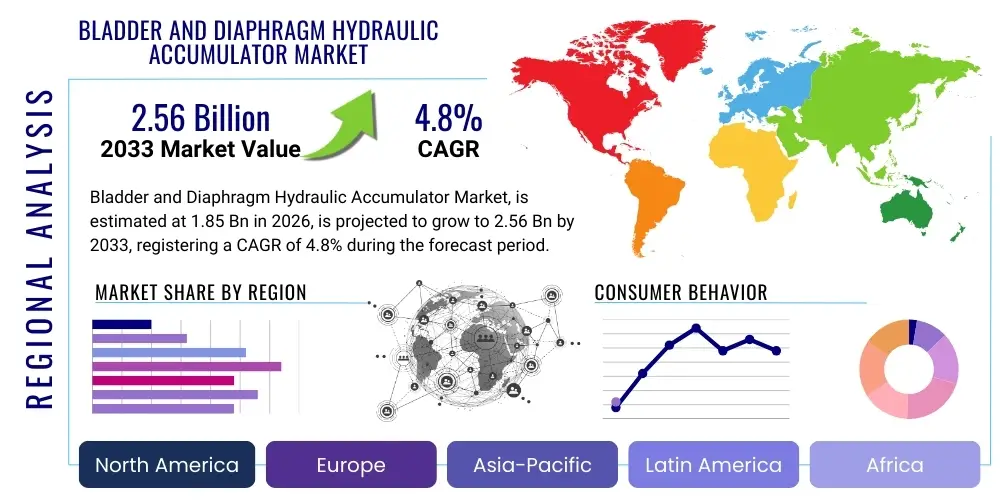

Bladder and Diaphragm Hydraulic Accumulator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443475 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Bladder and Diaphragm Hydraulic Accumulator Market Size

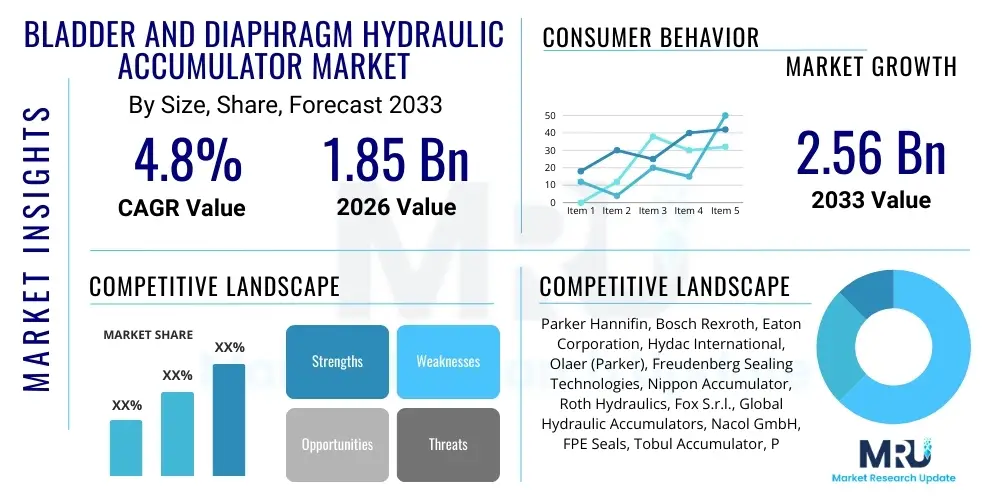

The Bladder and Diaphragm Hydraulic Accumulator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.56 Billion by the end of the forecast period in 2033.

Bladder and Diaphragm Hydraulic Accumulator Market introduction

The Bladder and Diaphragm Hydraulic Accumulator Market encompasses devices crucial for energy storage, shock absorption, pulsation dampening, and emergency power in hydraulic systems across numerous industrial sectors. These accumulators operate by storing non-compressible hydraulic fluid under pressure, using a pressurized gas (typically nitrogen) separated from the fluid by a flexible barrier—either a bladder or a diaphragm. Bladder accumulators are generally preferred for high-volume, high-pressure applications where rapid response is essential, offering superior performance in managing large fluid volumes and handling significant pressure fluctuations, thereby ensuring reliable peak power delivery and minimizing hydraulic circuit pulsations in heavy-duty machinery. Their construction emphasizes robustness and longevity under rigorous operational conditions, making them indispensable in sectors such as oil and gas and large construction projects.

Diaphragm accumulators, conversely, are typically employed in compact systems or low-volume applications, known for their lightweight design and resistance to contamination, making them ideal for mobile equipment and specialized industrial machinery where space is constrained and rapid installation is necessary. These smaller units are highly effective in dampening minor pressure ripples and providing localized pressure holding, often found integrated into braking systems, steering mechanisms, and compact manufacturing robotics. The inherent structural simplicity of diaphragm designs also contributes to reduced manufacturing costs and easier integration into pre-existing or modular hydraulic architectures, appealing strongly to OEMs focused on minimizing component footprint and overall system weight.

The primary driving factors propelling market expansion include stringent safety regulations mandating reliable emergency shutdown capabilities, the continuous global demand for energy-efficient hydraulic systems to reduce operational costs, and the proliferation of automation in manufacturing and heavy mobile machinery requiring precise and repeatable hydraulic control. The inherent benefits, such as reduced system operating costs through pump optimization, enhanced equipment lifespan due to minimized hydraulic shock, and improved manufacturing cycle times, further solidify the vital role these components play in modern industrial fluid power systems, ensuring sustained market growth throughout the forecast period as industries prioritize efficiency and safety compliance.

Bladder and Diaphragm Hydraulic Accumulator Market Executive Summary

The Bladder and Diaphragm Hydraulic Accumulator Market demonstrates robust growth driven primarily by macro-level business trends, including the global shift towards predictive maintenance protocols and the increasing implementation of high-pressure fluid power systems in infrastructure and energy projects worldwide. Key business trends involve manufacturers developing intelligent accumulators equipped with advanced IoT sensors for real-time monitoring of critical parameters such as pressure, temperature, and barrier integrity. This focus on "smart accumulators" facilitates preventive maintenance, reduces the likelihood of catastrophic system failures, and allows manufacturers to transition towards service-based revenue models focusing on system uptime guarantees. Furthermore, there is a pronounced focus on sustainable material development, prioritizing specialized composites and high-grade elastomers to enhance durability and reduce the environmental footprint of hydraulic components, particularly in highly corrosive environments.

Regionally, Asia Pacific (APAC) continues its trajectory as the dominant growth engine, underpinned by aggressive industrialization policies, massive infrastructural investments (e.g., high-speed rail, metropolitan expansion), and surging production of mobile construction and agricultural machinery across key economies like China, India, and Southeast Asia. These markets prioritize high-volume production and robust, cost-effective solutions. Conversely, North America and Europe maintain strong demand characterized by a focus on high-specification, technologically advanced replacement cycles, stringent environmental regulations necessitating leak-proof and highly efficient components, and high adoption rates within specialized sectors such as aerospace, precision machine tooling, and advanced automotive production lines where performance metrics are exceptionally high.

Segment trends reveal that the Bladder Accumulator segment retains significant market leadership in terms of overall revenue owing to its critical applicability in high-pressure, large-volume static systems used in demanding sectors like oil drilling and forging presses. However, the Diaphragm Accumulator segment is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR), primarily fueled by its growing utilization in compact and mobile hydraulics, battery-electric machinery, and emerging robotic applications where optimization of size, weight, and swift response is paramount. End-user segmentation analysis indicates that the Construction and Mining sector remains the foundational consumer base, yet the burgeoning Renewable Energy sector, specifically involving complex offshore and onshore wind turbine pitch control systems, is rapidly emerging as a high-potential market segment demanding extremely reliable, low-maintenance hydraulic accumulation solutions.

AI Impact Analysis on Bladder and Diaphragm Hydraulic Accumulator Market

User queries regarding the impact of Artificial Intelligence (AI) on the hydraulic accumulator market are heavily focused on leveraging AI for system optimization, specifically concerning predictive maintenance, dynamic performance tuning, and component longevity assessment. Users frequently ask how AI algorithms can effectively detect the subtle onset of bladder or diaphragm micro-leaks or fatigue before these failures precipitate costly system downtime. Additionally, there is significant user interest in whether AI can dynamically adjust and optimize accumulator pre-charge settings in real-time, adapting to constantly varying load conditions, ambient temperatures, and duty cycles to maximize system efficiency and prevent premature wear. The overriding expectation is that AI integration will fundamentally transform accumulators from passive hydraulic components into active, intelligent assets capable of self-diagnosis and communicating their health status, thereby transitioning maintenance practices from scheduled checks to data-driven, condition-based interventions.

The integration of advanced AI technologies, particularly machine learning (ML) and deep learning algorithms, into hydraulic systems facilitates sophisticated analysis of complex, multivariate data streams collected from embedded Internet of Things (IoT) sensors within or proximal to the accumulator. This capability allows manufacturers and end-users to establish highly accurate baseline performance models. By monitoring deviations in metrics such as pressure wave consistency, internal temperature profiles, and component vibration signatures, AI can detect subtle operational anomalies that unequivocally signal impending component degradation, specifically focusing on the erosion or failure of the internal flexible barrier. The resulting ability to accurately predict the Remaining Useful Life (RUL) of the accumulator minimizes the incidence of catastrophic, unpredicted system failures, significantly optimizes the allocation of maintenance resources, and ensures the accumulator performs its core functions—such as load leveling and shock mitigation—at peak effectiveness throughout its extended operational lifespan.

Moreover, AI is playing an increasingly crucial role in the initial design and virtual prototyping phase of new hydraulic systems and components. Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) simulation tools, enhanced by AI optimization routines, can rapidly iterate through thousands of potential design parameters. This accelerates the process of optimizing material selection, determining the most efficient internal geometry for fluid flow, and precisely sizing the accumulator for complex hydraulic circuits. This technological capability drastically shortens the product development cycle, resulting in the commercialization of accumulators that are inherently more durable, demonstrably energy efficient, and optimally matched to precise application specifications, thus providing a significant competitive advantage to manufacturers who actively adopt these advanced digital engineering methodologies in their operational workflow.

- Enhanced Predictive Maintenance: AI algorithms analyze high-frequency pressure and temperature data signatures to forecast the probability of bladder or diaphragm failure, drastically reducing unscheduled equipment downtime.

- Dynamic System Optimization: Machine learning dynamically adjusts internal gas pre-charge settings in intelligent accumulators based on continuous monitoring of operational load demands and fluctuating ambient conditions, maximizing energy efficiency.

- System Efficiency Maximization: AI identifies and corrects subtle inefficiencies within the hydraulic cycle, ensuring the accumulator contributes optimally to kinetic energy recuperation and storage functions, leading to reduced power consumption.

- Automated Fault Diagnostics: Immediate, autonomous detection and comprehensive reporting of unusual operational signatures, such as excessive vibration or rapid pressure decay, indicative of micro-leakage or structural fatigue.

- Optimized Supply Chain Logistics: Machine learning models accurately predict the periodic demand for specific accumulator types and high-wear replacement kits, enabling manufacturers to streamline inventory management and improve just-in-time delivery capabilities globally.

- Improved Component Design: AI-driven simulation tools accelerate the R&D process, optimizing accumulator shell materials and barrier geometry for superior performance and extended service life under extreme operational stress.

DRO & Impact Forces Of Bladder and Diaphragm Hydraulic Accumulator Market

The Bladder and Diaphragm Hydraulic Accumulator Market trajectory is dictated by a potent confluence of Drivers (D), Restraints (R), and Opportunities (O), all interacting under pervasive technological and economic Impact Forces. Primary drivers include the increasingly stringent global focus on industrial safety and environmental compliance, regulatory mandates that require reliable hydraulic shock suppression and rapid-response emergency power backup systems in heavy industrial and mobile machinery. The substantial and continuous expansion of the global heavy machinery sector, particularly spurred by massive public and private infrastructure investments across developing and developed nations, ensures a robust foundational demand for high-performance accumulators capable of reliably functioning under demanding operational cycles and environmental extremes. Furthermore, the imperative across all major industries to enhance the energy efficiency of fluid power systems—where accumulators are crucial for recovering, storing, and instantaneously reusing hydraulic energy—provides a powerful, persistent motivational force for widespread adoption.

Restraints impeding market growth are primarily technical and economic in nature, largely centered on managing the finite lifespan and maintenance requirements associated with the flexible barrier components. The integrity of the bladder or diaphragm is consistently challenged by harsh operational conditions, including extreme temperature fluctuations, chemical incompatibility with specialized or contaminated hydraulic fluids, and exposure to abrasive particle contamination, necessitating rigorous routine monitoring and costly component replacement schedules which significantly inflate the Total Cost of Ownership (TCO). A further restraint is the relatively high initial capital expenditure required for acquiring advanced, high-pressure, fully certified accumulators, which can be prohibitive for smaller enterprises, alongside the technical complexity inherent in accurately setting and routinely verifying the nitrogen pre-charge, demanding specialized training and calibrated equipment.

Opportunities for strategic expansion are extensive, particularly within the fast-growing segments of renewable energy generation, exemplified by the specialized, ultra-reliable accumulator requirements for precise pitch control systems in large offshore wind turbines and in developing wave and tidal power infrastructure. The pervasive industry trend towards miniaturization and simultaneous weight reduction in next-generation mobile hydraulics creates significant commercial avenues for advanced diaphragm accumulators utilizing lightweight, high-strength composite shells. Moreover, the strategic opportunity presented by the integration of sophisticated IoT and Artificial Intelligence technologies is paramount, enabling leading manufacturers to offer higher-value, digitally-enabled service contracts centered on dynamic remote performance optimization, health monitoring, and guaranteed condition-based maintenance, thereby successfully shifting the underlying revenue model towards recurring lifecycle management services.

The overarching Impact Forces currently shaping the market are overwhelmingly positive, strongly encouraging the increased adoption and technological advancement of these components. Material science breakthroughs, especially in high-performance elastomers and specialized metallic alloys for pressure vessel shells, are effectively mitigating many traditional restraints related to component lifespan and required maintenance frequency. Systemic regulatory pressures, specifically those demanding demonstrably safer and environmentally cleaner industrial operational practices globally, structurally mandate the continuous use of high-integrity fail-safe hydraulic components such as accumulators, providing a firm, non-negotiable foundation for consistent market demand. While acute global economic volatility in specific commodity-dependent industrial sectors, such as oil and gas or large-scale mining, may periodically depress immediate capital expenditure on new equipment, the long-term, irreversible global trends towards high levels of automation, critical energy recovery solutions, and progressively stricter safety and environmental control mechanisms ensure that bladder and diaphragm hydraulic accumulators remain an absolutely indispensable element of contemporary industrial fluid power architectures.

Segmentation Analysis

The Bladder and Diaphragm Hydraulic Accumulator Market is robustly segmented across multiple dimensions, including product configuration, constituent material composition, nominal operating pressure capacity, and primary end-user industrial application, facilitating a detailed, strategic understanding of specific market dynamics and underlying demand drivers. Segmentation based on product type—specifically comparing Bladder Accumulators versus Diaphragm Accumulators—is fundamental, reflecting intrinsically distinct operational characteristics: bladder accumulators are generally favored for high-volume, static energy storage and severe pulsation dampening, while diaphragm accumulators are tailored for low-volume, compact installations, and highly dynamic applications requiring low inertia and rapid response, such as in specialized mobile robotics and brake energy recovery systems.

Segmentation by the internal pressure containment material illuminates strategic choices between traditional carbon steel, specialized stainless steel, and emerging composite materials for the shell structure, selections that are critically driven by the application's required cost profile, necessary resistance to corrosion (especially critical in marine or chemical processing environments), and stringent weight optimization requirements. Furthermore, segmentation based on operating pressure clearly delineates market demand across performance severity levels, ranging from ubiquitous low-pressure applications (typically below 150 bar) found in general factory automation to ultra-high-pressure (>600 bar) systems specifically mandated for extreme duty cycles in deep-sea subsea oil and gas intervention equipment, where reliability under immense stress is non-negotiable. The integrity and precise composition of the elastomer barrier material are inherently dependent on these specific pressure rating demands.

End-user industry segmentation remains the most pivotal classification for demand forecasting, encompassing highly diverse sectors such as Construction, Oil & Gas, Agriculture, Machine Tools, Aerospace, and Renewable Energy. Each industry segment possesses unique, specialized accumulator requirements; for example, the Construction sector demands rugged, high-shock capacity units for boom suspension and load handling, whereas the Aerospace sector requires highly lightweight, fire-resistant, and zero-leakage diaphragm units for critical flight control surfaces. This granular segmentation analysis is essential for manufacturers to effectively customize highly specialized product lines, strategically prioritize focused Research and Development (R&D) investments, and tailor targeted sales and marketing initiatives towards the most lucrative, technologically demanding, and high-growth application niches across the global market landscape.

- By Type:

- Bladder Accumulators (Dominant in volume, high-pressure applications)

- Diaphragm Accumulators (Fastest growing, compact, mobile applications)

- By Operating Pressure:

- Low Pressure (Up to 150 Bar, common industrial use)

- Medium Pressure (150 Bar to 400 Bar, standard mobile and manufacturing)

- High Pressure (Above 400 Bar, subsea and heavy forging applications)

- By Material:

- Carbon Steel (Cost-effective, standard industrial use)

- Stainless Steel (Corrosion resistance, marine and chemical processing)

- Composite Materials (Lightweight, aerospace and high-performance mobile equipment)

- By End-User Industry:

- Construction and Mining (Shock absorption, emergency braking)

- Oil and Gas (Blowout preventers, subsea actuation, high pressure)

- Agriculture (Suspension, implement control)

- Machine Tools and Industrial Manufacturing (Clamping, energy saving, pulsation dampening)

- Aerospace and Defense (Flight controls, landing gear, critical actuation)

- Automotive and Transportation (Braking systems, hybrid vehicle energy recovery)

- Renewable Energy (Wind turbine pitch control, structural dampening)

Value Chain Analysis For Bladder and Diaphragm Hydraulic Accumulator Market

The comprehensive Value Chain for the Bladder and Diaphragm Hydraulic Accumulator Market initiates with crucial upstream activities centered on meticulous raw material procurement and preparation. This phase involves sourcing specific high-grade ferrous alloys (carbon steel and specialized stainless steel grades) necessary for robust pressure vessel shells, alongside advanced engineered polymers and elastomers (such as highly durable Nitrile, Butyl, or proprietary Viton compounds) essential for the flexible bladder and diaphragm barriers, and the consistent supply of certified dry compressed nitrogen gas for pre-charge. A primary challenge in the upstream segment is strategically managing intrinsic price volatility in global steel markets and specialized elastomer compounds, while simultaneously ensuring that all raw materials strictly adhere to demanding international pressure vessel standards (e.g., ASME Boiler and Pressure Vessel Code, PED in Europe), requiring rigorous material traceability and quality control throughout the sourcing process.

Midstream activities encompass the core, specialized manufacturing and assembly processes. This intensive stage includes the forging and precision machining of steel shells, automated welding processes certified for high pressure, the proprietary injection molding of bladders and diaphragms, and the intricate assembly of gas valves and ports. This production phase is significantly capital-intensive, requiring specialized, high-precision manufacturing equipment for accurate welding, non-destructive testing (NDT), and hydrostatic proof testing to certify structural integrity. Technological investment in this segment is strongly focused on advanced automation (robotics) to enhance production efficiency, minimize material waste, and ensure extremely tight dimensional tolerances for optimal component fit and secure sealing performance. The direct distribution channel in this phase involves manufacturers supplying high-volume, strategically integrated accumulators directly to major Original Equipment Manufacturers (OEMs) in sectors like heavy construction and energy, often requiring deep collaboration on customized, application-specific designs.

Downstream activities are focused on market penetration, sales, complex installation, and the profitable aftermarket service segment. The indirect distribution channel is crucial, relying heavily on a network of global, regional, and specialized industrial fluid power distributors and hydraulic service firms who maintain critical inventory levels, offer immediate technical support, and supply standardized replacement units, certified repair kits, and essential charging tools to a geographically dispersed base of smaller end-users and maintenance organizations. Aftermarket services—specifically pre-charge maintenance, scheduled bladder/diaphragm replacement, and mandatory periodic pressure vessel recertification—constitute a stable, high-margin segment of the value chain, driven by regulatory requirements and the necessity of ensuring system uptime. Successfully navigating this value chain requires market participants to prioritize robust, resilient supply chain logistics and cultivate a globally responsive, technically proficient field service network to deliver long-term reliability and specialized technical expertise, thereby achieving critical differentiation beyond simple component pricing.

Bladder and Diaphragm Hydraulic Accumulator Market Potential Customers

Potential customers for Bladder and Diaphragm Hydraulic Accumulators constitute a vast and diverse commercial ecosystem across virtually every industrial and mobile sector that relies critically on controlled, robust fluid power systems and guaranteed operational reliability. The most substantial and consistently recurring customer segment involves large-scale Original Equipment Manufacturers (OEMs) who design and produce heavy machinery, including but not limited to massive earthmoving excavators, towering cranes, large wheel loaders, specialized forestry equipment, and comprehensive material handling systems. These OEMs integrate accumulators as foundational components primarily for critical functions like mitigating severe hydraulic shock, stabilizing boom suspension systems, and providing indispensable emergency steering or braking capabilities, translating into substantial, often contract-based, demand for high-volume orders of both standard and highly customized, rigorously tested units tailored for continuous, harsh duty cycles.

Furthermore, critical high-value potential customers are situated within the capital-intensive energy and utility sectors. This includes major global oil and gas exploration and production companies (utilizing accumulators for activating massive blowout preventers and precise subsea valve controls), operators of large offshore and onshore wind farms (requiring highly reliable units for blade pitch control systems and structural vibration dampening), and conventional power generation facilities. Customer demand from these sectors is exceptionally stringent, characterized by mandates for absolute reliability, the compulsory use of specialized, corrosion-resistant materials (e.g., duplex stainless steel), and unequivocal compliance with demanding international regulatory and environmental safety protocols, often resulting in long-term procurement relationships based on component performance history and certifications.

Finally, a consistently profitable and broad customer base is found within the ecosystem of Maintenance, Repair, and Overhaul (MRO) service providers and specialized, independent machine manufacturing and refurbishment shops globally. This segment drives the substantial aftermarket for replacement parts and service components. These customers routinely procure standardized accumulator models, essential repair kits, specialized elastomer barriers, and associated diagnostic equipment (like charging rigs and pressure transducers) on an ongoing basis to ensure the maintained operational longevity and reliable performance of the massive existing installed base of hydraulic equipment across diverse applications ranging from plastic injection molding, automated die-casting, complex metal forming, and general factory automation lines. Effectively serving this dispersed customer segment requires manufacturers to ensure wide product availability, prompt delivery logistics, and accessible local technical support through a comprehensive global distribution network.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.56 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin, Bosch Rexroth, Eaton Corporation, Hydac International, Olaer (Parker), Freudenberg Sealing Technologies, Nippon Accumulator, Roth Hydraulics, Fox S.r.l., Global Hydraulic Accumulators, Nacol GmbH, FPE Seals, Tobul Accumulator, PacSeal International, Hydro Leduc, QHP Ltd., HYJ Hydraulic Accumulator, Accumulators, Inc., Weber-Hydraulik GmbH, WIKA Instrument. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bladder and Diaphragm Hydraulic Accumulator Market Key Technology Landscape

The technological landscape characterizing the Bladder and Diaphragm Hydraulic Accumulator Market is undergoing rapid and significant transformation, fundamentally driven by an industry-wide mandate for substantially enhanced reliability, streamlined maintenance procedures, and seamless digital integration into advanced control and monitoring systems. A core area of persistent innovation focuses on the material science of the internal flexible barriers. Manufacturers are continually dedicating substantial investment in Research and Development (R&D) to synthesize advanced, high-performance elastomer compounds. The objective is to produce materials that possess superior chemical compatibility with modern, environmentally mandated hydraulic fluids (such as rapidly evolving bio-degradable oils), significantly higher thermal tolerance for extreme operating environments, and demonstrably extended fatigue life under millions of rapid, severe pressure cycling events. These next-generation elastomers—including proprietary formulations of highly resistant Nitrile, hydrogenated nitrile butadiene rubber (HNBR), or Fluoroelastomer (FKM)—are absolutely critical for successfully penetrating the most demanding application niches, such as high-performance naval hydraulics and chemically aggressive specialized industrial processing plants.

A second, technologically disruptive development is the widespread adoption of integrated monitoring and sophisticated smart accumulator technologies. The market is witnessing a rapid commercial transition towards utilizing accumulators equipped with embedded Internet of Things (IoT) sensor arrays specifically designed for continuous, high-frequency condition monitoring. These highly integrated sensors meticulously track all critical operational parameters, including the hydraulic fluid temperature profile, the internal nitrogen gas pre-charge pressure decay, fluid contamination levels, and system vibration spectral analysis in real-time. This extensive digital integration is the foundation of modern predictive maintenance programs, empowering system operators to detect even the most minute gas leaks or the first indicators of barrier material deterioration well in advance of a potential system failure. The aggregated data is immediately processed using powerful embedded microcontrollers or specialized cloud-based analytical platforms, delivering actionable, high-certainty intelligence regarding the component's current health status and enabling precise, proactive optimization of operational efficiency.

Furthermore, significant technological progress is evident in the design and advanced manufacturing of the pressure vessel shell itself. There is a perceptible and accelerating shift towards utilizing lighter, extremely high-strength composite materials, particularly within market segments where substantial weight reduction is a non-negotiable design constraint, such as high-specification mobile hydraulic equipment and all aerospace platforms. While traditional forged and welded steel shells remain the default standard for the highest-pressure and most static industrial applications, composite-wound shells are increasingly offering comparable ultimate pressure ratings with an immensely reduced component weight. This weight saving directly translates into improved energy efficiency, enhanced vehicle handling dynamics, and significantly reduced overall structural loads for mobile equipment. Additional concurrent innovations include the development of specialized, tamper-proof gas valve designs that dramatically simplify the initial pre-charge process while simultaneously preventing unauthorized or inaccurate pressure adjustments, ensuring much safer and highly accurate system operation over vastly extended periods without requiring frequent manual intervention.

Regional Highlights

- Asia Pacific (APAC): Positioned as the leading growth region, APAC commands the highest market volume and demonstrates the fastest Compound Annual Growth Rate. This expansion is powered by unprecedented levels of government-led fixed asset investment in large-scale infrastructure projects, the rapid, continuous expansion of both the commercial and passenger automotive manufacturing base, and extensive, sustained growth in critical mining, construction, and general manufacturing activities across economic powerhouses like China, India, and Indonesia. The primary demand profile centers on high-volume requirements for reliable, medium-pressure hydraulic components used across general industrial and heavy mobile equipment sectors.

- North America: This region is characterized by exceptionally high technological maturity and a strong, consistent market demand for high-specification, certified, and ultra-reliable accumulators. Key consuming sectors include the volatile yet high-demand Oil & Gas industry (particularly in hydraulic fracturing and deep-water exploration), advanced Aerospace and Defense platforms, and precision machine tooling. North America is a major global adopter of digitally integrated, IoT-enabled smart accumulators, leveraging these components for sophisticated, data-driven predictive maintenance and adherence to demanding regulatory mandates such as ASME certifications.

- Europe: Defined as a mature, highly sophisticated market, Europe is characterized by the presence of stringent regulatory frameworks (e.g., the Pressure Equipment Directive (PED) and REACH chemical compliance) and a globally renowned, robust industrial manufacturing base, notably in advanced machine tools in Germany and the mobile hydraulics sector in Italy. The prevailing demand trend favors specialized, highly customized hydraulic solutions that focus intensely on energy efficiency, frequently utilizing accumulators to maximize the recovery and effective reuse of kinetic and braking energy within closed hydraulic systems.

- Latin America: Market performance in this region is intrinsically linked to global commodity price cycles, with demand primarily stimulated by large-scale mining operations (especially in Chile and Peru), aggressive agricultural expansion, and national infrastructure projects in key economies like Brazil and Mexico. The purchasing profile often prioritizes cost-effective, highly durable accumulators built to withstand harsh, remote operational environments, with overall market uptake exhibiting sensitivity to regional economic stability and the varying levels of capital expenditure within critical resource extraction industries.

- Middle East and Africa (MEA): Growth in the MEA market is heavily concentrated and dictated by the substantial investment and operational requirements of the region's core Oil and Gas sector, particularly in Saudi Arabia, UAE, and Qatar, where accumulators are indispensable for critical pressure control in complex drilling operations and long-distance pipeline transport. Secondary drivers include ambitious large-scale infrastructure construction and critical desalination projects, creating specific demand for highly corrosion-resistant (stainless steel) and internationally certified high-pressure accumulation devices. The region functions predominantly as a strategic import destination for advanced hydraulic technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bladder and Diaphragm Hydraulic Accumulator Market.- Parker Hannifin Corporation

- Bosch Rexroth AG

- Eaton Corporation plc

- Hydac International GmbH

- Freudenberg Sealing Technologies GmbH & Co. KG

- Nippon Accumulator Co., Ltd. (NAC)

- Roth Hydraulics GmbH

- Fox S.r.l.

- Tobul Accumulator, Inc.

- Global Hydraulic Accumulators, Inc.

- Nacol GmbH

- FPE Seals Ltd.

- Hydro Leduc S.A.S.

- Weber-Hydraulik GmbH

- WIKA Group (WIKA Instrument, LP)

- QHP Ltd.

- PacSeal International

- Accumulators, Inc.

- HYJ Hydraulic Accumulator

- SAIP S.r.l.

Frequently Asked Questions

Analyze common user questions about the Bladder and Diaphragm Hydraulic Accumulator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between bladder and diaphragm hydraulic accumulators?

The primary difference lies in the design and capacity: Bladder accumulators use a flexible rubber bladder separating the gas and fluid, offering large volume capacity and high flow rates, making them suitable for high-pressure, high-flow applications. Diaphragm accumulators utilize a disc-shaped diaphragm, are inherently more compact and lightweight, and are typically applied in smaller volume systems, mobile hydraulics, and specialized pulsation dampening where minimizing component size is critical.

How often should a hydraulic accumulator's pre-charge pressure be checked or replaced?

The accumulator pre-charge pressure must be checked regularly, generally recommended every 3 to 6 months, as the nitrogen gas can permeate the barrier or slowly leak through seals over time. Maintaining the precise pre-charge pressure is essential for efficient shock absorption and energy storage, and modern smart accumulators are equipped with continuous electronic sensors to mitigate the need for frequent manual checks.

What are the key benefits of using hydraulic accumulators in heavy machinery?

Hydraulic accumulators provide crucial benefits in heavy machinery, primarily mitigating severe hydraulic shock (water hammer), acting as an immediate emergency power reservoir for critical safety functions (such as steering or braking), compensating instantaneously for system leakage, and substantially enhancing energy efficiency by effectively recovering kinetic energy during deceleration, thereby smoothing pump operation and reducing peak power demands.

What technological advancement is most significantly impacting accumulator maintenance?

The most significant technological advancement impacting maintenance is the integration of Internet of Things (IoT) sensors and Artificial Intelligence (AI) for condition monitoring. This technology allows for the real-time tracking of pressure and temperature anomalies, enabling highly accurate predictive maintenance schedules that anticipate and prevent barrier failures, fundamentally shifting strategies from time-based maintenance to condition-based interventions.

Are composite accumulators replacing traditional steel designs?

Composite accumulators are increasingly replacing traditional steel designs in specific weight-sensitive sectors, notably aerospace, defense, and high-performance electric mobile equipment, owing to their superior strength-to-weight ratio and substantial mass reduction. However, traditional, highly durable carbon and stainless steel designs continue to be the standard and dominate high-volume, extremely high-pressure, and static industrial applications where cost-efficiency and absolute durability are the primary operational requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bladder and Diaphragm Hydraulic Accumulator Market Size Report By Type (Bladder Accumulators, Diaphragm Accumulators), By Application (Construction Equipment, Machine Tools, Agriculture, Automotive, Wind & Solar Industry, Fluid Power Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Bladder and Diaphragm Hydraulic Accumulator Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Bladder Accumulators, Diaphragm Accumulators), By Application (Construction Equipment, Machine Tools, Agriculture, Automotive, Wind and Solar Industry, Fluid Power Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager