Body Piercing Jewelry Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442625 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Body Piercing Jewelry Market Size

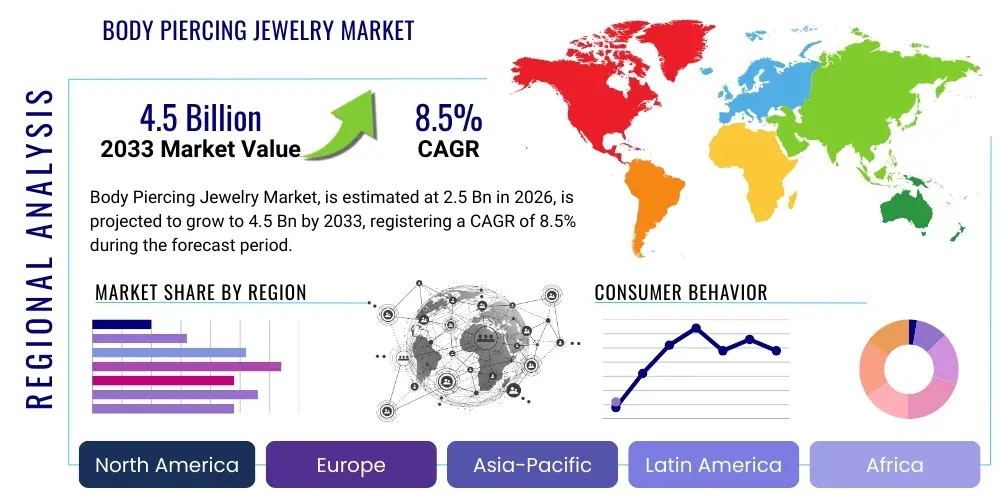

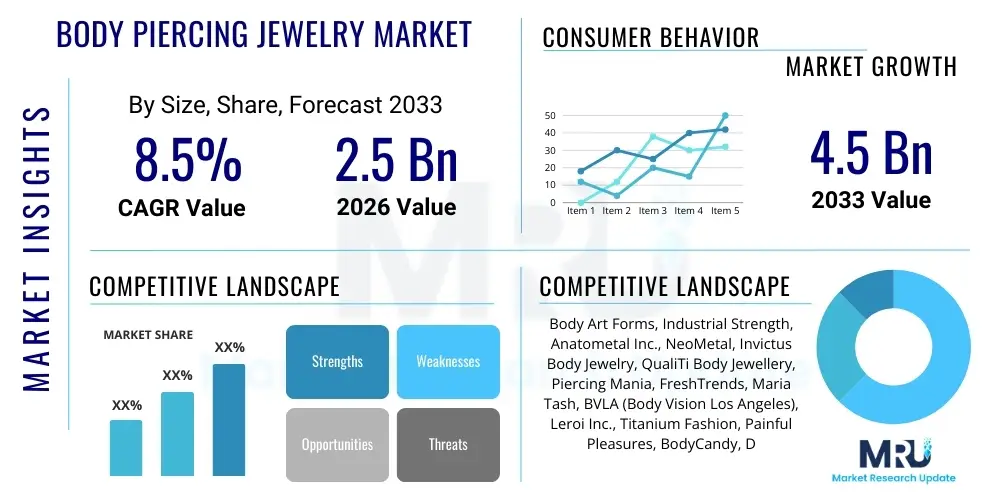

The Body Piercing Jewelry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the evolving cultural acceptance of body modifications, coupled with significant innovation in materials science and aesthetic design, appealing to a broader consumer demographic than previously observed. The demand acceleration is particularly noticeable in emerging economies where shifting fashion norms are leading to increased experimentation among younger populations, necessitating robust supply chain solutions and diversified product offerings from established market participants.

Body Piercing Jewelry Market introduction

The Body Piercing Jewelry Market encompasses the manufacturing, distribution, and retail of aesthetic ornaments designed specifically for insertion into temporary or permanent openings created in the human body, excluding traditional earlobe piercings which are often categorized separately. This specialized market includes a diverse range of products such as barbells, captive bead rings (CBRs), labrets, dermal anchors, and nose studs, fabricated from biocompatible materials including surgical stainless steel, titanium, niobium, gold, and various proprietary polymers. These jewelry pieces serve not only as fashion accessories but are frequently integrated into personal identity expression and cultural rituals, providing significant scope for customization and personalization that fuels consumer interest and expenditure within the sector.

Major applications for body piercing jewelry span aesthetic enhancement, fashion statement creation, and niche medical applications related to corrective piercing or specialized implants. The market structure is highly fragmented, featuring small artisanal crafters alongside large, globally operating jewelry manufacturers who leverage extensive distribution networks, primarily through specialized piercing studios, dedicated online platforms, and selective high-end retail outlets. The primary benefits driving market growth include the rising disposable incomes globally, increasing consumer engagement with social media influencing fashion trends, and crucial advancements in sterile, high-quality material production that significantly minimizes health risks associated with piercing, thereby encouraging first-time consumers.

Driving factors propelling the expansion of this market are centered on demographic shifts and increased social liberalization across key global regions. The growing acceptance of body modification in professional environments, alongside continuous marketing efforts emphasizing safety and style, contributes significantly to market resilience. Furthermore, the rapid expansion of e-commerce channels has dramatically improved access to diverse, internationally sourced jewelry designs, allowing consumers to bypass traditional physical retail limitations and facilitating direct-to-consumer models that enhance competitive pricing and product variety, ensuring robust growth over the forecast horizon. The desire for unique, statement-making accessories is a core emotional driver of purchase behavior.

Body Piercing Jewelry Market Executive Summary

The Body Piercing Jewelry Market is characterized by dynamic business trends, marked by a decisive shift towards premium, hypoallergenic materials like implant-grade titanium and solid gold, addressing heightened consumer awareness regarding material safety and longevity. Manufacturers are increasingly focusing on sustainable sourcing and ethical production practices, responding to growing demand for corporate social responsibility (CSR) initiatives, particularly among Gen Z and millennial consumers who prioritize conscious consumption. Key business strategies currently involve rapid product lifecycle management to align with transient fashion cycles, coupled with strategic partnerships with renowned piercing artists and social media influencers to capture niche market segments and rapidly disseminate new styles, thereby maintaining high engagement rates and driving conversion across digital platforms.

Regionally, the market exhibits strong growth momentum in North America and Europe, supported by mature retail infrastructure and a high concentration of established piercing culture. However, the Asia Pacific (APAC) region is poised to demonstrate the highest Compound Annual Growth Rate (CAGR), fueled by expanding middle-class populations, Westernization of fashion norms, and increasing urbanization, which facilitates greater access to piercing services and jewelry retail. Latin America and the Middle East and Africa (MEA) present substantial untapped opportunities, conditional on the development of robust regulatory frameworks concerning hygiene and material standards, which are essential for building consumer trust and encouraging broader market penetration in these emerging territories.

Segment trends indicate that the Material segment is heavily dominated by surgical stainless steel due to its cost-effectiveness and widespread use, but the high-end jewelry materials, specifically gold and titanium, are expected to register the fastest growth rate as consumers increasingly invest in durable, higher-quality pieces, prioritizing health and aesthetic value over initial cost savings. The Application segment continues to see strong performance in ear and nose piercings, though the rising popularity of advanced placements such as dermal implants and complex body jewelry arrangements (e.g., industrial and orbital piercings) suggests a premiumization trend within specialized studios, necessitating specialized training and certification for piercers to meet the complexity of modern installations.

AI Impact Analysis on Body Piercing Jewelry Market

Common user questions regarding the impact of Artificial Intelligence (AI) in the body piercing jewelry market revolve around themes of personalized design generation, inventory optimization, and enhanced retail experiences. Users frequently inquire whether AI can accurately predict niche trend emergence based on social media data, how generative AI tools might revolutionize custom jewelry creation, and the potential for AI-driven virtual try-on technologies to mitigate purchase hesitancy in the high-involvement jewelry category. Furthermore, significant concern is voiced regarding supply chain vulnerabilities and how predictive analytics could prevent stockouts of specific materials or popular gauges, particularly during seasonal peaks. This collective inquiry points towards an expectation that AI will primarily serve to hyper-personalize the purchasing journey, streamline operations, and introduce novel design capabilities previously unattainable by traditional manufacturing processes, thereby reshaping consumer interaction and competitive dynamics within the industry.

AI's primary influence is expected to manifest in transforming the customer experience and operational efficiency across the value chain, shifting the focus from mass-produced items to highly individualized pieces created on demand. Sophisticated machine learning algorithms are being deployed to analyze vast datasets of consumer preferences, historical sales, social media sentiment, and demographic data to inform design decisions, allowing manufacturers to drastically reduce lead times for trend-relevant items and minimize the risk associated with overstocking obsolete designs. This predictive capability extends beyond aesthetics, influencing material choice and gauge standardization based on regional health regulations and prevalent body types, ensuring compliance and enhancing customer satisfaction through proactive optimization.

Moreover, the integration of AI-powered tools offers significant improvements in logistics and anti-counterfeiting measures, addressing two critical challenges facing the luxury and niche jewelry sectors. Computer vision algorithms can analyze product authenticity by examining microscopic material structures and unique etchings, providing consumers and retailers with immediate verification, thus protecting brand integrity. In terms of retail, intelligent recommendation engines leverage historical purchase data and psychographic profiles to suggest complementary jewelry pieces or safe aftercare products, driving up average transaction value (ATV) and fostering brand loyalty by delivering a seamlessly customized and trustworthy shopping environment, essential for a product category intimately related to personal health and aesthetics.

- AI-driven trend forecasting minimizes production waste and maximizes alignment with rapidly changing consumer aesthetics.

- Generative AI tools enable personalized 3D models for custom jewelry, reducing design iteration cycles significantly.

- Predictive analytics optimize supply chain inventory management for specific hypoallergenic and premium materials (e.g., titanium, niobium).

- Virtual try-on applications, powered by augmented reality and machine learning, enhance e-commerce conversion rates by improving purchasing confidence.

- AI-based quality control systems improve manufacturing precision, especially for intricate, small-gauge jewelry pieces.

- Automated customer service bots provide immediate, detailed aftercare instructions and address common post-piercing queries.

- Machine learning algorithms assist in fraud detection and ensuring the authenticity of high-value jewelry pieces sold online.

DRO & Impact Forces Of Body Piercing Jewelry Market

The Body Piercing Jewelry Market is propelled by a confluence of robust drivers, notably the sustained expansion of globalization, which facilitates the rapid spread of diverse cultural and fashion trends across international borders, coupled with the increasing digitalization of retail, offering consumers unprecedented access to a vast array of specialized products. The diminishing stigma associated with body modifications in many professional and social settings is perhaps the most fundamental driver, normalizing piercing jewelry beyond niche subcultures and integrating it into mainstream fashion and self-expression. Simultaneously, technological advancements in material science, particularly the utilization of biologically inert and hypoallergenic materials like implant-grade titanium and specific PTFE grades, significantly mitigate health risks, encouraging higher consumer penetration rates and driving product quality standards upward, thereby supporting premium pricing strategies.

Conversely, the market faces significant restraints primarily related to health and safety concerns, often stemming from poorly regulated piercing practices or the influx of cheap, low-quality jewelry made from materials that contain nickel or other allergens, leading to adverse reactions and tarnishing the industry's reputation. Regulatory hurdles across different jurisdictions, particularly strict import standards in high-value markets concerning material traceability and sterilization protocols, create complexity for international suppliers and small-scale artisans who struggle to meet stringent compliance requirements. Furthermore, while social acceptance is increasing, deeply rooted cultural or religious prohibitions against body modification in certain demographics continue to restrict potential market size, necessitating geographically targeted marketing and product strategies that respect local customs and sensitivities.

Opportunities within the market abound, particularly in the development of technologically integrated jewelry, such as pieces featuring micro-sensors for health tracking or customizable LED elements, bridging the gap between traditional jewelry and wearable technology, appealing to the tech-savvy consumer base. The expansion of personalized services, including custom design consultations utilizing 3D printing capabilities, presents a lucrative high-margin avenue for specialized studios and online retailers, offering unique products that command premium prices. The greatest positive impact force remains the high degree of individualism prevalent among younger generations who view body piercing as a crucial medium for personal narration and aesthetic distinction, while the most critical negative impact force is the persistent challenge of ensuring universal hygiene standards and combating the proliferation of counterfeit or non-compliant jewelry, which necessitates continuous industry-wide vigilance and educational campaigns targeting consumers and piercers alike.

Segmentation Analysis

The Body Piercing Jewelry Market is intricately segmented based on Material Type, Product Type, Application (Piercing Location), Distribution Channel, and End-User, allowing for granular analysis of consumer preferences and operational focus across various segments. Understanding these segmentations is critical for manufacturers aiming to optimize their product portfolio, distribution strategies, and pricing models to effectively target high-growth areas. The differentiation in material types, ranging from commodity-grade metals to certified implant-grade materials, directly correlates with both production cost and retail price, reflecting consumer choices between short-term fashion statements and long-term, investment-grade jewelry that prioritizes biocompatibility and durability for permanent piercings.

The segmentation by Product Type, encompassing highly specific items like circular barbells, curved barbells, plugs, tunnels, and elaborate surface anchors, dictates the specialization required by both manufacturers and piercing professionals, as each type demands unique production tooling and specialized installation expertise. Application segmentation is crucial as consumer interest shifts dynamically between traditional locations (ear, nose) and emerging, high-complexity areas (dermal, microdermal, genital, and elaborate cartilage constellations), influencing demand for specific gauges and materials. E-commerce platforms are increasingly dominating the distribution channel segment, capitalizing on their ability to offer unparalleled inventory depth and cater to niche requirements globally, often bypassing traditional brick-and-mortar limitations.

Analyzing the End-User segment provides crucial insights into purchasing behavior, differentiating between frequent buyers focused on fashion turnover and investment buyers prioritizing medical-grade quality for permanent installations. This detailed market mapping enables strategic forecasting, allowing stakeholders to anticipate shifts in material preference, such as the increasing demand for hypoallergenic materials like titanium and niobium over traditional stainless steel, driven by greater health awareness and regulatory pressures. The structural clarity provided by robust segmentation is essential for developing competitive intelligence and driving targeted marketing campaigns that resonate effectively with diverse consumer profiles across regional boundaries, ensuring market relevance and sustained profitability throughout the forecast period.

- Material Type:

- Surgical Stainless Steel

- Titanium and Niobium

- Gold (14K, 18K, 24K)

- Silver

- Acrylic and Bioflex/PTFE

- Organic Materials (Wood, Bone, Stone)

- Product Type:

- Barbells (Straight, Curved, Circular)

- Captive Bead Rings (CBRs) and Segment Rings

- Labrets and Studs (Nose, Lip)

- Dermal Anchors and Surface Piercing Jewelry

- Plugs and Tunnels

- Belly Button Rings

- Application (Piercing Location):

- Ear Piercings (Helix, Tragus, Rook, Daith, Conch)

- Nose Piercings (Septum, Nostril)

- Facial Piercings (Eyebrow, Lip, Cheek)

- Torso and Navel Piercings

- Nipple and Genital Piercings

- Dermal/Microdermal Piercings

- Distribution Channel:

- Online Retail (E-commerce platforms, Direct-to-Consumer Websites)

- Specialized Piercing Studios

- Jewelry Stores and Boutiques

- Department Stores

- End-User:

- Fashion-Conscious Individuals

- Professional Piercers and Studios (B2B)

- Collectors and Enthusiasts

Value Chain Analysis For Body Piercing Jewelry Market

The value chain for the Body Piercing Jewelry Market begins with the Upstream Analysis, which is centered on the sourcing and refinement of specialized raw materials. This segment involves highly technical processes required to produce implant-grade materials, such as specific alloys of titanium (e.g., Ti-6AL-4V ELI) and surgical stainless steel (e.g., 316L). Suppliers of these raw materials must adhere to stringent international standards (like ASTM or ISO) regarding material purity and biocompatibility, as the quality directly impacts consumer safety and the final product's marketability. The cost and availability of these certified materials significantly influence the overall manufacturing margins, requiring strong, long-term relationships between jewelry manufacturers and certified metal refiners to ensure a stable supply of compliant feedstock, especially for high-demand metals.

The manufacturing and midstream processes involve sophisticated production techniques, including computer numerical control (CNC) machining, laser cutting, precision polishing, and highly specialized setting of gemstones, particularly for high-end jewelry incorporating diamonds or precious stones. Quality control is paramount during this stage, encompassing sterilization protocols and dimensional accuracy, as piercing jewelry demands extremely tight tolerances (measured in gauges and millimeters) for safe insertion and healing. Distribution channels form the critical link between production and the consumer, utilizing both Direct and Indirect routes. Direct channels, primarily through branded e-commerce platforms, allow manufacturers to capture higher margins, control brand messaging, and gain immediate customer feedback. Indirect channels rely heavily on specialized piercing studios, which act as expert retailers and service providers, offering professional advice and installation, crucial for complex piercings.

Downstream analysis focuses on the final consumption and aftercare segment, dominated by specialized retail and service delivery. Specialized piercing studios are vital as they provide the crucial service component—the actual piercing procedure—alongside selling the initial jewelry. This dual role makes them influential gatekeepers of material quality and trend dissemination. E-commerce platforms, however, are rapidly gaining market share for replacement and variety purchases, offering greater accessibility and competitive pricing for non-initial jewelry. The overall efficacy of the distribution strategy hinges on balancing the requirement for expert installation (studio dependence) with the consumer demand for broad selection and convenience (online retail), requiring an omnichannel approach for optimal market penetration and maximizing customer lifetime value within the highly specialized retail environment.

Body Piercing Jewelry Market Potential Customers

Potential customers for the Body Piercing Jewelry Market are broadly defined by demographic factors, psychographic profiles, and engagement with contemporary fashion and body modification culture, transcending traditional age brackets to include any individual seeking aesthetic self-expression through piercing. The primary end-user segment is dominated by young adults (Ages 18-35), often referred to as Gen Z and Millennials, who possess higher disposable income dedicated to personalized accessories and are highly influenced by social media trends and celebrity culture. These individuals are typically frequent buyers, seeking variety in materials and styles to match evolving fashion aesthetics and are often willing to pay a premium for custom or limited-edition pieces that reflect their unique identity and commitment to fashion-forward trends, viewing jewelry as an extension of their personal brand identity.

A secondary, but highly profitable, customer segment includes collectors and enthusiasts, characterized by high product knowledge and a strong preference for investment-grade, biocompatible materials like solid gold, platinum, and implant-grade titanium. These buyers are primarily concerned with long-term safety, durability, and the intricate craftsmanship of the jewelry, often purchasing high-value dermal anchors or elaborate cartilage arrangements that remain in place for extended periods. This segment drives demand for specialized, custom-designed pieces and is a core clientele for high-end piercing studios, contributing significantly to the average unit selling price (AUSP) across the entire market, valuing authenticity and certified material quality above all else.

In the Business-to-Business (B2B) context, the most critical customer segment comprises professional piercing studios and licensed piercers. These businesses serve as the essential purchasing entities, requiring reliable supply chains for bulk orders of sterilization-ready, standard gauge jewelry used for initial piercings (often basic surgical steel or titanium studs) and the retail stock sold to clients. Their purchasing decisions are heavily weighted by supplier certification, consistency in gauge accuracy, competitive wholesale pricing, and the speed of logistics, as their operational efficiency depends entirely on the reliable availability of certified, high-quality stock. Manufacturers must prioritize B2B relationships by offering specialized technical support and regulatory compliance documentation to serve this critical customer base effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Body Art Forms, Industrial Strength, Anatometal Inc., NeoMetal, Invictus Body Jewelry, QualiTi Body Jewellery, Piercing Mania, FreshTrends, Maria Tash, BVLA (Body Vision Los Angeles), Leroi Inc., Titanium Fashion, Painful Pleasures, BodyCandy, Diablo Body Jewelry, Metal Mafia, Buddha Jewelry Organics, Kaos Softwear, Junipurr Jewelry, TummyToys. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Body Piercing Jewelry Market Key Technology Landscape

The Body Piercing Jewelry Market is increasingly characterized by the integration of advanced manufacturing technologies, shifting production methods from traditional casting and manual craftsmanship towards precision engineering. Computer Numerical Control (CNC) machining remains a foundational technology, essential for achieving the micron-level accuracy required for standardized gauges and ensuring perfectly smooth surfaces crucial for minimizing tissue irritation and optimizing the healing process. This precision is non-negotiable, particularly for implant-grade materials like titanium, which are notoriously difficult to work with but offer superior biocompatibility. Furthermore, sophisticated laser welding and micro-setting techniques are widely utilized to securely fasten gemstones and intricate components without compromising the structural integrity or surface finish of the jewelry, thereby guaranteeing both aesthetic appeal and medical-grade quality standards for discerning consumers.

A transformative technology rapidly gaining traction is Additive Manufacturing, or 3D Printing, particularly utilized for prototyping complex, custom-designed jewelry pieces and producing specialized components like intricate plugs or large, non-standard gauge items that are difficult or cost-prohibitive to machine traditionally. 3D printing, especially using wax or resin models for investment casting (for gold and silver pieces) or directly printing in biocompatible nylon or titanium powders, dramatically reduces the lead time for unique, personalized orders, catering directly to the market demand for customization. This technological capability allows small studios and high-end designers to offer bespoke services previously restricted to large-scale manufacturers, decentralizing production capabilities and fostering high levels of design innovation across the competitive landscape.

Beyond manufacturing, the technological landscape is defined by the integration of Digital Transformation tools in the retail and consumer experience domain. E-commerce platforms leverage advanced Product Information Management (PIM) systems to handle the extensive variations in gauge sizes, material types, and certifications required for regulatory compliance, ensuring product data integrity for both retailers and consumers. Furthermore, the burgeoning use of Augmented Reality (AR) and Virtual Try-On (VTO) technologies, increasingly deployed on mobile applications and e-commerce websites, allows customers to digitally preview how a specific piece of jewelry will look on their body before purchase, significantly reducing return rates and boosting customer confidence, particularly for expensive or complex placements like dermal or septum piercings, streamlining the digital sales funnel effectively.

Regional Highlights

Regional dynamics significantly influence the Body Piercing Jewelry Market, with distinct consumption patterns and regulatory environments shaping market behavior across continents. North America, encompassing the United States and Canada, currently holds the largest market share, driven by a deeply ingrained body modification culture, high consumer spending power, and advanced retail infrastructure. The region benefits from a high concentration of professional piercing organizations that enforce strict health standards, driving demand for premium, certified materials. Innovation in design and marketing, heavily influenced by celebrity culture and high-profile social media influencers, consistently dictates global trends, positioning North America as the critical benchmark for style and material quality.

Europe represents a mature yet continually growing market, characterized by significant regional variations. Countries like the UK, Germany, and France show strong demand, particularly for high-quality gold and titanium pieces, adhering strictly to the European Union's REACH regulations concerning metal content (especially nickel limitations). The European market is highly fragmented, featuring numerous small-to-medium-sized specialized manufacturers known for intricate craftsmanship and unique, artisanal designs that emphasize sustainability and ethical sourcing. Regulatory rigor is a key determinant, compelling manufacturers to ensure compliance with strict material and hygiene standards, which inadvertently supports the premiumization of the market and enhances consumer trust in the locally sourced products.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapidly increasing disposable incomes in key economies such as China, India, and South Korea, coupled with a cultural shift towards embracing Western fashion and self-expression. While traditional cultural acceptance varies, urban populations are rapidly adopting piercing trends, driving huge volume demand for mass-market and mid-range products. The challenge in APAC lies in the wide disparity of regulatory oversight; while some countries are adopting international standards swiftly, others require localized strategies to manage quality control and distribution efficiently. Latin America and the Middle East and Africa (MEA) offer high potential, specifically targeting younger urban demographics, provided that market entry strategies effectively address localized distribution challenges and focus on building foundational consumer education regarding piercing safety and material quality.

- North America: Dominant market share due to mature piercing culture, high purchasing power, and stringent industry standards promoting high-quality materials (titanium, gold).

- Europe: Strong market growth driven by strict adherence to regulatory standards (REACH), emphasizing ethical sourcing and artisanal, high-end designs, especially in Western European nations.

- Asia Pacific (APAC): Highest projected CAGR, fueled by urbanization, rising middle-class income, and rapid adoption of global fashion trends, particularly in China and South Korea.

- Latin America (LATAM): Emerging market characterized by strong youth engagement and potential growth in urban centers, focusing primarily on affordable, fashion-forward accessories.

- Middle East and Africa (MEA): Niche market with growing acceptance in select urban areas; demand driven by luxury segments for gold and diamond-studded pieces, sensitive to localized cultural norms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Body Piercing Jewelry Market.- Body Art Forms

- Industrial Strength

- Anatometal Inc.

- NeoMetal

- Invictus Body Jewelry

- QualiTi Body Jewellery

- Piercing Mania

- FreshTrends

- Maria Tash

- BVLA (Body Vision Los Angeles)

- Leroi Inc.

- Titanium Fashion

- Painful Pleasures

- BodyCandy

- Diablo Body Jewelry

- Metal Mafia

- Buddha Jewelry Organics

- Kaos Softwear

- Junipurr Jewelry

- TummyToys

Frequently Asked Questions

Analyze common user questions about the Body Piercing Jewelry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Body Piercing Jewelry Market?

The primary driver is the widespread cultural acceptance of body modifications, coupled with enhanced material safety (e.g., implant-grade titanium) and the significant growth of e-commerce channels, which provide global access to diverse and specialized jewelry designs, appealing particularly to younger, fashion-conscious demographics seeking self-expression.

Which material segment is expected to show the fastest growth rate in the forecast period?

The Titanium and Gold segments are projected to exhibit the fastest growth. Consumers are increasingly prioritizing biocompatibility, durability, and long-term safety over initial cost, leading to higher investments in premium, high-quality materials for permanent and long-term piercings, supported by professional piercer recommendations and stringent health standards.

How is technology, specifically 3D printing, influencing the manufacturing of piercing jewelry?

3D printing is enabling rapid prototyping and the creation of highly customized, intricate designs that were previously too complex or expensive for traditional CNC machining. This technology supports bespoke jewelry services, dramatically reducing lead times for personalized orders and catering to the market demand for unique, artistic pieces.

What are the key differences between the North American and Asia Pacific markets for piercing jewelry?

North America is characterized by high market maturity, high average selling prices, and dominance of premium, certified materials. The Asia Pacific market, while smaller currently, offers the highest CAGR potential, driven by urbanization and disposable income growth, primarily focusing on mid-range and mass-market products as body modification culture gains widespread acceptance.

What is the most critical restraint facing the market, and how is the industry addressing it?

The most critical restraint is managing health and safety risks associated with low-quality, non-compliant jewelry and unhygienic piercing practices, which damages consumer trust. The industry addresses this through rigorous adherence to international material standards (e.g., ASTM, ISO), promoting certified piercing professionals, and utilizing AI-enhanced supply chain validation to ensure product authenticity and material traceability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager