Black Hair Care Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443015 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Black Hair Care Market Size

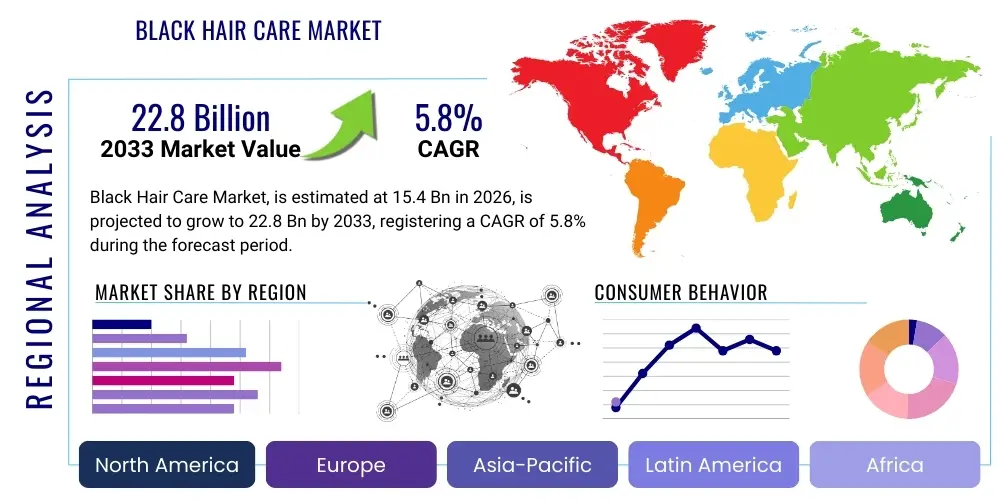

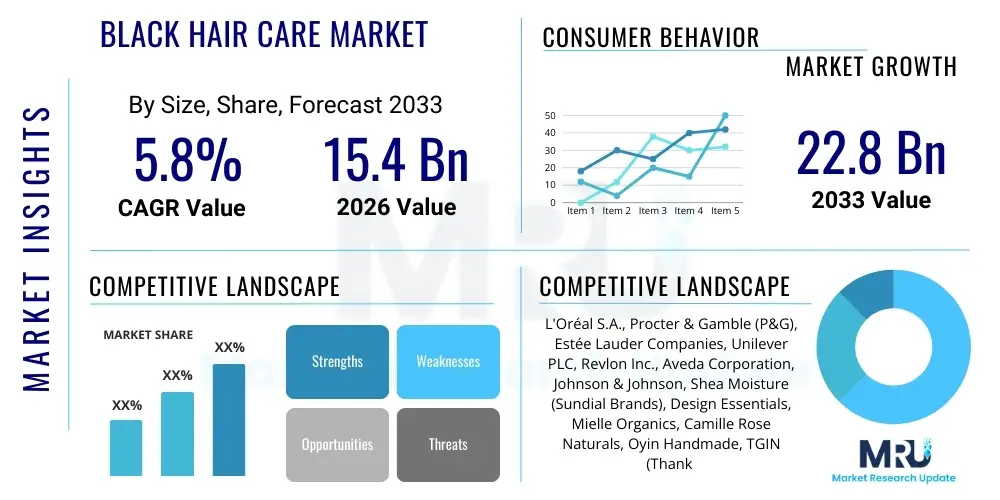

The Black Hair Care Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.4 Billion in 2026 and is projected to reach USD 22.8 Billion by the end of the forecast period in 2033.

Black Hair Care Market introduction

The Black Hair Care Market encompasses a diverse and specialized range of products and services tailored specifically to the unique structural, physiological, and maintenance requirements of Afro-textured hair. This niche, yet rapidly expanding, sector includes items such as moisturizing shampoos, deep conditioners, styling gels, protective style maintenance products, and specialized scalp treatments, all formulated to address characteristics such as high porosity, susceptibility to dryness, and the inherent fragility of tightly coiled hair structures. The industry is defined by its commitment to culturally resonant formulations, often prioritizing natural ingredients and minimizing harsh chemicals traditionally associated with relaxation processes.

The principal applications for these products span daily maintenance, elaborate protective styling (such as braids, twists, and locs), and therapeutic treatments aimed at addressing common issues like breakage, flaking, and scalp irritation, which are exacerbated by environmental factors and improper care. The market's robust expansion is fundamentally driven by a powerful confluence of cultural affirmation, increased consumer education regarding proper hair maintenance, and significant advancements in ingredient science that allow for the creation of high-performing, clean-label products. Consumers are increasingly seeking personalized routines and specialized products that cater to their individual curl patterns and hair goals, rejecting the 'one-size-fits-all' approach of general hair care brands.

Key benefits derived from this market include improved hair health, enhanced manageability, and the preservation of natural hair structure. The driving factors are multifaceted, including rising disposable incomes in key demographics, the amplified visibility of natural hair on mainstream media and social platforms, and the resultant shift away from chemical straightening towards embracing natural texture. Furthermore, significant investment in research and development by specialized and mainstream brands alike is leading to formulations that maximize moisture retention and minimize manipulation stress, providing superior results compared to legacy products.

Black Hair Care Market Executive Summary

The Black Hair Care Market is currently experiencing transformative growth, underpinned by dynamic shifts in business models, pervasive regional expansion, and notable segmentation trends. Businesses are rapidly pivoting from legacy product lines to formulations centered on natural, clean, and sustainable ingredients, responding directly to heightened consumer demand for transparency and ethical sourcing. The prominence of direct-to-consumer (D2C) sales channels and the strategic acquisition of niche, high-growth, Black-owned brands by major conglomerates define the current competitive landscape, fostering both innovation and consolidation across the value chain. This trend toward premiumization, where consumers are willing to invest more in specialized, high-efficacy products, is reshaping profitability metrics within the sector.

Regionally, while North America continues to dominate the market share due to its established infrastructure and high consumer awareness, significant growth acceleration is observed in emerging markets, particularly within Sub-Saharan Africa and key Western European countries with large diaspora populations. These regions are witnessing a rapid formalization of the hair care sector, moving away from informal distribution channels towards organized retail and e-commerce platforms. Latin America, specifically Brazil, also presents a substantial growth trajectory driven by local cultural shifts and increasing product availability, suggesting a geographically decentralized expansion strategy for international brands targeting this market.

Segment trends highlight a pronounced shift in consumer preference toward the 'Natural Hair Care' category, which eclipses traditional categories like relaxers and chemical treatments. Within product segmentation, the Treatment and Styling Products categories are demonstrating the highest growth rates, reflecting complex consumer routines and the need for specialized items for protective styles. Distribution channel analysis reveals that e-commerce is overwhelmingly the fastest-growing segment, providing unparalleled access to niche brands and detailed product information, although specialty ethnic beauty supply stores maintain their critical role as trusted advisory points for consumers.

AI Impact Analysis on Black Hair Care Market

Common user inquiries regarding AI in the Black Hair Care Market frequently revolve around personalization, ingredient safety, and optimized product recommendation systems. Users are keenly interested in how Artificial Intelligence can facilitate customized hair regimens based on detailed analysis of curl pattern, porosity, and environmental conditions, moving beyond generalized recommendations. Key concerns often focus on data privacy and the ethical implications of using biometrics (such as high-resolution scalp imagery) for diagnosis. Simultaneously, consumers expect AI to enhance transparency, helping to verify the efficacy and sourcing of natural ingredients, while manufacturers look to AI for accelerated product development and supply chain optimization, ultimately seeking solutions that address highly specific, previously underserved hair needs through algorithmic precision.

- AI-Powered Formulation Discovery: Utilizing machine learning algorithms to analyze ingredient interactions, predict optimal product stability, and accelerate the development of highly effective, specialized formulations targeting unique Black hair challenges (e.g., moisture retention at scale).

- Personalized Regimen Recommendations: Deployment of sophisticated AI tools, often embedded in mobile applications, that analyze user input (photos, environmental data, historical product use) to generate hyper-personalized hair care routines, product pairing suggestions, and styling advice, minimizing trial-and-error costs for consumers.

- Predictive Supply Chain Optimization: Using AI to forecast regional demand fluctuations for specific product types (e.g., highly moisturizing creams in dry climates) and adjust inventory levels in real-time, reducing waste and ensuring availability of specialized ethnic products in underserved markets.

- Virtual Try-On and Consultation: Implementation of augmented reality (AR) and AI for virtual hair styling consultations and color try-ons, enhancing the digital shopping experience and reducing the hesitation associated with purchasing specialized products online without physical inspection.

- Quality Control and Ingredient Sourcing Verification: Leveraging computer vision and data analytics to verify the authenticity and quality of natural raw materials used in formulations, enhancing consumer trust and supporting clean beauty claims through verifiable, traceable data points.

DRO & Impact Forces Of Black Hair Care Market

The market trajectory is significantly influenced by a balanced set of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces currently shaping strategic decisions within the Black Hair Care sector. Key drivers include the overwhelming cultural shift towards embracing natural hair textures globally, which has fundamentally redefined consumer product needs away from chemical modification and toward nourishment and protective styling. This movement is structurally supported by increased consumer access to specialized knowledge via social media platforms, leading to higher product literacy and demand for advanced formulations. However, this growth is simultaneously moderated by notable restraints, primarily the high cost associated with premium, naturally sourced ingredients and the complex, fragmented distribution landscape, particularly in international markets, which increases operational overheads and consumer pricing.

The dominant opportunities lie in innovation within the 'Clean Beauty' and 'Scalp Health' segments, where a significant market gap exists for certified organic, non-toxic, and dermatologically tested products tailored for sensitive Black hair and scalp needs. Furthermore, technological integration, particularly in e-commerce and personalized diagnostics, presents substantial potential for direct market engagement and brand loyalty creation. Strategic Impact Forces—such as intense competitive rivalry spurred by both niche Black-owned brands and large multinational entrants—compel continuous product differentiation and targeted marketing efforts. Sociocultural factors, specifically the increasing political and cultural visibility of Black consumer power, amplify the importance of brand authenticity and diversity in advertising and product development, serving as a powerful external force dictating market success.

These forces create a dynamic environment where brands must navigate the tension between maintaining cultural relevance and achieving mass-market scalability. The demand for highly specialized ingredients that meet the strict requirements of natural hair maintenance (e.g., specific oils, butters, and protein balances) often creates supply chain vulnerabilities. Success is therefore dependent not just on product quality, but also on operational efficiency, ethical sourcing practices, and deep engagement with the target consumer base through culturally sensitive marketing campaigns.

Segmentation Analysis

The Black Hair Care Market is meticulously segmented across product type, distribution channel, and specific hair characteristic, reflecting the intricate needs of the consumer base. The complexity of Afro-textured hair necessitates highly differentiated product categories, ranging from basic cleansing and conditioning agents to advanced therapeutic and styling systems designed for diverse curl patterns (4A, 4B, 4C) and porosity levels. This segmentation allows manufacturers to target specific hair goals, whether it is extreme moisture retention, enhanced curl definition, or the management of specific scalp conditions like dryness or eczema. The evolution of the market is evidenced by the declining significance of segments focused on permanent chemical alteration and the overwhelming growth of maintenance and treatment segments.

The distribution landscape provides a key differentiator, where traditional ethnic beauty supply stores continue to play an important advisory and access role, but are increasingly challenged by the expansive reach and pricing advantages offered by specialized e-commerce platforms and mass-market retailers. The move towards specialized online platforms has facilitated the discovery and availability of smaller, independent, and international brands, democratizing the consumer choice set. Understanding the purchasing habits across these channels is crucial for market penetration, as online platforms typically cater to highly informed consumers seeking specialty or premium items, while brick-and-mortar locations serve immediate needs and general upkeep products.

- By Product Type:

- Shampoo and Cleansers (Co-washes, Clarifying Shampoos)

- Conditioners (Rinse-out, Leave-in, Deep Conditioners/Treatments)

- Styling Products (Gels, Creams, Mousse, Edge Controls)

- Treatments and Oils (Hot Oil Treatments, Hair Masks, Scalp Serums)

- Relaxers and Perms (Declining Segment)

- By Hair Characteristic:

- Natural Hair

- Relaxed/Chemically Treated Hair

- Protective Styles (Locs, Braids, Weaves)

- By Distribution Channel:

- Online Retail (E-commerce Websites, Brand D2C, Marketplaces)

- Offline Retail

- Specialty Ethnic Beauty Supply Stores

- Supermarkets and Hypermarkets

- Drug Stores and Pharmacies

Value Chain Analysis For Black Hair Care Market

The value chain for the Black Hair Care Market is characterized by highly specialized stages, beginning with the upstream sourcing of exotic and often complex natural raw materials such as shea butter, argan oil, black castor oil, and specialized herbal extracts. Upstream actors include highly localized co-operatives and global chemical suppliers who must adhere to increasing demands for sustainability and fair-trade certifications. The complexity arises from ensuring the consistent quality and ethical origin of these high-demand ingredients, which are critical for the efficacy of premium Black hair formulations. The manufacturing stage involves specialized processes designed to handle the viscous nature of these formulations and the need for high levels of emulsification and blending to create stable, moisturizing products.

The downstream distribution network is particularly fragmented but strategic, involving multiple channels to reach the diverse consumer base. This includes direct distribution to major mass retailers and specialized distribution partnerships with ethnic beauty supply distributors. Specialty beauty supply stores act as critical informational hubs, offering personalized advice and access to niche brands. The direct-to-consumer (D2C) model, facilitated by robust e-commerce capabilities, is increasingly prominent, allowing emerging brands to bypass traditional intermediaries, control the customer experience, and capture higher profit margins. Marketing efforts in the downstream phase rely heavily on influencer collaborations and community engagement to build brand trust and cultural resonance.

Direct channels, predominantly D2C websites and social commerce, offer immediate feedback loops and superior data collection capabilities, crucial for rapid product adaptation based on consumer needs. Indirect channels, encompassing mass retailers and wholesalers, ensure broad accessibility and volume sales, particularly for staple products like shampoos and conditioners. The efficiency of the overall value chain is highly dependent on effective inventory management across both channels, ensuring that specialized products, often produced in smaller batches, are available when and where highly informed consumers are shopping. Effective logistical management, particularly cold chain for certain natural ingredients, adds another layer of complexity to the supply side.

Black Hair Care Market Potential Customers

The primary consumers, or end-users, of the Black Hair Care Market products are individuals of African descent who possess Type 3 and Type 4 hair textures, spanning all age groups from infants to seniors. This consumer base is highly diversified, including those committed to natural hair maintenance, individuals maintaining chemical treatments or relaxers, and users of complex protective styles such as weaves, wigs, and intricate braiding patterns. Demographic shifts indicate a strong purchasing power among millennial and Gen Z consumers who are often highly educated about ingredients and prefer ethical, environmentally conscious, and Black-owned brands, driving the clean beauty movement within this sector.

Beyond the core individual consumer, the market also targets professional hair stylists and barbers specializing in Afro-textured hair. These professionals act as influential buyers, determining the products used in salons and often recommending retail products to their clientele. Salons dedicated to protective styling or natural hair transformation represent a significant B2B segment, relying on professional-grade, high-volume products for daily operations. This segment places a premium on product performance, client comfort, and consistent bulk availability, necessitating tailored packaging and formulation sizes from manufacturers.

A crucial emerging segment of potential customers includes mainstream consumers interested in high-moisture, rich formulations for dry or damaged hair, or individuals maintaining mixed-race hair textures that share structural similarities with African hair. This crossover appeal is leveraged by brands that emphasize universal benefits like deep hydration and damage repair. Ultimately, purchasing decisions across all segments are deeply influenced by cultural identity, product efficacy, brand transparency regarding ingredients, and digital community endorsements, making the customer profile one of the most discerning and knowledgeable within the broader cosmetic industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.4 Billion |

| Market Forecast in 2033 | USD 22.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Procter & Gamble (P&G), Estée Lauder Companies, Unilever PLC, Revlon Inc., Aveda Corporation, Johnson & Johnson, Shea Moisture (Sundial Brands), Design Essentials, Mielle Organics, Camille Rose Naturals, Oyin Handmade, TGIN (Thank God I'm Natural), Carol's Daughter, Eden Bodyworks, Aunt Jackie's Curls & Coils, Kinky-Curly, Miss Jessie's, Dark & Lovely, ORS (Organic Root Stimulator) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Black Hair Care Market Key Technology Landscape

The Black Hair Care Market is undergoing a significant technological evolution, moving beyond basic product formulation to embrace advanced delivery systems and diagnostic tools. A core area of technological focus is the use of nanotechnology and encapsulation techniques to enhance the penetration and slow release of moisturizing agents, proteins, and essential oils into the hair shaft, which is particularly challenging given the tightly coiled structure and high porosity often found in Afro-textured hair. These advanced formulation techniques ensure sustained hydration and improved manageability, addressing the critical consumer pain point of chronic dryness. Furthermore, sophisticated polymer chemistry is being leveraged to create lightweight, non-flaking styling products that offer strong hold without the detrimental residue often associated with traditional ethnic hair gels.

Beyond the lab, digital technology is fundamentally transforming consumer interaction and product development. Advances in spectroscopy and microscopy are now integrated into portable diagnostic devices, allowing consumers and stylists to accurately measure hair porosity, density, and damage levels outside of a clinical setting. This objective data feeds into AI-driven recommendation engines, ensuring that personalized product sets are precisely matched to the hair's current biological state. This blend of biochemical innovation and digital diagnostics is lowering the barrier to entry for highly specialized treatments and democratizing access to professional-level hair analysis.

Another crucial technological advancement involves sustainable packaging and manufacturing processes. Brands are increasingly adopting bio-based or recycled plastics and waterless formulations to appeal to environmentally conscious consumers, utilizing technology to ensure product integrity remains high despite changes in composition and packaging materials. The implementation of blockchain technology is also emerging to create transparent supply chains, verifying the authenticity and ethical sourcing of high-value natural ingredients, which is a powerful differentiator in a market prioritizing ethical consumption.

Regional Highlights

Regional dynamics play a crucial role in the overall market size and segmentation strategy for Black Hair Care products, reflecting distinct cultural norms, diaspora sizes, and economic landscapes.

- North America (Dominance and Innovation): The United States and Canada represent the largest and most established markets globally, characterized by high consumer awareness, robust innovation, and the presence of both large multinational corporations and influential Black-owned small businesses. This region drives global trends, particularly in the natural and clean beauty movements, and features the highest density of specialty retail and digital commerce platforms.

- Europe (Emerging Growth and Diversity): Countries such as the United Kingdom, France, and Germany show accelerated growth, primarily driven by large Afro-Caribbean and African diaspora communities. The challenge here is adapting product availability and marketing to varying regulatory environments and achieving mainstream shelf space, often requiring dual-language packaging and specific regional product variations.

- Asia Pacific (Niche Expansion): While smaller in market size compared to Western regions, pockets of opportunity exist in countries with established diaspora communities or regions where mixed hair types are prevalent. The growth is slower but steady, focusing mainly on e-commerce distribution due to dispersed consumer locations.

- Latin America (Brazil as a Powerhouse): Brazil is a powerhouse within this regional segment due to its significant population of African descent. The market is highly localized, with strong demand for culturally specific straightening and conditioning products, though the natural hair movement is gaining momentum, driving localized brand growth and specialization.

- Middle East and Africa (MEA) (Growth Engine and Sourcing Hub): Africa, particularly Nigeria and South Africa, is experiencing exponential growth, driven by increasing urbanization, rising disposable incomes, and the shift from informal to formal retail channels. MEA also remains a critical upstream region for sourcing key raw materials like shea and cocoa butter, influencing global supply chain dynamics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Black Hair Care Market.- L'Oréal S.A.

- Procter & Gamble (P&G)

- Estée Lauder Companies

- Unilever PLC

- Revlon Inc.

- Aveda Corporation

- Johnson & Johnson

- Shea Moisture (Sundial Brands)

- Design Essentials

- Mielle Organics

- Camille Rose Naturals

- Oyin Handmade

- TGIN (Thank God I'm Natural)

- Carol's Daughter

- Eden Bodyworks

- Aunt Jackie's Curls & Coils

- Kinky-Curly

- Miss Jessie's

- Dark & Lovely

- ORS (Organic Root Stimulator)

Frequently Asked Questions

Analyze common user questions about the Black Hair Care market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Black Hair Care Market?

The primary driver is the global cultural affirmation movement encouraging the embrace of natural hair textures, coupled with rising consumer awareness of ingredient efficacy and a preference for clean, naturally derived formulations over harsh chemical processes.

Which product segment is experiencing the fastest growth in this market?

The Treatments and Styling Products segment, specifically deep conditioners, specialized oils, and products formulated for protective styles (braids, locs), is witnessing the highest growth due to increasingly complex and dedicated consumer care regimens.

How is digital technology impacting the Black Hair Care industry?

Digital technology is crucial for personalized diagnostics (analyzing hair type and condition), direct-to-consumer sales, and targeted marketing through social media influencers, significantly enhancing market access for niche brands and consumer education.

What are the main regional challenges facing market expansion?

Key challenges include managing a fragmented distribution network, ensuring product availability in international markets outside of North America, and mitigating the high costs associated with ethically and sustainably sourcing key natural ingredients.

Are traditional chemical relaxers still a significant part of the market?

No, the chemical relaxer segment is experiencing continuous decline globally, being systematically displaced by the surge in demand for moisturizing, strengthening, and protective products that support natural hair maintenance and manageability.

The continuous evolution of the Black Hair Care Market necessitates strategic adaptability from all stakeholders, particularly concerning product innovation and ethical sourcing. The consumer base is arguably the most engaged and informed demographic within the broader beauty sector, demanding transparency and authenticity. This engagement is fostered by pervasive digital communication, turning product reviews and community discussions into primary marketing tools. Consequently, brands that invest heavily in both digital presence and scientifically verifiable, culturally appropriate formulations are positioned for sustained competitive advantage. The future trajectory involves greater specialization in formulations targeting specific hair conditions, such as protein sensitivity or extreme moisture loss, driven by advancements in genomic and personalized beauty technology. Furthermore, the integration of sustainability practices throughout the supply chain is transitioning from a niche preference to a fundamental requirement, influencing investment decisions and market entry strategies worldwide.

Investment patterns reflect a strong movement toward acquiring or developing expertise in specialized ingredient compounds derived from African botanicals, focusing on formulations that minimize manipulation and maximize protective efficacy. Large conglomerates continue to leverage the expertise of smaller, established Black-owned brands, often through acquisition, to rapidly fill portfolio gaps and gain immediate cultural credibility. This consolidation trend, while providing capital for smaller brands to scale, simultaneously intensifies the competitive pressure on independent players to maintain differentiation through highly focused niche offerings and uncompromised ingredient quality. The regulatory environment, particularly concerning product safety and labeling claims related to 'natural' or 'organic' status, is also becoming increasingly rigorous, requiring brands to invest heavily in compliance and clear communication.

Geopolitical stability in key sourcing regions, particularly West Africa, remains a non-financial risk factor affecting the consistent supply and pricing of essential components like shea butter and cocoa butter. Market participants are increasingly mitigating this risk by establishing fair-trade agreements and investing directly in local community development, thereby securing ethical supply chains while simultaneously fulfilling corporate social responsibility mandates. The consumer’s willingness to pay a premium for ethically sourced, high-performing products continues to validate the strategy of value-added branding based on sustainability and community support. This intrinsic linkage between cultural resonance, social responsibility, and product performance dictates the overall resilience and growth potential of the Black Hair Care Market in the upcoming forecast period.

Furthermore, educational initiatives are becoming a crucial component of market success, particularly as consumer routines become more complex. Brands are investing in professional training programs for stylists and creating extensive online content (tutorials, ingredient deep-dives) to ensure proper product usage, which directly correlates with positive results and repeat purchases. This emphasis on consumer education acts as a critical differentiator in a crowded marketplace. The digital transformation also facilitates targeted health and wellness integrations, where hair care is increasingly viewed as an extension of overall physical health, opening avenues for collaboration with dermatologists and nutritionists. The synergy between external care, internal health, and advanced material science defines the cutting edge of product innovation.

The impact of cross-cultural styling trends and the mainstream media representation of Black hair significantly influences purchasing decisions globally. As natural hair becomes more visible in professional and entertainment spheres, the demand for sophisticated, professional-grade styling products that maintain definition and moisture without stiffness or residue rises commensurately. This shift accelerates the obsolescence of traditional, heavy formulations. Manufacturers must continuously invest in flexible research platforms that can quickly adapt to micro-trends within the vast diversity of Afro-textured hair types, ensuring their product lines remain relevant to the specific needs of consumers engaging in diverse protective styling, from knotless braids to complex twist-outs. This relentless demand for specialization necessitates agile product development cycles and targeted market launches, often testing formulations exclusively within focused consumer panels to guarantee cultural acceptance and functional efficacy before wider deployment.

Technological advancement is not limited to formulation chemistry; it also extends to retail experience enhancement. The adoption of smart shelves, personalized in-store product guidance via mobile apps, and enhanced inventory management systems are improving the physical shopping journey in specialty beauty supply stores. This hybrid approach—combining the educational trust of physical retail with the convenience and breadth of e-commerce—is critical for serving a consumer base that values both expert consultation and digital access. Future market competitiveness will be defined by the ability of brands to seamlessly integrate these digital and physical touchpoints, creating an omnipresent retail ecosystem that caters to the specific purchasing habits of the highly engaged Black Hair Care consumer. This integration requires significant capital investment in data infrastructure and staff training across all distribution channels to maintain consistency and relevance.

The sustainability mandate within the Black Hair Care Market is also pushing innovation toward water conservation. Given that water is often the primary ingredient in many hair products, the development of waterless concentrated formulas (e.g., solid shampoos and anhydrous conditioning bars) is gaining traction. This not only aligns with environmental goals but also offers logistical advantages, reducing shipping weights and carbon footprints. Furthermore, the industry is closely monitoring advances in biotechnology, particularly the use of fermentation and cellular agriculture to produce complex ingredients, offering sustainable alternatives to traditionally harvested, sometimes ecologically sensitive, botanicals. These biotechnological processes promise higher purity, enhanced consistency, and reduced reliance on volatile agricultural supply chains, marking a fundamental shift in sourcing strategy for premium brands in the sector.

Finally, the growing political and legislative support for hair equality, such as the implementation of CROWN Acts in various U.S. states and similar anti-discrimination legislation globally, further legitimizes the natural hair movement. This legal framework reduces professional and social pressure on individuals to chemically alter their natural hair texture, directly bolstering demand for maintenance and styling products catering to natural hair. This supportive environment creates long-term stability for market growth and reinforces the economic viability of specialized product development. The convergence of cultural pride, technological innovation, ethical sourcing, and supportive legislation is forging a resilient and dynamically expanding market poised for substantial valuation increase throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager