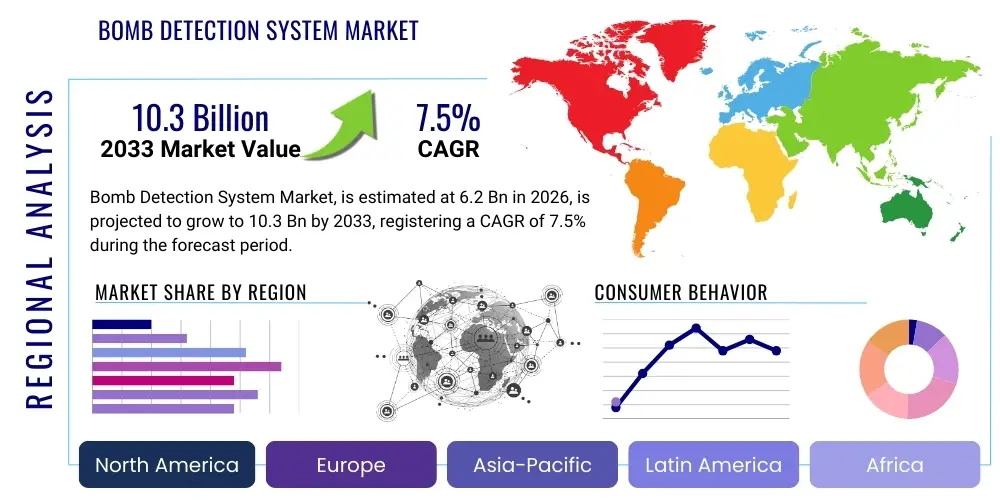

Bomb Detection System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440912 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Bomb Detection System Market Size

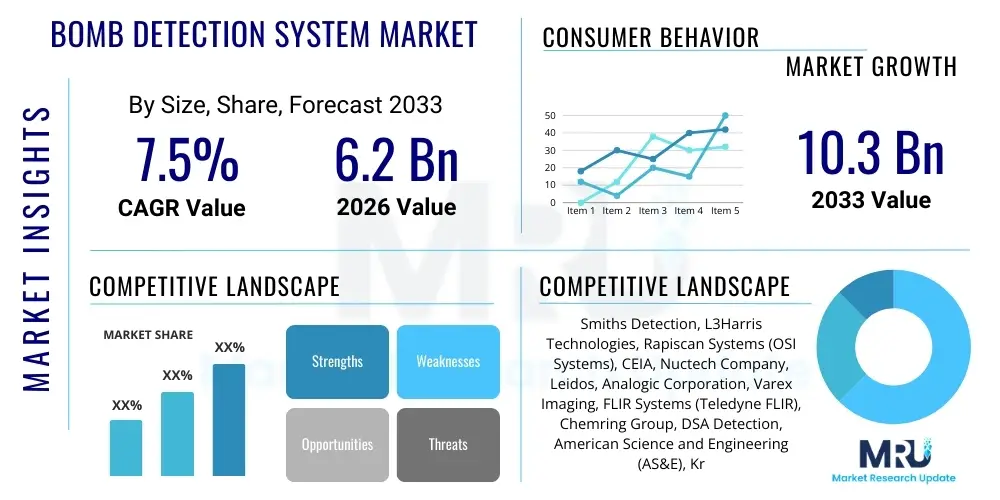

The Bomb Detection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by escalating global security concerns, the necessity for robust protection of critical infrastructure, and continuous technological advancements in detection modalities, particularly incorporating Artificial Intelligence (AI) and machine learning for enhanced threat identification accuracy and minimized false alarm rates.

Bomb Detection System Market introduction

The Bomb Detection System Market encompasses sophisticated technologies and equipment designed to identify, locate, and neutralize explosive devices across various operational environments. These systems are crucial components of national and international security infrastructure, utilized heavily in transportation hubs, government facilities, military operations, and critical commercial sectors. Products range from trace detection portals and handheld explosive detectors to advanced bulk liquid scanners and sophisticated robotic systems for explosive ordnance disposal (EOD), all aimed at preventing terrorist acts and mitigating risks associated with improvised explosive devices (IEDs).

Major applications driving the demand for these systems include aviation security, where regulatory mandates require strict screening protocols for passengers and cargo; infrastructure protection for power grids, nuclear facilities, and data centers; and public safety in mass transit areas, stadiums, and diplomatic compounds. The inherent benefits of these systems are multifaceted, offering proactive threat mitigation, ensuring public trust, and safeguarding economic stability by reducing the potential catastrophic impacts of successful bombing attempts. Furthermore, the development of non-intrusive and faster screening processes has significantly enhanced operational efficiency across high-throughput checkpoints.

Driving factors for sustained market growth are deeply rooted in geopolitical instability, the rising frequency of asymmetric threats globally, and continuous budgetary allocations by governmental bodies worldwide towards homeland security and defense modernization programs. Technological innovation, specifically the integration of nanotechnology and advanced algorithms for rapid and precise identification of novel and increasingly complex explosive materials, further accelerates adoption. Regulatory push, such as stricter global aviation security standards mandated by organizations like the TSA and ICAO, necessitates consistent upgrades and replacement cycles for existing detection equipment, ensuring a stable foundation for market expansion throughout the forecast period.

Bomb Detection System Market Executive Summary

The Bomb Detection System Market is characterized by intense technological competition, driven by the imperative to detect trace amounts of increasingly complex, homemade explosive compounds (HMEs). Current business trends indicate a strong shift towards networked, integrated security platforms that combine multiple detection technologies (e.g., X-ray computed tomography (CT), trace detection, and Raman spectroscopy) to create multi-layered defense mechanisms. Manufacturers are focusing heavily on miniaturization, portability, and enhanced connectivity to meet the diverse operational requirements of military, law enforcement, and commercial security end-users, alongside a notable trend in service-based models, offering long-term maintenance and software updates crucial for continuous operational efficacy and compliance.

Regionally, North America and Europe maintain leading positions due to robust regulatory environments, significant government spending on counter-terrorism measures, and the presence of major technology developers and early adopters of sophisticated systems. However, the Asia Pacific (APAC) region is poised for the highest growth rate, propelled by rapid urbanization, massive infrastructure development projects (such as new airports and rail networks), and increasing awareness and investments in internal security modernization, particularly in populous countries like China and India. The Middle East and Africa (MEA) market growth is volatile but significant, driven by ongoing geopolitical conflicts and high vulnerability of critical energy infrastructure.

Segment trends highlight the dominance of Trace Detection Technology, particularly Ion Mobility Spectrometry (IMS), owing to its high sensitivity and mobility, making it invaluable for checkpoint screening. However, the fastest-growing segment is likely to be Bulk Detection, fueled by the demand for advanced CT scanners in aviation cargo screening and vehicle-borne IED detection systems. Application-wise, the Aviation Security segment remains the largest consumer, but demand from the Critical Infrastructure and Military & Defense sectors is exhibiting accelerated growth, requiring customized, ruggedized systems capable of operating reliably in harsh and remote environments, further diversifying market opportunities beyond traditional airport security applications.

AI Impact Analysis on Bomb Detection System Market

User inquiries regarding the impact of Artificial Intelligence on the Bomb Detection System Market frequently center on concerns about accuracy, speed, and the mitigation of false alarms. Common questions include: "How can AI reduce the high rate of false positives in current trace detection systems?", "What role does machine learning play in identifying emerging or non-traditional explosive materials?", and "Will AI integration make detection systems faster and more autonomous?". Users are keenly interested in the integration of deep learning algorithms for automated threat recognition in complex visual data, such as CT scans and X-ray images, hoping to move beyond manual human analysis which is prone to fatigue and error, thereby enhancing decision support for security personnel and improving overall system throughput.

AI's fundamental impact lies in its ability to process vast datasets generated by high-resolution sensors, leading to profound improvements in pattern recognition specific to threat materials. Machine learning models, trained on millions of images and spectral signatures, can rapidly and reliably differentiate between harmless objects and subtle indicators of concealed explosives, significantly increasing detection sensitivity and minimizing the need for manual intervention. This technological leap addresses the primary operational bottleneck in security screening—the time and resource consumption associated with managing false alarms—while simultaneously ensuring the detection of novel, previously uncatalogued explosive compositions that might bypass older, rules-based systems, thus significantly elevating the security posture of facilities.

Furthermore, AI facilitates predictive maintenance and optimizes system performance. By analyzing operational data, AI can predict potential equipment failures before they occur, reducing downtime, and ensuring the continuous availability of critical security assets. In terms of deployment, AI-driven solutions are enabling greater autonomy in detection tasks, particularly in remote or high-risk environments where human presence is undesirable, such as EOD robotics. This incorporation of smart diagnostics and real-time learning capabilities transforms conventional detection systems into adaptive security tools that evolve dynamically with emerging threat profiles, cementing AI as a pivotal technological force restructuring the landscape of modern explosive detection.

- Enhanced Threat Recognition: Deep learning algorithms analyze complex sensor data (CT, X-ray) to identify concealed explosives with superior accuracy, reducing reliance on manual interpretation.

- False Alarm Reduction: AI models decrease false positive rates by accurately distinguishing between harmless clutter and genuine threats, significantly boosting operational efficiency.

- Identification of Novel Explosives: Machine learning enables the rapid identification and classification of new or homemade explosive mixtures (HMEs) not cataloged in traditional libraries.

- Autonomous Operation: AI drives the next generation of autonomous EOD robots and unmanned inspection systems, minimizing human exposure to risk.

- Predictive Maintenance: AI analyzes system health data to predict and prevent failures, ensuring maximum system uptime and continuous security coverage.

DRO & Impact Forces Of Bomb Detection System Market

The Bomb Detection System Market is propelled by powerful geopolitical and technological forces. Key drivers include the unrelenting rise in global terrorist activities utilizing IEDs, the stringent regulatory environment in aviation and critical infrastructure sectors, and substantial investments by governments in military modernization and homeland security initiatives. Restraints often center on the high acquisition and maintenance costs of advanced systems, the inherent operational challenge of minimizing false alarms without compromising sensitivity, and the difficulty of deploying complex technology reliably in diverse environmental conditions. Opportunities are abundant in integrating detection systems with wider smart city surveillance networks, developing highly portable and miniaturized trace detectors for border control, and expanding market reach into emerging economies undergoing massive infrastructure expansions and requiring foundational security frameworks. These factors create significant impact forces, dictating rapid innovation cycles and favoring manufacturers capable of delivering systems that offer high throughput, low operating costs, and validated reliability across highly regulated security environments globally.

Driving factors are inherently linked to the global security paradigm, where the proliferation of cheap, easily accessible components for constructing IEDs necessitates equally sophisticated countermeasures. This demand is reinforced by the need to secure highly concentrated population centers and vital economic assets, making security spending non-negotiable for governments and large corporations. The shift toward non-conventional explosive threats (HMEs) pushes technology developers to continually invest heavily in R&D, favoring analytical techniques like X-ray diffraction and neutron activation analysis which offer superior material discrimination capabilities over older technologies. Furthermore, competitive technological innovation, especially the race for faster analysis times at checkpoints, acts as a continuous market accelerator, compelling widespread system replacement and upgrading efforts across multiple end-user verticals, primarily aviation security and border management agencies.

However, the market faces significant structural restraints that impede universal adoption, especially in price-sensitive regions. The total cost of ownership (TCO) for advanced CT scanners or vehicle screening systems is substantial, limiting uptake by smaller or regional airports and private entities. Regulatory compliance complexity, particularly varying certification standards across countries (e.g., TSA standards versus ECAC mandates), creates barriers to entry and requires costly customization of equipment. Addressing the perpetual trade-off between sensitivity and false alarm rates remains a central operational challenge; overly sensitive systems cause bottlenecks and user frustration, while less sensitive systems pose unacceptable security risks. Overcoming these restraints necessitates developing lower-cost, highly accurate, and modular detection solutions that can be easily integrated and maintained globally, leveraging modular hardware and standardized software interfaces.

Segmentation Analysis

The Bomb Detection System Market is meticulously segmented based on the technology utilized, the deployment location, and the final application, reflecting the diverse and specialized requirements of end-users ranging from counter-terrorism units to commercial airport operators. Technology segmentation is critical as performance metrics—such as detection speed, sensitivity, and portability—are directly tied to the underlying analytical method employed, differentiating trace detection solutions like IMS from bulk detection systems like X-ray CT. Deployment segmentation analyzes fixed installations versus portable/handheld units, determining suitability for perimeter defense, checkpoint screening, or mobile patrol operations. Understanding these granular segments is vital for manufacturers to tailor product development and for end-users to procure systems optimized for specific operational mandates and threat environments.

- By Technology:

- Trace Detection

- Ion Mobility Spectrometry (IMS)

- Chemiluminescence

- Micro-Cantilevers

- Bulk Detection

- X-ray Computed Tomography (CT)

- Quadrupole Resonance (QR)

- Neutron Activation Analysis (NAA)

- Explosive Vapor Detection (EVD)

- Explosive Detection Dogs (EDD) & Canine Detection Systems

- Trace Detection

- By Product Type:

- Fixed Systems (e.g., Airport Checkpoint Scanners, Container Screening Systems)

- Portable & Handheld Detectors

- Vehicle-Mounted Detection Systems

- Robotic & Unmanned Detection Systems (EOD Robots)

- By End-Use Application:

- Aviation Security (Airports, Cargo Screening)

- Critical Infrastructure (Power Plants, Data Centers, Financial Institutions)

- Military & Defense

- Law Enforcement & Border Control

- Maritime Security (Ports, Vessels)

- Commercial & Residential Spaces (Stadiums, Malls, Hotels)

Value Chain Analysis For Bomb Detection System Market

The value chain for the Bomb Detection System market is complex, beginning with highly specialized upstream activities centered on R&D and the sourcing of critical, often proprietary, sensor components and software algorithms. Upstream success is defined by intellectual property related to detection methodologies (e.g., sensor physics, spectral libraries, AI algorithms) and securing stable supplies of specialized materials required for advanced sensors and high-energy imaging components. Key players in this phase include semiconductor manufacturers, specialized chemical suppliers for calibration materials, and advanced software development firms focused on threat recognition and image processing, requiring substantial capital investment and deep technical expertise to maintain a competitive advantage in a rapidly evolving technological landscape.

The midstream involves the manufacturing, system integration, and rigorous testing of the finalized detection equipment. This stage is characterized by high precision engineering, strict quality control processes mandated by international security standards (e.g., European Civil Aviation Conference (ECAC) certification, TSA qualification), and the integration of multiple subsystems—hardware, software, and networking capabilities—into a reliable, operational security product. Distribution channels for these high-value, specialized products are typically hybrid. Direct sales channels are frequently employed for large government and military contracts, facilitating customized solutions and ongoing support agreements, while indirect channels leverage specialized security distributors and system integrators who provide local installation, maintenance, and regional sales support to commercial and smaller municipal clients, ensuring wide market reach and localized service provision.

Downstream activities focus heavily on installation, calibration, operator training, and long-term service agreements, which often represent a significant portion of the total lifetime value. Effective downstream execution is crucial, as the performance of the system is heavily dependent on proper initial setup and continuous software and library updates to detect evolving threats. Potential customers, including aviation authorities and defense departments, prioritize suppliers that offer comprehensive, decades-long maintenance contracts, ensuring compliance and operational readiness. This dependency on after-sales service and regular technological refreshment solidifies a recurring revenue stream for key market participants, driving profitability and strengthening long-term client relationships crucial for market stability and expansion.

Bomb Detection System Market Potential Customers

The primary end-users and buyers of Bomb Detection Systems span governmental, military, and commercial entities with critical security needs. Government agencies, including Homeland Security departments, national police forces, customs and border control agencies, and specialized counter-terrorism units, constitute the largest segment. These entities require a comprehensive suite of detection products, ranging from large-scale fixed systems for national infrastructure protection to portable units for patrol and forensic investigation purposes. The procurement decisions in this segment are typically governed by lengthy tender processes, strict regulatory compliance, and requirements for high reliability and interoperability with existing national security architectures, focusing on strategic, long-term investments rather than immediate cost minimization.

The second major consumer segment is the Aviation Industry, encompassing airport authorities, airlines, and cargo handlers globally. Driven by stringent international aviation security mandates established by bodies like the International Civil Aviation Organization (ICAO) and the Transportation Security Administration (TSA), these customers require high-throughput, certified screening technologies for passenger baggage (both checked and carry-on), freight containers, and personnel. The constant need to upgrade systems to meet evolving regulatory benchmarks (e.g., moving from X-ray to CT technology for checked baggage) ensures consistent demand and robust sales cycles for manufacturers specializing in certified aviation security equipment, focusing on speed, accuracy, and seamless integration with airport operations management systems.

Finally, the Military & Defense sector remains a highly specialized and lucrative customer base, requiring ruggedized, mission-critical EOD (Explosive Ordnance Disposal) and mine detection systems designed for battlefield or high-threat operational environments. Additionally, the Critical Infrastructure segment, including nuclear power plants, major utilities, large financial data centers, and critical transportation networks (rail and subway systems), represents a rapidly growing buyer pool. These customers seek customized perimeter protection and access control solutions incorporating integrated detection capabilities, valuing durability, resistance to environmental factors, and network integration capabilities to centralize threat intelligence and response protocols effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smiths Detection, L3Harris Technologies, Rapiscan Systems (OSI Systems), CEIA, Nuctech Company, Leidos, Analogic Corporation, Varex Imaging, FLIR Systems (Teledyne FLIR), Chemring Group, DSA Detection, American Science and Engineering (AS&E), Kromek Group, Scanna MSC Ltd, Optosecurity, Sibel Ltd, ICx Technologies (Teledyne), Vidisco Ltd, Autoclear, Safran Identity & Security |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bomb Detection System Market Key Technology Landscape

The current technology landscape in the Bomb Detection System market is defined by a rapid evolution toward non-intrusive, real-time analysis, emphasizing high-resolution imaging and chemical identification. Core technologies include X-ray Computed Tomography (CT), which provides three-dimensional volumetric scanning, essential for certified checked baggage screening due to its superior material discrimination capabilities compared to traditional 2D X-ray systems. Simultaneously, Trace Detection (TD) systems, predominantly utilizing Ion Mobility Spectrometry (IMS), remain indispensable for rapid, point-of-contact analysis of surfaces for residual explosive particulates or vapors. The competitive edge is increasingly being secured by firms that successfully merge these modalities, creating systems that use high-throughput imaging for initial screening followed by targeted trace analysis when anomalies are detected, thereby maximizing both speed and security accuracy.

A significant emerging trend involves the deployment of advanced spectroscopic techniques, such as Raman and Infrared (IR) spectroscopy, which offer highly specific chemical fingerprinting of explosives, including increasingly popular homemade explosives (HMEs). These technologies are often integrated into portable or handheld devices for tactical operations and forensic analysis. Furthermore, the field of Explosive Vapor Detection (EVD) is advancing, moving beyond canine detection toward highly sensitive chemical sensors and electronic noses (e-noses) that can detect ultra-low concentrations of explosive vapors in the environment. This development is crucial for perimeter security and detection in covert or challenging environments where physical contact screening is impractical or impossible, demanding breakthroughs in sensor material science and cross-contamination mitigation strategies.

In addition to sensor innovation, the market is witnessing the critical role of software and data integration, particularly leveraging AI and deep learning. Modern bomb detection systems are no longer isolated devices but networked components within a holistic security ecosystem. Key technological investments are focused on developing sophisticated threat libraries, self-learning algorithms for automatic target recognition (ATR), and networking capabilities that allow centralized monitoring and real-time threat intelligence sharing across multiple deployed units and disparate geographical locations. This integration of information technology with physics-based detection technologies ensures that the market moves towards intelligent, adaptive, and highly responsive security solutions capable of countering the continually evolving and elusive nature of explosive threats globally.

Regional Highlights

- North America: North America, particularly the United States, commands a leading market share due to substantial governmental investment in homeland security driven by organizations like the TSA and DHS. The region benefits from a mature security infrastructure and a stringent regulatory environment that mandates continuous upgrades to detection technologies, especially in aviation and border control sectors. High adoption rates of advanced CT and IMS technologies, coupled with the presence of major domestic defense contractors and system integrators, ensure robust market growth. The focus here is on integrating AI into existing screening processes to enhance speed and reduce operational costs, making it a critical region for technology innovation and commercial deployment of highly sophisticated security solutions.

- Europe: Europe represents a significant market, propelled by persistent counter-terrorism challenges and harmonized security standards established by the European Civil Aviation Conference (ECAC) across member states. This regulatory alignment ensures a standardized demand for certified, high-quality detection systems, particularly for checked baggage screening (Standard 3 compliance) and enhanced trace detection capabilities. The emphasis on securing critical infrastructure, including extensive rail and metropolitan transit systems, drives substantial governmental procurement. Furthermore, European nations are leading innovators in chemical and spectroscopic analysis integrated into portable detection kits for law enforcement and EOD teams, maintaining strong growth through both regulatory compliance and threat-driven modernization initiatives.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive, ongoing investments in infrastructure development, notably the construction of hundreds of new airports, high-speed rail networks, and rapid urbanization demanding enhanced public safety measures. While cost sensitivity exists, the sheer volume of new deployments, especially in emerging economies like China, India, and Southeast Asian nations, offsets lower average system pricing. Market expansion is driven by both commercial security needs and growing state investments in military and border security modernization. The primary challenge remains the varied regulatory landscape across different nations, requiring manufacturers to adapt systems to diverse local standards, though the overall trajectory points toward unprecedented market expansion.

- Middle East and Africa (MEA): The MEA region exhibits high demand, primarily due to chronic geopolitical instability, active conflict zones, and the high concentration of critical energy infrastructure (oil and gas) requiring advanced protection. Government and defense spending on counter-IED and perimeter security systems is substantial, particularly in Gulf Cooperation Council (GCC) countries. The market is dominated by fixed detection systems for high-value installations and ruggedized military EOD equipment. Growth is highly sensitive to defense budgets and commodity prices, but the necessity for robust defense against both internal and external explosive threats ensures sustained demand for high-end, reliable detection technology procured mainly through direct government contracts.

- Latin America: The Latin American market for bomb detection systems is growing steadily but lags behind North America and Europe in terms of technological adoption speed. Market drivers include the need to secure major international events, increasing concerns over transnational crime, and moderate investments in modernizing key regional airports and port facilities. Demand is focused on cost-effective, reliable trace detection and basic X-ray screening systems. Brazil and Mexico are key markets due to their large economies and critical infrastructure. Future growth will be dependent on political stability, increased foreign investment in public security, and tighter enforcement of international security protocols, particularly those related to aviation and global trade logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bomb Detection System Market.- Smiths Detection

- L3Harris Technologies

- Rapiscan Systems (OSI Systems)

- CEIA

- Nuctech Company

- Leidos

- Analogic Corporation

- Varex Imaging

- FLIR Systems (Teledyne FLIR)

- Chemring Group

- DSA Detection

- American Science and Engineering (AS&E)

- Kromek Group

- Scanna MSC Ltd

- Optosecurity

- Sibel Ltd

- ICx Technologies (Teledyne)

- Vidisco Ltd

- Autoclear

- Safran Identity & Security

Frequently Asked Questions

Analyze common user questions about the Bomb Detection System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological challenges in detecting Homemade Explosives (HMEs)?

The primary challenge in detecting Homemade Explosives (HMEs) lies in their variable chemical composition and lack of standardized signatures, unlike military-grade explosives. Advanced systems must use broad-spectrum analysis technologies, such as Raman spectroscopy and AI-enhanced CT scanning, to reliably identify HMEs that might evade traditional detection libraries based on specific compound identifiers.

How is regulatory compliance impacting the adoption of new detection systems in airports?

Regulatory compliance, specifically mandates from the TSA and ECAC requiring certified technology like Standard 3 CT scanners for checked baggage, is the largest driver of market adoption and replacement cycles in the aviation sector. These regulations force airports to continuously invest in high-cost, certified equipment, accelerating the retirement of older X-ray technology to maintain operational licensing and international security standards.

What is the role of Ion Mobility Spectrometry (IMS) technology in modern bomb detection?

Ion Mobility Spectrometry (IMS) is the dominant technology in trace detection, used primarily for rapid screening of personnel and surfaces at checkpoints. IMS offers extremely high sensitivity, capable of detecting minute, nano-gram level traces of explosive residue. Its portability and speed make it essential for secondary screening, mobile patrols, and complementing bulk detection systems globally.

Which geographical region is expected to demonstrate the highest growth rate in the market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to unprecedented investment in new critical infrastructure, including airports, high-speed rail lines, and urbanization projects, leading to massive scale deployment requirements for foundational security systems across multiple emerging economies.

How does the integration of robotics influence Explosive Ordnance Disposal (EOD) operations?

Robotics significantly enhances EOD operations by allowing human operators to remotely investigate, identify, and neutralize suspected explosive devices, drastically minimizing the risk of casualties. Modern EOD robots integrate sophisticated sensors, manipulator arms, and AI-assisted navigation, enabling precise handling and disposal in high-threat environments far surpassing manual intervention capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager