Blu-ray Player Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442353 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Blu-ray Player Market Size

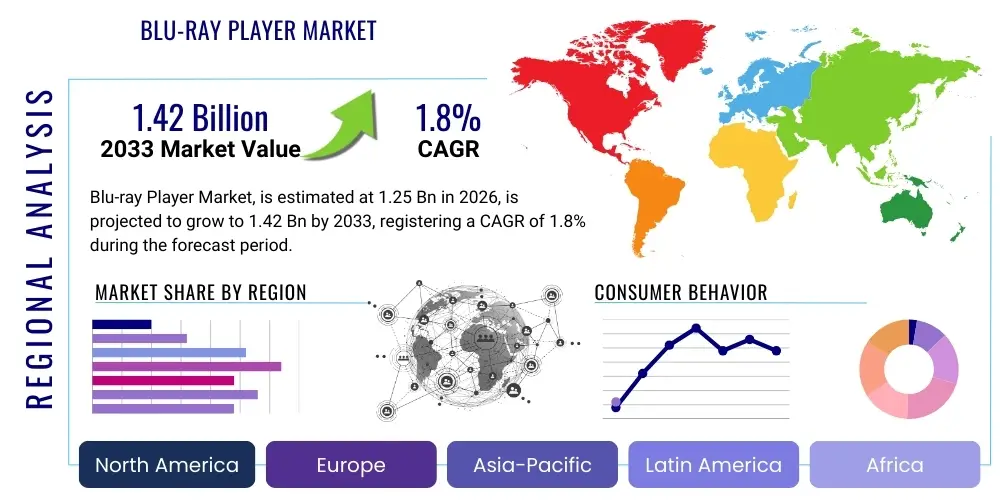

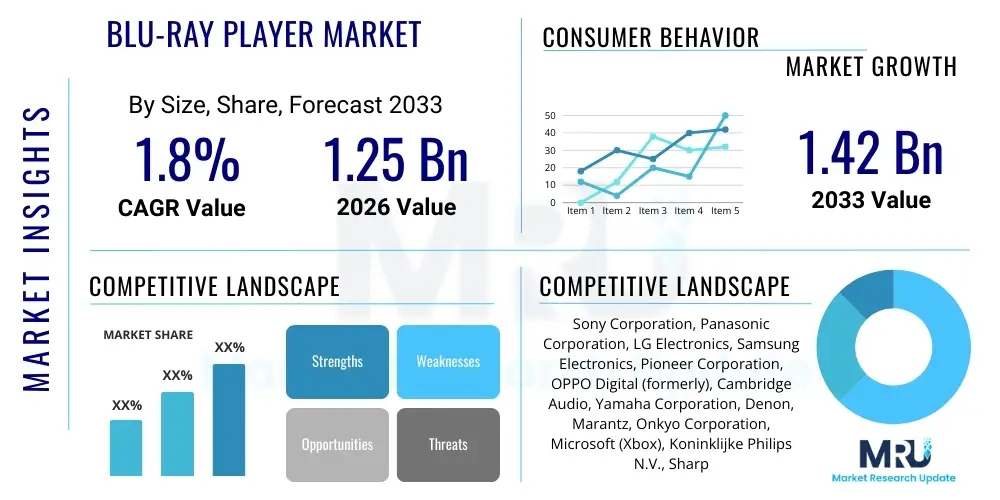

The Blu-ray Player Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 1.8% between 2026 and 2033. The market is estimated at $1.25 Billion USD in 2026 and is projected to reach $1.42 Billion USD by the end of the forecast period in 2033. This growth trajectory, though modest, reflects sustained demand from niche segments prioritizing superior audio-visual fidelity and permanent media ownership over the convenience of digital streaming services. The resilience of the market is largely attributed to the continuous adoption of 4K Ultra HD Blu-ray technology, which provides resolution and bitrate quality unattainable through current standard streaming methods, satisfying the requirements of high-fidelity home cinema enthusiasts globally. Furthermore, the convergence of high-end home audio standards, such as Dolby Atmos and DTS:X, necessitates a physical media source capable of handling these uncompressed lossless formats, thereby contributing significantly to the market valuation.

Blu-ray Player Market introduction

The Blu-ray Player Market encompasses the manufacturing, distribution, and sale of optical disc players designed specifically for reading and rendering high-definition content stored on Blu-ray discs, including standard Blu-ray (BD), Blu-ray 3D (BD3D), and Ultra HD Blu-ray (UHD BD). These devices serve as crucial components within modern home entertainment systems, offering superior video resolution (up to 4K and potential 8K upscaling) and uncompressed, lossless audio tracks, positioning them above standard DVD players and many compressed streaming platforms. Major applications include dedicated home cinema setups, integration with high-end gaming consoles (which often feature Blu-ray capabilities), and professional archival uses requiring durable, high-capacity physical media storage. Key benefits driving consumer adoption include unparalleled image quality due to higher bitrates, immunity from internet connectivity issues, guaranteed long-term media access, and the ability to access bonus features often exclusive to physical releases. The primary driving factors for the market's continued existence include the proliferation of 4K and 8K display technologies demanding native high-resolution input, the persistent collector culture favoring physical media, and the constant improvement in premium audio codecs that require the bandwidth only physical discs can reliably provide, ensuring a dedicated, albeit specialized, consumer base.

Blu-ray Player Market Executive Summary

The Blu-ray Player Market is characterized by a strategic shift towards premium, high-specification hardware, focusing heavily on 4K Ultra HD capabilities and enhanced audio processing standards such as Dolby Atmos and DTS:X, reflecting key business trends where manufacturers prioritize margin over volume. Business trends indicate market consolidation, with core established players dominating the innovation cycle by integrating advanced features like high dynamic range (HDR) compatibility (HDR10+, Dolby Vision) and sophisticated video processing chips designed to enhance lower-resolution content. The primary regional trends show the Asia Pacific (APAC) region, particularly China and Japan, exhibiting strong demand driven by high consumer propensity for the latest technological standards and a robust home entertainment ecosystem, coupled with strong manufacturing bases. North America and Europe remain crucial niche markets, sustained primarily by audiophiles, movie collectors, and consumers dissatisfied with the quality compromises inherent in compressed streaming. Segment trends definitively underscore the dominance of standalone 4K UHD players, which command a premium price point, although combination devices (like universal disc players capable of handling SACD and DVD-Audio) also retain significant market share among high-fidelity enthusiasts. The overall market narrative is one of specialization, moving away from mass-market necessity to high-value, performance-driven consumer electronics designed for discerning users.

AI Impact Analysis on Blu-ray Player Market

Common user questions regarding AI's impact on the Blu-ray Player Market frequently center on whether advanced AI upscaling algorithms in smart TVs and streaming devices will render high-resolution physical media unnecessary, and how AI might enhance the actual playback experience. Users are concerned that if AI can flawlessly reconstruct standard Blu-ray or even DVD content to look nearly 4K, the justification for purchasing expensive UHD discs and players diminishes. However, the analysis reveals that while AI heavily influences video processing in displays, its current impact on the dedicated Blu-ray hardware market is primarily focused on optimizing existing content. AI-driven features are increasingly integrated into high-end Blu-ray player chipsets to improve noise reduction, sharpen details, and manage color profiles dynamically (such as advanced metadata interpretation for HDR content). This integration positions AI not as a replacement for physical media quality but as an enhancement tool, ensuring that the already superior bitrate of a physical disc is displayed with maximum fidelity on modern high-resolution screens. The key theme is expectation management: AI improves the visual output of all sources, but it cannot create the massive data density inherent to a 4K UHD disc, thus preserving the core value proposition of premium physical media for dedicated enthusiasts.

- AI upscaling algorithms are integrated into player chipsets to optimize legacy content (DVDs, standard Blu-rays) for 4K/8K displays.

- Dynamic metadata processing uses AI to fine-tune HDR (Dolby Vision/HDR10+) color and contrast settings on a scene-by-scene basis, improving visual consistency.

- Predictive error correction and jitter reduction utilize machine learning to stabilize playback, particularly on damaged or slightly warped discs, enhancing playback reliability.

- AI analysis of network and disc buffering patterns helps optimize loading times and reduce latency during complex disc operations like layer switching.

- The perceived competitive threat from AI-enhanced streaming services challenges the market, forcing dedicated players to justify their superior quality through advanced internal processing capabilities.

DRO & Impact Forces Of Blu-ray Player Market

The dynamics of the Blu-ray Player Market are dictated by a delicate balance between persistent demand for quality and the overwhelming convenience of digital alternatives, summarized by the key forces of Drivers, Restraints, and Opportunities (DRO). Major drivers include the necessity for superior, uncompressed audio codecs like Dolby Atmos and DTS:X, which demand the high-bandwidth capabilities of physical media, alongside the rising adoption of high-resolution display technologies (4K and incipient 8K) that reveal the inherent compression artifacts in most streaming video, thereby cementing Blu-ray's position as the gold standard for image quality. Restraints are predominantly centered on the pervasive availability and low cost of Subscription Video on Demand (SVOD) services, which have significantly reduced the mainstream consumer’s reliance on physical media, coupled with the general obsolescence cycle of dedicated physical media hardware. Opportunities lie squarely within the premium niche—targeting dedicated home theater enthusiasts, audiophiles, and collectors who value curation, ownership, and uncompromising performance, alongside developing universal players that handle multiple legacy and current high-fidelity formats (SACD, DVD-A, UHD BD), thereby diversifying the product’s utility. The overall impact forces pressure manufacturers to innovate solely in the premium segment, guaranteeing the highest possible specifications to differentiate effectively from lower-cost, convenience-driven streaming solutions, making market success heavily reliant on technological superiority and feature differentiation.

Segmentation Analysis

The Blu-ray Player Market is structurally segmented based on crucial product characteristics, technological capabilities, primary application, and distribution channel, which aids in understanding specific consumer behaviors and tailored marketing strategies. Segmentation analysis is critical as the market shifts away from mass-market sales towards high-value niche segments, allowing manufacturers to optimize product offerings based on resolution capabilities (standard BD vs. 4K UHD), connectivity features (smart capabilities), and multi-format compatibility (universal disc players). The evolution of the market emphasizes the premium segment, dominated by 4K Ultra HD players, which cater to consumers willing to invest substantial capital for uncompromising audio-visual performance, driving higher average selling prices and focusing product innovation on sophisticated chipsets and superior build quality. Understanding these segments is paramount for strategic planning, determining which geographic regions are most receptive to high-end dedicated players versus those that favor multi-functional devices like gaming consoles.

- By Product Type:

- Standalone Blu-ray Players

- 4K Ultra HD Blu-ray Players (UHD BD)

- Universal Disc Players (SACD, DVD-A, CD compatibility)

- Portable Blu-ray Players

- By Resolution:

- Standard HD (1080p)

- 4K Ultra HD (2160p)

- By Application:

- Home Entertainment Systems

- Gaming Consoles (Integration/Accessory)

- Professional Archival/Data Storage

- By Distribution Channel:

- Offline (Retail Stores, Electronics Chains)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Blu-ray Player Market

The value chain for the Blu-ray Player Market begins with upstream activities involving the sourcing of highly specialized components, which include optical pickup units (lasers and lenses), advanced video processing chipsets (often customized System-on-Chips or SoCs for upscaling and HDR management), memory modules, and specialized mechanical assemblies for disc loading and rotation. Key upstream suppliers are focused primarily in East Asia, specializing in high-precision optical and semiconductor technologies required for accurate high-speed data retrieval. Manufacturing and assembly follow, often leveraging economies of scale in established consumer electronics hubs, focusing on quality control, acoustic dampening, and ensuring interoperability with various disc formats and protection standards (AACS). Downstream activities are centered on distribution and final sales, utilizing both direct and indirect channels to reach the specialized consumer base. The complexity of distribution requires robust logistics to handle delicate electronics, moving products through regional distributors and major retail chains to ensure product availability in key consumer electronics markets, particularly those with a high density of home theater enthusiasts.

The distribution channel structure heavily relies on indirect sales through major electronics retailers (both brick-and-mortar and large e-commerce platforms), which provide the necessary consumer reach and often feature dedicated demonstration areas where the quality difference between Blu-ray and streaming can be effectively showcased. Direct sales, primarily through manufacturers' websites or specialized high-fidelity audio-visual dealers, are crucial for premium and universal player models, allowing manufacturers to maintain higher margins and provide specialized customer support for complex integration issues. The efficiency of the value chain is increasingly scrutinized for sustainability and responsiveness, particularly given the lower volume nature of the current market compared to its peak, demanding tight inventory management to prevent obsolescence and minimize holding costs for specialized, high-cost components. Effective synchronization between component supply and final assembly remains a critical factor in maintaining competitive pricing while integrating the newest technological standards like HDMI 2.1 and advanced HDR protocols.

Blu-ray Player Market Potential Customers

Potential customers for the Blu-ray Player Market represent distinct, high-value segments characterized by a common emphasis on quality, ownership, and superior performance, moving beyond the mass-market demographic that has largely migrated to streaming. The primary end-users are defined as Home Theater Enthusiasts and Audiophiles, who possess high-end audio systems (often featuring complex multi-channel speaker setups supporting Dolby Atmos and DTS:X) and large 4K/OLED displays, for whom physical media provides the only source capable of fully leveraging their expensive equipment without compromise on bitrate or dynamic range. These customers are highly knowledgeable about technical specifications, prioritizing features like universal disc compatibility (including SACD and DVD-Audio playback), premium analog audio outputs, and robust build quality that minimizes internal vibration and noise, often opting for high-end players priced significantly above mass-market models.

Another crucial segment comprises Movie and Media Collectors, individuals who prioritize media ownership as a safeguard against content removal or changes in streaming catalogs, viewing physical discs as assets and archival material. This segment values bonus features, limited editions, and the tangible aspect of a physical library, often purchasing both standard and 4K UHD players to manage extensive collections. Furthermore, a significant number of consumers purchase Blu-ray players, particularly 4K UHD models, for data archival purposes, utilizing the higher capacity discs (BD-R/RE) for long-term secure storage of digital files, recognizing the longevity and reliability of optical media compared to magnetic or solid-state storage over decades. The market's sales strategy must pivot to addressing these niche quality and ownership needs directly, emphasizing the unparalleled audio-visual experience and the permanent accessibility that streaming cannot guarantee.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion USD |

| Market Forecast in 2033 | $1.42 Billion USD |

| Growth Rate | 1.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Panasonic Corporation, LG Electronics, Samsung Electronics, Pioneer Corporation, OPPO Digital (formerly), Cambridge Audio, Yamaha Corporation, Denon, Marantz, Onkyo Corporation, Microsoft (Xbox), Koninklijke Philips N.V., Sharp Corporation, Audiolab, Arcam, Reavon, Sanyo Electric Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blu-ray Player Market Key Technology Landscape

The technological landscape of the Blu-ray Player Market is dominated by advancements in optical reading precision, video processing, and audio codec compatibility, all aimed at maximizing the output quality for premium home cinema installations. The cornerstone technology is the 4K Ultra HD Blu-ray format itself, which uses triple-layer discs to achieve storage capacities up to 100GB, necessary for storing high bitrate H.265 encoded video and uncompressed audio tracks. Integration of High Dynamic Range (HDR) standards, specifically HDR10+, Dolby Vision, and increasingly, support for HLG (Hybrid Log-Gamma), is essential, allowing players to utilize dynamic metadata to optimize picture quality on compatible displays, providing significantly improved contrast and color saturation compared to standard SDR content. Furthermore, the mandatory inclusion of HDMI 2.0 or 2.1 outputs is required to handle the high bandwidth necessary for 4K/60p transmission with full color depth, ensuring compatibility with the latest generation of televisions and A/V receivers.

Audio technology remains a critical differentiator in this specialized market, with high-end players prioritizing full decoding and bitstream output support for object-based sound formats, primarily Dolby Atmos and DTS:X. Many premium universal players integrate sophisticated internal Digital-to-Analog Converters (DACs) and high-quality analog output stages to appeal directly to audiophiles seeking pristine sound reproduction for music formats like SACD and DVD-Audio, bypassing the DACs typically found in A/V receivers. Network connectivity, although secondary to disc playback, is often included to facilitate firmware updates, access to proprietary media libraries, and integration with smart home ecosystems, leveraging technologies like Wi-Fi 6 for stable connectivity. Advanced video processing chipsets (e.g., MediaTek or specialized proprietary chips) are crucial for executing high-quality chroma upsampling, noise reduction algorithms, and frame rate conversion, ensuring optimal performance regardless of the input disc quality, maintaining the market's focus strictly on delivering the absolute best possible fidelity.

The progression towards higher frame rates and potentially 8K content playback requires continuous innovation in optical reading heads and signal processing capabilities. While native 8K Blu-ray remains speculative due to capacity constraints, current high-end players focus on robust 8K upscaling solutions, utilizing powerful processing to render 4K content effectively on emerging 8K display technologies. This requires significant engineering investment in optical pickup stability, rotational speed control, and error correction algorithms to maintain the integrity of the massive data stream during playback. Security protocols, governed by the Advanced Access Content System (AACS) licensing, also form a critical technology element, constantly evolving to protect copyrighted 4K UHD content against unauthorized copying, necessitating regular player firmware updates and strict hardware compliance checks to ensure continued playback compatibility across the ecosystem.

Regional Highlights

- Asia Pacific (APAC): APAC represents a dynamic and critical region for the Blu-ray player market, driven by high technology adoption rates, strong manufacturing presence (Japan, South Korea, China), and robust consumer willingness to invest in premium home electronics. Japan, in particular, maintains a dedicated culture of high-fidelity audio-visual consumption, significantly boosting demand for both 4K UHD players and universal disc players capable of handling multiple esoteric formats like SACD. China's massive consumer base, coupled with increasing disposable income, shows a growing preference for high-quality cinema experiences at home, making it a key growth area for manufacturers focusing on mid-to-high-tier dedicated players.

- North America (NA): North America remains a mature but resilient market, defined by its strong niche segments, particularly movie collectors and dedicated home theater builders. Although overall unit sales volume has declined due to streaming, the Average Selling Price (ASP) for Blu-ray players remains high as consumers prioritize top-tier 4K UHD models from brands known for superior build quality (e.g., Sony, Pioneer). The installed base of high-end A/V equipment in the US drives consistent demand for media sources capable of outputting full, uncompressed Dolby Atmos and DTS:X audio tracks, sustaining the premium segment.

- Europe: The European market displays stability, driven primarily by Germany, the UK, and France, where physical media remains culturally significant, supported by a strong network of specialized A/V retailers and a large catalog of region-specific media releases. European consumers often show a strong preference for multi-functional entertainment centers, favoring players that seamlessly integrate streaming applications alongside physical media playback, with growing demand for environmentally conscious manufacturing and energy-efficient designs, influencing product specifications.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities, characterized by lower overall market penetration but potential growth linked to increasing access to high-speed internet and disposable income. Market penetration is currently hampered by varying import duties and consumer focus on affordability; however, as the infrastructure for 4K display technology improves, demand for affordable, functional Blu-ray players is anticipated to rise, especially in urban centers with robust retail ecosystems for electronics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blu-ray Player Market.- Sony Corporation

- Panasonic Corporation

- LG Electronics

- Samsung Electronics

- Pioneer Corporation

- OPPO Digital (formerly, highly relevant in legacy premium segment)

- Cambridge Audio

- Yamaha Corporation

- Denon

- Marantz

- Onkyo Corporation

- Microsoft (Xbox Console Integration)

- Koninklijke Philips N.V.

- Sharp Corporation

- Audiolab

- Arcam

- Reavon

- Sanyo Electric Co.

- ASUS (PC/External Drives)

- Dell Technologies (PC/External Drives)

Frequently Asked Questions

Analyze common user questions about the Blu-ray Player market and generate a concise list of summarized FAQs reflecting key topics and concerns.Is the Blu-ray Player Market still relevant considering the dominance of 4K streaming services?

Yes, the market remains highly relevant for niche consumers. Blu-ray players, especially 4K Ultra HD models, deliver superior video quality due to uncompressed high bitrates and lossless audio (Dolby Atmos/DTS:X), offering a performance level unattainable by current standard compressed streaming platforms. Relevance is sustained by home theater enthusiasts and media collectors.

What is the primary difference between a standard Blu-ray player and a 4K Ultra HD Blu-ray player?

A 4K Ultra HD Blu-ray player is necessary to read 4K UHD discs, which support 2160p resolution, High Dynamic Range (HDR such as Dolby Vision/HDR10+), and higher frame rates. Standard players are limited to 1080p resolution and cannot process the advanced formats utilized by UHD media, making the 4K variant the current industry standard for premium fidelity.

Which features are most critical when selecting a high-end Blu-ray player for an existing home theater system?

Critical features include support for both Dolby Vision and HDR10+, universal disc compatibility (SACD, DVD-Audio), robust internal build quality for noise reduction, dedicated premium analog audio outputs, and high-quality video processing chipsets for superior upscaling of older content to match 4K displays.

How is AI technology influencing the performance of dedicated Blu-ray players?

AI is primarily used for enhancing playback quality through advanced video processing, such as intelligent upscaling algorithms that reduce noise and enhance detail when playing 1080p or DVD content on a 4K display. AI also assists in dynamic HDR metadata management to optimize contrast and color on a scene-by-scene basis, maximizing visual fidelity.

What is the anticipated future growth trajectory for the Blu-ray Player Market through 2033?

The market is projected to experience modest growth, indicated by a 1.8% CAGR through 2033. This growth is volume-constrained but value-driven, sustained by the premium segment focusing on 4K UHD, universal compatibility, and advanced audio processing demanded by high-fidelity home cinema consumers worldwide, offsetting the decline in mass-market adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager