Brass Foils Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443294 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Brass Foils Market Size

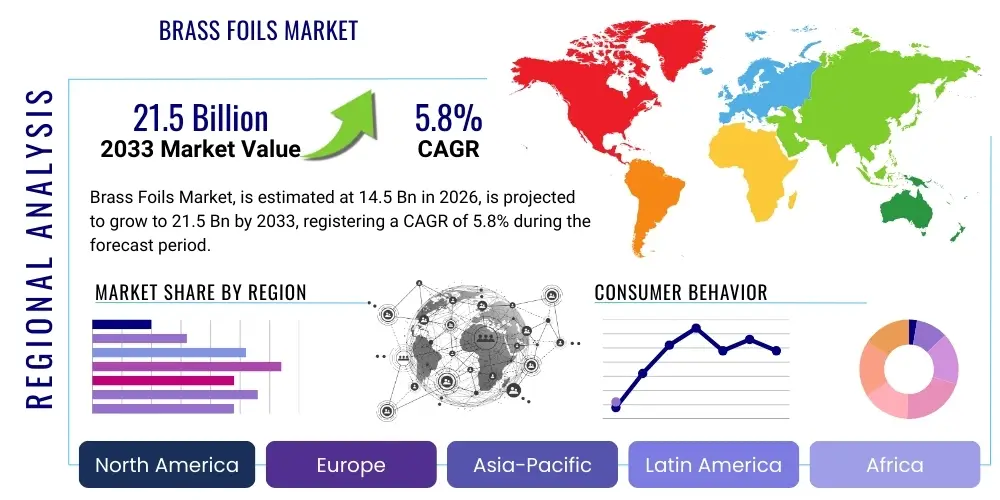

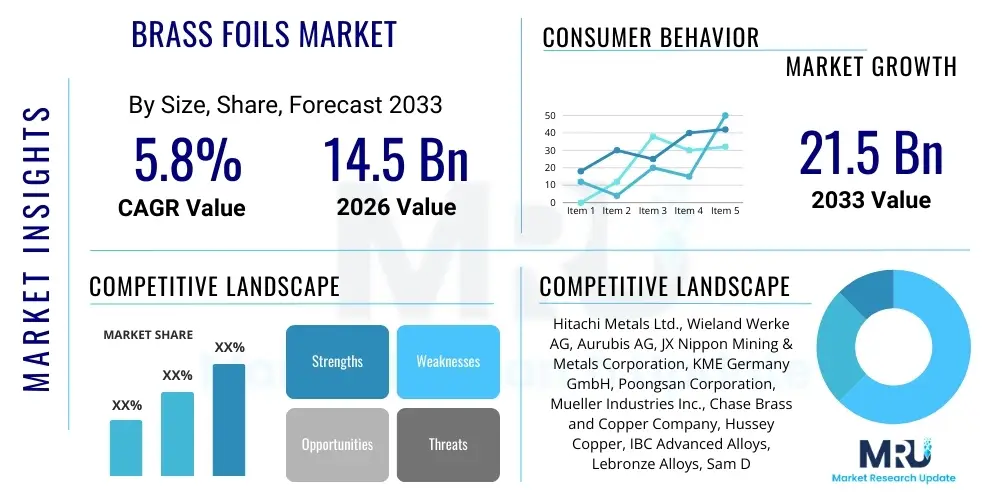

The Brass Foils Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 21.5 Billion by the end of the forecast period in 2033.

Brass Foils Market introduction

The Brass Foils Market encompasses the production and distribution of thin sheets of brass alloys, primarily composed of copper and zinc, tailored for applications requiring high electrical conductivity, excellent corrosion resistance, and specific mechanical properties like ductility and malleability. Brass foils are critical intermediate materials manufactured through rolling and annealing processes, ensuring precise thickness and surface finish suitable for high-precision engineering requirements. These products are standardized across various grades, such as CDA 260 (Cartridge Brass) and CDA 270 (Yellow Brass), each offering a distinct balance of strength and formability, driving their widespread adoption across diversified industrial sectors globally. The foundational strength of the market lies in the versatility of brass as a material that bridges the gap between pure copper's high conductivity and steel's high structural rigidity.

Major applications of brass foils span several high-growth industries, including electrical and electronics, automotive manufacturing, architectural design, and consumer goods production. In the electronics sector, they are extensively used in connectors, shielding components, and heat sinks due to their superior thermal and electrical transference characteristics. The automotive industry utilizes brass foils for radiator components, gaskets, and specialized sensors requiring resilience against temperature fluctuations and chemical exposure. Furthermore, the aesthetic appeal and ease of fabrication make brass foils popular in decorative applications, coinage, and precision stamping operations. The inherent benefits of using brass, such as its recyclability and durability, position it favorably against alternative materials in sustainability-focused economies.

Key driving factors propelling the expansion of the Brass Foils Market include the rapid growth of the global electronics industry, particularly the proliferation of 5G infrastructure and advanced consumer devices which demand high-performance conductive materials. The increasing adoption of electric vehicles (EVs) is also a significant catalyst, as brass foils are integral components in battery connections and thermal management systems within EV powertrains. Urbanization and growth in infrastructure development, requiring brass products for piping, fixtures, and architectural elements, further contribute to sustained market demand. Additionally, technological advancements in rolling and finishing processes are enabling the production of thinner, more precise foils, expanding their potential application scope in microelectronics and specialized engineering fields.

Brass Foils Market Executive Summary

The global Brass Foils Market demonstrates robust growth driven by accelerating demand from the electronics and automotive sectors, underpinned by technological advancements in alloy composition and manufacturing efficiency. Current business trends indicate a strong focus on high-precision, ultra-thin foils tailored for micro-electronic applications and flexible circuits, necessitating significant capital investment in advanced rolling mills and specialized annealing equipment. Market participants are increasingly engaging in strategic collaborations to secure stable supply chains for raw materials (copper and zinc) and to integrate downstream processing capabilities, allowing for the provision of customized foil products that meet strict industry standards such as RoHS compliance and high purity levels. The shift towards sustainable manufacturing practices is also forcing companies to optimize energy consumption during production and enhance the recyclability features of their end products.

Regionally, the Asia Pacific (APAC) stands as the dominant market, fueled by colossal manufacturing hubs in China, South Korea, and Japan, which serve as global centers for electronics production and automotive assembly. This dominance is further accentuated by massive government investments in infrastructure and renewable energy projects in the region, which utilize brass components for reliable power transmission and distribution. North America and Europe, while mature markets, are experiencing specialized growth in high-value, niche applications, particularly in aerospace, defense, and sophisticated medical devices, where material reliability and stringent quality control are paramount. The regulatory landscape across these regions is increasingly influencing material selection, favoring alloys that demonstrate superior performance under extreme conditions, thereby bolstering demand for specialized brass grades.

Segment-wise, the market is primarily segmented by foil thickness, end-use industry, and alloy type. The electronics segment remains the largest revenue contributor due to the continuous miniaturization of components requiring extremely thin foils with high conductivity. By alloy type, the high-zinc content brass foils, offering enhanced strength and hardness, are gaining traction in structural applications, while low-zinc grades are preferred for deep drawing and cold-forming operations due to their superior ductility. Future trends suggest a significant uplift in the demand for customized surface treatments and coated brass foils that offer enhanced adhesion and resistance to tarnishing, facilitating their integration into complex multi-layered electronic assemblies.

AI Impact Analysis on Brass Foils Market

User queries regarding AI's impact on the Brass Foils Market primarily focus on the potential for autonomous quality control, predictive maintenance of heavy rolling machinery, and optimization of complex alloy composition processes. Key themes revolve around how AI and Machine Learning (ML) can enhance the consistency of foil thickness down to the micron level, a critical requirement for microelectronics. Users are concerned about the efficiency gains—specifically, whether AI integration can significantly reduce material waste and energy consumption during the labor- and resource-intensive rolling processes. Expectations are high concerning AI's role in predictive modeling of raw material price volatility (copper and zinc), enabling better procurement strategies, and automating complex supply chain logistics for faster turnaround times on custom orders. The summary indicates that users view AI less as a disruptive force and more as a crucial enhancement tool for precision, operational efficiency, and cost management in a capital-intensive industry.

- AI-driven optimization of rolling mill parameters to ensure consistent thickness tolerance and surface finish, minimizing defects.

- Predictive maintenance analytics using sensor data to forecast equipment failures in annealing furnaces and cold rolling machines, drastically reducing downtime.

- Machine Learning algorithms deployed for real-time monitoring and adjustment of complex brass alloy melting and casting processes, ensuring precise composition control.

- Automated visual inspection systems (computer vision) replacing manual checks for identifying minute surface imperfections, improving quality assurance speed.

- Enhanced demand forecasting and inventory management through AI, optimizing raw material procurement (copper/zinc) and reducing working capital requirements.

- Simulation models powered by AI to predict the mechanical behavior (stress, strain) of new brass foil grades under specific application conditions, accelerating R&D.

DRO & Impact Forces Of Brass Foils Market

The dynamics of the Brass Foils Market are governed by a complex interplay of internal and external forces, categorized into Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary Impact Forces shaping market trajectory. The paramount driver remains the unrelenting global expansion of the electrical and electronic industries, especially in the context of advanced technologies such as 5G network deployment, IoT devices, and sophisticated thermal management solutions, all of which heavily rely on brass foils for conductivity and heat dissipation. Furthermore, the global automotive transition towards Electric Vehicles (EVs) serves as a significant accelerant, creating new high-demand niches for reliable, corrosion-resistant brass components within battery packs and high-voltage connections. These drivers are fundamentally linked to macroeconomic trends, including rapid industrialization in developing economies and increasing consumer spending on high-tech gadgets and durable goods.

Conversely, the market faces considerable restraints, notably the high volatility and escalating costs associated with primary raw materials, specifically copper and zinc. Since raw material cost constitutes a significant portion of the final product price, fluctuations introduce significant operational uncertainty and pressure on profit margins for manufacturers. Furthermore, intense competition from alternative conductive materials, particularly high-performance stainless steel alloys, aluminum, and advanced plastics, presents a challenge in applications where specific properties of brass are not strictly mandatory. Stricter environmental regulations concerning heavy metal usage and energy consumption during the manufacturing process also impose capital expenditure requirements for compliance and cleaner production technologies.

Opportunities for growth are abundant, particularly in developing ultra-thin and customized foils (e.g., thickness below 50 microns) for microelectronics, where market demand is currently underserved by standardized products. The increasing global emphasis on infrastructure modernization and smart city development opens avenues for brass foils in specialized building components, durable piping, and complex electrical systems requiring extended service life. Strategic vertical integration, from raw material sourcing to specialized finishing (e.g., plating and coating), represents a substantial opportunity for manufacturers to capture higher value and enhance supply chain resilience. The impact forces indicate a competitive environment where success is increasingly dependent on precision engineering, supply chain stability, and the ability to adapt to rapid technological shifts in end-user industries.

The cumulative impact of these forces suggests a moderately high growth trajectory, tempered by economic sensitivity to commodity prices. The driving forces, particularly technology adoption and EV growth, exert a constant upward pressure. However, resource scarcity and competition from substitutes act as stabilizing restraints. Companies that invest in process efficiency, raw material hedging strategies, and product innovation focused on high-specification markets (e.g., medical and aerospace) are positioned to maximize the opportunities arising from structural industrial shifts, thereby mitigating the negative impact of price volatility and regulatory burdens.

Segmentation Analysis

The Brass Foils Market is extensively segmented based on several critical dimensions, allowing for a precise understanding of market dynamics, targeted marketing strategies, and customized product development. Key segmentation dimensions include the type of alloy used, the physical dimensions (thickness), the specific manufacturing process employed, and the distinct end-use industry that consumes the product. Analyzing these segments helps stakeholders identify high-growth areas and allocate resources effectively, particularly distinguishing between commodity grades and high-performance specialty foils that command premium pricing.

Segmentation by alloy type focuses primarily on the Copper-Zinc ratio, dictating the mechanical and corrosion properties, such as Cartridge Brass (C26000), Yellow Brass (C27000), and Red Brass (C23000), each optimized for different processing methods like cold rolling, stamping, or deep drawing. Thickness segmentation is crucial, differentiating between standard foils (above 0.1 mm) and ultra-thin foils (below 0.05 mm), which are specifically utilized in high-density electronics and miniaturized components. The end-use segmentation is perhaps the most influential, mapping demand directly to industrial activity across the globe, with electronics and automotive sectors being the most dominant consumers, followed closely by architecture and general engineering applications.

- By Alloy Type:

- Cartridge Brass (C26000)

- Yellow Brass (C27000)

- Red Brass (C23000)

- Muntz Metal (C28000)

- Naval Brass (C46400)

- By Thickness:

- Standard Foils (0.1 mm and above)

- Thin Foils (0.05 mm to 0.1 mm)

- Ultra-Thin Foils (Below 0.05 mm)

- By End-Use Industry:

- Electrical & Electronics (Connectors, Shielding, Heat Sinks)

- Automotive (Radiators, Gaskets, Sensors)

- Industrial Machinery & Equipment

- Construction & Architecture

- Consumer Goods and Decorative Items

- Aerospace and Defense

- By Application Process:

- Stamping and Deep Drawing

- Etching and Chemical Milling

- Flexible Printed Circuit Boards (FPCBs)

- Lamination

Value Chain Analysis For Brass Foils Market

The value chain for the Brass Foils Market begins with intensive upstream activities focused on the procurement and processing of primary raw materials: copper and zinc. Upstream analysis involves major mining companies and refined metal suppliers who dictate the initial cost and quality standards. Copper cathode and zinc ingot producers are essential links, and their market consolidation or production efficiency directly impacts the cost structure of brass manufacturers. Given the high capital expenditure required for smelting and refining, suppliers often engage in long-term contracts with major metal exchanges to hedge against price volatility, a practice crucial for maintaining stable production costs in the highly competitive foil market.

The core manufacturing phase involves alloy formulation, casting of brass billets, and subsequent heavy-duty cold and hot rolling processes to reduce thickness to the desired gauge. Specialized manufacturers then engage in intermediate processing, including annealing (to adjust mechanical properties), precision slitting, and surface treatment (cleaning, polishing, or plating). The primary distribution channel for brass foils often involves large, specialized metals distributors and service centers that maintain inventories and provide just-in-time delivery and preliminary processing services, such as customized cutting and profiling, tailored to the specific needs of end-users. Direct distribution is common for very large volume orders or highly specialized, proprietary foil grades, where direct manufacturer-to-OEM communication is necessary for quality control and technical support.

Downstream analysis highlights the highly diversified end-user segments, where the foils are integrated into finished products. These include massive Electronics Manufacturing Services (EMS) providers, automotive component tier-one suppliers, and specialized engineering firms. The nature of distribution is bifurcated: indirect channels (through distributors) handle standard, high-volume products, while direct channels cater to niche markets like aerospace and advanced medical devices where tight specifications and supply chain traceability are mandatory. The profitability at the downstream end is driven by the value-add provided by the fabricator, emphasizing the need for high-quality, defect-free brass foil inputs that facilitate efficient subsequent manufacturing processes such as etching and stamping.

Brass Foils Market Potential Customers

Potential customers for brass foils span a wide range of sophisticated industrial sectors that require materials offering a unique combination of electrical conductivity, corrosion resistance, and specific mechanical characteristics. The largest category of buyers comprises Original Equipment Manufacturers (OEMs) within the electrical and electronics sector, including major producers of smart devices, telecommunication equipment (like 5G base stations), and consumer electronics components such as battery contacts, terminals, and electromagnetic shielding enclosures. These buyers prioritize ultra-thin, highly consistent foils capable of handling complex stamping and micro-etching operations while meeting stringent specifications for thermal management and signal integrity.

Another major segment consists of Tier 1 and Tier 2 automotive suppliers focusing on powertrain electrification and vehicle thermal systems. These customers utilize brass foils for critical applications like heat exchangers (radiators), wiring harness connectors, busbars in battery modules, and sensor components requiring high reliability under fluctuating temperatures and mechanical stress. The shift towards electric vehicles is rapidly expanding the volume and technical requirements from this customer base, demanding specialized alloys that offer superior mechanical strength and improved current carrying capacity compared to traditional brass grades.

Furthermore, general industrial fabricators and precision engineering companies constitute a substantial customer base, acquiring brass foils for manufacturing specialized gaskets, bellows, precision instruments, and decorative architectural finishes. These buyers often source through service centers and distributors due to diverse volume requirements and the need for value-added processing like slitting and precision blanking. Overall, the typical brass foil buyer is characterized by a high degree of technical requirement, rigorous quality assurance protocols, and a continuous search for materials that offer optimal performance-to-cost ratios for high-volume manufacturing environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 21.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals Ltd., Wieland Werke AG, Aurubis AG, JX Nippon Mining & Metals Corporation, KME Germany GmbH, Poongsan Corporation, Mueller Industries Inc., Chase Brass and Copper Company, Hussey Copper, IBC Advanced Alloys, Lebronze Alloys, Sam Dong Co. Ltd., Mitsubishi Shindoh Co. Ltd., Shandong Nanshan Aluminum Co. Ltd., Precision Specialty Metals Inc., Oriental Copper Co. Ltd., Olin Brass (GBC Metals), Luvata Oy, Kitz Metal Works Corporation, Shweiki Brass. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Brass Foils Market Key Technology Landscape

The manufacturing process of brass foils relies heavily on advanced metallurgical and rolling technologies to achieve the required mechanical properties, dimensional accuracy, and surface quality. Central to the technological landscape is the continuous casting process, which produces homogeneous brass billets with minimal internal defects, crucial for subsequent high-precision rolling. Modern casting techniques, such as horizontal continuous casting, allow for better control over grain structure and compositional uniformity, significantly reducing the likelihood of cracking or tearing during the extreme stress of cold rolling operations. Furthermore, sophisticated alloy preparation involves micro-alloying elements (like trace amounts of tin or nickel) to enhance specific performance metrics, such as corrosion resistance in marine environments or resistance to stress relaxation in electrical contacts.

In the rolling sector, the adoption of specialized cluster mills and Z-mills, often coupled with advanced automation and control systems, is pivotal. These mills are capable of achieving extremely tight gauge tolerances (down to a few microns) necessary for ultra-thin foils used in flexible electronics and sensitive sensor applications. The technological edge lies in the precision feedback loops integrated into these rolling systems, which utilize laser and X-ray gauges for real-time measurement and adjustment of roll gaps and tension, thereby ensuring maximum material yield and consistent quality across vast production lengths. The control over internal residual stress through highly optimized, multi-stage annealing cycles is another critical technology, determining the final formability and durability of the brass foil product.

Surface finishing and post-processing technologies represent the final, high-value step in the market’s technological landscape. This includes advanced electroplating (e.g., nickel, tin, or silver) to modify surface conductivity or enhance solderability, vital for electronic component integration. Chemical milling and high-speed slitting technologies ensure the foils meet the exact dimensional requirements of end-users without introducing edge burrs or internal stresses. Innovation is increasingly focused on developing sustainable and non-toxic surface passivation techniques to protect the brass foil from oxidation and tarnishing, which preserves electrical properties over extended periods and aligns with strict environmental regulations like REACH and RoHS directives in key global markets.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global brass foil production and consumption, driven overwhelmingly by the concentration of global electronics manufacturing and automotive assembly hubs in countries like China, South Korea, Japan, and Taiwan. China, in particular, dominates both production capacity and consumption, fueled by massive domestic demand for consumer electronics, 5G infrastructure rollout, and rapid adoption of EVs. The region benefits from lower manufacturing costs and government incentives supporting large-scale industrial output.

- North America: The North American market is characterized by a focus on high-specification, premium brass foils used primarily in demanding sectors such as aerospace, defense, precision industrial machinery, and high-reliability medical devices. While production volumes are lower than in APAC, the value per unit is significantly higher. Demand is stable, supported by stringent quality requirements and a preference for domestically sourced, high-purity materials, driving investments in advanced, highly automated manufacturing facilities.

- Europe: Europe represents a mature market with significant emphasis on sustainability, recycling, and specialized engineering applications. The German automotive industry and precision engineering sectors in Switzerland and Italy are major consumers. European manufacturers prioritize alloys that comply strictly with environmental and health directives (e.g., low lead content), pushing technological advancements in cleaner production and superior alloy design for complex components in energy and industrial automation.

- Latin America: This region presents emerging growth opportunities, primarily tied to recovering construction activities and localized automotive manufacturing bases, particularly in Brazil and Mexico. The market is often served by imports, though local manufacturing capacity is slowly expanding to meet domestic demand for standard brass foil grades used in fixtures, plumbing, and general engineering applications, focusing mainly on cost-effectiveness.

- Middle East and Africa (MEA): The MEA market is small but growing, highly dependent on large-scale infrastructure projects (especially in the Gulf Cooperation Council countries) and energy sector development. Demand for brass foils is concentrated in construction materials, electrical installations, and specialized oil and gas equipment that require non-sparking or corrosion-resistant metallic components, often sourced from established manufacturers in Asia and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Brass Foils Market.- Hitachi Metals Ltd.

- Wieland Werke AG

- Aurubis AG

- JX Nippon Mining & Metals Corporation

- KME Germany GmbH

- Poongsan Corporation

- Mueller Industries Inc.

- Chase Brass and Copper Company

- Hussey Copper

- IBC Advanced Alloys

- Lebronze Alloys

- Sam Dong Co. Ltd.

- Mitsubishi Shindoh Co. Ltd.

- Shandong Nanshan Aluminum Co. Ltd.

- Precision Specialty Metals Inc.

- Oriental Copper Co. Ltd.

- Olin Brass (GBC Metals)

- Luvata Oy

- Kitz Metal Works Corporation

- Shweiki Brass

Frequently Asked Questions

Analyze common user questions about the Brass Foils market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the current growth of the Brass Foils Market?

The market growth is primarily driven by the escalating global demand for high-performance conductive materials within the electrical and electronics sector, particularly for 5G components and compact consumer devices, coupled with the exponential adoption of electric vehicles (EVs) requiring brass components for battery systems and thermal management.

Which brass alloy types are most commonly used in high-precision electronic applications?

For high-precision electronic applications, Cartridge Brass (C26000) and specific phosphor bronze grades are highly utilized due to their excellent balance of electrical conductivity, strength, and superior cold workability, making them ideal for connectors, switches, and sensitive shielding applications.

How does raw material price volatility impact the profitability of brass foil manufacturers?

High volatility in the price of copper and zinc significantly impacts manufacturer profitability, as raw materials account for a large proportion of production costs. Manufacturers typically employ hedging strategies and long-term supply contracts to mitigate the financial risk associated with these commodity price fluctuations.

What role does Asia Pacific play in the global Brass Foils Market?

Asia Pacific is the dominant regional market, serving as the largest manufacturing and consumption hub globally. Its dominance is attributed to high-volume production of electronics and automobiles, supported by a strong supply chain and extensive infrastructure investment in key countries like China, South Korea, and Japan.

What is the future potential of ultra-thin brass foils in the industry?

The potential for ultra-thin brass foils (typically below 50 microns) is exceptionally high. They are critical for the miniaturization trend in microelectronics, flexible printed circuit boards (FPCBs), and advanced sensors, representing a specialized, high-margin niche expected to experience above-average market growth due to technological necessity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager