Bread Frozen Dough Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443321 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Bread Frozen Dough Market Size

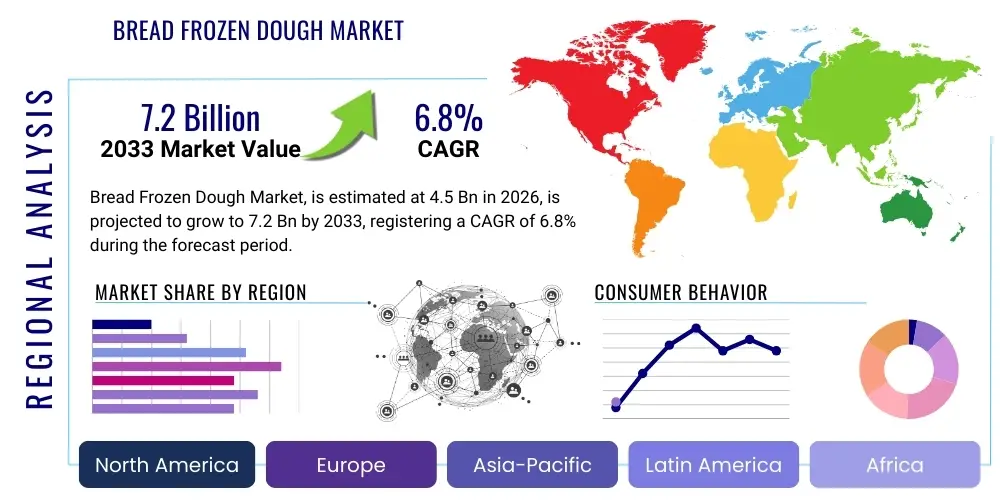

The Bread Frozen Dough Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for convenient, high-quality baked goods, particularly within the foodservice sector and in-store bakeries which seek to minimize labor costs and ensure consistent product output without sacrificing flavor or texture.

Bread Frozen Dough Market introduction

The Bread Frozen Dough Market encompasses commercially prepared dough products that are cryogenically or flash-frozen for extended preservation and convenience, allowing end-users to bake fresh bread on demand with minimal preparation time. These products range from partially baked items (par-baked) to raw, unproved dough designed for rapid final proofing and baking. The core product description covers a vast spectrum of bread types, including standard loaf bread, specialty rolls, baguettes, and laminated doughs like croissants and Danish pastries, catering to diverse global culinary preferences and institutional requirements. Major applications span quick-service restaurants (QSRs), full-service hotels, commercial and industrial bakeries, supermarkets operating in-store bakeries (ISBs), and increasingly, direct consumer retail channels.

The inherent benefits of utilizing frozen dough are numerous and serve as significant driving factors for market growth. These benefits include substantial labor cost savings due to reduced need for skilled bakers, enhanced inventory control by minimizing spoilage and managing fluctuating demand more effectively, and ensuring product consistency across multiple locations, which is critical for chain operations. Furthermore, the ability to offer "freshly baked" products throughout the day without intensive, localized production facilities appeals strongly to retailers aiming to attract customer foot traffic through sensory marketing, specifically the aroma of baking bread. The operational efficiency derived from the 'thaw-proof-bake' model provides a compelling economic proposition for businesses operating under tight margins.

Driving factors propelling this market forward include rapid urbanization, leading to time constraints among consumers who prioritize convenience; the global expansion of foodservice chains demanding standardized product sourcing; advancements in freezing and dough preparation technology that preserve the quality and viability of the yeast; and a burgeoning demand for premium, specialty, or ethnic bread varieties (such as sourdough or multigrain) that are complex to prepare from scratch. These combined elements position frozen dough as a strategic necessity rather than merely a convenience item, fundamentally reshaping the commercial baking landscape and supporting expansion into emerging economies where infrastructure for large-scale, fresh-daily production remains challenging.

Bread Frozen Dough Market Executive Summary

The Bread Frozen Dough Market is characterized by vigorous business trends focusing on vertical integration among key manufacturers and a strong emphasis on clean label ingredients and specialized diet formulations, such as gluten-free and high-fiber variants, catering to evolving health-conscious consumer bases. Regionally, North America and Europe maintain market leadership due to high penetration rates in the foodservice and retail sectors, robust cold chain logistics infrastructure, and consumer familiarity with frozen bakery products. However, the Asia Pacific region is demonstrating the highest growth trajectory, spurred by rapid expansion of Western-style quick-service restaurants and the modernization of local grocery retail formats adopting in-store bakery concepts. Segment trends indicate that par-baked products currently hold a dominant share owing to their superior texture and speed-to-market advantage, while the raw frozen dough segment is experiencing notable growth driven by specialty bakeries and artisan operators looking for greater control over the final proofing and baking process, thereby blurring the line between mass-produced convenience and artisanal quality.

AI Impact Analysis on Bread Frozen Dough Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) in the Bread Frozen Dough Market primarily revolve around operational efficiency, product consistency, and supply chain resilience. Users frequently ask how AI can optimize mixing times, predict flour quality variability and adjust recipes instantaneously, and minimize dough wastage during processing and freezing stages. Concerns also center on the feasibility of AI in complex areas like yeast activity monitoring and predicting the optimal proofing period based on real-time environmental data (temperature, humidity). Furthermore, significant interest exists regarding AI's role in predictive maintenance for specialized cryogenic freezing equipment and optimizing intricate global cold chain logistics to prevent temperature excursions that could compromise dough quality, thus ensuring better product integrity from factory to oven, ultimately guaranteeing the delivery of consistent, high-quality final products to consumers.

- AI-driven Predictive Quality Control: Machine learning models analyze raw material inputs (e.g., moisture, protein content in flour) to dynamically adjust ingredient ratios, ensuring consistency in dough rheology before freezing.

- Optimized Production Scheduling: AI algorithms forecast demand fluctuations based on historical sales, seasonal trends, and localized events, optimizing batch sizes and minimizing inventory holding costs for perishable frozen stock.

- Enhanced Cold Chain Logistics: Utilization of AI for route optimization, real-time temperature monitoring, and predictive failure analysis of refrigeration units, significantly reducing spoilage risk during distribution.

- Automated Recipe Development: Generative AI tools assist R&D teams in formulating novel frozen dough recipes, simulating ingredient interactions (especially with alternative flours or gluten substitutes) to achieve desired texture and flavor profiles upon baking.

- Process Automation and Robotics: Integrating AI-powered vision systems for quality checking dough shape, weight, and surface defects before rapid freezing, enhancing throughput and minimizing human error.

- Energy Consumption Management: AI systems manage the energy use of industrial mixers, freezers, and ovens, reducing utility costs associated with high-energy cryogenic processes crucial for frozen dough production.

DRO & Impact Forces Of Bread Frozen Dough Market

The market dynamics are defined by substantial drivers, persistent restraints, and transformative opportunities that collectively exert a complex set of impact forces on market trajectory and stakeholder strategy. Key drivers include the overwhelming consumer demand for convenience coupled with the expansion of foodservice outlets globally, requiring reliable and scalable baking solutions. Restraints largely center on the intensive capital requirements for establishing and maintaining robust cold chain infrastructure, particularly in developing economies, alongside the persistent consumer perception that frozen products may lack the quality or freshness associated with scratch-made items. Opportunities lie significantly in developing specialized, functional frozen dough products, such as those targeting ketogenic, low-carb, or plant-based diets, leveraging technological advancements in yeast stabilization and rapid freezing techniques to overcome textural degradation issues.

Impact forces stemming from these factors necessitate strategic differentiation. The convenience driver accelerates market adoption, especially in urbanized areas. Conversely, the high cost of maintaining a continuous, uninterrupted temperature-controlled supply chain acts as a significant barrier to entry for smaller firms and requires substantial ongoing investment from established players, compelling market consolidation. The increasing consumer focus on nutritional transparency and clean labels pressure manufacturers to reformulate products, moving away from chemical preservatives and artificial additives. Success in this market thus requires balancing the operational efficiencies provided by freezing technology with the consumer desire for authenticity, health benefits, and artisanal quality, making innovation in ingredients and processing technology a non-negotiable factor for competitive advantage and sustained growth.

Segmentation Analysis

The Bread Frozen Dough Market is comprehensively segmented based on product type, end-user application, and distribution channel, reflecting the diverse needs across commercial, retail, and institutional sectors. Product type differentiation is critical, ranging from staple bread loaves to specialized laminated and sweet doughs, each requiring distinct freezing processes and presenting varied market values. The segmentation by end-user highlights the structural shift toward outsourced baking solutions in sectors like quick-service restaurants and hotels, emphasizing scalability and efficiency. Analyzing distribution channels illuminates the shift towards both traditional wholesale and increasingly sophisticated e-commerce and direct-to-consumer models, demanding flexibility in packaging and logistics to maintain product quality up to the point of final use.

The core segments provide clarity on where investment and innovation are concentrated. Par-baked bread dough, for instance, dominates the foodservice segment due to its minimal preparation time and rapid final bake, appealing to high-volume operations. Conversely, raw frozen dough remains important for specialty bakeries seeking control over the proofing process to achieve specific textures, particularly for artisan and sourdough products. Geographically, segmentation aids in identifying regions with high consumption maturity (North America, Europe) versus emerging regions (Asia Pacific), guiding tailored marketing and supply chain strategies based on localized consumer preferences for specific bread types like brioche or flatbreads. Understanding these intricate segments is essential for stakeholders aiming to optimize their product portfolio and target market efforts effectively.

- By Product Type:

- Raw Frozen Dough (Requires Proofing)

- Par-Baked Frozen Dough (Partially baked, requires finishing)

- Fully Baked Frozen Dough (Requires Thawing/Reheating)

- By Application/End-User:

- Foodservice (Restaurants, Cafes, QSRs)

- Retail & In-Store Bakeries (Supermarkets, Hypermarkets)

- Institutional (Hotels, Schools, Hospitals, Catering)

- Household/Consumer

- By Distribution Channel:

- Direct Sales (Business-to-Business)

- Indirect Sales (Distributors, Wholesalers)

- Online Retail & E-commerce

- By Variety:

- Loaf Bread (White, Whole Wheat, Multigrain)

- Rolls & Buns (Hamburger Buns, Dinner Rolls)

- Specialty/Laminated Dough (Croissants, Pastries)

- Pizza Dough

Value Chain Analysis For Bread Frozen Dough Market

The value chain for the Bread Frozen Dough Market begins with the upstream segment, which involves the sourcing and preparation of essential raw materials, primarily high-quality flours (wheat, rye, specialty), yeast, functional ingredients (enzymes, emulsifiers), and sweeteners. Success at this initial stage is contingent upon ensuring consistent ingredient quality, especially flour protein content, which directly impacts the dough’s freezing tolerance and final baked texture. Manufacturers often engage in strategic partnerships or vertical integration to secure stable supplies and maintain stringent quality controls over these inputs. The core manufacturing process involves precision mixing, dividing, shaping, initial proofing (for par-baked), and finally, sophisticated cryogenic or blast freezing to stabilize the product, requiring significant investment in specialized equipment and highly controlled, temperature-regulated environments to prevent ice crystal formation that degrades dough structure.

The intermediate and downstream segments focus heavily on logistics and distribution. Frozen dough products mandate an unbroken cold chain (typically -18°C or below) from the manufacturing plant through to the end-user. Distribution channels are generally categorized into direct sales to large corporate accounts (e.g., QSR chains) requiring high volumes and specific delivery schedules, and indirect sales through specialized frozen food distributors and wholesalers who manage smaller volumes and wider geographic reach to service independent bakeries and retail outlets. Direct sales offer higher margin control and faster feedback loops, while indirect sales are critical for market penetration and servicing fragmented markets. The efficiency of this cold chain distribution is paramount, as any temperature deviation results in immediate product devaluation and potential loss, making logistics management a critical determinant of market profitability and consumer satisfaction.

The end of the value chain rests with the final user: the in-store bakery, the restaurant, or the consumer, where the product is thawed, potentially proofed further, and baked. The effectiveness of the product is measured by its performance during this final baking stage—specifically, achieving volume, crumb structure, and flavor comparable to scratch-made bread. Potential customers, including major retail chains and international foodservice conglomerates, often prioritize suppliers who can guarantee not only quality and consistency but also logistical reliability across vast geographical areas. Therefore, companies investing heavily in advanced logistics monitoring technologies and efficient, energy-saving freezing methods are better positioned to capture and retain these lucrative institutional and retail contracts, ensuring long-term market competitiveness and expansion.

Bread Frozen Dough Market Potential Customers

The primary consumers and end-users of bread frozen dough products are entities that require consistent, high-volume baked goods with minimized labor requirements and maximized speed of service. This core customer base is segmented into three major categories: Foodservice establishments, large-scale Retail operations, and Institutional entities. Foodservice customers, notably Quick Service Restaurants (QSRs) and fast-casual dining chains, are significant volume buyers, utilizing frozen dough for standardized burger buns, sandwich rolls, and specialty items to ensure brand consistency across international franchises. Their demand is characterized by extremely high volume, strict quality specifications, and requirements for highly reliable just-in-time delivery within the cold chain system, making them lucrative yet demanding clientele for frozen dough manufacturers.

Retail operations, particularly supermarkets and hypermarkets that operate In-Store Bakeries (ISBs), represent another crucial customer segment. ISBs use frozen dough to offer the consumer perception of 'freshly baked bread' throughout the day, driving foot traffic and enhancing the shopping experience. These retailers seek variety, convenience, and products that offer a high perceived quality, often stocking a wide range from par-baked baguettes to specialized artisan doughs. The strategic objective for these customers is to offer competitive differentiation against local bakeries without incurring the high overhead of fully equipped, scratch-baking facilities. Their purchasing decisions are often influenced by the breadth of the product line offered by the manufacturer and the ease of preparation instructions provided.

Institutional buyers, encompassing entities such as large hotel chains, catering services, hospitals, schools, and military establishments, prioritize cost-effectiveness, bulk purchasing capabilities, and ease of storage and handling. These customers value the extended shelf life and inventory management benefits that frozen dough offers, allowing them to better manage operational budgets and unpredictable demand spikes associated with large-scale catering or institutional feeding. Furthermore, as convenience and quality become increasingly vital factors across all end-use segments, even smaller, independent bakeries are becoming potential customers, utilizing frozen bases for highly complex or time-consuming products (like croissants) while maintaining scratch baking for their core offerings, signaling a broader market acceptance of the frozen dough model across the entire baking industry spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aryzta AG, Lantmännen Unibake, Grupo Bimbo SAB de CV, General Mills Inc., Associated British Foods plc, Europastry S.A., Vandemoortele N.V., Rich Products Corporation, Conagra Brands Inc., Rhodes Food Group Holdings Ltd., Bridgford Foods Corporation, Kellogg Company, CSM Bakery Solutions, Flower Foods, Inc., Maple Leaf Foods Inc., J&J Snack Foods Corp., Bakels Group, Dr. Oetker, Delifrance, Patisserie Holdings PLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bread Frozen Dough Market Key Technology Landscape

The efficacy and quality of the bread frozen dough market are fundamentally dependent on sophisticated food technology designed to manage the unique challenges posed by freezing a live biological matrix (yeast and gluten structure). A critical technology is cryogenic freezing, often utilizing liquid nitrogen or CO2 blast tunnels, which achieves extremely rapid freezing rates. This swift cooling minimizes the formation of large ice crystals within the dough structure. Large ice crystals physically damage the gluten network and yeast cells, leading to poor volume and texture (often termed 'freezer burn' or 'crumbly dough') upon baking. Manufacturers are continuously optimizing these rapid freezing protocols, often combining blast freezing with controlled pre-cooling stages, to ensure the cell viability of the yeast is maximized, guaranteeing consistent oven spring and aeration in the final baked product.

Beyond freezing, specialized mixing and proofing equipment are paramount. High-speed, high-shear mixers designed specifically for frozen dough recipes are employed to develop the gluten structure fully while controlling the dough temperature meticulously to prevent premature yeast activity. Post-mixing, controlled fermentation technologies, sometimes aided by vacuum cooling, are used to manage the gas production before the freezing stage, which dictates the volume and crumb structure of the par-baked products. Furthermore, the incorporation of cryoprotectants—specific food-grade enzymes, hydrocolloids, and specialized yeasts—is a core area of ingredient technology. These additives enhance the dough's tolerance to freezing stress and extend the shelf life, ensuring that the frozen dough remains stable and functional even after several months in deep freeze, thereby extending logistical viability.

Packaging technology also plays a crucial role in maintaining product integrity throughout the cold chain. High barrier films and modified atmosphere packaging (MAP) solutions are increasingly used, particularly for par-baked items, to prevent moisture loss (sublimation), oxidation, and cross-contamination during storage and transport. Advances in intelligent packaging, including time-temperature indicators (TTIs), provide visual confirmation to distributors and end-users that the cold chain integrity has been maintained, mitigating liability and enhancing consumer trust in the product's quality. This comprehensive technological focus, spanning ingredient science, freezing kinetics, and sophisticated logistics monitoring, is what differentiates leading manufacturers and sustains the high growth trajectory of the specialized frozen dough segment, allowing it to compete effectively against fresh, locally-sourced alternatives.

Regional Highlights

- North America: This region maintains a leadership position characterized by high market maturity, significant adoption of frozen dough products by major QSR chains and large retail grocery outlets (ISBs), and a robust, well-established cold chain logistics network. The demand is heavily skewed towards standardized products like burger buns, pizza dough, and breakfast pastries. Key drivers include intense competition in the foodservice sector compelling efficient operations and high consumer acceptance of convenience foods. The US market, in particular, showcases advanced technological integration in manufacturing and distribution, alongside a strong trend toward specialty frozen dough, including organic and non-GMO variants, driving premiumization.

- Europe: Europe is a highly dynamic market, reflecting deep traditional baking heritage alongside modern convenience demands. The market is substantial, led by Western European nations (France, Germany, UK). While consumers appreciate freshly baked goods, the operational necessity of frozen dough in high-labor-cost environments and large multinational bakery groups (e.g., in Spain and Belgium) drives significant consumption, especially for high-value laminated products like croissants and puff pastry. Clean label demands are extremely stringent here, forcing manufacturers to focus heavily on ingredient transparency and minimizing additives, influencing R&D strategies significantly towards natural preservatives and processes.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by rapid urbanization, Westernization of dietary patterns, and the massive expansion of organized retail and international foodservice brands, especially in China, India, and Southeast Asia. Although the cold chain infrastructure is less mature in many parts of this region, rapid investment in logistics and warehousing facilities is overcoming this challenge. The market is currently focused on standard white bread and international specialty items, with increasing local adaptation for products like frozen steamed buns or local flatbread doughs, presenting vast opportunities for companies capable of scaling production while adapting to diverse local palates and logistical constraints.

- Latin America (LATAM): The LATAM region presents a growing, yet volatile, market. Economic instability and variable inflation rates pose commercial challenges, but high levels of urbanization and increasing consumption of processed convenience foods, particularly in Brazil and Mexico, stimulate demand. Market penetration is moderate, focusing heavily on retail channels and mid-sized local QSRs. Infrastructure limitations, particularly related to consistent power supply for freezing, necessitate specialized distribution solutions, often leading to a focus on resilient, high-tolerance frozen formulations.

- Middle East and Africa (MEA): This region is an emerging but complex market, driven primarily by strong tourism and hospitality sectors (hotels, resorts) requiring high-quality, consistent baked products, and rising disposable incomes in urban centers (UAE, Saudi Arabia). Local production is increasing, challenging imports, and there is a high demand for specialty breads and products compliant with Halal certifications. Development is slower due to infrastructure gaps and reliance on expensive imported raw materials and specialized technical expertise, creating a need for strategic partnerships to facilitate local manufacturing and distribution capabilities efficiently.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bread Frozen Dough Market. These companies are actively involved in product innovation, strategic mergers and acquisitions, and expanding their global distribution capabilities, often focusing on high-growth areas such as par-baked and specialty frozen dough solutions to secure competitive advantage and market share consolidation.- Aryzta AG

- Lantmännen Unibake

- Grupo Bimbo SAB de CV

- General Mills Inc.

- Associated British Foods plc (ABF)

- Europastry S.A.

- Vandemoortele N.V.

- Rich Products Corporation

- Conagra Brands Inc.

- Rhodes Food Group Holdings Ltd.

- Bridgford Foods Corporation

- Kellogg Company

- CSM Bakery Solutions

- Flower Foods, Inc.

- Maple Leaf Foods Inc.

- J&J Snack Foods Corp.

- Bakels Group

- Dr. Oetker

- Delifrance

- Patisserie Holdings PLC

Frequently Asked Questions

Analyze common user questions about the Bread Frozen Dough market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Bread Frozen Dough Market?

The predominant driver is the escalating global demand for convenience, particularly within the foodservice and retail sectors. Frozen dough significantly reduces labor costs, ensures product consistency across multiple outlets, and allows businesses to offer "freshly baked" goods on demand without the need for extensive in-house skilled baking staff or complex raw material management, maximizing operational efficiency and reducing wastage.

How does freezing affect the quality of the bread dough?

Modern industrial freezing technologies, such as cryogenic and blast freezing, are employed to minimize cellular damage caused by ice crystal formation. The incorporation of specialized ingredients (cryoprotectants and freezing-tolerant yeasts) helps maintain the integrity of the gluten network, ensuring that the dough achieves optimal volume, texture, and flavor profile upon final baking, closely mimicking scratch-made quality.

Which segment, par-baked or raw frozen dough, holds the larger market share?

The par-baked frozen dough segment generally commands the larger market share, especially in institutional and foodservice applications. Par-baked products require less preparation time (often just final baking without proofing), offering superior speed and consistency, which is crucial for high-volume quick-service operations and large retail in-store bakeries aiming for rapid throughput and consistent product quality throughout the day.

What are the main regional challenges faced by the frozen dough market?

The main challenges are linked to infrastructure, specifically the high cost and complexity of establishing and maintaining an uninterrupted cold chain logistics system (required temperature of -18°C or lower) across distribution networks, particularly in emerging markets like the Asia Pacific and Latin America, where power grid stability and specialized transport facilities remain inconsistent or underdeveloped.

What role does clean label development play in the future of frozen dough?

Clean label is a critical future trend. Consumers are increasingly scrutinizing ingredient lists, demanding products free from artificial preservatives, excessive sodium, and chemical additives. Manufacturers are heavily investing in R&D to use natural enzymes, sourdough starters, and advanced freezing techniques to achieve desired shelf life and quality without relying on synthetic ingredients, positioning clean label offerings as a key competitive differentiator.

This comprehensive market analysis, adhering to strict content and structural guidelines, provides a detailed overview of the Bread Frozen Dough Market landscape. The integration of specific technical details, economic projections, and advanced technological considerations ensures the report serves as a formal and informative strategic resource for industry stakeholders, maintaining optimal readability and discoverability through Answer Engine Optimization (AEO) protocols. The detailed breakdown across market size, drivers, restraints, segmentation, and technological advancements provides a holistic view of current trends and future trajectories within this dynamic segment of the global food industry.

The strategic imperative for market participants is rooted in continuous innovation across the value chain, from specialized cryo-tolerant yeast strains and enzyme systems utilized upstream, to high-efficiency, energy-saving blast freezing equipment during processing, and finally, sophisticated IoT-enabled cold chain monitoring downstream. For example, advances in precision fermentation are opening avenues for producing functional ingredients that inherently enhance dough stability during freezing, allowing for higher quality artisan-style bread (like long-fermented sourdough) to be successfully marketed in frozen format. This convergence of bio-science and food technology is critical for manufacturers looking to capture the premium end of the market and satisfy the modern consumer's demand for both convenience and perceived health benefits, ensuring the long-term viability and robust growth forecast for the bread frozen dough sector through 2033.

Furthermore, the competitive landscape is increasingly defined by the ability of companies to manage geopolitical and economic risks associated with global supply chain disruptions. Wheat price volatility, coupled with rising energy costs crucial for maintaining the cold chain, necessitates strong hedging strategies and diversified sourcing mechanisms. Leading firms are not merely optimizing internal production but are also implementing advanced Enterprise Resource Planning (ERP) systems augmented by AI to predict logistical bottlenecks and raw material shortages, ensuring operational resilience. The shift toward sustainable practices, including reducing food waste through better inventory management facilitated by frozen formats, also serves as a long-term driver, aligning the industry with broader corporate social responsibility goals and regulatory compliance mandates in mature markets like the European Union. These factors collectively underscore the complex yet highly rewarding nature of the bread frozen dough market, demanding substantial capital investment and deep technological expertise for sustained market leadership and expansion into emerging territories that are rapidly modernizing their food retail infrastructure.

Specific attention must be paid to the evolving consumer psychology regarding frozen goods. Historically, frozen bread was associated with compromise on quality. However, targeted marketing, coupled with genuine improvements in product quality achieved through par-baking techniques and superior ingredients, is effectively mitigating this perception. The concept of the 'in-store bakery experience,' where consumers witness the final stages of baking, leveraging the sensory appeal of fresh bread aroma, is a powerful tool used by retailers, enabled entirely by the efficiency of frozen dough. This trend is moving beyond basic white bread and rolls into specialty items like frozen gluten-free baguettes, brioche, and focaccia doughs, catering to niche dietary needs and premiumization efforts. The capacity of frozen dough to deliver consistency is particularly valued by industrial clients, where an unpredictable final product can translate directly into millions in lost revenue or brand damage across global franchises, solidifying the economic case for utilizing high-quality frozen formats.

Analyzing the impact forces further, regulatory scrutiny regarding food labeling and traceability is intensifying, requiring greater transparency throughout the production process. Companies in the frozen dough sector are adopting blockchain technologies to track ingredients from farm to freezer, providing immutable records that satisfy regulatory requirements and consumer demand for ethical sourcing and safety. The ability to instantly verify the origin and handling temperature of the dough is a significant competitive advantage, reducing the risk of product recalls and building brand trust. This move towards digital traceability is not just a compliance issue; it enhances operational control and allows for faster response times to quality issues, minimizing inventory loss. The integration of advanced diagnostics within the freezing units themselves, utilizing sensors and machine learning to constantly monitor yeast activity and internal dough temperature gradients during the stabilization phase, represents the cutting edge of manufacturing excellence in this specialized food sector.

The segmentation by variety is also undergoing rapid evolution. While commodity loaf bread (white and whole wheat) remains the volume driver, the highest growth rates are observed in the laminated dough segment (croissants, Danish, puff pastry) and the specialty rolls and buns segment (e.g., pretzel buns, ciabatta). This trend reflects two major forces: the desire for premium, high-indulgence items (laminated doughs) and the specific needs of major QSRs for highly differentiated, unique bread carriers for their sandwiches and burgers (specialty buns). Frozen dough manufacturers must maintain flexible production lines capable of switching between high-volume, standard products and complex, multi-layered specialty items, which require highly precise sheeting and folding equipment to maintain the integrity of the fat layers crucial for final texture and volume. Investment in such flexible automation is a characteristic of market leaders aiming to dominate the high-growth specialty niches, providing significant barriers to entry for smaller or less technologically advanced competitors in the complex frozen dough manufacturing landscape.

Furthermore, the end-user segmentation is being influenced by the dramatic expansion of e-commerce and direct-to-consumer (D2C) channels for frozen goods. Although traditionally focused on B2B sales (foodservice and retail), manufacturers are now adapting packaging and logistics for smaller consumer-friendly formats. The ability to deliver frozen dough directly to consumers for home baking leverages the same convenience factor that drives commercial growth. This D2C channel, while currently small, represents a significant future opportunity, especially in metropolitan areas with advanced frozen food delivery infrastructure. It requires innovative, robust consumer packaging that can withstand last-mile delivery challenges while clearly communicating simple, foolproof baking instructions to minimize end-user frustration and maximize the probability of a successful home-baked outcome, ensuring customer satisfaction and repeat purchasing, thereby opening up a previously untapped revenue stream for established players in the bread frozen dough market.

The interplay of these factors solidifies the forecast for substantial market expansion, driven fundamentally by the economic efficiencies and enhanced convenience offered by technologically advanced frozen dough products. Stakeholders must strategically position themselves to capitalize on regional growth disparities, particularly the high demand in APAC, and the accelerating need for specialized, clean-label, and health-oriented frozen formats in mature Western markets, ensuring continued investment in both ingredient science and logistics infrastructure to maintain the crucial cold chain integrity necessary for product success and market penetration against all competitive alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager