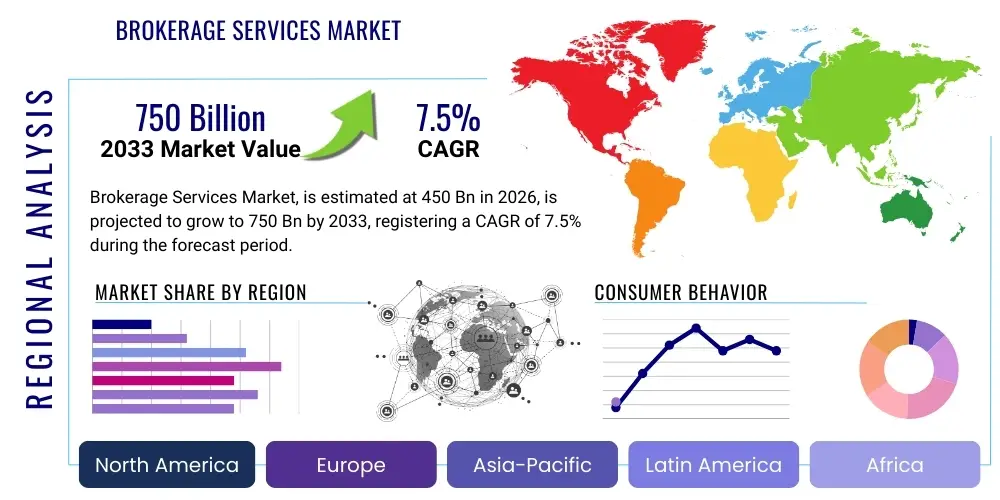

Brokerage Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443407 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Brokerage Services Market Size

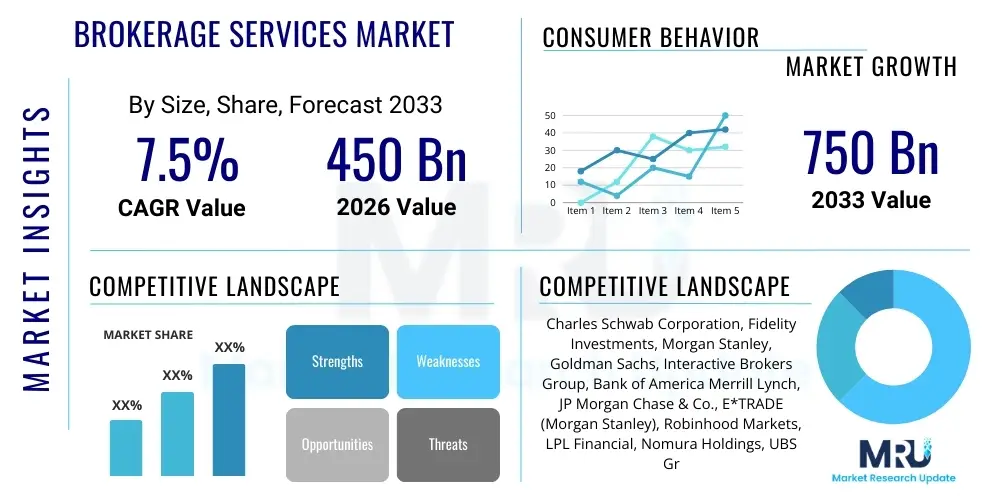

The Brokerage Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Billion in 2026 and is projected to reach USD 750 Billion by the end of the forecast period in 2033.

Brokerage Services Market introduction

The Brokerage Services Market encompasses a wide range of intermediary services facilitating transactions between buyers and sellers across various asset classes, including stocks, bonds, commodities, real estate, insurance, and foreign exchange. Market evolution is largely driven by rapid digitalization, the democratization of investment through zero-commission models, and the increasing demand for sophisticated financial advisory and wealth management solutions. Key applications span institutional trading, retail investment, corporate finance, and complex wealth planning for high-net-worth individuals (HNWIs). The fundamental benefit of brokerage services is the provision of liquidity, execution efficiency, compliance adherence, and access to global capital markets, transforming illiquid assets into tradable securities and connecting capital sources with deployment opportunities. Major driving factors include global economic expansion, rising disposable income in emerging markets, technological advancements lowering barriers to entry, and favorable regulatory reforms promoting financial transparency and market accessibility. The transition towards integrated digital platforms offering holistic financial management is redefining competitive strategies within this sector.

Brokerage Services Market Executive Summary

Current business trends emphasize convergence between traditional full-service firms and agile fintech brokers, leading to hybrid service models that combine advanced algorithmic trading capabilities with personalized human advice. Significant consolidation activities, driven by the need for economies of scale and cross-border expansion, are reshaping the competitive landscape, notably seen in mergers among major U.S. financial institutions acquiring smaller digital platforms to enhance technological stacks and broaden customer bases. Regional trends highlight North America's dominance due to high investment literacy and robust regulatory infrastructure, while the Asia Pacific (APAC) region is demonstrating the fastest growth, propelled by burgeoning middle-class wealth, increased digitization adoption in markets like India and Southeast Asia, and supportive government initiatives encouraging capital market participation. Segment trends show a pronounced shift towards digital-only platforms offering fractional share trading and thematic investment products, particularly appealing to younger, tech-savvy retail investors. Conversely, the institutional segment is increasingly demanding highly specialized execution services, quantitative research, and complex derivatives brokerage, prioritizing latency reduction and advanced risk management tools.

AI Impact Analysis on Brokerage Services Market

User queries regarding the impact of Artificial Intelligence (AI) frequently center on the balance between cost reduction and human oversight, specifically asking whether AI will fully replace financial advisors or merely augment their capabilities. Common concerns also revolve around the ethical implications of algorithmic decision-making, the potential for increased market volatility due to automated trading, and the security of proprietary client data handled by AI systems. Users seek clarification on how machine learning is enhancing trade execution speed, risk modeling, and regulatory compliance (RegTech). The consensus theme emerging from these discussions is the expectation that AI will fundamentally transform back-office operations, significantly improve predictive analytics for investment strategies, and personalize client interactions through sophisticated robo-advisory services, demanding rapid upskilling among traditional brokerage professionals to maintain relevance in an increasingly automated environment.

- Algorithmic Trading Optimization: AI significantly enhances execution speed and price discovery by processing massive datasets in real time, leading to lower latency and improved fill rates, particularly in high-frequency trading (HFT) environments.

- Enhanced Risk Management and Fraud Detection: Machine learning models are deployed to identify subtle patterns indicative of market manipulation, credit risk, or operational failures, offering proactive risk mitigation far beyond conventional statistical methods.

- Personalized Client Experience (Robo-Advisory): AI-driven platforms provide tailored portfolio construction, automatic rebalancing, and behavioral finance insights, dramatically lowering the cost of personalized financial advice for the mass affluent and retail segments.

- Regulatory Compliance (RegTech): AI systems automate monitoring, reporting, and documentation processes required by stringent financial regulations, minimizing human error and ensuring continuous adherence to global compliance standards, thereby reducing operational overheads.

- Operational Efficiency and Back-Office Automation: Automation of middle and back-office functions, such as settlement, reconciliation, and customer onboarding (KYC/AML), leveraging AI and Robotic Process Automation (RPA) to cut costs and improve data accuracy.

DRO & Impact Forces Of Brokerage Services Market

The market dynamics are governed by a complex interplay of forces. Key drivers include the global expansion of financial literacy and accessibility, coupled with the relentless innovation in financial technology (FinTech) that enables ubiquitous trading capabilities. The shift towards commission-free trading models, while pressuring revenue margins, has drastically lowered the entry barrier for retail investors, expanding the total addressable market globally. These drivers, characterized by technological democratization, accelerate market growth but necessitate significant reinvestment in secure, scalable digital infrastructure. Furthermore, regulatory shifts, such as MiFID II in Europe and ongoing digital asset regulations globally, necessitate modernization but also create clear frameworks that encourage greater institutional participation and safeguard investor interests, acting as a long-term catalyst for structured growth.

However, the market faces considerable restraints, primarily stemming from stringent and often fragmented regulatory environments across jurisdictions, which impose high compliance costs and limit operational scalability for global firms. The continuous threat of cyberattacks and data breaches remains a paramount concern, potentially eroding client trust and resulting in massive financial penalties, demanding continuous, expensive security upgrades. Furthermore, the inherent volatility of global financial markets, often influenced by macroeconomic factors like inflation, interest rate hikes, and geopolitical instability, can lead to reduced trading volumes and hesitant investment behavior among both retail and institutional clients, thereby dampening short-term revenue projections and market momentum.

Opportunities for expansion are abundant, particularly in the thematic investment space, focusing on ESG (Environmental, Social, and Governance) criteria, sustainable finance, and alternative assets like private equity and digital securities tokenization. Emerging markets present a vast untapped client base where improving digital connectivity and rising middle-class disposable incomes create fertile ground for digital brokerage penetration. Firms focusing on integrating AI-powered personalization, advanced data analytics for proprietary research, and offering seamless, multi-asset trading platforms are well-positioned for competitive advantage. The ability to converge traditional banking, wealth management, and brokerage services into a single, unified client portal represents a significant avenue for cross-selling and deepening client relationships, optimizing lifetime customer value.

- Drivers: Widespread adoption of digital trading platforms; Increased retail investor participation due to zero-commission models; Rising global wealth and disposable income; Demand for specialized wealth management advice.

- Restraints: Severe regulatory scrutiny and compliance costs; High susceptibility to market volatility and economic downturns; Significant operational risk from cybersecurity threats and data privacy requirements; Intense competitive pressure leading to margin compression.

- Opportunities: Expansion into digital assets and tokenized securities; Development of highly personalized robo-advisory services; Focus on ESG and sustainable investment products; Geographic penetration into rapidly digitizing emerging economies.

- Impact Forces: Technological Disruption (High); Regulatory Environment (High); Economic Cyclicality (Medium to High); Customer Expectations for Speed and Cost (High).

Segmentation Analysis

The Brokerage Services Market is extensively segmented based on the type of asset traded, the technology platform utilized, the service model provided, and the category of the end-user. This layered segmentation is critical for firms to tailor their offerings effectively, whether catering to sophisticated institutional demands for ultra-low latency execution or meeting the ease-of-use requirements of the mass-market retail investor using mobile applications. The differentiation of services allows brokerages to capture value across the entire spectrum of financial services, from basic transaction execution (discount brokerage) to comprehensive financial planning and tax optimization (full-service brokerage). Understanding these segment nuances informs strategic decisions regarding pricing, technology investment, and regulatory focus, ensuring market offerings align precisely with defined client needs.

- By Type of Asset: Stock Brokerage; Bond/Fixed Income Brokerage; Commodity Brokerage; Foreign Exchange (Forex) Brokerage; Derivative Brokerage; Insurance Brokerage; Real Estate Brokerage; Digital Asset Brokerage.

- By Platform: Online/Digital Platforms (Mobile-first, Web-based); Traditional/Offline Brokerage; Hybrid Brokerage.

- By Service Model: Discount Brokerage (Execution Only); Full-Service Brokerage (Advisory and Execution); Robo-Advisory Services.

- By End-User: Retail Investors (Individual); Institutional Investors (Hedge Funds, Pension Funds, Asset Managers); Corporates.

Value Chain Analysis For Brokerage Services Market

The value chain for brokerage services begins with upstream activities focused on market access and technology development. This involves establishing relationships with exchanges, central clearing parties, and liquidity providers to ensure optimal trading conditions and deep market access. Critical upstream components include the proprietary development or acquisition of trading infrastructure, sophisticated data feeds, market analysis tools, and robust cybersecurity protocols. Firms invest heavily in latency reduction technologies and high-performance computing to maintain a competitive edge, as milliseconds can determine profitability in institutional trading. Furthermore, securing licensing and regulatory approval across desired operating geographies forms a foundational upstream step, enabling subsequent client-facing operations.

The midstream process involves the actual delivery of core brokerage functions, encompassing client acquisition and onboarding (Know Your Customer/Anti-Money Laundering), trade execution, settlement, and clearing. Modern distribution increasingly relies on seamless digital channels, requiring advanced user interfaces and stable mobile applications to facilitate retail trading. For institutional clients, this stage involves high-touch sales support, specialized research dissemination, and customized algorithmic solutions. The efficiency of the midstream process directly impacts customer satisfaction and operational costs, making automation and straight-through processing (STP) crucial priorities for operational excellence.

Downstream activities focus on value-added services, customer relationship management, and regulatory reporting. This includes providing wealth management advice, portfolio performance reporting, tax documentation, and specialized customer service support. The distribution channel structure varies significantly: direct distribution dominates the discount brokerage model through proprietary online platforms, minimizing intermediary costs. Conversely, full-service models often utilize indirect distribution through networks of financial advisors, independent registered investment advisors (RIAs), or third-party wealth planning software integrations. The complexity of regulatory reporting and continuous market surveillance forms the final essential step, ensuring the firm adheres to all mandated disclosure and compliance requirements post-trade.

Brokerage Services Market Potential Customers

The primary customer base for brokerage services is broadly categorized into retail (individual) investors and institutional investors, with distinct needs and service expectations. Retail investors, ranging from young, nascent traders utilizing mobile apps for fractional shares to affluent retirees seeking comprehensive wealth preservation strategies, prioritize ease of access, low transaction costs, intuitive digital interfaces, and reliable fundamental educational resources. The growth trajectory in this segment is strongly tied to financial democratization and the availability of simplified, automated investment tools, targeting individuals with varied levels of financial sophistication and investment capital.

Institutional customers—such as mutual funds, hedge funds, sovereign wealth funds, and corporate treasuries—represent the segment demanding specialized, high-volume execution capabilities, proprietary quantitative research, and direct access to specialized market liquidity pools. Their purchasing decisions are driven by execution quality (best execution), counterparty risk management, technological integration capabilities (API access), and customized, confidential advisory services for large-scale, complex transactions. These customers often engage full-service or prime brokerage divisions that can handle complex mandates, including securities lending, specialized financing, and derivative clearing, focusing on minimizing market impact and achieving superior alpha generation.

A rapidly growing segment comprises corporate clients requiring capital raising and specialized advisory services, including underwriting, merger and acquisition (M&A) advisory, and risk hedging strategies. Furthermore, the burgeoning popularity of specialized asset classes, such as digital assets and private market securities, is creating new niches for potential customers seeking brokers equipped with the requisite technological infrastructure and regulatory clarity to facilitate trading in these innovative but highly regulated domains. Brokerages must tailor their technology stack and human capital to address the diverging, yet equally demanding, needs of these various end-user profiles to maintain market relevance and diversify revenue streams effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Billion |

| Market Forecast in 2033 | USD 750 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Charles Schwab Corporation, Fidelity Investments, Morgan Stanley, Goldman Sachs, Interactive Brokers Group, Bank of America Merrill Lynch, JP Morgan Chase & Co., E*TRADE (Morgan Stanley), Robinhood Markets, LPL Financial, Nomura Holdings, UBS Group AG, DriveWealth LLC, Zacks Trade, ICICI Securities, Zerodha Broking Ltd., Pershing (BNY Mellon), Ameriprise Financial, Apex Clearing Corporation, TradeStation Group Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Brokerage Services Market Key Technology Landscape

The modern brokerage services market is fundamentally reliant on sophisticated technological infrastructure to handle transaction volumes, ensure regulatory compliance, and provide seamless user experiences. Core to this landscape is the adoption of low-latency trading systems, which utilize dedicated fiber optics and co-location strategies near exchange data centers to minimize execution delays, a critical factor for institutional profitability. Furthermore, the migration to cloud-based infrastructure (e.g., AWS, Azure) provides brokerages with enhanced scalability, enabling them to quickly manage spikes in trading volume triggered by market events, alongside offering highly available disaster recovery and robust data warehousing capabilities necessary for advanced analytics and regulatory scrutiny.

Blockchain and Distributed Ledger Technology (DLT) are emerging as transformative technologies, particularly in the settlement and clearing processes, promising to reduce counterparty risk and drastically cut settlement times from T+2 to instantaneous atomic settlements. While still in nascent stages for mainstream equity brokerage, DLT is actively being explored for tokenized assets and specialized private markets, creating efficiencies by eliminating intermediaries. Concurrently, the proliferation of APIs (Application Programming Interfaces) is essential, allowing third-party developers, financial advisors, and institutional clients to integrate brokerage services directly into their own systems, fostering an open banking and embedded finance ecosystem that broadens the reach and utility of core brokerage platforms.

The technological evolution is heavily biased towards the front-end user experience, driven by mobile-first design philosophies and the integration of advanced data visualization tools. This includes implementing natural language processing (NLP) for efficient customer support chatbots and leveraging machine learning for real-time portfolio risk assessment and customized trade recommendations. The convergence of these technologies—cloud scalability, AI-powered analytics, and low-latency execution—forms the technological moat for market leaders, dictating the pace of innovation and competitive positioning within both the retail and institutional segments of the brokerage industry, ensuring continuous evolution toward hyper-personalized and cost-efficient financial services delivery.

Regional Highlights

- North America: This region maintains its dominant position, largely attributed to the maturity of its capital markets, the presence of major global financial centers (New York, Toronto), and high adoption rates of advanced trading technologies. The U.S. market is characterized by intense competition among large established players and disruptive zero-commission fintechs, driving continuous technological innovation, particularly in areas like options trading and automated wealth management. Robust regulatory oversight, while burdensome, ensures market integrity, fostering high institutional trust and massive trading volumes.

- Europe: The European market is highly fragmented but dynamic, governed largely by regulations like MiFID II, which mandated transparency and best execution. The region is seeing significant growth in cross-border brokerage services and strong adoption of sustainable and ESG-focused investment platforms. Key growth hubs include London, Frankfurt, and Amsterdam. However, navigating the post-Brexit regulatory divergence presents ongoing challenges for pan-European firms, necessitating localized compliance solutions.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive economic growth, increasing financial literacy among vast middle-class populations, and accelerated digital adoption, particularly in China, India, and Southeast Asia. The region is characterized by diverse market structures; while Japan and Australia possess highly developed, regulated markets, countries like Vietnam and Indonesia are experiencing rapid market liberalization and high demand for mobile-first trading applications that cater to young investors.

- Latin America (LATAM): The LATAM region presents significant long-term potential, though growth is often hampered by currency volatility and macroeconomic instability. Brazil and Mexico lead market development, showing increasing institutional interest and a growing shift toward formalized, digitally accessible brokerage services. Cross-border platforms offering access to U.S. markets are particularly popular among sophisticated investors seeking diversification and stability outside local economies.

- Middle East and Africa (MEA): Growth in MEA is concentrated in key financial hubs such as the UAE (Dubai, Abu Dhabi) and Saudi Arabia, driven by sovereign wealth fund activity, robust energy economies, and government initiatives aimed at diversifying capital markets. Digitalization is accelerating, with a strong focus on Sharia-compliant investment products. The African market remains relatively nascent but offers significant untapped potential as mobile money and internet penetration rates increase across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Brokerage Services Market.- Charles Schwab Corporation

- Fidelity Investments

- Morgan Stanley

- Goldman Sachs Group Inc.

- Interactive Brokers Group

- Bank of America Merrill Lynch

- JP Morgan Chase & Co.

- E*TRADE (Morgan Stanley)

- Robinhood Markets, Inc.

- LPL Financial Holdings Inc.

- Nomura Holdings Inc.

- UBS Group AG

- DriveWealth LLC

- Zacks Trade

- ICICI Securities Ltd.

- Zerodha Broking Ltd.

- Pershing (BNY Mellon)

- Ameriprise Financial

- Apex Clearing Corporation

- TradeStation Group Inc.

Frequently Asked Questions

Analyze common user questions about the Brokerage Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of zero-commission trading models in the brokerage industry?

The primary driver is intense technological disruption coupled with competitive pressures, notably from fintech entrants like Robinhood. These firms leverage payment for order flow (PFOF) and focus on generating revenue through securities lending, interest income on client cash balances, and premium services, allowing them to eliminate traditional trading commissions. This model lowers the entry barrier significantly for retail investors and forces traditional brokerages to rapidly follow suit to retain market share, fundamentally transforming the profitability structure of the industry.

How is regulatory compliance (RegTech) changing the operational requirements for global brokerage firms?

RegTech is fundamentally transforming compliance by utilizing AI and machine learning to automate complex monitoring, surveillance, and reporting mandates, such as those related to KYC, AML, and market abuse detection (MiFID II/MAR). This shift enables brokerages to manage cross-jurisdictional complexity efficiently, reduce manual compliance errors, and provide near real-time audit trails, mitigating the risk of substantial fines and enhancing institutional reputation in a tightly scrutinized global financial environment.

What are the key differences between institutional brokerage and retail brokerage services?

Retail brokerage caters to individual investors, prioritizing user experience, ease of execution, educational content, and low costs (often zero-commission). Institutional brokerage, conversely, serves sophisticated entities like hedge funds and asset managers, focusing on providing complex services such as high-volume, ultra-low latency execution (prime brokerage), sophisticated risk management, securities financing, customized research, and access to dark pools and specialized liquidity sources to minimize market impact.

What role does blockchain technology play in modernizing post-trade brokerage processes?

Blockchain and DLT hold significant potential for modernizing post-trade operations by facilitating instantaneous, atomic settlement and clearing. By creating a shared, immutable ledger among participants, DLT can drastically reduce settlement cycles (from T+2 to T+0), lower counterparty risk, reduce operational costs associated with clearing houses, and improve transparency in securities lending, though mass adoption is currently constrained by regulatory frameworks and interoperability challenges.

Which geographical region is expected to exhibit the fastest growth in the Brokerage Services Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate in the brokerage services market. This accelerated expansion is driven by robust economic development, rapidly increasing levels of disposable income among the burgeoning middle class, widespread adoption of mobile technology for trading and investing, and favorable regulatory movements in key markets like India, China, and Southeast Asian nations that are opening up and digitizing their local capital markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager