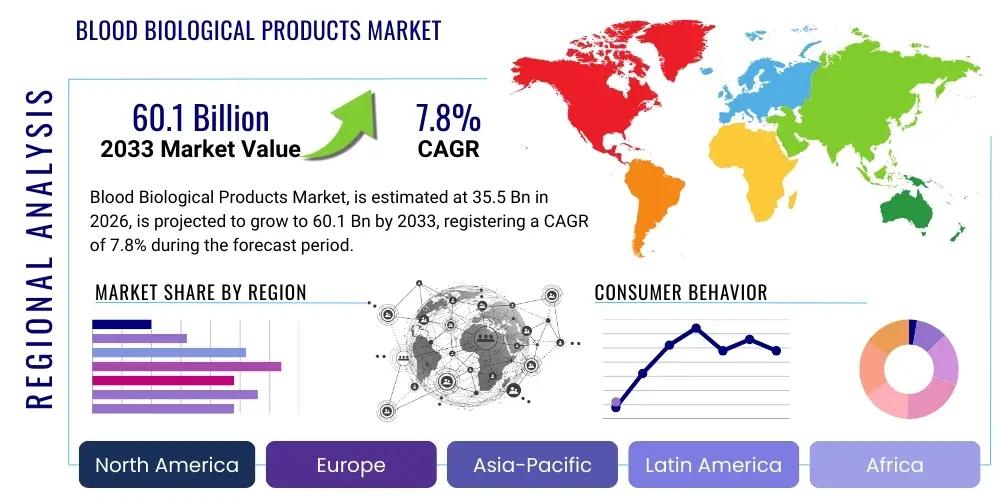

Blood Biological Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441894 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Blood Biological Products Market Size

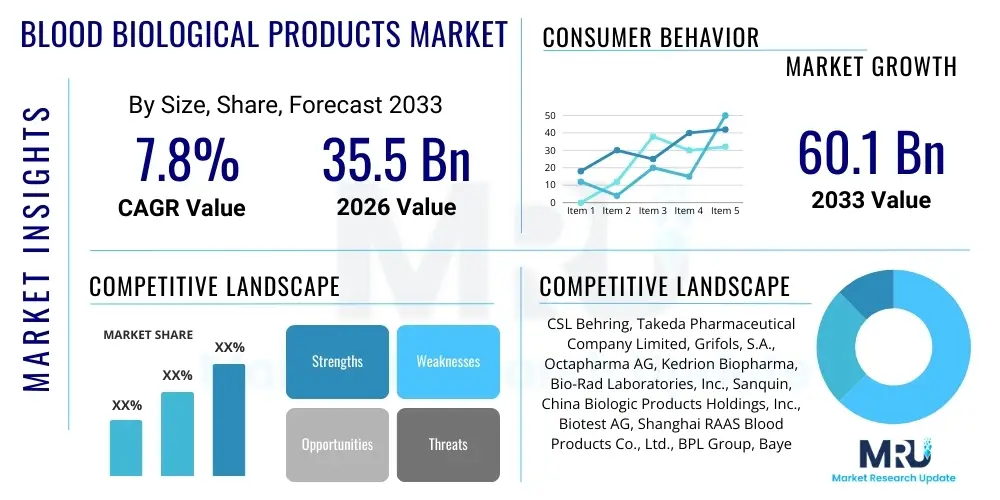

The Blood Biological Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 60.1 Billion by the end of the forecast period in 2033.

Blood Biological Products Market introduction

The Blood Biological Products Market encompasses therapeutic substances derived from human blood or plasma, crucial for treating a wide array of conditions including immunological deficiencies, bleeding disorders such as hemophilia, and severe burns. These products, primarily obtained through the highly specialized and regulated process of plasma fractionation, include key derivatives such as Immunoglobulins (IVIG and SCIG), Human Albumin, and various Coagulation Factors. The necessity of these treatments stems from their life-saving applications in patients who cannot naturally produce sufficient levels of these vital proteins, making the supply chain and manufacturing integrity paramount for global health systems.

The core product offerings are defined by rigorous safety standards, including extensive donor screening and effective viral inactivation techniques to mitigate the risk of pathogen transmission. The demand for these sophisticated therapies is fundamentally driven by the rising global prevalence of chronic autoimmune diseases, the expansion of therapeutic indications for plasma derivatives, and the increasing longevity of the global population, which correlates with a higher incidence of age-related conditions requiring plasma-derived treatment. Furthermore, advancements in product formulation and delivery methods, such as subcutaneous immunoglobulin therapies (SCIG), are enhancing patient compliance and quality of life, thereby fueling market expansion across developed economies.

Market growth is also significantly propelled by advancements in biomanufacturing technology, ensuring higher yields and purity of biological products. Governments and regulatory bodies, particularly in North America and Europe, play a critical role by enforcing strict quality standards and establishing reimbursement policies that support patient access to expensive, life-saving derivatives. Despite the emergence of recombinant alternatives for certain coagulation factors, the demand for natural plasma derivatives, particularly IVIG and Albumin, remains robust due to their broad therapeutic utility and established efficacy profile in clinical settings globally.

Blood Biological Products Market Executive Summary

The global Blood Biological Products Market is experiencing substantial growth, underpinned by favorable demographic trends, particularly the aging population, and the increasing recognition of plasma-derived therapies in neurology and immunology. A major business trend involves consolidation among leading plasma fractionators to secure the raw material supply—human plasma—which remains the critical bottleneck for production capacity expansion. Strategic investments are being directed towards establishing high-volume plasma collection centers globally, focusing particularly on regions with robust regulatory frameworks to ensure donor safety and product quality. Companies are also heavily investing in automation and optimization of the fractionation process to improve operational efficiency and reduce manufacturing costs associated with these complex biological products.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated reimbursement structures, and the presence of major industry players and extensive plasma collection networks. However, the Asia Pacific (APAC) region is projected to register the fastest growth, driven by improvements in healthcare infrastructure, increasing awareness regarding plasma therapies, and expanding insurance coverage in populous nations like China and India. European markets are characterized by stringent centralized regulatory controls and a high reliance on government-controlled blood collection systems, leading to a focus on sustainable supply chain management and standardized quality control across the continent.

Segment trends indicate that Immunoglobulins, specifically Intravenous Immunoglobulin (IVIG), dominate the market revenue share due to their expanding therapeutic use in treating primary immunodeficiency disorders, autoimmune diseases, and neurological conditions. The Albumin segment also exhibits stable growth, being essential for plasma volume expansion and burn treatment. Future growth hinges on overcoming persistent supply chain constraints and managing the complex regulatory landscape, while technological innovations in virus inactivation and fractionation promise to further enhance product safety and availability across all major derivative categories.

AI Impact Analysis on Blood Biological Products Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Blood Biological Products Market primarily revolve around enhancing the efficiency and safety of the plasma supply chain, optimizing donor management, and accelerating the drug discovery process for novel derivatives. Common concerns include how AI can mitigate the inherent variability and scarcity of plasma supply, whether machine learning can improve the accuracy of viral screening beyond current molecular methods, and the potential for AI-driven predictive analytics to forecast demand and prevent critical shortages of essential products like IVIG. Users are particularly interested in the application of AI algorithms to complex manufacturing processes, aiming for improved yield, purity, and automated quality control, thereby addressing the high operational costs associated with plasma fractionation.

AI is set to revolutionize several core aspects of the blood biological products sector, primarily through predictive modeling and automation. In plasma collection, sophisticated algorithms are being deployed to optimize donor recruitment strategies, predict donor retention rates, and manage collection scheduling based on real-time inventory needs, minimizing waste and maximizing yield. This data-driven approach allows plasma centers to identify and target low-risk donor populations more effectively, ensuring a consistent and high-quality raw material supply. Furthermore, the application of machine vision and deep learning in quality assurance processes during fractionation can detect minute anomalies in protein purity and structure earlier than conventional methods, leading to fewer batch failures and increased compliance.

Beyond logistics and manufacturing, AI is also accelerating preclinical research for new plasma derivatives and therapeutic uses. Machine learning models analyze vast datasets of patient outcomes, protein interactions, and disease mechanisms to identify novel therapeutic targets or optimize existing plasma-derived products for specific patient subgroups. This capability shortens the drug development lifecycle, particularly relevant for niche coagulation factors or specialized immunomodulatory proteins. The integration of AI also enhances pharmacovigilance by rapidly analyzing adverse event reports globally, providing crucial early warnings and enabling proactive regulatory adjustments, thus substantially enhancing overall product safety and market confidence.

- AI-driven optimization of plasma donor recruitment and retention campaigns using predictive analytics.

- Implementation of machine learning for real-time quality control during complex plasma fractionation steps, enhancing purity and yield.

- Deployment of advanced algorithms to model global supply chain dynamics, forecasting demand and identifying potential shortage risks for critical products like IVIG.

- Use of deep learning for rapid analysis of donor screening data, improving pathogen detection accuracy and overall biosafety.

- AI-assisted drug discovery for identifying novel indications or optimizing the therapeutic profile of existing plasma proteins.

- Automation of regulatory documentation and compliance checks, streamlining market entry processes for new biological products.

DRO & Impact Forces Of Blood Biological Products Market

The Blood Biological Products Market is influenced by a complex interplay of drivers, restraints, and opportunities, shaping its trajectory and operational landscape. A primary driver is the significant and continuous increase in the incidence and diagnosis rates of chronic, life-threatening diseases globally, including Primary Immunodeficiency (PID), various autoimmune disorders, and inherited bleeding disorders such as hemophilia, all of which necessitate regular, lifelong infusion of plasma derivatives. Coupled with this is the demographic shift towards an older population, which inherently requires more frequent and complex biological interventions. However, the market faces significant restraints, chiefly the critical dependence on voluntary human plasma donation, leading to persistent supply shortages that constrain manufacturing output. Furthermore, the highly regulated nature of blood collection and product manufacturing, combined with stringent safety protocols (especially concerning pathogen risk), imposes high operational costs and acts as a barrier to entry for new competitors.

Opportunities for market expansion are centered around capitalizing on unmet medical needs in emerging economies where access to advanced plasma derivatives is often limited, offering potential for geographic market penetration. Technological advancements in fractionation and purification techniques, specifically those that improve plasma yield or reduce reliance on large plasma pools, represent a key opportunity to enhance manufacturing efficiency and product consistency. The growing focus on developing recombinant alternatives for specific clotting factors, while a long-term threat to plasma-derived versions, also fosters a competitive environment that drives innovation in plasma processing safety and efficiency. Moreover, the shift towards patient-centric delivery systems, such as the increasing adoption of subcutaneous immunoglobulins (SCIG), offers better convenience and compliance, thereby broadening the addressable patient pool.

The impact forces within this market are substantial and systemic. The essential, often life-saving nature of these products grants the industry high pricing power, especially for products with limited alternatives, such as IVIG. Conversely, intense regulatory oversight concerning donor ethics and product safety ensures that quality standards are non-negotiable, acting as a powerful external force maintaining rigorous manufacturing standards. Finally, geopolitical factors and changes in public health crises (like pandemics) directly impact donor willingness and logistics, demonstrating the market's high vulnerability to external socio-economic and public health shocks, necessitating robust, globalized supply chain contingency planning.

Segmentation Analysis

The Blood Biological Products Market is meticulously segmented based on the product type, therapeutic application, and end-user, reflecting the diverse clinical utility of plasma-derived products. Product type segmentation is critical as it delineates revenue generation across high-volume items like Immunoglobulins and Albumin versus high-value specialty products such as specific Coagulation Factors (e.g., Factor VIII and IX concentrates). Understanding these segments allows manufacturers to align their plasma collection strategies and fractionation capacities with specific therapeutic demands. The continuous expansion of therapeutic indications, particularly for IVIG in treating complex autoimmune and neurological conditions, reinforces the dominance of the Immunoglobulin segment.

The application segmentation highlights the primary clinical domains utilizing these products, including hematology (for bleeding disorders), immunology (for primary and secondary immunodeficiencies), and critical care/trauma management (where albumin is essential for fluid management). This segmentation is vital for tailoring marketing and educational efforts to specific medical specialties. For instance, the neurology segment is growing rapidly due to the increased use of IVIG in conditions like Chronic Inflammatory Demyelinating Polyneuropathy (CIDP) and Multifocal Motor Neuropathy (MMN), driving strategic focus towards clinical trials in these niche areas.

End-user segmentation clearly defines the procurement channels, with hospitals and clinics serving as the primary volume purchasers, especially for large doses required in emergency situations and critical care settings. Specialty pharmacies and home care settings are also emerging as significant end-users, driven by the increasing shift towards self-administration of treatments like SCIG, which requires specialized logistical support and patient training. Analyzing end-user requirements provides insights into distribution efficiencies and the need for patient support programs associated with high-cost chronic therapies.

- By Product Type:

- Immunoglobulins (Intravenous Immunoglobulin (IVIG), Subcutaneous Immunoglobulin (SCIG), Hyperimmunoglobulins)

- Albumin (Human Serum Albumin)

- Coagulation Factors (Factor VIII, Factor IX, Prothrombin Complex Concentrates, Fibrinogen Concentrate)

- Others (Alpha-1 Antitrypsin, C1 Esterase Inhibitors)

- By Application:

- Neurology

- Immunology

- Hematology

- Critical Care

- Pulmonology

- Others (Rheumatology, Dermatology)

- By End User:

- Hospitals and Clinics

- Ambulatory Surgery Centers

- Specialty Pharmacies

- Academic and Research Institutes

Value Chain Analysis For Blood Biological Products Market

The value chain for the Blood Biological Products Market is characterized by highly specialized, capital-intensive processes starting far upstream with plasma collection and extending to specialized patient delivery. The upstream segment is critical and encompasses plasma collection centers, donor screening, and regulatory compliance associated with raw material sourcing. This phase is characterized by intense logistical demands, stringent ethical standards, and high fixed costs for maintaining certified collection facilities. Efficiency in donor management, yield per donation, and compliance with viral safety testing protocols are key determinants of overall supply stability and cost structure in this initial phase.

The core process segment involves the complex manufacturing steps, primarily Cohn fractionation, followed by purification and viral inactivation. This midstream phase demands sophisticated bioprocessing technology, highly skilled labor, and adherence to Good Manufacturing Practices (GMP). Manufacturers invest heavily in advanced chromatography techniques to achieve high purity levels for specific proteins and utilize multiple validated viral inactivation methods (such as solvent-detergent, pasteurization, and nanofiltration) to ensure product safety. Process yields and recovery rates during fractionation are crucial variables that directly impact the profitability and overall product availability across all derived therapies.

Downstream activities involve specialized distribution channels, marketing, and patient support. Distribution of blood biological products requires a robust cold chain logistics network due to the temperature sensitivity of the final formulations. Products are typically channeled through a mix of direct sales forces targeting large hospital systems and specialized pharmaceutical distributors who manage inventory and delivery to specialty clinics and home care settings. Due to the high cost and chronic nature of treatment, payer negotiations, reimbursement coordination, and patient education programs form a vital part of the downstream value proposition, ensuring patient access and adherence to complex treatment regimens. Indirect channels, particularly wholesalers, play a role in inventory management, while direct channels are often utilized for highly specialized or newly launched products requiring extensive physician education.

Blood Biological Products Market Potential Customers

The primary end-users and buyers in the Blood Biological Products Market are large institutional consumers, dominated by acute care hospitals and specialized medical centers. These facilities are the largest volume purchasers because they manage patients requiring immediate treatment in critical care (e.g., trauma, sepsis, shock where albumin is vital) and house specialized units such as hematology, oncology, and intensive care, where complex coagulation factor administration and high-dose IVIG are routinely required. Procurement decisions in this setting are heavily influenced by established clinical guidelines, product safety profiles, and institutional formulary acceptance based on cost-effectiveness and reliable supply.

A rapidly expanding segment of potential customers includes specialty clinics, particularly infusion centers focusing on immunology and neurology. These outpatient settings cater to the long-term management of chronic conditions, such as Primary Immunodeficiency (PID) patients receiving maintenance doses of IVIG or SCIG. These clinics prioritize ease of administration, patient comfort, and the logistical support required for chronic, recurring infusions. The shift towards SCIG treatments is further expanding the customer base to include patients utilizing home healthcare services, where the product is supplied through specialty pharmacies equipped to handle the complex logistics of temperature-sensitive biologicals and patient training for self-administration.

Furthermore, research laboratories and academic medical centers represent a niche but high-value customer segment, utilizing high-purity plasma components for clinical trials, diagnostic development, and basic research into protein therapeutics and infectious diseases. Government health agencies and national blood services also act as major centralized purchasers in many regions, especially where national fractionation programs are in place, making bulk contracts with these entities essential for manufacturers’ global revenue strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 60.1 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CSL Behring, Takeda Pharmaceutical Company Limited, Grifols, S.A., Octapharma AG, Kedrion Biopharma, Bio-Rad Laboratories, Inc., Sanquin, China Biologic Products Holdings, Inc., Biotest AG, Shanghai RAAS Blood Products Co., Ltd., BPL Group, Bayer AG, Pfizer Inc., Novo Nordisk A/S, Roche Holding AG, Emergent BioSolutions Inc., ADMA Biologics, Inc., LFB Group, Baxter International Inc., Hualan Biological Engineering Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Biological Products Market Key Technology Landscape

The manufacturing of blood biological products relies heavily on specialized bioprocessing technologies aimed at achieving the highest levels of purity, potency, and viral safety. The foundational technique remains Cohn's cold ethanol fractionation, though modern advancements focus on optimizing each subsequent purification step. A critical technological shift involves the integration of advanced chromatographic techniques, such as Ion-Exchange Chromatography (IEX) and Hydrophobic Interaction Chromatography (HIC), which significantly enhance the resolution and yield of specific proteins, allowing for the isolation of highly pure coagulation factors and immunoglobulins that were previously difficult to separate efficiently. Continuous flow processing and closed-system manufacturing are also gaining traction, reducing the risk of contamination and improving the scalability of production, which is essential given the immense volume of plasma required globally.

Viral safety is paramount, driving continuous innovation in inactivation and removal technologies. Modern manufacturing protocols employ multiple, orthogonal steps for robust viral reduction. Key technologies include Solvent-Detergent (S/D) treatment, which inactivates enveloped viruses; pasteurization (heat treatment); and nanofiltration, which physically removes both enveloped and non-enveloped viruses based on size exclusion. The development of next-generation nanofilters with smaller pore sizes and higher flow rates is enhancing process efficiency without compromising the integrity of the therapeutic proteins. Furthermore, manufacturers are increasingly implementing advanced molecular testing (Nucleic Acid Testing or NAT) early in the upstream process to screen donors and plasma pools with unprecedented sensitivity, ensuring the safety of the starting material.

The future technology landscape is being shaped by the adoption of recombinant DNA technology and genetic engineering, especially in the Coagulation Factors segment, offering non-plasma derived alternatives that eliminate the risk of blood-borne pathogen transmission entirely. However, for complex mixtures like IVIG and Albumin, plasma remains the primary source, leading to substantial investment in optimizing the source material acquisition. This includes smart plasma collection systems leveraging Internet of Things (IoT) sensors for real-time monitoring of donor vitals and collection metrics, and sophisticated data analytics platforms to optimize plasma quality and logistics across global collection networks, ensuring a steady, high-quality flow into the fractionation centers.

Regional Highlights

- North America: North America, particularly the United States, holds the dominant share in the Blood Biological Products Market, primarily due to the vast network of licensed plasma collection centers and the industry's ability to secure large volumes of voluntary plasma donations. The region benefits from a highly advanced healthcare infrastructure, substantial government and private investment in biopharmaceutical research, and favorable reimbursement policies for expensive chronic therapies like IVIG and specialized coagulation factors. High patient awareness regarding sophisticated treatments and the presence of the world's largest plasma fractionators further solidify its market position. Regulatory environment, spearheaded by the FDA, sets global benchmarks for product safety and manufacturing excellence, which drives premium pricing and market confidence.

- Europe: The European market is characterized by a high demand for plasma derivatives, but often operates under different plasma sourcing models, with several countries relying on non-profit or government-controlled blood services rather than commercial collection centers, leading to stricter supply controls. Western European countries exhibit robust consumption rates, driven by universal healthcare coverage and comprehensive treatment guidelines for immune and bleeding disorders. Regulatory harmonization efforts through the European Medicines Agency (EMA) ensure high safety standards, yet market growth is frequently tied to national procurement contracts and public health budgeting constraints, creating a complex, yet stable, operating environment.

- Asia Pacific (APAC): The APAC region is poised for the highest growth rate during the forecast period. This rapid expansion is primarily fueled by improving economic conditions, increased healthcare access, and modernization of regulatory frameworks in key markets such as China, India, and Japan. The large and aging population in this region, coupled with a rising incidence of chronic diseases, presents an immense patient pool for therapies like Albumin (often used in liver disease management, highly prevalent in Asia) and Immunoglobulins. While the region struggles with establishing sufficient local plasma collection infrastructure, increasing urbanization and foreign direct investment in local manufacturing capabilities are gradually addressing supply limitations and driving regional self-sufficiency initiatives.

- Latin America (LATAM): The LATAM market represents significant untapped potential, though current consumption levels are relatively low compared to North America and Europe. Market growth is gradually accelerating, supported by increasing healthcare spending and better penetration of diagnostic testing for bleeding and immune disorders. However, challenges persist related to unstable economic conditions, highly fragmented healthcare systems, and reliance on imports for high-cost derivatives, necessitating strategies focused on affordable access and streamlined distribution to meet the rising medical needs across major economies like Brazil and Mexico.

- Middle East & Africa (MEA): The MEA region is a relatively smaller market, concentrated in affluent Gulf Cooperation Council (GCC) countries which possess high per capita healthcare spending and modern infrastructure capable of utilizing high-end plasma derivatives. Market penetration is generally limited by varying regulatory oversight and lower patient awareness in many African nations. Growth is largely reliant on international partnerships, humanitarian aid, and focused government efforts in GCC nations to establish specialized care centers and reduce dependency on external supply chains for essential biological products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Biological Products Market.- CSL Behring

- Takeda Pharmaceutical Company Limited

- Grifols, S.A.

- Octapharma AG

- Kedrion Biopharma

- Biotest AG

- Bio-Rad Laboratories, Inc.

- Sanquin

- China Biologic Products Holdings, Inc.

- Shanghai RAAS Blood Products Co., Ltd.

- BPL Group

- ADMA Biologics, Inc.

- LFB Group

- Hualan Biological Engineering Inc.

- Kamada Ltd.

- Emergent BioSolutions Inc.

- Baxter International Inc.

- Thermo Fisher Scientific Inc.

- Sichuan Yuanda Shuyang Pharmaceutical Co., Ltd.

- Chongqing Dalin Biologic Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Blood Biological Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for Immunoglobulins (IVIG) in the market?

The demand for Immunoglobulins, particularly IVIG, is primarily driven by the increasing diagnosis of Primary Immunodeficiency (PID), the expanding therapeutic use in various autoimmune and neurological disorders (like CIDP), and the rising prevalence of chronic conditions requiring long-term immune modulation therapy. Supply shortages due to constraints in plasma collection further intensify the market demand dynamics.

How does plasma sourcing impact the cost and stability of the Blood Biological Products Market?

Plasma sourcing is the most critical constraint in the market value chain. Relying heavily on human donors, the cost and stability are directly influenced by collection efficiency, donor compensation models, and regulatory mandates. Shortages in raw plasma supply necessitate manufacturers to increase investment in collection infrastructure, which ultimately contributes to the high final cost of derivatives and can lead to price volatility and product scarcity during periods of high demand.

What role do recombinant coagulation factors play in relation to plasma-derived coagulation products?

Recombinant coagulation factors, such as recombinant Factor VIII and IX, offer alternatives that eliminate the theoretical risk of pathogen transmission associated with plasma-derived products. While they capture a significant market share, particularly in developed markets for hemophilia treatment, plasma-derived coagulation factors remain essential for certain patient groups and niche indications, especially in emerging markets where access to expensive recombinant alternatives is limited.

What is the significance of viral inactivation technology in the manufacturing process?

Viral inactivation technology is crucial for ensuring the safety and regulatory compliance of all blood biological products. Manufacturers are mandated to use validated, orthogonal viral inactivation (e.g., Solvent-Detergent, pasteurization) and removal (e.g., nanofiltration) steps to neutralize potential viruses. This multi-layered approach is the cornerstone of consumer and regulatory trust, mitigating the historical risk of transmitting blood-borne pathogens.

Which geographical region is expected to show the highest growth potential for blood biological products?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential. This growth is underpinned by improving healthcare expenditure, increasing health insurance coverage, and a large, aging population base. As standards of care align more closely with Western protocols, the diagnosis and treatment rates for conditions requiring plasma derivatives are rapidly escalating across major APAC economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager