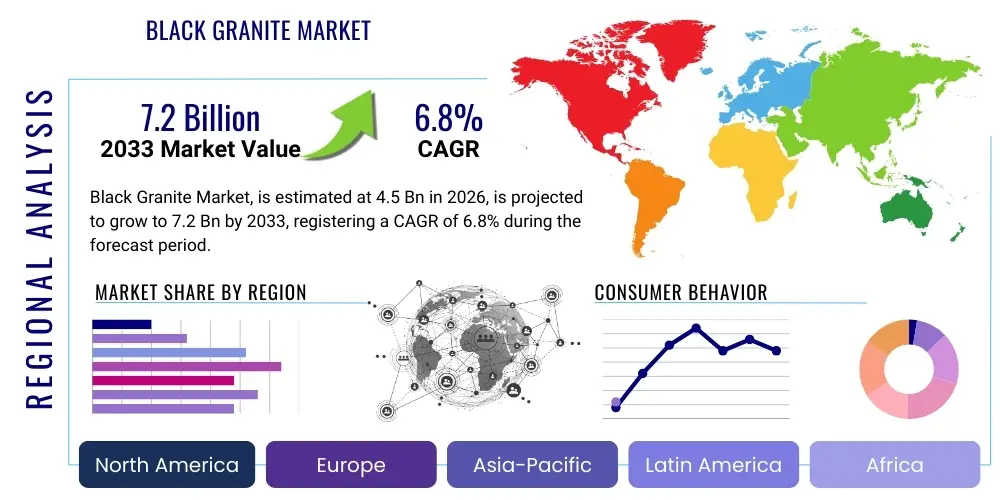

Black Granite Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442879 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Black Granite Market Size

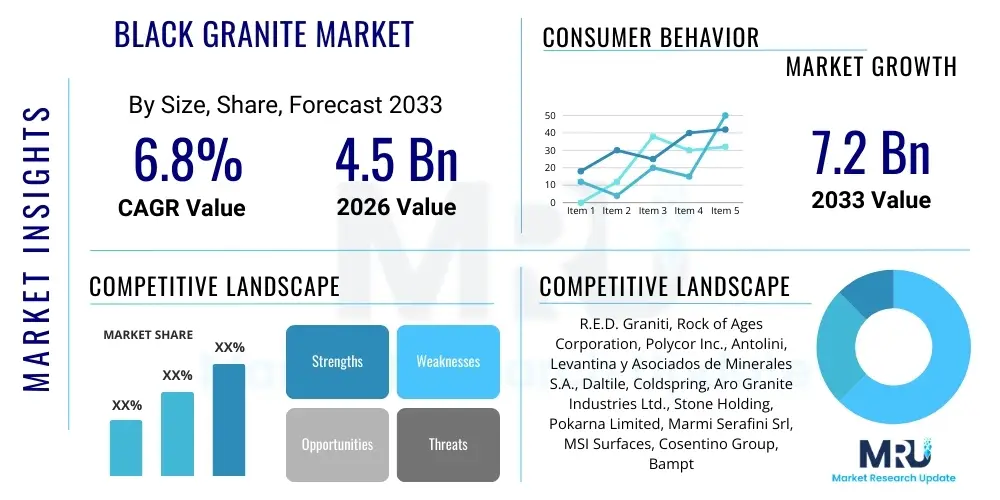

The Black Granite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.2 billion by the end of the forecast period in 2033.

Black Granite Market introduction

The Black Granite Market encompasses the global trade of igneous rock characterized by its deep, uniform black coloring, high density, and exceptional durability. This material is widely recognized for its aesthetic superiority and structural integrity, making it a premium choice in the construction and architecture sectors. Major applications include high-end residential and commercial countertops, luxury flooring, exterior cladding, and commemorative monuments. The primary benefit of black granite lies in its resistance to scratches, heat, and moisture, coupled with a timeless visual appeal that enhances property value. Key driving factors propelling market expansion include rapid urbanization in developing economies, increased consumer preference for natural, sustainable building materials, and rising investment in infrastructure development projects globally, particularly in Asia Pacific and the Middle East.

Black Granite Market Executive Summary

The Black Granite Market is experiencing robust expansion driven by favorable macro-economic conditions and evolving design trends emphasizing minimalism and natural stone aesthetics. Current business trends indicate a critical shift toward automated quarrying and processing techniques aimed at minimizing waste and increasing yield efficiency, thereby addressing supply chain consistency challenges. Regionally, Asia Pacific dominates the market due to expansive construction activities in China and India, although North America and Europe maintain significant value shares driven by high-margin luxury applications. Segment trends show that the countertop segment remains the largest consumer, benefiting from high renovation rates, while the demand for specialized finishes, such as leathered and honed black granite, is accelerating across residential and commercial sectors, signaling strong diversification within the product category and providing new avenues for specialized suppliers.

AI Impact Analysis on Black Granite Market

Analysis of common user inquiries regarding the impact of Artificial Intelligence (AI) on the Black Granite Market reveals consistent themes centered around operational efficiency, quality control, and predictive supply chain management. Users frequently question how AI can optimize resource allocation in geographically diverse quarrying sites, reduce material wastage during cutting and polishing processes, and accurately forecast demand fluctuations based on complex construction project timelines. Furthermore, there is significant interest in AI-driven grading systems that can classify black granite slabs based on vein consistency, color depth, and defect severity more reliably than manual inspection, ensuring quality standardization across international shipments. The collective expectation is that AI will primarily serve as a powerful tool for streamlining highly physical and variable processes inherent in natural stone extraction and fabrication, leading to lower operating costs and improved material traceability.

The adoption of AI and machine learning (ML) in the extraction phase is revolutionizing geological surveying and resource mapping. Advanced algorithms analyze satellite imagery, seismic data, and drilling logs to identify optimal quarry locations, estimate reserves more accurately, and determine the safest and most efficient blasting patterns, thereby maximizing recovery rates of premium black granite blocks. This integration mitigates risks associated with unpredictable geological formations and significantly reduces the exploration phase's timeline and cost. Furthermore, predictive maintenance powered by AI is deployed on heavy machinery, such as wire saws and block handling equipment, minimizing unplanned downtime and extending the lifespan of critical assets, which is vital in capital-intensive quarrying operations.

In the processing and finishing stages, computer vision systems, often leveraging deep learning models, are being installed in fabrication facilities. These systems rapidly scan large slabs of black granite, detecting minute imperfections, measuring thickness variations, and optimizing the cutting paths to yield the maximum number of usable pieces from each block. This automated quality control and optimization not only reduces human error but also addresses the industry's historical challenge of material inconsistency, ensuring that high-grade materials like Absolute Black or Black Galaxy meet stringent international quality standards demanded by architects and designers. This push towards smart manufacturing enhances the competitive edge of firms investing in these advanced technological capabilities.

- AI-driven optimization of quarrying patterns for maximal block extraction.

- Machine learning algorithms enhancing demand forecasting and inventory management.

- Computer vision systems enabling precise, automated quality grading of finished slabs.

- Predictive maintenance reducing machinery downtime in processing plants.

- Robotic systems accelerating precise cutting and polishing for custom fabrication.

DRO & Impact Forces Of Black Granite Market

The Black Granite Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the global uptick in infrastructure spending and sustained growth in the luxury residential market, where black granite is a hallmark of premium construction. However, the market faces strong restraints, primarily stemming from high transportation logistics costs due to the material's weight and strict environmental regulations governing quarrying activities, which often increase operational expenses and limit resource access. Conversely, opportunities arise from the increasing adoption of advanced processing technologies, allowing for enhanced product variety (e.g., specialized finishes) and the untapped potential in emerging economies across Africa and Latin America, which are beginning large-scale construction phases. These forces collectively shape the competitive landscape and dictate the strategic direction for major market participants.

One of the primary drivers is the escalating global focus on durable and low-maintenance building materials. Black granite inherently possesses superior qualities such as chemical resistance, UV stability, and minimal water absorption, making it highly preferred over engineered stone alternatives for exterior cladding and high-traffic flooring in public infrastructure projects (airports, metros, commercial centers). This material longevity translates into lower life-cycle costs for property owners, further fueling its adoption in large-scale commercial real estate development. The rapid pace of urbanization in Asian economies, particularly in India and Southeast Asia, creates massive demand for permanent, aesthetically pleasing architectural elements, directly boosting consumption of various black granite types.

Despite strong demand, the market's growth trajectory is tempered by several critical restraints. The initial cost of sourcing, cutting, and installing black granite is considerably higher than composite or ceramic options, posing a barrier to entry in the budget and mid-range construction segments. Furthermore, the quarrying process is ecologically sensitive; increasing scrutiny from regulatory bodies regarding land use, water consumption, and disposal of waste sludge necessitates substantial investment in sustainable practices and compliance measures. These regulatory hurdles slow down project initiation and raise the operational expenditure (OPEX) for granite producers, sometimes forcing consolidation among smaller, less compliant operators. The volatility in fuel prices also acts as an impact force, directly influencing the final delivered cost of this heavy material.

Segmentation Analysis

The Black Granite Market is systematically segmented primarily based on Application, Type, and End-User, allowing for targeted marketing and specialized product development tailored to distinct market needs. The Application segment is dominated by countertops and vanity tops, driven by high renovation rates in residential properties, followed closely by flooring and wall cladding, which caters extensively to the commercial and hospitality sectors. Segmentation by Type reveals a strong preference for uniform varieties like Absolute Black, though unique patterns such as Black Galaxy and Black Pearl maintain significant niche value due to their distinct aesthetic qualities. End-User segmentation highlights the robust consumption by the Residential sector, emphasizing kitchen and bath applications, while the growing Institutional sector (universities, hospitals) presents reliable, large-volume opportunities for standard black granite products.

A deeper analysis into the segmentation reveals geographic specificities in product preference. For instance, North American and European markets exhibit high demand for premium polished or leathered black granite slabs (often 3cm thickness) for kitchen surfaces, prioritizing flawless finish and detailed edge work. In contrast, the APAC region often focuses on high-volume, standard-sized tiles (1cm to 2cm thickness) for extensive commercial flooring and external facade applications, where durability and cost-effectiveness are paramount. This regional variation dictates the specific production capabilities required by manufacturers, leading to specialization in either slab production for luxury markets or tile production for volume markets. Understanding these nuances is essential for market players seeking to optimize their supply chain and pricing strategies across diverse global landscapes.

The monument and memorial application segment, although smaller in volume compared to construction, represents a high-stability segment, utilizing the dense and durable qualities of black granite for long-lasting external structures. This segment demands highly specialized cutting, engraving, and finishing services, often relying on traditional craftsmanship alongside modern CNC technology. The interplay between traditional methods and modern technological capabilities defines the competitive dynamics within specialized segments, ensuring that both high-volume standardized production and bespoke, artisanal output contribute significantly to the overall market value. Market entrants must strategically choose segments based on their resource accessibility and technological readiness.

- Application:

- Countertops and Vanity Tops

- Flooring and Wall Cladding

- Monuments and Memorials

- Exterior Cladding and Paving

- Others (Landscaping, Artifacts)

- Type:

- Absolute Black Granite (Uniform Fine Grain)

- Black Galaxy Granite (Metallic Flecked)

- Black Pearl Granite (Semi-Uniform Pattern)

- Impala Black Granite

- Other Varieties

- End-User:

- Residential Sector (New Construction and Renovation)

- Commercial Sector (Offices, Retail, Hospitality)

- Institutional Sector (Government, Educational, Healthcare)

Value Chain Analysis For Black Granite Market

The Black Granite market value chain is extensive, starting from resource identification and extraction (upstream) through processing and distribution (midstream) to final installation (downstream). The upstream segment involves geological surveying, quarrying, and primary cutting of rough blocks, which is capital-intensive and geographically concentrated in regions rich in black granite deposits (India, China, Brazil, South Africa). The quality of output at this stage directly influences the subsequent value addition. Midstream activities encompass sophisticated slab cutting, polishing, specialized surface finishing (honed, leathered), and quality sorting. Efficient logistics and optimized inventory management are critical here due to the bulkiness and weight of the material.

The distribution channel is multifaceted, relying heavily on both direct and indirect routes. Direct sales are often utilized for large commercial or institutional projects, where producers or their captive distribution centers engage directly with developers and major contractors to supply material in bulk. This channel offers better price control and minimizes material handling. Conversely, the indirect channel, which includes brokers, wholesalers, retailers, and dedicated stone distributors, services the fragmented residential renovation market and smaller contractors. These intermediaries provide essential value-added services such as local warehousing, customized cutting, and immediate supply, acting as critical links between large quarries and end-users who require smaller volumes or specific cuts.

Downstream activities involve specialized fabrication, where slabs are customized into countertops, tiles, or monuments, followed by professional installation services. The profitability and efficiency of the downstream segment are often dependent on the skill level of local fabricators and installers. Technological integration, particularly Computer Numerical Control (CNC) machinery for precision cutting and edge profiling, is crucial in the downstream process to maintain quality and minimize on-site waste. Effective vertical integration by large companies, encompassing quarrying through installation, allows for maximum margin capture and quality consistency across the entire value chain, posing a competitive challenge to smaller, specialized actors.

Black Granite Market Potential Customers

Potential customers for black granite span diverse sectors, primarily categorizing into large-scale developers and individual homeowners requiring high-quality, durable surfacing materials. Major institutional buyers include government agencies and public works departments investing in durable materials for public infrastructure such as transportation hubs, municipal buildings, and urban redevelopment projects where longevity is a primary requirement. Large commercial real estate developers, particularly those focused on luxury hotels, high-end retail spaces, and corporate headquarters, are high-volume consumers, utilizing black granite for lobby flooring, bathroom vanity tops, and exterior facades to convey sophistication and permanence. Their purchasing decisions are often driven by aesthetic specifications laid out by architectural firms and interior designers.

The residential sector, encompassing both new construction and extensive remodeling projects, represents the largest and most frequent end-user base. Homeowners, influenced by current design trends favoring dark, dramatic kitchens and bathrooms, drive significant demand for black granite countertops. This segment is highly fragmented and often serviced through local fabricators and retailers who provide customization and installation services. Additionally, specialized fabricators of monuments and memorials constitute a niche but consistent customer base, requiring specific types of dense, uniformly black granite suitable for etching and long-term outdoor exposure. Targeting these varied customer profiles requires distinct sales strategies, ranging from global supply chain contracts for developers to localized retail presence for homeowners.

The hospitality and fine dining sectors are also significant consumers, utilizing black granite for bar tops, reception areas, and kitchen surfaces due to its resistance to staining and scratching, ensuring the maintenance of a high-quality appearance under rigorous use. Architects and interior design firms often act as powerful influencers, specifying black granite in their designs, making them crucial stakeholders in the procurement process. Companies seeking to expand market penetration must prioritize building strong relationships with these specifying professionals, providing them with technical data, sustainability certifications, and material samples to ensure their products are included in future high-value projects across all customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | R.E.D. Graniti, Rock of Ages Corporation, Polycor Inc., Antolini, Levantina y Asociados de Minerales S.A., Daltile, Coldspring, Aro Granite Industries Ltd., Stone Holding, Pokarna Limited, Marmi Serafini Srl, MSI Surfaces, Cosentino Group, Bampton Stone, Black Diamond Stone Company, SMG Stone Company, Universal Granite, MGT Stone Company, Stonepeak Ceramics, Gramazini Marmores e Granitos. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Black Granite Market Key Technology Landscape

The key technology landscape in the Black Granite Market is defined by continuous innovation aimed at improving extraction efficiency, maximizing material recovery, and enhancing the aesthetic quality of finished products. Advanced quarrying technologies, such as diamond wire sawing and high-precision drilling machines, have replaced traditional blasting methods in many high-value sites. Diamond wire cutting allows for cleaner cuts, reducing micro-fractures in the material and thereby increasing the yield of large, usable blocks suitable for premium slab production. Furthermore, the integration of specialized geological scanning equipment, including Ground Penetrating Radar (GPR), enables miners to better understand the subterranean rock structure before extraction, minimizing operational risks and optimizing resource utilization.

In the processing stage, the shift toward highly automated and integrated production lines is evident. Multi-bridge saws and large-scale gang saws equipped with precise electronic controls ensure uniform thickness and dimensions across massive quantities of slabs, addressing the construction industry's need for standardization. Crucially, the introduction of robotic polishing and calibration machines allows for consistent surface finishes, ranging from ultra-high gloss mirror polish to specialized matte or textured (leathered, brushed) finishes, catering to diverse architectural specifications. These automated systems also contribute significantly to workplace safety by reducing manual interaction with heavy machinery and potentially harmful dust particles.

Sustainability-focused technologies are also gaining prominence. Water treatment and recycling systems are essential in processing plants to manage the vast amounts of water used during cutting and polishing, reducing environmental impact and operational costs. Furthermore, technologies focused on utilizing granite waste, such as crushing sludge into aggregates or raw material for engineered stone composites, are emerging as critical innovations. This focus on circular economy principles not only aids environmental compliance but also opens up new revenue streams. Overall, the technological evolution is characterized by precision engineering, automation, and environmental stewardship, driving efficiency improvements across the entire black granite supply chain.

Regional Highlights

The Black Granite market demonstrates significant regional diversity in terms of both supply and demand dynamics, heavily influenced by local construction trends, regulatory environments, and historical quarrying capabilities. Asia Pacific (APAC) holds the dominant share in terms of volume consumption and production capacity. Countries like India and China are global leaders in black granite quarrying, possessing rich deposits (such as Absolute Black from India and various varieties from China). India, in particular, exports significant quantities of high-quality rough blocks and finished slabs globally. The demand side is bolstered by rapid infrastructural development, high-density residential housing projects, and a cultural affinity for natural stone in both commercial and residential applications across the region.

North America (NA) and Europe represent mature markets characterized by high-value consumption, particularly in the premium residential renovation sector and high-end commercial architecture. These regions prioritize sophisticated finishes, customized fabrication, and adherence to strict aesthetic quality standards. While domestic quarrying exists (e.g., in the US and Scandinavia), these markets are heavily reliant on imports of black granite from Asia, Africa, and Latin America. The growth here is slower but stable, driven by replacement demand and consumer willingness to invest in luxurious and durable surfacing materials. Regulatory compliance regarding imported material standards and sustainability certifications (such as ethical sourcing) are key purchasing criteria in these highly conscious markets.

The Middle East and Africa (MEA) region is emerging as a critical growth center, fueled by massive government investment in diversification projects, smart city development, and large-scale hospitality infrastructure (hotels, resorts). Countries like Saudi Arabia, UAE, and Qatar are undergoing construction booms that generate substantial demand for high-quality imported black granite for opulent interiors and robust exteriors. Africa, particularly South Africa and various East African nations, possesses significant untapped granite reserves, positioning the continent as both an emerging supplier and a rapidly growing consumer market. Latin America, led by Brazil, is a major global supplier of various granite types, including several black varieties, and its local market demand is steadily increasing with domestic construction activities, leveraging its natural resource advantage and established export infrastructure.

- Asia Pacific (APAC): Dominates global production and consumption volume; driven by infrastructure, urbanization in China and India; focus on volume tiling and large commercial projects.

- North America (NA): High-value market focused on luxury residential remodeling and premium countertops; highly reliant on imports of high-grade slabs; strict quality and aesthetic requirements.

- Europe: Stable market with strong demand in Germany, UK, and Italy for specialized finishes and restoration projects; stringent adherence to environmental sourcing standards (CE marking).

- Middle East & Africa (MEA): High growth potential fueled by massive government infrastructure spending and luxury commercial real estate development; high consumption of imported, premium materials.

- Latin America (LATAM): Brazil is a major global supplier and exporter; increasing domestic demand driven by local construction booms and competitive pricing advantage due to proximity of resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Black Granite Market.- R.E.D. Graniti

- Rock of Ages Corporation

- Polycor Inc.

- Antolini

- Levantina y Asociados de Minerales S.A.

- Daltile

- Coldspring

- Aro Granite Industries Ltd.

- Stone Holding

- Pokarna Limited

- Marmi Serafini Srl

- MSI Surfaces

- Cosentino Group

- Bampton Stone

- Black Diamond Stone Company

- SMG Stone Company

- Universal Granite

- MGT Stone Company

- Stonepeak Ceramics

- Gramazini Marmores e Granitos

Frequently Asked Questions

Analyze common user questions about the Black Granite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Black Granite Market?

The Black Granite Market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven primarily by increasing global construction activities and aesthetic preferences for natural stone.

Which geographical region dominates the production and consumption of Black Granite?

The Asia Pacific (APAC) region currently dominates both the production and consumption volume of black granite, largely owing to extensive quarrying operations in countries like India and China, coupled with massive infrastructure investment.

What are the key types of black granite driving market demand?

Key black granite types influencing market demand include Absolute Black, known for its uniform color and high density, and varieties such as Black Galaxy and Black Pearl, which are favored for their distinct metallic or crystalline aesthetics in premium applications.

What is the primary application segment for black granite globally?

The largest application segment for black granite remains countertops and vanity tops, driven by high demand from the residential renovation sector and commercial hospitality projects valuing the material's durability and high-end appearance.

How do environmental regulations impact the Black Granite Market?

Environmental regulations act as a key restraint, increasing operational costs for quarrying and processing due to strict mandates on land reclamation, water management, and waste disposal, necessitating significant investment in sustainable technologies by market players.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager