide efficient, non-lead radiation shielding properties required in high-security environments, medical X-ray apparatus, and nuclear energy applications. Demand from these customers, while intrinsically linked to cyclical large-scale infrastructure and construction projects, maintains high quality control standards regarding trace element contamination, which is critical for optical clarity and radiation absorption effectiveness.

The chemical manufacturing and pharmaceutical processing industries represent a rapidly expanding, high-value customer base. In the chemical sector, Bismuth Oxide is valued as a versatile catalyst or critical precursor material used in the synthesis of complex organic intermediates and in advanced formulations designed for large-scale environmental remediation processes, such as water purification. Within pharmaceuticals, the material, typically converted into highly refined salts like bismuth subgallate or subsalicylate, acts as a raw material for specific anti-diarrheal and gastrointestinal therapeutic agents. These buyers operate under extremely strict regulatory regimes, requiring rigorous compliance with current Good Manufacturing Practices (cGMP) and ISO standards, along with complete, transparent material traceability. For these highly regulated buyers, stringent quality assurance is the paramount consideration, often outweighing cost concerns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1380 Million |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sigma-Aldrich (Merck KGaA), Lorad Chemical Corporation, 5N Plus Inc., Xiamen Tungsten Co., Ltd., BASF SE, Alfa Aesar (Thermo Fisher Scientific), Inframat Advanced Materials LLC, Shenzhen Baiming Electronic Materials Co., Ltd., China Minmetals Corporation, Dowa Metals & Mining Co., Ltd., American Elements, Central Glass Co., Ltd., Hunan Jinwang Bismuth Industrial Co., Ltd., Noah Technologies Corporation, Indium Corporation, Umicore N.V., Tejing Co., Ltd., Ganzhou Rare Earth & Non-ferrous Metals, Shanghai Metal Corporation, Guizhou Hongyida Bismuth Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bismuth Oxide Market Key Technology Landscape

The technological landscape driving innovation in the Bismuth Oxide market is fundamentally focused on pioneering new synthesis methodologies engineered to achieve unprecedented levels of ultra-high purity, precise control over the particle size distribution (PSD), and the development of sophisticated, tailor-made nano-structured forms capable of enhancing specific functional performance metrics. Conventional synthesis techniques, often relying on chemical precipitation or straightforward thermal decomposition of precursors like bismuth nitrate or carbonate, are progressively being supplemented or replaced by advanced methods. Contemporary innovations heavily favor controlled solution-based techniques, such as hydrothermal synthesis, solvothermal processing, and sol-gel methods, which provide substantially superior control over crystallographic phase purity, particle morphology, and size uniformity, all while potentially reducing the energy intensity and waste generation associated with the production of high-K dielectric materials.

A significant proportion of technological research and capital investment is currently allocated to optimizing the integration of bismuth oxide into complex electronic component fabrication, specifically concerning its application in the formulation of high-performance low-temperature co-fired ceramics (LTCC) and highly reliable zinc oxide varistor compositions. Manufacturers are strategically investing in advanced material handling and mixing technologies that facilitate the ultra-precise doping of bismuth oxide into ceramic base materials. This is critical for finely tuning the electrical properties, such as voltage dependency and the non-linear coefficient, which are crucial for ensuring efficient, rapid surge suppression in demanding applications like power electronics, industrial control systems, and critical automotive safety electronics. Furthermore, the development and standardization of high-purity thin-film deposition precursors and specialized sputtering targets utilizing bismuth oxide are rapidly gaining prominence for advanced optical coating applications and the formation of solid-state battery electrolyte layers.

The projected future technological trajectory is concentrated on scaling up the utilization of advanced nanotechnology to create highly stable, uniformly dispersed bismuth oxide nanoparticles and quantum dots, aiming to substantially enhance their performance in diverse fields such as heterogeneous catalysis, targeted drug delivery systems, and next-generation photovoltaic cells requiring optimized light harvesting. Intensive research efforts are also underway globally regarding the application of defect-engineered bismuth oxide materials as high-performance solid electrolytes for all-solid-state batteries, capitalizing on their relative ionic conductivity at moderate operating temperatures, offering a safer and more durable energy storage solution. Sustained and critical investment in continuous process improvement within purification technologies, including advanced physical separation techniques, chemical vapor deposition (CVD) methods, and zone refining, remains absolutely essential to consistently meet and exceed the extremely stringent material quality standards demanded by the most technologically sensitive, high-reliability sectors, notably aerospace electronics and high-frequency communication devices.

Regional Highlights

Regional dynamics exert a profoundly influential role in shaping the global Bismuth Oxide market, driven by distinct local variations in industrial concentration, established regulatory frameworks, and specialized technological expertise across different continents. Asia Pacific stands firmly established as the overwhelmingly dominant market, characterized by its immense production capacity and unparalleled consumption volume. This market leadership is fundamentally driven by the region's concentration of global, high-volume manufacturing centers dedicated to consumer electronics, advanced automotive components (especially electric vehicles), and large-scale technical ceramic fabrication, with key output hubs located in China, South Korea, and Japan. The persistent and aggressive regional push toward infrastructural modernization, the deployment of 5G networks, and the rapid expansion of EV supply chains collectively ensure APAC's leading market share and trajectory for the foreseeable future.

In contrast, North America and Europe represent highly mature, high-value market segments that prioritize the consumption of premium, ultra-high purity grades of Bi2O3. Demand in these regions is concentrated in specialized, high-reliability sectors such as national defense and aerospace component manufacturing, sophisticated medical diagnostics (utilizing bismuth oxide in scintillation crystals and advanced X-ray shielding), and cutting-edge academic research applications. Regulatory environments across the EU (e.g., REACH) and North America strictly enforce and strongly incentivize the substitution of traditional lead-containing materials, creating a constant, foundational demand driver for certified lead-free bismuth oxide solutions in specialized solders, industrial protective coatings, and environmental monitoring equipment. While the total volume consumed is lower than in APAC, the achieved value realization and associated profit margins per unit of high-purity bismuth oxide are significantly higher, reflecting the demanding quality specifications.

Latin America (LATAM) and the Middle East & Africa (MEA) are recognized as burgeoning, emerging markets that are exhibiting incremental but steady growth in Bismuth Oxide consumption. Demand in these regions is currently focused mainly on fundamental industrial applications, including its incorporation as a pigment in decorative and structural construction materials, specialized high-performance protective coatings for energy infrastructure, and as essential chemical additives in localized industrial manufacturing. Economic diversification initiatives and large-scale infrastructure investment programs, particularly across the Gulf Cooperation Council (GCC) countries in the Middle East, are expected to significantly boost regional demand for technical-grade Bismuth Oxide over the next decade, simultaneously promoting the necessary development of localized downstream manufacturing and formulation capabilities to reduce reliance on imports.

- Asia Pacific (APAC): Dominates both global supply and consumption, driven overwhelmingly by high-volume electronics manufacturing and expansive automotive and infrastructure construction in key markets (China, South Korea); focus is on cost-effective, high-throughput production.

- North America: Characterized by extremely high demand for specialized, ultra-high purity Bi2O3 for strategic applications in defense, aerospace, and advanced medical imaging; market growth is closely tied to rigorous R&D investment and compliance with stringent lead-free mandates.

- Europe: Strong, stable market significantly influenced by strict EU regulations (REACH) driving mandated lead substitution; major consumption areas include specialized technical glass, high-end automotive electronics, and strategic investment in sustainable, green chemistry solutions.

- Latin America (LATAM): A developing market demonstrating steady consumption growth primarily in construction chemicals, industrial paints, and regionalized electronics assembly operations; overall market maturity is dependent on consistent domestic industrialization and economic stability.

- Middle East and Africa (MEA): Emerging growth centered on robust industrial coatings, pigment formulation for new urban projects, and expansion of regional chemical processing capabilities; slow but certain transition towards adoption of higher-specification materials driven by international standards compliance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bismuth Oxide Market.- 5N Plus Inc.

- Xiamen Tungsten Co., Ltd.

- Sigma-Aldrich (Merck KGaA)

- Lorad Chemical Corporation

- BASF SE

- Alfa Aesar (Thermo Fisher Scientific)

- Inframat Advanced Materials LLC

- Shenzhen Baiming Electronic Materials Co., Ltd.

- China Minmetals Corporation

- Dowa Metals & Mining Co., Ltd.

- American Elements

- Central Glass Co., Ltd.

- Hunan Jinwang Bismuth Industrial Co., Ltd.

- Noah Technologies Corporation

- Indium Corporation

- Umicore N.V.

- Tejing Co., Ltd.

- Ganzhou Rare Earth & Non-ferrous Metals

- Shanghai Metal Corporation

- Guizhou Hongyida Bismuth Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Bismuth Oxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers propelling the growth of the Bismuth Oxide Market?

The primary drivers include global regulatory mandates favoring the substitution of toxic lead compounds in numerous industrial applications, coupled with the escalating demand from the dynamic consumer electronics sector for stable, high-performance dielectric materials essential for miniaturized components like varistors and MLCCs.

How is Bismuth Oxide segmented by purity, and why is this critical?

Bismuth Oxide is fundamentally segmented into Ultra-High Purity (99.99% and above) and Technical Grade. Purity is critical because ultra-high purity grades are mandatory for sensitive electronic, optical, and pharmaceutical applications where trace impurities significantly compromise functional performance, reliability, and stringent regulatory compliance.

Which geographical region dominates the Bismuth Oxide Market consumption?

The Asia Pacific (APAC) region fundamentally dominates the consumption of Bismuth Oxide, primarily driven by the massive concentration of global manufacturing bases for consumer electronics, semiconductors, and specialized technical ceramics located in major industrial nations like China, South Korea, and Japan.

What is the main restraint impacting the supply chain stability of Bismuth Oxide?

The main restraint is the inherent supply volatility of precursor bismuth metal, which is primarily obtained as a co-product of lead and copper refining. This co-product status results in an inelastic supply, meaning bismuth output cannot be flexibly adjusted to meet independent demand spikes, leading to periodic market price fluctuations.

Beyond electronics, what emerging opportunities exist for Bismuth Oxide?

Emerging opportunities are substantial in the advanced energy sector, specifically through the development of Bismuth Oxide-based solid electrolytes for next-generation solid-state batteries and high-density supercapacitors, alongside its expanding role in high-efficiency photocatalysis for environmental applications and specialized, non-lead radiation shielding.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager