Boat Speakers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441969 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Boat Speakers Market Size

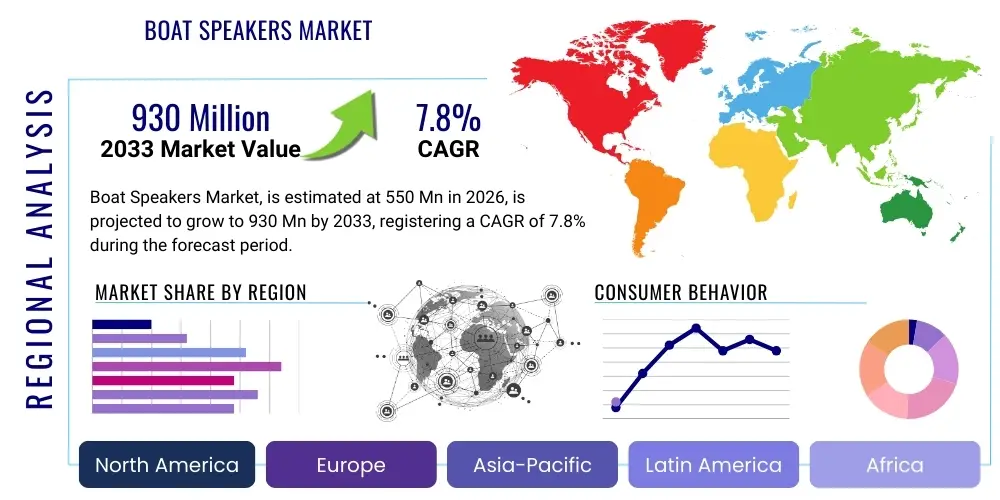

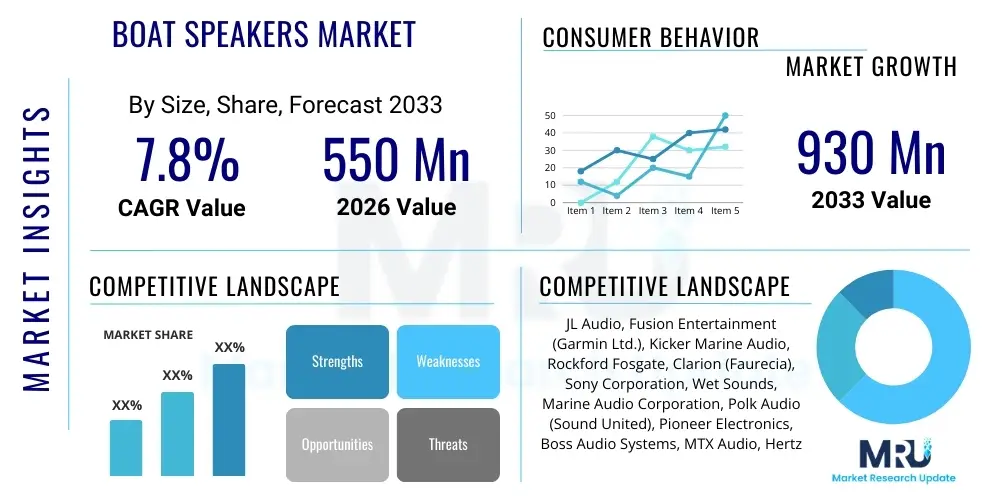

The Boat Speakers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $930 Million by the end of the forecast period in 2033.

The robust expansion of the marine recreational sector, coupled with continuous advancements in marine-grade audio technology, primarily fuels this substantial market growth trajectory. Increasing disposable incomes in developed and emerging economies have led to higher adoption rates of luxury and high-performance boats, directly boosting the demand for premium, durable, and weather-resistant speaker systems. Furthermore, the stringent requirements for corrosion resistance, UV stabilization, and superior waterproofing (IPX ratings) necessitate specialized product development, justifying the premium pricing structures inherent in this niche segment.

Market valuation reflects the widespread integration of complex audio architectures in both OEM (Original Equipment Manufacturer) installations on new vessels and the thriving aftermarket upgrade segment. The rising popularity of watersports and fishing activities globally necessitates sound systems capable of delivering high-fidelity audio output even in loud, open-air environments. Competitive dynamics among key manufacturers are centered on innovation in digital signal processing (DSP) and wireless connectivity standards, aiming to enhance user experience and system integration with modern marine navigation and entertainment platforms. This focus on technological differentiation ensures sustained revenue growth throughout the forecast period.

Boat Speakers Market introduction

The Boat Speakers Market encompasses the design, manufacturing, distribution, and sale of specialized audio transducers and sound systems engineered specifically for installation on marine vessels, including yachts, sailboats, fishing boats, and personal watercraft. Unlike standard consumer audio equipment, boat speakers are purpose-built to withstand the harsh marine environment, characterized by high humidity, salt spray, UV exposure, temperature fluctuations, and continuous vibration. Key product attributes include robust construction materials like ASA plastics or marine-grade stainless steel components, sealed enclosures, and advanced waterproofing standards, typically adhering to IPX5 or higher ratings, guaranteeing longevity and reliable performance offshore.

Major applications for marine audio systems span recreational boating, luxury cruising, commercial fishing fleets, and professional watersports activities. These speaker systems range from basic coaxial models and component speakers to high-powered tower speakers designed for wakeboarding boats and large, integrated subwoofer units necessary for producing deep bass tones in expansive yacht interiors. The primary benefits driving market adoption include enhanced onboard entertainment experience, improved safety through clear audio signaling capabilities, and increased aesthetic appeal through integrated lighting (LED) features now common in high-end marine speakers. These components are integral to the modern leisure marine experience, serving as a critical differentiator for vessel manufacturers.

Driving factors propelling this market include the global expansion of recreational boating ownership, particularly in coastal regions of North America and Europe, alongside significant technological maturation in audio processing and connectivity solutions. The demand for seamless integration with onboard GPS, sonar, and entertainment hubs, often facilitated by NMEA 2000 networks, pushes manufacturers toward smarter, network-enabled speaker systems. Moreover, consumer willingness to invest in premium marine lifestyle products, coupled with OEM agreements prioritizing high-quality standard audio packages, ensures a consistent and growing revenue stream for specialized boat speaker providers across the globe.

Boat Speakers Market Executive Summary

The Boat Speakers Market is defined by intense focus on durability and acoustic performance tailored for open-air, high-noise environments. Current business trends indicate a strong shift towards product convergence, where audio systems are increasingly integrated with complex marine electronics, moving beyond simple sound reproduction to function as part of a cohesive digital ecosystem. Key players are prioritizing investment in material science R&D to enhance resistance to corrosion and UV degradation, extending product lifecycles and justifying premium price points. Furthermore, strategic partnerships between marine electronics providers and audio specialists are becoming commonplace, aimed at delivering turn-key integrated solutions for boat builders seeking simplified installation and superior user interfaces.

Regional trends highlight North America as the dominant market, primarily due to the extensive coastline, high disposable income, and ingrained culture of recreational boating, especially wakeboarding and cruising. However, the Asia Pacific (APAC) region is demonstrating the fastest growth rate, fueled by rising affluence in coastal nations such as Australia, China, and Southeast Asian countries, leading to rapid expansion of yacht and leisure boat ownership. Europe remains a stable, mature market, characterized by strong demand for high-fidelity luxury audio systems often fitted in bespoke superyachts. Manufacturers are responding to these geographical differences by tailoring product lines to meet local regulatory standards and consumer aesthetic preferences, such as compact designs for smaller European vessels versus powerful tower speakers prevalent in the US market.

Segmentation trends reveal significant growth within the high-end, premium speaker segment, driven by consumer demand for superior acoustic quality comparable to home audio systems, alongside the rapidly expanding market for LED-integrated speakers, which combine entertainment with visual customization. By product type, coaxial speakers continue to hold the largest market share due to their versatility and ease of installation, but specialized segments like soundbars and marine subwoofers are witnessing accelerated adoption, reflecting a broader trend towards customized, multi-component audio installations. The aftermarket segment, focusing on replacement and upgrade cycles, remains critically important, leveraging consumer desires for the latest technology innovations like advanced Bluetooth 5.0 connectivity and multi-zone control features.

AI Impact Analysis on Boat Speakers Market

User inquiries regarding AI's influence on the Boat Speakers Market primarily center on three themes: acoustic optimization, intelligent system management, and personalized user experiences. Users frequently ask if AI can dynamically adjust sound profiles to compensate for environmental variables like engine noise, wind speed, or water turbulence, ensuring consistent audio quality regardless of operating conditions. There is also significant interest in AI-driven diagnostic tools for preventative maintenance of speaker systems and smart energy management to prolong battery life on smaller vessels. Furthermore, consumers anticipate AI integration to facilitate highly personalized audio recommendations, voice command capabilities specifically tailored for noisy marine settings, and sophisticated multi-zone control that learns preferred settings based on vessel location and activity.

The integration of AI technologies, particularly machine learning algorithms embedded in Digital Signal Processors (DSPs), is poised to revolutionize the functionality and user interface of marine audio equipment. These systems move beyond simple static equalization to active sound calibration, dynamically mapping the acoustic landscape of the vessel environment. This ensures optimal clarity and volume distribution across multiple zones, regardless of speed or sea conditions. This intelligence also enables predictive failure analysis, alerting boat owners or maintenance teams to potential issues with individual speaker drivers or amplifier components before catastrophic failure occurs, significantly enhancing product reliability and customer satisfaction in a demanding operational setting.

Future iterations of boat speakers will leverage advanced neural networks for nuanced voice recognition in high-decibel environments, allowing users to seamlessly control music, volume, and even integrated boat functions (e.g., lighting, bilge pumps) using intuitive natural language commands. This level of smart integration transforms the audio system from a simple entertainment device into a centralized control hub for the vessel’s leisure electronics, aligning marine technology with the "smart home" expectations prevalent in modern consumer electronics. The market shift necessitates increased investment in software development and data processing capabilities, creating new competitive barriers to entry focused on intelligence rather than purely hardware specifications.

- AI-Enhanced Digital Signal Processing (DSP): Enables real-time acoustic tuning to counteract wind, engine noise, and wave interference, ensuring optimal sound fidelity.

- Intelligent Power Management: Optimizes amplifier output and speaker usage to maximize battery efficiency, critical for smaller boats and extended excursions.

- Predictive Maintenance and Diagnostics: Machine learning algorithms analyze system performance metrics (e.g., thermal loads, distortion levels) to forecast component failure and schedule proactive servicing.

- Advanced Voice Command Integration: Utilizes specialized noise cancellation algorithms to accurately interpret voice commands in loud marine environments, improving hands-free operation.

- Personalized Audio Zones: AI learns user preferences for volume, EQ, and content based on geographical location or vessel activity (e.g., wakeboarding mode, relaxing cruise mode).

- Integration with Marine IoT: Allows audio systems to communicate seamlessly with other smart boat sensors and navigation equipment for unified control and alerts.

DRO & Impact Forces Of Boat Speakers Market

The Boat Speakers Market is primarily driven by the expanding global marine leisure industry and the relentless consumer demand for premium, durable, and technologically advanced entertainment solutions while at sea. Key drivers include increased global disposable incomes facilitating luxury boat purchases, and rapid technological innovations in audio components, particularly advanced materials science providing superior corrosion and weather resistance. Restraints include the high initial cost of specialized marine-grade equipment compared to standard consumer electronics, which can deter budget-conscious boat owners, and the long replacement cycles inherent to durable goods designed for extreme longevity. Moreover, the niche nature of the market necessitates specialized distribution and installation expertise, limiting broad market accessibility.

Opportunities for growth are abundant, focusing on the burgeoning aftermarket segment driven by upgrades and technological refreshes, especially the integration of smart features like voice control and complex networking capabilities. The expansion of recreational activities in emerging economies, coupled with increased focus on watersports like wakeboarding, which require high-power, directional audio systems (tower speakers), presents significant avenues for specialized product penetration. Impact forces, which dictate market momentum, are high, primarily driven by competitive intensity among a few dominant, highly specialized manufacturers. The continuous improvement in IP ratings and materials technology forces other players to innovate rapidly to maintain market relevance, ensuring that the technology landscape is perpetually advancing.

The market also faces the structural impact force of regulatory oversight regarding noise pollution in certain coastal and inland waterways, potentially restricting the usage or volume limits of high-output speaker systems. Conversely, the rising societal expectation for connectivity and entertainment—mirroring experiences found in high-end automotive or residential settings—acts as a powerful, sustained driving force. This compels manufacturers to integrate advanced networking protocols and superior acoustic design into increasingly compact and energy-efficient systems. Successfully navigating the balance between robust durability, technological sophistication, and price sensitivity determines long-term success in this specialized high-value sector.

Segmentation Analysis

The Boat Speakers Market is comprehensively segmented based on product type, vessel type, connectivity technology, end-user application, and distribution channel, providing granular insight into market dynamics and strategic focus areas. Understanding these segments is crucial for manufacturers tailoring their product lines, especially given the diverse requirements of different marine environments—from high-salt, high-UV exposure in tropical cruising to high-vibration environments in speed boats. Product differentiation is largely based on acoustic power output, physical dimensions, and most critically, the Ingress Protection (IP) rating, which defines resistance to water and dust penetration, directly correlating with suitability for external or internal marine installation.

By product type, the market is categorized into coaxial speakers, subwoofers, sound bars, and tower speakers, each addressing a distinct acoustic need and vessel type. Coaxial speakers, offering a balanced performance profile, dominate in volume due to their cost-effectiveness and versatility for both interior and exterior use. However, the fastest growth is observed in the subwoofers and tower speakers segment, driven by high-performance recreational users (e.g., wakeboarding and luxury yacht owners) demanding deep bass and directional sound projection. Connectivity segmentation, particularly the transition from wired to advanced wireless protocols like marine-grade Bluetooth 5.0 and proprietary networking, is reshaping user installation and control interfaces.

Geographically, the segmentation allows companies to strategically allocate resources, recognizing the mature, high-value demand in North America and Europe, versus the high-growth potential and price sensitivity prevalent in APAC. The end-user segmentation clearly separates the high-volume OEM market, where product integration ease is paramount, from the high-margin aftermarket segment, where consumers prioritize feature upgrades and premium audio fidelity. This structured analysis confirms that market resilience is maintained through diversity across these operational and technological segments, mitigating risks associated with reliance on a single product category or geographic area.

- By Product Type:

- Coaxial Speakers (Full-Range, 2-Way, 3-Way)

- Component Speakers (Separate Tweeters, Mid-Range Drivers)

- Subwoofers (Free-Air, Enclosed, Passive Radiators)

- Tower Speakers (Wakeboard-Specific, Directional Audio)

- Sound Bars (Integrated Systems for Smaller Vessels)

- Amplifiers and Receivers (Dedicated Marine Amps, Digital Media Receivers)

- By Vessel Type:

- Runabouts and Ski Boats

- Fishing Boats and Center Consoles

- Sailboats and Catamarans

- Cruisers and Yachts (20ft to 50ft)

- Superyachts (50ft+)

- Personal Watercraft (PWC)

- By Connectivity Technology:

- Wired (Traditional Speaker Wire, Proprietary Signal Cables)

- Wireless (Bluetooth 5.0 and above, Wi-Fi Streaming, Proprietary Low-Latency Wireless Links)

- Networked (NMEA 2000 compatible audio components for system integration)

- By End-User Application:

- OEM (Original Equipment Manufacturer Installations on New Boats)

- Aftermarket (Replacement, Upgrade, and Custom Installations)

- By Distribution Channel:

- Direct Sales (E-commerce, Manufacturer Websites)

- Specialty Marine Retail Stores

- Authorized Boat Dealers and Installers

- Mass Retail Channels (Limited Marine Products)

Value Chain Analysis For Boat Speakers Market

The value chain for the Boat Speakers Market begins with complex upstream activities focused on securing specialized raw materials, primarily marine-grade polymers (e.g., ASA, UV-stabilized polycarbonate), corrosion-resistant metals (stainless steel, specialized aluminum alloys), and high-performance electronic components (voice coils, magnets, DSP chips). Key activities in this stage include rigorous material testing for salt fog resistance and UV exposure, which significantly differentiate these inputs from standard consumer electronics components. Manufacturers must maintain high-security supply chains for proprietary waterproof adhesives and coatings essential for achieving stringent IP ratings. Cost optimization at this stage is challenging due to the specialized nature and low volume compared to mass-market electronics, leading to higher unit production costs.

Midstream activities involve sophisticated manufacturing, assembly, and quality assurance. Unlike conventional speakers, marine audio production requires specialized sealing processes and robust quality control procedures (e.g., pressurized water testing) to ensure marine durability specifications are met. Distribution channels are highly specialized: Direct channels include manufacturers supplying large OEM clients (boat builders) under multi-year contracts, ensuring speakers are integrated directly into the vessel design. Indirect channels rely heavily on a network of authorized marine electronics dealers, specialty installers, and reputable aftermarket retailers who possess the expertise required for correct installation and integration with other boat electronics (e.g., head units, multi-function displays).

Downstream activities focus on sales, professional installation, and customer support. The direct-to-consumer aspect is growing via e-commerce for easy-to-install aftermarket products, but the high-end market remains dependent on professional installation due to the complexity of wiring, amplifier setup, and multi-zone configuration on larger vessels. End-users (boat owners) benefit from warranties specifically covering environmental damage, which is a key competitive differentiator at the downstream level. The entire value chain is characterized by a high emphasis on product reliability and technical expertise at every touchpoint, demanding strong relationships between manufacturers, installers, and marine service centers.

Boat Speakers Market Potential Customers

The primary potential customers in the Boat Speakers Market are broadly segmented into two key categories: Original Equipment Manufacturers (OEMs) and end-user consumers (boat owners). OEMs, which include global and regional boat builders of recreational and luxury vessels, represent the largest volume purchasers. These customers require scalable, reliable audio systems that can be seamlessly integrated into new vessel designs, often seeking bulk pricing, customization options (e.g., branded speaker grilles), and long-term supply assurance. Their purchasing decisions are heavily influenced by ease of installation, overall system footprint, and the ability of the audio brand to enhance the perceived value and luxury status of the boat being sold.

The second major segment, end-user consumers, includes existing boat owners driving the high-margin aftermarket. These buyers are typically motivated by technology upgrades, replacement of failed or outdated equipment, or a desire for superior acoustic performance beyond the standard OEM installation. Within this segment, customers can be further broken down into recreational users (cruising, fishing), watersports enthusiasts (wakeboarders demanding high-powered tower speakers), and luxury yacht owners seeking custom, high-fidelity, and aesthetically pleasing audio solutions that often include complex multi-zone amplification and control systems. Marketing strategies for this group must emphasize durability, sound quality, and integration compatibility with existing marine electronics.

Furthermore, specialty segments such as commercial charter operators and marine service providers also constitute important customer bases. Commercial entities require extremely rugged and reliable systems that can withstand continuous, high-usage scenarios with minimal maintenance downtime. Marine service providers often act as intermediaries, recommending and installing products for boat owners, making them crucial influencers in the aftermarket segment. Targeting these various customer profiles requires tailored product lines, specialized technical training for installers, and robust warranty support reflecting the challenging operating environment of the products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $930 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JL Audio, Fusion Entertainment (Garmin Ltd.), Kicker Marine Audio, Rockford Fosgate, Clarion (Faurecia), Sony Corporation, Wet Sounds, Marine Audio Corporation, Polk Audio (Sound United), Pioneer Electronics, Boss Audio Systems, MTX Audio, Hertz Marine (Elettromedia), JBL, Vibe Audio, Pyle Audio, Kenwood Corporation, FOCAL Marine, Infinity Marine, Prospec Electronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Boat Speakers Market Key Technology Landscape

The technology landscape of the Boat Speakers Market is rapidly advancing, focusing primarily on enhancing durability and maximizing acoustic performance in challenging outdoor marine conditions. A critical technological evolution involves the deployment of advanced materials, such as specialized UV-resistant polymer cones (e.g., polypropylene and mica-filled composite cones) and high-temperature voice coils, encapsulated in sealed enclosures with superior IP ratings (typically IPX6 or IPX7) to guarantee long-term immunity against water immersion and salt corrosion. Furthermore, manufacturers are leveraging Finite Element Analysis (FEA) during the design phase to optimize speaker structure for maximum sound projection and minimum resonance within the boat hull, addressing the unique acoustic challenges presented by open-air and water reflection.

Connectivity and control represent the second major technological pillar. The shift from traditional analog wired systems to integrated digital solutions is pronounced. Modern boat speakers frequently incorporate advanced marine networking compatibility, such as NMEA 2000, allowing the audio system to be controlled via multi-function displays (MFDs) alongside navigation and radar systems. High-definition wireless audio transmission, facilitated by Bluetooth 5.0 and proprietary low-latency codecs, ensures stable streaming quality even at greater distances on larger vessels. Furthermore, the integration of multi-zone audio control systems, enabling independent volume and source management across different areas of the boat (cockpit, cabin, bow), is now standard in premium installations, often controlled via dedicated apps or touch-screen remotes.

Digital Signal Processing (DSP) technology is foundational to the current generation of marine audio components. Sophisticated DSP chips are embedded in amplifiers and receivers to perform real-time equalization and time alignment, compensating for the specific acoustic environment of the vessel and external noise sources. This intelligence allows users to optimize sound output for activities such as wakeboarding (directional audio projection) or stationary cruising (balanced spatial audio). Moreover, the proliferation of integrated LED lighting (RGB/W) within speaker grilles and enclosures is a significant aesthetic trend, requiring specialized waterproof lighting electronics and integration into the boat's existing lighting control networks, adding complexity and value to the product offering.

Regional Highlights

Regional dynamics significantly influence the Boat Speakers Market, driven by factors such as boating culture density, coastal infrastructure, and economic prosperity. North America, particularly the United States, represents the largest and most mature market segment globally. This dominance is attributed to a massive installed base of recreational boats, high consumer spending on marine leisure, and the presence of leading boat manufacturers (OEMs) and specialized marine electronics companies. The demand here is skewed towards high-output systems, specifically powerful subwoofers and tower speakers essential for watersports activities like wakeboarding and surfing, alongside luxury high-fidelity systems for yachts and large cruisers. The US market dictates many of the trends in technology and product feature sets, setting a global standard for performance and durability.

Europe holds the second-largest market share, characterized by a dual focus: strong demand for customized, premium audio solutions for the superyacht industry in countries like Italy, Germany, and the Netherlands, and robust consumption of durable, mid-range systems for sailing and small cruising in the UK and Scandinavia. European consumers often prioritize compact size and aesthetic integration due to the generally smaller harbor spaces and vessels compared to the US. Regulatory frameworks regarding noise levels also play a more pronounced role in certain European waterways, influencing product design towards controlled acoustic output and high efficiency. Growth in this region is stable, driven primarily by replacement cycles and the persistent demand for luxury marine upgrades.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid expansion is primarily fueled by increasing affluence in coastal economies, including Australia, New Zealand, China, and Southeast Asian nations, leading to substantial new boat registrations and marine infrastructure development. While currently focused on mid-range and entry-level products, the luxury boating segment is accelerating, particularly in China and Southeast Asia, creating significant opportunities for premium marine audio manufacturers. Challenges in APAC include greater product exposure to extreme heat and humidity, demanding even higher standards for materials science and environmental sealing than in temperate zones.

- North America: Market leader; characterized by high consumer expenditure on large recreational boats and watersports; primary demand for high-power tower speakers and sophisticated multi-zone systems; established OEM base and robust aftermarket distribution network.

- Europe: Mature market focusing on luxury yachts and sailing; stable demand for high-fidelity, aesthetically integrated, and often bespoke audio systems; regional variations in noise regulations impacting output requirements.

- Asia Pacific (APAC): Highest CAGR; growth driven by rising disposable incomes in coastal economies (China, Australia, Singapore); increasing adoption of both entry-level fishing vessels and high-end luxury yachts; demanding environment requiring superior heat and humidity resistance.

- Latin America (LATAM): Emerging market focused primarily on local fishing and smaller leisure craft; price sensitivity is a key purchasing factor; gradual growth anticipated as marine infrastructure and recreational spending improves.

- Middle East & Africa (MEA): Growth concentrated in the UAE and Gulf States driven by luxury yacht ownership and marine tourism; high demand for ultra-premium, durable, and highly customized audio installations capable of handling extreme heat and intense solar exposure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Boat Speakers Market.- JL Audio

- Fusion Entertainment (Garmin Ltd.)

- Kicker Marine Audio

- Rockford Fosgate

- Clarion (Faurecia)

- Sony Corporation

- Wet Sounds

- Marine Audio Corporation

- Polk Audio (Sound United)

- Pioneer Electronics

- Boss Audio Systems

- MTX Audio

- Hertz Marine (Elettromedia)

- JBL

- Vibe Audio

- Pyle Audio

- Kenwood Corporation

- FOCAL Marine

- Infinity Marine

- Prospec Electronics

Frequently Asked Questions

Analyze common user questions about the Boat Speakers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most crucial features differentiating marine speakers from standard car or home speakers?

The critical difference is environmental durability, including specific Ingress Protection (IP) ratings (e.g., IPX6/IPX7) for water resistance, UV stabilization materials (ASA plastic) to prevent sun damage, and corrosion-resistant components (marine-grade stainless steel) necessary to withstand salt spray and humidity encountered in boating environments. These features ensure operational longevity.

Which connectivity technologies are currently dominating the marine audio system market?

Advanced wireless connectivity, primarily Bluetooth 5.0, dominates for streaming flexibility. However, complex systems increasingly utilize proprietary low-latency wireless connections and integration with marine network standards like NMEA 2000, allowing centralized control via the vessel's multi-function displays (MFDs).

How does the segmentation by vessel type influence speaker system selection?

Vessel type dictates power requirements and speaker design. For example, wakeboard boats heavily rely on powerful, directional tower speakers, while luxury yachts require high-fidelity, multi-zone coaxial and component systems integrated discreetly into the vessel's structure, often with extensive subwoofer arrays.

Is the aftermarket or the OEM segment driving faster growth in the Boat Speakers Market?

While the OEM segment provides high volume and stable revenue, the aftermarket segment is experiencing faster growth in terms of technological adoption and value, driven by boat owners upgrading existing systems with newer, AI-enhanced DSP amplifiers, advanced connectivity, and LED-integrated speakers for aesthetic enhancement.

What role does Digital Signal Processing (DSP) play in modern marine speaker performance?

DSP is essential for optimal marine performance, as it allows for real-time acoustic tuning and equalization. This compensates for the challenging, non-reflective environment of open-air boating, dynamically mitigating external noise from engines and wind to deliver consistently clear and high-fidelity audio output across all defined listening zones.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager