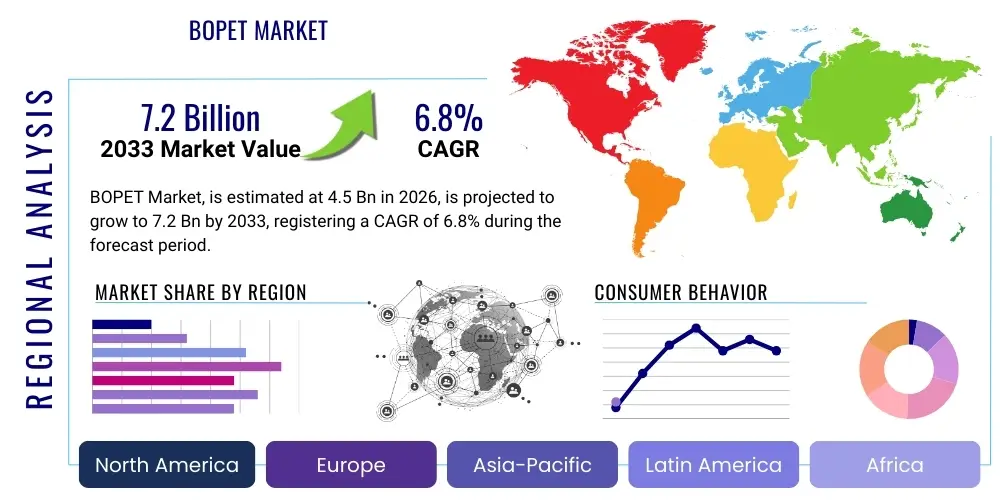

BOPET Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442051 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

BOPET Market Size

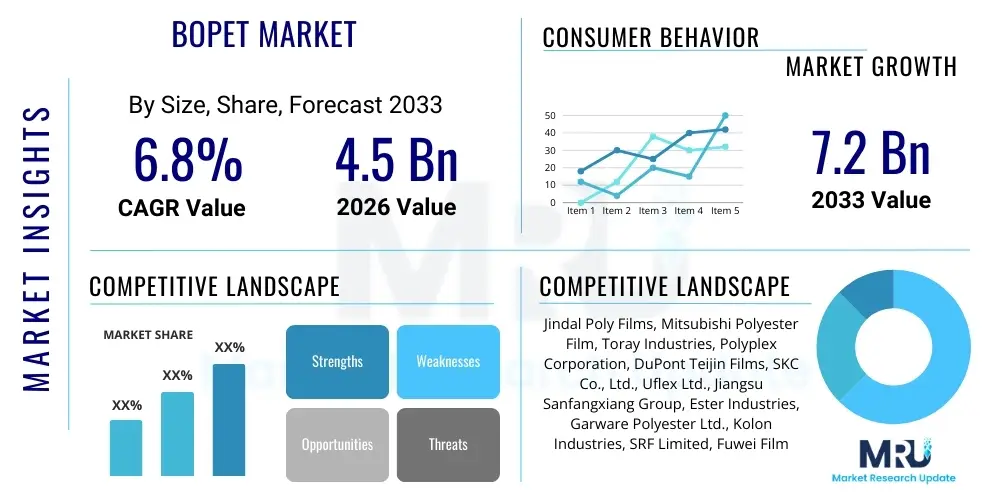

The BOPET Market (Biaxially-Oriented Polyethylene Terephthalate) is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This robust growth trajectory is primarily driven by escalating demand from the flexible packaging sector, coupled with the increasing penetration of specialized BOPET films in high-value electronic and renewable energy applications. The inherent advantages of BOPET, such as superior tensile strength, excellent barrier properties against moisture and oxygen, and thermal stability, position it as a critical material across diverse industrial landscapes, thereby ensuring sustained expansion throughout the forecast period.

The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This substantial valuation increase is indicative of capacity expansion across key manufacturing regions, particularly in Asia Pacific, where industrialization and growing middle-class populations fuel demand for packaged consumer goods. Furthermore, innovation in thin-gauge films and specialty coated variants, designed for enhanced performance in demanding applications like solar backsheets and advanced capacitors, contributes significantly to the market's overall revenue progression and unit volume growth.

BOPET Market introduction

The Biaxially-Oriented Polyethylene Terephthalate (BOPET) market encompasses the production, distribution, and utilization of polyester films manufactured through a process that involves stretching the Polyethylene Terephthalate (PET) material in both the machine direction and the transverse direction. This biaxial orientation imparts exceptional mechanical, thermal, and optical properties, making the resulting film superior to standard cast or mono-axially oriented films. Originating from the polymerization of Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG), BOPET film is prized for its high tensile strength, dimensional stability, chemical resistance, clarity, and effective barrier characteristics, which are crucial for preserving product integrity.

Major applications of BOPET films span across several vital industries. In flexible packaging, it is utilized extensively for food wrappings, sachets, retort pouches, and laminated structures due to its barrier capabilities, extending the shelf life of perishable goods. Beyond packaging, BOPET films are indispensable in the electrical and electronic sectors, serving as insulation materials in motors, cables, and capacitors. A rapidly expanding application lies in the photovoltaic industry, where specialized BOPET variants are used as durable backsheets for solar panels, providing protection against environmental degradation and ensuring long-term efficiency. Its use in magnetic media, graphic arts, and industrial laminates further underscores its versatility and wide-ranging utility.

The primary benefits driving the market's adoption include its inherent sustainability advantages when compared to certain competing polymers, offering excellent strength-to-weight ratios that allow for downgauging and reduced material usage. Key driving factors stimulating market growth involve the exponential rise in demand for packaged food and beverages, especially in developing economies, the continued expansion of the e-commerce sector requiring robust and lightweight packaging solutions, and increasing global investments in renewable energy infrastructure, specifically solar power, which relies heavily on high-performance BOPET backsheets for optimal operation and longevity.

BOPET Market Executive Summary

The global BOPET market is navigating a phase of dynamic growth characterized by evolving business trends centered on sustainability and specialty film innovation. Market participants are increasingly focusing on developing bio-based or recyclable BOPET formulations to align with global environmental mandates and consumer preferences for eco-friendly packaging materials. Capacity additions, primarily concentrated in the Asia Pacific region, are leading to competitive pricing structures, necessitating cost optimization and efficiency improvements across the value chain. Furthermore, there is a distinct business pivot toward high-margin specialty films, such as ultra-high barrier films, chemically treated films for printing, and metallized films, which offer superior performance characteristics essential for premium packaging and advanced industrial applications.

Regionally, Asia Pacific maintains its undisputed dominance, driven by robust manufacturing growth in countries like China and India, coupled with high consumption rates in the food, pharmaceutical, and electronic industries. North America and Europe, while mature markets, are experiencing stable, moderate growth, largely attributed to technological upgrades, stringent regulatory frameworks emphasizing food safety and material recyclability, and the expansion of the electronics manufacturing base. Emerging regions, including Latin America and the Middle East & Africa (MEA), are witnessing accelerated adoption, fueled by rapid urbanization, increased penetration of organized retail, and infrastructural developments that demand durable insulating materials.

Segment trends reveal that the packaging application segment remains the largest volume consumer, particularly the food and beverage category, which benefits directly from BOPET’s excellent barrier properties and printability. By film type, thin films (under 15 microns) are gaining traction due to material reduction initiatives, while thick films continue to serve established industrial and electrical insulation needs. The metallized film segment is exhibiting above-average growth, owing to its enhanced oxygen and moisture barrier performance, making it a critical component for sensitive products requiring extended preservation and premium presentation. This segmentation pattern underscores a dual market demand: high volume, cost-effective standard films for basic packaging, and technologically sophisticated, higher-value films for specialized industrial use.

AI Impact Analysis on BOPET Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the BOPET market primarily revolve around operational efficiency improvements, enhanced quality control mechanisms, and acceleration of material innovation. Users are keen to understand how AI-driven predictive maintenance can reduce unplanned downtime in complex stretching lines, which is crucial given the high capital expenditure associated with BOPET manufacturing. Furthermore, significant interest exists regarding AI's role in optimizing film properties, such as consistency of thickness and surface treatment uniformity, through real-time data analysis and automated process adjustments. The consensus expectation is that AI integration will fundamentally shift manufacturing from reactive maintenance and quality checks to proactive optimization, leading to reduced waste, lower production costs, and superior product quality tailored to increasingly precise customer specifications.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data from BOPET production lines (extruders, slitters, winders) to predict equipment failure, minimizing costly downtime and extending asset lifespan.

- Optimized Process Control: Real-time machine learning models adjust parameters like temperature, stretch ratio, and speed to maintain absolute film consistency and uniformity, improving yields.

- Advanced Quality Inspection: AI-powered vision systems detect microscopic defects (gels, holes, lines) at high speeds far exceeding human capability, ensuring high-quality films for specialized applications like solar backsheets.

- R&D Acceleration for Specialty Films: AI simulations predict the optimal combination of raw materials and additives (e.g., slip agents, UV stabilizers) required to achieve specific functional properties, speeding up new product development cycles.

- Supply Chain Efficiency: Machine learning optimizes raw material procurement (PTA/MEG) and finished goods inventory management, reacting dynamically to market fluctuations and global logistics challenges.

DRO & Impact Forces Of BOPET Market

The dynamics of the BOPET market are dictated by a balanced interaction between strong demand drivers and specific constraining factors, alongside evolving opportunities that shape future investment strategies. Key drivers include the exponential growth in demand for flexible packaging across emerging economies, spurred by rising disposable incomes and the shift towards convenient, single-serve packaging formats. Simultaneously, the imperative for lightweighting solutions in various sectors and the sustained expansion of the solar energy industry, particularly in Asia, ensure a continuous, high-volume requirement for BOPET films. These forces create a robust foundational demand, underpinning investment decisions in new manufacturing capacity and technological upgrades globally.

However, the market faces significant restraints that temper overall growth rates. The primary constraint is the volatility and fluctuation in the prices of key raw materials, namely Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG), which are petrochemical derivatives. Such price instability impacts profitability and investment planning, especially for smaller market players. Furthermore, competition from alternative packaging materials, such as Biaxially Oriented Polypropylene (BOPP) films and specialty polyamides, poses a continuous challenge in cost-sensitive segments. Environmental regulations concerning plastic waste also restrain the market, prompting significant R&D spending on recyclability and potentially increasing production costs in the short term.

Opportunities for market players are substantial, centering primarily on technological specialization and geographical expansion. The development of high-barrier BOPET films utilizing advanced coating techniques (e.g., AlOx, SiOx) opens lucrative avenues in pharmaceutical and high-end food packaging, offering superior performance to conventional metallized films. Secondly, expansion into untapped or rapidly growing regional markets, particularly in Southeast Asia and Latin America, presents significant revenue potential. The overriding impact force on the market is the dual pressure of sustainability and technological differentiation; companies that successfully integrate enhanced recyclability into their product portfolio while simultaneously offering niche, high-performance films will capture disproportionate market share, steering the industry toward value-added growth rather than mere volume expansion.

Segmentation Analysis

The BOPET market is comprehensively segmented based on various technical and functional parameters, allowing for detailed analysis of consumption patterns across different end-use industries. Primary segmentation occurs based on film type, which differentiates standard plain films from specialized variants like treated, metallized, clear, and coextruded films, each designed to meet specific performance criteria such as barrier resistance, adhesion, or printability. Further segmentation is carried out based on thickness, recognizing the distinct requirements of thin-gauge films for flexible packaging (often below 12 microns) versus thick-gauge films used in industrial applications, such as electrical insulation or magnetic tapes. Understanding these segments is crucial for manufacturers tailoring production capabilities and for end-users selecting materials optimally suited to their application needs.

Segmentation by application and end-use provides deep insight into demand dynamics. The packaging sector dominates consumption, encompassing food and beverages, pharmaceuticals, cosmetics, and industrial goods, demanding high-tensile strength and excellent moisture barrier properties. The electrical and electronic segment requires films with superior dielectric strength and thermal stability for insulation purposes. The specialized industrial application segment, including solar backsheets, labeling, and graphic arts, relies on the film's dimensional stability and durability. The diversity across these segments reflects BOPET's versatility and its indispensable role in numerous high-growth modern industries globally.

- By Film Type:

- Thin Film (Less than 15 microns)

- Thick Film (15 microns and above)

- Treated Film (Chemically or Corona treated)

- Metallized Film

- Co-extruded Film

- By Application:

- Packaging (Flexible Packaging, Rigid Packaging, Lidding)

- Electrical & Electronic (Insulation, Capacitors)

- Imaging & Graphics (Print Substrates, Labels)

- Industrial (Solar Backsheets, Release Liners, Tapes)

- Magnetic Media

- By End-Use Industry:

- Food & Beverage

- Pharmaceuticals

- Consumer Goods

- Industrial & Construction

- Automotive

- Renewable Energy (Solar)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For BOPET Market

The BOPET market value chain commences with the upstream segment, dominated by the sourcing and refinement of primary petrochemical raw materials. Key inputs include Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG), which are polymerized to produce PET resin chips. This upstream phase is highly capital-intensive and heavily influenced by global oil and gas price volatility, which dictates the cost structure for the entire downstream film production process. Integration between resin suppliers and film manufacturers is increasingly common, aiming to secure raw material supply, manage price risks, and ensure consistent quality necessary for high-performance film grades.

The core of the value chain involves the midstream manufacturing process, where PET chips are melted, extruded, and subjected to the biaxial orientation process (either Tenter frame or simultaneous stretching) to create the BOPET film. This stage also includes secondary processing such as corona treatment, chemical coating, or vacuum metallization to impart specific functionalities, such as enhanced print adhesion or superior barrier properties. Manufacturing requires substantial investment in highly specialized, complex machinery and requires sophisticated process control systems to maintain tight tolerances, especially for thin-gauge and high-clarity films destined for high-precision applications.

The downstream segment encompasses the distribution and end-use application of the finished film. Distribution channels are varied, involving direct sales to large, integrated end-users (e.g., major food companies or solar panel manufacturers) for high-volume orders, and indirect channels relying on specialized film converters, laminators, and regional distributors who handle smaller orders and provide value-added services like slitting and printing. Converter companies play a pivotal role, transforming the base BOPET film into final products like flexible pouches or labels before they reach the ultimate consumer or buyer in industries such as Food & Beverage, Pharmaceutical, and Electronics. The efficiency of the downstream supply chain significantly influences the final cost and availability of BOPET products across different geographical markets.

BOPET Market Potential Customers

Potential customers for BOPET films are diverse, reflecting the material’s wide range of functional capabilities, with the largest volume consumers concentrated within the packaging industry. Food and beverage manufacturers are paramount buyers, utilizing BOPET for high-barrier flexible packaging applications, including coffee pouches, snack food laminates, and ready-meal packaging, where the film’s impermeability to gases and moisture is critical for extending product shelf life and maintaining flavor integrity. The pharmaceutical and medical device industries also represent high-value customers, requiring sterile, dimensionally stable films for blister packs, transdermal patches, and medical device packaging that must comply with stringent regulatory standards and sterilization processes.

Beyond traditional packaging, the second significant customer base resides in the electrical, electronic, and renewable energy sectors. Electronic component manufacturers purchase BOPET films for their excellent dielectric properties, using them as insulating layers in motor winding, capacitors, and cable wraps. Furthermore, companies involved in solar photovoltaic module manufacturing constitute a rapidly growing customer segment, purchasing specialty UV-resistant and weatherable BOPET backsheets essential for protecting the solar cells from moisture and degradation over the panel's multi-decade lifespan. These industrial customers prioritize technical specifications, long-term durability, and consistent supply security over simple cost considerations, driving the market for high-specification specialty films.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Jindal Poly Films, Mitsubishi Polyester Film, Toray Industries, Polyplex Corporation, DuPont Teijin Films, SKC Co., Ltd., Uflex Ltd., Jiangsu Sanfangxiang Group, Ester Industries, Garware Polyester Ltd., Kolon Industries, SRF Limited, Fuwei Films (Holdings) Co., Ltd., Taiwan Futech Co., Ltd., Flex Films, Max Specialty Films, Cosmo Films, CCL Industries, Toyobo Co., Ltd., Thai Film Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

BOPET Market Key Technology Landscape

The manufacturing technology for BOPET films is sophisticated, relying primarily on high-precision extrusion and orientation processes. The dominant method historically has been the Tenter Frame process, where the film is stretched sequentially—first in the machine direction (MD) using rollers, and then in the transverse direction (TD) using clips in a heated chamber. This method is highly flexible and well-established, allowing for the production of a wide range of film thicknesses and specialized characteristics. More recently, Simultaneous Stretching Technology has gained prominence. This advanced technique stretches the film in both MD and TD simultaneously, offering superior uniformity, reduced internal stresses, and improved film flatness, making it ideal for high-end applications such as display films and advanced electronic substrates where dimensional stability is critical.

Beyond the orientation mechanism, technological advancements are heavily focused on surface modification and functional coatings to enhance film performance. Metallization, typically using aluminum vapor deposition in a vacuum, remains a standard technique for achieving high oxygen and moisture barriers, crucial for food packaging. However, the emerging trend involves high-barrier transparent coatings, such as Alumina Oxide (AlOx) and Silicon Oxide (SiOx) deposition. These transparent barrier technologies offer performance comparable to metallization while maintaining clarity and allowing the film to be more easily sorted and recycled, addressing growing sustainability demands, particularly in Europe and North America.

Further innovation lies in the development of specialty co-extruded films and material formulations. Manufacturers are engineering multi-layered structures where different polymer grades or additives are incorporated into distinct layers to tailor surface properties (e.g., heat sealability, anti-fog capability) while maintaining the core strength of the BOPET structure. Research and development are also intensely focused on developing bio-based PET precursors derived from renewable resources, striving to create films with reduced carbon footprints that can meet the rigorous performance requirements of traditional BOPET. These technological developments are vital for maintaining BOPET’s competitive edge against alternative substrates and ensuring its continued relevance in demanding, high-specification markets.

Regional Highlights

Asia Pacific (APAC) stands as the principal growth engine and the largest consuming region for the BOPET market globally. This dominance is attributed to several macroeconomic factors, including the rapid expansion of the manufacturing base, particularly in China, India, and Southeast Asian nations. The region benefits from increasing disposable incomes, which drive the adoption of packaged consumer goods and processed foods, directly boosting the demand for flexible packaging films. Furthermore, APAC is the global leader in solar panel manufacturing, leading to exceptionally high demand for specialized BOPET films used in photovoltaic backsheets. Significant capital investments in new production lines and lower operational costs compared to Western counterparts solidify APAC's central position in the market.

North America and Europe represent mature yet highly influential markets, characterized by stringent quality standards and a strong emphasis on sustainable solutions. In North America, growth is stable, driven by the demand for high-end specialty films in the electronics and medical device sectors, as well as films engineered for recyclability to meet evolving regulatory compliance. Europe is a frontrunner in sustainable packaging innovation; market growth here is largely fueled by the transition towards mono-material flexible structures and the adoption of advanced barrier coatings (AlOx/SiOx) that minimize environmental impact while maintaining necessary barrier protection. European manufacturers often focus on premium, lower-volume, high-specification products rather than bulk commodity films.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized as emerging markets exhibiting high growth potential. LATAM demand is spurred by urbanization and the expansion of the organized retail sector, particularly in countries like Brazil and Mexico, creating new avenues for packaged food and beverage sales. The MEA region, influenced by infrastructural development and substantial investment in petrochemical capacity, is experiencing increasing domestic production and consumption. Growth in both regions is supported by infrastructure projects and rising consumer awareness, leading to a steady increase in the consumption of durable and protective BOPET materials across diverse industrial applications.

- Asia Pacific (APAC): Dominant consumer and producer; driven by population size, food packaging demand, and massive solar PV manufacturing base. Key countries include China, India, and South Korea.

- North America: Focus on high-value specialty films, electronics, medical packaging, and films designed for enhanced recyclability and material reduction initiatives.

- Europe: Characterized by high environmental regulation compliance; leading adoption of transparent barrier coatings (AlOx/SiOx) and sustainable/bio-based BOPET formulations.

- Latin America (LATAM): High growth potential fueled by urbanization, retail penetration, and expanding food processing industries in Brazil and Mexico.

- Middle East & Africa (MEA): Emerging market with rising demand linked to infrastructural growth and increasing local petrochemical capacity, supporting regional consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the BOPET Market.- Jindal Poly Films

- Mitsubishi Polyester Film

- Toray Industries

- Polyplex Corporation

- DuPont Teijin Films

- SKC Co., Ltd.

- Uflex Ltd.

- Jiangsu Sanfangxiang Group

- Ester Industries

- Garware Polyester Ltd.

- Kolon Industries

- SRF Limited

- Fuwei Films (Holdings) Co., Ltd.

- Taiwan Futech Co., Ltd.

- Flex Films

- Max Specialty Films

- Cosmo Films

- CCL Industries

- Toyobo Co., Ltd.

- Thai Film Industries

Frequently Asked Questions

Analyze common user questions about the BOPET market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the current demand for BOPET film?

The primary applications driving BOPET demand are flexible food packaging, due to its exceptional barrier properties against moisture and oxygen, and industrial uses, specifically solar panel backsheets, where its durability and thermal stability are essential for photovoltaic performance and longevity.

How does the volatility of raw material prices impact the profitability of BOPET manufacturers?

Raw material price volatility, particularly for PTA and MEG, significantly impacts manufacturer profitability by increasing operational costs and creating uncertainty in pricing models. Integrated manufacturers or those with long-term procurement contracts are typically better insulated from these market fluctuations.

What technological advancements are most crucial for the future growth of the BOPET market?

Crucial technological advancements include the deployment of high-barrier transparent coatings (AlOx/SiOx) for enhanced performance and recyclability, and the adoption of simultaneous stretching technology, which yields superior film uniformity and dimensional stability required for high-precision electronic and display applications.

Which geographical region dominates the BOPET market in terms of production and consumption?

Asia Pacific (APAC) dominates the BOPET market in both production capacity and consumption volume, driven by high industrial growth rates, massive demand from the food and beverage packaging sector, and the region's concentration of solar energy manufacturing.

Is BOPET film considered a sustainable or recyclable packaging material?

BOPET is generally recyclable, although its recyclability can be complicated when used in multi-layer laminates. However, the industry is increasingly focused on developing mono-material BOPET solutions and bio-based variants to improve end-of-life options and align with global sustainability and circular economy objectives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- BOPET Packaging Films Market Statistics 2025 Analysis By Application (Food and Beverages, Cosmetics and Personal Care, Electrical & Electronics, Pharmaceuticals, Other), By Type (Thickness: 15 m, Thickness: 15-30 m, Thickness: 30-50 m, Thickness: >50 m), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- BOPET Market Statistics 2025 Analysis By Application (Packaging, Industrial & Specialties, Electrical, Imaging), By Type (Universal Film, Electrical Insulating Film, Capacitor Film, Laminating Film), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Metallized BOPET Rollstock Film Market Statistics 2025 Analysis By Application (Food, Personal Care, Chemical & Fertilizers, Pharmaceuticals), By Type (Pouches, Bags, Labels, Decoration, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Metallized Rollstock BOPET Film Market Statistics 2025 Analysis By Application (Food, Personal Care, Chemical & Fertilizers, Pharmaceuticals), By Type (Pouches, Bags, Labels, Decoration, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Bopet Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Universal Film, Electrical Insulating Film, Capacitor Film, Laminating Film), By Application (Packaging, Industrial & Specialties, Electrical, Imaging, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager