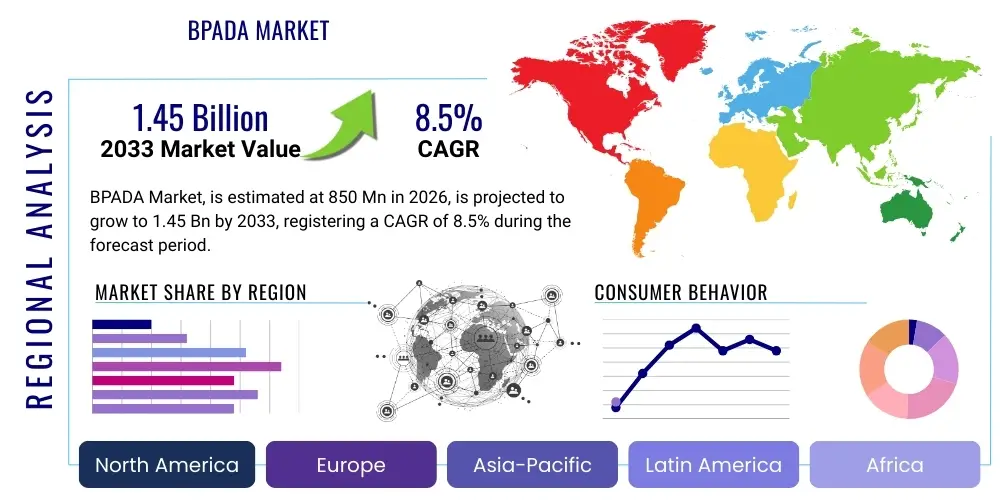

BPADA Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443549 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

BPADA Market Size

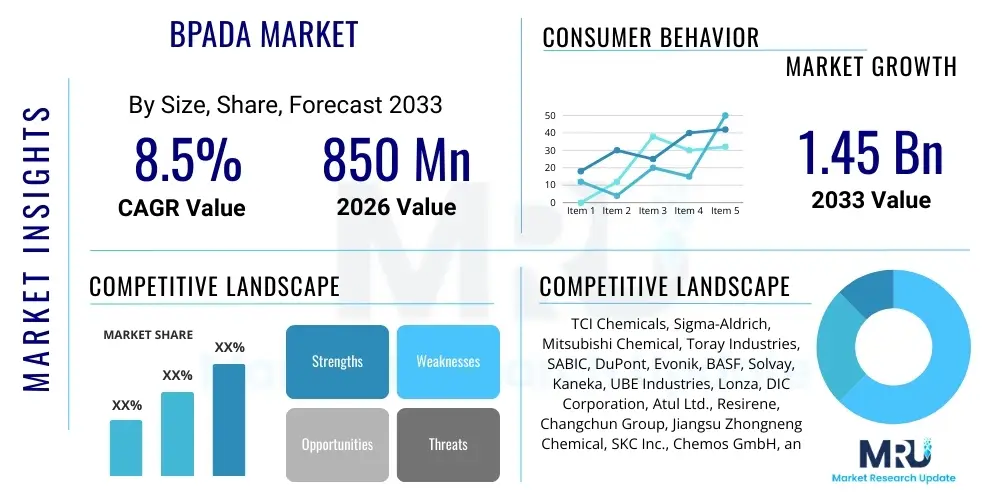

The BPADA Market (Bisphenol A Dianhydride) is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1.45 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for high-performance polymeric materials, particularly polyimides, which are crucial components in advanced electronics, aerospace, and automotive sectors. BPADA serves as a primary monomer in the synthesis of these heat-resistant polymers, making its market trajectory intrinsically linked to the innovation cycles within these highly demanding end-use industries.

The market valuation reflects a robust shift towards lightweighting and superior thermal stability requirements across critical infrastructure applications. As global regulatory bodies emphasize energy efficiency and material durability, products formulated using BPADA-derived polyimides offer distinct competitive advantages over traditional materials, especially in environments exposed to extreme temperatures or harsh chemical conditions. Furthermore, the increasing complexity of semiconductor manufacturing and the push for miniaturization necessitate insulating materials that maintain integrity under high operational stress, cementing BPADA’s irreplaceable role in the electronic encapsulation and flexible circuitry segments.

Geographically, the growth is heavily influenced by the manufacturing capabilities in the Asia Pacific region, specifically China, Japan, and South Korea, which dominate global electronics production and are rapidly expanding their domestic aerospace and electric vehicle (EV) supply chains. The maturation of specialized application segments, such as high-temperature adhesives and advanced composite matrices, further contributes to the overall market valuation. Price fluctuations of raw materials, such as Bisphenol A (BPA) and acetic anhydride, introduce volatility, yet the indispensable nature of BPADA in high-value applications mitigates significant downward pressure on the overall market size projection.

BPADA Market introduction

The BPADA (Bisphenol A Dianhydride) market encompasses the global production, distribution, and consumption of this specialized organic chemical compound, primarily utilized as a critical monomer in synthesizing high-performance polymers, particularly polyimides. BPADA is characterized by its high purity, symmetrical structure, and exceptional reactivity, allowing the resultant polymers to exhibit superior thermal stability, excellent mechanical strength, and outstanding electrical insulating properties. These polymers are essential for functioning reliably in extreme conditions, which mandates strict quality control and specialized manufacturing processes for the anhydride itself. The market’s dynamism is directly tied to technological advancements in sectors requiring ultra-reliable materials, positioning BPADA as a strategic chemical commodity.

Major applications of BPADA are deeply rooted in the manufacture of advanced polyimides used across several high-tech industries. In aerospace, these materials are utilized for structural composites and protective coatings on engine components due to their lightweight and resistance to high operational temperatures. In the electronics sector, BPADA-derived polyimides form the basis of flexible printed circuit boards (FPCBs), wire and cable insulation, and semiconductor packaging, offering thermal resistance necessary for modern, densely packed electronic devices. The primary benefit derived from BPADA usage is the creation of polymers that substantially outperform traditional plastics and resins in terms of durability, thermal resilience (often exceeding 300°C), and dimensional stability, ensuring long-term operational reliability.

The market is significantly driven by several macroeconomic and technological factors, notably the global proliferation of 5G infrastructure, which requires high-performance dielectric materials, and the rapid expansion of the electric vehicle (EV) industry, demanding lightweight, fire-retardant, and thermally stable battery components and motor insulation. Furthermore, increasing investments in space exploration and commercial aviation necessitate continuous innovation in composite materials, generating sustained high demand for BPADA. These driving factors, combined with ongoing research into BPADA-modified epoxy resins and other specialty chemicals, ensure a positive and accelerating demand outlook throughout the forecast period, emphasizing high purity grades suitable for sophisticated applications.

BPADA Market Executive Summary

The BPADA market is characterized by robust business trends centered on technological specialization and integrated supply chains. Key stakeholders, including major chemical manufacturers, are increasingly focusing on vertical integration, managing the entire process from raw material synthesis (BPA) through to the final anhydride product, ensuring purity and consistency crucial for end-use performance. Furthermore, strategic partnerships between BPADA producers and key downstream polyimide manufacturers are becoming common, allowing for customized product formulations and guaranteed long-term supply agreements. The overarching business environment emphasizes R&D expenditure directed toward cleaner synthesis methods and the development of specialized grades, particularly those designed for solvent-free polymerization techniques, aiming to improve sustainability metrics and manufacturing efficiency.

Regional trends reveal the dominance of the Asia Pacific (APAC) region, which commands the largest market share due to its established ecosystem for electronics manufacturing and rapidly maturing aerospace and automotive industries, particularly in China and India. North America and Europe, while possessing slower absolute growth rates, maintain leadership in high-value, niche applications such as advanced military aviation, medical devices, and high-end automotive sensors, driving demand for ultra-high-purity BPADA grades. Regulatory variations regarding chemical usage and environmental protection impact regional production capacities; for instance, stricter EU regulations prompt continuous innovation in process efficiency and waste reduction, while APAC focuses on scaling production volume to meet burgeoning industrial demand.

Segmentation trends highlight the increasing prominence of the Application segment, particularly the demand for polyimides and specialty adhesives. Within polyimides, the shift towards flexible electronics and high-temperature wire insulation dictates segment growth, emphasizing grades compatible with complex film-casting processes. The Purity Grade segment sees accelerated demand for the high-purity variant, especially from the semiconductor and microelectronics sectors, where trace impurities can severely compromise device reliability and longevity. This trend confirms a market evolution where value is increasingly placed on material quality and specific performance characteristics over mere volume, reinforcing the premium pricing structure associated with specialized BPADA derivatives.

AI Impact Analysis on BPADA Market

Common user questions regarding AI's impact on the BPADA market often revolve around optimizing synthesis processes, improving quality control, predicting demand fluctuations for key end-use materials (like polyimide films), and accelerating material discovery. Users seek to understand how Artificial Intelligence and machine learning (ML) can minimize batch-to-batch variability in BPADA production, thereby ensuring the ultra-high purity required for sensitive applications like semiconductors, and how predictive models can stabilize the volatile supply chain influenced by upstream raw material costs. The consensus is that AI will predominantly drive efficiency gains in manufacturing and quality assurance, shifting R&D from empirical experimentation to simulation-driven material design, ultimately leading to faster development cycles for BPADA-derived specialty polymers tailored to futuristic requirements in aerospace and high-speed electronics.

- AI-driven optimization of chemical reaction parameters, enhancing yield and purity of BPADA synthesis.

- Predictive maintenance analytics for reactors and specialized purification equipment, reducing unplanned downtime.

- Machine learning models used to forecast precise polyimide demand in flexible electronics, optimizing BPADA inventory management.

- Accelerated discovery of novel BPADA derivatives and co-monomers with enhanced mechanical or thermal properties through simulation.

- Enhanced quality control systems utilizing computer vision and ML for defect detection in raw BPADA crystals and final powders.

- Optimization of complex supply chain logistics, minimizing cost exposure related to upstream Bisphenol A price volatility.

DRO & Impact Forces Of BPADA Market

The BPADA market trajectory is fundamentally shaped by a powerful synergy of drivers and underlying impact forces, primarily stemming from global technological evolution. Key drivers include the exponential growth in demand for high-performance materials in the aerospace industry, where polyimides are instrumental in reducing weight and increasing fuel efficiency under extreme thermal loads, and the rapid expansion of the 5G and subsequent 6G wireless infrastructures, which demand low-dielectric-loss materials derived from BPADA for high-frequency signal transmission. Furthermore, the automotive sector’s electrification trend necessitates advanced insulation materials for battery systems and high-voltage wiring, providing sustained, high-volume growth opportunities for BPADA-based formulations, thereby creating a compelling positive force on market expansion.

However, the market faces significant restraints that temper the aggressive growth projections. The primary restraint involves the volatility and rising cost of key raw materials, especially Bisphenol A (BPA), which is subject to fluctuating petrochemical prices and increasing regulatory scrutiny in various regions due to environmental and health concerns, prompting substitution research. Additionally, the complex, capital-intensive nature of BPADA synthesis and purification processes, coupled with the necessity for highly specialized production facilities, limits market entry for smaller players and creates high fixed operating costs. Furthermore, the existence of alternative dianhydrides (such as PMDA or ODPA) in certain less-demanding polyimide applications presents competitive pressure, especially in cost-sensitive segments.

The primary opportunity lies in the burgeoning market for specialized coatings and high-temperature adhesives, offering new avenues for BPADA incorporation beyond traditional polyimide films and molding compounds. Innovation in environmentally benign, solvent-free polymerization techniques presents a significant chance for market differentiation and compliance with stricter regulatory frameworks, opening up high-premium segments. The main impact force shaping the competitive landscape is the continuous imperative for miniaturization and enhanced thermal stability in electronics, which elevates the indispensable nature of BPADA-based materials, creating a powerful barrier to substitution by lower-performing alternatives, ultimately sustaining high profit margins in specialized applications.

Segmentation Analysis

The BPADA market segmentation provides critical insights into the differing product requirements and end-use applications, ensuring producers can strategically align their offerings with specific market needs. The market is primarily segmented based on Purity Grade and Application. The purity grade is a vital determinant of the material’s suitability for high-tech applications; standard purity BPADA serves general industrial composites and less sensitive structural components, while high-purity grades are strictly reserved for sophisticated electronics, aerospace, and medical devices where even trace impurities can lead to performance failure. Understanding this purity dichotomy is crucial, as the pricing and competitive intensity vary dramatically between these grades, reflecting the stringent manufacturing processes required for ultra-pure output.

The segmentation by application further dissects the market, with Polyimides commanding the dominant share. Within this segment, specialized areas include high-temperature insulating films, molding powders for extreme environment components, and advanced composite matrices utilized in military and commercial aircraft. A growing secondary application is the use of BPADA as a high-performance epoxy curing agent, lending superior thermal resistance and mechanical integrity to epoxy systems used in protective coatings and adhesives. The dynamics within the application segments are driven by regional capital investments in infrastructure and technological innovation, such as the deployment of advanced radar systems or the proliferation of consumer electronics, which directly influence demand volumes for specific BPADA-derived materials.

The segmentation analysis confirms that future growth will be concentrated in segments demanding the highest performance characteristics. As electronics move toward higher frequencies and operating temperatures, the demand structure shifts toward the high-purity BPADA category, reinforcing premium pricing and encouraging technological investment in purification techniques. Geographic segmentation remains critical, with manufacturing hubs in Asia Pacific driving volume consumption, while technological innovation centers in North America and Europe define the requirements for new, application-specific BPADA formulations. This structure allows market participants to tailor their marketing and sales efforts toward either high-volume, standard-grade markets or high-value, specialty-grade niches.

- Purity Grade:

- Standard Purity

- High Purity (Electronic Grade)

- Application:

- Polyimides Manufacturing

- Films and Foils

- Coatings and Varnishes

- Molding Powders

- Composites

- Epoxy Curing Agents

- Specialty Adhesives and Sealants

- Other Chemical Intermediates

- Polyimides Manufacturing

Value Chain Analysis For BPADA Market

The BPADA value chain commences with the upstream extraction and synthesis of foundational petrochemical raw materials, primarily Bisphenol A (BPA) and acetic anhydride, which are sourced from large chemical refining complexes. This upstream segment is highly concentrated and globally commoditized, meaning BPADA manufacturers are highly sensitive to fluctuating oil and gas prices, which dictate the cost of these precursors. Efficient sourcing, long-term contractual agreements, and strategic inventory management are essential for BPADA producers to mitigate cost volatility and maintain competitive margins. Furthermore, environmental regulations concerning BPA production and handling significantly influence the operational complexity and capital expenditure required at the upstream stage, impacting overall supply stability.

Midstream activities involve the complex chemical synthesis and rigorous purification of BPADA itself. This phase is characterized by proprietary manufacturing processes and significant technical barriers to entry, as the final purity level directly correlates with the polymer performance in sensitive applications like electronics. Producers invest heavily in specialized reactors, crystallization units, and stringent quality assurance protocols to achieve electronic-grade purity. The midstream is the primary value-adding segment, where raw commodities are transformed into a high-value, functional intermediate chemical. Efficiency in this stage, including energy consumption minimization and solvent recovery, dictates the profitability of the BPADA producer.

The downstream segment involves the conversion of BPADA into polyimides, specialty epoxy resins, and adhesives, followed by final product fabrication. Key downstream users include flexible PCB manufacturers, aerospace component builders, and automotive sensor encapsulators. Distribution channels are varied: high-volume, standard-purity BPADA is often sold indirectly through established chemical distributors and wholesalers, leveraging their global logistics networks. Conversely, high-purity, specialized grades are typically sold directly from the producer to the key end-user, often under confidentiality agreements and long-term contracts, ensuring technical support and tailored formulations specific to the buyer’s unique polymerization processes.

BPADA Market Potential Customers

The primary potential customers and end-users of BPADA are deeply embedded within high-technology and mission-critical industries that demand materials capable of exceptional performance under extreme operating conditions. Foremost among these are manufacturers of advanced electronic devices, particularly those involved in producing flexible printed circuits (FPCs), semiconductor packaging, and high-temperature wire insulation for motors and transformers. These customers prioritize BPADA’s ability to confer superior dielectric properties and extreme thermal stability, ensuring the longevity and reliability of miniaturized and densely packed electronic assemblies. The sustained global trend toward smaller, faster, and more heat-intensive electronics guarantees a continuously expanding customer base within this sector.

A second major customer cluster includes aerospace and defense contractors, along with commercial aircraft manufacturers. These customers utilize BPADA-derived polyimides in structural composites, protective coatings, and cabin components to achieve essential weight reduction goals while meeting stringent fire resistance and thermal performance specifications dictated by flight safety and efficiency standards. The adoption of advanced, high-performance composites in both military and commercial aviation is a steady driver of demand, with specific purchasing decisions often influenced by long-term strategic contracts and regulatory approvals related to material certification. The stringent material requirements in this sector necessitate consistent, high-quality BPADA supply.

Furthermore, the rapidly evolving electric vehicle (EV) market and specialized industrial equipment manufacturers represent a burgeoning customer segment. EV producers require BPADA-based materials for insulating battery modules, motor windings, and power electronics, where thermal management and robust electrical insulation are crucial for safety and operational range. Similarly, manufacturers of industrial machinery, specialized oil and gas exploration tools, and high-performance industrial coatings rely on BPADA-cured systems for components exposed to high temperatures, abrasive environments, or corrosive chemicals. These customers value the material’s chemical resistance and durability, contributing significantly to the market’s volume consumption and diversification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1.45 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TCI Chemicals, Sigma-Aldrich, Mitsubishi Chemical, Toray Industries, SABIC, DuPont, Evonik, BASF, Solvay, Kaneka, UBE Industries, Lonza, DIC Corporation, Atul Ltd., Resirene, Changchun Group, Jiangsu Zhongneng Chemical, SKC Inc., Chemos GmbH, and others. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

BPADA Market Key Technology Landscape

The technology landscape for the BPADA market is dominated by proprietary chemical synthesis routes aimed at maximizing yield while achieving ultra-high purity, which is critical for electronic applications. The most common industrial process involves the reaction of Bisphenol A (BPA) with acetic anhydride, followed by complex cyclization and dehydration steps. Technological innovation centers around optimizing reaction kinetics, managing energy consumption, and crucially, improving downstream purification techniques. Advanced separation technologies, such as multi-stage crystallization and specialized solvent treatments, are continuously being refined to remove trace metal ions and unreacted precursors, ensuring the BPADA meets the stringent specifications required for microelectronics encapsulation and flexible circuit board manufacturing, where impurities can compromise performance.

Beyond the fundamental synthesis process, a significant portion of the technology landscape is focused on the specialized handling and conversion of BPADA into functional polymers. This includes developing novel polymerization methods, such as those that minimize or eliminate the use of traditional organic solvents, aligning with green chemistry principles and environmental regulatory trends. Techniques like solid-state polymerization or melt polycondensation require BPADA with specific particle size distribution and morphology, driving investment in specialized grinding and micronization technologies. Furthermore, the integration of continuous flow chemistry techniques, replacing traditional batch processes, is an emerging technological trend promising higher throughput, better consistency, and improved cost efficiency in large-scale BPADA production.

Another crucial element of the technology landscape involves quality assurance and analytical chemistry. High-performance liquid chromatography (HPLC), gas chromatography-mass spectrometry (GC-MS), and thermal analysis techniques (TGA, DSC) are routinely employed to certify the purity and thermal properties of BPADA batches before distribution. The trend toward Industry 4.0 integration sees the adoption of smart sensors and real-time data analytics, often utilizing AI algorithms, directly into the production line. This allows for immediate process adjustments based on feedback loops, reducing waste and enhancing overall product consistency, thereby supporting the transition towards more sophisticated, custom-engineered polyimide solutions for next-generation applications in space and high-frequency communication systems.

Regional Highlights

Asia Pacific (APAC) is undeniably the cornerstone of the BPADA market, commanding the highest market share and registering the most vigorous growth rate throughout the forecast period. This dominance is intrinsically linked to the region’s status as the global manufacturing hub for consumer electronics, semiconductors, and automotive components. Countries like China, South Korea, and Japan host massive fabrication facilities and advanced R&D centers that drive high consumption of polyimide films and epoxy systems based on BPADA. The rapid expansion of local aerospace programs and significant government investments in domestic infrastructure, including high-speed rail and telecommunications networks (5G/6G), further solidify APAC’s market leadership, necessitating vast quantities of high-performance dielectric and insulating materials.

North America represents a mature yet highly valuable market segment, characterized by demand for high-performance, specialized BPADA grades used primarily in defense, commercial aerospace, and advanced medical device manufacturing. The region is home to major defense contractors and pioneering technology firms that require certified, ultra-high-purity BPADA for mission-critical applications where material failure is unacceptable. While volume growth may be moderate compared to APAC, North America maintains strong competitive pricing power due to its focus on research-intensive applications and specialized composite structures. Innovation in material science, often supported by academic institutions and government grants, continues to generate demand for new BPADA derivatives tailored for extreme environments.

Europe constitutes another critical region, driven primarily by stringent environmental regulations and a focus on high-value automotive components (especially in Germany) and specialized industrial machinery. European demand for BPADA is concentrated in its role as a key monomer in heat-resistant coatings and advanced structural adhesives, crucial for the continent's stringent safety and efficiency standards. The region’s emphasis on sustainability has spurred technological developments focused on green chemistry, leading to demand for BPADA suppliers who can demonstrate reduced environmental impact in their manufacturing processes. Eastern European countries are emerging as potential growth pockets due to increasing foreign investment in localized electronics assembly and automotive component manufacturing.

- Asia Pacific (APAC): Dominates consumption volume driven by electronics, semiconductor fabrication, and expanding EV manufacturing base in China and South Korea.

- North America: Focuses on high-value, niche applications in defense, commercial aviation, and medical electronics, demanding ultra-high-purity grades.

- Europe: Driven by strict automotive and industrial standards, emphasizing environmental compliance and specialized adhesive/coating formulations.

- Latin America & MEA: Emerging markets with incremental demand related to infrastructure development and localized oil and gas exploration requiring high-performance seals and coatings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the BPADA Market.- TCI Chemicals

- Sigma-Aldrich

- Mitsubishi Chemical

- Toray Industries

- SABIC

- DuPont

- Evonik

- BASF

- Solvay

- Kaneka

- UBE Industries

- Lonza

- DIC Corporation

- Atul Ltd.

- Resirene

- Changchun Group

- Jiangsu Zhongneng Chemical

- SKC Inc.

- Chemos GmbH

- Hubei Huitian New Material

Frequently Asked Questions

Analyze common user questions about the BPADA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is BPADA primarily used for and why is it essential for high-tech applications?

BPADA (Bisphenol A Dianhydride) is fundamentally used as a monomer to synthesize high-performance polyimides. It is essential because it imparts exceptional thermal stability, superior mechanical strength, and excellent dielectric properties to the resulting polymers, making them crucial for electronics (flexible PCBs, insulation) and aerospace composites where extreme heat resistance and lightweighting are required.

Which geographical region holds the largest market share for BPADA and what drives its growth?

The Asia Pacific (APAC) region holds the largest market share for BPADA. Its growth is primarily driven by the colossal manufacturing base for semiconductors and consumer electronics in countries like China, South Korea, and Japan, coupled with massive regional investments in 5G infrastructure and electric vehicle production, all requiring BPADA-derived high-temperature materials.

What are the main purity grades available in the BPADA market and how do they differ in application?

The main purity grades are Standard Purity and High Purity (often termed Electronic Grade). High Purity BPADA is specifically mandated for microelectronics, aerospace components, and sensitive optical applications where trace impurities compromise performance. Standard Purity BPADA is generally utilized for industrial composites, general coatings, and less stringent structural components.

What are the key market restraints affecting the growth and profitability of BPADA producers?

The primary restraints include the significant volatility and rising costs of upstream raw materials, particularly Bisphenol A (BPA), which is linked to petrochemical price fluctuations. Additionally, stringent and evolving environmental regulations, coupled with the high capital intensity required for achieving ultra-high purity levels in production, limit market entry and compress operating margins.

How is the demand for electric vehicles (EVs) influencing the BPADA market?

The rapid growth of the EV sector significantly drives BPADA demand by necessitating high-performance, thermally stable polyimide films and insulating varnishes. These materials are critical for ensuring the safety and operational efficiency of high-voltage battery modules, motor windings, and power electronics in electric and hybrid vehicles, creating a robust, high-volume application segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager