Blockchain as a Service (BaaS) Platform Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441238 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Blockchain as a Service (BaaS) Platform Market Size

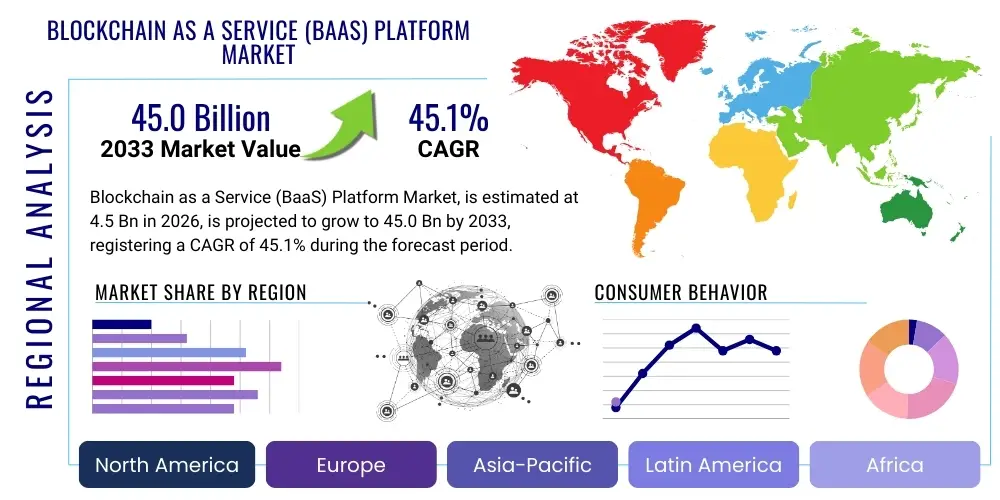

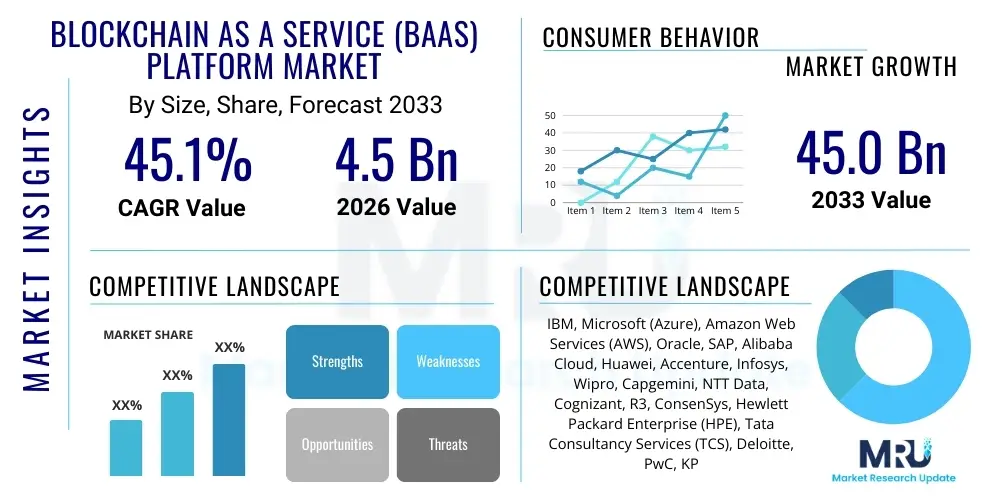

The Blockchain as a Service (BaaS) Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.1% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 45.0 Billion by the end of the forecast period in 2033.

Blockchain as a Service (BaaS) Platform Market introduction

The Blockchain as a Service (BaaS) Platform Market encompasses third-party managed services that allow enterprises to leverage blockchain technology for building, hosting, and operating decentralized applications and smart contracts without the complexity and resource expenditure of setting up an in-house blockchain infrastructure. BaaS platforms offer crucial infrastructure, middleware, and development tools, providing essential services such as identity management, private key protection, and data governance, making distributed ledger technology accessible to mainstream businesses. The product description centers on delivering operational efficiencies, enhancing transparency across supply chains, and facilitating secure digital transactions in regulated industries like finance and healthcare. Major applications span digital identity verification, cross-border payments, trade finance, and intellectual property management, addressing core organizational needs for trust and immutability.

The primary benefits derived from adopting BaaS include significantly reduced time-to-market for blockchain initiatives, lower capital expenditure by eliminating the need for extensive hardware and personnel investment, and enhanced scalability provided by cloud providers managing the underlying network complexities. Furthermore, BaaS platforms typically offer robust security protocols and compliance frameworks, streamlining the regulatory hurdles faced by enterprises experimenting with decentralized systems. The driving factors behind this explosive growth are the increasing acceptance of distributed ledger technology (DLT) in enterprise environments, the imperative for improved supply chain visibility, and the growing demand for secure and transparent transaction frameworks across multiple industry verticals. The shift from experimental pilots to production-grade deployments is a key market accelerator.

Crucially, the inherent ease of integration offered by BaaS solutions, particularly those offered by major cloud hyperscalers, simplifies the onboarding process for large corporations previously hesitant about blockchain adoption due to technical complexity. This democratization of blockchain capability enables firms to focus purely on business logic and innovation rather than infrastructure maintenance. The convergence of cloud computing flexibility with the security and trust offered by blockchain protocols establishes BaaS as a fundamental component of future enterprise IT architecture, driving sustained market penetration globally across diverse economic sectors seeking immutable record-keeping and enhanced transactional integrity.

Blockchain as a Service (BaaS) Platform Market Executive Summary

The BaaS Platform market is characterized by robust business trends focusing on platform interoperability and the development of specialized consortia chains tailored for specific industry needs, moving beyond generalized foundational platforms. Major cloud providers are aggressively expanding their BaaS offerings, leveraging their existing client base and infrastructure capabilities to dominate the deployment landscape, simultaneously driving down the entry barrier for smaller enterprises. Regional trends indicate North America maintaining market dominance, propelled by high technological adoption rates and significant investment in fintech and healthcare DLT solutions, while the Asia Pacific region is demonstrating the highest growth trajectory, primarily fueled by massive digital transformation initiatives in countries like China and India, particularly focused on supply chain and government use cases. Regulatory clarity, although still nascent in many jurisdictions, is incrementally improving, contributing positively to market confidence and subsequent investment decisions.

Segment trends reveal that the financial services sector remains the largest consumer segment, utilizing BaaS for cross-border payments, trade finance settlement, and Know Your Customer (KYC) processes, demanding highly secure and permissioned blockchain environments. However, the manufacturing and retail segments are rapidly closing the gap, driven by the critical need for transparent provenance tracking and anti-counterfeiting measures across complex global supply chains. Technology-wise, platforms based on Ethereum and Hyperledger Fabric continue to lead the market share, but solutions supporting Corda and Quorum are gaining traction due to their enterprise-grade features focusing on privacy and permissioned environments. The strong movement toward hybrid blockchain deployments, combining the transparency of public chains with the control of private chains, signifies a mature segmentation requirement tailored to varied enterprise governance needs.

The competitive landscape is intensifying, characterized by strategic partnerships between technology giants and specialized blockchain startups, aiming to offer end-to-end industry-specific solutions that integrate DLT with other emerging technologies such as Artificial Intelligence (AI) and Internet of Things (IoT). This integration capability is becoming a critical differentiator, enabling advanced functionalities like automated contractual execution based on real-time sensor data. Furthermore, the focus on user experience (UX) and developer tooling is paramount, with platforms investing heavily in intuitive interfaces, pre-built templates, and APIs to accelerate enterprise adoption. These trends underscore a shift from conceptual experimentation to standardized, scalable, and economically viable BaaS deployments across the global corporate sphere.

AI Impact Analysis on Blockchain as a Service (BaaS) Platform Market

Common user inquiries regarding the intersection of AI and BaaS platforms typically revolve around three core themes: first, how AI can enhance the performance and efficiency of blockchain networks, particularly concerning resource optimization and transaction throughput; second, concerns about the security implications of integrating intelligent algorithms that manage or execute smart contracts; and third, the practical applications where the immutability of blockchain records combined with AI-driven analytics yields unique business value. Users are keenly interested in predictive maintenance facilitated by AI analyzing IoT data stored on BaaS infrastructure, and automated compliance checking where AI monitors immutable records against regulatory standards. The primary expectation is that AI will transform BaaS from a static record-keeping mechanism into a dynamic, automated business processing engine, significantly reducing latency and operational risk associated with decentralized systems.

The fusion of Artificial Intelligence with Blockchain as a Service platforms is creating powerful synergies, primarily by enhancing the data validation, network management, and smart contract automation capabilities of BaaS offerings. AI algorithms are increasingly employed to optimize network consensus mechanisms, predicting potential bottlenecks and proactively allocating resources to maintain high throughput and minimize latency, particularly crucial for high-volume enterprise applications. Furthermore, AI is utilized to improve the integrity and trustworthiness of data entering the blockchain, screening inputs from IoT devices or external systems for anomalies or fraudulent patterns before they are immutably recorded, thus addressing the common "garbage in, garbage out" concern associated with DLT.

This integration also facilitates the development of highly sophisticated, self-optimizing smart contracts, where AI models trigger contract execution based on complex, real-time data analysis, moving beyond simple predefined conditions. For example, in supply chain finance, an AI model analyzing inventory levels, demand forecasts, and logistical status stored on the BaaS platform could automatically execute payment terms, significantly reducing manual intervention and accelerating settlement cycles. This evolution transforms BaaS from a foundational ledger technology into an intelligent, automated digital ecosystem, increasing its utility and value proposition across regulated and complex transactional environments. The market expects a surge in "Intelligent BaaS" solutions that bundle predictive analytics and machine learning capabilities directly into the service offering.

- AI optimizes transaction routing and resource allocation in BaaS networks for increased throughput.

- Machine learning models enhance data validation, ensuring integrity of information recorded on the blockchain.

- AI-driven smart contracts enable complex, automated business logic and trigger execution based on predictive insights.

- Predictive analytics integrated with BaaS enhance supply chain visibility and demand forecasting accuracy.

- AI monitors network health and security, detecting and mitigating sophisticated cyber threats in real time.

- Automated regulatory compliance checking is facilitated by AI analyzing immutable blockchain records against evolving standards.

DRO & Impact Forces Of Blockchain as a Service (BaaS) Platform Market

The dynamics of the BaaS market are shaped by a powerful interplay of drivers, restraints, opportunities, and their combined impact forces. Key drivers include the overwhelming need for supply chain transparency and traceability, the imperative for secure and efficient cross-border payments, and the reduced infrastructural complexity offered by cloud-managed BaaS solutions, making DLT accessible to a broader corporate audience. However, the market faces significant restraints, primarily stemming from persistent regulatory uncertainties across various geographies, particularly concerning data privacy (e.g., GDPR applicability to immutable ledgers) and jurisdiction over decentralized autonomous organizations (DAOs). Furthermore, the lack of standardized protocols for interoperability among different blockchain networks presents technical friction, limiting seamless data exchange across diverse enterprise systems.

Significant opportunities exist in emerging use cases, such as fractionalization of real-world assets (RWAs) and the widespread deployment of tokenization across financial instruments, which require scalable and robust BaaS infrastructure for management and settlement. The proliferation of specialized industry consortiums focused on building shared trust layers (e.g., in healthcare claims processing or pharmaceutical tracking) further fuels demand for customized BaaS offerings. The cumulative impact forces drive a rapid consolidation toward solutions that offer both flexibility and regulatory compliance. The market is propelled by a positive feedback loop: as major cloud vendors invest heavily, standardization improves, which in turn reduces complexity, attracting more enterprises and generating greater data volume that validates the technology's effectiveness.

Conversely, the constraining forces of talent shortage—specifically, skilled blockchain developers and architects—and concerns surrounding scalability limitations of current public chain technologies, temper the market's maximum growth potential. The ongoing debate regarding environmental sustainability, especially concerning energy-intensive Proof-of-Work (PoW) chains, also influences adoption decisions, favoring BaaS providers who utilize more energy-efficient consensus mechanisms like Proof-of-Stake (PoS) or optimized permissioned architectures. The balance of these forces suggests a high-growth environment, but one requiring continuous technological refinement and proactive engagement with global regulatory bodies to sustain momentum and ensure long-term, widespread enterprise acceptance.

Segmentation Analysis

The BaaS Platform market is systematically segmented based on deployment type, application area, end-use vertical, and organization size, reflecting the diverse and specialized requirements of modern enterprises adopting distributed ledger technology. This granular segmentation provides essential clarity for vendors to tailor their offerings precisely to market demand, moving beyond generic blockchain infrastructure to highly optimized, industry-specific solutions. Deployment models differentiate between public, private, and hybrid BaaS offerings, with hybrid models gaining significant traction as they offer a blend of network control and public verifiability. Application segmentation is crucial, covering areas from supply chain management and identity management to payments and smart contract development, each requiring distinct platform capabilities regarding throughput and privacy.

The segmentation by end-use vertical highlights the varying maturity and investment levels across industries, with Banking, Financial Services, and Insurance (BFSI) currently leading adoption due to high regulatory pressure and the potential for substantial cost reduction in back-office operations. However, segments like government, healthcare, and retail are experiencing accelerating growth, demanding BaaS solutions optimized for data sovereignty and cross-organizational data sharing. Analyzing the market by organization size reveals that large enterprises were the initial adopters, necessitating highly customized, high-cost private BaaS deployments, whereas Small and Medium-sized Enterprises (SMEs) are increasingly entering the market through cost-effective, easily deployable public and hybrid BaaS solutions offered by cloud platforms, ensuring democratization of DLT access.

Understanding these segments allows market participants to refine their strategic focus, prioritizing investment in high-growth application areas like non-fungible token (NFT) creation for digital assets management and decentralized finance (DeFi) infrastructure integration for institutional clients. The trend toward modular BaaS architectures, enabling clients to select specific components (e.g., identity services, oracle integration) rather than an entire stack, further underscores the importance of detailed segmentation. This targeted approach ensures that BaaS platforms remain relevant and economically viable for a wide spectrum of technical and operational requirements globally.

- By Component:

- Tools

- Services (Consulting, Managed Services, Support and Maintenance)

- By Deployment Type:

- Public BaaS

- Private BaaS

- Hybrid BaaS

- By Organization Size:

- SMEs (Small and Medium-sized Enterprises)

- Large Enterprises

- By Application:

- Supply Chain Management

- Payments and Settlements

- Digital Identity and Access Management

- Smart Contracts Management

- Governance, Risk, and Compliance (GRC)

- Asset Tokenization

- By End-Use Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Life Sciences

- IT and Telecom

- Retail and E-commerce

- Government and Public Sector

- Manufacturing

- Media and Entertainment

- Transportation and Logistics

Value Chain Analysis For Blockchain as a Service (BaaS) Platform Market

The BaaS value chain begins with the upstream segment, dominated by core technology providers and infrastructure layer developers, including open-source blockchain frameworks like Ethereum, Hyperledger Fabric, and Corda, alongside hardware manufacturers supplying specialized servers and cryptographic accelerators. This stage focuses on developing the foundational protocols and ensuring the security and performance of the underlying distributed ledger technology. Essential activities at this stage include protocol refinement, creation of consensus algorithms, and development of core cryptographic libraries. The critical suppliers are the foundational layer developers and the major cloud providers (AWS, Azure, Google Cloud, etc.) who furnish the necessary compute, storage, and networking resources required to host the decentralized infrastructure, thereby dictating the scalability and reliability of the BaaS offering.

Moving downstream, the value chain centers on the BaaS platform providers themselves, who package the raw infrastructure into managed, user-friendly services. This middle layer involves crucial activities such as providing API gateways, offering developer tools (SDKs, IDEs), integrating identity management solutions, and developing pre-built smart contract templates tailored for specific industry applications. The distribution channel is predominantly indirect, utilizing global system integrators (GSIs) and specialized consulting firms (e.g., Accenture, Capgemini) who assist clients with strategic planning, custom development, and integration of the BaaS platform into legacy enterprise systems. Direct distribution also occurs when large cloud vendors sell their proprietary BaaS products directly to existing enterprise cloud customers, leveraging established commercial relationships and streamlined deployment processes within their ecosystems.

The final stage involves the end-users and specialized application developers who leverage the BaaS platform to build and deploy specific business solutions, such as cross-border settlement applications or traceable supply chain systems. Feedback from these end-users is vital, informing platform providers about scalability requirements, new feature needs (like specific regulatory compliance modules), and interoperability demands. The success of the BaaS market is highly dependent on the efficiency of this downstream integration process, where the platform must seamlessly interact with existing enterprise resource planning (ERP) systems and Customer Relationship Management (CRM) tools. The strong reliance on specialized integrators underscores the complexity of transitioning to DLT, making the indirect distribution channel through experienced partners the most impactful route to market penetration.

Blockchain as a Service (BaaS) Platform Market Potential Customers

Potential customers, or end-users/buyers, of BaaS platforms are predominantly organizations requiring enhanced trust, transparency, and immutability in their record-keeping and transactional processes, spanning nearly every major industry vertical globally. The initial and most significant adopters are institutions within the BFSI sector, including commercial banks, investment firms, clearing houses, and insurance companies, who utilize BaaS for streamlining cross-border payments, automating trade finance documentation, reducing fraud in insurance claims, and enhancing regulatory compliance through audit-ready immutable records. These institutions are driven by the necessity to reduce multi-party reconciliation costs and accelerate settlement times, justifying the investment in managed blockchain infrastructure provided by BaaS vendors.

Beyond finance, the second major cohort includes large global manufacturers, retailers, and logistics providers, who are increasingly utilizing BaaS platforms to address complex supply chain challenges. These organizations seek immutable provenance tracking to combat counterfeiting, verify ethical sourcing, and provide real-time, tamper-proof information about product movement from raw material to consumer. Specific applications include tracking high-value goods like pharmaceuticals (for cold chain monitoring and anti-counterfeiting) and luxury items. The complexity and multi-jurisdictional nature of modern supply chains make the managed, shared ledger architecture of BaaS an indispensable tool for establishing a single source of truth among disparate partners.

Furthermore, government agencies and public sector organizations represent a growing segment of potential customers, particularly those focused on digital identity management, land registries, and transparent voting systems. Healthcare providers, research institutions, and pharmaceutical companies utilize BaaS to manage electronic health records (EHRs) securely, ensuring patient data privacy while allowing controlled access for research purposes. Essentially, any enterprise managing sensitive, multi-party data or seeking to automate contractual relationships through smart contracts constitutes a potential customer, with the decision criteria often boiling down to the BaaS provider's security track record, regulatory compliance features, and demonstrated network scalability for enterprise-grade deployment volumes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 45.0 Billion |

| Growth Rate | 45.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft (Azure), Amazon Web Services (AWS), Oracle, SAP, Alibaba Cloud, Huawei, Accenture, Infosys, Wipro, Capgemini, NTT Data, Cognizant, R3, ConsenSys, Hewlett Packard Enterprise (HPE), Tata Consultancy Services (TCS), Deloitte, PwC, KPMG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blockchain as a Service (BaaS) Platform Market Key Technology Landscape

The BaaS platform market is built upon several foundational and emerging technologies that enable the managed delivery of distributed ledger capabilities. Core to the landscape are the underlying blockchain protocols, primarily Hyperledger Fabric, which dominates the enterprise permissioned segment due to its modular architecture, and Ethereum, increasingly used through customized enterprise variants (like Quorum) for smart contract-intensive applications and asset tokenization due to its vast developer ecosystem. Corda, developed by R3, remains prominent in the financial sector, focusing on contractual relationships and high regulatory compliance needs. BaaS providers build layers of abstraction over these protocols, offering management tools that mask the complexity of node management, ledger configuration, and consensus mechanism selection, allowing enterprises to switch between protocols with minimal friction.

Cloud infrastructure is arguably the most critical enabling technology, as BaaS fundamentally relies on the massive scalability, reliability, and global reach of hyperscale cloud platforms (AWS, Azure, GCP). These platforms provide the computational backbone for hosting decentralized applications, managing key pairs, and ensuring high availability across geographically dispersed nodes. Furthermore, the integration of enterprise-grade security technologies, including hardware security modules (HSMs) for cryptographic key protection and sophisticated identity and access management (IAM) tools, is paramount. BaaS differentiates itself through providing these robust security features as a service, addressing major enterprise concerns regarding data integrity and key loss.

Emerging technologies significantly influencing BaaS include integration with Oracles, which act as middleware connecting real-world data (off-chain) to smart contracts (on-chain), thereby increasing the utility and sophistication of automated agreements. Zero-Knowledge Proofs (ZKPs) and other privacy-enhancing technologies are crucial for BaaS platforms catering to heavily regulated industries, allowing transaction verification without revealing underlying sensitive data, directly tackling privacy restraints. Furthermore, robust API and microservices architectures are essential for seamless integration of BaaS features into existing monolithic enterprise software, ensuring minimal disruption during deployment and maximizing interoperability with legacy IT systems, thereby defining the technological advantage of successful BaaS offerings.

Regional Highlights

The global BaaS market exhibits distinct regional adoption patterns, influenced by regulatory environments, technological maturity, and the presence of dominant industry verticals. Regional highlights reveal differential growth rates and specific application focuses.

- North America: This region maintains the largest market share, driven by rapid technological adoption, significant early investment in blockchain startups, and a strong presence of major cloud service providers (AWS, Microsoft, IBM). The BFSI and Healthcare sectors are the primary end-users, focusing on regulatory technology (RegTech) and secure digital identity solutions. The culture of innovation and high digital infrastructure maturity ensure continued leadership, especially in developing sophisticated AI-integrated BaaS platforms.

- Europe: The European market is characterized by stringent regulatory frameworks, particularly GDPR, which necessitates BaaS providers to focus heavily on privacy-enhancing features and data sovereignty solutions. Western Europe, led by the UK, Germany, and France, shows strong adoption in the manufacturing and automotive sectors for supply chain optimization. The region’s growth is steady, emphasizing cross-border trade finance solutions utilizing permissioned networks like Corda.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive government initiatives promoting digital transformation and substantial investments in logistics and e-commerce infrastructure, particularly in China, South Korea, and India. BaaS adoption here is accelerated by the need for transparent food supply chains and efficient cross-border settlements, particularly within emerging economies seeking to leapfrog traditional financial infrastructure using DLT.

- Latin America (LATAM): Adoption is nascent but rapidly increasing, primarily driven by the need to combat high inflation and instability through digital currency and stablecoin implementations. BaaS is utilized in sectors like banking and real estate for record digitalization and fractional ownership, aiming to improve transparency and reduce institutional corruption.

- Middle East and Africa (MEA): The MEA region is witnessing high-profile, government-backed initiatives, particularly in the UAE (Dubai Blockchain Strategy) and Saudi Arabia, focusing on public services, smart city development, and energy sector optimization. BaaS platforms are essential for these national digital transformation agendas, establishing secure digital infrastructure and transparent governance frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blockchain as a Service (BaaS) Platform Market.- IBM

- Microsoft (Azure)

- Amazon Web Services (AWS)

- Oracle

- SAP

- Alibaba Cloud

- Huawei

- Accenture

- Infosys

- Wipro

- Capgemini

- NTT Data

- Cognizant

- R3

- ConsenSys

- Hewlett Packard Enterprise (HPE)

- Tata Consultancy Services (TCS)

- Deloitte

- PwC

- KPMG

Frequently Asked Questions

Analyze common user questions about the Blockchain as a Service (BaaS) Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a BaaS platform over building an in-house blockchain?

The primary benefit of a BaaS platform is significantly reduced operational complexity and lower capital expenditure (CAPEX). BaaS providers manage all infrastructure deployment, maintenance, security, and scalability issues, allowing enterprises to focus exclusively on developing and deploying their decentralized applications and business logic without needing specialized in-house DLT engineering teams.

Which industries are leading the adoption of Blockchain as a Service solutions globally?

The Banking, Financial Services, and Insurance (BFSI) sector currently leads global adoption, driven by the need for secure, efficient cross-border payments, automated compliance, and streamlined trade finance. Following closely are the supply chain and logistics sectors, utilizing BaaS for immutable provenance tracking, anti-counterfeiting, and enhanced multi-party transparency across global distribution networks.

How do BaaS platforms address concerns regarding data privacy and regulatory compliance?

BaaS platforms address privacy and compliance concerns by primarily supporting permissioned blockchain architectures (like Hyperledger Fabric or Corda), which allow strict control over access and visibility. Many platforms also integrate advanced cryptographic techniques, such as Zero-Knowledge Proofs, and provide built-in regulatory compliance modules that ensure adherence to standards like GDPR, ensuring data sovereignty and controlled disclosure.

What are the key technological differences between Public, Private, and Hybrid BaaS deployment models?

Public BaaS leverages open, permissionless networks (like managed Ethereum services) suitable for high transparency but offering lower control. Private BaaS uses permissioned networks restricted to selected participants, guaranteeing high speed and strong governance. Hybrid BaaS combines elements of both, allowing specific data to be transparently recorded on a public chain while sensitive transaction details are kept private, offering an optimal balance of trust and control for many enterprise applications.

How is the integration of AI influencing the future capabilities of BaaS platforms?

AI integration is transforming BaaS platforms into intelligent ecosystems by enhancing key functions. AI is used to optimize network performance, predict potential network failures, validate data integrity before it enters the ledger, and enable highly sophisticated, automated smart contracts that execute based on complex, real-time data analysis, greatly increasing operational efficiency and reducing manual oversight requirements across decentralized applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager