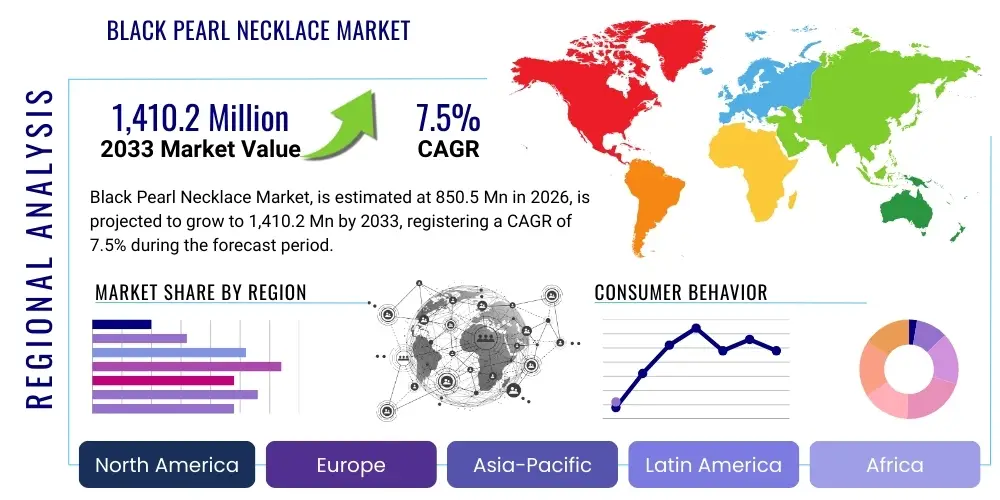

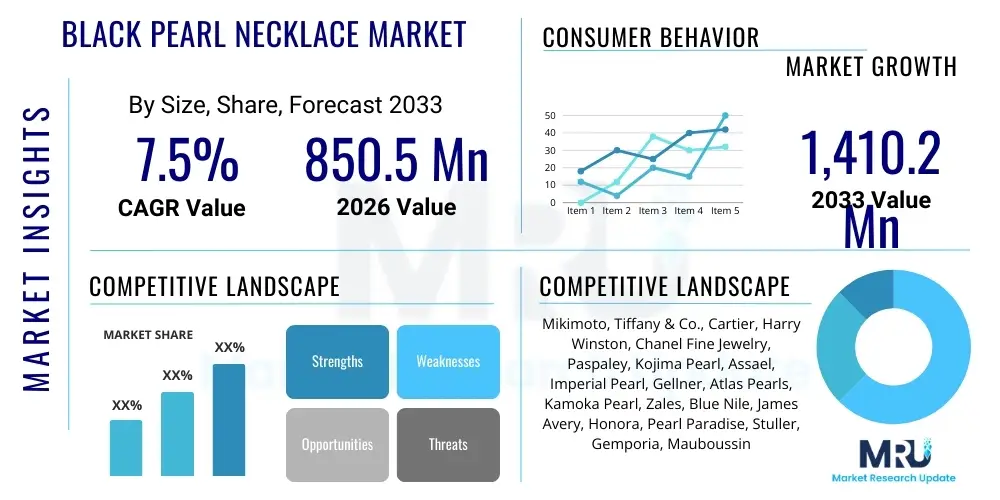

Black Pearl Necklace Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441009 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Black Pearl Necklace Market Size

The Black Pearl Necklace Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,410.2 Million by the end of the forecast period in 2033.

Black Pearl Necklace Market introduction

The Black Pearl Necklace Market encompasses the global trade and consumption of necklaces primarily featuring black pearls, predominantly sourced from the Pinctada margaritifera oyster, resulting in the highly coveted Tahitian black pearl. This segment of the luxury jewelry market is characterized by high craftsmanship, stringent quality grading, and strong consumer demand for unique, sophisticated accessories. Major applications include high-end fashion, bridal wear, and investment jewelry, positioning black pearls as a staple in the luxury sector. Key benefits driving market growth include the pearl's natural luster, exotic appeal, and increasing association with exclusivity and heritage. Driving factors involve rising disposable income among global affluent populations, robust marketing strategies emphasizing sustainable luxury, and shifting consumer preferences toward colored gemstones and unique organic materials in personal adornment. The market dynamics are heavily influenced by the supply chain constraints inherent in pearl aquaculture, particularly in regions like French Polynesia, which sets the benchmark for quality and price.

Black Pearl Necklace Market Executive Summary

The Black Pearl Necklace Market is exhibiting robust growth, propelled primarily by enduring business trends focused on bespoke jewelry and personalized luxury experiences. Retailers are increasingly utilizing digital platforms and virtual try-on technologies to enhance consumer engagement, overcoming traditional barriers associated with high-value purchases online. Regionally, Asia Pacific (APAC) is emerging as a dominant force, fueled by rapid wealth creation in economies like China and India, where black pearls are gaining cultural significance as investment pieces and status symbols. North America and Europe maintain strong market shares driven by established luxury consumer bases and a steady preference for classic jewelry designs updated with modern aesthetics. Segment-wise, the Tahitian black pearl category continues to command the highest market value due to its rarity and quality specifications, while the mid-range market sees significant expansion through enhanced freshwater black pearl offerings. Furthermore, the market is characterized by increasing transparency requirements regarding pearl origin and treatment, driving manufacturers toward ethical sourcing certifications and advanced provenance tracking mechanisms.

AI Impact Analysis on Black Pearl Necklace Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) in the Black Pearl Necklace market often center on three key themes: authenticity verification, personalized design recommendations, and supply chain optimization. Consumers frequently ask how AI can guarantee that a high-cost black pearl is genuine, natural-colored, and ethically sourced, reflecting concerns over counterfeiting and lack of transparency. Furthermore, potential buyers are keen on understanding how AI algorithms can analyze their style preferences, social media data, and existing jewelry collections to curate highly specific black pearl necklace designs or suggest optimal necklace lengths and setting styles. For businesses, the focus is on predictive analytics—specifically, how AI can forecast shifts in raw pearl supply, predict consumer demand spikes during seasonal periods, and optimize inventory management to reduce holding costs for high-value items. The consensus expectation is that AI will primarily serve as a powerful tool for quality assurance, hyper-personalization, and operational efficiency, thereby elevating the trustworthiness and responsiveness of the luxury pearl sector.

- AI-driven image recognition systems enhance pearl grading accuracy, assessing luster, shape uniformity, and surface quality with objective metrics, reducing human error in valuation.

- Predictive modeling optimizes aquaculture operations by analyzing environmental factors (water temperature, salinity) to forecast optimal harvest yields and quality consistency.

- Machine Learning algorithms analyze vast consumer data sets to generate hyper-personalized necklace designs, material combinations, and pricing strategies for target demographics.

- Blockchain integration, often managed by AI platforms, provides immutable provenance tracking, ensuring authenticity and ethical sourcing claims for premium Tahitian black pearls.

- AI chatbots and virtual assistants provide 24/7 customer service, offering style advice, handling customization requests, and guiding consumers through complex purchasing decisions.

DRO & Impact Forces Of Black Pearl Necklace Market

The Black Pearl Necklace Market is significantly influenced by a balanced set of market dynamics encapsulated by Drivers, Restraints, and Opportunities (DRO), all contributing to its Impact Forces. Primary drivers include the escalating global demand for luxury goods, the unique aesthetic value and increasing popularity of black and colored pearls compared to traditional white pearls, and effective marketing linking black pearls to exclusivity and status. Restraints primarily involve the inherent limitations of the aquaculture supply chain, susceptibility to climate change affecting pearl oyster health, high input costs, and the persistent challenge of distinguishing natural black pearls from treated or dyed alternatives, leading to consumer skepticism in some segments. Opportunities lie in expanding into nascent high-growth economies in APAC and MEA, leveraging digital tools for direct-to-consumer sales and customization, and developing sophisticated synthetic pearl authentication technologies to build consumer trust. These forces collectively dictate market trajectory, compelling industry stakeholders to invest heavily in sustainable cultivation practices and robust brand storytelling to maintain premium positioning and counteract supply volatility.

Segmentation Analysis

The Black Pearl Necklace Market is highly segmented based on intrinsic product characteristics, resulting in variations in price points, target consumers, and distribution strategies. Segmentation by pearl type (Tahitian, Freshwater, Dyed) dictates the luxury hierarchy, with natural Tahitian pearls forming the top tier due to their unique coloration and size. Length segmentation (Choker, Opera, Rope) reflects diverse fashion trends and usage occasions, while end-user demographics (Men, Women) reveal specialized design requirements. The distribution channel breakdown underscores the continued importance of high-touch physical retail alongside the rapid expansion of curated online luxury platforms, reflecting evolving consumer purchasing habits for high-value jewelry items.

- By Pearl Type

- Tahitian Black Pearls

- Freshwater Black Pearls (Treated)

- Dyed Black Pearls

- By Necklace Length

- Choker (Approx. 14-16 inches)

- Princess (Approx. 17-19 inches)

- Matinee (Approx. 20-24 inches)

- Opera (Approx. 28-36 inches)

- Rope (Over 36 inches)

- By Distribution Channel

- Offline Retail (Specialty Jewelry Stores, Department Stores, Exclusive Boutiques)

- Online Retail (E-commerce Platforms, Brand Websites)

- By End-User

- Women

- Men

Value Chain Analysis For Black Pearl Necklace Market

The Black Pearl Necklace value chain is complex, starting significantly upstream with the delicate and time-intensive process of pearl aquaculture. Upstream activities involve oyster farming, meticulous nucleus insertion (grafting), and the multi-year cultivation period, primarily concentrated in the lagoons of French Polynesia and select regions of Southeast Asia. The quality of the raw pearl produced at this stage dictates the majority of the final product's value. Following harvest, the pearls undergo grading and sorting based on critical attributes like size, shape, luster, and color, which is a specialized step often performed by dedicated pearl houses or major luxury brands committed to maintaining high standards. This phase requires significant expertise and is a bottleneck point in the supply chain.

Midstream activities involve processing, which includes matching pearls for strand uniformity and crafting the necklaces. This step often requires high-precision drilling, careful threading, and the addition of precious metal findings and clasps. Design and manufacturing facilities, typically located in established jewelry hubs in Europe, North America, and parts of Asia, convert the raw material into finished luxury goods. Companies must manage strict quality control to ensure the integrity of the final piece matches the high perceived value of black pearls. Innovations in clasp design and knotting techniques are constantly being introduced to enhance durability and aesthetic appeal.

Downstream distribution channels are bifurcated into direct and indirect routes. Direct distribution involves proprietary brand boutiques and exclusive e-commerce portals, allowing for maximum control over pricing and brand messaging. Indirect distribution relies on high-end specialty jewelry stores, established luxury department stores, and curated third-party online luxury retailers. Given the high average transaction value of black pearl necklaces, personalized service and comprehensive warranties are critical components of the downstream process. The efficiency of logistics, including secure transportation and insured delivery, heavily impacts customer satisfaction and operational costs across all segments of the market.

Black Pearl Necklace Market Potential Customers

Potential customers for black pearl necklaces primarily reside within the High-Net-Worth Individual (HNWI) segment globally, characterized by significant disposable income and a strong appetite for collectible and unique luxury items. These consumers value rarity, provenance, and the investment potential of natural, high-grade Tahitian pearls. Demographically, the core female consumer base spans ages 35 to 65, often purchasing for personal milestones, generational gifting, or as a sophisticated addition to their existing jewelry wardrobe. Marketing efforts target individuals seeking distinctive statement pieces that transcend fleeting fashion trends, appealing to those who favor classic elegance with a modern, darker aesthetic twist.

Beyond the traditional female luxury buyer, the market is experiencing growth among younger affluent demographics, particularly Millennials and Generation Z, who are seeking ethical and sustainably sourced jewelry. This segment is highly responsive to transparent sourcing stories and customizable options. They tend to favor shorter, more modern necklace styles (like princess or choker lengths) often mixed with alternative materials or worn in layered arrangements. Additionally, the male consumer segment is emerging, driven by increasing acceptance of men’s fine jewelry. While typically favoring simpler, single-strand or pendant styles, these male buyers appreciate the deep, masculine color palette and sophistication inherent in black pearls, viewing them as a symbol of subtle power and refined taste.

Corporate buyers also represent a niche customer base, utilizing high-quality black pearl necklaces for exclusive corporate gifts, awards, and employee recognition programs, especially within financial, technology, and luxury sectors. International tourists and luxury travelers, particularly those from Asian markets visiting European or American luxury destinations, form a significant purchasing cluster, often driven by tax advantages and the desire to acquire globally renowned luxury brands. Successful market penetration strategies must address the varied needs of these distinct segments, ranging from ultra-high-end bespoke services for HNWIs to engaging digital content focused on sustainability for younger audiences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,410.2 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mikimoto, Tiffany & Co., Cartier, Harry Winston, Chanel Fine Jewelry, Paspaley, Kojima Pearl, Assael, Imperial Pearl, Gellner, Atlas Pearls, Kamoka Pearl, Zales, Blue Nile, James Avery, Honora, Pearl Paradise, Stuller, Gemporia, Mauboussin |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Black Pearl Necklace Market Key Technology Landscape

The Black Pearl Necklace market is increasingly adopting technological advancements to maintain authenticity and enhance consumer experience. One crucial area is advanced pearl grading technology, utilizing high-resolution spectrometry and computerized color analysis to provide objective, standardized metrics for luster, iridescence, and body color. This technology helps differentiate premium, natural black pearls from lower-grade or treated varieties, ensuring fair pricing and building consumer trust. Furthermore, blockchain technology is becoming essential for securing the supply chain, allowing brands to digitally trace the pearl from the harvest lagoon through to the final setting, providing customers with an immutable record of provenance, supporting ethical sourcing claims, and combating fraud effectively.

In the design and manufacturing phase, 3D printing (Additive Manufacturing) is being leveraged extensively. Jewelers use high-precision 3D printing to create intricate and complex clasps and necklace settings that are difficult or impossible to achieve using traditional casting methods. This not only allows for rapid prototyping and bespoke customization but also enhances the structural integrity and aesthetic complexity of the final product. Coupled with Computer-Aided Design (CAD) software, 3D technology enables brands to quickly respond to niche fashion trends and offer consumers unique designs, significantly reducing the time-to-market for new collections. These technologies are particularly important for high-value items where flawless execution is paramount.

Retail and customer engagement technologies are also transforming the landscape. E-commerce platforms now incorporate sophisticated augmented reality (AR) and virtual try-on tools, allowing potential buyers to visualize how a black pearl necklace sits against their skin tone and clothing, bridging the gap between online browsing and the physical luxury shopping experience. Additionally, robust Customer Relationship Management (CRM) systems, often powered by AI, capture detailed purchasing histories and preferences, enabling personalized marketing communications and recommendations, thereby fostering loyalty among affluent clientele. The convergence of these technologies supports a high-touch, secure, and globally accessible market environment for black pearl necklaces.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to register the fastest growth rate, primarily driven by China and India. Rapid urbanization, increasing household wealth, and cultural emphasis on jewelry as both adornment and financial investment fuel demand. The black pearl’s unique status appeals strongly to younger, affluent Chinese consumers seeking differentiation from traditional gold or jade jewelry. Supply chain optimization in Southeast Asian pearl farming nations further solidifies the region's importance.

- North America: This region maintains a significant market share, characterized by a mature luxury consumer base and strong retail infrastructure. Demand is steady, focusing on classic, high-quality Tahitian pearl strands sold through established luxury houses and major online retailers. Consumer trends lean toward sustainability and transparency, compelling brands to provide detailed sourcing information and ethical certifications.

- Europe: Europe remains a core market for high-end, designer black pearl necklaces, led by key luxury hubs in France, Italy, and the UK. The market is defined by a preference for exceptional craftsmanship, limited-edition collections, and collaborations between pearl houses and haute couture designers. European consumers often prioritize historical provenance and artisanal quality over sheer size or volume.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, demonstrates burgeoning demand driven by high disposable incomes and a cultural affinity for opulent and visible luxury items. Black pearls are viewed as desirable status symbols, leading to a strong demand for customized, high-carat gold settings combined with large, high-luster pearls.

- Latin America: While smaller, the market in Latin America is growing, particularly in Brazil and Mexico. Economic stabilization and expanding luxury access points are slowly boosting consumption. The focus remains primarily on accessible luxury segments, including treated freshwater black pearls, though demand for certified Tahitian pearls is rising among the elite.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Black Pearl Necklace Market.- Mikimoto

- Tiffany & Co.

- Cartier

- Harry Winston

- Chanel Fine Jewelry

- Paspaley

- Kojima Pearl

- Assael

- Imperial Pearl

- Gellner

- Atlas Pearls

- Kamoka Pearl

- Zales

- Blue Nile

- James Avery

- Honora

- Pearl Paradise

- Stuller

- Gemporia

- Mauboussin

Frequently Asked Questions

Analyze common user questions about the Black Pearl Necklace market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes a Tahitian black pearl necklace from other black pearl varieties?

Tahitian black pearls are naturally colored, derived from the Pinctada margaritifera oyster found primarily in French Polynesia. They exhibit deep, natural pigmentation and unique overtone colors (peacock, green, silver), distinguishing them from dyed freshwater or Akoya pearls.

How is the value of a black pearl necklace determined?

Value is determined by a strict grading scale based on five criteria: size (in millimeters), shape (round being most valuable), luster (intensity of reflection), surface quality (lack of blemishes), and color/overtone uniqueness. Rarity and provenance also significantly influence the final price.

Are black pearl necklaces considered a good investment?

High-quality, certified, and large Tahitian black pearl necklaces from reputable luxury brands often retain or increase in value due to their finite supply and sustained luxury demand. Lower-grade or treated black pearls are primarily considered fashion items rather than long-term investments.

What are the primary factors restraining growth in the Black Pearl Necklace market?

Key restraints include the long cultivation period required for genuine black pearls, volatility in the aquaculture supply chain due to environmental changes, and the ongoing challenge of combating the market saturation caused by less expensive, dyed imitations.

Which distribution channel is dominating the sales of black pearl necklaces?

While traditional offline specialty jewelry stores historically dominated sales, the Online Retail channel is rapidly gaining ground, fueled by increased consumer trust in digital luxury transactions, sophisticated e-commerce security measures, and the convenience of global shopping access.

Detailed Market Dynamics and Competitive Landscape

The competitive landscape of the Black Pearl Necklace market is intensely fragmented at the lower tier, yet highly consolidated at the premium, high-value end, dominated by globally recognized luxury jewelry houses and specialized pearl merchants. Companies like Mikimoto, Paspaley, and Assael maintain control over the high-grade Tahitian segment due to established sourcing relationships and stringent quality control standards. These key players leverage heritage, craftsmanship, and brand legacy to justify premium pricing. The market's competitiveness is defined not just by price, but by verifiable authenticity, unique design narratives, and the ability to offer exceptional customer experiences, including personalized design consultations and lifetime maintenance services. Mid-tier competition is increasing with the entry of online specialty retailers who focus on transparency and competitive pricing for high-quality, though not always top-grade, black pearls, appealing strongly to middle-affluent consumers.

Pricing strategies across the market are complex and dynamic. For natural black Tahitian pearls, pricing is inelastic and governed by rarity and the specific characteristics of the annual harvest yield. Conversely, dyed or enhanced black pearls compete on a more elastic pricing structure, driven by fashion trends and volume sales, particularly through department stores and general e-commerce platforms. A critical dynamic is the integration of technology, particularly in quality assurance; companies that can provide verifiable digital proof of a pearl's origin and treatment status (via blockchain or AI grading) gain a distinct competitive advantage over competitors relying solely on traditional paper certifications. Furthermore, sustainability is shifting from a niche concern to a core competitive requirement, with leading brands actively marketing their commitment to environmentally sound aquaculture practices, attracting a discerning segment of luxury consumers.

Strategic partnerships are becoming essential for market stability. Upstream pearl farmers are forming long-term contracts with major distributors and luxury retailers to secure consistent purchase prices and mitigate the risks associated with volatile global pearl output. Downstream, collaborations between jewelry designers and technology providers for customized design (e.g., 3D printing) and enhanced retail experiences (e.g., AR fitting rooms) are crucial for market differentiation. These strategic moves aim to streamline the value chain, reduce intermediaries, and ensure that the final consumer receives an authenticated, high-quality product, thereby reinforcing the overall market value proposition of black pearl necklaces.

Black Pearl Necklace Market Outlook: Trends and Future Trajectory

The future trajectory of the Black Pearl Necklace market is heavily reliant on evolving consumer aesthetics and technological integration. One significant trend is the 'Return to Color,' where traditional white pearls are being supplemented or replaced by colored organic gems, positioning black pearls perfectly to capitalize on this movement. Consumers are increasingly seeking deep, iridescent colors that offer a sophisticated alternative to traditional diamond or gold jewelry. This trend is amplified by social media influence, where unique, high-contrast jewelry pieces gain considerable visibility and desirability. Furthermore, the segmentation of the market by length and style is blurring; layering necklaces of different lengths and materials, including mixed metals with pearls, is highly popular among contemporary buyers, necessitating greater design flexibility from manufacturers.

From an operational perspective, the long-term outlook mandates significant investment in climate change resilience strategies within aquaculture. As ocean temperatures and acidity levels fluctuate, pearl farming operations face heightened risks of oyster mortality and inconsistent pearl quality. Future market leaders will be those who pioneer closed-loop or environmentally controlled farming techniques, ensuring a stable, sustainable supply regardless of external environmental pressures. Innovation in nucleus technology and grafting techniques aimed at maximizing the yield of large, perfectly round, highly lustrous black pearls will be key differentiating factors in the supply chain, directly influencing the availability of premium raw materials for the luxury segment.

Geographically, while established markets in the West will prioritize authenticity and sustainability, the growth engine will decidedly be in emerging Asian markets. The outlook predicts a substantial shift in luxury spending power towards Generation Z and younger Millennials in APAC, who view fine jewelry as personal expression rather than just inheritance. Brands must adapt their marketing narratives to resonate with this younger demographic, focusing on self-purchase and ethical luxury. This demographic shift necessitates a move towards omni-channel retail excellence, integrating seamless online discovery with exclusive in-store experiences, maintaining the high-touch service expected in luxury transactions while offering digital convenience.

Analysis by Pearl Type

The segmentation by pearl type is fundamental to the Black Pearl Necklace market structure, directly correlating with price, rarity, and luxury status. Tahitian Black Pearls, originating from French Polynesia, dominate the premium segment. Their natural, often complex coloration—ranging from deep charcoal to shimmering peacock green—is highly prized and cannot be replicated synthetically. The time and difficulty associated with cultivating these specific pearls ensure their consistently high market value, appealing to high-end collectors and legacy brands seeking flawless materials. Demand for certified, unenhanced Tahitian strands remains robust, supported by their reputation for deep luster and large size potential. However, their supply remains critically constrained, impacting market growth potential at the top tier.

In contrast, Freshwater Black Pearls (often enhanced or treated to achieve dark coloration) and Dyed Black Pearls occupy the accessible and mid-range market tiers. Freshwater pearls offer superior affordability and greater variability in shape, allowing for broader design flexibility and volume production. While they lack the unique luster and overtone of a natural Tahitian pearl, technological advancements in dyeing and enhancement processes have significantly improved their visual appeal, making them highly attractive to first-time luxury buyers or consumers seeking fashion-forward, statement pieces without the investment cost of Tahitian varieties. These segments are vital for overall market volume growth, particularly in developing economies.

The challenge for the entire market lies in consumer education and transparency. As the difference between natural Tahitian color and enhanced color can be subtle to the untrained eye, reputable market players must invest in clear labeling and guarantee certifications. The increasing availability of high-quality dyed pearls poses a restraint on the pricing power of genuine low-to-mid-grade Tahitian pearls, requiring constant vigilance in grading and marketing communication to maintain distinct market positioning. Successful brands in this segment invest heavily in differentiating their premium, naturally colored offerings through rigorous certification standards and sophisticated storytelling centered on origin and rarity.

Analysis by Distribution Channel

The Black Pearl Necklace market leverages both Offline and Online Retail channels, each serving specific consumer needs and influencing purchasing decisions differently. Offline Retail, encompassing specialty jewelry boutiques, dedicated brand stores, and high-end department stores, remains critically important for premium and bespoke black pearl necklaces. These physical channels offer a vital high-touch environment where consumers can physically inspect the pearls, assess luster and color under optimal lighting, and receive expert consultation. For high-value purchases, the trust and personalized service established in a physical store often finalize the sale, reinforcing the luxury brand experience and providing assurance regarding authenticity and after-sales service.

Conversely, Online Retail, including proprietary e-commerce sites and major third-party luxury platforms (such as Blue Nile and Net-a-Porter), is experiencing explosive growth. This channel offers unparalleled global reach, convenience, and increasingly sophisticated visual tools (like AR try-ons) that mitigate the traditional hesitations associated with buying high-value jewelry sight-unseen. The online channel is particularly strong in the accessible luxury and mid-range segments, where price transparency and comparative shopping are highly valued. Digital platforms also excel at targeting niche demographics, using data analytics to tailor product recommendations and market specific styles, such as customizable lengths or contemporary settings, driving volume sales.

The future of distribution is undoubtedly omni-channel, where the synergy between physical and digital presence determines market success. Consumers frequently research complex purchase decisions, like black pearl necklaces, extensively online before finalizing the transaction either in-store or through a secure online portal. Retailers are investing in inventory synchronization and seamless transition services, such as ordering a specific necklace length online for in-store pickup and fitting. Maintaining secure logistics, high insurance coverage, and professional presentation during delivery are crucial requirements for luxury goods sold online, distinguishing successful digital retailers in this competitive segment. The channel dynamics reflect a balancing act between maintaining the tradition of luxury service and embracing the efficiency of digital commerce.

Analysis by End-User Segment

The end-user segmentation for black pearl necklaces traditionally places Women as the overwhelmingly dominant segment. For women, black pearl necklaces serve multifaceted roles, ranging from classic heirloom pieces—often long, opera-length strands—to modern, fashion-forward chokers or pendants. Purchasing drivers are diverse, encompassing personal indulgence, celebration of major life milestones, or receiving luxury gifts. Consumer preferences within this segment are broad, spanning the highest-quality, perfectly round Tahitian pearls for formal events, to irregularly shaped, baroque black pearls that cater to a more artistic and bohemian aesthetic. The female segment is heavily influenced by celebrity endorsement, runway trends, and historical luxury advertising, requiring brands to maintain fresh and diverse collections.

While historically a smaller cohort, the Men's end-user segment is exhibiting notable expansion, reflecting broader shifts in men's fashion toward expressive, non-traditional fine jewelry. Male consumers typically favor minimalistic black pearl designs, often featuring a single large pearl as a pendant or integrated into leather and metal settings for a rugged yet luxurious appeal. Black pearls resonate strongly with this segment due to their perceived masculinity, deep color, and unique material composition, offering an alternative to standard metal chains or gemstone jewelry. This segment is driven by personalization and the desire for unique, subtle status symbols, particularly in metropolitan luxury markets across North America and Europe. Marketing strategies targeting men focus heavily on sophistication, material quality, and design innovation.

The growth of both segments is interdependent on cultural acceptance and economic stability. For women, sustained economic empowerment globally ensures continued self-purchase of luxury items. For men, the normalization of fine jewelry in professional and casual settings opens up new avenues for black pearl product lines. Future opportunities lie in developing gender-neutral or adaptable black pearl necklace designs that appeal to both segments, focusing on modularity and customization. Understanding the distinct psychological drivers—whether it's heritage and investment for the female consumer or individuality and contemporary style for the male consumer—is paramount for effective product development and marketing in both end-user segments.

Future Challenges and Strategic Recommendations

Despite promising growth projections, the Black Pearl Necklace market faces several critical future challenges that require strategic intervention. Foremost among these is the ecological vulnerability of the supply chain. Climate change poses an existential threat to pearl oyster farms, risking not only reduced output but also compromised quality, particularly the color and luster highly valued in Tahitian pearls. To mitigate this, sustained investment in marine science and resilient aquaculture technology, including controlled environment farming and genetic research for hardier oysters, is essential. Furthermore, ensuring fair trade practices and economic stability for the remote communities involved in pearl farming is a moral and strategic imperative to secure long-term, ethical supply.

Another significant challenge is managing market integrity against counterfeiting and misrepresentation. The ease with which lower-grade pearls can be dyed or treated to mimic the appearance of expensive natural black pearls demands sophisticated verification mechanisms. Brands must collaborate to establish universal, digitally verifiable standards for grading and provenance, ideally leveraging blockchain technology industry-wide. Consumer education initiatives are equally critical, empowering buyers to confidently distinguish between naturally rare specimens and chemically enhanced alternatives. Failure to address this erosion of trust could significantly depress the price ceiling for all but the most exclusively branded, top-tier black pearls.

To capitalize on the growth opportunities, particularly in APAC, strategic recommendations include focused product diversification and enhanced digital engagement. Brands should develop capsule collections that incorporate black pearls with locally relevant materials or design motifs, moving beyond classic Western aesthetics to appeal to varied cultural tastes. Furthermore, leveraging AI-driven predictive analytics to anticipate localized demand fluctuations—such as seasonal gifting customs in China or India—will allow for optimized inventory placement and tailored marketing campaigns. Ultimately, sustained success hinges on combining the timeless allure of the black pearl with modern demands for transparency, sustainability, and technological convenience in the purchasing journey.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager